Ground Penetrating Radar Market by Offering (Equipment, Services), Type (Handheld, Cart-based and Vehicle-mounted), Application (Utility Detection, Concrete Investigation, Transportation, Law Enforcement) and Region - Global Forecast to 2030

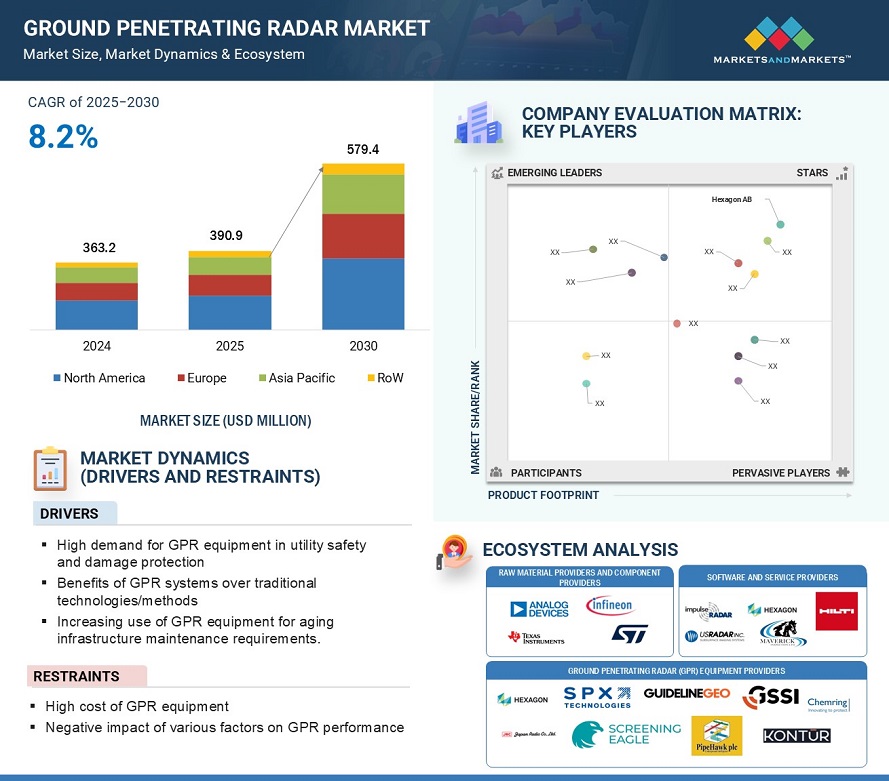

The ground penetrating radar market size is predicted to grow from USD 390.9 million in 2025 to USD 579.4 million by 2030, at a CAGR of 8.2%.

The Ground Penetrating Radar (GPR) market encompasses a variety of technologies and solutions that facilitate subsurface imaging, analysis, and mapping in distinct industries. It encompasses Ground Penetrating Radar Sensors, Ground Penetrating Radar Systems, and Ground Penetrating Radar Services, which enable the efficient identification of underground structures, utilities, and geological features with high resolution. These solutions improve survey quality, safety, and effective decision-making in construction, archaeology, environmental surveys, and defense systems. GPR systems provide real-time data acquisition, allowing accurate and non-invasive subsurface exploration. With industries increasingly embracing innovative sensing technologies, the market demand for Ground Penetrating Radar solutions keeps rising, improving efficiency, safety, and innovation in infrastructure planning and asset maintenance.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

DRIVER: High demand for GPR equipment in utility safety and damage protection

The market is being driven by the increasing demand for Ground Penetrating Radar (GPR) equipment in utility safety and damage prevention, which is driven by the need for accurate subsurface detection to prevent costly infrastructure damage. The possibility of inadvertent strikes during excavation and construction activities is increased as utilities, including water pipelines, gas lines, and electrical cables, are increasingly tightly packed underground due to the expansion of urbanization and infrastructure projects. GPR technology offers a highly precise and non-invasive approach to locating subsurface utilities, thereby decreasing the probability of service disruptions, costly restorations, and safety hazards. The adoption of GPR is further expedited by regulatory frameworks that mandate utility mapping and damage prevention, thereby minimizing financial liabilities and ensuring conformance with safety standards. Furthermore, the demand for GPR is further fueled by the increasing reliance of industries like telecommunications and energy on it for the efficient deployment and maintenance of networks. GPR is a preferred solution for assuring operational safety and efficiency due to the incorporation of advanced features, such as real-time data processing and AI-driven analytics, which enhance its effectiveness. The demand for GPR in utility protection is anticipated to increase significantly as infrastructure modernization continues, thereby facilitating long-term market expansion.

RESTRAINT: Negative impact of various factors on GPR performance

Ground Penetrating Radars usually help identify the horizontal positioning of targets in their exact locations. However, there are several other factors that can affect the speed and accuracy of depth measurement and analysis, including soil type and moisture content, among others. The velocity of the radar signal depends on the composition of the material being scanned and the depth of the target. For instance, the signal will travel slower through soil types that are more difficult to penetrate, such as clay and sand surfaces. Likewise, the velocity of the signal will be affected in materials that contain moisture. Therefore, it is generally impossible to identify the exact velocity with which the GPR signal travels through a material; hence, it is usually estimated to be 90% accurate. In addition, owing to the natural differences in the composition of geological layers, the exact velocity of a signal will vary from one point to the next during underground investigation. Hence, the soil type and moisture content affect the GPR analysis and interpretation.

