COVID-19 Impact on Display Panel Market by Product (PC Monitors, Tablets, Smartphones, Wearables, Automotive Displays, TVs, and Large Screen), Industry, and Region - Global Forecast to 2025

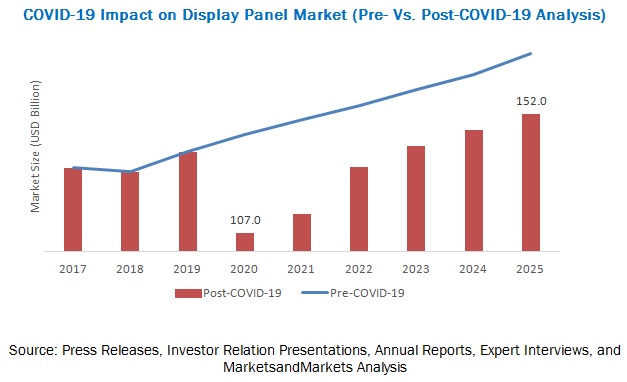

Post-COVID-19, the global display panel market is projected to grow from USD 107.0 billion in 2020 to USD 152.0 billion by 2025, at a CAGR of 7.3%. The estimation for 2020 is down by ~26% compared to the pre-COVID-19 estimate.

Factors that drive the growth of the post-COVID-19 display panel market include the growing acceptance of the work-from-home norm, rising focus of regional financial institutions to design fiscal policies for keeping the display market floating during the COVID-19 crisis, shifting manufacturing units to less affected regions, increasing demand for 4K and 8K displays with the availability of UHD content, surging adoption of OLED displays in smartphones and rising demand for flexible display panels, and increasing investments for the construction of new OLED and LCD panel manufacturing facilities. The booming automotive display industry and rising focus on the development of energy-efficient, attractive, and high-end-specification display products using advanced technologies such as OLED, AMOLED are some other key factors that are likely to foster the market growth.

Lower capacity utilization may adversely impact demand for display panel products

The lockdown, which has resulted in bringing the economic activity to a standstill, is expected to have a greater impact in the coming 2 months with more stringent measures being adopted by the governments across the world. A prolonged lockdown could lead to the temporary shutting down of factories, which will hamper the production and shipments of goods. In the display industry, manufacturers anticipate product shipments to be delayed by more than 8 weeks. However, utilization rates have dropped significantly because of factory closures. Lower capacity utilization is a short-term impact of COVID. The normalcy is likely to rely on the directives enforced by governments as the health of citizens is of utmost importance.

Shifting manufacturing units to less affected regions is expected to propel growth of display panel market

Another short-term strategy that companies are currently undertaking is the shift in manufacturing priorities. For instance, Samsung Electronics and LG Display are shifting their manufacturing units to low-cost areas, such as Vietnam, Korea, Mexico, and other Southeast Asian countries. Automakers and consumer electronics companies have started manufacturing ventilators, masks, and preventive kits to combat the virus, as well as to minimize losses. For example, Ford has entered into a partnership agreement with 3M and GE Healthcare to manufacture respirators and ventilators to fight coronavirus.

Around 200 US companies are focusing on shifting their manufacturing base from China to India to avoid overdependency on China for raw materials. For instance, Apple, an iPhone manufacturer, plans to move some of its manufacturing units to India from China for uninterrupted production. Taipei-listed Wistron is targeting India, along with Vietnam and Mexico. Another iPhone assembler—Pegatron—has also announced its plans to kick-start manufacturing operations in Vietnam by 2021 after setting up a new plant in Indonesia. This strategy leads to higher performance and lowers supply chain risks by making supply chains more resilient.

