COVID-19 Impact on Digital Agriculture Market by Smart Farming Systems (Livestock Monitoring, Yield Monitoring, Crop Scouting, Field Mapping, Real-Time Safety Testing, and Climate Smart), and Region - Global Forecast to 2021

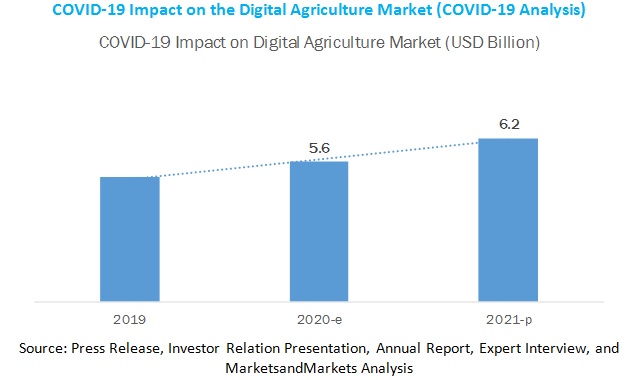

[85 Pages Report] Post COVID-19, the global digital agriculture market size is estimated to grow from USD 5.6 billion in 2020 and is projected to reach USD 6.2 billion by 2021, recording a CAGR of 9.9%. The increase in demand for agricultural food products, shift in consumer preferences to higher standards of food safety and quality, and non-availability of labor during COVID-19 are some of the driving factors for the market.

Increased farm mechanization and developing digital agriculture infrastructure are expected to increase the adoption of digital agriculture among the farmers. The COVID-19 impact on the market is estimated to be positive. Labor shortages and supply chain disruptions are expected to raise the need for digital agriculture, globally.

“Precision farming is the most attractive end-user industry in the digital agriculture market.”

The precision farming market is likely to increase in the long term after the COVID-19 outbreak, as precision farming makes it possible to monitor the state of the crops while not being physically present through the usage of automation, minimizing the need to contact other people, which is crucial during these times. This farming is an approach where inputs are utilized in precise amounts to get increased average yields, compared to traditional cultivation techniques. However, in the short term, COVID-19 would affect the market and the growth of the market would be relatively slower in the first and second quarters of the year 2020 due to economic slowdown and inflation.

These practices save time and costs: reduce fertilizer and chemical application costs, reduce pollution through less use of chemicals. Also, they help in monitoring the soil and plant physiochemical conditions: by placing sensors to measure parameters such as electrical conductivity, nitrates, temperature, evapotranspiration, radiation, and leaf and soil moisture, so that the optimal conditions required for plant growth can be achieved. These factors help to obtain a greater output with limited labor force during this pandemic situation where there is a shortage of labor and thus would help in a regular supply of food, thereby ensuring food security.

“Farm labor management remains the worst affected market during COVID-19.”

With the COVID-19 outbreak, farm labor management remains worst affected in the digital agriculture industry. The pandemic has a significant negative impact on the livelihoods of millions of workers engaged in export-oriented, labor-intensive agricultural production in developing countries. The pandemic may also have a serious impact on processing due to labor shortages and the temporary cessation of production. For example, according to International Labour Organization (ILO) 2020, Europe’s agricultural sector is facing dramatic labor shortages due to border closures that prevent hundreds of thousands of seasonal workers from reaching farms that rely on their labor during the harvest period. The impact on the sector is expected to be long term. Many major European agricultural producers, including France, Germany, Italy, Spain, and Poland, are particularly vulnerable. According to Coldiretti, the Italian organization representing farmers, over a quarter of the food produced in the country relies on approximately 370,000 regular seasonal migrant workers.

Key Market Players

Some of the major players in the market are DTN (US), Farmers Edge (Canada), Taranis (Israel), Eurofins (Luxembourg), and AgriWebb (Australia). DTN specializes in subscription-based services for the analysis and delivery of real-time weather, agricultural, energy, and commodity market information. The company mainly operates through four business segments, namely, agriculture, energy, weather, and financial analytics. The company offers different smart farming systems through the agriculture segment. Its agriculture segment provides an analysis of commodity markets; hyper-local weather and disease insights to guide planting, growing and harvesting operations to farmers and agribusinesses; and a real-time pulse on the industry so they are aware of the trends and how they may affect their operations.

