COVID-19 Impact on EV and EV Infrastructure Market by Vehicle (Passenger Cars and Commercial Vehicles), Propulsion (BEV, PHEV and FCEV), Charging Station (Normal and Super) and Region - Global Forecast to 2021

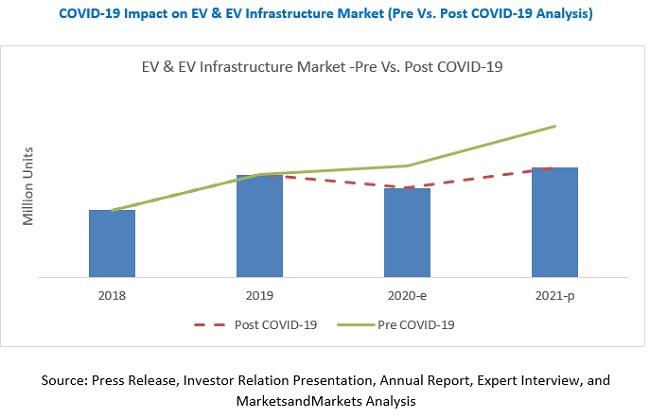

[53 Pages Report] Post COVID-19, the global EV and EV infrastructure market is projected to reach 4.18 million units by 2021 from an estimated 3.42 million units in 2020, at a CAGR of 22.1%. The projection for 2021 is estimated to be down by 34% as compared to pre-COVID estimation.

The electric vehicle market has witnessed rapid evolution with ongoing developments in the automotive sector. Favorable government policies & support in terms of subsidies & grants, tax rebates, and other non-financial benefits in the form of carpool lane access is one of the primary factors driving the growth of the market. New car registrations, specifically in China, where ICE vehicle registration are banned in some urban areas, are also expected to play a crucial role in market growth.

“Sales of electric passenger cars are expected to be the most impacted in the electric vehicle market, by vehicle type, during the forecast period.”

The adoption rate of electric vehicles is increasing, and many countries across the globe are investing heavily in R&D. Countries such as Canada, France, India, the Netherlands, and France have introduced various campaigns to boost the adoption of electric vehicles. However, because of the COVID-19 outbreak, the global automobile industry is facing a slowdown due to the lockdown in several countries that has restricted the production of electric vehicles. The operations of some crucial companies affected by COVID-19 epidemics include Nissan Motor Co., Kia Motors Corp., BMW AG, Daimler AG, and Tesla, Inc. Most of these companies have shut down their electric vehicle production facilities and shifted their focus towards the manufacturing of personal protective equipment.

“Charging station is estimated to be the fastest-growing segment during the forecast period.”

The government stimulus packages in the future could help the EV market get through an economic crisis brought by COVID-19 by investing heavily in charging infrastructure. China is one of the countries set to make such an investment to help stimulate its automotive industry. The Chinese government has emphasized “new infrastructure” as part of a stimulus strategy to boost its economy after the slowdown caused in part by trade tensions and coronavirus. Thus, most governments from affected regions have resorted to infrastructure rehabilitation as an economic stimulus method.

“Electric vehicle components are facing a high revenue drop.”

As the impact of COVID-19 related lockdowns spread during the first quarter of 2020, global electric vehicle sales in major markets, including Europe and the US, are expected to fall significantly. Falling consumer demand, disruption to upstream and downstream supply chains, and government guidelines have now resulted in the suspension and curtailment of production at major automotive OEMs and battery manufacturers. European and US automakers have delayed Asian Li-ion battery shipments initially scheduled for Q2 2020 amid the growing uncertainty for automotive demand.

Key Market Players

Some of the major players in the electric vehicle and electric vehicle infrastructure market are Tesla (US), BYD (China), BMW (Germany), Volkswagen (Germany), and Nissan (Japan), LG Chem (S. Korea), Panasonic (S. Korea), and Bosch (Germany) among others.