Potential opportunities for new vendors due to localization of components in long run can mitigate risks of demand-supply

In most cases, as the factories are shut down and logistics taking time, there is a shortage in supply of display components. It is hard to presume to regularize supply until the situation comes back to normal. The whole value chain has gone for a toss. However, in some cases, factories are open but not running at their full capacity; neither they have enough resources. This would take another 3 to 4 months to normalize. Taking all these factors into consideration, display manufacturers are looking at other destinations, such as Vietnam and India, for importing components, thereby providing huge opportunities for them. Additionally, most of the companies are taking COVID-19 Impact on Display Panel Market as a wake-up call for the entire display industry to focus more on the localization of components in the long run. Again, this will generate ample opportunities for vendors to earn a significant market share in the local market. For instance, Samsung is setting up India's first smartphone display manufacturing unit on the outskirts of Delhi and has invested 3,500 crores, which would produce displays for mobile phones and IT displays. India can be considered as a preferable alternative for manufacturing low- and medium-end goods. Samsung Display is partnering with local players providing digital signage solutions to maintain its position and earn better revenue in the competitive market scenario.

Key Market Players

Samsung Display; LG Display; BOE Technology Group Co. Ltd.; AU Optronics Corp.; Innolux Corp.; Japan Display Inc.; Sharp Corp.; China Star Optoelectronics Technology; Tianma Microelectronics Co. Ltd.; and Truly International Holdings Ltd. are a few of the dominating players in the global COVID-19 Impact on Display Panel Market. Other companies involved in the development of display panels include Chunghwa Picture Tubes Ltd.; HannStar Display Corporation; Chengdu Panda Display Technology Co. Ltd; BOE Varitronix Limited; eMagin Corporation; and Kopin Corporation, Apple Inc.; Sony Corporation; E Ink Holdings Inc.; Universal Display Corporation; and JOLED Inc.

Samsung Display

Samsung Display (a subsidiary of Samsung Electronics) is primarily focused on developing display panels. The company has maintained its leading position among global display panel manufacturers and provides a wide variety of display panel products for various applications such as smartphones and TVs. The company’s Display Panel division is engaged in the production of TFT-LCD and OLED panels for TVs, monitors, notebook PCs, mobile devices, and other smart display devices. The group has a widespread geographic presence in countries such as the US, Canada, Korea, and India and comprises 272 subsidiaries.

LG Display

Incorporated in 1985 and headquartered in Seoul, South Korea, LG Display is a part of LG Electronics. The company manufactures display panels for televisions, desktop monitors, notebook computers, tablet computers, mobiles, and other applications (industrial solutions, entertainment systems, automobiles, portable navigation devices, medical diagnostic equipment, etc.).

LG Display has expanded its manufacturing capabilities in recent years by installing new manufacturing plants for LCD and OLED panels. The company offers a wide range of display panels for devices such as television sets, smartphones, tablets, and notebooks, desktops, automobiles, and smart wearables.

Report Scope:

|

Report Metric |

Details |

|

Years considered |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) in million/billion |

|

Product segments covered |

Consumer electronics; automotive; sports & entertainment; healthcare; education; retail, hospitality, & BFSI; defense and aviation; enterprise and industrial; and others |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Samsung Display; LG Display; BOE Technology Group Co., Ltd.; AU Optronics Corp.; Innolux Corp.; Japan Display Inc.; Sharp Corp.; China Star Optoelectronics Technology; Tianma Microelectronics Co., Ltd.; and Truly International Holdings Ltd. |

In this report, the global display panel market is segmented based on product and end-user industry

COVID-19 Impact on Display Panel Market ,by Product

- PC, Monitors & Laptop

- Tablets

- Smartphones

- Smart Wearables

- Automotive Displays

- Large Format Display

- Televisions

COVID-19 Impact on Display Panel Market , by Industry

- Consumer

- Automotive

- Sports & Entertainment

- Transportation

- Retail, Hospitality, & BFSI

- Industrial & Enterprise

- Education

- Healthcare

- Military, Defense, & Aerospace

- Others (Telecommunications, Agriculture, and Construction)

COVID-19 Impact on Display Panel Market , by Region

- North America

- US

- Canada & Mexico

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- South Korea

- Taiwan

- Rest of the World (RoW)

Critical Questions:

- What is the impact of COVID-19 on the display panel market and its product segments?

- What are the opportunities for display panel providers?

- Which end-user industry provides lucrative growth opportunities compared to others?

- Will suppliers continue to explore new avenues for display panels?

