Automotive Vehicle-to-Everything (V2X) Market by Offering (Hardware, Software), Type (V2V, V2I, V2P, V2G, V2H, and V2N), Connectivity Type (DSRC and Cellular), Vehicle Type (Passenger and Commercial), Application - Global Forecast to 2022

The automotive V2X market is expected to be valued at USD 767.5 Million in 2017 and is expected to reach USD 2,815.5 Million by 2022, at a CAGR of 29.69% between 2017 and 2022. The automotive V2X market is expected to be commercialized in 2017; therefore, the forecast period considered for the study is between 2017 and 2022.

Objective of the Study:

- To define, describe, and forecast the automotive vehicle-to-everything (V2X) market on the basis of offering, communication type, connectivity type, vehicle type, application, and geography

- To forecast the size of the various market segments with respect to four main regions—North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contributions to the total market

- To gauge the entry barriers to this market using the Porter’s five forces analysis, along with the value chain analysis and market roadmaps to study the evolution and timeline of the V2X market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape of the market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, new product developments, and research and developments (R&Ds) in the automotive V2X market

Research Methodology:

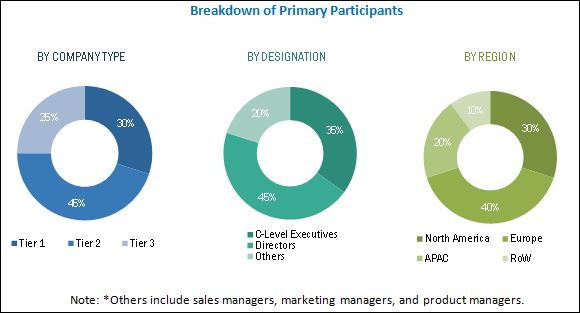

The research methodology used to estimate and forecast the automotive V2X market begins with capturing data through secondary research such as Hoovers, Bloomberg Business, Factiva, and OneSource. The primary sources mainly comprise several industry experts from core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, and standards and certification organizations related to the various segments of this industry’s value chain. Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets in the overall V2X market. After arriving at the overall market size, the total market has been split into several segments and sub-segments which have been verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The automotive V2X market’s value chain consists of V2X systems market, semiconductor market, and automobile manufacturers market. The V2X systems consists of RF transceivers and V2X chipsets and has players like Continental AG (Germany) and Delphi Automotive PLC (U.K.). The semiconductor market provides the V2X processors and has players such as Qualcomm Inc. (U.S.) and Infineon Technologies AG (Germany). The automobile manufacturers include players such as Daimler AG (Germany) and Audi AG (Germany) among others.

Key Target Audience:

- Automobile manufacturers

- Research laboratories in universities

- Government institutions

- Research organizations

- Forums, alliances, and associations

Want to explore hidden markets that can drive new revenue in Automotive Vehicle-to-Everything (V2X) Market?

The research report segments the neuromorphic computing market into the following submarkets:

By Offering:

- Hardware

- Software

By Communication Type:

- Vehicle-to-Vehicle

- Vehicle-to-Infrastructure

- Vehicle-to-Pedestrian

- Vehicle-to-Grid

- Vehicle-to-Home

- Vehicle-to-Network

By Connectivity Type:

- DSRC

- Cellular

By Vehicle Type:

- Passenger

- Commercial

By Application:

- Automated Driver Assistance

- Intelligent Traffic System

- Emergency Vehicle Notification

- Passenger Information System

- Fleet and Asset Management

- Parking Management System

- Remote Monitoring and Diagnostics

- Predictive Maintenance

By Geography:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations:

- Analysis of industries in the automotive vehicle-to-everything market in different geographical regions. Customization can be provided on country-wise analysis of the automotive vehicle-to-everything market with respect to industries.

- Detailed analysis and profiling of additional market players (up to five)

According to the MarketsandMarkets forecast, the automotive V2X market is expected to be valued at USD 767.5 Million in 2017 and is expected to reach USD 2,815.5 Million by 2022, at a CAGR of 29.69% between 2017 and 2022. . Demand for real-time traffic and incident alerts for increasing public safety, increasing financial aid from various government funds for better traffic management, and increased environmental concerns are the key factors driving the growth of the market.

