COVID-19 Impact on Fingerprint Sensor Market by Technology (Capacitive, Optical, Thermal and Ultrasonic), Application (Consumer Electronics, Banking & Finance, Travel & Immigration and Government & Law Enforcement) and Region - Global Forecast to 2025

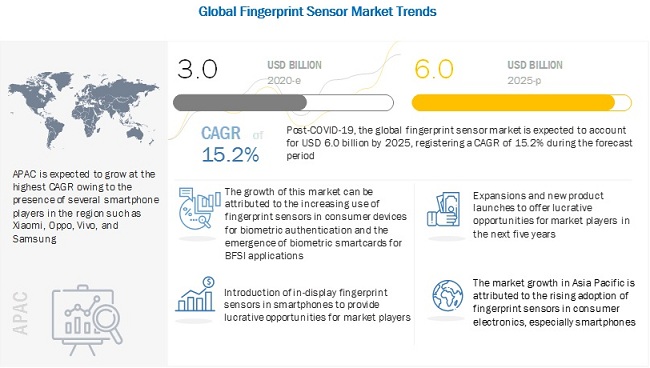

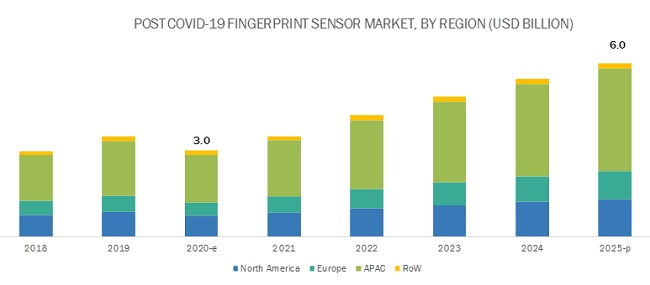

[92 Pages Report] Post-COVID-19, the global fingerprint sensor market size is expected to grow from USD 3.0 billion in 2020 to USD 6.0 billion by 2025, at a CAGR of 15.2%.

The growing use of fingerprint sensors in consumer devices for biometric authentication is one of the primary factors driving the market growth. Moreover, the emergence of biometric smartcards for BFSI applications will drive the demand for these products in the near future.

COVID-19 Impact on the Global Fingerprint Sensor Market

The fingerprint sensor market includes major Tier I and II players like Goodix, Fingerprint Cards, Apple, IDEX Biometrics, ELAN Microelectronics, and Qualcomm. These players have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and RoW. COVID-19 has impacted their businesses as well.

- Foxconn (Taiwan), who manufactures Apple’s iPhones, announced that it halted production activities in China in February 2020 due to the COVID-19 outbreak. The production resumed by the end of March 2020. Also, Apple closed its retail stores across the world in early March 2020 up to the end of the month to curb the spread of COVID-19.

- ELAN Microelectronics announced that its business was majorly affected in February 2020 due to COVID-19, as most of its touch modules were outsourced. To counter the problem, ELAN relocated partial production of its outsourced touchpad module to its in-house production line in Taiwan.

- IDEX Biometrics, on March 24, 2020, announced that it established an internal virus response team, which is responsible for ongoing contingency planning. The company also announced that all travel and face-to-face meetings have been stopped and work from home for the majority of its staff came into effect from March 16, 2020.

COVID-19 Impact on Fingerprint Sensor Market Dynamics

Driver: Emergence of biometric smartcards in BFSI applications

Government, banking and finance, and healthcare are likely to be other key application areas for biometric cards wherein digital security and authentication are of utmost importance. To ensure a secure transaction, financial institutions and banks are involved in extensive testing of payment cards in which fingerprint sensors are used. Due to the COVID-19 pandemic, people are shifting toward the use of biometric smartcards for transactions to reduce the use of cash. The governments across the world, too, are vouching for contactless financial cards and are increasing the payment cap for contactless transactions to allow more people to make purchases without touching a keypad or payment terminal.

Restraint: Health concerns related to the use of fingerprint sensors amid COVID-19 pandemic

As fingerprint scanner is a contact biometric technology, government authorities around the world are looking to reduce its usage as health concerns related to their use are growing due to an exponential rise in COVID-19 cases. Organizations are shifting toward contactless technologies, such as facial and iris recognition or contactless smart card access systems, as these technologies do not require the person to touch any surface. The facial recognition technology also offers thermal scanning to check body temperatures and thus minimizes the risk of spreading COVID-19 to others. Thus, health concerns related to the use of fingerprint sensors amid the COVID-19 pandemic is expected to be the major factor restraining market growth.

