COVID-19 Impact on Lubricants Market by Product type (Engine Oil, Hydraulic Oil, Compressor Oil, Metalworking Fluid, Gear Oil, Turbine Oil and Grease), End-use Industry and Region - Global Forecast to 2021

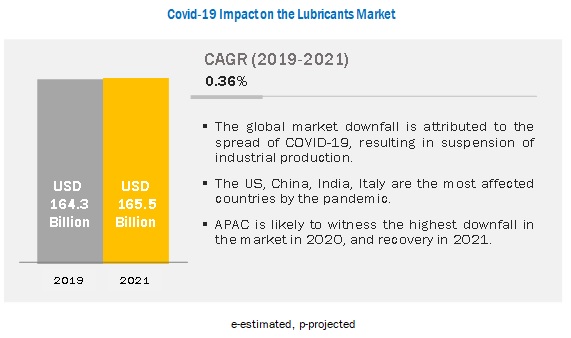

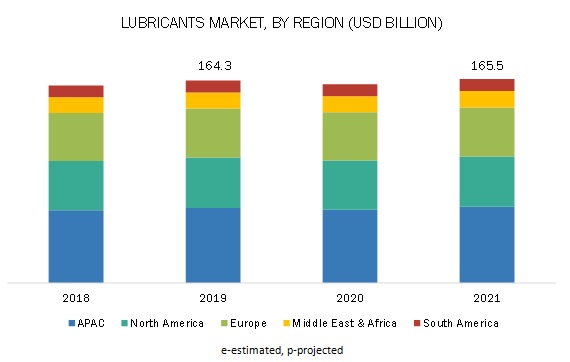

[119 Pages Report] The global lubricants market is projected to reach USD 165.5 billion in 2021 from USD 164.3 billion in 2019. Massive industrialization in APAC and the Middle East & Africa, coupled with the rise in process automation in most of the industries, and the increasing number of vehicles on road are key factors driving the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Engine oil is projected to be the largest and most affected product type segment during the forecast period.

Engine oil is expected to witness a downfall in demand in the global lubricants market in 2020. The impact on engine oil is mainly due to its wide usability in the transportation and construction industries, production in which is on halt due to the pandemic.

Transportation is projected to be the largest application during the forecast period in the lubricants market.

Based on end-use industry, the market is segmented into transportation and industrial lubricants. The demand for lubricants is high in the transportation segment due to large number of vehicles on road in China, the US, and India. With the lockdown across the globe, the activities in transportation sector are almost paused causing decline in demand of lubricants.

APAC is estimated to account for the largest share of the global lubricants market during the forecast period.

APAC is expected to account for the largest share in the global lubricants industry during the forecast period, in terms of both volume and value. The increasing population in the region, accompanied by rising spending in the industrial sector and infrastructural developments in China, India, and Indonesia, is projected to make this region an ideal destination for the lubricants industry.

Key Market Players

The key COVID-19 Impact on Lubricants Market players profiled in the report include Royal Dutch Shell Plc. (Netherlands), ExxonMobil Corporation (US), Chevron Corporation (US), BP p.l.c. (UK), Total S.A. (France), PetroChina Company Limited (China), Sinopec Limited (China), LUKOIL (Russia), Fuchs Petrolub AG (Germany), and Idemitsu Kosan Co. Ltd (Japan).

Royal Dutch Shell is one of the leading producers of lubricants. The company has undertaken a few measures to sustain their position in the market despite decline in demand. For instance, the company diverted resources to produce isopropyl, the main ingredient to produce hand sanitizers.

ExxonMobil is ranked at the second position in the lubricants market. The company also reduced the budgeted capital expenditure along with reduced operational expenditure to decrease the impact on profitability.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Lubricants Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Lubricants Market?

|

Report Metric |

Details |

| Years considered for the study | 2018-2021 |

| Base Year | 2019 |

| Forecast period | 2020-2021 |

| Units considered | Value (USD Thousand), Volume (Kiloton) |

| Segments covered | Product Type, End-Use Industry, and Region |

| Regions covered | APAC, North America, Europe, Middle East & Africa, and South America |

| Companies profiled | Royal Dutch Shell (Netherlands), ExxonMobil (US), BP PLC (UK), Chevron Corporation (US), Total S.A. (France), PetroChina Company Limited (China), Idemitsu Kosan Co. Ltd. (Japan), Sinopec Limited (China), Fuchs Petrolub AG (Germany), Valvoline (US), LUKOIL (Russia), Petronas (Malaysia), Gazprom Neft (Russia), Pertamina (Indonesia), and others. |

This report categorizes the global lubricants market based on product type, end-use industry, and region.

