Animal Feed Additives Market by Types, Livestock & Geography Global Trends & Forecasts up to 2017

Animal feed additives are pharmaceutical or nutritional substances that are not natural feedstuffs and are added to made-up and stored feeds for various purposes, such as to control infectious diseases in animals, to promote growth, and to enhance feed digestibility in animals. Owing to the increasing population as well as the declining availability of grains and cereals such as maize and corn, it has become critical to optimize animal feed for maximum efficiency and nutrition.

Feed additives have now become an essential part of the globally increasing meat production industry. Feed additives are important ingredients that are combined with basic feed mix to provide essential nutrition to animals and improve their overall growth. Feed additives help to improve the rate of weight gain, prevent diseases in animals, prevent vitamin deficiencies, and improve feed digestion and conversion. Most of the feed additives are used in micro quantities in the form of injectables, pellets, liquids, and powders. A variety of feed additives are available that are used in different quantities and concentrations depending upon the types of animal.

The global animal health sector includes animal diagnostics, animal biologicals, packaged pharmaceuticals, and feed additives. Animal feed additives account for 42.7% of the overall animal health industry. This is primarily due to the availability of a large number of products, and the wide ranging benefits of feed additives such as amino acids, vitamins, and acidifiers; with multiple market driving factors such as industrialization in meat production, increasing demand for protein rich meat products globally, and rising awareness towards meat products quality.

Antibiotics, which dominate the feed additives market, accounted for the largest market share of 27.9% in the market in 2010. This was primarily due to their ability to promote growth in livestock animals. After the complete ban on antibiotics usage as growth promoters in the European Union in 2006 and the U.S. in 2009, majority of global demand for antibiotics is expected to come from the Asian and Latin American regions. Feed amino acids and vitamins accounted for 26.5% and 10.2% of the market share in 2010 respectively, and are expected to experience steady demand in the global feed additives market. Feed acidifiers accounted for 7.7% share of the global market, but are expected to grow further as an alternative for antibiotics.

In terms of feed additive consumption, China is the largest market in the Asian continent; this is due to a large population base, high economic growth, and increasing domestic demand for meat protein. Strong growth in the Chinese feed additive industry is further supported by increasing per capita consumption in the domestic market, and rising awareness of meat quality and nutrition content. The amino acids and antibiotics segments accounted for 54.4% of the market in 2010, with a strong CAGR of 7.93% and 6.46% respectively during the years 2011 to 2016. Poultry accounted for 43% of the overall Chinese feed additive industry in 2010, due to increasing consumer preference for poultry meat. China is the largest producer of pork meat, with a global share of more than 50%; hence pork had a share of 40% in the Chinese feed additives market in 2010.

Recently, disease outbreaks such as avian flu and foot-and-mouth diseases have also increased concern over animal health across the world. With pressure on regulatory authorities to prevent the use of AGPs (Antibiotic Growth Promoters), the industry is expected to move towards feed enzymes and amino acids.

The report provides a comprehensive review of major market drivers, challenges, and products such as vitamins, feed acidifiers, amino acids and antibiotics. The market is further segmented and forecasted for major geographic regions: North America, Europe, Asia, and Rest of the World including South America (Brazil and Argentina), Oceania, Africa, and the Middle East. Top players of the industry are profiled in detail with their recent developments and other strategic industry activities.

Want to explore hidden markets that can drive new revenue in Animal Feed Additives Market?

This animal feed additives market research report categorizes the global market on the basis of products, livestock and geography; forecasting revenue and analyzing trends in each of the following submarkets:

On the basis of Products: Antibiotic Growth Promoters (AGPs), Antioxidants, Vitamins, Amino Acids, Feed Enzymes, and Feed Acidifiers.

On the basis of Livestock: Cattle, Swine, Sea-food, and Poultry.

On the basis of Geography: North America, Europe, Asia, and ROW

Animal Feed Additives Market (2009 - 2016)

The global feed additives industry has been in a higher growth trajectory from the last four years. This growth is largely fueled by the increasing meat consumption and rising concern over meat quality and safety. Some of the major drivers of the global feed additives industry identified in this report are rise in global meat consumption, increasing awareness towards meat quality and safety, increasing mass production of meat, and recent livestock disease outbreaks. Major restraints identified in this report are regulatory structure and intervention, and rising raw material cost. Growth is particularly high in emerging countries such as China, India, and Brazil due to increasing income levels and rising per capita meat consumption.