- Who are the top 5 players in the display panel market?

- What would be the growth opportunities for the manufacturers of display panels that find applications in various industries?

- What are the key industry trends in the display panel market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 14)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size by top-down approach (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

3.1 PRE-COVID-19

3.2 REALISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

3.4 OPTIMISTIC SCENARIO

4 IMPACT OF COVID-19 ON DISPLAY PANEL MARKET DYNAMICS (Page No. - 35)

4.1 MARKET DYNAMICS

4.1.1 DRIVERS

4.1.1.1 Growing acceptance of work from the home norm

4.1.1.2 Rising focus of regional financial institutions to design fiscal policies for keeping display market floating during COVID-19 crisis

4.1.1.3 Shifting manufacturing units to less affected regions

4.1.1.4 Increasing demand for 4K and 8K displays with the availability of UHD content

4.1.1.5 Surging adoption of OLED displays in smartphones and rising demand for flexible display panels

4.1.1.6 Increasing investments for the construction of new OLED and LCD panel manufacturing facilities

4.1.1.7 Booming automotive displays industry

4.1.1.8 Rising focus on development of energy-efficient, attractive, and high-end-specification display products using advanced technologies

4.1.2 RESTRAINTS

4.1.2.1 Impact on supply chain

4.1.2.2 Lower capacity utilization

4.1.2.3 Restrictions on trading

4.1.2.4 Adverse impact of lockdown and social distancing hamper commercial trades

4.1.2.5 Trade restrictions imposed by US on China

4.1.3 OPPORTUNITIES

4.1.3.1 Need for large number of medical displays to treat increasing number of patients

4.1.3.2 Deployment of touchless kiosks

4.1.3.3 Growing number of vendors adopting OLED display panels for televisions

4.1.3.4 Emerging use cases—smart displays, smart mirrors, smart home appliances

4.1.3.5 Emerging display technologies—micro-LED and true quantum dots

4.1.3.6 Growth in smart wearable display market—AR/VR HMDs and smartwatches

4.1.3.7 Potential opportunities for new vendors due to localization of components in long run

5 SYSTEM AND EXTENDED ECOSYSTEM OF DISPLAY PANEL MARKET (Page No. - 43)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