Opportunity: Increasing demand for laptops and notebooks due to COVID-19

The COVID-19 pandemic is changing the way companies work. The majority of employers across the world have asked employees to work from home as a preventive measure to curb the spread of COVID-19. This has increased the demand for laptops and notebooks. Various companies in the fingerprint sensor market are experiencing increasing demand for sensors for applications in notebooks and laptops. Companies, especially in IT businesses, are looking to make permanent options for the majority of their employees in the next few years. This is expected to fuel the demand for laptops and notebooks in the coming years and consequently create lucrative opportunities for the players operating in the fingerprint sensors market.

Challenge: Government restrictions pertaining to COVID-19 lockdown

Governments across various major economies have enforced lockdowns to combat the COVID-19 pandemic. With lockdown in place, the manufacturing activities have been affected significantly. The global manufacturing PMI slumped from 47.3 in March 2020 to 39.7 in April 2020. Governments across the world have come up with different regulations during the lockdown. For instance, the Indian government had closed down all non-essential manufacturing plants from the end of March 2020 to early May 2020. This included the closure of plants of various smartphone players, such as Xiaomi, Samsung, Oppo, and Vivo. Thus, government restrictions during COVID-19 lockdowns are expected to be the major challenge for the manufacturing sector. However, with ease in lockdown in countries such as China, India, the US, and Spain, the manufacturing sector is expected to pick up gradually in the coming months.

Optical fingerprint technology is expected to witness the highest market growth during the forecast period

The fingerprint sensor market for optical fingerprint technology is expected to register the highest CAGR during the forecast period. Optical sensors create fingerprint images by using light and converting it into electrical signals. This technology uses the light-emitting phosphor layer to capture the fingerprint by illuminating the surface via total internal reflection. Various smartphone manufacturers are launching new products with optical in-display fingerprint sensors. A lot of new product launches have been seen in Q12020, even during the COVID-19 pandemic, and a similar trend is expected to be seen during the forecast period, which in turn, will drive the market for optical technology.

Banking and finance application is expected to witness the largest market growth during the forecast period

In the banking and finance sector, fingerprint sensor devices are acting as game-changers. The COVID-19 pandemic has fueled the growth of the biometric payment cards market. The WHO has advised to avoid the use of cash and switch to contactless payment options to curb the spread of coronavirus. People across the world are reducing physical cash usage to prevent the spread of COVID-19. Various companies have noted that public health concerns have created more interest in contactless biometric payment solutions and expect the demand for biometric financial cards to increase in the coming years. This is expected to drive the market for banking and finance applications during the forecast period.

APAC is the leading fingerprint sensor market, globally, by value, in 2019

The market in APAC is expected to register the highest CAGR from 2020–2025. APAC presents huge opportunities for the fingerprint sensor device market owing to the growing demand for these devices in numerous verticals, including consumer electronics, automotive, and commercial sectors in Asian countries such as China, Japan, Taiwan, the Philippines, and India. Rising deployment of fingerprint sensors in consumer electronics, especially in smartphones, has fueled the growth of the fingerprint sensor market in APAC. Key markets in APAC include China, Japan, India, and South Korea. China is playing a significant role in the growth of the fingerprint sensor market in APAC as a few of the key smartphone manufacturers, including Xiaomi, Oppo, and Vivo, are headquartered in China.

The recent COVID-19 pandemic is expected to impact the global biometric industry. The entire supply chain is disrupted due to the limited supply of components. Chinese suppliers around the globe have placed production lines on halt or shut them down completely. Also, legal and trade restrictions, such as sealed borders, increase the shortage of required components. Such disruptions in the supply chain are expected to affect the assembly of OEMs in APAC, Europe, and North America.

The fingerprint sensor market is dominated by players such as Goodix (China), Fingerprint Cards (Sweden), Syanaptics (US), Apple (US), and Qualcomm (US).

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Fingerprint Sensor Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Fingerprint Sensor Market?

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Technology, By Application |

|

Geographies covered |

North America, Europe, APAC, Rest of the World |

|

Companies covered |

The major market players include Goodix (China), Fingerprint Cards (Sweden), Synaptics (US), Apple (US), and Qualcomm (US) (Total 13 players are profiled) |

The study categorizes the fingerprint sensor market based on technology and application at the regional and global levels.

