COVID-19 Impact On Medical Plastics Market by Type (Engineering Plastics and Standard Plastics), Application (Medical Disposables, Prosthetics, Medical Instruments & Tools and Drug Delivery) and Region - Global Forecast to 2021

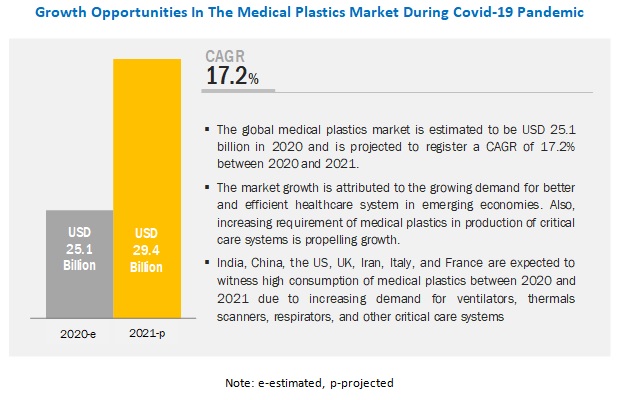

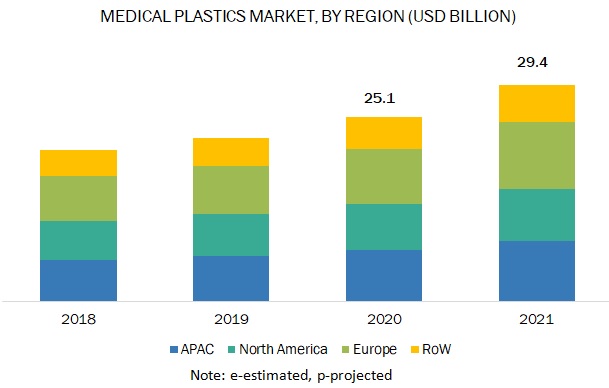

[57 Pages Report] The global medical plastics market size during this pandemic is projected to grow from USD 25.1 billion in 2020 to USD 29.4 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 17.2% during the forecast period. The major drivers for the medical plastics industry include the growing demand from OEMs and medical device/equipment manufacturers for the production of critical care systems such as ventilators, thermal scanners, respirators, and so on. Also, growing awareness around maintaining proper health & hygiene is driving medical plastics consumption.

Based on type, the standard plastics segment is projected to lead the medical plastics market during the forecast period.

Standard plastics are conventional plastics, which are obtained from petroleum and are non-renewable sources. These plastics generally include PVC, PE, PP, PS, PMMA, and EVA. The major applications of these plastics include the manufacturing of masks, gloves, drapes, gowns, trays, catheters, syringes, orthopedic devices, surgical tools, and lab wares. Increased requirements of PPEs will boost the consumption of standard plastics such as PP, PE, and drive demand.

Based on the application, the medical disposables segment is projected to register the highest CAGR during the forecast period in the medical plastics market

The use of medical plastics is increasing due to their versatility. Medical disposables can be defined as single-use products that are used in surgical as well as procedural applications. The use of these medical products in procedural applications and general checkup is increasing. Besides, the use of these disposables as instructed by various agencies, such as USFDA and Europe FDA, are propelling the demand for medical plastics globally. Increased demand for disposables such as gloves, masks, gowns, and other PPEs will drive the market during this pandemic.

APAC is projected to be the largest medical plastics industry during the projected crisis period.

APAC is expected to be the largest medical plastics market during the forecast period. This growth is attributed primarily to the large medical device manufacturing base and increased requirement of PPEs in the region. Also, APAC has immense growth potential driven by the increasing demand for a better healthcare system. Across these economies, local governments are reforming regulations in fields such as IT integration, advanced materials, and others in the healthcare industry to increase the efficiency and efficacy of medical devices and related healthcare services in this crisis period.

