COVID 19 Impact on IVD (In Vitro Diagnostics) Market by Technology (PCR, NGS, ELISA, Rapid Test, Hematology, Hemostasis, Clinical Chemistry, Microbiology Testing, Urinalysis), End-user and Region - Global Forecast to 2025

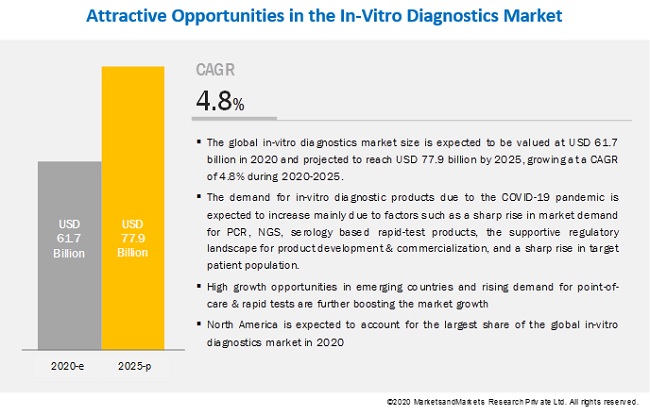

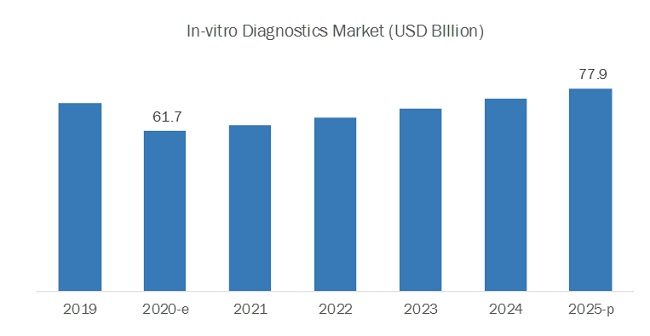

[70 Pages Report] The global in-vitro diagnostics market size is expected to be valued at USD 61.7 billion in 2020 and projected to reach USD 77.9 billion by 2025, growing at a CAGR of 4.8% during 2020-2025. The demand for in-vitro diagnostic products due to the COVID-19 pandemic is expected to increase mainly due to factors such as a sharp rise in market demand for PCR, NGS, serology based rapid-test products, the supportive regulatory landscape for product development & commercialization, and a sharp rise in target patient population. These factors have prompted market players to improve and strengthen their current manufacturing and distribution capabilities as well as to focus on product commercialization & upgrades.

The PCR segment is expected to hold the largest share of the market in 2020 H1

Based on technology, the in-vitro diagnostics market is segmented into PCR, NGS, ELISA, rapid-tests, clinical chemistry, hematology, hemostasis, urinalysis, microbiology testing, and others. The PCR segment is expected to hold the largest share of the global in-vitro diagnostics market in 2020 – H1. Factors such as the increasing patient emphasis on effective & early patient screening, continued commercialization of novel COVID screening platforms by major players, early efforts of key players to address supply chain bottlenecks, and easy availability of controls & standards are driving the growth of this segment.

The US to account for the largest share of the in-vitro diagnostics market in 2020 H1

The US is expected to account for the largest share of the in-vitro diagnostics market in 2020 - H1, followed by Europe. This can primarily be attributed to the continuous commercialization of innovative diagnostic products coupled with ongoing advancements in the field of gene & immunoassay based products, the recent discovery of genetic biomarkers & their clinical role in immunoassay testing, supportive government policies & their emphasis on novel product development, and the significant expansion of target patient population.

Key Market Players

As of 2019, some of the prominent players in the in-vitro diagnostics market are Roche Diagnostics (Switzerland), Abbott Laboratories (US), Thermo Fisher Scientific (US), Becton, Dickinson and Company (US), Bio-Rad Laboratories (US), Biomerieux (France), and QIAGEN (Germany), among others.

An analysis of the market developments between December 2019 to April 2020 revealed that product commercialization, developmental collaborations, and product distribution partnerships were adopted by market players to maintain a competitive position in the in-vitro diagnostics market to mitigate the COVID-19 impact. Product commercialization was the most widely adopted growth strategy.

Roche Diagnostics is the top player in the global in-vitro diagnostics market. Roche Diagnostics was the leading player in the IVD market. The company’s leading position in the IVD market is attributed to its diverse product portfolio across clinical chemistry, immunochemistry, molecular diagnostics, and tissue diagnostics products. The company also has a strong geographic presence across major healthcare markets in North America, Europe, Asia, as well as MEA, which enables it to cater to a large consumer base worldwide. To maintain its leadership position in the global IVD market, the company mainly focuses on product commercialization, developmental collaborations, and product distribution partnerships.

