Clinical Trial Supplies Market by Services (Manufacturing, Packaging, Logistics), Phases, Type (Small Molecules, Biologics), Therapeutic Areas (Oncology, CVD, Infectious, Immunology), End User (Pharma, Biotech, CROs), & Region - Global Forecast to 2028

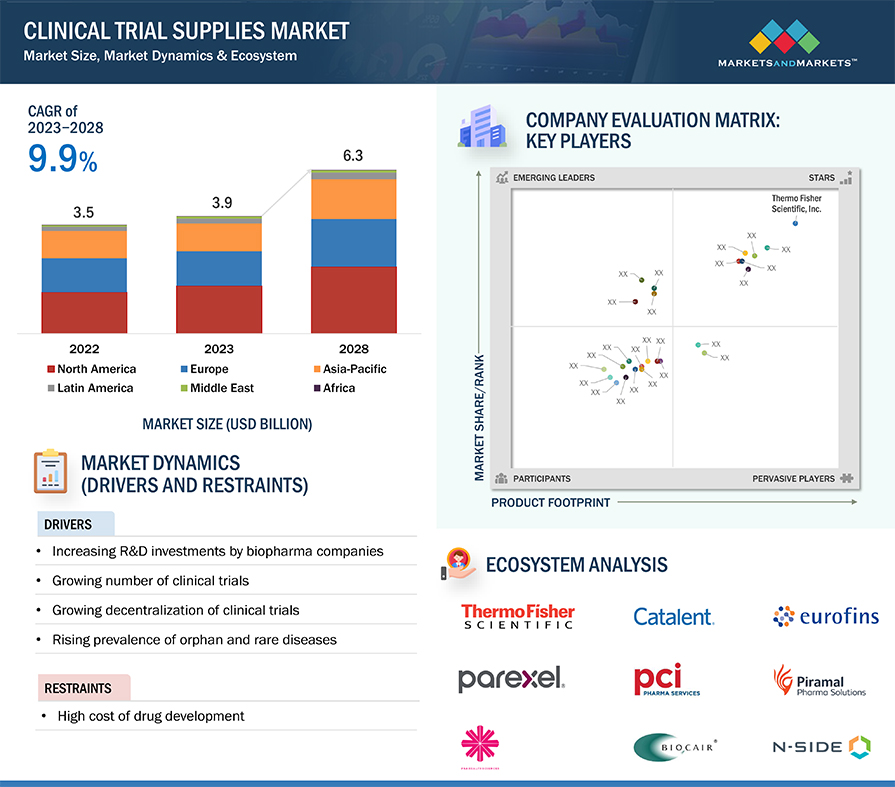

The clinical trial supplies market is projected to reach USD 6.3 billion by 2028 from USD 3.9 billion in 2023, at a CAGR of 9.9 % during the forecast period. The growth of the clinical trial supplies market is driven by increasing trial complexity, particularly with the rise of biologics, biosimilars, and advanced therapies. Heightened regulatory scrutiny and the need for robust temperature-controlled logistics for sensitive materials, such as cell and gene therapies, are driving the adoption of advanced technologies. Furthermore, increasing industrial collaborations for drug development is likely to give momentum to clinical trials supplies market growth.

Clinical Trial Supplies Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Global Clinical Trial Supplies Market Dynamics

Drivers: Increasing the number of registered clinical trials

The growing number of registered clinical trials is a key driver of the clinical trial supplies market. As research into innovative therapeutics expands, the demand for specialized supplies, including comparator drugs, biological samples, and ancillary equipment, has surged. For instance, clinical.gov in 2024 number of registered studies was around 43,680 in a year with 10.0% growth compared to 2023. As of January 2025, around 1,768 clinical trials studies have been registered. The rise in trials targeting complex diseases like cancer, neurological disorders, and rare diseases further intensifies the need for temperature-controlled logistics and advanced packaging solutions, specifically for biologics and cell-based therapies.

The increasing number of registered clinical trials is directly driving market growth by raising demand for advanced packaging, labeling, and delivery solutions. With more trials targeting complex biologics and decentralized models, companies must invest in temperature-controlled packaging, multi-language labeling systems, and direct-to-patient delivery methods to ensure compliance and drug integrity. These needs are creating opportunities for providers of specialized supplies and logistics services.

Restraints: High Cost of clinical trials/drug development

The substantial costs associated with clinical trials represent a critical impediment to the growth of the clinical trial supplies market. The expenses involved encompass trial design, patient recruitment, site management, and logistics, often reaching millions of dollars per trial phase. According to industry estimates, the average cost to bring a new drug to market exceeds ~ USD 1 billion, with a substantial portion allocated to clinical trial phases. The patient recruitment alone constituting up to 40% of total expenses due to the challenges in identifying, enrolling, and retaining suitable participants. Logistics and supply chain complexities, especially for temperature-sensitive biologics, add another layer of expense. For instance, the global distribution of mRNA-based COVID-19 vaccines during clinical trials, which required specialized cold chain solutions, significantly increasing costs.

Opportunities: Growing Decentralized Clinical Trials (DCTs)

The growing adoption of Decentralized Clinical Trials (DCTs) is revolutionizing the clinical trial landscape, creating lucrative growth opportunities in the clinical trial supplies market. DCTs leverage telemedicine, remote monitoring, and digital platforms to bring trials closer to patients, eliminating the need for frequent site visits. This paradigm shift increases the demand for direct-to-patient (DTP) supply models, home healthcare services, and robust logistics networks.