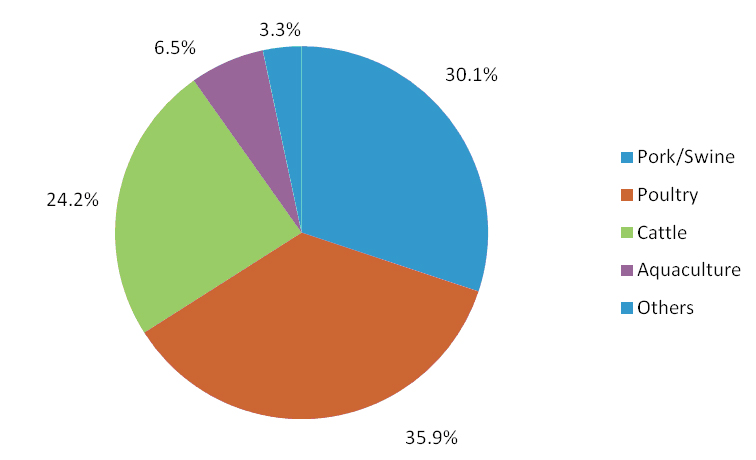

Global Animail Feed Additives Market, by Livestock, 2010

Source: MarketsandMarkets

Poultry, pork and cattle are the three largest consumers of animal feed additives globally and accounted for 84.4% share of the overall animal feed additives market in 2010. Of these, poultry segment is the largest with 35.8% share, followed by pork with 30.1% share.

The global feed additives market is estimated to reach $18.7 billion by 2016 with an expected CAGR of 3.8% from 2011 to 2016. The market in Asia is driving the sales and is expected to hold 28.5% of the global market share by 2016. The market in Asia is expected to have a high CAGR of 4.74% due to increasing demand for meat products in the region, and rising domestic meat production. Europe is the leading market for feed additives, with 35% share in 2011 resulting from higher regulatory concerns over meat quality and safety, and increasing per capita meat consumption. North America is the second largest market, with a share of 28.5% in 2011; the U.S. is the largest market with a share of more than 80%.

Antibiotics is the leading demand generating product with a share of more than 27% in 2011, followed by amino acid with 26.5% share in the global feed additives market. The consumption of antibiotics is high due to increasing demand in Asian and Latin American regions to meet the high domestic and export demand for meat.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 STAKEHOLDERS

1.4 RESEARCH METHODOLOGY

1.4.1 MARKET SIZE

1.4.2 KEY DATA POINTS TAKEN FROM SECONDARY SOURCES

1.4.3 KEY DATA POINTS TAKEN FROM PRIMARY SOURCES

1.4.4 ASSUMPTIONS MADE FOR THE REPORT

1.4.5 LIST OF COMPANIES COVERED DURING PRIMARIES

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.1.1 GLOBAL ANIMAL HEALTH INDUSTRY

