Data Center Interconnect Market by Type (Products, Software, Services), Application (Real-Time Disaster Recovery and Business Continuity, Workload (VM) and Data (Storage) Mobility), End User and Region - 2030

The data center interconnect market is projected to grow from USD 6.79 billion in 2025 to USD 8.88 billion by 2030, at a CAGR of 5.1% from 2025 to 2030.

In recent times, most organizations have more than one data center, most use more than one cloud, and several are evolving toward hybrid, multi-cloud infrastructures spanning various sites across countries. Whether a private or public sector enterprise, data centers are essential for hosting mission-critical applications. Worldwide, data center infrastructure and services are emerging businesses. In India, the world's largest democracy, the data economy provides unlimited opportunities as citizens, businesses, markets, politics, culture, sports, and entertainment sectors are increasingly using services with data. India's increasingly robust domestic data consumption will help it advance toward a data-driven economy, thereby paving the way for the increased adoption of data centers and consequently driving the adoption of data center interconnect networks.

Attractive Opportunities in Data Center Interconnects Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: The growing borderless nature of the global economy

As data centers are located far apart, it becomes imperative to interconnect them to enable seamless data flow. Thus, this has led to increased demand for data interconnect solutions, thereby contributing to the market growth.

Submarine optical fiber cables are increasingly being deployed to support these growth trends and provide more affordable connectivity across data centers. Submarine network vendors continually strive to improve submarine systems' technical capabilities, with higher transmission capacity, better network connectivity and resiliency, and faster deployment and provisioning.

Restraint: Latency issues due to long-distance data centers

The interconnect applications vary significantly in size and scope in response to the data centers dispersed worldwide, in a metro area, or around a country. Hence, it becomes critical to carry most of the data bits farthest; however, when the distance between the data centers increases, the latency increases as well. Data centers often require minimum latency; long distances between data centers can give rise to latency issues. Technological development has also focused on providing data centers with the best interconnect links to locations spaced much farther apart and not collocated in the same physical campus. In a typical data center campus environment, typical data center interconnect lengths are 2 km or less. These relatively short distances enable one cable to be used to provide connectivity without any splicing points. However, with data centers also being deployed around metropolitan areas, distances are increasing and can approach up to 75 km. Using an extreme-density cable design in these applications is not financially viable because of the cost to connect the high number of fibers over a long distance. While choosing the shortest route may minimize latency, in some instances the usage of deficient equipment may also lead to latency.

Opportunity: Growing focus on the 5G network

5G is in a state of accelerated development. Industry experts and users alike are eager to reap the benefits of a revamped wireless architecture. Considering speed as the priority, Edge networks and local computing are coming into focus as the key solutions for the data center market, which will increasingly rely on building optimized centers and bringing data processing closer to the end users. More and more data centers are moving closer to users due to the trend of having a more widespread geographical footprint. This will encourage deploying applications that depend upon 5G's inherently lower network latency, effectively introducing a tiered data processing model. The network capacity and resiliency needed to support high volumes of data coming in and going out of data centers also become crucial. As the need for locally sourced content grows and data centers move closer to end users, the number of data centers will likely increase. At the same time, the size of the facilities will become more compact to accommodate more locations. As the adoption of 5G technology is about to rise in the data center interconnect market, it is expected to support massive, fast, and denser streams of data, which would demand more data center capacity This can be achieved by the expansion of existing data center infrastructure, which would pave way for the deployment of data interconnect networks for their interconnection.

Challenge: Security Concerns

Since data centers store sensitive information, financial transactions, personnel records, and other corporate data that are crucial and confidential, data center network connections must be reliable, safe, and, in many cases, encrypted to avoid costly breaches and data losses. While encryption and stringent rules for access to stored data are widely deployed to protect against intrusions, advances in networking equipment can also deliver in-flight data encryption. To secure the data from the moment it leaves one data center to the moment it enters another data center over an interconnecting network, data interconnect providers have to adhere to stringent rules and regulations. The interconnect links between the data centers must deliver very high performance, with particular attention to low latency, while ensuring high security. The Federal Information Processing Standard Publication (FIPS PUB) 140-2 standard defines varying levels of device security that a few interconnect operators may require. Security threats and attack vectors appear frequently, requiring constant attention to monitoring, defense, and mitigation of attack impacts.

Data Center Interconnect Ecosystem Analysis

The figure depicts the schematic analysis of the data center interconnect ecosystem.A few of the top companies providing hardware, software, and software services in the data center interconnect ecosystem are Broadcom (US), Cisco Systems (US), Intel Corporation (US), Micron Technology (US), Smasung Electronics (South Korea) among others. The data center interconnect market is highly competitive. It is marked by the presence of a few tier 1 companies, such as Ciena Corporation (US), Nokia Corporation (Finland), Infinera Corporation (US), Juniper Networks Inc. (US), ADVA Optical Networking SE (Germany), and Fujitsu Ltd (Japan).

These companies have created a competitive ecosystem by investing in research and development to launch highly efficient and reliable products, software, and solutions. Different data center interconnect solution providers offer a wide range of products that cater to the requirements of various verticals. They play a significant role in managing different operational aspects of projects on which these solutions are deployed. Developers of data center interconnect solutions have been focusing on developing infrastructure to meet the requirements of various emerging technologies.

