COVID-19 Impact on Airport Operations Market by Technology (Passenger Screening, Baggage Scanners, Smart Tag & RFID, E-gate & E-Kiosk, 5G infrastructure, Cybersecurity Solutions and Ground Support Equipment) and Region - Global Forecast to 2025

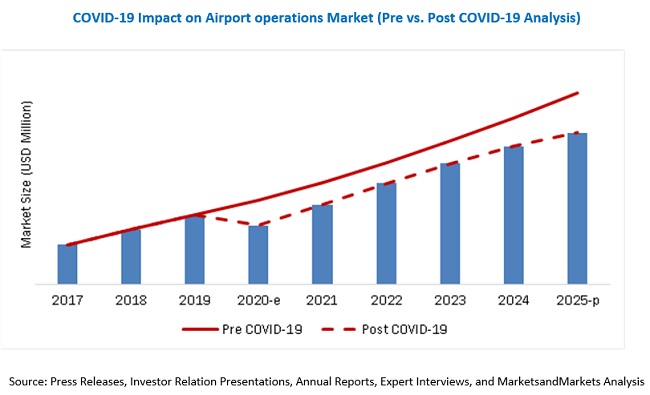

[85 Pages Report] Post COVID-19, the size of the global airport operation market is estimated to grow from USD 8.5 billion in 2020 and projected to reach USD 14.5 billion by 2025, at a CAGR of 11.0%.

The current projection for 2025 is estimated to be lower than pre-COVID-19 estimates. Realistically, the market is expected to recover from mid-2021 and will be struggling with a (12.0)% growth rate from 2020 to 2021. Whereas optimistically speaking, the market is expected to recover from Q3 of 2020 owing to government funding for airport operations and a rise in cargo activity.

FLIR Systems (US), Honeywell (US), SITA (Switzerland), Collins Aerospace (US), Siemens AG (Germany), Fluke Corporation (US), Thales Group (France) Daifuku Co., Ltd. (Japan), Amadeus IT Group (Spain), among others are some of the leading players operating in the airport operations market. These players have adopted growth strategies such as new product developments, contracts, partnerships, agreements, collaborations, and acquisitions to expand their presence in the market further. There are opportunities for innovative companies to manufacture smart biometric solutions, themal imaging , and fever detection scanners.

A major factor driving the growth of the airport operation market is the increasing demand for smart passenger screening and management systems across the globe.

“The ongoing COVID-19 pandemic has led to the suspension of passenger flights, which has caused a setback for the ground support equipment sub-segment of the technology segment of this market”

Ground support equipment on the ramp side of airports is responsible for the smooth and efficient loading and unloading of baggage and cargo from the aircraft as well as the disembarkation and boarding of passengers and crew. As per the IATA, more than 100 countries have implemented travel restrictions because of the COVID-19 crisis. As a result, the ground handlers say that they have lost 95% of their revenues in the Q1 of 2020. Orders for ground support equipment that were scheduled to be delivered in 2020 have also been canceled.

“Travel bans leading to a loss in air traffic have had a substantially negative impact on the Asia Pacific region”

Airports Council International (ACI) Asia-Pacific warns that the prolonged duration of the COVID-19 outbreak will prevent the region’s airports from achieving previously-forecasted growth prospects. The airport association urges regulators and governments to implement well-defined adjustments and relief measures tailored to suit local-level contexts. According to ACI World estimates, Asia Pacific is impacted the worst, with passenger traffic volumes down 24% for the first quarter of 2020 compared to forecasted traffic levels without COVID-19. Within the Asia Pacific region, mainland China, Hong Kong SAR, and the Republic of Korea remain widely affected by sizeable losses in traffic volumes. Meanwhile, there is a sharp spike in the number of COVID-19 cases in several countries in West Asia, which is expected to negatively impact traffic by -4.2% as travelers and airlines adjust their aircraft and seat offerings.

Key Market Players

The major players in the airport operations market are FLIR Systems (US), Honeywell (US), SITA (Switzerland), Collins Aerospace (US), Siemens AG (Germany), Fluke Corporation (US), Thales Group (France) Daifuku Co., Ltd. (Japan), Amadeus IT Group (Spain), among others. These players have adopted various growth strategies such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements to expand their presence in the airport operations market further.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Airport Operations Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Airport Operations Market?