3.1.2 BENEFITS OF ANIMAL FEED ADDITIVES

3.1.2.1 Improve animal nutritional growth

3.1.2.2 Improve feed quality

3.1.2.3 Enhance meat quality

3.1.2.4 Cost benefits

3.1.3 DIFFERENT TYPES OF FEED ADDITIVES

3.1.3.1 Sensory feed additives

3.1.3.2 Nutritional feed additives

3.1.3.3 Zoo-technical feed additives

3.2 MARKET DRIVERS

3.2.1 RISE IN GLOBAL MEAT CONSUMPTION

3.2.2 RISING AWARENESS REGARDING MEAT QUALITY & DAIRY PRODUCTS

3.2.3 MASS PRODUCTION OF MEAT

3.2.4 LIVESTOCK DISEASE OUTBREAKS DRIVE FEED ADDITIVES USAGE

3.3 MARKET RESTRAINTS

3.3.1 REGULATORY STRUCTURE & INTERVENTION

3.3.2 RISING RAW MATERIALS COST

3.4 MARKET OPPORTUNITIES

3.4.1 RISING COST OF NATURAL FEED PRODUCTS INCREASE DEMAND FOR FEED ADDITIVES

3.4.2 BAN ON ANTIBIOTICS - AN OPPORTUNITY

3.5 PORTERS FIVE FORCE ANALYSIS

3.5.1 SUPPLIER POWER

3.5.2 BUYER POWER

3.5.3 THREAT FROM NEW ENTRANTS

3.5.4 THREAT FROM SUBSTITUTES

3.5.5 DEGREE OF COMPETITION

3.6 PATENT ANALYSIS

4 GLOBAL FEED ADDITIVES MARKET BY PRODUCT TYPES

4.1 INTRODUCTION

4.2 GLOBAL FEED ADDITIVES MARKET BY PRODUCTS

4.2.1 ANTIBIOTICS

4.2.2 VITAMINS

4.2.3 ANTIOXIDANTS

4.2.4 AMINO ACIDS

4.2.5 FEED ENZYMES

4.2.6 ACIDIFIERS

4.3 ANCILLARY SUPPLEMENTS

4.3.1 ANIMAL FEED PREBIOTICS

4.3.2 ANIMAL FEED PROBIOTICS

5 GLOBAL FEED ADDITIVES MARKET BY LIVESTOCK

5.1 INTRODUCTION

5.1.1 PORK

5.1.2 SEA FOOD

5.1.3 CATTLE

5.1.4 POULTRY

6 GLOBAL FEED ADDITIVES MARKET BY GEOGRAPHY

6.1 NORTH AMERICA: FEED ADDITIVES MARKET

6.1.1 U.S.

6.1.2 CANADA

6.1.3 NORTH AMERICAN REGULATORY ENVIRONMENT

6.2 EUROPE: FEED ADDITIVES MARKET

6.2.1 GERMANY

6.2.2 UK

6.2.3 FRANCE

6.2.4 RUSSIA

6.2.5 EUROPEAN REGULATORY ENVIRONMENT ANALYSIS

6.3 ASIA: FEED ADDITIVES MARKET

6.3.1 CHINA

6.3.2 INDIA

6.3.3 JAPAN

6.3.4 ASIAN REGULATORY ENVIRONMENT

6.4 REST OF WORLD (ROW)

6.4.1 BRAZIL

6.4.2 ARGENTINA

7 COMPETITIVE LANDSCAPE

7.1 INTRODUCTION

7.2 MERGERS & ACQUISITIONS IS THE MOST PREFFERED STRATEGY

7.3 RAPID DEVELOPMENT IN GLOBAL FEED ADDITIVES MARKET IN 2010

7.4 EUROPE HAS WITNESSED MAXIMUM DEVELOPMENTS

7.5 MOST ACTIVE COMPANIES IN GLOBAL FEED ADDITIVES MARKET

8 COMPANY PROFILES

8.1 ADDCON GROUP GMBH

8.1.1 OVERVIEW

8.1.2 FINANCIALS

8.1.3 PRODUCTS & SERVICES

8.1.4 STRATEGY

8.1.5 DEVELOPMENTS

8.2 BLUE STAR ADISSEO

8.2.1 OVERVIEW

8.2.2 FINANCIALS

8.2.3 PRODUCTS & SERVICES

8.2.4 STRATEGY

8.2.5 DEVELOPMENTS

8.3 ARCHER DANIELS MIDLAND CO

8.3.1 OVERVIEW

8.3.2 PRODUCTS & SERVICES

8.3.3 FINANCIALS

8.3.4 STRATEGY

8.3.5 DEVELOPMENTS

8.4 ALLTECH INC

8.4.1 OVERVIEW

8.4.2 FINANCIALS

8.4.3 PRODUCTS & SERVICES

8.4.4 STRATEGY

8.4.5 DEVELOPMENTS

8.5 ALPHARMA INC

8.5.1 OVERVIEW

8.5.2 FINANCIALS

8.5.3 PRODUCTS & SERVICES

8.5.4 STRATEGY

8.5.5 DEVELOPMENTS

8.6 BASF SE

8.6.1 OVERVIEW

8.6.2 FINANCIALS

8.6.3 PRODUCTS & SERVICES

8.6.4 STRATEGY

8.6.5 DEVELOPMENTS

8.7 BIOMIN HOLDING GMBH

8.7.1 OVERVIEW

