COVID-19 Impact on Medical Tubing Market by Material (PVC, TPE & TPU, Polyolefin, and Silicone), Application (Drug Delivery, Bulk Disposable Tubing, Catheters & Cannulas, and Special Applications) and Country - Forecast to 2021

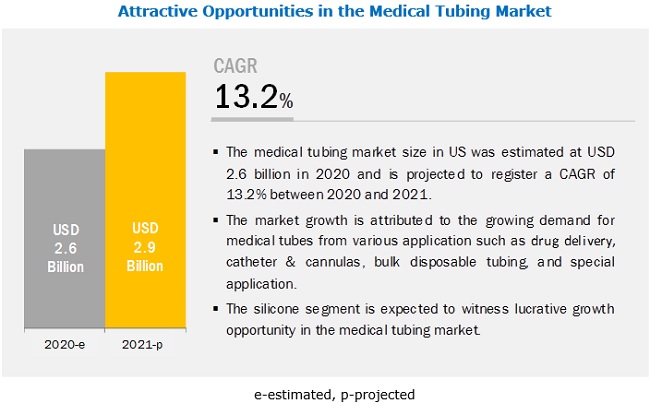

[63 Pages Report] The US medical tubing market size is estimated to be valued at USD 2.6 billion in 2020 and projected to reach USD 2.9 billion by 2021, at a CAGR of 13.2% during the same period. The demand for medical tubing is driven mainly by its growing demand in various applications such as drug delivery, catheter & cannulas, bulk disposable tubing, and special application.

Based on material, silicone segment is expected to be the most significant contributor in the medical tubing market.

The silicone segment is estimated to have the highest market share during the forecast period. The growth in this segment is attributed to its increasing demand from various medical applications as silicone is a versatile material and has high dielectric strength and semi-permeability to certain materials, making it useful for use in drug-eluting applications. Furthermore, silicone possesses various unique properties such as resistance to high temperature, water resistance, mechanical strength, and durability. The factors mentioned above are expected to drive demand during the forecast period.

By application, drug delivery segment is expected to be biggest consumer of medical tubing.

Based on application, the drug delivery segment is expected to account for the largest share of the market in 2020. The growth in this segment is attributed to growing usage of medical tubes as a device or channel of delivery in drug delivery systems. The demand for drug delivery system is increasing due to the rising incidence of COVID-19 cases, globally. The market is also influenced by growing COVID-19 infection in people having existing medical conditions such as asthma and diabetics. There is considerable growth in the demand for drug delivery devices and equipment such as nasogastric tubes, nebulizers, spacer devices, and others. These factors are expected to drive demand during the forecast period.

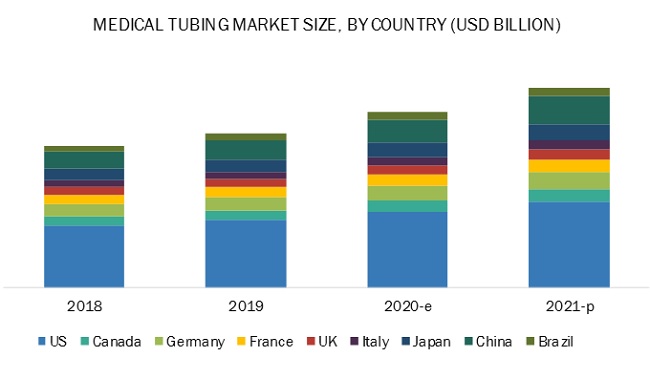

US is expected to account for the largest market share during the forecast period.

The US is the largest and fastest-growing medical tubing market, owing to the increasing usage in various medical applications such as drug delivery, catheter & cannulas, bulk disposable tubing, and special application. Furthermore, the presence of a robust industrial base and large number of established manufacturers of medical tubing in the country are strengthening the market in the country. These factors are expected to fuel the demand for medical tubing in the country during the forecast period.

Key Market Players

The major vendors in the medical tubing market include Zeus Industrial Products (US), Saint Gobain Performance Plastics (France), Teleflex (US), Optinova (US), and Lubrizol Corporation (Vesta) (US).

Key questions addressed by the report

- Which are the future revenue pockets in the medical tubing market?

- Which key developments are expected to have a high impact on the market?

- Which products/technologies are expected to overpower the existing technologies?

- How is the COVID-19 expected to impact the market?

- What will be the future product mix in the medical tubing market?

- What are the prime strategies of leaders in the market?

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Medical Tubing Market?

Scope of the Report:

Scope of the Report:

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Medical Tubing Market?

|

Report Metric |

Details |

|

Market size available for years |

2018–2021 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2021 |

|

Unit considered |

Value (USD Million), Volume (KT) |

|

Segments covered |

Application, Material, and Countries |

|

Countries covered |

US, Canada, Japan, China, UK, France, Italy, and Germany, among others |

|

Companies covered |

Zeus Industrial Products (US), Saint Gobain Performance Plastics (France), Teleflex (US), Optinova (US), and Lubrizol Corporation (Vesta) (US), among others. |

This research report categorizes the medical tubing market based on application, material, and country.