By Technology

- Capacitive

- Optical

- Thermal

- Ultrasonic

By Application

- Consumer Electronics

- Smartphones

- Laptop & Notebooks

- Wearable Devices

- USB Flash Drives

- Travel and Immigration

- Government and Law Enforcement

- Banking and Finance

- Commercial

- Smart Homes

- Military, Defense, and Aerospace

- Healthcare

- Others

By Region

- North America

- Europe

- APAC

- Rest of the World

Recent Developments

- IDEX Biometrics is increasing its focus on providing fingerprint sensors for application in smart cards due to the ongoing COVID-19 pandemic. The company announced in April that its fingerprint sensors are integrated into the UnionPay (China)-certified payment cards.

- In Q3 2020 financial update, Synaptics announced that its PC-related business is benefitting due to the COVID-19 pandemic as a large number of companies have implemented work from home facilities for the employees. As a result, the sale of its touchpads, fingerprint sensors, and high-speed wired connectivity for docking stations is increasing rapidly.

- On March 13, 2020, Apple announced the reopening of its 42 retail stores in China, which were closed since early February as a precaution against coronavirus. Apple also added that many suppliers of the company have reopened their factories in the country, e.g., Foxconn (Taiwan), which is the largest manufacturer of iPhone.

Frequently Asked Questions (FAQ):

What is the pre-COVID-19 and post-COVID-19 size of the global fingerprint sensor market?

The pre-COVID-19 global fingerprint sensor market was estimated to be USD 4.3 billion in 2020 and was projected to reach USD 7.5 billion by 2025, at a CAGR of 12.1%. The post-COVID-19 global fingerprint sensor market is estimated to be USD 3.0 billion in 2020 and is projected to reach USD 6.0 billion by 2025, at a CAGR of 15.2%.

What are the major driving factors and opportunities in the fingerprint sensor market amidst the COVID-19 pandemic?

Increasing use of fingerprint sensing technology in consumer devices for biometric authentication and the emergence of biometric smartcards for BFSI applications are the key drivers for the market. Also, the introduction of in-display fingerprint sensors in smartphones and increasing demand for laptops and notebooks due to COVID-19 are the major opportunities for the market players.

Who are the leading players in the global fingerprint sensor market?

Companies such as Goodix, Fingerprint Cards, Apple, Synaptics, and Qualcomm are the leaders in the market. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have multiple contracts with global OEMs and have effective supply chain strategies. Such advantages give these companies an edge over other companies in the market.

What is the COVID-19 impact on fingerprint sensor market manufacturers?

Industry experts believe that COVID-19 could affect the global biometric industry significantly in 2020. This also translates into a snowballing effect on the fingerprint sensor market. For instance, in March 2020, ELAN Microelectronics announced that its business was majorly affected in February 2020 due to COVID-19, as most of its touch modules were outsourced. To counter the problem, ELAN relocated partial production of its outsourced touchpad module to its in-house production line in Taiwan.

What are some of the technological advancements in the market?

The latest development that aids this market is the introduction of in-display fingerprint sensors in smartphones. In-display fingerprint sensors work well with wet or greasy hands, something that was not possible with capacitive fingerprint sensors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 14)

1.1 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: MAXIMUM COVID-19 CASES REGISTERED IN THE US

1.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.2.1 COVID-19 IMPACT ON ECONOMY—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size by bottom-up approach (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size by top-down approach (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR THE RESEARCH STUDY

2.5 STAKEHOLDERS

3 EXECUTIVE SUMMARY (Page No. - 28)

FIGURE 10 GROWTH OF THE FINGERPRINT SENSOR MARKET TO DECLINE CONSIDERABLY DURING 2019–2020 OWING TO THE COVID-19 PANDEMIC

FIGURE 11 GROWTH OF FINGERPRINT SENSOR MARKET IN TERMS OF VOLUME TO DECLINE CONSIDERABLY DURING 2019–2020 OWING TO THE COVID-19 PANDEMIC

FIGURE 12 OPTICAL FINGERPRINT SENSORS TO REGISTER THE HIGHEST CAGR POST-COVID-19 (DURING THE FORECAST PERIOD)

FIGURE 13 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF FINGERPRINT SENSOR MARKET IN 2020