8.7.2 FINANCIALS

8.7.3 PRODUCTS & SERVICES

8.7.4 STRATEGY

8.7.5 DEVELOPMENTS

8.8 BIOVET JSC

8.8.1 OVERVIEW

8.8.2 FINANCIALS

8.8.3 PRODUCTS & SERVICES

8.8.4 STRATEGY

8.8.5 DEVELOPMENTS

8.9 CARGILL INC

8.9.1 OVERVIEW

8.9.2 FINANCIALS

8.9.3 PRODUCTS & SERVICES

8.9.4 STRATEGY

8.9.5 DEVELOPMENTS

8.10 CHAREON POKPHAND FOODS

8.10.1 OVERVIEW

8.10.2 FINANCIALS

8.10.3 PRODUCTS & SERVICES

8.10.4 STRATEGY

8.10.5 DEVELOPMENTS

8.11 DANISCO A/S

8.11.1 OVERVIEW

8.11.2 FINANCIALS

8.11.3 PRODUCTS & SERVICES

8.11.4 STRATEGY

8.11.5 DEVELOPMENTS

8.12 DSM NUTRITIONAL PRODUCTS

8.12.1 OVERVIEW

8.12.2 FINANCIALS

8.12.3 PRODUCTS & SERVICES

8.12.4 STRATEGY

8.12.5 DEVELOPMENTS

8.13 ELANCO ANIMAL HEALTH

8.13.1 OVERVIEW

8.13.2 FINANCIALS

8.13.3 PRODUCTS & SERVICES

8.13.4 STRATEGY

8.13.5 DEVELOPMENTS

8.14 EVONIK INDUSTRIES AG

8.14.1 OVERVIEW

8.14.2 FINANCIALS

8.14.3 PRODUCTS & SERVICES

8.14.4 STRATEGY

8.14.5 DEVELOPMENTS

8.15 CHR. HANSEN

8.15.1 OVERVIEW

8.15.2 FINANCIALS

8.15.3 PRODUCTS & SERVICES

8.15.4 STRATEGY

8.15.5 DEVELOPMENTS

8.16 INVIVO NSA

8.16.1 OVERVIEW

8.16.2 FINANCIALS

8.16.3 PRODUCTS & SERVICES

8.16.4 STRATEGY

8.16.5 DEVELOPMENTS

8.17 KEMIN INDUSTRIES INC

8.17.1 OVERVIEW

8.17.2 FINANCIALS

8.17.3 PRODUCTS & SERVICES

8.17.4 STRATEGY

8.17.5 DEVELOPMENTS

8.18 LALLEMAND INC

8.18.1 OVERVIEW

8.18.2 FINANCIALS

8.18.3 PRODUCTS & SERVICES

8.18.4 STRATEGY

8.18.5 DEVELOPMENTS

8.19 LESAFFRE FEED ADDITIVES

8.19.1 OVERVIEW

8.19.2 FINANCIALS

8.19.3 PRODUCTS & SERVICES

8.19.4 STRATEGY

8.20 NOVOZYMES AS

8.20.1 OVERVIEW

8.20.2 FINANCIALS

8.20.3 PRODUCTS & SERVICES

8.20.4 STRATEGY

8.20.5 DEVELOPMENTS

8.21 NOVUS INTERNATIONAL INC

8.21.1 OVERVIEW

8.21.2 FINANCIALS

8.21.3 PRODUCTS & SERVICES

8.21.4 STRATEGY

8.21.5 DEVELOPMENTS

8.22 NUTRECO HOLDING N.V.

8.22.1 OVERVIEW

8.22.2 FINANCIALS

8.22.3 PRODUCTS & SERVICES

8.22.4 STRATEGY

8.22.5 DEVELOPMENTS

8.23 PHIBRO ANIMAL HEALTH CORP

8.23.1 OVERVIEW

8.23.2 FINANCIALS

8.23.3 PRODUCTS & SERVICES

8.23.4 STRATEGY

8.23.5 DEVELOPMENTS

8.24 PROVIMI HOLDING B.V.

8.24.1 OVERVIEW

8.24.2 FINANCIALS

8.24.3 PRODUCTS & SERVICES

8.24.4 STRATEGY

8.24.5 DEVELOPMENTS

8.25 SICHUAN NEW HOPE AGRIBUSINESS CO. LTD

8.25.1 OVERVIEW

8.25.2 FINANCIALS

8.25.3 PRODUCTS & SERVICES

8.25.4 STRATEGY

8.25.5 DEVELOPMENTS

APPENDIX

1 U.S. PATENTS

2 EUROPE PATENTS

3 JAPAN PATENTS

LIST OF TABLES

TABLE 1 GLOBAL FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 2 CLASSIFICATION OF BASIC ANIMAL FEED ADDITIVES

TABLE 3 IMPACT OF MAJOR DRIVERS ON GLOBAL FEED ADDITIVES MARKET

TABLE 4 GLOBAL MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (MILLION METRIC TONNES)

TABLE 5 GLOBAL POPULATION TRENDS, 2008 2020 (IN THOUSAND)

TABLE 6 INCREASING PER CAPITA INCOME IN DEVELOPING NATIONS

TABLE 7 ANIMAL FEED PRODUCTION, BY GEOGRAPHY, 2009 2016 (MILLION METRIC TONS)