Market for carrier-neutral providers/internet content providers expected to grow at a considerable CAGR during the forecast period

The data center interconnect market for carrier-neutral providers/internet content providers is expected to grow significantly during the forecast period. Carrier neutrality refers to carrier-neutral data centers that allow interconnection between several colocation and interconnection providers. Carrier-neutral data centers are not tied to any one service provider (telecommunications, ISP, or other), providing diversity and flexibility for the client seeking service. In a non-carrier-neutral environment, a customer only has one option for service and few options for connectivity and colocation. Consumers in a data center tied to one specific carrier can easily fall victim to high prices, limited bandwidth, and lack of competition, as, in that case, they are at the mercy of whatever provider the data center is tied to. Carrier-neutral providers are the ones that allow interconnection between multiple carriers, colocation providers, and their respective customers. Thus, if a data center is carrier-neutral, it allows interconnection between several colocation and interconnection providers, providing diversity and flexibility for organizations. This approach enables a connectivity-rich data center network that can provide a scalable and resilient platform wherever needed. This is imperative to be able to create density. Carrier-neutral colocation allows the user to connect the most critical of systems to multiple data centers for redundancy that cannot be duplicated in a single-carrier environment.

Market for optical data center product type segment expected to grow at a faster rate, than that of packet-switching networking during the forecast period

The optical data center interconnect product type market is expected to grow at a higher CAGR during the forecast period. Packet optical transport enables the transport of IP packets on fixed as well as mobile optical networks. It offers the most efficient, cost-effective, and forward-looking infrastructure for residential broadband, mobile backhaul, and enterprise service delivery, and enables service providers to offer unique time- division multiplexing (TDM)-equivalent Ethernet services. Packet optical transport is the technology of choice for IP-centric aggregation and transport infrastructure networking. Packet ONPs are a fused progression of conventional reconfigurable optical add-drop multiplexer (ROADM) and multi-service provisioning platform (MSPP) transport platforms with advanced connection-oriented Ethernet aggregation capabilities.

Data Center Interconnect Market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The Asia Pacific market is expected to grow at the highest CAGR during the forecast period. The data center interconnect market in Asia Pacific is expected to grow across all industry verticals. The increasing number of new data centers and innovations in data center interconnect solutions are driving the demand for adopting data center interconnect networks in the region. Asia Pacific has been witnessing the expansion of corporate and government networks to meet the challenges of growing businesses and operations, along with the explosion of cloud-based services. This is expected to increase the use of high-performance data centers, further increasing the requirement for efficiently interconnecting these facilities with robust data center interconnect network infrastructure. The strong presence of data center interconnect companies such as Fujitsu Ltd (Japan), Huawei Technologies (China), and ZTE Corporation (China) has led to the availability of data center interconnect solutions for a wide range of industry verticals. Furthermore, the rising number of small and medium enterprises (SME), the growing adoption of cloud services by SMEs, the rising advancements in communication infrastructure are the major factors that are further projected to propel the market growth during the forecast period. Data center interconnect products are widely being deployed by companies to avail benefits they offer in terms of enhanced capacity and lower power consumption. Several industries are leveraging data center interconnect services for obtaining critical targets, developing a skill set for developing the internal planning & control process, and remotely maintaining customers, IT infrastructure, and systems of end users, because of which the services segment is expected to witness the highest growth in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the data center interconnect market include Ciena Corporation (US), Nokia Corporation (Finland), Huawei Technologies (China), Juniper Networks, Inc. (US), Infinera Corporation (US), Adtran Networks (Germany), Cisco Systems (US), Extreme Networks, Inc. (US), Fujitsu Ltd (Japan), Colt Technology Services Group Limited (UK), Eqiunix (US), ZTE Corporation (China), Megaport (Australia), Broadcom (US), Centersquare (US), CoreSite Realty Corporation (US), Digital Realty Trust, Inc (US), Fiber Mountain (US), Flexential (US) , XKL (US), EKINOPS S.A. (France),Cologix (US), Pluribus Networks (US), Marvell Technology (US).

Data Center Interconnect Market Scope

|

Report Metric |

Detail |

|

Market size available for years |

2025—2030 |

|

Base year |

2030 |

|

Forecast period |

2025—2030 |

|

Segments covered |

Type, Application, End-User, and Region |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Ciena Corporation (US), Nokia Corporation (Finland), Huawei Technologies (China), Juniper Networks, Inc. (US), Infinera Corporation (US), ADVA Optical Networking SE (Germany), Cisco Systems (US), Extreme Networks, Inc. (US), Fujitsu Ltd (Japan), Colt Technology Services Group Limited (UK), Eqiunix (US), XKL, LLC (US), Ekinops S.A(France), Cologix (US), Pluribus Networks (US), Ranovus (Canada), Innovium (US), ZTE Corporation (China), Megaport (Australia), Brocade Communication Systems (US), Evoque Data Center Solutions (US), CoreSite Realty Corporation (US), Digital Realty Trust, Inc (US), Fiber Mountain (US), Flexential (US), Cyxtera Technologies (US). |

Data Center Interconnect Market Categorization

This research report categorizes the market based on type, application, end-user, and region.

