COVID-19 Impact on Food Safety Testing Market by Testing Technologies (DNA-based, Immunoassay-based, Chromatography- & Spectroscopy-based), Targets Tested (Pathogen, GMO, Allergen, and Mycotoxin), and Region - Global Forecast to 2021

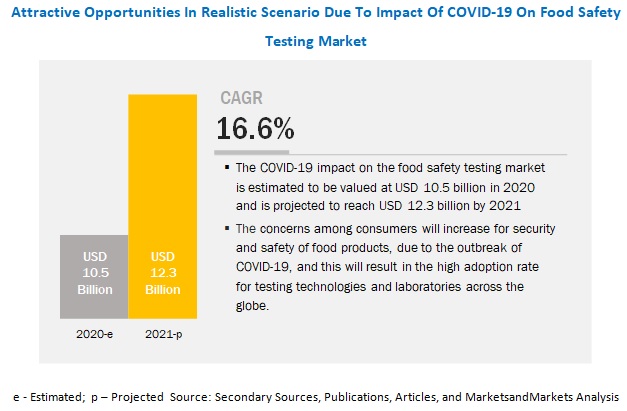

[87 Pages Report] According to MarketsandMarkets, the COVID-19 impact on food safety testing market is estimated to be valued at USD 10.5 billion in 2020 in the realistic scenario, whereas it is projected to reach USD 13.3 billion by 2021 in the optimistic scenario. The CAGR for the optimistic scenario is expected to be 21.4% from 2019 to 2021.

The rising number of health-conscious consumers and increasing awareness about healthy and safe food products have led to the demand for food safety testing. Moreover, the outbreaks caused due to foodborne diseases have further encouraged the government to introduce various regulations on food safety and its quality; these factors have significantly driven the growth of the food safety testing market.

By testing technologies, the DNA-based segment is projected to account for the larger share in the food safety testing market

The DNA-based segment is expected to dominate the market based on testing technologies during the forecast period. This is attributed to the precise results provided by DNA-based technology. The technology helps in determining the presence of various contaminants such as pathogens, mycotoxin, GMO, and allergens. Thus, the use of DNA-based technology will witness significant growth in food laboratories globally, as it generates results in lesser duration with higher accuracy.

By targets tested, the pathogen segment accounted for the larger size in the food safety testing market during the forecast period

Based on targets tested, the market is segmented into pathogens, GMO, mycotoxin, and allergen. The pathogen segment is estimated to account for the larger share as the consumption of pathogens via food products can cause severe foodborne diseases. The rise in new technologies and modern analytical instruments to detect foodborne pathogens has led to the growth of the food safety testing market. Moreover, changes in consumer trends toward healthy food products are driving the market growth,

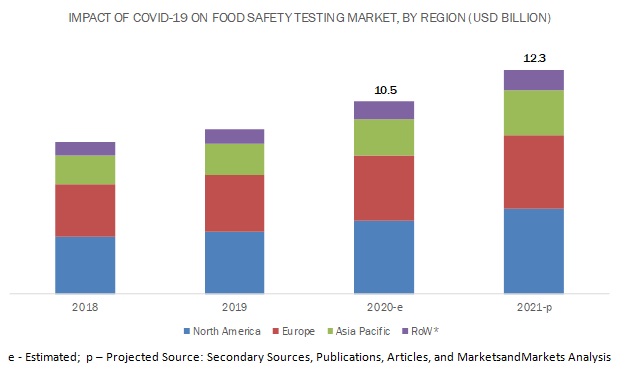

North America is projected to account for the largest market share during the forecast period

North America accounted for the largest share of the global food safety testing market during the forecast period. The food safety testing market in the North American region is driven primarily by growing consumer awareness toward safe food products and stringent food standard regulations. North America is a key producer of processed food, especially in the US and Canada. Growth in these two countries can be attributed to a high stringency of food safety regulations, labeling laws, enforcement, and effective monitoring of these laws. Moreover, a significant focus on consumer protection and their interests, and a large number of sample tests conducted in correspondence to food production and trade are driving the market growth. These factors drive the food safety testing market in the North American region.