The growing adoption of DCTs has significantly increased the need for advanced supply chain solutions, including real-time tracking technologies and temperature-controlled packaging, to maintain product integrity. Logistics providers that can deliver these capabilities are well-positioned for growth as sponsors and contract research organizations (CROs) emphasize flexibility and a patient-centric approach.

Moreover, DCTs are enhancing trial accessibility for diverse and underserved populations, adding complexity and scale to supply chain operations. Businesses that invest in robust infrastructure, digital technologies, and patient-focused logistics solutions are strategically placed to seize opportunities in this transformative market shift.

Challenges: Supply Chain Complexity

Supply chain complexity is a critical challenge impacting the growth of the clinical trial supplies market. The globalization of clinical trials requires seamless coordination across multiple countries, each with unique regulatory requirements, customs protocols, and logistical hurdles. The need for precise temperature-controlled storage and transportation for biologics and other sensitive products adds to the complexity. Unpredictable patient enrolment and shifting trial designs further complicate demand forecasting, increasing risks of overproduction, stockouts, and waste. Additionally, geopolitical disruptions and supply chain bottlenecks can delay deliveries and compromise trial timelines.

Global Clinical trial supplies Ecosystem Analysis

The clinical trial supplies market operates within a complex ecosystem with a wide array of stakeholders, each playing a crucial role in developing and adopting clinical trial supplies. This ecosystem encompasses service providers, end users, and regulatory bodies. It evaluates their interactions, dependencies, and contributions within the industry, providing insights into the broader market dynamics and trends. Prominent companies in the market include companies operating for several years that possess diversified service portfolios, strong global sales, and marketing networks.

Logistics and distribution segment dominated the clinical trial supplies market in 2022.

The clinical trial supplies market by services is segmented into logistics & distribution, packaging, labelling & binding, storage & retention, manufacturing, comparator sourcing and other services. The logistics & distribution dominated the market in 2022. Logistics and distribution play a critical role in ensuring the timely and compliant delivery of investigational products. Key factors driving their dominance include the complexity of supply chain management, the need to comply with regulatory standards (such as GDP), and the increasing intricacy of trials, particularly those involving decentralized and advanced therapies, which require specialized logistics services.

Small molecule drugs segment dominated the type of segment in clinical trial supplies market in 2022.

The clinical trial supplies market is broadly segmented into biologic drugs, small molecule drugs, and medical devices. The small molecule drugs segment dominated the market in 2022 and anticipated grow at significant rate in coming years. The clinical trial supplies market for small molecules is driven by the consistent development of conventional pharmaceuticals and generics.

Oncology segment is anticipated to grow at significant CAGR during the forecast period.

The clinical trial supplies market is segmented into oncology, infectious diseases, neurology, metabolic disorders, immunology, cardiology, genetic and rare diseases, and other therapeutic areas (respiratory disorders, dermatological disorders, ENT diseases, and nephrology). The areas of oncology, cardiology, and infectious diseases are expected to see the most significant growth. Oncology is the largest therapeutic area in the clinical trial supplies market, owing to high prevalence of cancer, the increasing focus on targeted therapies and immunotherapy, and the complex clinical trial designs required for these therapies.

The pharmaceutical and biotechnology companies segment accounted for the largest share in 2022.

Based on end users, the clinical trial supplies market is further segmented into, pharmaceutical & biotechnology companies, contract research organizations (CROs), and medical device companies. In 2022, the pharmaceutical and biotechnology companies accounted for the largest share of this market. This dominance is driven by their extensive involvement in drug and therapy development, leading to a high demand for clinical trial supplies. The rise of biologics, biosimilars, and advanced therapies like gene and cell therapies has further expanded the need for specialized clinical trial supplies, particularly for temperature-sensitive and highly regulated products.

US dominated North America clinical trial supplies market in 2022.

The market is segmented into six major regions namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa. In 2022, North America dominated the clinical trial supplies market and anticipated grow at significant CAGR during the forecast period of 2023-2028. US dominated North America clinical trial supplies market, driven by presence of robust pharmaceutical and biopharmaceutical companies, advanced healthcare infrastructure, and extensive clinical trials activity. For instance, as per WHO US accounts for more than 20% of the total clinical trials registered across the globe. Europe accounted for second largest share in 2022, some of the factor uplifting the market are companies are increasingly outsourcing clinical trial logistics and supply chain management to specialized service providers in Europe. Asia Pacific witnessing highest growth rate owing to an increase in clinical trials due to its large, diverse patient pool and the growing prevalence of chronic and rare diseases. Furthermore, rapid expansion of the pharmaceutical and biotechnology industries in APAC is driving the need for robust clinical trial infrastructure.

Over the course of the forecast, Asia Pacific is expected to expand somewhat quickly. One of the elements responsible for the expansion is the increase in clinical trials conducted by biotechnology and pharmaceutical businesses. Moreover, the availability of a sizable and varied patient population, less running costs than in industrialised countries, and strong legislative backing for clinical research is probably going to drive regional market expansion.