TABLE 8 GLOBAL MEAT TRADE, BY LIVESTOCK, 2009 2016 (MILLION METRIC TONNES)

TABLE 9 GLOBAL MAIZE PRODUCTION & PRICES (2008 2010)

TABLE 10 GLOBAL WHEAT PRODUCTION & PRICES (2008 2010)

TABLE 11 PORTERS FIVE FORCE ANALYSIS

TABLE 12 FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 13 GLOBAL PER CAPITA MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (KG/PER CAPITA/YEAR)

TABLE 14 ANTIBIOTIC FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 15 ANTIBIOTIC FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 16 DIETARY VITAMIN SUPPLY & VITAMIN REQUIREMENTS IN PORK (INTERNATIONAL UNITS/KILO)

TABLE 17 VITAMIN FEED ADDITIVES MARKET REVENUE, BY VITAMIN TYPES, 2009 2016 ($MILLION)

TABLE 18 VITAMIN FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 19 VITAMIN FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 20 ANTIOXIDANT FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 21 ANTIOXIDANT FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 22 AMINO ACID FEED ADDITIVES MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 23 AMINO ACID FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 24 AMINO ACID FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 25 FEED ENZYMES MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 26 FEED ENZYME MARKET REVENUE,, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 27 FEED ENZYMES MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 28 FEED ACIDIFIERS MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 29 FEED ACIDIFIERS MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 30 ANIMAL FEED PREBIOTICS MARKET, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 31 ANIMAL FEED PROBIOTICS MARKET, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 32 GLOBAL MEAT PRODUCTION FORECAST, BY LIVESTOCK, 2009 2016 (MILLION TONNES)

TABLE 33 GLOBAL FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 34 PORK PER CAPITA CONSUMPTION: MAJOR COUNTRIES, 2009 2016 (KG/YEAR)

TABLE 35 PORK FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 36 MAJOR PORK IMPORTERS IN THE WORLD, 2009 2016 (MILLION TONNES)

TABLE 37 PORK FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 38 PER CAPITA FISH CONSUMPTION IN MAJOR COUNTRIES (KG/YEAR)

TABLE 39 SEA FOOD FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 40 SEA FOOD FEED ADDITIVES MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 41 CATTLE MEAT PER CAPITA CONSUMPTION: MAJOR REGIONS, 2009 2016 (KG/YEAR)

TABLE 42 BEEF & VEAL FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 43 BEEF & VEAL FEED ADDITIVES MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 44 POULTRY PER CAPITA CONSUMPTION: MAJOR COUNTRIES, 2009 2016 (KG/YEAR)

TABLE 45 POULTRY FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 46 POULTRY FEED ADDITIVES MARKET REVENUE, BY REGION, 2009 2016 ($MILLION)

TABLE 47 NORTH AMERICA: PER CAPITA MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (KG/YEAR)

TABLE 48 NORTH AMERICA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 49 NORTH AMERICA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 50 U.S.: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 51 U.S.: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 52 CANADA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 53 CANADA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 54 EUROPE: PER CAPITA MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (KG/YEAR)

TABLE 55 EUROPE: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 56 EUROPE: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 57 GERMANY: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 58 GERMANY: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 59 UK: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 60 UK: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 61 FRANCE: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 62 FRANCE: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 63 RUSSIA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 64 RUSSIA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 65 ASIA: PER CAPITA MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (KG/YEAR)

TABLE 66 ASIA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 67 ASIA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 68 CHINA: PER CAPITA MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (KG/YEAR)

TABLE 69 CHINA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 70 CHINA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 71 INDIA: PER CAPITA MEAT CONSUMPTION, BY LIVESTOCK, 2009 2016 (KG/YEAR)

TABLE 72 INDIA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 73 INDIA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 74 JAPAN: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 75 JAPAN: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 76 BRAZIL: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 77 BRAZIL: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 78 ARGENTINA: FEED ADDITIVES MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 79 ARGENTINA: FEED ADDITIVES MARKET REVENUE, BY LIVESTOCK, 2009 2016 ($MILLION)

TABLE 80 AGREEMENTS & COLLABORATIONS (JANUARY 2008 TO MARCH 2011)

TABLE 81 EXPANSION (JANUARY 2008 TO MARCH 2011)

TABLE 82 MERGERS & ACQUISITIONS (JANUARY 2008 TO MARCH 2011)

TABLE 83 NEW PRODUCT LAUNCHES (JANUARY 2008 TO MARCH 2011)