SABIC (Saudi Arabia), BASF (Germany), Celanese (US), Evonik (Germany), Solvay (Belgium), and Covestro (Germany) are some of the leading market players in the global medical plastics market. CSR activities, increase in production, and partnerships were the major growth strategies adopted by the market players during this period to enhance their regional presence and meet the growing demand for medical plastics in the affected regions.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact On Medical Plastics Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact On Medical Plastics Market?

|

Report Metric |

Details |

|

Years considered for the study |

2018–2021 |

|

Base year |

2019 |

|

Forecast period |

2020–2021 |

|

Units considered |

Value (USD), Volume (Kiloton) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, APAC, Europe, and RoW |

|

Companies |

SABIC (Saudi Arabia), BASF (Germany), Celanese (US), Evonik (Germany), Solvay (Belgium), and Covestro (Germany) |

This research report categorizes the medical plastics market based on type, application, and region.

By Type:

- Engineering plastics

- Standard plastics

- Others (PEEK, TPE & TPU, polystyrene, PS, PTFE, and silicone)

By Application:

- Medical disposables

- Prosthetics

- Medical instruments & tools

- Drug delivery

- Others (medical trays, sterilization trays, and lab wares)

By Region:

- APAC

- Europe

- North America

- Rest of the World

Recent Developments

- In April 2020, Lubrizol announced an increase in the production of Carbopol polymers and Estane TPU materials. This strategy was undertaken to support the rising demand for protective garments, face shields, barrier curtains, hoses, tubing and cables, medical device components utilized in ventilators, valves, and infusion pumps, and other devices produced through 3D printing. The company is also collaborating with its customers to help serve their needs and address critical shortages.

- In April 2020, Celanese Corporation pledged to prioritize production of those materials which are used for the manufacturing of ventilators, respirators, and other critical medical equipment and supplies. The company is also planning to expand its supply chain base to cater to the increased demand for medical plastics from the healthcare industry. Various plastics that are used in the manufacturing of medical devices are POM, PBT, UHMW-PE, PET, EVA, and others.

- In April 2020, Solvay partnered with Boeing to produce protective equipment for healthcare professionals dealing with COVID-19. Solvay will be supplying the high-performance, medical-grade transparent film to Boeing, who will use this material for the production of face shields. The thermoplastic film is manufactured using Solvay’s medical-grade Radel polyphenyl sulfone (PPSU) or Udel polysulfone (PSU). Both of these are transparent specialty polymers that are used widely for medical devices due to their ability to be sterilized and withstand aggressive disinfectants.

- In April 2020, To meet the demand for PPE in the US, DuPont is manufacturing 2.25 million Tyvek suits at its Vietnam facility. HDPE sheet to make these suits are being supplied by DuPont (US). It has the capacity to manufacturer an additional 4.5 million units if the demand increases.

Critical questions the report answers:

- What are the upcoming trends for the medical plastics market during this period?

- How are the market dynamics for different types of medical plastics during this period?

- What are the significant trends in applications influencing the medical plastics market during this period?

- What are the factors governing the medical plastics market in each region during this period?

- What are the strategies followed by various companies during this period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 11)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MEDICAL PLASTICS

1.2.2 COVID-19

1.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

1.4 MARKET SCOPE

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 COVID-19 IMPACT ON MEDICAL PLASTICS ECOSYSTEM (Page No. - 15)