Clinical Trial Supplies Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players in the market include Thermo Fisher Scientific Inc. (US), Marken (US), Catalent, Inc. (US), Eurofins Scientific (France), and PRA Health Sciences (US), Parexel International (MA) Corporation (US), Biocair (UK), AlmacGroup (UK), Piramal Pharma Solutions (India), Sharp Services, LLC (US), PCI Pharma Services (US), Nuvisan (Germany), Lonza Group (Switzerland), OCT Group LLC (US), Corex Logistic Limited (Ireland), Acnos Pharma GMBH (Germany), Clinical Service International (UK), Klifo (Denmark), Clinigen Limited (UK), Ancillare LP (US), N-Side (Europe), ADAllen pharma (UK), Durbin (UK), Recipharm AB (Sweden), IPS Pharma (UK).

Scope of the Clinical Trial Supplies Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$3.9 billion |

|

Estimated Value by 2028 |

$6.3 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 9.9% |

|

Market Driver |

Increasing the number of registered clinical trials |

|

Market Opportunity |

Growth opportunities in emerging markets |

This report categorizes the clinical trial supplies market to forecast revenue and analyze trends in each of the following submarkets:

By Service

- Logistics & Distribution

- Storage & Retention

- Packaging, Labelling & Blinding

- Manufacturing

- Comparator Sourcing

- Other Services (Solutions and Ancillary supplies)

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

- BA/BE Studies

By Type

- Small-Molecules

- Biologic Drugs

- Medical Devices

By Therapeutic Area

- Oncology

- Infectious Diseases

- Neurology

- Metabolic Disorders

- Immunology

- Cardiology

- Genetic Diseases

- Other Therapeutic Areas (Respiratory diseases, dermatological conditions, rare diseases, ENT diseases, and nephrology)

By End User

- Pharmaceutical and Biotechnology Companies

- Contract Research Organisations (CRO's)

- Medical Device Companies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Netherlands

- Rest of Europe (ROE)

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Singapore

- Rest of Asia Pacific

-

Latin America

- Mexico

- Brazil

- RoLATAM

- Middle East

- Africa

Recent Developments Clinical Trial Supplies Industry

- In July 2023, Thermo Fisher Scientific Inc. (US) and national minority quality forum (NMQF) entered into collaboration with the), which is a non-profit organization dedicated to research and education. This collaboration facilitated through NMQF’s Alliance for Representative Clinical Trials (ARC) in order to increase the inclusion of historically underprivileged patient groups in clinical research.

- In April 2023, Almac Group (UK), introduced the IXRS3 Partnership Network, designed to expedite the creation and deployment of advanced eClinical solutions for biopharmaceutical sponsors.

- In March 2023, Icon Plc (Ireland) and LEO Pharma (Denmark) entered into a strategic partnership in order to enhance LEO Pharma's clinical trial operations, focusing on patient-centricity, cost-efficiency and to strengthen LEO Pharma.

- In August 2022, Marken (US) acquired Bomi Group (Italy) to boost cold chain capacity in key European and Latin American countries and therefore help the expansion in healthcare logistics by strengthening the company's worldwide presence.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global clinical trial supplies market?

The global clinical trial supplies market boasts a total revenue value of $6.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global clinical trial supplies market?

The global clinical trial supplies market has an estimated compound annual growth rate (CAGR) of 9.9% and a revenue size in the region of $3.9 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

-

5.3 CLINICAL TRIAL SUPPLIES MARKET: IMPACT ANALYSISDRIVERS- Increasing R&D investments by biopharma companies- Growing number of clinical trials- Growing decentralization of clinical trials- Rising prevalence of orphan and rare diseases- Increasing outsourcing activities in emerging Asian economiesRESTRAINTS- High cost of drug developmentOPPORTUNITIES- Growth opportunities in emerging markets- Increased investments in development of biologics and biosimilars- Rising demand for specialized testing servicesCHALLENGES- High cost of clinical trials

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 PRICING ANALYSISINDICATIVE PRICING ANALYSIS OF OVERALL CLINICAL TRIALS, BY PHASE.

-

5.6 TECHNOLOGY ANALYSISINTERACTIVE RESPONSE TECHNOLOGY (IRT)

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 ECOSYSTEM ANALYSIS

- 5.9 SUPPLY CHAIN ANALYSIS

- 5.10 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.11 REGULATORY ANALYSISREGULATORY LANDSCAPE FOR CLINICAL TRIAL SUPPLIES- North America- Europe- Asia Pacific- Rest of the WorldREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSDEGREE OF COMPETITION

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR CLINICAL TRIAL SUPPLY SERVICES

- 6.1 INTRODUCTION

-

6.2 LOGISTICS & DISTRIBUTIONINCREASING COMPLEXITY AND EVOLVING TREATMENT PROTOCOLS TO DRIVE DEMAND FOR LOGISTICS & DISTRIBUTION SERVICES

-

6.3 STORAGE & RETENTIONGROWING DEMAND FOR DIRECT-TO-PATIENT AND DIRECT-TO-SITE SERVICES TO DRIVE GROWTH

-

6.4 PACKAGING, LABELING, AND BLINDINGRISING DEMAND FOR ADVANCED PACKAGING TO DRIVE SEGMENTAL GROWTH

-

6.5 MANUFACTURINGGROWING FOCUS OF COMPANIES ON INCREASING MANUFACTURING CAPACITIES TO DRIVE MARKET GROWTH

-

6.6 COMPARATOR SOURCINGINTENSE MARKET COMPETITION AND RISING NUMBER OF CLINICAL TRIALS IN EMERGING COUNTRIES TO DRIVE GROWTH