5.3 COVID-19 IMPACT ON SUPPLY CHAIN OF DISPLAY ECOSYSTEM

5.3.1 IMPLICATIONS ON R&D/RAW MATERIAL AND INPUT SUPPLY

5.3.2 IMPLICATIONS ON MANUFACTURING

5.3.3 IMPLICATIONS ON ASSEMBLY AND INTEGRATION

5.3.4 IMPLICATIONS ON INPUT SUPPLIERS

5.4 POTENTIAL SHIFT IN CLIENTS’ REVENUES

6 IMPACT OF COVID-19 ON DISPLAY BY PRODUCT, TECHNOLOGY, AND PLAYER (Page No. - 47)

6.1 INTRODUCTION

6.2 BY PRODUCT

6.2.1 BIGGEST GAINERS

6.2.1.1 PC monitors and laptops

6.2.2 BIGGEST LOSERS

6.2.2.1 Smartphone

6.3 BY PLAYER

6.3.1 BIGGEST GAINERS

6.3.1.1 Samsung Display

6.3.2 BIGGEST LOSERS

6.3.2.1 LG Display

6.4 BY TECHNOLOGY

6.4.1 BIGGEST GAINERS

6.4.1.1 OLED & Amoled

6.4.2 BIGGEST LOSERS

6.4.2.1 LCD

7 INDUSTRY ANALYSIS (Page No. - 51)

7.1 CONSUMER

7.2 AUTOMOTIVE

7.3 SPORTS & ENTERTAINMENT

7.4 TRANSPORTATION

7.5 RETAIL, HOSPITALITY, AND BFSI

7.6 INDUSTRIAL & ENTERPRISE

7.7 EDUCATION

7.8 HEALTHCARE

7.9 AEROSPACE, DEFENSE, & MILITARY

7.10 OTHERS

8 PRODUCT ANALYSIS (Page No. - 63)

8.1 PC, MONITORS AND LAPTOPS

8.2 LARGE FORMAT DISPLAYS

8.3 TELEVISIONS

8.4 AUTOMOTIVE DISPLAYS

8.5 SMART WEARABLES

8.6 SMARTPHONES

8.7 TABLETS

9 GEOGRAPHIC ANALYSIS (Page No. - 72)

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.2 JAPAN

9.2.3 SOUTH KOREA

9.2.4 TAIWAN

9.3 NORTH AMERICA

9.3.1 US

9.3.2 CANADA AND MEXICO

9.4 EUROPE

9.4.1 GERMANY

9.4.2 UK

9.4.3 FRANCE

9.5 ROW

10 COMPANY PROFILES (Page No. - 89)

10.1 INTRODUCTION

(Business Overview, Products/Solutions/Services offered, Key developments during COVID crisis, and MnM View)*

10.2 KEY PLAYERS

10.2.1 SAMSUNG DISPLAY

10.2.2 LG DISPLAY

10.2.3 BOE TECHNOLOGY

10.2.4 AU OPTRONICS (AUO)

10.2.5 INNOLUX CORPORATION

10.2.6 JAPAN DISPLAY (JDI)

10.2.7 SHARP (FOXCONN)

10.2.8 CHINA STAR OPTOELECTRONICS TECHNOLOGY (CSOT) (CDOT) (TCL)

10.2.9 TIANMA MICROELECTRONICS

10.2.10 TRULY ELECTRONICS

10.3 KEY INNOVATORS

10.3.1 APPLE (LUXVUE)

10.3.2 SONY

10.3.3 E INK HOLDINGS

10.3.4 UNIVERSAL DISPLAY CORP. (UDC)

10.3.5 JOLED

10.3.6 EMAGIN CORPORATION

10.3.7 KOPIN CORPORATION

*Details on (Business Overview, Products/Solutions/Services offered, Key developments during COVID crisis, and MnM View might not be captured in case of unlisted companies.

10.4 SHORT-TERM AND LONG-TERM STRATEGIES

10.4.1 SHORT-TERM STRATEGIES

10.4.1.1 Modify business-related strategies

10.4.1.2 Prioritize companies’ manufacturing essential raw materials

10.4.1.3 Prioritize employee health and safety

10.4.2 MID-TERM STRATEGIES

10.4.2.1 Communicate with relevant stakeholders

10.4.2.2 Build resilience in preparation for new normal

10.4.2.3 Adjust hiring to temporarily adjusted demand

10.4.2.4 Evaluate and adjust procurement strategic priorities

10.4.3 LONG-TERM STRATEGIES

10.4.3.1 Strengthening supply chains

10.4.3.2 Implement digital and automated manufacturing capabilities paired with strong manufacturing excellence

10.4.3.3 Embrace digitalization to evaluate supply chains

10.4.3.4 Invest in more collaborative and agile planning and fulfillment capabilities

11 APPENDIX (Page No. - 115)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AUTHOR DETAILS

LIST OF TABLES (4 Tables)

TABLE 1 COVID-19 IMPACT ON DISPLAY PANEL MARKET BY REGION, 2017–2025 (USD BILLION)

TABLE 2 DISPLAY PANEL MARKET IN APAC, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 3 COVID-19 IMPACT ON DISPLAY PANEL MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 4 DISPLAY PANEL MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD BILLION)

LIST OF FIGURES (52 Figures)

FIGURE 1 COVID-19 THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 DISPLAY PANEL MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 8 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

