COVID-19 Impact on Gas Sensors Market by Technology (Electrochemical, MOS, IR, Catalytic, Laser), End-use Industry, and Region - Global Forecast to 2021

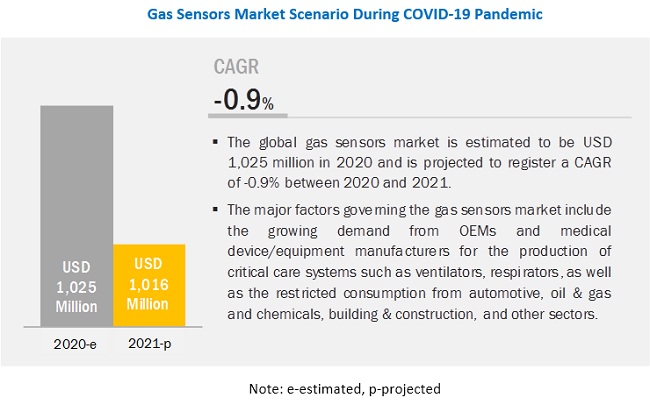

[65 Pages Report] The global gas sensors market size during this pandemic is projected to decline from USD 1,025 million in 2020 to USD 1,016 million by 2021, at a Compound Annual Growth Rate (CAGR) of -0.9% during the forecast period. The major factors governing the gas sensors industry include the growing manufacturing of ventilators, respirators, and other medical device/equipment necessary in critical care of patients, as well as the constrained growth in sectors such as automotive, oil & gas and chemicals, building & construction, and others.

Based on technology, the electrochemical segment is projected to lead the gas sensors market during the forecast period.

Based on technology, the electrochemical gas sensing technology segment is expected to lead the gas sensors market during the forecast period. Electrochemical gas sensors measure the concentration of a target gas by oxidizing or reducing the target gas at an electrode and measuring the resulting current. These sensors use less power and are less affected by changes in temperature and pressure than others. These sensors are interference-resistant and are used to detect gases such as O2, CO, H2S, ammonia, and others. They are used in industries such as automotive and healthcare.

Gas sensors market in medical & healthcare segment projected to register highest CAGR during the forecast period

Based on end-use industry, the medical & healthcare segment is expected to register the highest CAGR between 2020 and 2021. The use of gas sensors is increasing due to their versatility, necessity in the detection of harmful gases, and for the proper functioning of establishments. In the medical & healthcare sector, gas sensors are used in the manufacturing of critical care equipment such as ventilators, oxygen concentrators, and other patient care systems. Increasing demand for these types of equipment during this crisis period is the major driving factor for gas sensors in the industry.

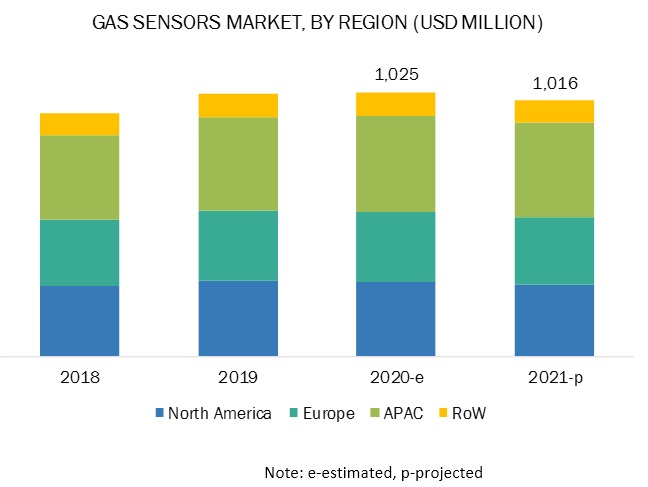

APAC is projected to be the largest gas sensors market during the projected period.