OPPORTUNITY: Growing demand for GPRs in military applications

The increasing use of Ground Penetrating Radar (GPR) in the military is a principal growth opportunity for the GPR market. Militaries worldwide are adopting Ground Penetrating Radar technology for landmine detection, unexploded ordnance (UXO), and hidden tunnel detection, enhancing battlefield performance and security. The high-resolution subsurface imaging capability of GPR on diverse terrains makes it a critical instrument for military engineering, reconnaissance, and infrastructure protection. The technological advancement in lightweight, portable, and vehicle-mounted GPR systems is making more widespread deployments in war zones and along borders. Governments are spending money on defense capability building, boosting procurement of GPR systems for surveillance, threat detection, and forensic analysis. Integration with artificial intelligence (AI) and data analysis also enhances the productivity of GPR, allowing real-time decision-making in mission-critical applications. As the defense budgets of countries increase, the demand for advanced GPR solutions for military applications will grow, offering new opportunities for manufacturers and service providers in the market.

CHALLENGE: Requirement of skilled professionals to operate GPR equipment

The use of GPR in utility locating processes involves precise inspection of the field to locate underground utilities. The field inspectors should know about the construction and operations of the underground utility distribution and collection systems and the related policies and procedures. They should also have computer expertise and software-related operations to gather information on the exact physical characteristics and location of the utility. Insufficiency of information about electronic or manual GPR equipment and field survey practice and knowledge of utility maps and construction plans makes it a time-consuming process for field officers to locate the utility. The need for competent staff to interpret the GPR data appropriately is gradually rising owing to the complexity of urban infrastructure. Ongoing training is required to avert detection faults, which emphasizes the importance of standardized programs and sectoral coordination towards enhancing operational efficiency and field experience, owing to the advancement in GPR technology. Data misinterpretation leads to expensive project delays and safety risks if appropriate training is not conducted.

Ground Penetrating Radar Market Ecosystem:

Key players operating in ground penetrating radar market are Hexagon AB (Sweden), SPX TECHNOLOGIES (US), Geophysical Survey Systems, Inc. (US), Guideline Geo (Sweden), and Chemring Group PLC (UK) .These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint. Players in this market have adopted various growth strategies including partnerships and expansions in order to set their foothold in the market. The market ecosystem has several participants, and each participant has played a crucial role in developing and deploying ground penetrating radar solutions worldwide.

The Handheld GPR for ground penetrating radar market is projected to grow at a significant CAGR during the forecast period.

The Handheld Ground Penetrating Radar (GPR) market will see tremendous growth over the forecast period with increasing demand for portable and high-precision subsurface imaging technology. Handheld GPR systems offer greater mobility and convenience, which is suitable for applications like utility locating, archaeological surveys, forensic investigation, and military use. The increasing demand for efficient and non-destructive detection of buried utilities like pipelines, cables, and structures is driving demand in construction and infrastructure markets. In addition, advancements in Ground Penetrating Radar Sensors and Ground Penetrating Radar Systems like improved signal processing and real-time data visualization are enhancing accuracy and efficiency with handheld systems. Growing investments in public safety and damage prevention are driving market growth, particularly in developed economies with stringent utility mapping regulations. Additionally, growth in Ground Penetrating Radar Services for site investigation and field inspection is supplementing handheld GPR solutions demand. As industries are putting greater emphasis on cost-effective and reliable subsurface exploration technology, the handheld GPR segment will see strong growth.

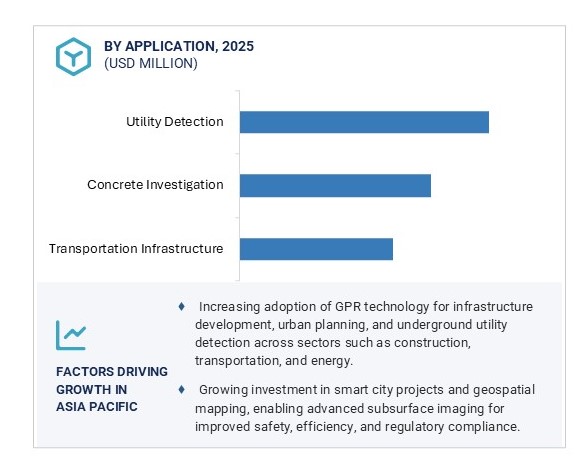

The market for transportation infrastructure is expected to grow at the highest CAGR during the forecast period

The transportation infrastructure market is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period, as a result of the growing global investment in airports, railways, roadways, and tunnels. The demand for sophisticated subsurface imaging technologies, such as Ground Penetrating Radar (GPR) Systems, is being driven by a combination of factors, including ageing infrastructure, increasing traffic volumes, and expanding urbanization. By facilitating the precise inspection of road conditions, bridge spans and railway tracks, GPR is essential for the preservation of structural integrity and safety in transportation infrastructure projects. Furthermore, the risk of damage during construction and maintenance activities is mitigated by the use of Ground Penetrating Radar Sensors, which improve the detection of buried utilities. The market expansion is further bolstered by the increasing adoption of Ground Penetrating Radar Services for transportation projects, as regulatory authorities prioritize non-invasive surveying techniques for efficient asset management. The implementation of GPR in large-scale infrastructure initiatives is being driven by advancements in real-time data processing and AI integration, which are enhancing its capabilities. With the anticipated increase in government and private sector expenditures on sustainable and resilient transport networks, the demand for GPR solutions in infrastructure development is anticipated to increase substantially.

Asia Pacific is expected to grow at the highest rate during the forecast period.