This report segments the automotive V2X market based on offerings, communication type, connectivity type, vehicle type, application, and geography. The market has been segmented on the basis of offering into hardware and software. According to Global Status Report on Road Safety 2015 by World Health Organization, more than 1.2 million people die every year due to road accidents. V2X communication is expected to provide improved active safety, better traffic efficiency and increased situational awareness which are expected to be the major driver for the growth of V2X hardware market.

The vehicle-to-infrastructure system can be used to mitigate vehicle crashes to enable a wide range of other safety, mobility, and environmental benefits. These benefits of V2I communication are the major factors expected to drive the automotive V2I market. In August 2016, Audi announced that it would launch the first V2I technology called Traffic light information on selected models such as Audi Q7, A4 and A4 in the U.S. by early 2017.

Passenger cars constitute the largest segment, accounting for the largest share of the global vehicle production in 2015. Connected passenger vehicles would mean that passenger vehicles, buses, traffic lights, and travelers would communicate with each other throughout the journey. This would have advantages such as less time stuck in traffic, more productivity while travelling, less congestion and emissions, more informed about ways to travel, and fewer traffic accidents. These advantages are expected to drive the passenger vehicles segment in the automotive V2X market based on vehicle type.

There is performance degradation leading to research in cellular connectivity owing to the increase in network load due to high user density. Companies such as Qualcomm Inc. (U.S.) has started testing LTE for V2X system connectivity. Cellular connectivity for V2X system is expected to be commercialized by 2019. This development is expected to drive the cellular connectivity market for automotive V2X market, thereby making it the fastest growing segment.

The growing number of vehicles is a major reason for the growing traffic congestion and increasing greenhouse emissions. According to the U.S. Environmental Protection Agency (EPA), the transportation sector accounted for 26% of the total greenhouse gas emissions in the U.S. in 2014. According to Eurostat, European Environment Agency, fuel combustion for transport is the second-most important source for greenhouse gas emission with 23.2% in 2014.

Intelligent traffic systems would lead to better traffic control and lower gas emissions, thereby acting as a major driver for the high growth of the automotive V2X market in intelligent traffic system.

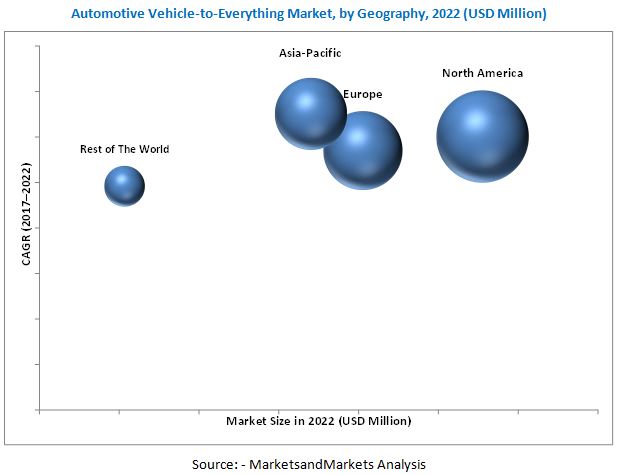

North America is expected to dominate in the automotive V2X market owing to factors such as huge demand for automobiles in the region, favorable policies and regulations by government, and need for a better and effective transportation system. The usage of four wheelers and heavy vehicles is very high in North America, which has resulted in a huge requirement for an effective transportation system. Also, the demand for cars has witnessed a boost recently with the convergence of the ICT sector, the automotive sector, and the transportation sector resulting in the emergence of the connected vehicle ecosystem.