APAC is expected to be the largest gas sensors industry during the forecast period. This growth is attributed primarily to the large medical device manufacturing base and increased construction of care institutions such as hospitals, care homes, and others in the region. Also, APAC has immense growth potential driven by the increasing demand for a better healthcare system. Across these economies, local governments are reforming regulations in IT integration, advanced materials & devices, and others in the healthcare industry to increase the efficiency and efficacy of medical devices and related healthcare services in this crisis period.

Honeywell Analytics (US), MSA Safety (US), Amphenol (US), Figaro (Japan), Alphasense (UK), Sensirion AG (Switzerland), and AKM (Japan) are some of the leading players operating in the gas sensors market. They have adopted short, mid, and long term growth strategies such as donations, increased production, supply chain remodeling, new product development, and others to serve their customers efficiently and improve their future market shares.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Gas Sensors Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Gas Sensors Market?

|

Report Metric |

Details |

|

Years considered for the study |

2018–2021 |

|

Base year |

2019 |

|

Forecast period |

2020–2021 |

|

Units considered |

Value (USD) |

|

Segments |

Technology, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, and RoW |

|

Companies |

Honeywell Analytics (US), MSA Safety (US), Amphenol (US), Figaro (Japan), and Alphasense (UK) |

This research report categorizes the gas sensors market based on technology, end-use industry, and region.

By Technology:

- Electrochemical

- Photoionization Detection (PID)

- Metal oxide semiconductor (MOS)

- Catalytic

- Infrared

- Laser

- Zirconia

- Holographic

- Others (paramagnetic, flame ionization detection (FID), chemiluminescence, carbon nanotubes, polymers, and ultraviolet)

By End-use Industry:

- Automotive & Transportation

- Building & Construction

- Oil & Gas and Chemicals

- Medical & Healthcare

- Water Treatment

- Food & Beverage

- Others (consumer electronics, mining, and metal processing)

By Region:

- APAC

- Europe

- North America

- Rest of the World

Recent Developments

- In March 2020, Honeywell announced adding manufacturing capabilities to its existing aerospace site to produce 20 million N95 masks in support of the US government’s response to COVID-19. This development is expected to help the company in maintaining long term strategic relations with local government and also aid in revenue generation in a post-pandemic world.

- In March 2020, Sensirion introduced a new flow sensor SFM3019 to the market. This development is expected to meet the high demand from ventilator manufacturers. The sensor has been optimized for respiratory applications and allows for easy integration and very high scalability. It is projected to boost revenue growth while gaining more trust from the end users.

- In March 2020, ZOLL Medical Corporation, an Asahi Kasei Group company which manufactures medical devices and related software solutions, had taken aggressive steps to increase manufacturing capacity to 10,000 ventilators per month in response to the COVID-19 pandemic. This development represented nearly a 25-fold expansion from recent production volumes.

- In April 2020, MSA Safety donated 65,000 N95 masks to the Pittsburgh Medical Community to help medical workers active in the area. The company also announced that it would continue to produce advanced air-purifying respirators, such as elastomeric half-mask, full-facepiece respirators, and powered air-purifying respirators (PAPRs). This development is expected to help the company in maintaining mid to long term relations with customers, which will prove to be a driving factor in the post-pandemic world.

Critical questions the report answers:

- What are the upcoming trends for the gas sensors market during this period?

- How are the market dynamics for different technologies of gas sensors during this period?

- What are the significant trends in end-use industries which are influencing the gas sensors market during this period?

- What are the factors governing the gas sensors market in each region during this period?

- What are the strategies followed by various companies during this period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 11)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 GAS SENSORS

1.2.2 COVID-19

1.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 COVID-19 IMPACT ON GAS SENSORS ECOSYSTEM (Page No. - 15)