Key Market Players:

The key players in this market include Eurofins (Luxembourg), SGS (Switzerland), Intertek (UK), Bureau Veritas (France), and TUV SUD (Germany). Eurofins (Luxembourg) is an international group of laboratories that provide testing and support services to the food industries as well as to governments. The company capitalizes on a portfolio of 150,000 reliable analytical methods that enable it to offer services that characterize and study the safety, identity, purity, composition, authenticity, and origin of products & biological substances. As a result of the COVID-19 outbreak, the company is providing the guidelines for handling food products to have better and safe food for consumption.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Food Safety Testing Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Food Safety Testing Market?

|

Report Metric |

Details |

|

Market size estimation |

2018–2021 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2021 |

|

Units considered |

Value (USD Billion) |

|

Segments covered |

Testing technologies, targets tested, and region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies studied |

|

This research report categorizes the impact of COVID-19 on the food safety testing market based on testing technologies and targets tested.

Target Audience

- Raw material manufacturers and suppliers

- Research institutions

- Government bodies

- Distributors

Testing Technologies

- DNA-based

- Immunoassay-based

- Chromatography- & spectroscopy-based

Targets tested

- Pathogen

- GMO

- Mycotoxin

- Allergen

Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Key Questions Addressed by the Report

- What is the impact on each stage of the value chain of the food safety testing industry? Which factors are attributing to market growth?

- How can consumer shift affect the growth rate of the food safety testing market? What change can be observed in the demand for testing technologies?

- Which are the most attractive market opportunity, and which market segments can be worst affected?

- How are key vendors in the market planning their short term-mid term-long term strategies to sustain in the economic pandemic?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 10)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH DATA