The Ground Penetrating Radar (GPR) market is anticipated to experience the highest Compound Annual Growth Rate (CAGR) in the Asia Pacific region during the forecast period. This growth is being driven by accelerated urbanization, infrastructure development, and increasing investments in construction and utility projects. China, India, Japan, and South Korea are some of the nation’s experiencing high demand for GPR systems due to the fact that these systems are capable of providing clear subsurface images, locating underground utilities, and ensuring safety in excavation and construction activities. Smart city development initiatives in the region, along with regulatory requirements for the safety of utilities and prevention of damage, are also propelling demand for GPR technology. Rising use of GPR for military purposes to protect borders and identify threats also stimulates the market. With improvements in Ground Penetrating Radar Sensors and systems, and availability of cost-effective GPR services, the Asia Pacific region is rapidly emerging as a leader in the GPR solution market with massive opportunities for manufacturers and services providers to enhance their presence and address the growing demand.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players operating in ground penetrating radar (GPR) market are as follows:

- Hexagon AB (Sweden)

- SPX Technologies (US)

- GSSI Inc. (US)

- Guideline Geo (Sweden)

- Chemring Group PLC (UK)

- Japan Radio Co.,Ltd. (Japan)

- Hilti (Liechtensteiner)

- Screening Eagle Technologies (Switzerland)

- PipeHawk plc (UK)

- Kontur (Norway)

Want to explore hidden markets that can drive new revenue in Ground Penetrating Radar Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in Ground Penetrating Radar Market?

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025–2030 |

|

Units |

Value (USD Million) |

|

Segments Covered |

Offering, Type, and Application |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Hexagon AB (Sweden), SPX Corporation (US), Geophysical Survey Systems, Inc. (US), Guideline Geo (Sweden), Chemring Group PLC (UK) and Others- (Total 20 players have been covered) |

This research report categorizes the ground penetrating radar market by offering, type, application, and region.

Ground Penetrating Radar Market By Offering:

- Equipment

- Services

Ground Penetrating Radar Market By Type:

- Handheld Systems

- Cart-based Systems

- Vehicle-mounted Systems

Ground Penetrating Radar Market By Application:

- Utility Detection

- Concrete Investigation

- Transportation Infrastructure

- Archaeology

- Geology & Environment

- Law Enforcement & Military

- Others

Ground Penetrating Radar Market By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

Recent Developments

- In December 2024, Hexagon AB introduced the Leica DSX Pro, an advanced ground-penetrating radar solution designed for high-precision subsurface mapping. The system integrates AI-driven data processing to enhance detection accuracy for utilities, archaeology, and geophysical applications, streamlining field operations with automated reporting tools.

- In January 2024, IDS GeoRadar, part of Hexagon, introduced its latest concrete inspection solutions, the C-thrue XS handheld GPR scanner and NDT Reveal software, at World of Concrete in Las Vegas. These innovations enhance efficiency in subsurface detection and data analysis, enabling construction teams to conduct safer and more precise inspections.

- In September 2023, IDS GeoRadar, part of Hexagon, introduced the Chaser XR, a compact and lightweight ground-penetrating radar (GPR) solution designed for subsurface profiling. Equipped with Equalised scrambled Technology (EsT), the device delivers unmatched resolution and penetration, setting a new benchmark for geophysical surveying.

- In May 2022, IDS GeoRadar s.r.l., a part of Hexagon AB, announced the newest solution for utility professionals, AiMaps, which offers intelligent cloud-processing of GPR data to deliver the right information to detect the underground utilities faster.

- In January 2022, Sensors & Software Inc. announced the release of SPIDAR SDK, a software development kit. It is designed for those who want to use GPRs in their own platforms and control a GPR with their own data acquisition and data processing software.

- In September 2021, Guideline Geo introduced the MALA Easy Locator Core for utility locating. This is designed in a way that it is capable of traversing the toughest terrains.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the ground penetrating radar market during 2025-2030?

The global ground penetrating radar market is expected to record a CAGR of 8.2% from 2025–2030

What are the driving factors for the ground penetrating radar market?

The ground penetrating radar market is driven by the rising demand for infrastructure assessment, subsurface mapping in construction, mining, and archaeology, and advancements in GPR technology, such as improved resolution and portability. Increasing urbanization, stringent safety and quality regulations, and the need for efficient utility management also fuel growth. Additionally, expanding applications in environmental monitoring, disaster management, and defense sectors are creating new opportunities for market expansion.

Which are the significant players operating in the ground penetrating radar market?

Hexagon AB (Sweden), SPX TECHNOLOGIES (US), Geophysical Survey Systems, Inc. (US), Guideline Geo (Sweden), and Chemring Group PLC (UK) are among a few key players in the ground penetrating radar market.

What are the key components of a Ground Penetrating Radar system?

A Ground Penetrating Radar System consists of a transmitter, receiver, control unit, and Ground Penetrating Radar Sensor, which work together to emit and analyze electromagnetic waves for subsurface detection.

What role do Ground Penetrating Radar services play in market expansion?

Ground Penetrating Radar Services are essential for infrastructure maintenance, environmental surveys, and defense applications, providing expertise in non-invasive subsurface imaging and reducing operational risks.

What is the impact of the AI on the ground penetrating radar market?

Artificial Intelligence (AI) is significantly impacting the ground penetrating radar (GPR) market by enhancing data analysis and interpretation capabilities. AI-powered algorithms can process large volumes of GPR data more efficiently, improving accuracy in detecting subsurface objects and anomalies. This reduces human error and speeds up decision-making in applications like utility detection, archaeology, and infrastructure inspection. Additionally, AI enables predictive maintenance by identifying potential issues in underground structures, further driving the adoption of GPR systems. Overall, AI integration is transforming the GPR market by making it more reliable, efficient, and cost-effective.

Which region to offer lucrative growth for the ground penetrating radar market by 2030?