Want to explore hidden markets that can drive new revenue in COVID 19 Impact on IVD (In Vitro Diagnostics) Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID 19 Impact on IVD (In Vitro Diagnostics) Market?

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, end user, and region/country |

|

Geographies covered |

US, Germany, France, UK, Spain, Italy, China, Japan, Australia, India, South Korea, the Americas, Europe, Asia-Pacific, Middle East, and Africa |

|

Companies covered |

Major players covered include Bio-Rad Laboratories, Inc. (US), F. Hoffman-La Roche Ltd. (Switzerland), QIAGEN NV (Netherlands), Thermo Fisher Scientific Inc. (US), bioMérieux S.A., Immucor, Inc. (US), Illumina, Inc. (US), Luminex Corporation (US), CareDx (US), Becton, Dickinson and Company (US), Hologic (US), GenDx (Netherlands), Biofortuna (UK), Takara Bio, and BAG Healthcare |

This research report categorizes the in-vitro diagnostics market into the following segments and subsegments:

By Technology

- Polymerase chain reaction

- Next-generation Sequencing

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Rapid/PoC Tests

- Clinical Chemistry

- Microbiology Testing

- Hematology

- Coagulation & Hemostasis

- Urinalysis

- Other Technologies

By End User

- Hospital-based Laboratories

- Independent Laboratories

- Reference Laboratories

- Point of Care and Self Testing

- Researchers & Academia

- Other End Users

By Region

- US

- Germany

- France

- UK

- Spain

- Italy

- China

- Japan

- India

- Australia

- South Korea

- Rest of Americas

- Rest of Europe

- Rest of Asia-Pacific

- The Middle East and Africa

Recent Developments (2019-2020):

- In March 2020, Abbott expanded their manufacturing capacity to offer 5 million ID now test kits per month from April onwards

- In April 2020, Hologic has strengthened its production line for CDx units to provide 600K test kits per month

- In March 2020, IDT has announced its capabilities to offer 5 million diagnostic test kits from April 1st week for COVID screening

- In March 2020, BARDA (US) has provided funding of USD 0.7 million to Hologic to develop rapid diagnostic kits for COVID

Key Questions Addressed by the Report:

- What would be major IVD technologies impacted by COVID-19 during 2020-2021?

- What are the growth opportunities related to the adoption of in-vitro diagnostic products across major countries/regions in the future?

- Emerging countries show immense opportunities for the growth and adoption of in-vitro diagnostic technologies. Will this scenario continue in the next five years?

- Where will the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the newest trends and advancements in the in-vitro diagnostics market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 RESEARCH SCOPE

1.3.1 SEGMENTS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 MAJOR MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING MARKET ESTIMATION

2.2.2 PROCEDURE BASED BASED MARKET ESTIMATION

2.2.3 PRIMARY DATA VALIDATION

2.3 COVID-19 IMPACT ASSESSMENT METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 IN VITRO DIAGNOSTICS INDUSTRY ECOSYSTEM

3.1 MAJOR TECHNOLOGIES

3.2 KEY APPLICATION AREAS

3.3 PROMINENT END USER CATEGORIES

3.4 50 MAJOR GLOBAL MANUFACTURERS

4 IN VITRO DIAGNOSTICS: INDUSTRY INSIGHTS

4.1 MARKET DYNAMICS

4.1.1 DRIVERS

4.1.2 RESTRAINTS

4.1.3 OPPORTUNITIES

4.1.4 CHALLENGES

4.2 GLOBAL REGULATORY SCENARIO

4.3 GLOBAL SUPPLY CHAIN ASSESSMENT

5 IN VITRO DIAGNOSTICS MARKET ASSESSMENT FOR COVID IMPACT, BY TECHNOLOGY [USD MILLION; 2019, 2020 (H1), 2020 (H2), 2021, 2025]