FIGURE 14 APAC TO HOLD LARGEST SHARE OF FINGERPRINT SENSOR MARKET IN 2020 POST COVID-19

4 IMPACT ON ECOSYSTEM AND EXTENDED ECOSYSTEM (ADJACENT MARKETS) (Page No. - 33)

4.1 INTRODUCTION

4.2 FINGERPRINT SENSOR MANUFACTURERS

4.3 ORIGINAL EQUIPMENT MANUFACTURERS

4.4 INTEGRATORS

4.5 DISTRIBUTORS

4.6 COVID-19-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

FIGURE 15 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

4.6.1 DRIVERS

4.6.1.1 Increasing use of fingerprint sensing technology in consumer devices for biometric authentication

4.6.1.2 Emergence of biometric smartcards in BFSI applications

4.6.2 RESTRAINTS

4.6.2.1 Health concerns related to the use of fingerprint sensors amid COVID-19 pandemic

4.6.3 OPPORTUNITIES

4.6.3.1 Introduction of in-display fingerprint sensors in smartphones

4.6.3.2 Increasing demand for laptops and notebooks due to COVID-19

4.6.4 CHALLENGES

4.6.4.1 Government restrictions pertaining to COVID-19 lockdown

5 BUSINESS IMPLICATIONS OF COVID-19 ON FINGERPRINT SENSOR MARKET (Page No. - 39)

5.1 IMPLICATION ON TECHNOLOGY SEGMENTS

5.1.1 CAPACITIVE

FIGURE 16 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET FOR CAPACITIVE TECHNOLOGY

TABLE 1 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET, BY CAPACITIVE TECHNOLOGY, 2017–2025 (USD MILLION)

5.1.2 OPTICAL

FIGURE 17 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET FOR OPTICAL TECHNOLOGY

TABLE 2 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET, BY OPTICAL TECHNOLOGY, 2017–2025 (USD MILLION)

5.1.3 THERMAL

FIGURE 18 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET FOR THERMAL TECHNOLOGY

TABLE 3 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET, BY THERMAL TECHNOLOGY, 2017–2025 (USD MILLION)

5.1.4 ULTRASONIC

FIGURE 19 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET FOR ULTRASONIC TECHNOLOGY

TABLE 4 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET, BY ULTRASONIC TECHNOLOGY, 2017–2025 (USD MILLION)

6 BUSINESS IMPLICATIONS OF COVID-19 ON DIFFERENT PRODUCTS FEATURING FINGERPRINT SENSORS (Page No. - 45)

6.1 IMPLICATIONS ON TYPE SEGMENT

6.1.1 SMART DEVICES AND WEARABLES

6.1.2 ACCESS CONTROL SYSTEMS

6.1.2.1 Biometric Systems

6.1.2.2 Digital Locks

6.1.3 BIOMETRIC SMARTCARDS

6.1.3.1 Financial Cards

6.1.3.2 ID Cards

6.1.4 VEHICLES

6.1.5 OTHERS

7 COVID-19 IMPACT ON MAJOR END-USE APPLICATIONS WITH USE CASES AND HOW CLIENTS ARE RESPONDING TO CURRENT SITUATION (Page No. - 49)

7.1 INTRODUCTION

7.2 CONSUMER ELECTRONICS

7.2.1 SMARTPHONES

7.2.2 LAPTOPS & NOTEBOOKS

7.2.3 WEARABLE DEVICES

7.2.4 USB FLASH DRIVES

7.2.5 FORECAST 2020–2025

FIGURE 20 IMPACT OF COVID-19 ON THE CONSUMER ELECTRONICS SEGMENT OF THE FINGERPRINT SENSOR MARKET

TABLE 5 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR CONSUMER ELECTRONICS APPLICATION, 2017–2025 (USD MILLION)

7.2.6 KEY USE CASES

7.2.7 MNM VIEWPOINT

7.3 TRAVEL AND IMMIGRATION

7.3.1 FORECAST 2020–2025

FIGURE 21 IMPACT OF COVID-19 ON THE TRAVEL AND IMMIGRATION SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 6 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR TRAVEL AND IMMIGRATION APPLICATION, 2017–2025 (USD MILLION)

7.3.2 KEY USE CASES

7.3.3 MNM VIEWPOINT

7.4 GOVERNMENT AND LAW ENFORCEMENT

7.4.1 FORECAST 2020–2025

FIGURE 22 IMPACT OF COVID-19 ON THE GOVERNMENT AND LAW ENFORCEMENT SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 7 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR GOVERNMENT AND LAW ENFORCEMENT APPLICATION, 2017–2025 (USD MILLION)