Lack of cellular connectivity coverage, cost burden on consumers, and lack of infrastructure are the major restraints of automotive V2X market. The key players in the automotive vehicle-to-everything (V2X) market are Continental AG (Germany), Delphi Automotive PLC (U.K.), Qualcomm Inc. (U.S.), Infineon Technologies AG (Germany), Daimler AG (Germany), and Audi AG (Germany) among others. Continental AG, Qualcomm Inc. and Daimler AG are the highest-ranked companies in the automotive V2X market. These three players rely on their strong R&D capabilities, diversified product portfolio, global reach, strategic partnerships, and mergers and acquisitions to hold a large share of the automotive V2X market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for This Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Demand-Side and Supply-Side Analysis of the Vehicle-To-Everything Market

2.2.1 Demand-Side Analysis

2.2.1.1 Total Number of Vehicles Produced

2.2.1.2 Growth of Connected Devices

2.2.2 Supply-Side Analysis

2.2.2.1 Incumbent Companies are Providing Enhanced Features

2.2.2.2 Development of Efficient Connectivity Technology

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Market Share Estimation

2.6 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 38)

4.1 Attractive Market Opportunities in the Automotive V2X Market

4.2 Software Expected to Grow at A Higher Rate in Automotive V2X Market Between 2017 and 2022

4.3 Vehicle-To-Vehicle Expected to Dominate the Automotive V2X Market Between 2017 and 2022

4.4 Cellular Connectivity Expected to Be Commercialized By 2019

4.5 Passenger Vehicles Expected to Grow in the Automotive V2X Market, By Vehicle Type

4.6 Application and Region Snapshot of Automotive V2X Market

4.7 China Expected to Grow at the Highest Rate in the Automotive V2X Market Between 2017 and 2022

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Offering

5.3.2 By Communication Type

5.3.3 By Connectivity Type

5.3.4 By Vehicle Type

5.3.5 By Application

5.3.6 By Geography

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Demand for Real-Time Traffic and Incident Alerts for Increasing Public Safety