5.1 POLYMERASE CHAIN REACTION (PCR)

5.2 NEXT GENERATION SEQUENCING (NGS)

5.3 MICROARRAY

5.4 ISOTHERMAL NUCLEIC ACID AMPLIFICATION (INAAT)

5.5 ENZYME LINKED IMMUNOSORBENT ASSAY (ELISA)

5.6 LATERAL FLOW ASSAY

5.7 HEMATOLOGY

5.8 HEMOSTASIS

5.9 URINANALYSIS

5.10 MICROBIAL TESTING

5.11 CLINICAL CHEMISTRY

5.12 OTHER TECHNOLOGIES

6 IN VITRO DIAGNOSTICS: END USER LANDSCAPE

6.1 HOSPITAL-BASED LABORATORIES

6.2 INDEPENDENT LABORATORIES

6.3 REFERENCE LABORATORIES

6.4 POINT-OF-CARE AND SELF TESTING

6.5 RESEARCHERS & ACADEMIA

6.6 OTHER END USERS

7 IN VITRO DIAGNOSTICS MARKET ASSESSMENT FOR COVID IMPACT, BY COUNTRY [USD MILLION; 2019, 2020 (H1), 2020 (H2), 2021, 2025]

7.1 US

7.2 GERMANY

7.3 UK

7.4 FRANCE

7.5 ITALY

7.6 SPAIN

7.7 CHINA

7.8 JAPAN

7.9 INDIA

7.10 SOUTH KOREA

7.11 AUSTRALIA

7.12 REST OF AMERICAS

7.13 REST OF EUROPE

7.14 REST OF ASIA-PACIFIC

7.15 MIDDLE EAST AND AFRICA

8 COMPETITIVE LANDSCAPE

8.1 OVERVIEW

8.2 MARKET SHARE OF TOP 5 VENDORS (IN TERMS OF %REVENUE, AS OF 2019)

8.3 PRODUCT PORTFOLIO OF MAJOR VENDORS FOR COVID DIAGNOSTICS

8.4 RECENT STRATEGIC INITIATIVES (DURING DECEMBER 2019 – MARCH 2020)

8.4.1 PORTFOLIO DIVERSIFICATION

8.4.2 INVESTMENTS AND FUNDINGS

8.4.3 PRODUCT DEVELOPMENT PARTNERSHIPS

8.4.4 STRATEGIC COLLABORATIONS

9 MAJOR INDUSTRY USE CASES

9.1 IN VITRO DIAGNOSTIC VENDORS

9.2 ADJACENT INDUSTRY VENDORS

9.3 RAW MATERIAL AND COMPONENT SUPPLIERS

9.4 HEALTHCARE SOFTWARE PROVIDERS

The study involved four major activities in estimating the current size of the global in-vitro diagnostics market as well as impact assessment of the COVID-19 pandemic at the country level. Exhaustive secondary research was conducted to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Businessweek, and Factiva) were referred to identify and collect information for this study.

Primary Research

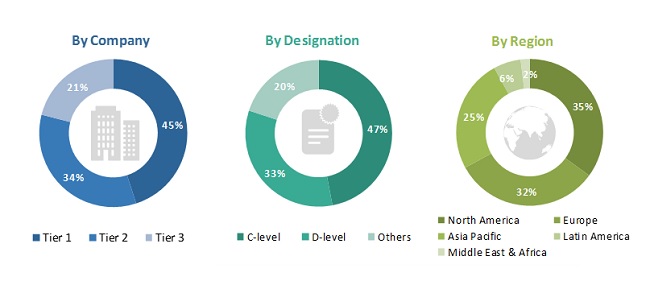

The global in-vitro diagnostics market comprises several stakeholders such as original equipment manufacturers (OEMs), product distributors and channel partners, hospitals and diagnostic centers, emergency care units and trauma centers, diagnostic laboratories, contract manufacturers and third-party suppliers, research laboratories and academic institutes, clinical research organizations (CROs), government and non-governmental regulatory authorities, and market research and consulting firms. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the global in-vitro diagnostics market and other dependent submarkets, as mentioned below.

- Key players in the global in-vitro diagnostics market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of significant market players as well as interviews with industry experts for detailed market insights.

- All percentage shares, splits, and breakdowns for the global in-vitro diagnostics market were determined using secondary sources and verified through primary sources.

- All key macro-indicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added to detailed inputs, analyzed, and presented in this report.

Data Triangulation

After arriving at the overall market size of the global in-vitro diagnostics market through the methodology as mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the global in-vitro diagnostics market based on the product, end user, and region

- To provide detailed information on the major factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contributions to the overall in-vitro diagnostics market

- To forecast the market value of various segments and subsegments for target countries (US, Germany, UK, France, Spain, Italy, China, India, Japan, South Korea, Australia) and regions— Americas, Europe, Asia Pacific, and Middle East & Africa

- To identify key players in the global in-vitro diagnostics market and comprehensively analyze their global revenue shares and core competencies

- To track and analyze competitive market-specific developments w.r.t. COVID-19 pandemic such as product launches/approvals; partnerships, collaborations, agreements; expansions; and acquisitions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in COVID 19 Impact on IVD (In Vitro Diagnostics) Market