2.1 INTRODUCTION

2.2 VALUE CHAIN OF GAS SENSORS INDUSTRY

2.2.1 RAW MATERIAL SUPPLIERS

2.2.2 SENSOR MANUFACTURERS

2.2.3 DISTRIBUTORS/MARKETING AND SALES

2.2.4 END USERS

2.3 MARKET OVERVIEW

2.3.1 DRIVERS

2.3.1.1 Growing demand from the healthcare industry

2.3.2 CHALLENGES

2.3.2.1 Technical issues and cost & time factor

2.3.2.2 Decline in demand from oil & gas industry

3 CUSTOMER ANALYSIS (Page No. - 20)

3.1 SHIFT IN OIL & GAS AND CHEMICALS INDUSTRY

3.1.1 DISRUPTION IN THE INDUSTRY

3.1.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO IMPROVE PRODUCTION

3.1.3 IMPACT ON CUSTOMERS’ REVENUES

3.1.4 CUSTOMER’S MOST CRUCIAL REGIONS

3.1.5 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

3.2 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

3.2.1 MEASURES TAKEN BY CUSTOMERS

3.2.2 CUSTOMERS PERSPECTIVE ON GROWTH OUTLOOK

3.3 SHIFT IN BUILDING & CONSTRUCTION INDUSTRY

3.3.1 DISRUPTION IN THE INDUSTRY

3.3.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO IMPROVE PRODUCTION

3.3.3 IMPACT ON CUSTOMERS’ REVENUES

3.3.4 CUSTOMER’S MOST CRUCIAL REGIONS

3.3.5 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

3.4 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

3.4.1 MEASURES TAKEN BY CUSTOMERS

3.4.2 CUSTOMERS PERSPECTIVE ON THE GROWTH OUTLOOK

4 IMPACT OF COVID-19 ON GAS SENSOR SEGMENTS (Page No. - 32)

4.1 IMPACT ON END-USE INDUSTRIES

4.1.1 MEDICAL & HEALTHCARE

4.1.2 OIL & GAS AND CHEMICALS

4.1.3 FOOD & BEVERAGE

4.1.4 AUTOMOTIVE &TRANSPORTATION

4.1.5 BUILDING & CONSTRUCTION

4.1.6 WATER TREATMENT

4.1.7 OTHERS

4.2 IMPACT ON TECHNOLOGIES

4.2.1 TECHNOLOGIES USED IN VARIOUS END-USE INDUSTRIES

4.2.1.1 MOS

4.2.1.2 Infrared (IR)

4.2.1.3 Catalytic

4.2.1.4 Electrochemical

4.2.1.5 Photoionization detection (PID)

4.2.1.6 Zirconia

4.2.1.7 Holographic

4.2.1.8 Laser

4.2.1.9 Others

4.3 BIGGEST GAINERS, BY TOP COMPANIES

5 IMPACT OF COVID-19 IN GAS SENSORS MARKET, BY REGION (Page No. - 38)

5.1 INTRODUCTION

5.2 APAC

5.2.1 CHINA

5.3 EUROPE

5.3.1 ITALY

5.3.2 GERMANY

5.3.3 UK

5.3.4 SPAIN

5.4 NORTH AMERICA

5.4.1 US

5.5 REST OF WORLD

6 STRATEGIES OF GAS SENSORS COMPANIES DURING COVID-19 PANDEMIC (Page No. - 47)

6.1 HONEYWELL ANALYTICS

(Impact on Company Portfolio, Product/Material, Application, and Covid-19 Related Developments/ Strategy)*

6.2 MSA

6.3 AMPHENOL

6.4 FIGARO

6.5 ALPHASENSE

6.6 AMS AG

6.7 MEMBRAPOR AG

6.8 DYNAMENT

6.9 SENSIRION AG

6.10 ASAHI KASEI (AKM)

6.11 OTHER RELATED PLAYERS

*Details on Impact on Company Portfolio, Product/Material, Application, and Covid-19 Related Developments/Strategy might not be captured in case of unlisted companies.