Data Center Interconnect Market, Type :

-

Products

- Packet-Switching Networking

- Optical DCI

- Software

-

Services

- Professional Services

- Managed Services

Market, by Application:

- Real-time Disaster Recovery and Business Continuity

- Shared Data and Resources/Server High-availability Clusters (Geoclustering)

- Workload (VM) and Data (Storage) Mobility

Market, by End-User:

- Communication Service Providers

- Internet Content Providers/ Carrier-Neutral Providers

- Governments

-

Enterprises

- Banking and Finance

- Healthcare

- Utility and Power

- Media and Entertainment

- Retail & E-commerce

- Others (Education, Manufacturing and Insurance)

Data Center Interconnect Market, By Region:

-

North America

- US

- Canada

- Rest of North America

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East

- Africa

- South America

Recent Developments

- In November 2024, Nokia Corporation (Finland) has partnered with Cloudbear, a Dutch hosting services provider, to implement an advanced data center networking infrastructure based on a Kubernetes environment. This deployment features Nokia's reliable data center fabric switching and gateway routers, enhancing Cloudbear's capability to deliver customized and efficient hosting services across Europe. The collaboration aims to improve the speed, reliability, and security of Cloudbear's offerings, ultimately meeting specific customer needs more effectively.

- In November 2024, Virgin Media O2 (UK) partnered with Ciena Corporation (US). It successfully launched a Converged Interconnect Network (CIN) that integrates its fixed and mobile networks to handle both types of traffic. This next-generation network is designed for scalability, ensuring it can adapt to the changing demands of consumers and businesses alike. By combining these networks, Virgin Media O2 aims to enhance service efficiency and resilience, ultimately improving the customer experience.

- In November 2024, Adtran (Germany) has announced a strategic partnership with Sonic Fiber Internet (US) to introduce 50Gbit/s passive optical network (50G PON) connectivity in California. This collaboration aims to enhance Sonic's ability to provide ultra-fast broadband services, addressing the increasing demand for higher capacity and faster internet speeds across the U.S. By leveraging Adtran's advanced technology, Sonic will be well-positioned to meet the evolving needs of both residential and business customers.

- In October 2024, Juniper Networks(US) has announced the deployment of its AI-Native Networking Platform by Seoul Semiconductor(South Korea) to enhance both wired and wireless access services. This upgrade, powered by Mist AI™, aims to boost employee productivity while reducing operational costs through reliable and measurable network performance. By leveraging advanced AIOps and a microservices cloud, the platform ensures an excellent user and operator experience.

- In October 2024, Megaport(Australia) has expanded its presence in Europe by adding 14 new data center locations across seven countries and forming strategic partnerships with Portus Data Centers, NorthC Data Centers, and Sipartech. This expansion enhances Megaport's ability to provide its Network as a Service (NaaS) offerings, enabling customers to connect to a broader ecosystem of service providers and data centers throughout Europe.

Frequently Asked Questions (FAQ):

What key strategies are key companies adopting in the data center interconnect market?

Product launches, acquisitions, and collaborations have been and continue to be some of the significant strategies adopted by the key players to grow in the data center interconnect market.

What region will have the most significant data center interconnect market growth?

The Asia Pacific region will have the most significant data center interconnect market growth.

What application segment dominates the data center interconnect market?

Real-time disaster recovery and business continuity application segment dominated the market during the forecast period.

Which type of segment dominates the data center interconnect market?

Product type is expected to have the largest market size during the forecast period

Which end user is expected to grow with the highest CAGR during the forecast period?

Enterprise is expected to have highest growth rate during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DATA CENTER INTERCONNECT MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

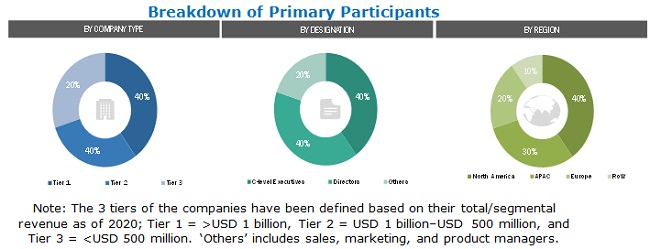

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

3.1 IMPACT OF COVID-19 ON DATA CENTER INTERCONNECT MARKET

FIGURE 7 EFFECT OF COVID-19 ON MARKET, 2017–2026 (USD BILLION)

3.2 REALISTIC SCENARIO (POST-COVID-19)

TABLE 1 REALISTIC SCENARIO: DATA CENTER INTERCONNECT, 2017–2026 (USD BILLION)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 2 POST-COVID-19 OPTIMISTIC SCENARIO: DATA CENTER INTERCONNECT MARKET, 2017–2026 (USD BILLION)

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 POST-COVID-19 PESSIMISTIC SCENARIO: DATA CENTER INTERCONNECT, 2017–2026 (USD BILLION)

FIGURE 8 SERVICES SEGMENT EXPECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS TO HOLD LARGEST SHARE OF DATA CENTER INTERCONNECT MARKET DURING FORECAST PERIOD

FIGURE 10 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING) SEGMENT EXPECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA HELD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN DATA CENTER INTERCONNECT MARKET

FIGURE 12 INCREASING ADOPTION OF CLOUD-BASED APPLICATIONS EXPECTED TO DRIVE MARKET DURING FORECAST PERIOD

4.2 MARKET, BY APPLICATION AND REGION

FIGURE 13 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY APPLICATION AND NORTH AMERICA TO DOMINATE MARKET IN 2021