Tesla (US) is one of the leading players in this market. The company is continuously delivering new advanced electric vehicles and charging technologies. Despite COVID-19 impact, Tesla delivered more than 88,000 electric vehicles in the first quarter of 2020, surpassing Volkswagen sales. The company has the potential to manufacture highly innovative automobiles and has proved it over a period of time. The company has kept making deliveries in the US despite shutting down production at its Fremont, California factory, and it also started delivering the Model Y — its fifth electric vehicle — this quarter as well.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on EV and EV Infrastructure Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on EV and EV Infrastructure Market?

|

Report Metric |

Details |

|

Market size available for years |

2018–2021 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2021 |

|

Forecast units |

Volume (Units) |

|

Segments covered |

Vehicle type, propulsion type, charging station type |

|

Geographies covered |

North America, Asia Pacific, and Europe |

|

Companies covered |

Tesla (US), BYD (China), BMW (Germany), Volkswagen (Germany), and Nissan (Japan). LG Chem (S. Korea), Panasonic (S. Korea) |

This research report categorizes the given EV and EV infrastructure market based on, vehicle type, propulsion type, charging station type,

Based on vehicle Type:

- Passenger Car

- Commercial Vehicle

Based on the charging station type:

- Normal

- Super

Based on the propulsion type:

- BEV

- PHEV

- FCEV

Based on the region:

- Asia Pacific

- China

- India

- North America

- US

- Europe

- France

- Germany

- Spain

- Norway

Key Questions Addressed by the Report:

- What is the impact of COVID-19 on the electric vehicle market and its segments?

- What are the opportunities for EV charging infrastructure providers?

- How much growth is expected from the electric vehicle charging station segment in the market amide COVID-19 impact?

- What are the company-specific developments amid COVID-19?

- Who are the major competitors in the electric vehicle segment, and what are their growth strategies?

- How will the government support from the affected regions to boost the electric vehicle industry in their respective regions?

- Who are the new entrants in the electric vehicle ecosystem during the COVID-19 pandemic?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 COVID-19

1.2 CONFIRMED CASES AND DEATHS BY GEOGRAPHY

1.3 KEY MEASURES TAKEN BY KEY COUNTRIES

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 ELECTRIC VEHICLE – AN OVERALL ECOSYSTEM

2.3 ELECTRIC VEHICLE ECOSYSTEM AND INDICATION OF IMPACT OF COVID-19 ON ECOSYSTEM

2.2 COMPANIES FROM ELECTRIC VEHICLE ECOSYSTEM & IMPACT ANALYSIS OF COVID-19 ON THEM

2.2.1 COVID-19: COMPANY SPECIFIC DEVELOPMENTS (PRODUCT/USE CASES, SHIFT IN SHORT/LONG TERM STRATEGIES, GEO-SPECIFIC, PARTNERS)

