COVID-19 impact on Medical Supplies Market by Type (Intubations, Personal Protective Equipment, Infusion, Radiology, Wound Care Supplies), End User (Hospitals, Clinics) - Global Forecast to 2021

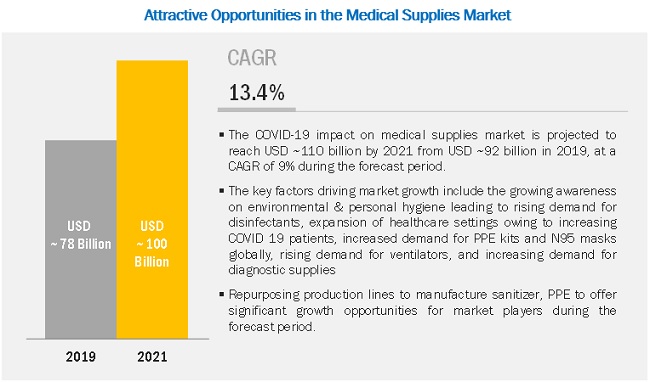

[150 Pages Report] The COVID-19 impact on the global medical supplies market is expected to reach USD ~100 billion by 2021 from an estimated value of USD ~78 billion in 2019, growing at a CAGR of ~13.4% during the forecast period. The market for medical supplies is driven primarily by the growing awareness on environmental & personal hygiene leading to rising demand for disinfectants , expansion of healthcare settings owing to increasing COVID 19 patients, increased requirement of PPE kits & N95 masks globally, rising demand for ventilators, and increasing demand for diagnostic supplies. In addition, repurposing liquor production lines to manufacture sanitizers offers an opportunity for players in this market. However, delays in non-urgent treatment and surgical procedures and impact on supply chain and logistics due to lockdown is likely to restrain the growth of this market.

The disinfectant segment is projected to grow at the highest CAGR during the forecast period

Based on products, the market is segmented into intubation and ventilation supplies, disinfectant, personal protective equipment, diagnostic supplies, sterilization supplies, infusion and injectable supplies, dialysis supplies, wound care supplies, radiology supplies, and other medical supplies. The disinfectant segment is expected to grow at the highest rate during the forecast period. This can be attributed to the increasing demand for sanitizers and other disinfectants to safeguard people from the cross-contamination of coronavirus.

In 2019, the hospital segment will drive the growth of the medical supplies market

Based on end-users, the medical supplies industry has been segmented into hospitals, clinics, and other end users. The hospital segment accounted for the largest share of the market in 2019 and expected to grow at the highest growth rate during the forecast period. The highest growth of this segment is attributed to the increasing demands for hospital beds and intensive care units, increasing demand for specialized staff in hospitals, increased consumption of personal protective equipment.

North America accounted for the largest share of the medical supplies market in 2019

The medical supplies industry is segmented into four major regions, namely, North America, Europe, the Asia Pacific (APAC), and Rest of the World. In 2019, North America accounted for the largest share of the medical supplies market. The large share of this region can primarily be attributed to the high adoption of intubation and ventilation supplies, a high number of positive COVID-19 cases and deaths in the US, a strong healthcare system, and the presence of many large hospitals in the region. Moreover, a large number of major global players are based in the US, owing to which the US can easily manufacture these devices.

Key Market Players

The key players in the global medical supplies market are Medtronic plc (Ireland), Cardinal Health, Inc. (US), Becton, Dickson and Company (US), Johnson & Johnson (US), and B. Braun Melsungen AG (Germany), Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International, Inc. (US), STERIS Corporation (US), Getinge Group (Sweden), Advanced Sterilization Products (US), 3M Company (US), Smith & Nephew (U.K.), Mölnlycke Health Care AB (Sweden), among others.

Critical questions the report answers:

- Where will these developments take the industry in the mid-to-long term?

- What are the recent trends in the medical supplies market?

- What are the major market dynamics and their impact on overall market growth?

- What is the global scenario of the medical supplies market?

- What initiatives are market players undertaking to sustain in the market?