Based on Product Type:

- Engine Oil

- Hydraulic fluid

- Metalworking fluid

- Gear Oil

- Compressor oil

- Grease

- Turbine Oil

- Others

- Transformer Oil

- Refrigeration Oil

- Textile Machinery Lubricants

Based on the End-Use Industry:

- Transportation

- Commercial vehicles

- Passenger vehicles

- Aviation

- Railways

- Marine

- Industrial

- Construction & Mining

- Metal Production

- Cement Production

- Power Generation

- Automobile Manufacturing

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

Based on the Region:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Key questions addressed by the report:

- What are the major developments impacting the market?

- Which end-use industry of lubricants is most impacted due to COVID-19?

- Which region will witness major downfall in demand for lubricants during 2020 and 2021?

- Analyze the impact of COVID-19 on the lubricants market.

- Which are the most impacted countries?

- What measures are taken by stakeholders to overcome the situation and sustain their market position?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 14)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGION COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 17)

2.1 CRITICAL COVID-19 FACTORS IMPACTING THE LUBRICANT MARKET IN 2020

2.2 RESEARCH METHODOLOGY: TRANSPORT SEGMENT ANALYSIS FOR THE NORTH AMERICA IN 2020

2.3 PRODUCT TYPE SEGMENT ANALYSIS FOR NORTH AMERICA IN 2020

2.4 LUBRICANTS MARKET PROJECTIONS BASED ON DRIVING FACTORS AND COVID-19 IMPACT

2.5 PRIMARY DATA

2.5.1 BREAKDOWN OF PRIMARY INTERVIEWS

2.5.2 KEY INDUSTRY INSIGHTS

3 COVID-19 ASSESSMENT (Page No. - 21)

3.1 COVID-19 HEALTH ASSESSMENT

3.2 COVID-19 ECONOMIC ASSESSMENT

3.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

4 IMPACT OF COVID-19 ON LUBRICANTS ECOSYSTEM (Page No. - 27)

4.1 VALUE CHAIN OF LUBRICANTS INDUSTRY

4.2 KEY TAKEAWAYS

4.2.1 IMPACT ON TRANSPORTATION

4.2.2 IMPACT ON INDUSTRIAL APPLICATIONS

4.3 FACTORS DRIVING THE GROWTH

4.3.1 COVID-19 IMPACT: FACTORS DRIVING THE GROWTH

4.3.1.1 Emission limits and fuel economy requirements to drive the demand for lubricants in emerging markets such as China and India after COVID-19