By Material

- PVC

- TPU & TPE

- Silicone

- Polyolefin

- Others (polyether ether ketone (PEEK), fluoropolymer, polycarbonate (PC), bioabsorbable polymers, polyester, and polyimide)

By Application:

- Bulk Disposable Tubing

- Catheters & Cannulas

- Drug Delivery

- Special Application

By Country:

- US

- Canada

- China

- Japan

- Germany

- France

- UK

- Brazil

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 10)

1.1 OBJECTIVES OF THE STUDY

1.2 COVID-19

1.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

1.4 ILLUSTRATIVE CORONAVIRUS SCENARIOS HIGHLIGHT THE ADVERSE IMPACT ON GROWTH

1.5 MARKET DEFINITION

1.6 IMPACT OF COVID-19 ON MEDICAL TUBING

1.7 MARKET SCOPE

1.7.1 MEDICAL TUBING MARKET SEGMENTATION

1.7.2 YEARS CONSIDERED FOR THE STUDY

1.8 CURRENCY

1.9 LIMITATIONS

1.1 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 15)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

3 COVID-19 IMPACT ON MEDICAL TUBING ECOSYSTEM (Page No. - 22)

3.1 MEDICAL TUBING INDUSTRY ECOSYSTEM

3.2 VALUE CHAIN OF MEDICAL TUBING INDUSTRY

3.3 IMPACT ON VALUE CHAIN

3.3.1 RAW MATERIAL SUPPLIERS

3.3.2 MEDICAL GRADE TUBE SUPPLIERS

3.3.3 MOLDERS/APPLICATORS

3.3.4 APPLICATIONS (DRUG DELIVERY AND DISPOSABLES)

3.4 MACROECONOMIC INDICATOR

3.4.1 INTRODUCTION

3.5 MARKET DYNAMICS

3.5.1 DRIVERS

3.5.1.1 Growing demand for medical tubing in ventilators

3.5.1.2 Increasing demand for medical devices that incorporate tubing

3.5.2 CHALLENGES

3.5.2.1 Significant time and investment required for product development

3.5.2.2 Fighting time from supply chain & logistics

3.5.2.3 Restricting counterfeit products

4 CUSTOMER ANALYSIS (Page No. - 27)

4.1 INTRODUCTION

4.1.1 SHIFT IN HEALTHCARE INDUSTRY

4.1.1.1 Disruption in the industry

4.1.1.2 Impact on customers’ output & strategies to improve production

4.1.1.3 Impact on customers’ revenues

4.1.1.4 Customer’s most crucial regions

4.1.1.5 Short-term strategies to manage cost structure and supply chain

4.1.2 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

4.1.2.1 Measures taken by customers

4.1.2.2 Customers perspective on growth outlook

4.2 SHIFT IN DRUG DELIVERY APPLICATION

4.2.1 DISRUPTION IN THE SECTOR

4.2.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

4.2.2.1 Impact on customers’ revenues

4.2.2.2 Customer’s most impacted regions

4.2.2.3 Short term strategies to manage cost structure and supply chains

4.2.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

4.2.3.1 Measures taken by customers

4.2.3.2 Customers perspective on growth outlook

4.3 SHIFT IN DISPOSABLES APPLICATION

4.3.1 DISRUPTION IN THE SECTOR

4.3.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

4.3.2.1 Impact on customers’ revenues

4.3.2.2 Customer’s most impacted regions

4.3.2.3 Short term strategies to manage cost structure and supply chain

4.3.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

4.3.3.1 Measures taken by customers

4.3.3.2 Customers perspective on growth outlook

5 IMPACT OF COVID-19 ON MEDICAL TUBING COMPANIES (Page No. - 34)

5.1 BIGGEST GAINERS, BY TOP APPLICATIONS

5.1.1 DRUG DELIVERY SYSTEM

5.1.1.1 Implantables and injectables

5.1.1.2 Increased use of silicone

5.1.2 CATHETERS AND CANNULAS

5.1.2.1 Materials for cardiovascular, invasive, and urinal application

5.2 MODERATE GAINERS, BY TOP APPLICATIONS

5.2.1 DIALYSIS & INTRAVENOUS

5.2.2 PUMP TUBES

5.2.3 GAS TUBES

5.3 BIGGEST GAINERS, BY TOP MATERIAL

5.3.1 FLUOROPOLYMER

5.3.1.1 Polytetrafluoroethylene(PTFE)

5.3.1.2 Fluorinated Ethylene Propylene (FEP)

5.3.1.3 Ethylene Tetrafluoroethylene (ETFE)

5.3.2 PVC

5.3.3 SILICONE

5.4 MODERATE GAINERS, BY TOP MATERIAL

5.4.1 POLYESTERS

5.5 BIGGEST GAINERS, BY TOP COMPANIES

5.6 MODERATE GAINERS, BY TOP COMPANIES

6 IMPACT OF COVID-19 ON SHORT-TERM STRATEGIES OF MEDICAL TUBING COMPANIES (Page No. - 39)

6.1 IMPACT ON MEDICAL TUBING COMPANIES PORTFOLIO

6.1.1 PRODUCT

6.1.2 APPLICATION

6.1.3 GEOGRAPHICAL

6.2 WINNING STRATEGIES TO GAIN MARKET SHARE

6.2.1 SHORT TERM STRATEGIES

6.2.2 MID-TERM STRATEGIES

6.2.3 LONG-TERM STRATEGIES

7 BUSINESS IMPLICATIONS OF COVID-19 ON MEDICAL TUBING MARKET (Page No. - 43)

