COVID-19 Impact on Feed Market by Application (Poultry, Swine, and Aquaculture), Ingredient & Additive Type (Amino Acids, Phosphates, Vitamins, Minerals, Commodity Ingredients, Phytogenics, and Probiotics) and Region - Global Forecast to 2021

[63 Pages Report] According to MarketsandMarkets, the global animal feed market is estimated to be valued at USD 289.02 billion in 2021, recorded a CAGR of 2.2%, in terms of value. Animal Feed helps in improving the overall animal’s health which includes accelerating growth and weight gain and developing immunity. Rapid urbanization across the globe will boost the demand of animal products such as milk, eggs, and meat products which eventually increase the market of animal feed across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the animal feed market

The COVID-19 pandemic had an enormous impact on the global economy and recovery from the crisis would be uneven. The animal feed market is witnessing a sluggish growth due to the impact of COVID-19 spread. Livestock farmers and animal breeders are facing challenges at various levels, such as trade barriers, lockdowns, and shipment delays. However, due to the increased need and use of animal feed, such as vitamins, amino acids, minerals, and probiotics, to enhance the production of products obtained from livestock, the market for animal feed is estimated to grow.

Market Dynamics

Drivers: Growing awareness regarding animal health & biosecurity

Modernization of livestock industry and increasing awareness about livestock nutrition are the major drivers for animal feed market globally. Livestock nutrition is the science of feed preparation and feeding, which is the foundation for the production of adequate and safe food materials such as eggs, milk, and non-food materials such as wool, manure. Good nutrition increases milk production of lactating animals and also increases the reproductive efficiency. Various global companies such as ADM, BASF, and Cargill, are using sanitizers and surface disinfectants, for maintaining hygiene at work. As per various regulatory guidelines, industries are using disinfectants for disinfecting equipment, containers, consumption utensils, surfaces or pipework associated with the production, transport, storage or consumption of food or feed (including drinking water) for humans and animals.

Restraints: Impact on animal feed production and supply chain

The poultry industry is battling rumors of coronavirus spreading through the consumption of meat and meat products. In some regions, lockdowns have been announced as a part of the efforts to control the coronavirus pandemic, which has impacted the movement of animals across the countries and also changed the legislation of local and international export market. Also, effected the production of animal feed manufacturers across the globe due to decrease in labor force.

By type, the commodity ingredients segment is projected to account for the largest market share in the animal feed market during the forecast period

The commodity ingredients segment is expected to account for the largest market share in the animal feed market. Commodity ingredients includes wheat, corn, canola, and soyabean are the necessary animal feed which are used to feed animals on large scale. Livestock breeders are opting for domestic sources for feeding animals, as international trade is immensely disrupted. Therefore, instead of usual commodities, which include grains, milling by-products, added vitamins, minerals, fats/oils, and other nutritional and energy sources, breeders will have to rely on local ingredients.

By region, the Asia-Pacific account for the largest market share in the animal feed market

Asia Pacific’s large market share is due to the presence of large livestock population. Furthermore, the region has witnessed an increase in the number of feed mills and feed production, particularly in countries, such as India and Japan. This increase in the number of feed mills in the region impacts feeds production. According to the Alltech Feed Survey of 2018, the region witnessed a 7% increase in its feed production from 356.5 million tons in 2012 to 381.1 million tons in 2017. The largest feed producer, China, contributes significantly to the region’s leading position, with Thailand and Indonesia being the emerging feed producing countries, while India is demonstrating constant growth in feed production. According to the same source, among the top 20 feed companies in the world, 16 of them are based in the Asia Pacific region, which makes this region a highly competitive market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Key players in this market include Cargill (US), ADM (US), and BASF (Germany). Companies are taking various strategies in order to deal the COVID-19 scenario. For example, DuPont Animal Nutrition sites in Europe and other regions around the world are still in operation to deliver solutions to customers. The animal nutrition business is considered an essential business, and as such, the company will continue to safely produce and ship customer orders while protecting the safety and health of its employees.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Feed Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Feed Market?