Want to explore hidden markets that can drive new revenue in COVID-19 impact on Medical Supplies Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 impact on Medical Supplies Market?

|

Report Metric |

Details |

|

Market size available for years |

2018–2021 |

|

Base year considered |

2019 |

|

Forecast period |

2019–2021 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, End User, and Region |

|

Geographies covered |

North America, Europe, the Asia Pacific, Rest of the World |

|

Companies covered |

Medtronic plc (Ireland), Cardinal Health, Inc. (U.S.), Becton, Dickson and Company (U.S.), Johnson & Johnson (U.S.), and B. Braun Melsungen AG (Germany), Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International, Inc. (U.S.), STERIS Corporation (U.S.), Getinge Group (Sweden), Advanced Sterilization Products (U.S.), 3M Company (U.S.), Smith & Nephew (U.K.), Mölnlycke Health Care AB (Sweden), among others. |

This report categorizes the medical supplies market into the following segments and subsegments:

This report categorizes the medical supplies market into the following segments

By Type

- Diagnostic supplies

- Sample collection consumables

- Diagnostics catheters

- Disinfectants

- Intubation & ventilation supplies

- Personal protection equipment

- Sterilization supplies

- Infusion and injectable supplies

- Dialysis consumables

- Peritoneal dialysis consumables

- Hemodialysis consumables

- Wound care supplies

- Advanced wound dressings

- Surgical wound care

- Traditional wound care

- Radiology supplies

- Other medical supplies

By End User

- Hospitals

- Physician’s Offices/Clinics

- Other End Users

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Recent Developments

- In April 2020, Baxter received USFDA Emergency Use Authorization for Oxiris Blood Purification Filter for COVID-19 Treatment

- In Arizona, the US, SanTan Brewing, has repurposed its beer production line to manufacture hand sanitizer. In April 2020, SanTan began producing 400 gallons of medical-grade hand sanitizer for first responders and healthcare professionals.

- In New York (US), in March 2020, Pernod Ricard’s facility in Fort Smith, Ark. produced 1,000 gallons of hand sanitizer; it originally produced Malibu coconut rum and Seagram’s gin.

- In India (Bengaluru), Diageo India, which sells McDowell’s whiskey and Smirnoff vodka, announced that it would produce 300,000 liters of hand sanitizers to help overcome the shortage.

- Hungarian lubricant manufacturer Mol stated that it had has been granted permission to produce and supply disinfectants for 180 days. The company has transformed one of its production facilities at Almásfüzitõ into a sanitizer production plant to manufacture ~50,000 liters of two ethanol-based products every day.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.4 MARKETS COVERED