4.3 DATA CENTER INTERCONNECT MARKET, BY TYPE

FIGURE 14 SERVICES SEGMENT EXPECTED TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 DATA CENTER INTERCONNECT MARKET, BY APPLICATION

FIGURE 15 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.5 MARKET, BY END USER

FIGURE 16 CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS TO HOLD LARGEST SHARE OF DATA CENTER INTERCONNECT MARKET DURING FORECAST PERIOD

4.6 MARKET, BY COUNTRY (2021–2026)

FIGURE 17 NORTH AMERICA ACCOUNTED FOR MAJOR SHARE OF DCI MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DATA CENTER INTERCONNECT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 19 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Rising migration to cloud-based solutions

FIGURE 20 ANNUAL PUBLIC CLOUD EXPENDITURE BY ENTERPRISES

5.2.1.2 Surging consumption of OTT services due to nationwide lockdown imposed on account of COVID-19

FIGURE 21 OTT SUBSCRIBER BASE IN INDIA IN 2020

5.2.1.3 Growing borderless nature of global economy

5.2.2 RESTRAINTS

FIGURE 22 DATA CENTER INTERCONNECT MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 High initial investment required in setting up data centers

5.2.2.2 Latency issues due to long distances between data centers

5.2.3 OPPORTUNITIES

FIGURE 23 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Anticipated deployment of 5G

5.2.3.2 Growing digitization of financial services

5.2.3.3 Increasing disaster recovery and business continuity requirements

5.2.4 CHALLENGES

FIGURE 24 MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Capacity limitations

5.2.4.2 Security concerns

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS OF DATA CENTER INTERCONNECT MARKET ECOSYSTEM

5.3.1 EXPERTS RESPONSIBLE FOR PLANNING AND REVISING FUNDS

5.3.2 RESEARCH & DEVELOPMENT ENGINEERS

5.3.3 HARDWARE AND SOFTWARE PROVIDERS

5.3.4 DCI SOLUTION PROVIDERS

5.3.5 DISTRIBUTORS & SUPPLIERS

5.3.6 END USERS

5.3.7 AFTER-SALE SERVICE PROVIDERS

5.4 ECOSYSTEM/MARKET MAP

TABLE 4 PLAYERS AND THEIR ROLE IN ECOSYSTEM

5.5 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

5.6 PORTER’S FIVE FORCES MODEL

TABLE 5 DATA CENTER INTERCONNECT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDIES

5.7.1 HUAWEI TECHNOLOGIES HELPS CYBERAGENT INC. TO BUILD IDN CLOUD DC

5.7.2 CIENA CORPORATION HELPED INTERXION TO GROW ITS DATA CENTER OPERATIONS WITH SCALABLE, AGILE DCI NETWORKS

5.7.3 NOKIA CORPORATION HELPED ESPANIX TO SCALE ITS PEERING PLATFORM WITH ITS MODULAR DATA CENTER INTERCONNECT SOLUTION

5.7.4 DIGITAL REALTY HELPED RACKSPACE TO ENHANCE INTERCONNECTIVITY AT LOWER COSTS

5.7.5 INFINERA CORPORATION HELPED JPIX TO ADDRESS ISSUES RELATED TO TRAFFIC SURGES WITH ITS DCI SOLUTION

5.8 TECHNOLOGY ANALYSIS

5.8.1 INTEGRATION OF CLOUD COMPUTING WITH DATA CENTER INTERCONNECT TECHNOLOGY

5.8.2 ADOPTION OF PROGRAMMABLE COHERENT OPTICS TECHNOLOGY TO SUPPORT INCREASED CAPACITY FOR DCI NETWORKS

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO

5.9.1.1 Import scenario for data center interconnect products

TABLE 6 IMPORT DATA BY COUNTRY FOR COMMUNICATION APPARATUS

TABLE 7 IMPORT DATA BY COUNTRY, FOR OPTICAL FIBER CABLES

5.9.2 EXPORT SCENARIO

5.9.2.1 Export scenario for data center interconnect products

TABLE 8 EXPORT DATA BY COUNTRY FOR COMMUNICATION APPARATUS

TABLE 9 EXPORT DATA BY COUNTRY, FOR OPTICAL FIBER CABLES

5.10 PATENT ANALYSIS

TABLE 10 NUMBER OF PATENTS REGISTERED IN MARKET FROM 2010 TO 2020

FIGURE 27 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS BETWEEN 2010 AND 2020