7 APPENDIX (Page No. - 58)

7.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

7.2 AVAILABLE CUSTOMIZATIONS

7.3 RELATED REPORTS

7.4 AUTHOR DETAILS

LIST OF TABLES (15 TABLES)

TABLE 1 RECENT CHANGES IN CAPEX OF SELECTED COMPANIES

TABLE 2 OUTPUT FOR MAJOR OPEC COUNTRIES UNDER 3 PHASES OF THE APRIL 2020 DEAL, (THOUSANDS BARREL PER DAY)

TABLE 3 OUTPUT FOR MAJOR NON-OPEC COUNTRIES UNDER 3 PHASES OF THE APRIL 2020 DEAL, (THOUSANDS BARREL PER DAY)

TABLE 4 STRATEGIES UNDERTAKEN BY SOME MAJOR OIL & GAS COMPANIES

TABLE 5 CAPEX REDUCTION/REVISION BY SELECTED COMPANIES, 2020

TABLE 6 GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 7 GAS SENSORS MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 8 GAS SENSORS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 9 CHINA: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 10 ITALY: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 11 GERMANY: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 12 UK: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 13 SPAIN: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 14 US: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 15 ROW: GAS SENSORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

LIST OF FIGURES (8 FIGURES)

FIGURE 1 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

FIGURE 2 OVERVIEW OF GAS SENSORS VALUE CHAIN

FIGURE 3 COVID-19 IMPACT ON GAS SENSORS ECOSYSTEM

FIGURE 4 2025 CHEMICAL INDUSTRY SCENARIO BEFORE AND AFTER COVID-19

FIGURE 5 VOLATILITY IN OIL PRICES/OIL PRICE DEPRESSION, 2011–2020

FIGURE 6 CAPITAL EXPENDITURE REVISION OF SELECTED OIL & GAS COMPANIES, 2020

FIGURE 7 DECREASE IN DEMAND FOR GAS SENSORS EXPECTED IN AUTOMOTIVE & TRANSPORTATION SEGMENT IN 2021

FIGURE 8 APAC TO BE THE LARGEST MARKET FOR GAS SENSORS

The study involved four major activities in estimating the global gas sensors market size. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the gas sensors market study. The secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; news sources, articles from recognized authors; authenticated directories; and databases. Secondary research was conducted primarily to obtain key information about the supply chain of the industry, the monetary chain of the market, the total market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand side were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as marketing directors, consultants, R&D managers, and related key executives from major companies and organizations operating in the market. The primary sources from the demand side included refinery engineers, OEMs, and sales/purchase managers from end-use industries.

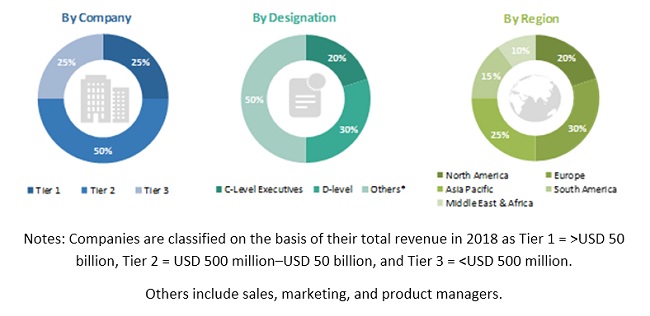

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the gas sensors market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All the percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the gas sensors market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the various sectors.

Objectives of the Study:

- To analyze the impact of COVID-19 on the gas sensors market by technology, end-use industry, and region

- To provide detailed information about the major factors (drivers and challenges) influencing the trends in the gas sensors market during the COVID-19 pandemic

- To analyze the impact of a prolonged pandemic on the supply-demand scenario of oil and gas and eventually on the gas sensors demand

- To study the health and economic impact of COVID-19 on various industries

- To analyze the shift in the expenditure of critical end-use industries of gas sensors such as healthcare, oil & gas and chemicals, and others

- To examine the shift in revenue patterns of gas sensor manufacturers in 2020 as well as 2021 and their capabilities to address emerging demand during this global COVID-19 pandemic

- To analyze the change in short-term strategies of manufacturers and end users in the gas sensors market

- To track key developments, such as new product launches, partnerships, agreements, and collaborations, in the context of the COVID-19 pandemic in the global gas sensors market

Growth opportunities and latent adjacency in COVID-19 Impact on Gas Sensors Market