2.1 INTRODUCTION

2.2 VALUE CHAIN OF MEDICAL PLASTICS INDUSTRY

2.2.1 RAW MATERIAL SUPPLIERS

2.2.2 MANUFACTURERS

2.2.3 DISTRIBUTORS/CONVERTORS

2.2.4 OEM/MEDICAL DEVICE MANUFACTURERS

2.3 MACROECONOMIC INDICATORS

2.3.1 DRIVERS

2.3.1.1 Growing awareness & concern about health & personal hygiene

2.3.1.2 Growing demand for medical plastics from various end users in healthcare industry

2.3.2 CHALLENGES

2.3.2.1 Maintaining supply chain and logistics

2.3.2.2 Restricting counterfeit products

3 CUSTOMER ANALYSIS (Page No. - 19)

3.1 INTRODUCTION

3.1.1 SHIFT IN HEALTHCARE INDUSTRY

3.1.1.1 Disruption in the industry

3.1.1.2 Impact on customers’ output & strategies to improve production

3.1.1.3 Impact on customers’ revenues

3.1.1.4 Customer’s most crucial regions

3.1.1.5 Short-term strategies to manage cost structure and supply chains

3.1.2 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

3.1.2.1 Measures taken by customers

3.1.2.2 Customers perspective on the growth outlook

4 IMPACT OF COVID-19 ON MEDICAL PLASTICS SEGMENTS (Page No. - 22)

4.1 TOP APPLICATIONS IN HEALTHCARE INDUSTRY

4.1.1 MEDICAL DISPOSABLES

4.1.2 MEDICAL INSTRUMENTS & TOOLS

4.1.3 DRUG DELIVERY

4.2 BOTTOM RANKING APPLICATIONS IN HEALTHCARE INDUSTRY

4.2.1 PROSTHETICS

4.2.2 DENTAL TOOLS

4.3 TOP POLYMER TYPES IN HEALTHCARE INDUSTRY

4.3.1 STANDARD PLASTICS

4.3.1.1 PVC

4.3.1.2 PP

4.3.1.3 PE

4.3.2 ENGINEERING PLASTICS

4.3.2.1 PC

4.3.2.2 PA

4.3.2.3 PET

4.3.3 OTHERS

4.3.3.1 PEEK

4.3.3.2 TPE & TPU

4.3.3.3 Others

4.4 BIGGEST GAINERS, BY TOP COMPANIES

5 IMPACT OF COVID-19 IN MEDICAL PLASTICS MARKET, BY REGION (Page No. - 28)

5.1 INTRODUCTION

5.2 APAC

5.2.1 CHINA

5.2.2 INDIA

5.2.3 JAPAN

5.3 EUROPE

5.3.1 ITALY

5.3.2 GERMANY

5.3.3 SPAIN

5.3.4 UK

5.4 NORTH AMERICA

5.4.1 US

5.5 REST OF WORLD

6 STRATEGIES OF MEDICAL PLASTICS COMPANIES DURING COVID-19 PANDEMIC (Page No. - 39)

6.1 SABIC

6.1.1 IMPACT ON COMPANY PORTFOLIO

6.1.1.1 Product/Material

6.1.1.2 Application

6.1.1.3 COVID-19 related developments/Strategy

6.2 BASF

6.2.1 IMPACT ON COMPANY PORTFOLIO

6.2.1.1 Product/Material

6.2.1.2 Application

6.2.1.3 COVID-19 related developments/strategy

6.3 CELANESE CORPORATION

6.3.1 IMPACT ON COMPANY PORTFOLIO

6.3.1.1 Product/Material

6.3.1.2 Application

6.3.1.3 COVID-19 related developments/strategy

6.4 SOLVAY

6.4.1 IMPACT ON COMPANY PORTFOLIO

6.4.1.1 Product/Material

6.4.1.2 Application

6.4.1.3 COVID-19 related developments/strategy

6.5 ARKEMA

6.5.1 IMPACT ON COMPANY PORTFOLIO

6.5.1.1 Product/Material

6.5.1.2 Application

6.5.1.3 COVID-19 related developments/strategy

6.6 COVESTRO

6.6.1 IMPACT ON COMPANY PORTFOLIO

6.6.1.1 Product/Material

6.6.1.2 Application

6.6.1.3 COVID-19 related developments/strategy

6.7 ENSINGER

6.7.1 IMPACT ON COMPANY PORTFOLIO

6.7.1.1 Product/Material

6.7.1.2 Application

6.7.1.3 COVID-19 related developments/strategy

6.8 LUBRIZOL

6.8.1 IMPACT ON COMPANY PORTFOLIO

6.8.1.1 Product/Material

6.8.1.2 Application

6.8.1.3 COVID-19 related developments/strategy

6.9 EVONIK

6.9.1 IMPACT ON COMPANY PORTFOLIO

6.9.1.1 Product/Material

6.9.1.2 Application

6.9.1.3 COVID-19 related developments/strategy

6.1 TRINSEO

6.10.1 IMPACT ON COMPANY PORTFOLIO

6.10.1.1 Product/Material

6.10.1.2 Application

6.10.1.3 COVID-19 related developments/strategy

6.11 OTHER RELATED DEVELOPMENTS

7 APPENDIX (Page No. - 51)

7.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

7.2 AUTHOR DETAILS

LIST OF TABLES (25 Tables)

TABLE 1 MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 2 MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 3 MAPPING OF POLYMERS WITH PROCESSING TECHNOLOGIES