2.2 RESEARCH ASSUMPTIONS

2.3 RESEARCH LIMITATION

2.4 SCENARIO BASED MODELING

2.5 BREAKDOWN OF PRIMARY INTERVIEWS

2.6 EXCLUSION

2.7 STAKEHOLDERS

3 EXECUTIVE SUMMARY (Page No. - 21)

4 COVID-19 IMPACT FOOD SAFETY TESTING ECOSYSTEM (Page No. - 26)

4.1 INTRODUCTION

4.2 IMPACT ON VALUE CHAIN

4.2.1 TESTING EQUIPMENT & CONSUMABLES SUPPLIERS

4.2.2 LABORATORIES

4.2.3 FOOD MANUFACTURERS/GROWERS

4.2.4 DISTRIBUTORS/RETAIL CHANNELS

4.3 MACROECONOMIC INDICATORS

4.3.1 DRIVERS

4.3.1.1 Growing number of foodborne illnesses

4.3.1.2 Globalization of food trade

4.3.1.3 Stringent food safety regulations

4.3.2 RESTRAINTS

4.3.2.1 Lack of food control infrastructure & resources in developing countries

4.3.2.2 Heavy-duty on test kits

5 CUSTOMER ANALYSIS (Page No. - 34)

5.1 INTRODUCTION

5.2 ADOPTION OF TESTING TECHNOLOGIES

5.2.1 DEMAND FOR RAPID TEST KITS

5.2.1.1 DNA-based test kits for pathogen testing

5.2.2 MULTI-CONTAMINANT ANALYZING TECHNOLOGY

5.2.2.1 New market opportunities/growth opportunities

5.3 CONSUMER SHIFT

5.3.1 ALLERGEN TESTING

5.3.2 CONFORMATION ON FOOD AUTHENTICITY

5.3.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

6 IMPACT ON RELATED MARKETS (Page No. - 42)

6.1 INTRODUCTION

6.2 MOST ATTRACTIVE MARKET – IMPACT & OPPORTUNITIES

6.2.1 FREE-FROM FOOD TESTING

6.2.2 NUTRITIONAL ANALYSIS

6.2.3 REAL-TIME PCR TECHNOLOGY

6.3 WORST-AFFECTED MARKET – IMPACT & OPPORTUNITIES

6.3.1 CULTURE-BASED TECHNOLOGIES

6.3.2 MEAT & SEAFOOD TESTING

7 CUSTOMER GROWTH OPPORTUNITIES IN THE FOOD SAFETY TESTING MARKET (Page No. - 46)

7.1 IMPACT ON FOOD SAFETY TESTING COMPANIES PORTFOLIO

7.1.1 PRODUCTS & SERVICES

7.1.2 GEOGRAPHICAL

7.2 WINNING STRATEGIES TO GAIN MARKET SHARE

7.2.1 SHORT-TERM STRATEGIES

7.2.2 MID-TERM STRATEGIES

7.2.3 LONG-TERM STRATEGIES

8 COVID-19 IMPACT ON THE FOOD SAFETY TESTING SYSTEM (Page No. - 50)

8.1 TESTING TECHNOLOGIES

8.1.1 DNA-BASED

8.1.2 IMMUNOASSAY-BASED

8.1.3 CHROMATOGRAPHY- & SPECTROSCOPY-BASED

8.2 TARGETS TESTED

8.2.1 ALLERGEN

8.2.2 MYCOTOXIN

8.2.3 PATHOGEN

8.2.4 GMOS

8.3 GEOGRAPHY

8.3.1 INTRODUCTION

8.3.1.1 MnM viewpoint

8.3.1.2 Forecast for 2020-2021

8.3.1.2.1 Pessimistic scenario

8.3.1.2.2 Realistic scenario

8.3.1.2.3 Optimistic scenario

8.3.2 NORTH AMERICA

8.3.2.1 MnM viewpoint

8.3.2.2 Forecast for 2020-2021

8.3.2.2.1 Pessimistic scenario

8.3.2.2.2 Realistic scenario

8.3.2.2.3 Optimistic scenario

8.3.3 EUROPE

8.3.3.1 MnM viewpoint

8.3.3.2 Forecast for 2020-2021

8.3.3.2.1 Pessimistic scenario

8.3.3.2.2 Realistic scenario

8.3.3.2.3 Optimistic scenario

8.3.4 ASIA PACIFIC

8.3.4.1 MnM viewpoint

8.3.4.2 Forecast for 2020-2021

8.3.4.2.1 Pessimistic scenario

8.3.4.2.2 Realistic scenario

8.3.4.2.3 Optimistic scenario

8.3.5 REST OF THE WORLD

8.3.5.1 MnM viewpoint

8.3.5.2 Forecast for 2020-2021

8.3.5.2.1 Pessimistic scenario

8.3.5.2.2 Realistic scenario

8.3.5.2.3 Optimistic scenario

9 COVID-19 FOCUSED PROFILES OF KEY VENDORS (Page No. - 77)

(Company overview, Services offered & MnM View)*

9.1 EUROFINS

9.2 SGS

9.3 INTERTEK

9.4 BUREAU VERITAS

9.5 TÜV SÜD

*Details on Company overview, Services offered & MnM View might not be captured in case of unlisted companies.

10 APPENDIX (Page No. - 82)

10.1 KEY INSIGHTS BY INDUSTRY EXPERTS

10.2 DISCUSSION GUIDE

10.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

10.4 AUTHOR DETAILS

LIST OF TABLES (49 Tables)