FIGURE 28 DATA CENTER INTERCONNECT PATENTS PUBLISHED BETWEEN 2010 AND 2020

TABLE 11 PATENTS IN DATA CENTER INTERCONNECT MARKET, 2018–2020

5.11 TARIFFS

TABLE 12 MFN TARIFFS FOR DATA CENTER INTERCONNECT PRODUCTS EXPORTED BY US

TABLE 13 MFN TARIFFS FOR DATA CENTER INTERCONNECT PRODUCTS EXPORTED BY CHINA

5.11.1 POSITIVE IMPACT OF TARIFFS ON DATA CENTER INTERCONNECT PRODUCTS

5.11.2 NEGATIVE IMPACT OF TARIFFS ON DATA CENTER INTERCONNECT PRODUCTS

5.11.3 REGULATIONS AND STANDARDS

5.11.3.1 Standards

5.11.3.1.1 Statement on Standards for Attestation Engagements

5.11.3.1.2 Service Organization Controls

5.11.3.1.3 Telecommunication Infrastructure Standard for Data Centers

5.11.3.1.4 Distributed Management Task Force Standards

5.11.3.1.5 Data Centre Site Infrastructure Tier Standard (Up time Institute)

5.11.3.1.6 NIST Special Publication (SP) 800-53

5.11.3.2 Regulations

5.11.3.2.1 Regulations in North American countries

5.11.3.2.2 Regulations in European countries

5.11.3.2.3 Regulations in countries in Asia Pacific

5.12 AVERAGE SELLING PRICES OF VARIOUS HARDWARE COMPONENTS ASSOCIATED WITH DCI NETWORKS

TABLE 14 OPTICAL DCI HARDWARE COMPONENTS, SELLING PRICES

TABLE 15 PACKET-SWITCHING DCI HARDWARE COMPONENTS, SELLING PRICES

6 DATA CENTER INTERCONNECT MARKET, BY TYPE (Page No. - 83)

6.1 INTRODUCTION

FIGURE 29 MARKET, BY TYPE

TABLE 16 DCI MARKET, BY TYPE, 2017–2020 (USD BILLION)

FIGURE 30 SERVICES SEGMENT EXPECTED TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 17 DCI MARKET, BY TYPE, 2021–2026 (USD BILLION)

6.2 PRODUCTS

TABLE 18 DCI MARKET, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 19 DCI MARKET, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 20 DCI MARKET FOR PRODUCTS, BY REGION, 2017–2020 (USD BILLION)

FIGURE 31 APAC EXPECTED TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 21 DCI MARKET FOR PRODUCTS, BY REGION, 2021–2026 (USD BILLION)

6.2.1 PACKET SWITCHING NETWORK

TABLE 22 DCI MARKET FOR PACKET SWITCHING NETWORKING, BY REGION, 2017–2020 (USD BILLION)

TABLE 23 DCI MARKET FOR PACKET SWITCHING NETWORKING, BY REGION, 2021–2026 (USD BILLION)

6.2.2 OPTICAL DCI

TABLE 24 OPTICAL DCI MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 25 OPTICAL DCI MARKET, BY REGION, 2021–2026 (USD BILLION)

6.2.2.1 COMPACT DCI

6.2.2.1.1 Designed to fit within data center environment from power consumption, form factor, and operational perspective

6.2.2.2 Traditional WDM for DCI

6.2.2.2.1 Consists of integrated WDM system that includes transponders/muxponders and WDM line system

6.3 SOFTWARE

6.3.1 HELPS IN BOOSTING PERFORMANCE AND INCREASING OPERATIONAL SIMPLICITY OF PHYSICAL AND VIRTUAL INFRASTRUCTURES IN DCI APPLICATIONS

TABLE 26 DCI MARKET FOR SOFTWARE, BY REGION, 2017–2020 (USD BILLION)

TABLE 27 DCI MARKET FOR SOFTWARE, BY REGION, 2021–2026 (USD BILLION)

6.4 SERVICES

TABLE 28 DCI MARKET, BY SERVICE, 2017–2020 (USD BILLION)

TABLE 29 DCI MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 30 DCI MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD BILLION)

TABLE 31 DCI MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 32 DCI MARKET FOR SERVICES, BY REGION, 2017–2020 (USD BILLION)

TABLE 33 DCI MARKET FOR SERVICES, BY REGION, 2021–2026 (USD BILLION)

6.4.1 PROFESSIONAL SERVICES

TABLE 34 DCI MARKET FOR PROFESSIONAL SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 DCI MARKET FOR PROFESSIONAL SERVICES, BY REGION, 2021–2026 (USD MILLION)

6.4.1.1 Consulting and integration

6.4.1.1.1 Consulting and Integration services help end users achieve critical targets and develop skillset for improving their internal planning and control processes

TABLE 36 DCI MARKET FOR CONSULTING AND INTEGRATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 DCI MARKET FOR CONSULTING AND INTEGRATION, BY REGION, 2021–2026 (USD MILLION)

6.4.1.2 Training, support, and maintenance

6.4.1.2.1 Focus on seamless maintenance and transformation of business-critical applications to propel market growth for these services

TABLE 38 DCI MARKET FOR TRAINING, SUPPORT, AND MAINTENANCE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 DCI MARKET FOR TRAINING, SUPPORT, AND MAINTENANCE, BY REGION, 2021–2026 (USD MILLION)

6.4.2 MANAGED SERVICES

TABLE 40 DCI MARKET FOR MANAGED SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 DCI MARKET FOR MANAGED SERVICES, BY REGION, 2021–2026 (USD MILLION)

7 DATA CENTER INTERCONNECT MARKET, BY APPLICATION (Page No. - 98)

7.1 INTRODUCTION

FIGURE 32 MARKET, BY APPLICATION

TABLE 42 DCI MARKET, BY APPLICATION, 2017–2020 (USD BILLION)

FIGURE 33 DCI MARKET FOR SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 43 DCI MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

7.2 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY

7.2.1 HELPS IN MAINTAINING DATA CENTER SERVICE CONTINUITY DURING FAILURE OF DATA CENTER FACILITY

TABLE 44 DCI MARKET FOR REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY, BY REGION, 2017–2020 (USD BILLION)

TABLE 45 DCI MARKET FOR REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY, BY REGION, 2021–2026 (USD BILLION)

7.3 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING)