- 6.7 OTHER SERVICES

- 7.1 INTRODUCTION

-

7.2 PHASE IIILARGE PATIENT POPULATION ASSOCIATED WITH PHASE III TRIALS TO DRIVE DEMAND

-

7.3 PHASE IIABILITY OF PHASE II CLINICAL TRIALS TO PROVIDE CLARITY ON EFFECTIVENESS AND SAFETY OF DRUGS TO DRIVE MARKET GROWTH

-

7.4 PHASE IIMPORTANCE OF QUALITY CLINICAL TRIAL SUPPLIES IN PHASE I CLINICAL TRIALS TO BOOST MARKET

-

7.5 PHASE IVINCREASING NUMBER OF STUDIES UNDER PHASE IV TRIAL TO SUPPORT GROWTH

-

7.6 BA/BE STUDIESINCREASING PATENT EXPIRATION TO INCREASE DEMAND FOR BA/BE STUDIES

- 8.1 INTRODUCTION

-

8.2 SMALL-MOLECULE DRUGSLOW COST OF DEVELOPING SMALL-MOLECULE DRUGS TO DRIVE MARKET GROWTH

-

8.3 BIOLOGIC DRUGSRELATIVELY LOW RATE OF ATTRITION OF BIOLOGIC DRUGS COMPARED TO SMALL-MOLECULE DRUGS TO BOOST GROWTH

-

8.4 MEDICAL DEVICESINCREASING NUMBER OF TRIALS FOR MEDICAL DEVICES TO SUPPORT GROWTH

- 9.1 INTRODUCTION

-

9.2 ONCOLOGYGROWING STUDIES ON CANCER THERAPEUTICS TO DRIVE MARKET GROWTH

-

9.3 INFECTIOUS DISEASESINCREASING CASES OF INFECTIOUS DISEASES TO ACCELERATE EFFORTS TO DEVELOP NEW DRUGS

-

9.4 NEUROLOGYGROWING INVESTMENTS BY PHARMACEUTICAL COMPANIES FOR NEUROLOGY RESEARCH TO DRIVE GROWTH

-

9.5 METABOLIC DISORDERSINCREASING PREVALENCE OF DIABETES AND OTHER METABOLIC DISORDERS TO DRIVE MARKET GROWTH

-

9.6 IMMUNOLOGYCONTINUOUS GROWTH IN CLINICAL STUDIES FOR IMMUNE SYSTEM DISEASES TO FUEL DEMAND FOR CLINICAL TRIAL SUPPLIES

-

9.7 CARDIOLOGYGROWING INVESTMENTS BY PHARMACEUTICAL COMPANIES FOR CVD RESEARCH TO DRIVE GROWTH

-

9.8 GENETIC & RARE DISEASESINCREASING R&D FOR DEVELOPMENT OF EFFECTIVE DRUGS TO DRIVE DEMAND

- 9.9 OTHER THERAPEUTIC AREAS

- 10.1 INTRODUCTION

-

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESINCREASING OUTSOURCING OF CLINICAL TRIAL SUPPLIES BY PHARMA & BIOTECH COMPANIES TO BOOST MARKET

-

10.3 CONTRACT RESEARCH ORGANIZATIONSINCREASING OUTSOURCING OF CLINICAL TRIALS TO DRIVE ADOPTION OF CLINICAL TRIAL SUPPLIES AMONG CROS

-

10.4 MEDICAL DEVICE COMPANIESINCREASING NUMBER OF TRIALS OF MEDICAL DEVICES TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Increasing R&D investments to drive market growth in USCANADA- Growing preference of pharmaceutical companies to conduct trials in Canada to favor market growthNORTH AMERICA: RECESSION IMPACT

-

11.3 EUROPEGERMANY- Growing number of sponsored trials to boost demand for clinical trial supplies in GermanyUK- Government policies leading to costlier R&D and supply chain restrictions post Brexit to limit market growthFRANCE- Presence of leading pharmaceutical companies to support market growth in FranceITALY- Increasing number of drug approvals to drive market for clinical trial supplies in ItalySPAIN- Increasing biologics production to support market growth in SpainSWITZERLAND- Growing R&D efforts to provide growth opportunities for clinical trial supplies market in SwitzerlandNETHERLANDS- Increasing pharmaceutical production to boost clinical trial supplies market in NetherlandsREST OF EUROPEEUROPE: RECESSION IMPACT

-

11.4 ASIA PACIFICCHINA- Favorable government regulations to boost market growth in ChinaJAPAN- Government initiatives for drug innovation to support market growthINDIA- Low manufacturing costs and skilled workforce to attract outsourcing and investments to IndiaAUSTRALIA- Presence of many research institutes conducting clinical trials to boost market growthSOUTH KOREA- Government investments to contribute to market growth in South KoreaSINGAPORE- Presence of world-class infrastructure to drive market growth in SingaporeREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 LATIN AMERICABRAZIL- Growth in pharmaceutical R&D to support market growthMEXICO- Growing number of Phase III clinical trials to drive market growthREST OF LATIN AMERICALATIN AMERICA: RECESSION IMPACT