|

Report Metric |

Details |

|

Market size available for years |

2020–2021 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2021 |

|

Forecast units (for the market in terms of value) |

USD million, USD billion |

|

Segments covered |

Feed additives and geography |

|

Regions covered |

US, North America, Europe, APAC, and RoW |

|

Companies covered |

ADM , Cargill, and BASF |

Animal feed Market Segmentation

By Feed Additives Type

- Amino acids

- Phosphates

- Vitamins & minerals

- Phytogenics

- Probiotics

- Commodity ingredients

- Others (Enzymes and acidifiers)

By Geography

- US

- Europe

- APAC

- RoW

Frequently Asked Questions (FAQ):

Which are the major feed types considered in this study and which segments are projected to have promising growth rates in the future?

All the major feed types such as are considered in the scope of the study. Commodity ingredients is currently accounting for a dominant share in the animal feed market followed by vitamins & minerals. The phytogenics segment is projected to experience the highest growth rate in the next five years, due to an increase in its usage as more people are opting for organic and healthy products as compared to synthetic products.

I am interested in the Asia Pacific market for commodity ingredients and the vitamins & minerals segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects including market size, forecast, market dynamics, company profiles & competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- India

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the animal feed market?

Global animal feed market is characterized by the following drivers:

- Drivers: Growing awareness regarding animal health & biosecurity

The demand for these products is increasing because consumers are more concerned about the animal health and quality outputs from the animals. Increasing awareness about the livestock nutrition is the major driver for the animal feed market globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 10)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