4.3.1.2 Growth in demand for biocompatible silicone-grade lubricants for medical devices

4.3.1.3 Lower crude oil prices will benefit lubricants suppliers after COVID-19

4.3.1.4 Demand for renewable energy and power generation to positively impact the lubricants market

5 IMPACT OF COVID-19 ON LUBRICANTS MARKET, CUSTOMER ANALYSIS (Page No. - 35)

5.1 CUSTOMERS

5.1.1 DISRUPTION IN THE AUTOMOTIVE INDUSTRY

5.1.1.1 Impact on customers’ output & strategies to resume/improve production

5.1.1.2 Customer’s most impacted regions

5.1.1.3 Risk assessment and opportunities

5.1.1.4 MnM viewpoint on growth outlook and new market opportunities

5.1.2 DISRUPTION IN METAL & MINING INDUSTRY

5.1.2.1 Impact on customers’ output & strategies to resume/improve production

5.1.2.2 Customer’s most impacted regions

5.1.2.3 Risk assessment and opportunities

5.1.2.4 MnM viewpoint on growth outlook and new market opportunities

5.1.3 DISRUPTION IN THE CONSTRUCTION INDUSTRY

5.1.3.1 Impact in customers’ output & strategies to resume/improve production

5.1.3.2 Customer’s most impacted regions

5.1.3.3 MnM viewpoint on growth outlook and new market opportunities

5.1.4 DISRUPTION IN THE OIL & GAS INDUSTRY

5.1.4.1 Impact on customers’ output & strategies to resume/improve production

5.1.4.2 Customer’s most impacted regions

5.1.4.3 MnM viewpoint on growth outlook and new market opportunities

6 COVID-19 IMPACT: SHORT-TERM STRATEGIES OF LUBRICANT COMPANIES (Page No. - 46)

6.1 IMPACT ON LUBRICANT COMPANIES

6.1.1 ROYAL DUTCH SHELL PLC.

6.1.1.1 Business overview

6.1.1.2 Products offered

6.1.1.3 Impact of COVID-19

6.1.2 EXXONMOBIL CORPORATION

6.1.2.1 Business overview

6.1.2.2 Products offered

6.1.2.3 Impact of COVID-19

6.1.3 CHEVRON CORPORATION

6.1.3.1 Business overview

6.1.3.2 Products offered

6.1.3.3 Impact of COVID-19

6.1.4 BP PLC

6.1.4.1 Business overview

6.1.4.2 Products offered

6.1.4.3 Impact of COVID-19

6.1.5 TOTAL S.A.

6.1.5.1 Business overview

6.1.5.2 Products offered

6.1.5.3 Impact of COVID-19

6.1.6 PETROCHINA COMPANY LIMITED

6.1.6.1 Business overview

6.1.6.2 Products offered

6.1.6.3 Impact of COVID-19

6.1.7 SINOPEC LIMITED

6.1.7.1 Business overview

6.1.7.2 Products offered

6.1.7.3 Impact of COVID-19

6.1.8 JXTG GROUP

6.1.8.1 Business overview

6.1.8.2 Products offered

6.1.8.3 Impact of COVID-19

6.1.9 PETRONAS

6.1.9.1 Business overview

6.1.9.2 Products offered

6.1.9.3 Impact of COVID-19

6.1.10 PERTAMINA

6.1.10.1 Business overview

6.1.10.2 Products offered

6.1.10.3 Impact of COVID-19

6.1.11 GAZPROM NEFT

6.1.11.1 Business overview

6.1.11.2 Product offered

6.1.11.3 Impact of COVID-19

6.1.12 REPSOL SA

6.1.12.1 Business overview

6.1.12.2 Product offered

6.1.12.3 Impact of COVID-19

6.1.13 PHILLIPS 66

6.1.13.1 Business overview

6.1.13.2 Product offered

6.1.13.3 Impact of COVID-19

6.1.14 PETROBRAS

6.1.14.1 Business overview

6.1.14.2 Products offered

6.1.14.3 Impact of COVID-19

6.1.15 INDIAN OIL CORPORATION LIMITED (IOCL)

6.1.15.1 Business overview

6.1.15.2 Product offered

6.1.15.3 Impact of COVID-19

6.2 WINNING STRATEGIES TO OVERCOME THE SITUATION

6.2.1 STRATEGIES ADOPTED BY STAKEHOLDERS

6.3 MNM VIEWPOINT ON STRATEGIES TO OVERCOME THE SITUATION

7 IMPACT OF COVID-19 ON LUBRICANTS MARKET, BY PRODUCT TYPE (Page No. - 66)

7.1 INTRODUCTION

7.2 ENGINE OIL

7.3 HYDRAULIC OIL

7.4 METALWORKING FLUID

7.5 GEAR OIL

7.6 COMPRESSOR OIL

7.7 GREASE

7.8 TURBINE OIL

7.9 OTHERS

8 IMPACT OF COVID-19 ON LUBRICANT MARKET, BY END-USE INDUSTRY (Page No. - 77)

8.1 INTRODUCTION

8.2 TRANSPORTATION

8.2.1 COMMERCIAL VEHICLE

8.2.2 PASSENGER VEHICLE

8.2.3 AVIATION

8.2.4 MARINE

8.2.5 RAILWAY

8.3 INDUSTRIAL

8.3.1 CONSTRUCTION

8.3.2 METAL & MINING

8.3.3 CEMENT PRODUCTION

8.3.4 POWER GENERATION

8.3.5 AUTOMOTIVE MANUFACTURING

8.3.6 CHEMICAL

8.3.7 OIL & GAS

8.3.8 TEXTILE

8.3.9 FOOD PROCESSING

8.3.10 OTHERS

9 IMPACT OF COVID-19 ON LUBRICANTS MARKET, BY REGION (Page No. - 95)

9.1 INTRODUCTION

9.2 APAC

9.2.1 APAC LUBRICANTS MARKET, BY COUNTRY

9.2.2 APAC LUBRICANT MARKET, BY PRODUCT TYPE

9.2.3 APAC LUBRICANTS MARKET, BY END-USE INDUSTRY

9.3 NORTH AMERICA

9.3.1 NORTH AMERICA LUBRICANTS MARKET, BY COUNTRY

9.3.2 NORTH AMERICA LUBRICANT MARKET, BY PRODUCT TYPE

9.3.3 NORTH AMERICA LUBRICANTS MARKET, BY END-USE INDUSTRY

9.4 EUROPE

9.4.1 EUROPE LUBRICANTS MARKET, BY COUNTRY

9.4.2 EUROPE LUBRICANT MARKET, BY PRODUCT TYPE

9.4.3 EUROPE LUBRICANTS MARKET, BY END-USE INDUSTRY

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA LUBRICANTS MARKET, BY COUNTRY