The impact of COVID-19 on DTN is low as of now, but after the second to third quarters of the year 2020, the demand is projected to be revived as the adoption of smart farming technologies will help avoid contamination COVID-19 and require less labor. This crisis has impacted the infrastructure funding in the company due to economic slowdown and recession; industry players are reluctant to invest in the company. The company is witnessing limited disruptions in the supply chain for raw materials such as software and hardware components as the company has its plants still in operation. Despite various challenges and hindrances faced by the company, DTN is delivering essential services globally by providing digitalized farming solutions. Therefore, DTN’s supply and demand are not affected significantly in the digital agriculture division and the impact on business is moderate as of now.

Key Questions Addressed by the Report:

- What is the impact of COVID-19 pandemic on the digital agriculture market and its segments?

- What are the opportunities for digital solution providers?

- How much growth is expected from raw material such as hardware and software component manufacturers in the market?

- Which smart farming system type is lucrative as compared to others?

- Who are the major competitors, and what are their growth strategies?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 11)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

2 COVID 19 IMPACT ON GLOBAL AGRICULTURAL PRODUCTION AND FOOD SECURITY (Page No. - 17)

2.1 INTRODUCTION

2.2 EFFECT ON GLOBAL AGRICULTURAL PRODUCTION

2.3 EFFECT ON GLOBAL FOOD SECURITY

3 COVID-19 IMPACT ON DIGITAL AGRICULTURE ECOSYSTEM (Page No. - 20)

3.1 VALUE CHAIN

3.2 IMPACT ON THE VALUE CHAIN

3.2.1 SOFTWARE APPLICATION SOLUTION PROVIDERS

3.2.2 INFRASTRUCTURE AND PROTOCOL PROVIDERS

3.2.3 DISTRIBUTION AND LOGISTICS

3.2.4 END-USE INDUSTRY

3.3 MACROECONOMIC INDICATORS

3.3.1 DRIVERS

3.3.1.1 Increase in agricultural produce by helping farmers in making informed decisions

3.3.1.2 Growth in consumption of animal-based products and a rise in demand for higher production of animal feed

3.3.2 RESTRAINTS

3.3.2.1 Lack of proper standardization practices

3.3.2.2 Technological awareness among farmers

4 CUSTOMER ANALYSIS (Page No. - 29)

4.1 INTRODUCTION

4.2 SHIFT IN THE AGRICULTURE AUTOMATION/PRECISION FARMING

4.2.1 DISRUPTION IN THE INDUSTRY

4.2.2 IMPACT IN CUSTOMERS OUTPUT & STRATEGIES TO IMPROVE PRODUCTIVITY

4.2.3 NEW MARKET OPPORTUNITIES

4.2.4 RISK MITIGATION STRATEGY

4.3 SHIFT IN THE LIVESTOCK INDUSTRY

4.3.1 DISRUPTION IN THE INDUSTRY

4.3.2 IMPACT IN CUSTOMERS OUTPUT & STRATEGIES TO RESUME/ IMPROVE ANIMAL FEED PRODUCTION

4.3.3 NEW MARKET OPPORTUNITIES

4.3.4 RISK MITIGATION STRATEGY

4.4 SHIFT IN THE FOOD AND FEED SAFETY INDUSTRY

4.4.1 DISRUPTION IN THE INDUSTRY

4.4.2 BIOSECURITY AND SAFETY SOLUTIONS TO ENHANCE TRADE

4.4.3 QUALITY MANAGEMENT SYSTEMS TO COMBAT COVID 19

4.4.4 RISK MITIGATION STRATEGY

5 GROWTH OPPORTUNITIES IN THE DIGITAL AGRICULTURE INDUSTRY (Page No. - 37)