2.3 MACRO-ECONOMIC INDICATORS

2.3.1 SHORT TERM DRIVERS

2.3.2 SHORT TERM RESTRAINTS

3 IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM

3.1 INTRODUCTION

3.2 IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM

3.2.1 REALISTIC SCENARIO: FORECAST 2020-2021

3.2.2 PESSIMISTIC SCENARIO: FORECAST 2020-2021

3.2.3 OPTIMISTIC SCENARIO: FORECAST 2020-2021

3.3 IMPACT OF COVID-19 ON GLOBAL ELECTRIC PASSENGER CAR MARKET

3.3.1 ELECTRIC PASSENGER CAR: FORECAST 2020-2021 WITH PESSIMISTIC, REALISTIC AND OPTIMISTIC SCENARIOS

3.3.2 PRESENCE OF INDUSTRY LEADERS LIKE TESLA AND BYD TO DRIVE THE SEGMENT

3.4 IMPACT OF COVID-19 ON GLOBAL ELECTRIC COMMERCIAL VEHICLE MARKET

3.4.1 ELECTRIC COMMERCIAL VEHICLE: FORECAST 2020-2021 WITH PESSIMISTIC, REALISTIC AND OPTIMISTIC SCENARIOS

3.4.1.1 NATIONWIDE LOCKDOWN ACROSS THE WORLD WOULD LEAD TO SLUGGISH GROWTH OF THE SEGMENT

3.4.2 ELECTRIC BUS: FORECAST 2020-2021 WITH PESSIMISTIC, REALISTIC AND OPTIMISTIC SCENARIOS

3.4.3 ELECTRIC TRUCK: FORECAST 2020-2021 WITH PESSIMISTIC, REALISTIC AND OPTIMISTIC SCENARIOS

3.5 ELECTRIC VEHICLE CHARGING STATION

3.5.1 GOVERNMENT EFFORTS TO RECOVER FROM COVID-19 BY STIMULATING CHARGING INFRASTRUCTURE TO DRIVE THE SEGMENT

3.6 BIGGEST GAINERS AND LOSERS - ELECTRIC VEHICLE ECOSYSTEM MARKET

3.6.1 BIGGEST GAINERS: EV CHARGING INFRASTRUCTURE

3.6.2 BIGGEST GAINERS: ELECTRIC VEHICLE COMPONENT – BATTERIES RAW MATERIALS

3.6.3 BIGGEST LOSERS: OEMS SPREAD ACROSS REGIONS WITH HIGH EV DEMAND

4 IMPACT OF COVID-19 ON ELECTRIC VEHICLE MARKET IN KEY COUNTRIES

4.1 INTRODUCTION

4.2 CHINA

4.3 US

4.4 GERMANY

4.5 FRANCE

4.6 NORWAY

4.7 SPAIN

5 COMPETITIVE LANDSCAPE AND COVID-19

5.1 INTRODUCTION

5.2 LONG-TERM IMPACT ON ELECTRIC VEHICLE COMPANIES & THEIR ECOSYSTEM

5.2.1 COVID-19: CURRENT STATUS AND UPCOMING CHALLENGES

5.2.2 COVID-19: LONG TERM IMPCAT

5.3 RIGHT TO WIN DURING COVID-19 PERIOD

5.3.1 STRATEGIC ALLIANCES DURING COVID-19

5.3.2 A NEW LINE OF BUSINESS EMERGE: EV CHARGING EQUIPMENT AND SERVICES

5.3.3 STRATEGIC INVESTMENT DURING COVID-19

5.3.4 WINNING STRATEGIES TO GAIN THE MARKET MOMENTUM

5.3.4.1 TESLA’S STRATEGIES ON GAINING THE MARKET MOMENTUM

6 CONSUMER TRENDS OUTLOOK

6.1 INTRODUCTION

6.2 DISCONNECT FROM THE CONSUMERS

6.2.1 AUTOMAKERS DISCONNECTED FROM THE MARKET

6.2.2 DIFFICULT TO SUSTAIN WITH LIMITED CAPITAL LIQUIDITY DURING COVID-19

6.2.3 CONSUMER TRENDS – MIRED EV ADOPTION

6.3 CONNECT WITH THE CONSUMERS

6.2.1 CHINESE AUTOMAKERS ARE LOOKING FOR NOVEL WAYS TO REACH CUSTOMERS

LIST OF TABLES (23 TABLES)

TABLE 1 COVID-19 IMPACT ON ELECTRIC VEHICLE ECOSYSTEM

TABLE 2 IMPACT ON ELECTRIC VEHICLE OEMS

TABLE 3 IMPACT ON CRITICAL COMPONENTS SUPPLIERS (SUCH AS BATTERY)

TABLE 4 IMPACT ON ELECTRIC VEHICLE CHARGING INFRASTRUCTURE PROVIDERS

TABLE 5 REALISTIC SCENARIO: IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM MARKET, 2018 VS. 2021 (MILLION UNITS)

TABLE 6 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM MARKET, 2018 VS. 2021 (MILLION UNITS)

TABLE 7 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM MARKET, 2018 VS. 2021 (MILLION UNITS)

TABLE 8 IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY REGION, 2018–2021 (MILLION UNITS) WITH REALISTIC SCENARIO

TABLE 9 IMPACT OF COVID-19 ON ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2018–2021 (UNITS) WITH REALISTIC SCENARIO

TABLE 10 IMPACT OF COVID-19 ON ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS) WITH REALISTIC SCENARIO

TABLE 11 IMPACT OF COVID-19 ON ELECTRIC BUS MARKET, BY REGION, 2018–2021 (UNITS) WITH REALISTIC SCENARIO

TABLE 12 IMPACT OF COVID-19 ON ELECTRIC TRUCK MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 13 IMPACT OF COVID-19 ON NORMAL CHARGING STATIONS, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 14 IMPACT OF COVID-19 ON SUPER CHARGING STATIONS, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 15 ASIA OCEANIA: IMPACT OF COVID-19 ON ELECTRIC VEHICLE MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 16 CHINA: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (UNITS)