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 SECONDARY DATA

2.1.1 KEY DATA FROM SECONDARY SOURCES

2.2 PRIMARY DATA

2.2.1 KEY DATA FROM PRIMARY SOURCES

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 GROWTH FORECAST

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

3 COVID-19 OUTBREAK

3.1 COVID-19 HEALTH ASSESSMENT

3.2 COVID-19 ECONOMIC ASSESSMENT

3.3 COVID-19 IMPACT ON ECONOMY-SCENARIO ASSESSMENT

4 MARKET OVERVIEW

4.1 INTRODUCTION

4.2 MARKET DYNAMICS

4.2.1 DRIVERS

4.2.1.1 Growing awareness for environmental & personal hygiene leading to rising demand of disinfectants

4.2.1.2 Increasing number of emergency centers, hospital settings and ICUs during the Pandemic

4.2.1.3 Increasing need of healthcare workers in hospitals and government camps & surveys

4.2.1.4 Increased demand of PPE kits and n95 masks globally

4.2.1.5 Increasing demand of ventilation supplies for effective management of critical COVID-19 patients

4.2.1.6 Increasing demand of diagnostic supplies for rapid diagnosis of COVID- 19

4.2.2 RESTRAINTS

4.2.2.1 Delay in the non-urgent treatment and surgical procedures

4.2.2.2 Impact on supply chain and logistics due to lockdown

4.2.3 OPPORTUNITIES

4.2.3.1 Development of specific testing kits for COVID-19

4.2.3.2 Repurposing of liquor production line into sanitizer manufacturing to meet the demands

5 GLOBAL MEDICAL SUPPLIES MARKET, BY TYPE

5.1 INTRODUCTION-MOST ATTRACTIVE MARKETS

5.2 DIAGNOSTIC AND BLOOD COLLECTION SUPPLIES

5.2.1 BLOOD COLLECTION SUPPLIES

5.2.2 DIAGNOSTICS CATHETERS

5.3 DISINFECTANTS

5.4 INTUBATION & VENTILATION SUPPLIES

5.5 PERSONAL PROTECTION EQUIPMENT

5.6 STERILIZATION SUPPLIES

5.7 INFUSION AND INJECTABLE SUPPLIES

5.8 DIALYSIS SUPPLIES

5.8.1 PERITONEAL DIALYSIS CONSUMABLES

5.8.2 HEMODIALYSIS CONSUMABLES

5.9 WOUND CARE SUPPLIES

5.9.1 ADVANCED WOUND DRESSINGS

5.9.2 SURGICAL WOUND CARE

5.9.3 TRADITIONAL WOUND CARE

5.1 RADIOLOGY SUPPLIES

5.11 OTHER MEDICAL SUPPLIES

6 GLOBAL MEDICAL SUPPLIES MARKET, BY END USER

6.1 INTRODUCTION

6.2 HOSPITALS

6.3 CLINICS/PHYSICIAN OFFICES

6.4 OTHER END USERS

7 GLOBAL MEDICAL SUPPLIES MARKET, BY REGION

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.2.1 US

7.2.2 CANADA

7.3 EUROPE

7.3.1 GERMANY

7.3.2 FRANCE

7.3.3 U.K.

7.3.4 ITALY

7.3.5 SPAIN

7.3.6 REST OF EUROPE (ROE)

7.4 ASIA PACIFIC

7.4.1 CHINA

7.4.2 JAPAN

7.4.3 INDIA

7.4.4 REST OF ASIA PACIFIC (ROAPAC)

7.5 REST OF THE WORLD

8 COMPETITIVE LANDSCAPE

8.1 OVERVIEW

8.2 INTUBATION AND VENTILATION SUPPLIES

8.2.1 KEY COMPANIES

8.2.2 SHORT TERM STRATEGIES

8.3 PERSONAL PROTECTIVE EQUIPMENT

8.3.1 KEY COMPANIES

8.3.2 RECENT DEVELOPMENT

8.3.3 SHORT TERM STRATEGIES

8.4 DISINFECTION

8.4.1 KEY COMPANIES

8.4.2 RECENT DEVELOPMENT

8.4.3 SHORT TERM STRATEGIES

8.5 DIAGNOSTIC AND BLOOD COLLECTION SUPPLIES

8.5.1 KEY COMPANIES

8.5.2 RECENT DEVELOPMENT

8.5.3 SHORT TERM STRATEGIES

8.6 STERILIZATION SUPPLIES

8.6.1 KEY COMPANIES

8.6.2 RECENT DEVELOPMENT

8.6.3 SHORT TERM STRATEGIES

8.7 INFUSION & INJECTABLE SUPPLIES

8.7.1 KEY COMPANIES

8.7.2 RECENT DEVELOPMENT

8.7.3 SHORT TERM STRATEGIES

8.8 DIALYSIS SUPPLIES

8.8.1 KEY COMPANIES

8.8.2 RECENT DEVELOPMENT

8.8.3 SHORT TERM STRATEGIES

8.9 WOUND CARE SUPPLIES

8.9.1 KEY COMPANIES

8.9.2 RECENT DEVELOPMENT

8.9.3 SHORT TERM STRATEGIES

8.10 RADIOLOGY SUPPLIES

8.10.1 KEY COMPANIES

9 APPENDIX

9.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

9.2 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

9.3 RELATED REPORTS

9.4 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the COVID-19 impact on the medical supplies market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to evaluate the size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for this study of the medical supplies market. The secondary sources used for this study include the World Health Organization (WHO), Food and Drug Administration (FDA), National Institutes of Health (NIH), National Center for Biotechnology Information (NCBI), Organisation for Economic Co-operation and Development (OECD), American Diabetic Association, National Pressure Ulcer Advisory Panel (NPUAP), Journal of Wound Care (JWC), American Physical Therapy Association (APTA), American Professional Wound Care Association (APWCA), National Alliance of Wound Care and Ostomy (NAWCO), National Institute for Health and Care Excellence (NICE), Medicare, Alliance of Wound Care Stakeholders, Annual Reports, SEC Filings, Expert Interviews, and MarketsandMarkets Analysis

Primary Research

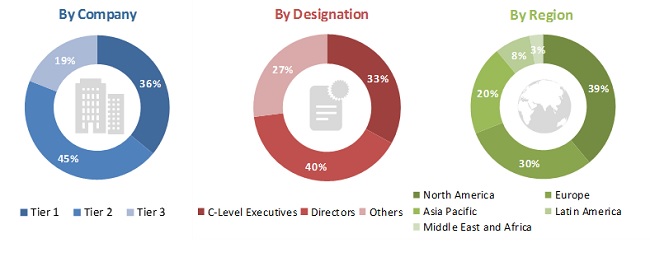

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical supplies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the medical supplies market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the medical supplies market based on the product, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market

- To strategically analyze micromarkets with respect to their individual growth trends, prospects, and contributions to the overall medical supplies market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the medical supplies market segments with respect to four major regions, namely, North America, Europe, the Asia Pacific and Rest of the World

- To profile key market players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, new product launches, expansions, agreements, partnerships, collaborations, and R&D activities in the medical supplies market

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the medical supplies market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in COVID-19 impact on Medical Supplies Market