5.1 INTRODUCTION

5.2 SCENARIO-BASED ANALYSIS

5.3 MOST ATTRACTIVE MARKET: IMPACT & OPPORTUNITIES

5.3.1 PRECISION FARMING: SOIL AND CROP MONITORING

5.3.2 LIVESTOCK FARMING: MILK HARVESTING

5.4 WORST-AFFECTED MARKET: IMPACT AND OPPORTUNITIES

5.4.1 FARM LABOR MANAGEMENT

6 SHORT- AND MID-TERM STRATEGY SHIFTS BY DIGITAL AGRICULTURE COMPANIES TO MITIGATE COVID IMPACT (Page No. - 42)

6.1 SHORT- AND MID-TERM STRATEGIES

6.1.1 PRODUCT LEVEL

6.1.2 APPLICATION LEVEL

6.2 REGIONAL/GEOGRAPHIC ANALYSIS

6.2.1 US

6.2.2 ASIA PACIFIC

6.2.3 EUROPE

6.2.4 ROW

6.3 WINNING STRATEGIES IN THE INDUSTRY TO GAIN MARKET SHARE

6.3.1 SHORT-TERM

6.3.2 MID-TERM

6.3.3 LONG-TERM

7 DIGITAL AGRICULTURE MARKET: MARKET OUTLOOK DUE TO COVID-19 (Page No. - 50)

7.1 SMART FARMING SYSTEMS

7.1.1 YIELD MONITORING

7.1.2 FIELD MAPPING

7.1.3 CROP SCOUTING

7.1.4 CLIMATE SMART

7.1.5 LIVESTOCK MONITORING

7.1.6 REAL-TIME SAFETY TESTING

7.2 GEOGRAPHY

7.2.1 INTRODUCTION

7.2.2 ASIA PACIFIC

7.2.2.1 India

7.2.2.2 China

7.2.3 EUROPE

7.2.3.1 Germany

7.2.3.2 France

7.2.3.3 UK

7.2.3.4 Rest of Europe

7.2.4 US

7.2.5 ROW

8 COMPANY PROFILES (Page No. - 69)

(Business Overview, Impact Analysis of COVID-19 Pandemic on Digital Agriculture Ecosystem, Impact Analysis of COVID-19, Winning Strategies in the Industry)

8.1 DTN

8.2 FARMERS EDGE

8.3 TARANIS

8.4 EUROFINS

8.5 AGRIWEBB

*Details on Business Overview, Impact Analysis of COVID-19 Pandemic on Digital Agriculture Ecosystem, Impact Analysis of COVID-19, Winning Strategies in the Industry might not be captured in case of unlisted companies

9 APPENDIX (Page No. - 79)

9.1 INSIGHTS OF INDUSTRY EXPERTS

9.2 DISCUSSION GUIDE

9.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

9.4 AUTHOR DETAILS

LIST OF TABLES (15 Tables)

TABLE 1 RECENT TECHNOLOGIES USED IN DIGITAL AGRICULTURE

TABLE 2 COVID-19 IMPACT ON SMART FARMING SYSTEMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 3 COVID-19 IMPACT ON YIELD MONITORING MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 4 COVID-19 IMPACT ON FIELD MAPPING MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 5 COVID-19 IMPACT ON CROP SCOUTING MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 6 COVID-19 IMPACT ON CLIMATE SMART MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 7 COVID-19 IMPACT ON LIVESTOCK MONITORING MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 8 COVID-19 IMPACT ON REAL-TIME SAFETY TESTING MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 9 COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY REGION/COUNTRY, 2019–2021 (USD MILLION)

TABLE 10 ASIA-PACIFIC: COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY SMART FARMING SYSTEMS, 2019–2021 (USD MILLION)

TABLE 11 ASIA PACIFIC: COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 12 EUROPE: COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY SMART FARMING SYSTEM, 2019–2021 (USD MILLION)

TABLE 13 EUROPE: COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 14 US: COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY SMART FARMING SYSTEM, 2019–2021 (USD MILLION)