5.4.1.2 Increasing Financial Aid From Various Governments for Better Traffic Management

5.4.1.3 Increasing Environmental Concerns to Lead to the Adoption of Connected Vehicles

5.4.2 Restraints

5.4.2.1 Lack of Cellular Connectivity Coverage in Developing Countries

5.4.2.2 Cost Burden on Consumers

5.4.2.3 Lack of Infrastructure

5.4.3 Opportunities

5.4.3.1 Autonomous Cars to Transform Automotive Industry

5.4.3.2 Predictive Maintenance Using Real-Time Monitoring

5.4.4 Challenges

5.4.4.1 Lack of Standardization

5.4.4.2 Lack of Willingness to Adopt New Technology

5.4.4.3 Security of Data Generated By Vehicles

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of Substitutes

6.3.4 Threat of New Entrants

6.3.5 Degree of Competition

7 Automotive Vehicle-To-Everything Market, By Offering (Page No. - 62)

7.1 Introduction

7.2 Hardware

7.3 Software

7.3.1 Device Management

7.3.2 Application Management

7.3.3 Network Management

8 Automotive Vehicle-To-Everything Market, By Communication Type (Page No. - 69)

8.1 Introduction

8.2 Vehicle-To-Vehicle (V2V)

8.3 Vehicle-To-Infrastructure (V2I)

8.4 Vehicle-To-Pedestrian (V2P)

8.5 Vehicle-To-Home (V2H)

8.6 Vehicle-To-Grid (V2G)

8.7 Vehicle-To-Network (V2N)

9 Automotive Vehicle-To-Everything Market, By Vehicle Type (Page No. - 78)

9.1 Introduction

9.2 Passenger Vehicles

9.3 Commercial Vehicles

10 Automotive Vehicle-To-Everything Market, By Connectivity Type (Page No. - 87)

10.1 Introduction

10.2 Dedicated Short Range Communication (DSRC) Connectivity

10.3 Cellular Connectivity

11 Automotive Vehicle-To-Everything Market, By Application (Page No. - 94)

11.1 Introduction

11.2 Automated Driver Assistance

11.3 Intelligent Traffic Systems

11.4 Emergency Vehicle Notification

11.5 Passenger Information System

11.6 Fleet & Asset Management

11.7 Parking Management System

11.8 Remote Monitoring & Diagnostics

11.9 Predictive Maintenance

12 Geographic Analysis (Page No. - 106)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 U.K.

12.3.3 France

12.3.4 Italy

12.3.5 Spain

12.3.6 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 South Korea

12.4.4 India

12.4.5 Rest of APAC

12.5 RoW

12.5.1 Middle East & Africa

12.5.2 South America

13 Competitive Landscape (Page No. - 130)

13.1 Overview

13.2 Key Players in the Automotive Vehicle-To-Everything Market

13.3 Competitive Situations and Trends

13.4 Partnerships, Collaborations, Agreements, Expansions & Joint Ventures

13.5 New Product Launches

13.6 Mergers & Acquisitions

14 Company Profiles (Page No. - 137)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

14.2 Continental AG

14.3 Qualcomm Inc.

14.4 Daimler AG

14.5 Delphi Automotive PLC

14.6 Infineon Technologies AG

14.7 Audi AG

14.8 Intel Corporation

14.9 NXP Semiconductors N.V.

14.10 Tomtom N.V.

14.11 International Business Machines Corporation

14.12 Cisco Systems, Inc.

14.13 AT&T Inc.

14.14 Vodafone Group PLC.

14.15 Robert Bosch GmbH

14.16 Harman International Industries, Inc.

14.17 Nvidia Corporation

14.18 Mobileye NV

14.19 PTC Inc.

14.20 Autotalks Limited

14.21 Cohda Wireless PTY Ltd.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 198)

15.1 Insights From Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customization

15.6 Related Reports

15.7 Author Details

List of Tables (67 Tables)

Table 1 Government Initiatives in the V2X Technology Market, 2014–2016

Table 2 Automotive V2X Market, By Offering, 2017–2022 (USD Million)

Table 3 Automotive V2X Market for Hardware Market, By Region, 2017–2022 (USD Million)

Table 4 Automotive V2X Market for Hardware, By Region, 2017–2022 (Thousand Units)

Table 5 Automotive V2X Market for Hardware, By Connectivity Type, 2017–2022 (USD Million)

Table 6 Automotive V2X Market, By Software, 2017–2022 (USD Million)

Table 7 Automotive V2X Market, By Communication Type, 2017–2022 (USD Million)

Table 8 Automotive V2V Market, By Region, 2017–2022 (USD Million)

Table 9 Automotive V2I Market, By Region, 2018–2022 (USD Million)

Table 10 Automotive V2P Market, By Region, 2018–2022 (USD Million)

Table 11 Automotive V2H Market, By Region, 2018–2022 (USD Million)

Table 12 Automotive V2G Market, By Region, 2018–2022 (USD Million)

Table 13 Automotive V2N Market, By Region, 2017–2022 (USD Million)

Table 14 Automotive V2X Market, By Vehicle Type, 2017–2022 (USD Million)

Table 15 Automotive V2X Market, By Vehicle Type, 2017–2022 (Thousand Units)

Table 16 Automotive V2X Market for Passenger Vehicles, By Region, 2017–2022 (USD Million)

Table 17 Automotive V2X Market for Passenger Vehicles, By Region, 2017–2022 (Thousand Units)

Table 18 Automotive V2X Market for Passenger Vehicles, By Connectivity Type, 2017–2022 (USD Million)

Table 19 Automotive V2X Market for Commercial Vehicles, By Vehicle Type, 2017–2022 (USD Million)

Table 20 Automotive V2X Market for Commercial Vehicles, By Region, 2017–2022 (USD Million)

Table 21 Automotive V2X Market for Commercial Vehicles, By Region, 2017–2022 (Thousand Units)

Table 22 Automotive V2X Market for Commercial Vehicles, By Connectivity Type, 2017–2022 (USD Million)

Table 23 Automotive V2X Market, By Connectivity Type, 2017–2022 (USD Million)

Table 24 Automotive V2X Market, By Connectivity Type, 2017–2022 (Thousand Units)

Table 25 Automotive V2X Market for DSRC Connectivity, By Vehicle Type, 2017–2022 (USD Million)

Table 26 Automotive V2X Market for DSRC Connectivity, By Vehicle Type, 2017–2022 (Thousand Units)

Table 27 Automotive V2X Market for Communication Type, By Region, 2017–2022 (USD Million)

Table 28 Automotive V2X Market for Cellular Connectivity, By Vehicle Type, 2019–2022 (USD Million)

Table 29 Automotive V2X Market for Cellular Communication, By Vehicle Tpe, 2019–2022 (Thousand Units)

Table 30 Automotive V2X Market for Cellular Communication, By Region, 2019–2022 (USD Million)