TABLE 17 INDIA: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (UNITS)

TABLE 18 EUROPE: IMPACT OF COVID-19 ON ELECTRIC VEHICLE MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 19 GERMANY: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (UNITS)

TABLE 20 FRANCE: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (USD BILLION)

TABLE 21 NORWAY: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (UNITS)

TABLE 22 SPAIN: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (UNITS)

TABLE 23 US: IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR MARKET, BY PROPULSION TYPE, 2018–2021 (‘000 UNITS)

LIST OF FIGURES (14 FIGURES)

FIGURE 1 MARKET SIZE ESTIMATION METHODOLOGY FOR THE ELECTRIC VEHICLE MARKET: BOTTOM-UP APPROACH

FIGURE 2 REALISTIC SCENARIO: IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM MARKET, 2020 VS. 2021 (MILLION UNITS)

FIGURE 3 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM MARKET, 2020 VS. 2021 (MILLION UNITS)

FIGURE 4 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON ELECTRIC VEHICLE ECOSYSTEM MARKET, 2020 VS. 2021 (MILLION UNITS)

FIGURE 5 IMPACT OF COVID-19 ON ELECTRIC PASSENGER CAR, COMPARISON WITH MARKET SCENARIO, 2020 VS 2021 (MILLION UNITS)

FIGURE 6 IMPACT OF COVID-19 ON ELECTRIC COMMERCIAL VEHICLE, COMPARISON WITH MARKET SCENARIO, 2020 VS 2021 (MILLION UNITS)

FIGURE 7 IMPACT OF COVID-19 ON ELECTRIC BUS, COMPARISON WITH MARKET SCENARIO, 2020 VS 2021 (MILLION UNITS)

FIGURE 8 IMPACT OF COVID-19 ON ELECTRIC TRUCK, COMPARISON WITH MARKET SCENARIO, 2020 VS 2021 (UNITS)

FIGURE 9 ELECTRIC VEHICLE CHARGING INFRASTRUCTURE MARKET, BY CHARGING STATION TYPE, 2020 VS 2021 (UNITS)

FIGURE 10 IMPACT OF COVID-19 ON ELECTRIC VEHICLE MARKET WITH AND WITHOUT COVID-19, BY COUNTRY, (MILLION UNITS)

FIGURE 11 ASIA OCEANIA: ELECTRIC VEHICLE MARKET WITH AN IMPACT OF COVID-19, BY COUNTRY, 2020 VS. 2021 (MILLION UNITS)

FIGURE 12 EUROPE: IMPACT OF COVID-19 ON ELECTRIC VEHICLE MARKET, BY COUNTRY, 2020 VS. 2021 (‘000 UNITS)

FIGURE 13 LONG TERM IMPACT OF COVID-19 ON ELECTRIC VEHICLE INDUSTRY

FIGURE 14 E-MOBILITY, SMART MANUFACTURING IN EV INFRASTURCTURE, LIGHTWEIGHTING WHICH WILL IMPACT FUTURE REVENUE MIX!

The study involved four major activities in estimating the current size of the global electric vehicle market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market, and the impact of COVID-19. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of electric vehicles’ OEMs, country-level automotive associations & trade organizations, and the US Department of Transportation (DOT)], electric vehicle magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles were used to identify and collect information useful for an extensive commercial study of the global electric vehicle market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the electric vehicle market size, in terms of volume (units)

- To define, describe, and forecast the electric vehicle market based on charging station type, propulsion type, vehicle type, and region

- To segment and forecast the market by charging station type (normal charging, supercharging)

- To segment and forecast the market by propulsion type [Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV), and Battery Electric Vehicle (BEV)]

- To segment and forecast the market by vehicle type (passenger car and commercial vehicle)

- To assess the impact of COVID-19 on each of the above segments and regions

- To strategically profile the key players and comprehensively analyze the impact of COVID-19 on their respective lines of businesses

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the smart lighting market report.

- Detailed analysis and profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in COVID-19 Impact on EV and EV Infrastructure Market

What will be the decline in overall automotive market you guys expect this year ?

What will be the impact of COVID19 on EV charging infrastructure market ?

Is South America market covered in this report ?