During the projected period, the Asia Pacific is expected to offer lucrative opportunities in the ground penetrating radar market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by using top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 38)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR GROUND PENETRATING RADAR MARKET

4.2 GROUND PENETRATING RADAR MARKET, BY OFFERING

4.3 GROUND PENETRATING RADAR MARKET, BY TYPE

4.4 GROUND PENETRATING RADAR MARKET, BY APPLICATION

4.5 GROUND PENETRATING RADAR MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

4.6 GROUND PENETRATING RADAR MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand for GPR equipment in utility safety and damage protection

5.2.1.2 Benefits of GPR systems over traditional technologies/methods

5.2.1.3 Government safety mandates are driving adoption of GPRs

5.2.1.4 Increasing use of GPRs for aging infrastructure maintenance requirements

5.2.2 RESTRAINTS

5.2.2.1 High cost of GPR equipment

5.2.2.2 Negative impact of various factors on GPR performance

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for real-time data through GPRs

5.2.3.2 GPR software expected to offer growth opportunities

5.2.3.3 Growing demand for GPRs in military applications

5.2.4 CHALLENGES

5.2.4.1 Requirement of skilled professionals to operate GPR equipment

5.3 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTERNET OF THINGS

5.7.2 AUGMENTED REALITY

5.8 PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

5.9.2 BUYING CRITERIA

5.10 CASE STUDIES

5.11 TRADE ANALYSIS

5.12 PATENT ANALYSIS

5.13 KEY CONFERENCES & EVENTS, 2022–2023

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 STANDARDS

6 GROUND PENETRATING RADAR MARKET, BY OFFERING (Page No. - 70)

6.1 INTRODUCTION

6.2 EQUIPMENT

6.2.1 EQUIPMENT TO ACCOUNT FOR LARGER SHARE OF GROUND PENETRATING RADAR MARKET IN 2027

6.2.2 ANTENNAS

6.2.2.1 Antennas with different depth specifications are required for different applications

6.2.3 CONTROL UNITS

6.2.3.1 Control units allow efficient data processing and analysis in ground penetrating radar equipment

6.2.4 POWER SUPPLIES

6.2.4.1 Batteries are considered popular power supply sources

6.3 SERVICES

6.3.1 TRAINING AND CONSULTING SERVICES TO DRIVE SERVICES MARKET DEMAND

7 GROUND PENETRATING RADAR MARKET, BY TYPE (Page No. - 77)

7.1 INTRODUCTION

7.2 HANDHELD SYSTEMS

7.2.1 CONCRETE INVESTIGATION TO DRIVE DEMAND FOR HANDHELD GROUND PENETRATING RADAR SYSTEMS

7.3 CART-BASED SYSTEMS

7.3.1 CART-BASED SYSTEMS ARE CONSIDERED HIGHEST-QUALITY GROUND INSPECTION DATA PROVIDERS

7.4 VEHICLE-MOUNTED SYSTEMS

7.4.1 TRANSPORTATION INFRASTRUCTURE TO DRIVE DEMAND FOR VEHICLE-MOUNTED SYSTEMS

8 GROUND PENETRATING RADAR MARKET, BY APPLICATION (Page No. - 83)

8.1 INTRODUCTION

8.2 UTILITY DETECTION

8.2.1 GROUND PENETRATING RADARS HELP DETECT UNDERGROUND UTILITY STRUCTURES

8.3 CONCRETE INVESTIGATION

8.3.1 GROUND PENETRATING RADARS FACILITATE GREATER DEPTH INSPECTIONS THAN TRADITIONAL SYSTEMS

8.4 TRANSPORTATION INFRASTRUCTURE

8.4.1 REPAIR AND MAINTENANCE OF URBAN TRANSPORTATION INFRASTRUCTURE TO DRIVE USE OF GROUND PENETRATING RADARS

8.5 ARCHAEOLOGY

8.5.1 LARGE AREA MAPPING FEATURE OF GROUND PENETRATING RADARS DRIVES DEMAND IN ARCHAEOLOGY

8.6 GEOLOGY & ENVIRONMENT

8.6.1 GROUND PENETRATING RADARS HELP RETRIEVE CRUCIAL SUBSURFACE INFORMATION

8.7 LAW ENFORCEMENT & MILITARY

8.7.1 GROUND PENETRATING RADAR APPLICATIONS IN MILITARY SECTOR TO FUEL MARKET GROWTH

8.8 OTHERS

9 GROUND PENETRATING RADAR MARKET, BY GEOGRAPHY (Page No. - 102)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Rising government investments in transportation & infrastructure to drive demand for ground penetrating radars

9.2.2 CANADA

9.2.2.1 Growing renewable energy industry to propel demand for ground penetrating radars

9.2.3 MEXICO

9.2.3.1 Growing infrastructure sector to fuel ground penetrating radar market

9.3 EUROPE

9.3.1 UK

9.3.1.1 Improvement in transportation infrastructure to contribute to growth of ground penetrating radars

9.3.2 GERMANY

9.3.2.1 Military and construction sectors to fuel market growth

9.3.3 FRANCE

9.3.3.1 High demand for ground penetrating radars in infrastructure projects to drive market growth

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 Increasing investments by government in infrastructure development to fuel market

9.4.2 JAPAN

9.4.2.1 Demand for safety measures in transportation infrastructure to drive market

9.4.3 SOUTH KOREA

9.4.3.1 Growing demand for inspection systems in bridges, buildings, and tunnels to propel market growth

9.4.4 INDIA

9.4.4.1 Demand for ground penetrating radars in utility detection and archaeological surveys to fuel market

9.4.5 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD

9.5.1 MIDDLE EAST

9.5.1.1 Increasing government investments in infrastructural development to drive market

9.5.2 AFRICA

9.5.2.1 Growing infrastructural projects in African countries to drive market

9.5.3 SOUTH AMERICA

9.5.3.1 Rising number of geological surveys in South American countries to drive market

10 COMPETITIVE LANDSCAPE (Page No. - 125)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.3 TOP 3 COMPANY’S REVENUE ANALYSIS