-

11.6 MIDDLE EASTGROWING PRESENCE OF PHARMACEUTICAL COMPANIES TO DRIVE MARKET GROWTHMIDDLE EAST: RECESSION IMPACT

-

11.7 AFRICAGROWING DEMAND FOR OUTSOURCING SERVICES TO DRIVE MARKET GROWTHAFRICA: RECESSION IMPACT

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE SHARE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 COMPANY FOOTPRINTSERVICE FOOTPRINT OF TOP 25 COMPANIESREGIONAL FOOTPRINT OF TOP 25 COMPANIES

-

12.7 COMPANY EVALUATION MATRIX: START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 12.8 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

-

12.9 COMPETITIVE SCENARIO AND TRENDSSERVICES LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

13.1 KEY MARKET PLAYERSTHERMO FISHER SCIENTIFIC, INC.- Business overview- Services offered- Recent developments- MnM viewCATALENT, INC.- Business overview- Services offered- Recent developments- MnM viewEUROFINS SCIENTIFIC- Business overview- Services offered- MnM viewPIRAMAL PHARMA SOLUTIONS- Business overview- Services offered- Recent developmentsPRA HEALTH SCIENCES (A SUBSIDIARY OF ICON PLC)- Business overview- Services offered- Recent developmentsMARKEN (A SUBSIDIARY OF UPS)- Business overview- Services offered- Recent developmentsPAREXEL INTERNATIONAL (MA) CORPORATION- Business overview- Services offered- Recent developmentsBIOCAIR- Business overview- Services offered- Recent developmentsALMAC GROUP- Business overview- Services offered- Recent developmentsSHARP SERVICES, LLC- Business overview- Services offered- Recent developmentsPCI PHARMA SERVICES- Business overview- Services offered- Recent developmentsNUVISAN- Business overview- Services offered- Recent developmentsLONZA GROUP- Business overview- Services offered

-

13.2 OTHER PLAYERSOCT GROUP LLCCOREX LOGISTICS LIMITEDACNOS PHARMA GMBHCLINICAL SERVICES INTERNATIONALKLIFOCLINIGEN LIMITEDANCILLARE LPN-SIDEADALLEN PHARMADURBINRECIPHARM ABIPS PHARMA

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 R&D INVESTMENTS BY MAJOR PLAYERS (2022)

- TABLE 5 LIST OF BIOLOGICS APPROVED BY US FDA, 2022

- TABLE 6 PHASE III ONCOLOGY CLINICAL TRIAL COST (US AND EUROPEAN COUNTRIES)

- TABLE 7 PHASE I ONCOLOGY CLINICAL TRIAL COST (SPAIN)

- TABLE 8 CLINICAL TRIAL SUPPLIES MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 9 CLINICAL TRIAL SUPPLIES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 CLINICAL TRIAL SUPPLIES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 17 CLINICAL TRIAL SUPPLIES MARKET FOR LOGISTICS & DISTRIBUTION SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR LOGISTICS & DISTRIBUTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR LOGISTICS & DISTRIBUTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR LOGISTICS & DISTRIBUTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR LOGISTICS & DISTRIBUTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 CLINICAL TRIAL SUPPLIES MARKET FOR STORAGE & RETENTION SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR STORAGE & RETENTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR STORAGE & RETENTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR STORAGE & RETENTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR STORAGE & RETENTION SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 CLINICAL TRIAL SUPPLIES MARKET FOR PACKAGING, LABELING, AND BLINDING SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PACKAGING, LABELING, AND BLINDING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR PACKAGING, LABELING, AND BLINDING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR PACKAGING, LABELING, AND BLINDING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR LABELING, AND BLINDING SERVICES, COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 CLINICAL TRIAL SUPPLIES MARKET FOR MANUFACTURING SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR MANUFACTURING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR MANUFACTURING SERVICES, COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 CLINICAL TRIAL SUPPLIES MARKET FOR COMPARATOR SOURCING SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR COMPARATOR SOURCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR COMPARATOR SOURCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR COMPARATOR SOURCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR COMPARATOR SOURCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 CLINICAL TRIAL SUPPLIES MARKET FOR OTHER SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 48 CLINICAL TRIAL SUPPLIES MARKET FOR PHASE III CLINICAL TRIALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE III CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE III CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE III CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE III CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 CLINICAL TRIAL SUPPLIES MARKET FOR PHASE II CLINICAL TRIALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE II CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE II CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE II CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE II CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 CLINICAL TRIAL SUPPLIES MARKET FOR PHASE I CLINICAL TRIALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE I CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE I CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE I CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE I CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 CLINICAL TRIAL SUPPLIES MARKET FOR PHASE IV CLINICAL TRIALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE IV CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE IV CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE IV CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHASE IV CLINICAL TRIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 CLINICAL TRIAL SUPPLIES MARKET FOR BA/BE STUDIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR BA/BE STUDIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR BA/BE STUDIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR BA/BE STUDIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR BA/BE STUDIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 CLINICAL TRIAL SUPPLIES MARKET FOR SMALL-MOLECULE DRUGS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 CLINICAL TRIAL SUPPLIES MARKET FOR BIOLOGIC DRUGS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR BIOLOGIC DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR BIOLOGIC DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR BIOLOGIC DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR BIOLOGIC DRUGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 90 NEW FDA-APPROVED ONCOLOGY DRUGS (2023)