9.5.2 MIDDLE EAST & AFRICA LUBRICANT MARKET, BY PRODUCT TYPE

9.5.3 MIDDLE EAST & AFRICA LUBRICANTS MARKET, BY END-USE INDUSTRY

9.6 SOUTH AMERICA

9.6.1 SOUTH AMERICA LUBRICANTS MARKET, BY COUNTRY

9.6.2 SOUTH AMERICA LUBRICANT MARKET, BY PRODUCT TYPE

9.6.3 SOUTH AMERICA LUBRICANTS MARKET, BY END-USE INDUSTRY

10 APPENDIX (Page No. - 116)

10.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

10.2 AVAILABLE CUSTOMIZATIONS

10.3 RELATED REPORTS

10.4 AUTHOR DETAILS

LIST OF TABLES (91 Tables)

TABLE 1 IMPLEMENTATION DATES OF EMISSION STANDARDS FOR LIGHT-DUTY VEHICLES IN CHINA

TABLE 2 CRUDE OIL PRICE FORECAST

TABLE 3 AUTOMOTIVE COMPANIES ANNOUNCEMENTS

TABLE 4 OPPORTUNITY ASSESSMENT – SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

TABLE 5 MINING COMPANIES ANNOUNCEMENTS

TABLE 6 OPPORTUNITY ASSESSMENT – SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

TABLE 7 CONSTRUCTION COMPANIES ANNOUNCEMENTS

TABLE 8 OIL & GAS COMPANIES ANNOUNCEMENTS

TABLE 9 OPPORTUNITY ASSESSMENT – SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

TABLE 10 LUBRICANTS MARKET SIZE, BY PRODUCT TYPE, 2018-2021 (KILOTON)

TABLE 11 LUBRICANT MARKET SIZE, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

TABLE 12 ENGINE OIL: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 13 ENGINE OIL: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 14 HYDRAULIC OIL: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 15 HYDRAULIC OIL: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 16 METALWORKING FLUID: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 17 METALWORKING FLUID: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 18 GEAR OIL: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 19 GEAR OIL: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 20 COMPRESSOR OIL: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 21 COMPRESSOR OIL: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 22 GREASE: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 23 GREASE: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 24 TURBINE OIL: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 25 TURBINE OIL: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 26 OTHERS: LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 27 OTHERS: LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 28 LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

TABLE 29 LUBRICANT MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

TABLE 30 LUBRICANTS MARKET SIZE IN COMMERCIAL VEHICLE, BY REGION, 2018-2021 (KILOTON)

TABLE 31 LUBRICANT MARKET SIZE IN COMMERCIAL VEHICLE, BY REGION, 2018-2021 (USD MILLION)

TABLE 32 LUBRICANTS MARKET SIZE IN PASSENGER VEHICLE, BY REGION, 2018-2021 (KILOTON)

TABLE 33 LUBRICANT MARKET SIZE IN PASSENGER VEHICLE, BY REGION, 2018-2021 (USD MILLION)

TABLE 34 LUBRICANTS MARKET SIZE IN AVIATION INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 35 LUBRICANT MARKET SIZE IN AVIATION INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 36 LUBRICANTS MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 37 LUBRICANT MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 38 LUBRICANTS MARKET SIZE IN RAILWAY INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 39 LUBRICANT MARKET SIZE IN RAILWAY INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 40 LUBRICANTS MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 41 LUBRICANT MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 42 LUBRICANTS MARKET SIZE IN METAL & MINING INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 43 LUBRICANT MARKET SIZE IN METAL & MINING INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 44 LUBRICANTS MARKET SIZE IN CEMENT PRODUCTION, BY REGION, 2018-2021 (KILOTON)

TABLE 45 LUBRICANT MARKET SIZE IN CEMENT PRODUCTION, BY REGION, 2018-2021 (USD MILLION)