2 COVID-19 IMPACT ON FOOD, ANIMAL HEALTH, AND AGRICULTURE (Page No. - 16)

2.1 INTRODUCTION

2.2 EFFECT ON GLOBAL MEAT CONSUMPTION

2.3 EFFECTS ON ANIMAL HEALTH

2.4 EFFECTS ON FEED CONSUMPTION

3 COVID-19 IMPACT ON ECOSYSTEM OF FEED INDUSTRY (Page No. - 18)

3.1 VALUE CHAIN

3.2 IMPACT ON VALUE CHAIN

3.2.1 FEED RAW MATERIALS/SUPPLIERS

3.2.2 FEED FORMULATORS

3.2.3 DISTRIBUTION AND LOGISTICS

3.2.4 END-USE INDUSTRY

3.3 MARKET DYNAMICS

3.3.1 DRIVERS

3.3.1.1 Growing awareness regarding animal health & bio-security

3.3.2 RESTRAINTS

3.3.2.1 Impact on feed production and supply chain

3.3.2.2 Impact on demand for meat, dairy, and animal products

4 GROWTH OPPORTUNITIES IN THE FEED INDUSTRY APPLICATIONS (Page No. - 26)

4.1 INTRODUCTION

4.2 SCENARIO-BASED ANALYSIS

4.3 MOST ATTRACTIVE MARKET - IMPACT & OPPORTUNITIES

4.3.1 AQUACULTURE

4.4 WORST-AFFECTED MARKET

4.4.1 POULTRY

4.4.2 SWINE

5 CUSTOMER ANALYSIS (Page No. - 30)

5.1 INTRODUCTION

5.2 SHIFT IN THE DAIRY INDUSTRY

5.2.1 DISRUPTIONS IN THE INDUSTRY

5.2.2 RISK MITIGATION STRATEGY

5.2.3 NEW MARKET OPPORTUNITIES

5.3 SHIFT IN THE MEAT & POULTRY INDUSTRY

5.3.1 DISRUPTIONS IN THE INDUSTRY

5.3.2 RISK MITIGATION STRATEGY

5.3.3 NEW MARKET OPPORTUNITIES

5.4 SHIFT IN THE SEAFOOD INDUSTRY

5.4.1 DISRUPTIONS IN THE INDUSTRY

5.4.2 RISK MITIGATION STRATEGY

5.4.3 NEW MARKET OPPORTUNITIES

6 SHORT AND MID-TERM STRATEGY SHIFTS BY FEED ADDITIVE COMPANIES TO MITIGATE COVID-19 IMPACT (Page No. - 33)

6.1 SHORT AND MID-TERM STRATEGIES

6.1.1 PRODUCT LEVEL

6.1.2 APPLICATION LEVEL

6.2 REGIONAL/GEOGRAPHIC LEVEL

6.2.1 US

6.2.2 ASIA PACIFIC

6.2.3 EUROPE

6.2.4 ROW

6.3 WINNING STRATEGIES IN THE INDUSTRY TO GAIN MARKET SHARE

6.3.1 SHORT TERM

6.3.2 MID-TERM

6.3.3 LONG TERM

7 FEED MARKET: MARKET OUTLOOK DUE TO COVID-19 (Page No. - 37)

7.1 FEED INGREDIENTS & ADDITIVES

7.1.1 AMINO ACIDS

7.1.2 PHOSPHATES

7.1.3 VITAMINS & MINERALS

7.1.4 PHYTOGENICS

7.1.5 PROBIOTICS

7.1.6 COMMODITY INGREDIENTS

7.1.7 OTHERS

7.2 GEOGRAPHY

7.2.1 INTRODUCTION

7.2.2 ASIA PACIFIC

7.2.2.1 India

7.2.2.2 China

7.2.3 EUROPE

7.2.3.1 Italy

7.2.3.2 Spain

7.2.3.3 UK

7.2.3.4 Other European countries

7.2.4 US

7.2.5 REST OF WORLD

8 COMPANY PROFILES (Page No. - 52)

(Business overview, Impact analysis of COVID-19 pandemic on feed additives and ingredients & Winning strategies)*

8.1 CARGILL

8.2 ADM

8.3 BASF

*Details on Business overview, Impact analysis of COVID-19 pandemic on feed additives and ingredients & Winning strategies might not be captured in case of unlisted companies.

9 APPENDIX (Page No. - 58)

9.1 INSIGHTS OF INDUSTRY EXPERTS

9.2 DISCUSSION GUIDE

9.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

9.4 AUTHOR DETAILS

LIST OF TABLES (16 Tables)

TABLE 1 STRATEGIES UNDERTAKEN BY LEADING MANUFACTURERS ON DEALING WITH THE COVID-19 SCENARIO

TABLE 2 COVID-19 IMPACT ON THE FEED MARKET, BY TYPE, 2019-2021 (USD MILLION)

TABLE 3 AMINO ACIDS: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2019-2021 (USD MILLION)

TABLE 4 PHOSPHATES: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 5 VITAMINS & MINERALS: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 6 PHYTOGENICS: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 7 PROBIOTICS: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 8 COMMODITY INGREDIENTS: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 9 OTHERS: COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 10 COVID-19 IMPACT ON THE FEED MARKET, BY REGION, 2020-2021 (USD MILLION)

TABLE 11 ASIA PACIFIC: COVID-19 IMPACT ON THE FEED MARKET, BY TYPE, 2020-2021 (USD MILLION)

TABLE 12 ASIA PACIFIC: COVID-19 IMPACT ON THE FEED MARKET, BY COUNTRY, 2020-2021 (USD MILLION)

TABLE 13 EUROPE: COVID-19 IMPACT ON THE FEED MARKET, BY COUNTRY, 2020-2021 (USD MILLION)

TABLE 14 EUROPE: COVID-19 IMPACT ON THE FEED MARKET, BY TYPE, 2020-2021 (USD MILLION)

TABLE 15 US: COVID-19 IMPACT ON THE FEED MARKET, BY TYPE, 2020-2021 (USD MILLION)

TABLE 16 REST OF THE WORLD: COVID-19 IMPACT ON THE FEED MARKET, BY TYPE, 2020-2021 (USD MILLION)

LIST OF FIGURES (16 Figures)

FIGURE 1 COVID-19 THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 VALUE CHAIN: FEED ADDITIVES & INGREDIENTS MARKET