FIGURE 9 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

FIGURE 10 DATA TRIANGULATION

FIGURE 11 ASSUMPTIONS OF RESEARCH STUDY

FIGURE 12 PRE- AND POST-COVID-19 IMPACT ANALYSIS ON DISPLAY MARKET

FIGURE 13 IMPACT OF COVID-19 ON PRODUCT

FIGURE 14 IMPACT OF COVID-19 ON DISPLAY PANEL, BY REGION

FIGURE 15 MARKET DYNAMICS: DISPLAY MARKET

FIGURE 16 CARES ACT PACKAGE BREAKUP

FIGURE 17 DISRUPTION IN MANUFACTURING ECOSYSTEM

FIGURE 18 COVID-19 IMPACT ON DISPLAY PANEL MARKET : VALUE CHAIN ANALYSIS

FIGURE 19 USE CASES: SHIFT IN CLIENTS’ REVENUES: WITH EXTENDED LENS ON GROW DISPLAY

FIGURE 20 COVID-19 IMPACT ON DISPLAY PANEL MARKET SEGMENTATION, BY INDUSTRY

FIGURE 21 CONSUMER-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 22 AUTOMOTIVE-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 23 SPORTS & ENTERTAINMENT-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 24 TRANSPORTATION-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 25 RETAIL, HOSPITALITY & BFSI-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 26 INDUSTRIAL & ENTERPRISE-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 27 EDUCATION-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 28 HEALTHCARE-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 29 MILITARY, DEFENCE & AEROSPACE-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 30 OTHER INDUSTRY-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 31 COVID-19 IMPACT ON DISPLAY PANEL MARKET SEGMENTATION, BY PRODUCT

FIGURE 32 PC MONITOR & LAPTOP-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 33 LARGE FORMAT DISPLAY-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 34 TELEVISION-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 35 AUTOMOTIVE DISPLAY-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 36 SART WEARABLES-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 37 SMARTPHONES-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 38 TABLET-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 39 COVID-19 IMPACT ON DISPLAY PANEL MARKET, BY REGION

FIGURE 40 APAC-SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 41 CHINA ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 42 JAPAN ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 43 SOUTH KOREA ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 44 TAIWAN ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 45 NORTH AMERICA ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 46 US ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 47 CANADA & MEXICO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 48 EUROPE ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 49 GERMANY ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 50 UK ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 51 FRANCE ANALYSIS: PRE-COVID-19 AND POST-COVID-19

FIGURE 52 ROW ANALYSIS: PRE-COVID-19 AND POST-COVID-19

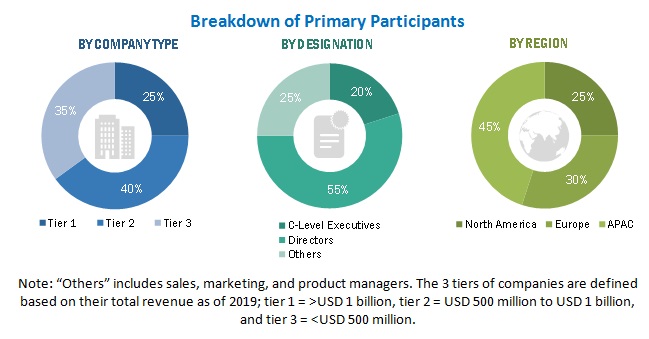

The study involved 4 major activities for estimating the size of the display panel market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, the parent market, and the impact of COVID-19 on the market. The next step involved has been validating these findings, assumptions, and sizing, with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall market size. After that, the market breakdown and data triangulation techniques have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations have been used to identify and collect information for an extensive technical and commercial study of the display panel market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, especially with respect to the impact of COVID-19. Key players in the display panel market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research included studying annual reports of top market players and interviewing key opinion leaders such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the post-COVID-19 size of the display panel market and other dependent submarkets listed on this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

All percentage shares, splits, breakdowns, and COVID-19 impact estimation have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total display panel market has been split into several product segments. To complete the overall market engineering process and arrive at exact statistics for all segments, market breakdown, and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the display panel market, in terms of product and industry

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To assess the impact of COVID-19 on each of the above segments and regions

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the display panel market growth

- To provide a comprehensive overview of the value chain of the display panel ecosystem

- To analyze opportunities for stakeholders in the display panel market by identifying its high-growth product segments and end-user industries

- To identify players in a specific country and region, and types of products in application areas such as commercial; consumer; automotive; industrial and enterprise; military, defense, and aerospace; medical; and education

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the display panel market report.

Company information:

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in COVID-19 Impact on Display Panel Market