TABLE 46 LUBRICANTS MARKET SIZE IN POWER GENERATION INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 47 LUBRICANT MARKET SIZE IN POWER GENERATION INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 48 LUBRICANTS MARKET SIZE IN AUTOMOTIVE MANUFACTURING, BY REGION, 2018-2021 (KILOTON)

TABLE 49 LUBRICANT MARKET SIZE IN AUTOMOTIVE MANUFACTURING, BY REGION, 2018-2021 (USD MILLION)

TABLE 50 LUBRICANTS MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 51 LUBRICANT MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 52 LUBRICANTS MARKET SIZE IN OIL & GAS INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 53 LUBRICANT MARKET SIZE IN OIL & GAS INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 54 LUBRICANTS MARKET SIZE IN TEXTILE INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 55 LUBRICANT MARKET SIZE IN TEXTILE INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 56 LUBRICANTS MARKET SIZE IN FOOD PROCESSING INDUSTRY, BY REGION, 2018-2021 (KILOTON)

TABLE 57 LUBRICANT MARKET SIZE IN FOOD PROCESSING INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

TABLE 58 LUBRICANTS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2021 (KILOTON)

TABLE 59 LUBRICANT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2021 (USD MILLION)

TABLE 60 LUBRICANTS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

TABLE 61 LUBRICANT MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

TABLE 62 APAC: LUBRICANTS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 63 APAC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 APAC: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (KILOTON)

TABLE 65 APAC: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 66 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

TABLE 67 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (KILOTON)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 74 EUROPE: LUBRICANTS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 75 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (KILOTON)

TABLE 77 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

TABLE 79 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA: LUBRICANT MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 81 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (KILOTON)

TABLE 83 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

TABLE 85 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 86 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 87 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (KILOTON)

TABLE 89 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 90 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

TABLE 91 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

LIST OF FIGURES (13 Figures)

FIGURE 1 LUBRICANTS: MARKET SEGMENTATION

FIGURE 2 COVID-19: THE GLOBAL PROPAGATION

FIGURE 3 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 4 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 5 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 6 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 7 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 8 LUBRICANTS MARKET: ECOSYSTEM

FIGURE 9 IMPACT OF COVID-19 ON LUBRICANTS - KEY HOTSPOTS OF ACTIVITIES GAINING MOMENTUM

FIGURE 10 IMPACT OF COVID-19 ON LUBRICANT ECOSYSTEM

FIGURE 11 LUBRICANTS TRANSPORTATION VALUE CHAIN TO BE ADVERSELY AFFECTED

FIGURE 12 MIX IMPACT ON LUBRICANTS INDUSTRIAL VALUE CHAIN THROUGH 2021

FIGURE 13 IMPACT OF COVID-19 ON LUBRICANT MANUFACTURERS

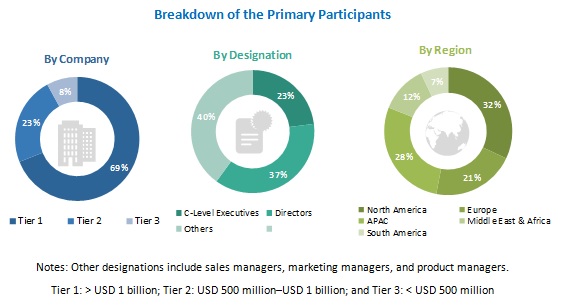

The study involved four major activities in estimating the impact of COVID-19 on lubricants market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, announcements, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The lubricants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The end-use industries characterize the demand side of this market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the lubricants market, incorporating the impact of COVID-19 at global, regional, and country level. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Identifying the key players in the industry through extensive secondary research

- Identifying the COVID-19 affected countries and regions and measures taken by government as well as different industries to overcome the situation

- Analyzing the demand from affected industries in current and normal scenario to estimate to overall impact on the market size

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the lubricants market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of lubricants considering the pandemic scenario.

Report Objectives

- To analyze and forecast the impact of COVID-19 on the lubricants market, in terms of value and volume

- To provide information about the key factors influencing the growth of the market

- To define, segment, and project the size of the global lubricants market on the basis of product type and end-use industry

- To project the size of the market, with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America, with their key countries

- To strategically profile key players and comprehensively analyze the impact of COVID-19 on their business

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the lubricants market report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional source type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in COVID-19 Impact on Lubricants Market