TABLE 1 FOODBORNE OUTBREAKS IN THE US, 2017-2020

TABLE 2 FOOD RECALLS IN THE US, 2020

TABLE 3 FOOD PRODUCTS FROM THE US BANNED IN OTHER COUNTRIES

TABLE 4 COVID-19 IMPACT ON FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 5 DNA-BASED: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 6 DNA-BASED: COVID-19 IMPACT ON THE ALLERGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 7 DNA-BASED: COVID-19 IMPACT ON THE PATHOGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 8 DNA-BASED: COVID-19 IMPACT ON THE GMO TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 9 IMMUNOASSAY-BASED: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 10 IMMUNOASSAY-BASED: COVID-19 IMPACT ON THE ALLERGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 11 IMMUNOASSAY-BASED: COVID-19 IMPACT ON THE MYCOTOXIN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 12 IMMUNOASSAY-BASED: COVID-19 IMPACT ON THE PATHOGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 IMMUNOASSAY-BASED: COVID-19 IMPACT ON THE GMO TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 CHROMATOGRAPHY- & SPECTROSCOPY-BASED: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 CHROMATOGRAPHY- & SPECTROSCOPY-BASED: COVID-19 IMPACT ON THE ALLERGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 16 CHROMATOGRAPHY- & SPECTROSCOPY-BASED: COVID-19 IMPACT ON THE MYCOTOXIN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 CHROMATOGRAPHY- & SPECTROSCOPY-BASED: COVID-19 IMPACT ON THE PATHOGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 CHROMATOGRAPHY- & SPECTROSCOPY-BASED: COVID-19 IMPACT ON THE GMO TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 20 COVID-19 IMPACT ON THE ALLERGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 COVID-19 IMPACT ON THE ALLERGEN TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 22 FDA ACTION LEVELS FOR AFLATOXINS

TABLE 23 AVERAGE CONCENTRATIONS FOR OCHRATOXIN A IN DIFFERENT FOOD PRODUCTS

TABLE 24 COVID-19 IMPACT ON THE MYCOTOXIN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 COVID-19 IMPACT ON THE MYCOTOXIN TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 26 COVID-19 IMPACT ON THE PATHOGEN TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 COVID-19 IMPACT ON THE PATHOGEN TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 28 COVID-19 IMPACT ON THE GMO TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 COVID-19 IMPACT ON THE GMO TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 30 GLOBAL PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 GLOBAL REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 GLOBAL OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 FOODBORNE DISEASE OUTBREAK IN THE US, 2019

TABLE 34 NORTH AMERICA PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 35 NORTH AMERICA REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 36 NORTH AMERICA REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 37 NORTH AMERICA OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 38 EUROPE PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 39 EUROPE REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 40 EUROPE REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 41 EUROPE OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 42 ASIA PACIFIC PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 43 ASIA PACIFIC REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 44 ASIA PACIFIC REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 45 ASIA PACIFIC OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 46 ROW PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 47 ROW REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

TABLE 48 ROW REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 49 ROW OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET SIZE, BY TARGETS TESTED, 2018–2021 (USD MILLION)

LIST OF FIGURES (27 Figures)

FIGURE 1 COVID-19 THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 IMPACT OF COVID-19 ON FOOD SAFETY TESTING MARKET: RESEARCH DESIGN

FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

FIGURE 9 SCENARIO-BASED MODELLING: COVID-19 IMPACT ON GLOBAL FOOD SAFETY TESTING MARKET, 2018-2021 (USD MILLION)

FIGURE 10 ATTRACTIVE OPPORTUNITIES DUE TO COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET (REALISTIC SCENARIO)

FIGURE 11 FOOD SAFETY TESTING MARKET SNAPSHOT, BY TARGETS TESTED, 2018 VS. 2021 (REALISTIC SCENARIO)

FIGURE 12 FOOD SAFETY TESTING MARKET SNAPSHOT, BY TARGETS TESTED AND REGIONS, 2020 (REALISTIC SCENARIO)

FIGURE 13 FOOD SAFETY TESTING MARKET SNAPSHOT, BY TECHNOLOGY AND TARGETS TESTED, 2020 (REALISTIC SCENARIO)

FIGURE 14 FOOD SAFETY TESTING MARKET SHARE & GROWTH, BY REGION, 2020 (REALISTIC SCENARIO)