TABLE 4 MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 5 MEDICAL PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 6 MEDICAL PLASTICS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 7 MEDICAL PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 8 CHINA: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 9 CHINA: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 10 INDIA: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 11 INDIA: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 12 JAPAN: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 13 JAPAN: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 14 ITALY: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 15 ITALY: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 16 GERMANY: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 17 GERMANY: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 18 SPAIN: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 19 SPAIN: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 UK: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 21 UK: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 US: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 23 US: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 ROW: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 25 ROW: MEDICAL PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

LIST OF FIGURES (6 Figures)

FIGURE 1 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

FIGURE 2 MEDICAL PLASTICS MARKET SEGMENTATION

FIGURE 3 REGIONS COVERED

FIGURE 4 YEARS CONSIDERED FOR THE STUDY

FIGURE 5 OVERVIEW OF MEDICAL PLASTICS VALUE CHAIN

FIGURE 6 COVID-19 IMPACT ON MEDICAL PLASTIC ECOSYSTEM

The study involved four major activities in estimating the global medical plastics market size. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the medical plastics market study. The secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; news sources, articles from recognized authors; authenticated directories; and databases. Secondary research was conducted primarily to obtain key information about the supply chain of the industry, the monetary chain of the market, the total market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand side were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as marketing directors, consultants, managers, and related key executives from major companies and organizations operating in the market. The primary sources from the demand side included lab technicians, technologists, and sales/purchase managers from end-use industries.

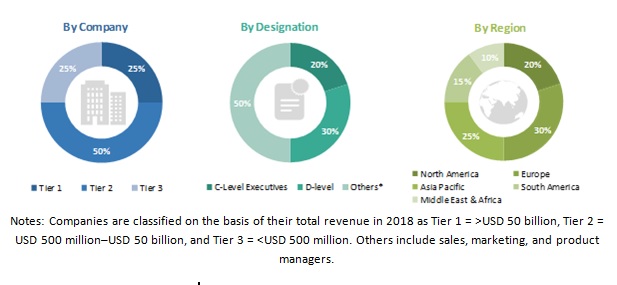

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total impact on the size of the medical plastics market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research.

- All the percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes as explained above-the medical plastics market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical device/equipment sector.

Objectives of the Study:

- To analyze the impact of COVID-19 on the medical plastics market by type, application, and region

- To provide detailed information about the major factors (drivers and challenges) influencing the trends in the medical plastics market during the COVID-19 phase

- To analyze the impact of a prolonged pandemic on the supply-demand scenario of medical plastics

- To study the health and economic impact of COVID-19 on various industries

- To analyze the shift in the expenditure of critical end-use industries of the medical plastics such as healthcare, chemicals, and others

- To examine the shift in revenue patterns of medical plastics manufacturers in 2020 and their capabilities to address emerging demand during this global COVID-19 pandemic

- To analyze the change in short-term strategies of manufacturers and end-users in the medical plastics market

- To track key developments, such as new product launches; partnerships, agreements, and collaborations, in context to the COVID-19 in the global medical plastics market

Growth opportunities and latent adjacency in COVID-19 Impact On Medical Plastics Market