FIGURE 8 FEED ADDITIVES MARKET DYNAMICS

FIGURE 9 GLOBAL FEED PRODUCTION 2018 (MILLION METRIC TON)

FIGURE 10 US PRODUCTION AND CONSUMPTION OF MEAT PRODUCTS (MILLION POUND)

FIGURE 11 PORK PRODUCTION - TOP COUNTRIES SUMMARY (1,000 METRIC TONS, CARCASS WEIGHT EQUIVALENT)

FIGURE 12 CHICKEN MEAT PRODUCTION - TOP COUNTRIES SUMMARY (1,000 METRIC TONS, READY TO COOK EQUIVALENT)

FIGURE 13 ELEMENTS OF UNCERTAINTY: FEED ADDITIVES & INGREDIENTS MARKET

FIGURE 14 COVID-19 IMPACT ON THE FEED MARKET, BY FEED ADDITIVES, 2019-2021 (USD MILLIONS)

FIGURE 15 COVID-19 IMPACT ON THE ANIMAL FEED MARKET, BY REGION, 2020

FIGURE 16 ASIA PACIFIC: COVID-19 IMPACT ON THE FEED MARKET, 2020

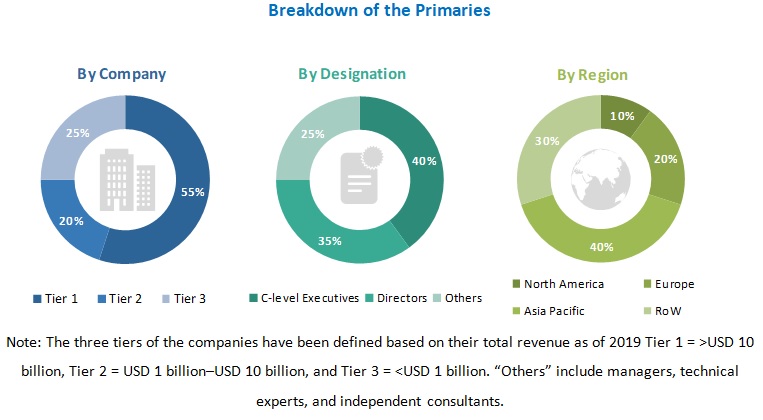

The study involved both secondary and primary research processes in estimating the current size of the global feed market. Exhaustive secondary research was done to collect information on the market, the peer markets, the parent market, and the impact of COVID-19. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations; white papers, feed-based marketing-related journals, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through primary research. The secondary data has been gathered and analyzed to arrive at the global feed market size, which has further been validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply-side include key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants from key companies and organizations operating in the feed market.

Primary research has also been conducted to identify various segmentation types and key players, as well as to analyze the competitive landscape, key market dynamics (drivers, restraints, and opportunities), and major growth strategies adopted by market players. During the market engineering, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the market, including the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during the complete market engineering process to list the key information/insights throughout the report. Primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the overall feed market and other dependent submarkets listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights.

Major players in the feed market have been identified through primary research and secondary research. This involved studying annual and financial reports of top market players and interviews with industry experts (such as CEOs, vice presidents, directors, and marketing executives) for key insights—both quantitative and qualitative.

All percentage shares, splits, breakdowns, and COVID-19 impact estimations have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the feed market report.

Data Triangulation

After arriving at the overall market size through the process explained above, the total feed market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives

- To define, describe, forecast, and analyze the feed market by feed additives (amino acids, phosphates, vitamins & minerals, phytogenics, probiotics, commodity ingredients, and others) and geography

- To forecast the market for feed additive segments with regard to four main regions, namely, the US, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To assess the impact of COVID-19 pandemic on each of the above segments and regions

- To provide detailed information regarding the major factors influencing the growth of the feed market (drivers and restraints)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the feed market

- To strategically profile the key players and comprehensively analyze the impact of COVID-19 on their respective lines of businesses

Available Customization

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the animal feed market report.

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in COVID-19 Impact on Feed Market

Good insights on implications of COVID on feed manufacturers and supply chain.