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Technology and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, , and Rest of the World |

|

Companies |

FLIR Systems (US), Honeywell (US), SITA (Switzerland), Collins Aerospace (US), Siemens AG (Germany), Fluke Corporation (US), Thales Group (France) Daifuku Co., Ltd. (Japan), and Amadeus IT Group (Spain), among others |

This research report categorizes the Airport operations Market based on technology and region.

On the basis of technology:

- Baggage Scanners

- Passenger Screening

- Hand Held Scanners

- Walk Through Scanners

- Full Body Scanners

- E-gate & E-Kiosk

- Smart Boarding Systems

- Smart Biometric Systems

- Smart Tag & Kiosk

- Cybersecurity Solutions

- Ground Support Equipment

- 5G Infrastructure

On the basis of region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In 2019, Collins Aerospace entered into a multi-year agreement with Salvador - Deputado Luís Eduardo Magalhães International Airport (SSA). Under the agreement, Collins Aerospace will provide SSA with several industry-leading solutions that help ease congestion, improve passenger processing times, and increase efficiency at the airport.

- In 2019, FLIR systems launched 3 new pan-tilt-zoom (PTZ) security cameras, namely, FLIR Elara DX-Series, FLIR Saros DM-Series, and e FLIR Quasar 4K IR PTZ.

- In 2018, Swissport International Ltd. signed a five-year agreement with Honeywell to deploy the GoDirect Ground Handling solution across its global operation.

Key Questions Addressed by the Report:

- What is the impact of COVID-19 on the airport operation market and its segments?

- What are the drivers for airport operation technology providers?

- How much growth is expected from airport operation technology in the market?

- Who are the major competitors, and what are their growth strategies?

- Who are the major gainers and losers in the airport operation segment?

- Who are the key players and innovators in the ecosystem of the airport operations?

- How is the competitive landscape changing in the client ecosystem and is impacting the revenues of companies?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 7)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 13)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET DEFINITION & SCOPE

2.2.1 SEGMENT DEFINITIONS

2.2.1.1 Impact of COVID-19 on airport operation technologies market, by technology

2.2.2 EXCLUSIONS

2.3 MARKET SIZE ESTIMATION & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.3 DATA TRIANGULATION FROM SECONDARY SOURCES