10.4 MARKET SHARE ANALYSIS, 2021

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

10.6 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

10.7 GROUND PENETRATING RADAR MARKET: COMPANY FOOTPRINT

10.8 COMPETITIVE BENCHMARKING

10.9 COMPETITIVE SITUATIONS AND TRENDS

10.9.1 GROUND PENETRATING RADAR MARKET: PRODUCT LAUNCHES

10.9.2 GROUND PENETRATING RADAR MARKET: DEALS

11 COMPANY PROFILES (Page No. - 140)

11.1 KEY PLAYERS

11.1.1 HEXAGON AB

11.1.1.1 Business overview

11.1.1.2 Products offered

11.1.1.3 Recent developments

11.1.1.4 MnM view

11.1.1.4.1 Key strengths/right to win

11.1.1.4.2 Strategic choices made

11.1.1.4.3 Weaknesses and competitive threats

11.1.2 SPX CORPORATION

11.1.2.1 Business overview

11.1.2.2 Products offered

11.1.2.3 Recent developments

11.1.2.4 MnM view

11.1.2.4.1 Key strengths/right to win

11.1.2.4.2 Strategic choices made

11.1.2.4.3 Weaknesses and competitive threats

11.1.3 GEOPHYSICAL SURVEY SYSTEMS, INC.

11.1.3.1 Business overview

11.1.3.2 Products offered

11.1.3.3 Recent developments

11.1.3.4 MnM view

11.1.3.4.1 Key strengths/right to win

11.1.3.4.2 Strategic choices made

11.1.3.4.3 Weaknesses and competitive threats

11.1.4 GUIDELINE GEO

11.1.4.1 Business overview

11.1.4.2 Products offered

11.1.4.3 Recent developments

11.1.4.4 MnM view

11.1.4.4.1 Key strengths/right to win

11.1.4.4.2 Strategic choices made

11.1.4.4.3 Weaknesses and competitive threats

11.1.5 CHEMRING GROUP PLC

11.1.5.1 Business overview

11.1.5.2 Products offered

11.1.5.3 MnM view

11.1.5.3.1 Key strengths/right to win

11.1.5.3.2 Strategic choices made

11.1.5.3.3 Weaknesses and competitive threats

11.1.6 JAPAN RADIO CO., LTD.

11.1.6.1 Business overview

11.1.6.2 Products offered

11.1.7 HILTI

11.1.7.1 Business overview

11.1.7.2 Products offered

11.1.8 SCREENING EAGLE TECHNOLOGIES

11.1.8.1 Business overview

11.1.8.2 Products offered

11.1.8.3 Recent developments

11.1.9 PIPEHAWK PLC

11.1.9.1 Business overview

11.1.9.2 Products offered

11.1.10 KONTUR

11.1.10.1 Business overview

11.1.10.2 Products offered

11.2 OTHER PLAYERS

11.2.1 IMPULSERADAR

11.2.2 US RADAR INC.

11.2.3 TRANSIENT TECHNOLOGIES

11.2.4 GEOSCANNERS AB

11.2.5 GEOTECH

11.2.6 GPR, INC.

11.2.7 OKM GMBH

11.2.8 SUBSITE ELECTRONICS

11.2.9 NOVATEST SRL

11.2.10 SEWERVUE

12 ADJACENT & RELATED MARKETS (Page No. - 176)

12.1 INTRODUCTION

12.2 EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION

12.3 NORTH AMERICA

12.3.1 IMPACT OF COVID-19 ON EMBEDDED ANTENNA SYSTEMS MARKET IN NORTH AMERICA

12.3.2 US

12.3.2.1 High penetration of IoT devices in homes and industries to drive embedded antenna shipments in US

12.3.3 CANADA

12.3.3.1 Short replacement cycle length of personal electronic devices and anticipated rollout of 5G are likely to offer new growth opportunities

12.3.4 MEXICO

12.3.4.1 Shift toward digitalization led by COVID-19 and remote work to drive shipments of embedded antenna-based wireless devices

13 APPENDIX (Page No. - 184)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

LIST OF TABLES (155 TABLE)

TABLE 1 GROUND PENETRATING RADAR MARKET: ECOSYSTEM

TABLE 2 AVERAGE SELLING PRICES OF GROUND PENETRATING RADARS OFFERED BY TOP COMPANIES, 2021

TABLE 3 INDICATIVE PRICES OF GROUND PENETRATING RADARS

TABLE 4 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS (USD)

TABLE 5 GROUND PENETRATING RADAR MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 8 GPR SLICE SOFTWARE HELPED ANALYZE DATA FROM GPR

TABLE 9 WHEEL-MOUNTED SEEKER SPR ALLOWED ANALYSIS OF SUBSURFACE ROCKS ON TRENCH LINES

TABLE 10 C-THRUE GPR USED TO IDENTIFY METAL ELEMENTS IN STRUCTURAL ELEMENTS

TABLE 11 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

TABLE 12 LIST OF FEW PATENTS IN GROUND PENETRATING RADAR MARKET, 2019–2021

TABLE 13 GROUND PENETRATING RADAR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 STANDARDS FOR GROUND PENETRATING RADAR MARKET

TABLE 19 GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 20 GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 21 EQUIPMENT: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 EQUIPMENT: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 23 EQUIPMENT: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 EQUIPMENT: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 SERVICES: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 SERVICES: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 27 SERVICES: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 SERVICES: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 31 HANDHELD SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 HANDHELD SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 33 CART-BASED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 CART-BASED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 35 VEHICLE-MOUNTED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 VEHICLE-MOUNTED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 37 KEY GROUND PENETRATING RADAR APPLICATIONS AND SUB-APPLICATIONS