- TABLE 91 CLINICAL TRIAL SUPPLIES MARKET FOR ONCOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 CLINICAL TRIAL SUPPLIES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 LIST OF PIPELINE DRUGS FOR NEUROLOGICAL DISORDERS (2020)

- TABLE 102 CLINICAL TRIAL SUPPLIES MARKET FOR NEUROLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 CLINICAL TRIAL SUPPLIES MARKET FOR METABOLIC DISORDERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR METABOLIC DISORDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR METABOLIC DISORDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR METABOLIC DISORDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR METABOLIC DISORDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 LIST OF PIPELINE DRUGS FOR IMMUNOLOGICAL DISORDERS (2022)

- TABLE 113 CLINICAL TRIAL SUPPLIES MARKET FOR IMMUNOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 LIST OF PIPELINE DRUGS FOR CARDIOVASCULAR DISEASES (2023)

- TABLE 119 CLINICAL TRIAL SUPPLIES MARKET FOR CARDIOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR CARDIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR CARDIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR CARDIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR CARDIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 124 CLINICAL TRIAL SUPPLIES MARKET FOR GENETIC & RARE DISEASES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR GENETIC & RARE DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR GENETIC & RARE DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR GENETIC & RARE DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR GENETIC & RARE DISEASES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 LIST OF PIPELINE DRUGS FOR SKIN DISEASES (2022)

- TABLE 130 CLINICAL TRIAL SUPPLIES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 135 CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 CLINICAL TRIAL SUPPLIES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 141 CLINICAL TRIAL SUPPLIES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 143 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 145 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 146 CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICE COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 148 EUROPE: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 151 CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 US: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 159 US: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 160 US: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 US: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 162 US: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 163 CANADA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 164 CANADA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 165 CANADA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 CANADA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 167 CANADA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 168 EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 169 EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 170 EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 171 EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 173 EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 174 GERMANY: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 175 GERMANY: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 176 GERMANY: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 GERMANY: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 178 GERMANY: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 179 UK: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 180 UK: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 181 UK: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 UK: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 183 UK: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 184 FRANCE: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 185 FRANCE: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 186 FRANCE: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 FRANCE: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 188 FRANCE: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 189 ITALY: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 190 ITALY: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 191 ITALY: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 ITALY: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 193 ITALY: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 SPAIN: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 195 SPAIN: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 196 SPAIN: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 SPAIN: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 198 SPAIN: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 199 SWITZERLAND: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 200 SWITZERLAND: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 201 SWITZERLAND: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 SWITZERLAND: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 203 SWITZERLAND: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 204 NETHERLANDS: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 205 NETHERLANDS: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 206 NETHERLANDS: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 NETHERLANDS: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 208 NETHERLANDS: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 209 REST OF EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 210 REST OF EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 211 REST OF EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 REST OF EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 213 REST OF EUROPE: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 219 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 220 CHINA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 221 CHINA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 222 CHINA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 CHINA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 224 CHINA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 225 JAPAN: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 226 JAPAN: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 227 JAPAN: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 JAPAN: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 229 JAPAN: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 230 INDIA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 231 INDIA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 232 INDIA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 INDIA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 234 INDIA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 235 AUSTRALIA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 236 AUSTRALIA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 237 AUSTRALIA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 AUSTRALIA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 239 AUSTRALIA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 240 SOUTH KOREA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 241 SOUTH KOREA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 242 SOUTH KOREA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 SOUTH KOREA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 244 SOUTH KOREA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 245 SINGAPORE: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 246 SINGAPORE: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 247 SINGAPORE: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 248 SINGAPORE: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 249 SINGAPORE: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 260 LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 261 BRAZIL: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 262 BRAZIL: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 263 BRAZIL: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 BRAZIL: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 265 BRAZIL: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 266 MEXICO: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 267 MEXICO: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 268 MEXICO: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 269 MEXICO: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 270 MEXICO: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 275 REST OF LATIN AMERICA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 276 MIDDLE EAST: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 277 MIDDLE EAST: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 278 MIDDLE EAST: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 MIDDLE EAST: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 280 MIDDLE EAST: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 281 AFRICA: CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 282 AFRICA: CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 283 AFRICA: CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 284 AFRICA: CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2021–2028 (USD MILLION)

- TABLE 285 AFRICA: CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 286 CLINICAL TRIAL SUPPLIES MARKET: DEGREE OF COMPETITION

- TABLE 287 CLINICAL TRIAL SUPPLIES MARKET: COMPANY SERVICE FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 288 CLINICAL TRIAL SUPPLIES MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 289 CLINICAL TIAL SUPPLIES MARKET: DETAILED LIST OF KEY START-UP/SME PLAYERS

- TABLE 290 CLINICAL TRIAL SUPPLIES MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SME PLAYERS

- TABLE 291 CLINICAL TRIAL SUPPLIES MARKET: SERVICE LAUNCHES, JANUARY 2021–AUGUST 2023

- TABLE 292 CLINICAL TRIAL SUPPLIES MARKET: DEALS, JANUARY 2021–JULY 2023

- TABLE 293 CLINICAL TRIAL SUPPLIES MARKET: OTHER DEVELOPMENTS, JANUARY 2021–JULY 2023

- TABLE 294 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 295 CATALENT, INC.: BUSINESS OVERVIEW