7.3.1 PROVIDE BENEFIT OF PROVIDING PROTECTION OF WORKLOAD ACROSS GLOBALLY DISTRIBUTED DATA CENTERS TO HELP GROW MARKET FOR GEOCLUSTERING APPLICATION

TABLE 46 DCI MARKET FOR SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING), BY REGION, 2017–2020 (USD BILLION)

TABLE 47 DCI MARKET FOR SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING), BY REGION, 2021–2026 (USD BILLION)

7.4 WORKLOAD (VM) AND DATA (STORAGE) MOBILITY

7.4.1 ENABLES MIGRATION FROM ONE SERVER TO ANOTHER WITHIN SAME OR DIFFERENT DATA CENTER WITHOUT TRAFFIC TROMBONING, TO INCREASE VM APPLICATION IN DCI MARKET

TABLE 48 DCI MARKET FOR WORKLOAD (VM) AND DATA (STORAGE) MOBILITY, BY REGION, 2017–2020 (USD BILLION)

TABLE 49 DCI MARKET FOR WORKLOAD (VM) AND DATA (STORAGE) MOBILITY, BY REGION, 2021–2026 (USD BILLION)

8 DATA CENTER INTERCONNECT MARKET, BY END USER (Page No. - 106)

8.1 INTRODUCTION

FIGURE 34 MARKET, BY END USER

TABLE 50 DCI MARKET, BY END USER, 2017–2020 (USD BILLION)

FIGURE 35 CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS SEGMENT EXPECTED TO LEAD DCI MARKET, IN TERMS OF SIZE, DURING FORECAST PERIOD

TABLE 51 DCI MARKET, BY END USER, 2021–2026 (USD BILLION)

TABLE 52 DCI MARKET, BY ENTERPRISE TYPE, 2017–2020 (USD BILLION)

TABLE 53 DCI MARKET, BY ENTERPRISE TYPE, 2021–2026 (USD BILLION)

8.2 COMMUNICATION SERVICE PROVIDERS

8.2.1 CSPS TO INCREASINGLY USE DCI SOLUTIONS TO CONNECT THEIR DATA CENTERS TO SUPPORT SERVICE DELIVERY AND BACK-OFFICE FUNCTIONS

TABLE 54 DCI MARKET FOR COMMUNICATION SERVICE PROVIDERS, BY REGION, 2017–2020 (USD BILLION)

TABLE 55 DCI MARKET FOR COMMUNICATION SERVICE PROVIDERS, BY REGION, 2021–2026 (USD BILLION)

8.3 CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS

8.3.1 DCI TECHNOLOGY HELPS ICPS TO ASSIST WEB-SCALE DATA CENTER SOLUTIONS

TABLE 56 DCI MARKET FOR CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS, BY REGION, 2017–2020 (USD BILLION)

TABLE 57 DCI MARKET FOR CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS, BY REGION, 2021–2026 (USD BILLION)

8.4 GOVERNMENTS

8.4.1 REQUIREMENT FOR FAST AND RELIABLE TECHNOLOGY TO PROCESS DATA TO INCREASE DCI USAGE BY GOVERNMENT AGENCIES

TABLE 58 DCI MARKET FOR GOVERNMENTS, BY REGION, 2017–2020 (USD BILLION)

TABLE 59 DCI MARKET FOR GOVERNMENTS, BY REGION, 2021–2026 (USD BILLION)

8.5 ENTERPRISES

TABLE 60 DCI MARKET FOR ENTERPRISES, BY REGION, 2017–2020 (USD BILLION)

TABLE 61 DCI MARKET FOR ENTERPRISES, BY REGION, 2021–2026 (USD BILLION)

8.5.1 BANKING AND FINANCE

8.5.1.1 Ability to connect multiple operation sites cost-effectively and securely to increase use of DCI solutions

8.5.2 UTILITY AND POWER

8.5.2.1 To ensure business continuity and data recovery, utilities are turning to DCI solutions

8.5.3 HEALTHCARE

8.5.3.1 Increasing need of connecting and exchanging data between disparate IT systems in healthcare institutions to push DCI market growth

8.5.4 MEDIA AND ENTERTAINMENT

8.5.4.1 Benefits of DCI such as high-performance computing, high bandwidth availability, and active/passive business continuity to increase its usage in media and entertainment

8.5.5 RETAIL AND E-COMMERCE

8.5.5.1 With increasing requirement for higher bandwidth, retail and e-commerce industry is adopting DCI solutions

8.5.6 OTHERS

9 GEOGRAPHIC ANALYSIS (Page No. - 122)

9.1 INTRODUCTION

FIGURE 36 DATA CENTER INTERCONNECT MARKET, BY REGION

FIGURE 37 GEOGRAPHIC SNAPSHOT: INDIA EMERGING AS KEY GROWTH MARKET

TABLE 62 DCI MARKET, BY REGION, 2017–2020 (USD BILLION)

FIGURE 38 APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 63 DCI MARKET, BY REGION, 2021–2026 (USD BILLION)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET SNAPSHOT

TABLE 64 DCI MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD BILLION)

TABLE 65 DCI MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD BILLION)