FIGURE 15 VALUE CHAIN OF FOOD SAFETY TESTING INDUSTRY

FIGURE 16 GLOBAL AGRI-FOOD EXPORT, 2016-2018 (USD BILLION)

FIGURE 17 CONSUMER CHECKS FOR LABEL AND NUTRITIONAL INFORMATION PANEL (NIP) ON FOOD PRODUCTS (% OF CONSUMERS)

FIGURE 18 COVID IMPACT AND DISRUPTION IN THE FOOD & BEVERAGE SECTOR

FIGURE 19 FAO FOOD PRICE INDEX FOR MEAT, 2019-2020

FIGURE 20 IMPACT SCENARIO: SUBSECTORS OF THE FOOD TESTING INDUSTRY

FIGURE 21 COVID-19 IMPACT ON FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2020

FIGURE 22 COVID-19 IMPACT ON THE FOOD SAFETY TESTING MARKET, BY TARGETS TESTED AND TECHNOLOGY, 2020

FIGURE 23 NORTH AMERICA MARKET SNAPSHOT FOR COVID-19 IMPACT ON FOOD SAFETY TESTING, 2020

FIGURE 24 BORDER REJECTION CASES AGAINST CONTAMINATED FOODS IN EUROPE, 2018–2019 68

FIGURE 25 EUROPEAN MARKET SNAPSHOT FOR COVID-19 IMPACT ON FOOD SAFETY TESTING, 2020

FIGURE 26 INVESTMENT OPPORTUNITIES IN INDIA , 2019

FIGURE 27 ASIA PACIFIC MARKET SNAPSHOT FOR COVID-19 IMPACT ON FOOD SAFETY TESTING, 2020

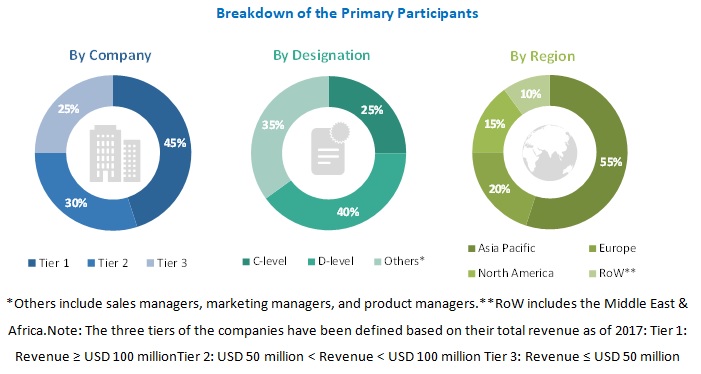

The study involved four major activities in estimating the size for COVID-19 impact on food safety testing market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The food safety testing market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of the market is characterized by the presence of various industrial products processors such as food & beverage, which includes meat and seafood processors, alcoholic drinks processors and carbonated drinks processors, and research institutions. The supply-side is characterized by the presence of raw material manufacturers, suppliers, distributors, researchers, and service providers. Various primary sources from both the supply- and demand-sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the impact of COVID-19 on the food safety testing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the food safety testing market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the COVID-19 impact on food safety testing market, in terms of testing technologies, targets tested, and region

- To describe and forecast the impact of COVID-19 on food safety testing market, in terms of value, by region–Asia Pacific, Europe, North America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the impact of COVID-19 on food safety testing market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the impact of COVID-19 on food safety testing market

- To strategically profile the key players and comprehensively analyze their market position, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches such as acquisitions & divestments, expansions, product launches & approvals, and agreements in the COVID-19 impact on food safety testing market.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the World impact of COVID-19 on food safety testing market into South America, Africa, and the Middle East

- Further country-level analysis on the impact of COVID-19 outbreak on the food safety testing market

Growth opportunities and latent adjacency in COVID-19 Impact on Food Safety Testing Market