7.4.2 KEY USE CASES

7.4.3 MNM VIEWPOINT

7.5 BANKING AND FINANCE

7.5.1 FORECAST 2020–2025

FIGURE 23 IMPACT OF COVID-19 ON THE BANKING AND FINANCE SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 8 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR BANKING AND LAW FINANCE APPLICATION, 2017–2025 (USD MILLION)

7.5.2 KEY USE CASES

7.5.3 MNM VIEWPOINT

7.6 COMMERCIAL

7.6.1 FORECAST 2020–2025

FIGURE 24 IMPACT OF COVID-19 ON THE COMMERCIAL SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 9 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR COMMERCIAL APPLICATION, 2017–2025 (USD MILLION)

7.6.2 KEY USE CASES

7.6.3 MNM VIEWPOINT

7.7 SMART HOMES

7.7.1 FORECAST 2020–2025

FIGURE 25 IMPACT OF COVID-19 ON THE SMART HOMES SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 10 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR SMART HOMES APPLICATION, 2017–2025 (USD MILLION)

7.7.2 KEY USE CASES

7.7.3 MNM VIEWPOINT

7.8 MILITARY, DEFENSE, AND AEROSPACE

7.8.1 FORECAST 2020–2025

FIGURE 26 IMPACT OF COVID-19 ON THE MILITARY, DEFENSE, AND AEROSPACE SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 11 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR MILITARY, DEFENSE, AND AEROSPACE APPLICATION, 2017–2025 (USD MILLION)

7.8.2 KEY USE CASES

7.8.3 MNM VIEWPOINT

7.9 HEALTHCARE

7.9.1 FORECAST 2020–2025

FIGURE 27 IMPACT OF COVID-19 ON THE HEALTHCARE SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 12 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR HEALTHCARE APPLICATION, 2017–2025 (USD MILLION)

7.9.2 KEY USE CASES

7.9.3 MNM VIEWPOINT

7.1 OTHERS

7.10.1 FORECAST 2020–2025

FIGURE 28 IMPACT OF COVID-19 ON THE OTHERS SEGMENT OF FINGERPRINT SENSOR MARKET

TABLE 13 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET FOR OTHERS APPLICATION, 2017–2025 (USD MILLION)

7.10.2 KEY USE CASES

7.10.3 MNM VIEWPOINT

8 COVID-19 IMPACT ON REGIONS (Page No. - 67)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 MNM VIEWPOINT

8.2.2 FORECAST 2020–2025

FIGURE 29 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET IN NORTH AMERICA

TABLE 14 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET IN NORTH AMERICA, 2017–2025 (USD MILLION)

8.3 EUROPE

8.3.1 MNM VIEWPOINT

8.3.2 FORECAST 2020–2025

FIGURE 30 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET IN EUROPE

TABLE 15 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET IN EUROPE, 2017–2025 (USD MILLION)

8.4 ASIA PACIFIC

8.4.1 MNM VIEWPOINT

8.4.2 FORECAST 2020–2025

FIGURE 31 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET IN APAC

TABLE 16 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET IN APAC, 2017–2025 (USD MILLION)

8.5 REST OF THE WORLD

8.5.1 MNM VIEWPOINT

8.5.2 FORECAST 2020–2025

FIGURE 32 IMPACT OF COVID-19 ON FINGERPRINT SENSOR MARKET IN ROW

TABLE 17 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET IN ROW, 2017–2025 (USD MILLION)

9 COVID-19 FOCUSED PROFILES OF KEY VENDORS (Page No. - 75)

(Company Overview, COVID-19 Company-Specific Developments)*

9.1 INTRODUCTION

9.2 GOODIX

9.3 FINGERPRINT CARDS

9.4 SYNAPTICS

9.5 APPLE

9.6 IDEX BIOMETRICS

9.7 NEXT BIOMETRICS

9.8 NOVATEK MICROELECTRONICS

9.9 QUALCOMM

9.10 ELAN MICROELECTRONICS

9.11 JAPAN DISPLAY

9.12 EGIS TECHNOLOGY

9.13 CRUCIALTEC

9.14 Q TECHNOLOGY

*Details on Company Overview, COVID-19 Company-Specific Developments might not be captured in case of unlisted companies.