TABLE 66 DCI MARKET IN NORTH AMERICA, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 67 DCI MARKET IN NORTH AMERICA, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 68 DCI MARKET IN NORTH AMERICA, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 69 DCI MARKET IN NORTH AMERICA, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 70 DCI MARKET IN NORTH AMERICA, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 71 DCI MARKET IN NORTH AMERICA, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 72 DCI MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 73 DCI MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 74 DCI MARKET IN NORTH AMERICA, BY END USER, 2017–2020 (USD BILLION)

TABLE 75 DCI MARKET IN NORTH AMERICA, BY END USER, 2021–2026 (USD BILLION)

TABLE 76 NORTH AMERICA: DCI MARKET, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 77 NORTH AMERICA: DCI MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

9.2.1 US

9.2.1.1 US is expected to dominate DCI market in North America, in terms of size, during forecast period

9.2.2 CANADA

9.2.2.1 Canada is expected to witness fastest growth during forecast period.

9.2.3 REST OF NORTH AMERICA

9.3 EUROPE

FIGURE 40 EUROPE: DATA CENTER INTERCONNECT MARKET SNAPSHOT

TABLE 78 DCI MARKET IN EUROPE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 79 DCI MARKET IN EUROPE, BY TYPE, 2021–2026 (USD BILLION)

TABLE 80 DCI MARKET IN EUROPE, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 81 DCI MARKET IN EUROPE, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 82 DCI MARKET IN EUROPE, BY SERVICE, 2017–2020 (USD BILLION)

TABLE 83 DCI MARKET IN EUROPE, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 84 DCI MARKET IN EUROPE, BY PROFESSIONAL SERVICE, 2017–2020 (USD BILLION)

TABLE 85 DCI MARKET IN EUROPE, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 86 DCI MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 87 DCI MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 88 DCI MARKET IN EUROPE, BY END USER, 2017–2020 (USD BILLION)

TABLE 89 DCI MARKET IN EUROPE, BY END USER, 2021–2026 (USD BILLION)

TABLE 90 DCI MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 91 DCI MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD BILLION)

9.3.1 GERMANY

9.3.1.1 Germany’s growing technology community and its requirement for increased bandwidth to push DCI market growth in region

9.3.2 UK

9.3.2.1 Focus of several DCI companies on expanding their presence in UK to boost DCI market growth

9.3.3 FRANCE

9.3.3.1 Increasing focus on 5G to propel DCI market growth in France

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 41 APAC: DATA CENTER INTERCONNECT MARKET SNAPSHOT

TABLE 92 DCI MARKET IN APAC, BY TYPE, 2017–2020 (USD BILLION)

TABLE 93 DCI MARKET IN APAC, BY TYPE, 2021–2026 (USD BILLION)

TABLE 94 DCI MARKET IN APAC, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 95 DCI MARKET IN APAC, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 96 DCI MARKET IN APAC, BY SERVICE, 2017–2020 (USD BILLION)

TABLE 97 DCI MARKET IN APAC, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 98 DCI MARKET IN APAC, BY PROFESSIONAL SERVICE, 2017–2020 (USD BILLION)

TABLE 99 DCI MARKET IN APAC, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 100 DCI MARKET IN APAC, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 101 DCI MARKET IN APAC, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 102 DCI MARKET IN APAC, BY END USER, 2017–2020 (USD BILLION)

TABLE 103 DCI MARKET IN APAC, BY END USER, 2021–2026 (USD BILLION)

TABLE 104 DCI MARKET IN APAC, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 105 DCI MARKET IN APAC, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 106 DCI MARKET IN INDONESIA, 2017–2020 (USD MILLION)

TABLE 107 DCI MARKET IN INDONESIA, 2021–2026 (USD MILLION)

TABLE 108 DCI MARKET INDONESIA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 109 DCI MARKET IN INDONESIA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increasing demand for wireless and touch interactivity, video, and demographic analytics is pushing growth of DCI market in China

9.4.2 JAPAN

9.4.2.1 Growing demand for bandwidth in several sectors, such as data centers and computer networking in Japan is boosting DCI market growth

9.4.3 INDIA

9.4.3.1 Unprecedented increase in data consumption is increasing need for DCI solutions in India

9.4.4 SOUTH KOREA

9.4.4.1 Rising focus on rolling out 5G network and eventual growth of data usage are leading to growth of DCI market

9.4.5 REST OF APAC

9.5 REST OF THE WORLD

FIGURE 42 ROW: DATA CENTER INTERCONNECT MARKET SNAPSHOT

TABLE 110 DCI MARKET IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 DCI MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 112 DCI MARKET IN ROW, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 113 DCI MARKET IN ROW, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 114 DCI MARKET IN ROW, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 115 DCI MARKET IN ROW, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 116 DCI MARKET IN ROW, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 117 DCI MARKET IN ROW, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 118 DCI MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 119 DCI MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 120 DCI MARKET IN ROW, BY END USER, 2017–2020 (USD BILLION)

TABLE 121 DCI MARKET IN ROW, BY END USER, 2021–2026 (USD BILLION)

TABLE 122 DCI MARKET IN ROW, BY REGION, 2017–2020 (USD BILLION)

FIGURE 43 DCI MARKET IN AFRICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 123 DCI MARKET IN ROW, BY REGION, 2021–2026 (USD BILLION)