TABLE 15 ROW: COVID-19 IMPACT ON DIGITAL AGRICULTURE, BY SMART FARMING SYSTEM, 2019–2021 (USD MILLION)

LIST OF FIGURES (15 Figures)

FIGURE 1 COVID-19 THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 VALUE CHAIN: DIGITAL AGRICULTURE

FIGURE 8 DIGITAL AGRICULTURE MARKET: MACROECONOMIC INDICATORS

FIGURE 9 GLOBAL PER CAPITA CONSUMPTION OF FOOD PRODUCTS, 1964–2030 (KCAL/PERSON/DAY)

FIGURE 10 MEAT CONSUMPTION, BY REGION/COUNTRY, 1961–2018 (MILLION TONNE)

FIGURE 11 ELEMENTS OF UNCERTAINTY: DIGITAL AGRICULTURE MARKET

FIGURE 12 COVID-19 IMPACT SHARE ON DIGITAL AGRICULTURE, BY SMART FARMING SYSTEM, 2019 VS. 2021

FIGURE 13 OVERALL SUPPLY EXPOSURE LEVELS, BY REGION/COUNTRY, 2020

FIGURE 14 COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, BY REGION/COUNTRY, 2020

FIGURE 15 ASIA PACIFIC: COVID-19 IMPACT ON DIGITAL AGRICULTURE MARKET, 2020 (USD MILLION)

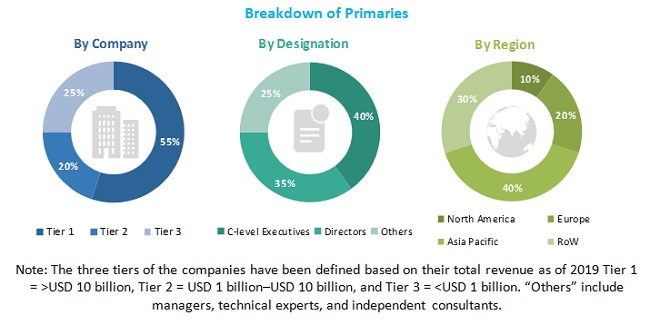

The study involved both secondary and primary research processes in estimating the current size of the global digital agriculture market. Exhaustive secondary research was done to collect information on the market, the peer markets, the parent market, and the impact of COVID-19. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations; white papers, digital agriculture-based marketing-related journals, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through primary research. The secondary data has been gathered and analyzed to arrive at the global digital agriculture market size, which has further been validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply-side include key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants from key companies and organizations operating in the digital agriculture market.

Primary research has also been conducted to identify various segmentation types and key players, as well as to analyze the competitive landscape, key market dynamics (drivers, restraints, and opportunities), and major growth strategies adopted by market players. During the market engineering, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the market, including the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during the complete market engineering process to list the key information/insights throughout the report. Primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the overall digital agriculture market and other dependent submarkets listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights.

Major players in the digital agriculture market have been identified through primary research and secondary research. This involved studying annual and financial reports of top market players and interviews with industry experts (such as CEOs, vice presidents, directors, and marketing executives) for key insights—both quantitative and qualitative.

All percentage shares, splits, breakdowns, and COVID-19 impact estimations have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the digital agriculture market report.

Data Triangulation

After arriving at the overall market size through the process explained above, the total digital agriculture market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives

- To define, describe, forecast, and analyze the digital agriculture market by smart farming system (livestock monitoring, yield monitoring, crop scouting, field mapping, real-time safety testing, and climate-smart) and geography

- To forecast the market for digital agriculture segments with regard to four main countries/regions, namely, the US, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To assess the impact of COVID-19 pandemic on each of the above segments and regions

- To provide detailed information regarding the major factors influencing the growth of the digital agriculture market (drivers and restraints)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the digital agriculture market

- To strategically profile the key players and comprehensively analyze the impact of COVID-19 on their respective lines of businesses

Growth opportunities and latent adjacency in COVID-19 Impact on Digital Agriculture Market

Need information on start-ups in this domain, along with their finances and related information