Table 31 Automotive V2X Market, By Application, 2017–2022 (USD Million)

Table 32 Automotive V2X Market for Automated Driver Assistance, By Region, 2017–2022 (USD Million)

Table 33 Automotive V2X Market for Intelligent Traffic Systems, By Region, 2018–2022 (USD Million)

Table 34 Automotive V2X Market for Emergency Vehicle Notifications, By Region, 2018–2022 (USD Million)

Table 35 Automotive V2X Market for Passenger Information Systems, By Region, 2018–2022 (USD Million)

Table 36 Automotive V2X Market for Fleet & Asset Management, By Region, 2018–2022 (USD Million)

Table 37 Automotive V2X Market for Parking Management Systems, By Region, 2018–2022 (USD Million)

Table 38 Automotive V2X Market for Remote Monitoring & Diagnostics, By Region, 2018–2022 (USD Million)

Table 39 Automotive V2X Market for Predictive Maintenance, By Region, 2018–2022 (USD Million)

Table 40 Automotive V2X Market, By Region, 2017–2022 (USD Million)

Table 41 Automotive V2X Market, By Region, 2017–2022 (Thousand Units)

Table 42 Automotive V2X Market in North America, By Country, 2017–2022 (USD Million)

Table 43 Automotive V2X Market in North America, By Country, 2017–2022 (Thousand Units)

Table 44 Automotive V2X Market in North America, By Application, 2017–2022 (USD Million)

Table 45 Automotive V2X Market in North America, By Vehicle Type, 2017–2022 (USD Million)

Table 46 Automotive V2X Market in North America, By Vehicle Type, 2017–2022 (Thousand Units)

Table 47 Automotive V2X Market in Europe, By Country, 2017–2022 (USD Million)

Table 48 Automotive V2X Market in Europe, By Country, 2017–2022 (Thousand Units)

Table 49 Automotive V2X Market in Europe, By Application, 2017–2022 (USD Million)

Table 50 Automotive V2X Market in Europe, By Vehicle Type, 2017–2022 (USD Million)

Table 51 Automotive V2X Market in Europe, By Vehicle Type, 2017–2022 (Thousand Units)

Table 52 Automotive V2X Market in Asia-Pacific, By Country, 2017–2022 (USD Million)

Table 53 Automotive V2X Market in Asia-Pacific, By Country, 2017–2022 (Thousand Units)

Table 54 Automotive V2X Market in Asia-Pacific, By Application, 2017–202 (USD Million)

Table 55 Automotive V2X Market in Asia-Pacific, By Vehicle Type, 2017–2022 (USD Million)

Table 56 Automotive V2X Market in Asia-Pacific, By Vehicle Type, 2017–2022 (Thousand Units)

Table 57 Automotive V2X Market in Rest of the World, By Region, 2017–2022 (USD Million)

Table 58 Automotive V2X Market in Rest of the World, By Region, 2017–2022 (Thousand Units)

Table 59 Automotive V2X Market in Rest of the World, By Application, 2017–2022 (USD Million)

Table 60 Automotive V2X Market in Rest of the World, By Vehicle Type, 2017–2022 (USD Million)

Table 61 Automotive V2X Market in Rest of the World, By Vehicle Type, 2017–2022 (Thousand Units)

Table 62 Continental AG Expected to Lead the V2X Systems Market for Automotive Vehicle-To-Everything Market, 2015

Table 63 Qualcomm Inc. Expected to Lead the Semiconductor Market for Automotive Vehicle-To-Everything Market, 2015

Table 64 Daimler AG Expected to Lead the Automobile Manufacturers Market for Automotive Vehicle-To-Everything Market, 2015

Table 65 Partnerships, Collaborations, Agreements, Expansions & Joint Ventures, 2015–2016

Table 66 New Product Launches, 2016

Table 67 Mergers & Acquisitions, 2015–2016

List of Figures (95 Figures)