9.5.1 MIDDLE EAST AND AFRICA

9.5.1.1 Increasing bandwidth requirement is expected to drive DCI market in Middle East and Africa

9.5.2 SOUTH AMERICA

9.5.2.1 Emerging trend of high-quality video streaming services to propel DCI market growth in South America

10 COMPETITIVE LANDSCAPE (Page No. - 158)

10.1 INTRODUCTION

TABLE 124 OVERVIEW OF STRATEGIES DEPLOYED BY DATA CENTER INTERCONNECT COMPANIES

10.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 44 3 YEARS REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

10.3 MARKET SHARE ANALYSIS (2020)

TABLE 125 DEGREE OF COMPETITION, DATA CENTER INTERCONNECT MARKET (2020)

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 EMERGING LEADER

10.4.3 PERVASIVE

10.4.4 PARTICIPANT

FIGURE 45 MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

10.5 STARTUP/SME EVALUATION MATRIX

TABLE 126 STARTUPS/SMES IN MARKET

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 46 MARKET, STARTUP/SME EVALUATION MATRIX, 2020

10.6 COMPANY PRODUCT FOOTPRINT

TABLE 127 COMPANY FOOTPRINT

TABLE 128 COMPANY TYPE FOOTPRINT

TABLE 129 COMPANY APPLICATION FOOTPRINT

TABLE 130 COMPANY REGION FOOTPRINT

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 131 PRODUCT LAUNCHES, 2018–2021

10.7.2 DEALS

TABLE 132 DEALS, 2018–2021

11 COMPANY PROFILES (Page No. - 176)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1.1 CIENA CORPORATION

TABLE 133 CIENA CORPORATION: BUSINESS OVERVIEW

FIGURE 47 CIENA CORPORATION: COMPANY SNAPSHOT

11.1.2 HUAWEI TECHNOLOGIES

TABLE 134 HUAWEI TECHNOLOGIES CO. LTD.: BUSINESS OVERVIEW

FIGURE 48 HUAWEI TECHNOLOGIES: COMPANY SNAPSHOT

11.1.3 INFINERA CORPORATION

TABLE 135 INFINERA CORPORATION.: BUSINESS OVERVIEW

FIGURE 49 INFINERA CORPORATION: COMPANY SNAPSHOT

11.1.4 CISCO SYSTEMS

TABLE 136 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 50 CISCO SYSTEMS: COMPANY SNAPSHOT

11.1.5 NOKIA CORPORATION

TABLE 137 NOKIA CORPORATION: BUSINESS OVERVIEW

FIGURE 51 NOKIA CORPORATION: COMPANY SNAPSHOT

11.1.6 JUNIPER NETWORKS, INC.

TABLE 138 JUNIPER NETWORKS INC.: BUSINESS OVERVIEW

FIGURE 52 JUNIPER NETWORKS, INC.: COMPANY SNAPSHOT

11.1.7 ADVA OPTICAL NETWORKING SE

TABLE 139 ADVA OPTICAL NETWORKING SE: BUSINESS OVERVIEW

FIGURE 53 ADVA OPTICAL NETWORKING SE: COMPANY SNAPSHOT

11.1.8 EXTREME NETWORKS, INC.

TABLE 140 EXTREME NETWORKS, INC.: BUSINESS OVERVIEW

FIGURE 54 EXTREME NETWORKS, INC.: COMPANY SNAPSHOT

11.1.9 FUJITSU LTD.

TABLE 141 FUJITSU LTD.: BUSINESS OVERVIEW

FIGURE 55 FUJITSU LTD.: COMPANY SNAPSHOT

11.1.10 COLT TECHNOLOGY SERVICES GROUP LIMITED

TABLE 142 COLT TECHNOLOGY SERVICES.: BUSINESS OVERVIEW

11.1.11 EQUINIX

TABLE 143 EQUINIX: BUSINESS OVERVIEW

FIGURE 56 EQUINIX.: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 XKL, LLC

11.2.2 EKINOPS S.A.

11.2.3 COLOGIX

11.2.4 PLURIBUS NETWORKS

11.2.5 INNOVIUM

11.2.6 ZTE CORPORATION

11.2.7 MEGAPORT

11.2.8 BROCADE COMMUNICATION SYSTEMS

11.2.9 RANOVUS

11.2.10 EVOQUE DATA CENTER SOLUTIONS

11.2.11 CORESITE REALTY CORPORATION

11.2.12 DIGITAL REALTY TRUST INC.

11.2.13 FIBER MOUNTAIN

11.2.14 FLEXENTIAL

11.2.15 CYXTERA TECHNOLOGIES

12 APPENDIX (Page No. - 247)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involved four major activities in estimating the size for data center interconnect market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the data center interconnect market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the data center interconnect market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (DCI providers) across 4 major geographic regions: North America, Europe, APAC, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the DCI market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Center Interconnect Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply side. Along with this, the market has been validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and estimate the data center interconnect (DCI) market based on type, application, and end user

- To forecast the market size with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To identify drivers, restraints, opportunities, and challenges impacting the growth of the market and submarkets

- To analyze the data center interconnect supply chain and identify opportunities for participants

- To provide key technology trends and a patent analysis related to the data center interconnect market

- To provide information regarding trade data related to the data center interconnect market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the data center interconnect ecosystem

- To strategically profile the key players in the market and comprehensively analyze their market share and core competencies2 in each segment

- To benchmark the market players using the proprietary, company evaluation matrix framework, which analyses them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as collaboration, partnerships, mergers and acquisitions, product launches and developments, and research & development (R&D) in the data center interconnect market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Center Interconnect Market