7.1 PRODUCT TYPE

7.1.1 PVC

7.1.2 TPU & TPE

7.1.3 SILICONE

7.1.4 POLYOLEFIN

7.1.5 OTHERS

7.2 MEDICAL TUBING MARKET, BY APPLICATION

7.2.1 BULK DISPOSABLE TUBING

7.2.2 CATHETERS & CANNULAS

7.2.3 DRUG DELIVERY SYSTEMS

7.2.4 SPECIAL APPLICATIONS

7.3 MEDICAL TUBING MARKET, BY GEOGRAPHY

7.3.1 US

7.3.2 CANADA

7.3.3 CHINA

7.3.4 JAPAN

7.3.5 GERMANY

7.3.6 ITALY

7.3.7 FRANCE

7.3.8 UK

7.3.9 BRAZIL

8 APPENDIX (Page No. - 59)

8.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

8.2 AVAILABLE CUSTOMIZATIONS

8.3 RELATED REPORTS

8.3.1 ONGOING REPORTS:

8.3.2 UPCOMING REPORTS:

8.4 AUTHOR DETAILS

LIST OF TABLES (28 TABLES)

TABLE 1 PVC: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 2 PVC: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 3 TPU & TPE: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 4 TPU & TPE: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 5 SILICONE: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 6 SILICONE: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 7 POLYOLEFIN: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 8 POLYOLEFIN: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 9 OTHERS: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 10 OTHERS: MEDICAL TUBING MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 11 US MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 12 US: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 13 CANADA: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 14 CANADA: MEDICAL TUBING MARKET SIZE, BY MATERIAL,2018–2021 (KILOTON)

TABLE 15 CHINA: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 16 CHINA: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 17 JAPAN: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 18 JAPAN: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 19 GERMANY: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 20 GERMANY: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 21 ITALY: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 22 ITALY: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 23 FRANCE: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 24 FRANCE: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 25 UK: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 26 UK: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

TABLE 27 BRAZIL: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 28 BRAZIL: MEDICAL TUBING MARKET SIZE, BY MATERIAL, 2018–2021 (KILOTON)

LIST OF FIGURES (6 FIGURES)

FIGURE 1 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

FIGURE 2 MEDICAL TUBING MARKET: IMPACT OF COVID-19 ON MEDICAL TUBING

FIGURE 3 MEDICAL TUBING - MARKET SIZE CALCULATION METHODOLOGY (BASE YEAR – 2019)

FIGURE 4 MEDICAL TUBING MARKET: DATA TRIANGULATION

FIGURE 5 OVERVIEW OF FACTORS GOVERNING THE MEDICAL TUBING MARKET

FIGURE 6 IMPACT OF COVID-19 ON MEDICAL TUBING COMPANIES PORTFOLIO

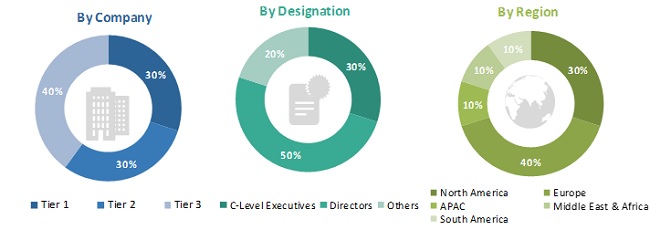

The study involved four major activities in estimating the current size of the medical tubing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

The medical tubing market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the medical tubing industry characterize the demand side. The supply side is characterized by market consolidation activities undertaken by the manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the medical tubing market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical tubing market.

Report Objectives

- To define, describe, and forecast the medical tubing market size, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the medical tubing market size based on application, material, and country

- To project the market size of the key countries, namely, US, Canada, Japan, China, UK, France, Italy, and Germany, among others

- To strategically analyze the various segment of the market for individual growth trends, prospects, and their contribution to the overall market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe medical tubing market into Netherland and Spain

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in COVID-19 Impact on Medical Tubing Market