Figure 1 Vehicle-To-Everything Market

Figure 2 Automotive Vehicle-To-Everything Market: Research Design

Figure 3 Number of Vehicles Produced, 2012–2015

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Breakdown of Primaries

Figure 7 Data Triangulation

Figure 8 Flow of Report Writing

Figure 9 Automotive V2X Market, By Offering, 2017 vs 2022

Figure 10 Automotive V2X Market, By Communication Type, 2017 vs 2022

Figure 11 Automotive V2X Market, By Vehicle Type, 2017 vs 2022

Figure 12 Automotive V2X Market, By Connectivity Type, 2017 vs 2022

Figure 13 Automotive V2X Market: By Application, 2017 vs 2022

Figure 14 Automotive V2X Market, By Region, 2017

Figure 15 Automotive V2X Market Expected to Grow at A High Rate Between 2017 and 2022

Figure 16 Hardware Expected to Hold A Larger Size of the Automotive V2X Market Between 2017 and 2022

Figure 17 Vehicle-To-Infrastructure Expected to Grow at the Highest Rate Between 2018 and 2022

Figure 18 DSRC Connectivity Expected to Hold A Larger Size of the Automotive V2X Market By 2022

Figure 19 Passenger Vehicles Expected to Hold the Largest Share of the Automotive V2X Market By 2022

Figure 20 Automated Driver Assistance to Hold the Largest Share of the Automotive V2X Market for Applications in 2017

Figure 21 U.S. Likely to Hold the Largest Share of the Automotive V2X Market Between 2017 and 2022

Figure 22 Evolution of Automotive Vehicle-To-Everything Technology

Figure 23 Automotive Vehicle-To-Everything Market, By Geography

Figure 24 Automotive Vehicle-To-Everything Market Dynamics

Figure 25 Number of Road Traffic Deaths, Worldwide

Figure 26 Value Chain Analysis of the Automotive Vehicle-To-Everything Market, 2015

Figure 27 Overview of the Porter’s Five Forces Analysis of the Automotive Vehicle-To-Everything Market (2015)

Figure 28 Automotive Vehicle-To-Everything Market: Porter’s Five Forces Analysis (2015)

Figure 29 High Impact of Bargaining Power of Suppliers on the Automotive V2X Market

Figure 30 Medium Impact of Bargaining Power of Buyers on the Automotive V2X Market

Figure 31 Low Impact of Threat of Substitutes on the Automotive V2X Market

Figure 32 Medium Impact of Threat of New Entrants on the Automotive V2X Market

Figure 33 High Impact of Degree of Competition on the Automotive V2X Market

Figure 34 Automotive V2X Segmentation, By Offering

Figure 35 Automotive V2X Market for Software Expected to Grow at A Higher Rate Between 2017 and 2022

Figure 36 North America Expected to Hold the Largest Size, in Terms of Volume, of the Automotive V2X Hardware Market Between 2017 and 2022

Figure 37 Device Management Expected to Dominate the Automotive V2X Market for Software Between 2017 and 2022

Figure 38 Automotive V2X Segmentation, By Communication Type

Figure 39 V2V Communication Expected to Hold the Largest Size of the Automotive V2X Market Between 2017 and 2022

Figure 40 North America Expected to Dominate the Automotive V2I Market Between 2018 and 2022

Figure 41 Asia-Pacific Expected to Grow at the Highest Rate in the Automotive V2G Market Between 2018 and 2022

Figure 42 Automotive Vehicle-To-Everything Market Segmentation, By Vehicle Type

Figure 43 Passenger Vehicles Expected to Dominate the Automotive Vehicle-To-Everything Market Between 2017 and 2022

Figure 44 Asia-Pacific Expected to Grow at the Highest Rate in the Automotive V2X Market for Passenger Vehicles Between 2017 and 2022

Figure 45 DSRC Connectivity to Hold A Larger Size of the Automotive Vehicle-To-Everything Market for Passenger Vehicle Between 2017 and 2022

Figure 46 Light Commercial Vehicles to Hold A Larger Size of the Automotive V2X Market for Commercial Vehicles Between 2017 and 2022

Figure 47 Asia-Pacific Expected to Grow at the Highest Rate in the Automotive V2X Market for Commercial Vehicles Between 2017 and 2022

Figure 48 Automotive V2X Segmentation, By Connectivity Type

Figure 49 Cellular Connectivity Expected to Grow at A Higher Rate in the Automotive V2X Market Between 2017 and 2022