- TABLE 296 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 297 PIRAMAL PHARMA SOLUTIONS: BUSINESS OVERVIEW

- TABLE 298 PRA HEALTH SCIENCES: BUSINESS OVERVIEW

- TABLE 299 UPS: BUSINESS OVERVIEW

- TABLE 300 PAREXEL INTERNATIONAL (MA) CORPORATION: BUSINESS OVERVIEW

- TABLE 301 BIOCAIR: BUSINESS OVERVIEW

- TABLE 302 ALMAC GROUP: BUSINESS OVERVIEW

- TABLE 303 SHARP SERVICES, LLC: BUSINESS OVERVIEW

- TABLE 304 PCI PHARMA SERVICES: BUSINESS OVERVIEW

- TABLE 305 NUVISAN: BUSINESS OVERVIEW

- TABLE 306 LONZA GROUP: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 CLINICAL TRIAL SUPPLIES MARKET: PRIMARY RESPONDENTS

- FIGURE 3 CLINICAL TRIAL SUPPLIES MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2022

- FIGURE 5 MARKET SIZE VALIDATION FROM PRIMARY EXPERTS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 CLINICAL TRIAL SUPPLIES MARKET (DEMAND SIDE): GROWTH ANALYSIS OF DEMAND-SIDE FACTORS

- FIGURE 8 CLINICAL TRIAL SUPPLIES MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 CLINICAL TRIAL SUPPLIES MARKET, BY SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 CLINICAL TRIAL SUPPLIES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC AREA, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 CLINICAL TRIAL SUPPLIES MARKET, BY PHASE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF CLINICAL TRIAL SUPPLIES MARKET

- FIGURE 16 RISING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

- FIGURE 17 SMALL-MOLECULE DRUGS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN CLINICAL TRIAL SUPPLIES MARKET IN 2022

- FIGURE 18 LOGISTICS & DISTRIBUTION SERVICES TO CONTINUE TO DOMINATE MARKET IN 2028

- FIGURE 19 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 20 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH RATES FROM 2023 TO 2028

- FIGURE 21 CLINICAL TRIAL SUPPLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 NUMBER OF REGISTERED CLINICAL TRIALS (2011–2022)

- FIGURE 23 ONGOING CLINICAL TRIALS, BY PHASE (% SHARE), 2022

- FIGURE 24 OVERVIEW OF TOP 20 COMPANIES FOCUSING ON RARE DISEASES (AS OF 2023)

- FIGURE 25 PERCENTAGE OF NEW ACTIVE SUBSTANCES LAUNCHED WITH ORPHAN DRUG DESIGNATION, 2012–2022

- FIGURE 26 TOTAL NUMBER OF NEW DRUGS (NEW CHEMICAL ENTITIES AND BIOLOGICS) APPROVED BY US FDA (2015–2022)

- FIGURE 27 BIOSIMILAR APPROVALS AND LAUNCHES (2015–2022)

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CLINICAL TRIAL SERVICE PROVIDERS

- FIGURE 29 VALUE CHAIN ANALYSIS: RAW MATERIAL AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF CLINICAL TRIAL SUPPLY SERVICES

- FIGURE 31 KEY BUYING CRITERIA FOR END USERS

- FIGURE 32 US CANCER INCIDENCE IN MALES, BY TYPE (2022)

- FIGURE 33 US CANCER INCIDENCE IN FEMALES, BY TYPE (2022)

- FIGURE 34 GLOBAL ONCOLOGY-RELATED CLINICAL TRIALS, 2010–2021 (THOUSAND)

- FIGURE 35 ESTIMATED NUMBER OF INDIVIDUALS WITH DIABETES, 2000–2045 (MILLION)

- FIGURE 36 NORTH AMERICA: CLINICAL TRIAL SUPPLIES MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: CLINICAL TRIAL SUPPLIES MARKET SNAPSHOT

- FIGURE 38 CLINICAL TRIAL SUPPLIES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS (2020–2022)

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 41 CLINICAL TRIAL SUPPLIES MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 42 CLINICAL TRIAL SUPPLIES MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 43 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 44 CATALENT, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 45 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2022)

- FIGURE 46 PIRAMAL PHARMA SOLUTIONS: COMPANY SNAPSHOT (2022)

- FIGURE 47 ICON PLC: COMPANY SNAPSHOT (2022)

- FIGURE 48 UPS: COMPANY SNAPSHOT (2022)

- FIGURE 49 LONZA GROUP: COMPANY SNAPSHOT (2022)