2.3.4 INSIGHTS FROM PRIMARY SOURCES

2.4 PRIMARY INSIGHTS

2.5 DATA TRIANGULATION

2.6 MARKET SIZING & FORECASTING

2.7 RESEARCH ASSUMPTIONS

3 COVID-19 IMPACT ON AIRPORT ECOSYSTEM (Page No. - 28)

3.1 INTRODUCTION

3.2 IMPACT ON AIRPORT VALUE CHAIN

3.2.1 EQUIPMENT SUPPLIERS

3.2.2 GROUND OPERATORS

3.2.3 SERVICE PROVIDERS

3.2.4 TECHNOLOGY PROVIDERS

3.3 MACRO INDICATORS

3.3.1 DRIVERS

3.3.1.1 Demand for smart technologies and management systems at airports

3.3.2 RESTRAINTS

3.3.2.1 Decrease in Passenger Traffic

3.3.2.2 Reduction in airline capacity utilization & flight operations

4 SHORT-TERM STRATEGIES OF AIRPORT TECHNOLOGY COMPANIES AND OPERATORS (Page No. - 42)

4.1 INTRODUCTION

4.2 IMPACT ON AIRPORT OPERATORS

4.2.1 MAINTAINING CURRENT STATE OF OPERATIONS

4.2.2 HEALTH AND SAFETY OF STAFF, PASSENGERS, AND OTHER STAKEHOLDERS

4.2.3 COST CONTROL AND MANAGING WORKING CAPITAL

4.2.4 MANAGING SUPPLIERS, VENDORS, AND CUSTOMERS

4.2.5 CAPACITY BUILDING TO MITIGATE SIMILAR THREATS

4.3 IMPACT ON AIRPORT TECHNOLOGY COMPANIES

4.3.1 PRODUCT & SERVICE OFFERINGS

4.3.2 ENHANCED CUSTOMER SUPPORT

4.3.3 CONTRACT MANAGEMENT

4.4 WINNING STRATEGIES BY AIRPORT TECHNOLOGY COMPANIES

4.5 MNM VIEWPOINT

5 COVID-19 IMPACT ON AIRPORT OPERATION CUSTOMERS (Page No. - 53)

5.1 INTRODUCTION

5.2 STRATEGIC SHIFTS IN AIRPORT OPERATIONS

5.2.1 BUSINESS/OPERATING MODELS

5.2.2 REVENUE MIX & COST STRUCTURE

5.3 AIRPORT OPERATIONS

5.3.1 CAPACITY UTILIZATION AND COST OPTIMIZATION

5.3.2 TECHNOLOGY USE CASES AND INNOVATION

5.3.3 SPENDING & INVESTMENT PRIORITIES

5.3.4 RISK MANAGEMENT AND BUSINESS CONTINUITY

5.4 AIRPORT BUSINESS STRATEGY

5.4.1 CONNECTED/SMART AIRPORTS

5.4.2 DIGITALIZATION TRENDS

5.4.3 ENHANCING PASSENGER EXPERIENCE

6 IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY TECHNOLOGY (Page No. - 62)

6.1 INTRODUCTION

6.2 IMPACT ON AIRPORT OPERATION TECHNOLOGIES MARKET, 2018-2025, (USD MILLION)

6.2.1 BAGGAGE SCANNERS

6.2.2 PASSENGER SCREENING

6.2.2.1 Handheld scanners

6.2.2.2 Walk-through metal detectors

6.2.2.3 Full-body Scanners

6.2.3 E-GATE & KIOSK

6.2.3.1 Smart biometric systems

6.2.3.2 Smart boarding systems

6.2.4 CYBERSECURITY SOLUTIONS

6.2.5 SMART TAGS & RFID

6.2.6 GROUND SUPPORT EQUIPMENT

6.2.7 5G IN AIRPORTS

7 REGIONAL ANLAYIS (Page No. - 72)

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.2.1 US

7.2.2 CANADA

7.3 EUROPE

7.3.1 GERMANY

7.3.2 FRANCE

7.3.3 UK

7.3.4 ITALY

7.3.5 SPAIN

7.4 ASIA PACIFIC

7.4.1 SOUTH KOREA

7.4.2 JAPAN

7.4.3 INDIA

7.4.4 CHINA

7.5 REST OF THE WORLD

7.5.1 MIDDLE EAST

7.5.2 LATIN AMERICA & AFRICA

8 APPENDIX (Page No. - 85)

8.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

8.2 AUTHOR DETAILS

LIST OF TABLES (27 TABLES)

TABLE 1 IMPACT OF COVID-19 ON EQUIPMENT SUPPLIERS

TABLE 2 IMPACT OF COVID-19 ON GROUND OPERATORS

TABLE 3 IMPACT OF COVID-19 ON SERVICE PROVIDERS

TABLE 4 IMPACT OF COVID-19 ON TECHNOLOGY PROVIDERS

TABLE 5 IMPACT OF COVID-19 ON THE AVIATION INDUSTRY AS OF MARCH 2, 2020, BY REGION/COUNTRY

TABLE 6 CHANGE IN AIRLINE FLIGHT CAPACITY, BY COUNTRY (FIRST QUARTER 2020)

TABLE 7 AIRPORT ACTIONS AMID COVID-19

TABLE 8 EARLY STEPS TAKEN BY AIRPORT OPERATORS AMID COVID-19

TABLE 9 CURRENT STEPS TAKEN BY AIRPORT OPERATORS AMID COVID-19

TABLE 10 MAJOR COST CONTROL STEPS UNDERTAKEN BY AIRPORTS AND AIRLINES

TABLE 11 IMPACT OF COVID-19 ON AIRPORT BUSINESS

TABLE 12 AIRPORT OPERATIONAL ISSUES AND CONSIDERATIONS

TABLE 13 IMPACT OF COVID-19 ON BAGGAGE SCANNERS MARKET, 2019-2025 (USD MILLION)

TABLE 14 IMPACT OF COVID-19 ON HANDHELD SCANNERS MARKET, 2019-2025 (USD MILLION)

TABLE 15 IMPACT OF COVID-19 ON WALK-THROUGH METAL DETECTORS MARKET, 2019-2025 (USD MILLION)

TABLE 16 IMPACT OF COVID-19 ON FULL-BODY SCANNERS MARKET, 2019-2025 (USD MILLION)

TABLE 17 IMPACT OF COVID-19 ON BIOMETRIC SOLUTIONS MARKET 2019-2025 (USD MILLION)

TABLE 18 IMPACT OF COVID-19 ON CYBERSECURITY SOLUTIONS MARKET 2019-2025 (USD MILLION)

TABLE 19 IMPACT OF COVID-19 ON SMART TAGS & KIOSKS MARKET, 2019-2025 (USD MILLION)