Figure 50 Passenger Vehicle Expected to Hold A Larger Size of the Automotive V2X Market for DSRC Between 2017 and 2022

Figure 51 Asia-Pacific Expected to Grow at the Highest Rate in the Automotive V2X Market for Cellular Connectivity Between 2019 and 2022

Figure 52 Automotive V2X Segmentation, By Application

Figure 53 Automated Driver Assistance Application Expected to Hold the Largest Size of the Automotive V2X Market Between 2017 and 2022

Figure 54 North America Expected to Hold the Largest Size of the Automotive V2X Market for Automated Driver Assistance Between 2017 and 2022

Figure 55 Asia-Pacific Expected to Grow at the Highest Rate in the Automotive V2X Market for Fleet & Asset Management Between 2018 and 2022

Figure 56 Automotive Vehicle-To-Everything Market Segmentation, By Region

Figure 57 Automotive V2X Market in China Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 58 Snapshot of Automotive Vehicle-To-Everything Market in North America

Figure 59 U.S. Expected to Grow at the Highest Rate in the Automotive V2X Market in North America Between 2017 and 2022

Figure 60 Passenger Vehicles Expected to Dominate the Automotive Vehicle-To-Everything Market, in Terms of Volume, in North America Between 2017 and 2022

Figure 61 Snapshot of Automotive Vehicle-To-Everything Market in Europe

Figure 62 Germany Expected to Hold the Largest Size of the Automotive V2X Market in Europe Between 2017 and 2022

Figure 63 Automated Driver Assistance System Expected to Hold the Largest Size of the Automotive V2X Market in Europe Between 2017 and 2022

Figure 64 Snapshot of Automotive Vehicle-To-Everything Market in APAC

Figure 65 Japan Expected to Hold the Largest Size of the Automotive Vehicle-To-Everything Market in Asia-Pacific Between 2017 and 2022

Figure 66 Passenger Vehicles Expected to Hold A Larger Size of the Automotive V2X Market in Asia-Pacific Between 2017 and 2022

Figure 67 Automated Driver Assistance Systems to Hold the Largest Size of the Automotive V2X Market in RoW Between 2017 and 2022

Figure 68 Passenger Vehicles Expected to Dominate the Automotive V2X Market in Rest of the World Between 2017 and 2022

Figure 69 Companies Adopted Partnerships, Agreements, Expansions, & Collaborations as the Key Growth Strategy in the Past Two Years (2015–2016)

Figure 70 Battle for Market Share: Partnerships, Collaborations, Agreements, Expansions & Joint Ventures Was the Key Strategy Adopted By Companies Between 2015 and 2016

Figure 71 Geographic Revenue Mix of Major Companies

Figure 72 Continental AG: Company Snapshot

Figure 73 SWOT Analysis: Continental Ag

Figure 74 Qualcomm Inc.: Company Snapshot

Figure 75 SWOT Analysis: Qualcomm Inc.

Figure 76 Daimler AG: Company Snapshot

Figure 77 SWOT Analysis: Daimler Ag

Figure 78 Delphi Automotive PLC: Company Snapshot

Figure 79 SWOT Analysis: Delphi Automotive PLC

Figure 80 Infineon Technologies AG: Company Snapshot

Figure 81 SWOT Analysis: Infineon Technologies Ag

Figure 82 Audi AG: Company Snapshot

Figure 83 Audi AG : SWOT Analysis

Figure 84 Intel Corporation: Company Snapshot

Figure 85 NXP Semiconductors: Company Snapshot

Figure 86 Tomtom N.V.: Company Snapshot

Figure 87 International Business Machines Corporation : Company Snapshot

Figure 88 Cisco Systems, Inc.: Company Snapshot

Figure 89 AT&T Inc.: Company Snapshot

Figure 90 Vodafone Group PLC.: Company Snapshot

Figure 91 Bosch Group: Company Snapshot

Figure 92 Harman International Industries Inc.: Company Snapshot

Figure 93 Nvidia Corporation : Company Snapshot

Figure 94 Mobileye NV : Company Snapshot

Figure 95 PTC Inc.: Company Snapshot

Growth opportunities and latent adjacency in Automotive Vehicle-to-Everything (V2X) Market