TABLE 38 KEY GROUND PENETRATING RADAR APPLICATIONS MAPPING

TABLE 39 GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 41 UTILITY APPLICATIONS

TABLE 42 UTILITY DETECTION: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 43 UTILITY DETECTION: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 44 UTILITY DETECTION: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 UTILITY DETECTION: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 UTILITY DETECTION: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 UTILITY DETECTION: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 CONCRETE INVESTIGATION: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 49 CONCRETE INVESTIGATION: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 50 CONCRETE INVESTIGATION: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 51 CONCRETE INVESTIGATION: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 52 CONCRETE INVESTIGATION: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 CONCRETE INVESTIGATION: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 TRANSPORTATION INFRASTRUCTURE: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 55 TRANSPORTATION INFRASTRUCTURE: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 56 TRANSPORTATION INFRASTRUCTURE: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 57 TRANSPORTATION INFRASTRUCTURE: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 TRANSPORTATION INFRASTRUCTURE: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 TRANSPORTATION INFRASTRUCTURE: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 ARCHAEOLOGY: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 61 ARCHAEOLOGY: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 62 ARCHAEOLOGY: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 63 ARCHAEOLOGY: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 64 ARCHAEOLOGY: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 ARCHAEOLOGY: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 GEOLOGY & ENVIRONMENT: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 67 GEOLOGY & ENVIRONMENT: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 68 GEOLOGY & ENVIRONMENT: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 69 GEOLOGY & ENVIRONMENT: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 70 GEOLOGY & ENVIRONMENT: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 GEOLOGY & ENVIRONMENT: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 LAW ENFORCEMENT & MILITARY: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 73 LAW ENFORCEMENT & MILITARY: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 74 LAW ENFORCEMENT & MILITARY: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 LAW ENFORCEMENT & MILITARY: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 76 LAW ENFORCEMENT & MILITARY: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 LAW ENFORCEMENT & MILITARY: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 OTHERS: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 79 OTHERS: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 80 OTHERS: GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 81 OTHERS: GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 OTHERS: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 OTHERS: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 EUROPE: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 95 EUROPE: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 EUROPE: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 ROW: GROUND PENETRATING RADAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 ROW: GROUND PENETRATING RADAR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 MIDDLE EAST: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 MIDDLE EAST: GROUND PENETRATING RADAR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 ROW: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 109 ROW: GROUND PENETRATING RADAR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 110 ROW: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 ROW: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 113 GROUND PENETRATING RADAR MARKET: MARKET SHARE ANALYSIS (2021)

TABLE 114 COMPANY FOOTPRINT

TABLE 115 APPLICATION: COMPANY FOOTPRINT

TABLE 116 REGIONAL: COMPANY FOOTPRINT

TABLE 117 GROUND PENETRATING RADAR MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 118 GROUND PENETRATING RADAR MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 119 HEXAGON AB: BUSINESS OVERVIEW

TABLE 120 HEXAGON AB: PRODUCT OFFERINGS

TABLE 121 HEXAGON AB: PRODUCT LAUNCHES

TABLE 122 SPX CORPORATION: BUSINESS OVERVIEW

TABLE 123 SPX CORPORATION: PRODUCT OFFERINGS

TABLE 124 SPX CORPORATION: PRODUCT LAUNCHES

TABLE 125 SPX CORPORATION: DEALS

TABLE 126 GEOPHYSICAL SURVEY SYSTEMS, INC.: BUSINESS OVERVIEW

TABLE 127 GEOPHYSICAL SURVEY SYSTEMS, INC.: PRODUCT OFFERINGS

TABLE 128 GEOPHYSICAL SURVEY SYSTEMS, INC.: PRODUCT LAUNCHES

TABLE 129 GEOPHYSICAL SURVEY SYSTEMS, INC.: DEALS

TABLE 130 GUIDELINE GEO: BUSINESS OVERVIEW

TABLE 131 GUIDELINE GEO: PRODUCT OFFERINGS

TABLE 132 GUIDELINE GEO: PRODUCT LAUNCHES

TABLE 133 CHEMRING GROUP PLC: BUSINESS OVERVIEW

TABLE 134 CHEMRING GROUP PLC: PRODUCT OFFERINGS

TABLE 135 JAPAN RADIO CO., LTD.: BUSINESS OVERVIEW

TABLE 136 JAPAN RADIO CO., LTD.: PRODUCT OFFERINGS

TABLE 137 HILTI: BUSINESS OVERVIEW

TABLE 138 HILTI: PRODUCT OFFERINGS

TABLE 139 SCREENING EAGLE TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 140 SCREENING EAGLE TECHNOLOGIES: PRODUCT OFFERINGS

TABLE 141 SCREENING EAGLE TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 142 PIPEHAWK PLC: BUSINESS OVERVIEW

TABLE 143 PIPEHAWK PLC: PRODUCT OFFERINGS

TABLE 144 KONTUR: BUSINESS OVERVIEW

TABLE 145 KONTUR: PRODUCT OFFERINGS

TABLE 146 EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 147 EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 148 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 149 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 150 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018–2020 (USD MILLION)

TABLE 151 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021–2027 (USD MILLION)

TABLE 152 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 153 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2021–2027 (USD MILLION)

TABLE 154 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 155 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

LIST OF FIGURES (59 FIGURES)