LIST OF FIGURES

FIGURE 1 SEGMENT WISE MARKET SHARE IN ANIMAL HEALTH INDUSTRY (2010)

FIGURE 2 ANIMAL FEED ADDITIVES MANUFACTURING & DISTRIBUTION CHANNELS

FIGURE 3 BENEFITS OF ANIMAL FEED ADDITIVES

FIGURE 4 PATENT ANALYSIS BY COMPANIES (JANUARY 2005 - FEBRUARY 2011)

FIGURE 5 PATENT ANALYSIS BY GEOGRAPHY (JANUARY 2005 FEBRUARY 2011)

FIGURE 6 PATENT TRENDS IN DIFFERENT GEOGRAPHIES (JANUARY 2005 FEBRUARY 2011)

FIGURE 7 PATENT REGISTRATION TRENDS

FIGURE 8 GLOBAL FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 9 MAJOR PRODUCT SEGMENTS IN FEED ADDITIVES MARKET

FIGURE 10 GLOBAL FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 11 ANTIBIOTIC FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 12 ANTIBIOTIC FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 13 VITAMIN FEED ADDITIVES MARKET, BY TYPES (2010)

FIGURE 14 VITAMIN FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 15 VITAMIN FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 16 ANTIOXIDANT FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 17 ANTIOXIDANT FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 18 AMINO ACIDS FEED ADDITIVES MARKET SHARE, BY TYPES (2010)

FIGURE 19 AMINO ACID FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 20 AMINO ACID FEED ADDITIVES MARKET SHARE, BY REGION, (2010)

FIGURE 21 FEED ENZYMES MARKET SHARE, BY TYPES (2010)

FIGURE 22 FEED ENZYMES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 23 FEED ENZYMES MARKET SHARE, BY REGION (2010)

FIGURE 24 FEED ACIDIFIERS MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 25 FEED ACIDIFIERS MARKET SHARE, BY REGION (2010)

FIGURE 26 ANIMAL FEED PREBIOTICS MARKET, BY GEOGRAPHY (2010)

FIGURE 27 ANIMAL FEED PROBIOTIC MARKET, BY GEOGRAPHY (2010)

FIGURE 28 GLOBAL ANIMAL FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 29 PORK FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 30 PORK FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 31 SEA FOOD FEED ADDITIVES MARKET SHARE, BY PRODUCT TYPES (2010)

FIGURE 32 SEA FOOD FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 33 BEEF & VEAL FEED ADDITIVES MARKET SHARE, BY PRODUCT (2010)

FIGURE 34 BEEF & VEAL FEED ADDITIVES MARKET SHARE, BY REGION, (2010)

FIGURE 35 GLOBALLY RISING POULTRY MEAT TRADE (MILLION TONNES)

FIGURE 36 POULTRY FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 37 POULTRY FEED ADDITIVES MARKET SHARE, BY REGION (2010)

FIGURE 38 U.S.: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 39 U.S.: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 40 CANADA: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 41 CANADA: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 42 GERMANY: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 43 GERMANY: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 44 UK: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 45 UK: FEED ADDITIVES MARKET SHARE BY LIVESTOCK (2010)

FIGURE 46 FRANCE: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 47 FRANCE: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 48 RUSSIA: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 49 RUSSIA: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 50 ASIA: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 51 ASIA: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 52 CHINA: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 53 CHINA: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 54 INDIA: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 55 INDIA: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 56 JAPAN: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 57 JAPAN: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 58 BRAZIL: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 59 BRAZIL: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 60 ARGENTINA: FEED ADDITIVES MARKET SHARE, BY PRODUCTS (2010)

FIGURE 61 ARGENTINA: FEED ADDITIVES MARKET SHARE, BY LIVESTOCK (2010)

FIGURE 62 GROWTH STRATEGIES IN GLOBAL FEED ADDITIVES MARKET (JANUARY 2008 TO MARCH 2011)

FIGURE 63 DEVELOPMENTS IN GLOBAL FEED ADDITIVES MARKET (JANUARY 2008 MARCH 2011)

FIGURE 64 GEOGRAPHY WISE DEVELOPMENTS IN GLOBAL FEED ADDITIVES MARKET (JANUARY 2008 TO MARCH 2011)

FIGURE 65 COMPANY WISE DEVELOPMENTS IN FEED ADDITIVES INDUSTRY (JANUARY 2008 TO MARCH 2011)

Growth opportunities and latent adjacency in Animal Feed Additives Market