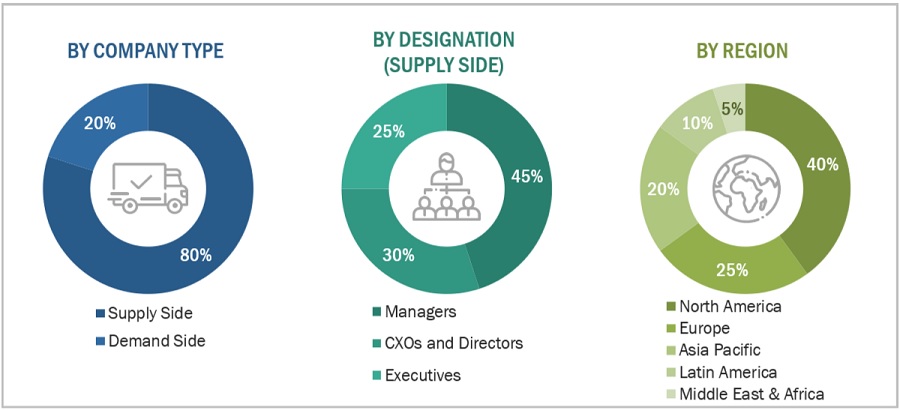

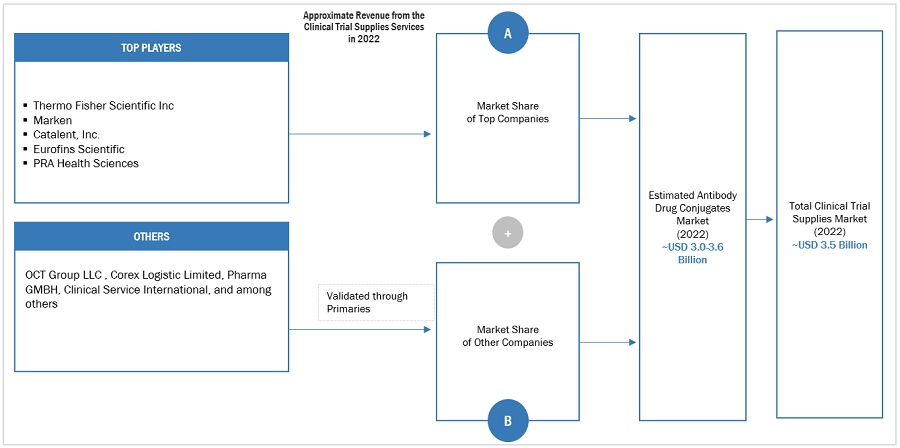

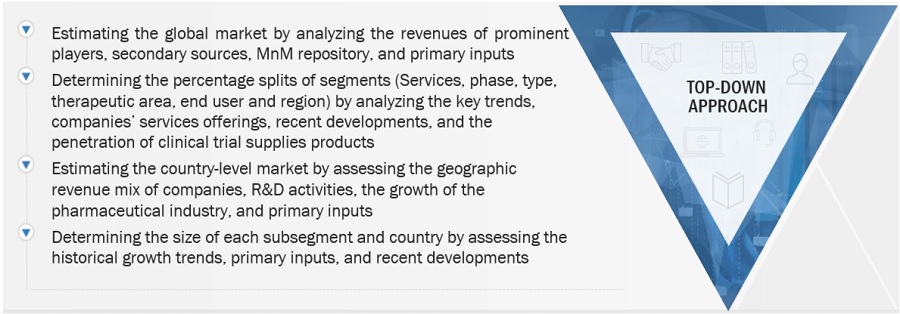

This study involved four major activities in estimating the current size of the clinical trial supplies market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the clinical trial supplies market. The secondary sources used for this study include Association of International Contract Research Organizations (AICROS), American Association of Pharmaceutical Scientists (AAPS), Clinical and Contract Research Association (CCRA), Association of Clinical Research Organizations (ACRO), Food and Drug Administration (FDA), Committee for Medicinal Products for Human Use (CHMP), ClinicalTrials.gov, Association of Clinical Research Professionals (ACRP), Society for Clinical Trials (SCT), American Association for Cancer Research (AACR), American Federation for Medical Research (AFMR), World Health Organization (WHO), Indian Society for Clinical Research (ISCR), Strategic Center of Biomedical Advanced Vaccine Research and Development for Preparedness and Response (SCARDA), Annual Reports, SEC Filings, Investor Presentations, Press Releases, Conferences, Journals, Expert Interviews, and MarketsandMarkets Analysis

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the clinical trial supplies market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The major players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the clinical trial supply service business of players operating in the market have been determined through secondary research and primary analysis.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach-

Data Triangulation

After estimating the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The clinical trial supplies market includes the supply services which are required throughout the process of new drug development. And these services are provided either as end-to-end services throughout the drug development process or as a part of the supply chain of clinical trial supplies.

Key Stakeholders

- Pharmaceutical and biopharmaceutical companies

- Companies Developing Medical Devices

- Manufacturers of clinical trial supplies

- Contract manufacturing organizations (CMOs)

- Life science research institutes

- Venture Capitalists

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the clinical trial supplies market by service, type, phase, therapeutic area, end user and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall clinical trial supplies market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific (APAC), Latin America (LATAM), Middle East and the Africa

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments, such as product launches, acquisitions partnerships, agreements, collaborations, and expansions

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Service Analysis

- Service matrix, which provides a detailed comparison of the service portfolio of each company in the Clinical Trial Supplies Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Trial Supplies Market

What are the major growth strategies prevalent in the Clinical Trial Supplies Market?

Which factors are influencing the global growth of Clinical Trial Supplies Market?

Which are the different geographies covered in the global study of Clinical Trial Supplies Market?