FIGURE 1 GROUND PENETRATING RADAR MARKET: SEGMENTATION

FIGURE 2 GROUND PENETRATING RADAR MARKET: RESEARCH DESIGN

FIGURE 3 GROUND PENETRATING RADAR MARKET: BOTTOM-UP APPROACH

FIGURE 4 GROUND PENETRATING RADAR MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR GROUND PENETRATING RADAR MARKET: SUPPLY-SIDE ANALYSIS

FIGURE 6 DATA TRIANGULATION

FIGURE 7 GROUND PENETRATING RADAR MARKET, 2018–2027 (USD MILLION)

FIGURE 8 EQUIPMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 9 CART-BASED SYSTEMS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 UTILITY DETECTION TO ACCOUNT FOR LARGEST MARKET SHARE BETWEEN 2022 AND 2027

FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 RISING NEED FOR AGING INFRASTRUCTURE MAINTENANCE TO FUEL DEMAND FOR GROUND PENETRATING RADARS DURING FORECAST PERIOD

FIGURE 13 EQUIPMENT SEGMENT TO CAPTURE LARGEST MARKET SHARE FROM 2022 TO 2027

FIGURE 14 CART-BASED SYSTEMS TO REGISTER HIGHER CAGR FROM 2022 TO 2027

FIGURE 15 UTILITY DETECTION TO HOLD LARGEST MARKET SHARE IN 2027

FIGURE 16 UTILITY DETECTION AND US TO BE LARGEST MARKET SHAREHOLDERS IN NORTH AMERICA IN 2027

FIGURE 17 CHINA TO EXHIBIT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 18 GROUND PENETRATING RADAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 19 GROUND PENETRATING RADAR MARKET: IMPACT ANALYSIS OF DRIVERS

FIGURE 20 GROUND PENETRATING RADAR MARKET: IMPACT ANALYSIS OF RESTRAINTS

FIGURE 21 GROUND PENETRATING RADAR MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

FIGURE 22 GROUND PENETRATING RADAR MARKET: IMPACT ANALYSIS OF CHALLENGES

FIGURE 23 GROUND PENETRATING RADAR MARKET: VALUE CHAIN ANALYSIS

FIGURE 24 GROUND PENETRATING RADAR MARKET: ECOSYSTEM ANALYSIS

FIGURE 25 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS

FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN GROUND PENETRATING RADAR MARKET

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

FIGURE 29 IMPORT SCENARIO FOR RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

FIGURE 30 EXPORT DATA FOR RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 33 GROUND PENETRATING RADAR MARKET: BY OFFERING

FIGURE 34 EQUIPMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 35 GROUND PENETRATING RADAR MARKET: BY TYPE

FIGURE 36 CART-BASED SYSTEMS TO HOLD LARGEST MARKET SIZE IN GROUND PENETRATING RADAR MARKET

FIGURE 37 GROUND PENETRATING RADAR MARKET, BY APPLICATION

FIGURE 38 UTILITY DETECTION APPLICATION TO HOLD LARGEST MARKET SHARE IN 2027

FIGURE 39 GROUND PENETRATING RADAR MARKET, BY GEOGRAPHY

FIGURE 40 CHINA TO EXHIBIT HIGHEST CAGR IN GROUND PENETRATING RADAR MARKET FROM 2022 TO 2027

FIGURE 41 NORTH AMERICA: GROUND PENETRATING RADAR MARKET SNAPSHOT

FIGURE 42 US TO ACCOUNT FOR LARGEST SHARE OF GROUND PENETRATING RADAR MARKET IN NORTH AMERICA DURING FORECAST PERIOD

FIGURE 43 EUROPE: GROUND PENETRATING RADAR MARKET SNAPSHOT

FIGURE 44 UK TO REGISTER HIGHEST CAGR IN GROUND PENETRATING RADAR MARKET IN EUROPE DURING FORECAST PERIOD

FIGURE 45 ASIA PACIFIC: GROUND PENETRATING RADAR MARKET SNAPSHOT

FIGURE 46 CHINA TO ACCOUNT FOR LARGEST SHARE OF GROUND PENETRATING RADAR MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

FIGURE 47 MIDDLE EAST TO HOLD LARGEST SHARE OF GROUND PENETRATING RADAR MARKET IN ROW DURING FORECAST PERIOD

FIGURE 48 GROUND PENETRATING RADAR MARKET: REVENUE ANALYSIS OF 3 KEY PLAYERS, 2017–2021

FIGURE 49 GROUND PENETRATING RADAR MARKET: COMPANY EVALUATION QUADRANT, 2021

FIGURE 50 GROUND PENETRATING RADAR MARKET, SME EVALUATION QUADRANT, 2021

FIGURE 51 HEXAGON AB: COMPANY SNAPSHOT

FIGURE 52 SPX CORPORATION: COMPANY SNAPSHOT

FIGURE 53 CHEMRING GROUP PLC: COMPANY SNAPSHOT

FIGURE 54 HILTI: COMPANY SNAPSHOT

FIGURE 55 PIPEHAWK PLC: COMPANY SNAPSHOT

FIGURE 56 ASIA PAC TO HOLD LARGEST SHARE OF EMBEDDED ANTENNA SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 57 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY

FIGURE 58 NORTH AMERICA: EMBEDDED ANTENNA SYSTEMS MARKET SNAPSHOT

FIGURE 59 ANALYSIS OF EMBEDDED ANTENNA SYSTEMS MARKET IN NORTH AMERICA: PRE- AND POST-COVID-19 SCENARIOS

The study involved four major activities in estimating the current size of the ground penetrating radar market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the ground penetrating radar market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred ground penetrating radar providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