10 APPENDIX (Page No. - 88)

10.1 INSIGHTS OF INDUSTRY EXPERTS

10.2 DISCUSSION GUIDE

10.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

10.4 AUTHOR DETAILS

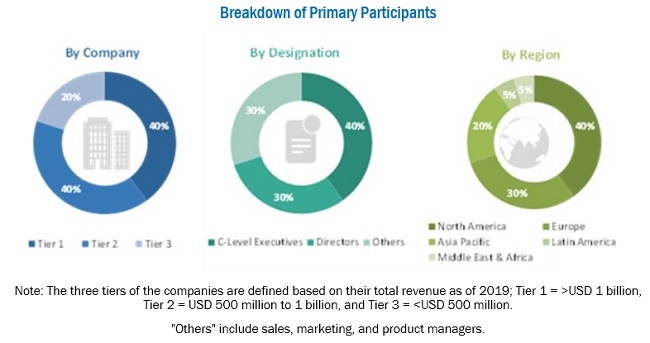

The study involved four major activities in estimating the COVID-19 impact on the global fingerprint sensor market. The market has been estimated and forecasted for the pre-and post-COVID-19 scenarios. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include fingerprint sensor organizations such as the International Biometrics+Identity Association (IBIA), Center for Biometrics and Security Research (CBSR), and corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and fingerprint sensor associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the fingerprint sensor market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-and supply-side players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (Middle East & Africa and South America). Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the overall size of the fingerprint sensor market. These methods have also been used extensively to estimate the size of various market subsegments.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Focusing initially on the top line investments being made in the fingerprint sensor ecosystem

- Calculating the market size by considering the revenues generated by players through the sale of fingerprint sensors. Estimating 2020 values by considering COVID-19 impact across the value chain of fingerprint sensors. Analyzing recovery scenarios across the globe to further forecast values.

- Analyzing R&D activities and key developments in major market areas

- Building and developing information related to the revenue generated by players offering key products for various applications

- Conducting multiple on-field discussions with key opinion leaders across major companies involved in the development of fingerprint sensors to understand pre-COVID-19 and post-COVID-19 scenarios

- Estimating the geographic split using secondary sources based on various factors such as the number of players in a specific country and region, the role of major players in the market for the development of innovative products, adoption and penetration rates in a particular country for various end-use applications, and impact of COVID-19 across various geographies

- Breaking down the total market based on verified splits and key growth pockets across all segments

The research methodology used to estimate the market size by bottom-up approach includes the following:

- Identifying various types of fingerprint sensors used in various devices such as smart devices and wearables, access control systems, biometric smartcards, and vehicles

- Analyzing major providers of fingerprint sensors, studying their portfolios, and understanding different fingerprint sensor offerings. Analyzing developments pre-COVID-19 and post-COVID-19. Studying company’s measures/steps taken to deal with COVID-19

- Analyzing the adoption of fingerprint sensors in various end-use applications for pre-COVID-19 and post-COVID-19 scenarios based on secondary & primary research.

- Analyzing the anticipated change in the demand in the post-COVID-19 scenario

- Carrying out multiple discussion sessions with key opinion leaders to understand different types of fingerprint sensors, technologies, end-use applications, and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies for pre-COVID-19 and post-COVID-19 scenarios

- Estimating the total number of shipments for pre-COVID-19 & post-COVID-19 scenarios and considering demand in various applications. Analyzing different pricing trends and then multiplying the number of shipments with average selling prices (ASPs) to arrive at the global number

- Validating the market estimates by analyzing the revenues of the companies generated from each type of fingerprint sensor, and then combining the same to get the market estimate. Considering companies developments & measures taken post-COVID-19 to further forecast numbers

- Conducting multiple discussion sessions with key opinion leaders to understand various different types of fingerprint sensors and their implementation in various applications, which would help in analyzing the breakup of the scope of work carried out by each major company; the discussion also includes the impact of COVID-19 on the ecosystem of the fingerprint sensor market

- Verifying and crosschecking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the consumer electronics, travel and immigration, government and law enforcement, banking and financial, commercial, smart homes, military, defense, and aerospace, and healthcare among other applications.

Report Objectives

- To describe and forecast the COVID-19 impact on the fingerprint sensor market, based on technology, type, application, and geography.

- To describe and forecast the market size, for pre- and post-COVID-19 scenarios, for four main regions: North America, Europe, APAC, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the fingerprint sensor market amidst COVID-19.

- To provide an overview of the COVID-19 impact on the value chain pertaining to the fingerprint sensor market.

- To analyze strategies followed by various companies to mitigate the COVID-19 effect on the fingerprint sensor ecosystem.

Available Customizations

- MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of fingerprint sensor market

- Profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in COVID-19 Impact on Fingerprint Sensor Market