TABLE 20 IMPACT OF COVID-19 ON GROUND SUPPORT EQUIPMENT MARKET, 2019-2025 (USD MILLION)

TABLE 21 IMPACT OF COVID-19 ON 5G IN AIRPORTS MARKET, 2019-2025 (USD MILLION)

TABLE 22 IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 23 NORTH AMERICA: IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 24 EUROPE: IMPACT OF COVID-1 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 25 SPAIN: ESTIMATED ECONOMIC LOSS IN AVIATION INDUSTRY DUE TO COVID-19 OUTBREAK, MARCH 2020

TABLE 26 ASIA PACIFIC: IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 27 ROW: IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY REGION, 2018-2025 (USD MILLION

LIST OF FIGURES (30 FIGURES)

FIGURE 1 COVID-19 THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 REPORT PROCESS FLOW

FIGURE 8 IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET: RESEARCH DESIGN

FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 12 INSIGHTS OF AIRPORT STAKEHOLDERS ON COVID-19 IMPACT

FIGURE 13 DATA TRIANGULATION: AIRPORT OPERATION TECHNOLOGIES MARKET

FIGURE 14 ESTIMATED AIRPORT REVENUE LOSSES FOR 2020, BY REGION

FIGURE 15 IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES, BY REGION, 2020

FIGURE 16 YEAR-ON-YEAR PASSENGER MOVEMENT (IN MILLION), WITHOUT COVID-19 IMPACT

FIGURE 17 IMPACT OF COVID-19 ON PASSENGER MOVEMENT (IN MILLION)

FIGURE 18 COVID-19 IMPACT ON AIRLINE REVENUE IN 2020

FIGURE 19 SHIFT IN TECHNOLOGY ADOPTION AMID COVID-19 CRISIS (USD MILLION)

FIGURE 20 QUARTERLY CHANGE IN AIRLINE PASSENGER CAPACITY, BY REGION

FIGURE 21 REALISTIC SCENARIO IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET

FIGURE 22 PESSIMISTIC SCENARIO IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET

FIGURE 23 OPTIMISTIC SCENARIO IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET

FIGURE 24 REALISTIC SCENARIO IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY REGION

FIGURE 25 PESSIMISTIC SCENARIO IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY REGION

FIGURE 26 OPTIMISTIC SCENARIO IMPACT OF COVID-19 ON AIRPORT OPERATION TECHNOLOGIES MARKET, BY REGION

FIGURE 27 US: PASSENGER TRAFFIC CHANGE IN Q-1 2020

FIGURE 28 EUROPE: PASSENGER TRAFFIC CHANGE IN Q-1 2020

FIGURE 29 IMPACT OF COVID-19 ON FRENCH AIRPORTS: AIRCRAFT TRAFFIC FROM FEBRUARY TO MARCH 2020

FIGURE 30 ASIA PACIFIC: PASSENGER TRAFFIC CHANGE IN Q-1 OF 2020

The study involved four major activities for estimating the current market size of the Airport operations Market. Exhaustive secondary research was undertaken to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the market, its segments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to in order to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and MRO software databases.

Primary Research

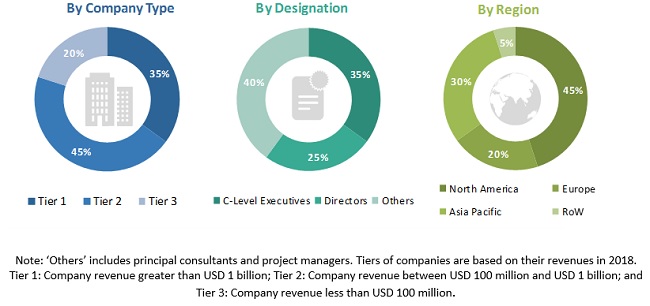

The Airport operations Market comprises several stakeholders, such as software providers, solution providers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by various end users, such as airports and airport technology providers. The supply side is characterized by technological advancements in airport operations. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Airport operations Market. These methods were also used extensively to estimate the size of the various subsegments of the market. The research methodology used to estimate the market size includes the following steps:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Airport Operation arket in the aviation industry.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Airport operations Market

- To analyze the impact of macro and micro indicators on the market

- To forecast the size of the market and its segments for five regions; namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contributions to the overall market

- To identify the short-term strategies adopted by players in the Airport operations Market to tackle the COVID-19 pandemic

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Country Information

- Detailed analysis of countries like Singapore, Brazil, UAE, Russia.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in COVID-19 Impact on Airport Operations Market