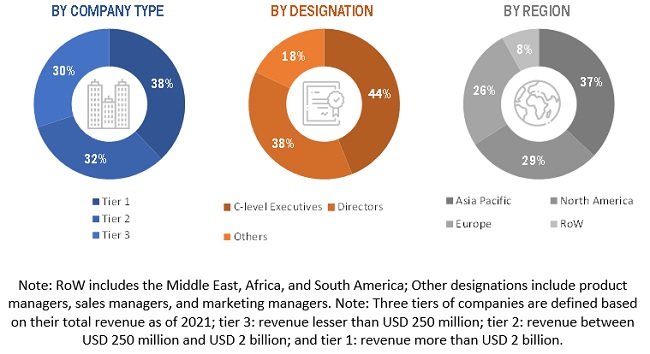

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from ground penetrating radar providers, such as Hexagon AB (Sweden), SPX Corporation (US), Geophysical Survey Systems, Inc. (US), Guideline Geo (Sweden), and Chemring Group PLC (UK); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the ground penetrating radar market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the ground penetrating radar market based on offering and type

- To define, describe, and forecast the ground penetrating radar market based on different applications

- To describe and forecast the size of the ground penetrating radar market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the ground penetrating radar market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Ground Penetrating Radar Market Summary:

Ground Penetrating Radar (GPR), Geo Radar, and Ground Radar are different terms used to describe similar technology used for subsurface imaging. The Ground Penetrating Radar market refers to the market for GPR technology and related products, services, and applications. Geo Radar is a type of GPR used for geological and environmental applications, while Ground Radar is a broader term that may refer to any type of radar technology used for subsurface imaging, including GPR.

Key Applications of Geo Radar Market:

- Construction And Engineering: Geo radar is used to detect subsurface objects and utilities such as pipes, cables, and voids before excavation or drilling.

- Archaeology: Geo radar is used to map archaeological sites and detect buried artifacts and structures.

- Geology And Environmental Studies: Geo radar is used to study the subsurface geology and environmental conditions such as groundwater levels and contamination.

- Forensics: Geo radar is used to detect buried objects or remains in criminal investigations.

- Military And Security: Geo radar is used for mine detection, unexploded ordnance detection, and locating underground tunnels.

- Agriculture: Geo radar is used to study soil characteristics and root structures for crop production.

- Transportation: Geo radar is used to study and monitor the condition of roads, bridges, and tunnels.

Growth Opportunities for GPR Market:

Ground-penetrating radar (GPR) technology has a wide range of applications and offers significant growth opportunities in various industries. Some of the growth opportunities for GPR include:

- Construction Industry: GPR technology can be used in construction for mapping underground utilities, locating rebar and post-tension cables in concrete, and identifying potential voids or other subsurface hazards. With the growth of the construction industry, the demand for GPR technology is also expected to increase.

- Transportation Industry: GPR technology can be used to inspect roads, bridges, and tunnels for cracks, voids, and other defects. This can help identify potential safety hazards and prevent accidents. With the growth of the transportation industry, the demand for GPR technology is also expected to increase.

- Archaeology and Forensics: GPR technology can be used in archaeology and forensics for mapping underground structures, identifying burial sites, and detecting buried objects. With the increasing demand for these services, the demand for GPR technology is also expected to increase.

- Environmental Monitoring: GPR technology can be used to detect underground water tables, map soil conditions, and locate buried hazardous waste. With the growing concern for environmental protection and sustainability, the demand for GPR technology is also expected to increase.

- Mining Industry: GPR technology can be used in mining for mapping underground mineral deposits, identifying potential hazards, and monitoring the stability of mine shafts. With the growing demand for minerals and metals, the demand for GPR technology is also expected to increase.

Key Challenges for Ground Radar Market in the Future:

While ground-penetrating radar (GPR) technology has significant growth opportunities, there are also some key challenges that it may face in the future. Some of the challenges include:

- Interpretation of Data: GPR technology generates large amounts of data, which can be difficult to interpret accurately. As the complexity and volume of data increase, it may become more challenging for users to analyze and interpret the results effectively.

- Cost: GPR technology can be expensive, particularly for large-scale projects that require multiple units. The high cost of the technology may limit its adoption, particularly in smaller organizations or for projects with limited budgets.

- Limitations in Depth of Penetration: The depth of penetration of GPR technology is limited by the properties of the material being scanned. While it is effective for shallow depths, it may not be suitable for deeper scans, which may require more invasive techniques.

- Environmental Interference: GPR technology is sensitive to environmental interference, such as changes in temperature, humidity, and soil conditions. These factors can affect the accuracy of the data generated by the technology, which can lead to errors in interpretation.

- Regulatory Compliance: The use of GPR technology may be subject to regulatory compliance requirements in certain industries, such as environmental monitoring and mining. Compliance with these regulations can be challenging and may require specialized expertise.

Future Use-cases of GPR Market:

The future use-cases of the GPR market are numerous and varied, and they include:

- Construction And Engineering: GPR technology can be used to locate and map underground utilities, such as water and gas pipes, electrical cables, and communication lines. This information can help construction and engineering companies to avoid costly mistakes and reduce the risk of accidents.

- Transportation: GPR can be used to locate and map underground transportation infrastructure, such as subway and train tunnels, and to detect defects in bridges and roads.

- Archeology And Forensics: GPR can be used to locate buried artifacts and structures, and to detect evidence of buried graves or other criminal activity.

- Environmental studies: GPR can be used to study soil and bedrock conditions, map groundwater resources, and monitor the effects of climate change on the environment.

- Mining And Mineral Exploration: GPR can be used to locate and map mineral deposits, and to detect underground voids or caves that can pose a hazard to mining operations.

- Military And Defense: GPR can be used for a variety of military and defense applications, such as detecting buried landmines and unexploded ordnance, and locating hidden tunnels and bunkers.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ground Penetrating Radar Market