COVID-19 Impact on Industrial Robotics Market by Type (Articulated, SCARA, Parallel, Cartesian Robots), Industry (Automotive; Electrical and Electronics; Food & Beverages; Pharmaceuticals and Cosmetics), and Region – Global Forecast to 2025

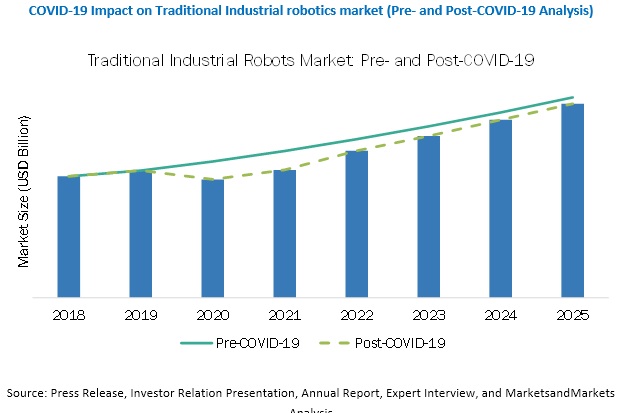

[111 Pages Report] Post-COVID-19, The traditional covid-19 impact on industrial robotics market size (including the prices of peripherals, software, and system engineering), is expected to grow from USD 44.6 billion in 2020 to USD 73.0 billion by 2025; it is expected to grow at a CAGR of 10.4% during the forecast period. The projection for 2025 is estimated to be down by ~3% as compared to pre-COVID-19 estimation.

Dearth of skilled labor and solicitation of proposals by governments and public-private companies to mitigate the adverse impact of COVID-19 are key driving factors for the market. Although the COVID-19 pandemic will negatively affect the market growth till Q2 or Q3 of 2020, the market is expected to grow from 2021 onwards as the players in the industrial robotics market might till then clear their backlogs and start with the new orders. For instance, for the FY 2019, the Robotics business division of KUKA (Germany) had order backlogs worth USD 309 million (EUR 276 million).

“Post-COVID-19, articulated robots to hold a larger market share in 2020.”

Articulated robots are in use in a larger set of industries compared to other types of industrial robots. The automotive industry accounts for the major share of articulated robots as their production processes are heavily automated. Although most industries are affected due to the COVID-19 pandemic, articulated robots are still expected to maintain the highest share of the industrial robotics market during the forecast period. Other robots, such as SCARA and parallel robots, are more specialized and not as versatile in terms of payload and reach compared to articulated robots. Hence, articulated robots will still maintain the largest share in the industrial robotics industry throughout the forecast period.

“Even though COVID-19 has negatively impacted the automotive industry worldwide, it is expected to dominate the traditional industrial robotics market throughout the forecast period.”

Since the 1960s, the automotive industry continues to use industrial robots in their assembly line. The industry has seen the most extensive use for robots in manufacturing and assembling components such as engines, chassis, axles, and brakes. The automotive industry is one of the largest users of industrial robots; however, the market is expected to be severely affected due to the COVID-19 pandemic. The pandemic has hindered production and significantly reduced consumer demand. Due to this, vehicle manufacturers are expected to reduce their investments in automation, affecting the market for industrial robots. Since other industries are also being affected due to the pandemic, the industrial robot market for the automotive industry is still expected to hold the largest share despite experiencing a decline in 2020.

“Post-COVID-19 APAC industrial robotics market is expected to maintain the highest share during 2020–2025.”

Although APAC held the largest share of the market in 2019, it is expected to experience negative growth in 2020. 2018 marked a decrease in the sales of industrial robots in countries like China due to the falling demand from the automotive sector and the effects of the US-China trade war. The recent COVID-19 pandemic in 2020 is expected to affect the market even further. As a result, major industrial robot manufacturers with operations in China are also likely to experience negative growth and revenue for the next two years. However, since countries in North America and Europe are similarly affected due to the COVID-19 pandemic, APAC is still expected to maintain the largest share of the market during the forecast period.

Key Market Players

Major companies in the covid-19 impact on industrial robotics market are ABB (Switzerland), YASKAWA (Japan), FANUC (Japan), KUKA (Germany), Mitsubishi Electric (Japan), Kawasaki Heavy Industries (Japan), DENSO (Japan), NACHI-FUJIKOSHI (Japan), EPSON (Japan), Dürr (Germany). Apart from these, Franka Emika (Germany) and Techman Robots (Taiwan) are few of the emerging companies in the industrial robotics industry.

YASKAWA (Japan) is one of the key players in the industrial robotics market. YASKAWA is engaged in the manufacture, sale, installation, maintenance, and engineering of mechatronics products. It operates through four primary business segments that include Motion Control, Robotics, System Engineering, and Other. The Robotics segment is responsible for supplying articulated robots for various applications that include welding, assembly, palletizing, machining, deburring, and painting. The company offers both traditional as well as collaborative industrial robots, which include articulated and parallel robots. The payload capacity of the robots provided range anywhere from 0.5 Kg to 900 Kg. These line-up of robots are offered under the MOTOMAN brand. YASKAWA has established a business operation in 30 countries and has production facilities in 12 countries around the world. The company has subsidiaries at major countries across North America, Europe, APAC, Middle East, Africa, and South America. Some of the subsidiaries of YASKAWA are YASKAWA Electric (China) Co., Ltd. (China), YASKAWA Europe GmbH (Germany), YASKAWA America, Inc. (US), and YASKAWA Electric India Pvt. Ltd. (India).

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Industrial Robotics Market?

Scope of the Report:

Scope of the Report:

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Industrial Robotics Market?

|

Report Metric |

Details |

|

Market size available for years |

2018—2025 |

|

Base year |

2019 |

|

Forecast period |

2020—2025 |

|

Units |

Value (USD million/billion) |

|

Segments covered |

Type, Industry, and Geography. |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

ABB (Switzerland), YASKAWA (Japan), FANUC (Japan), KUKA (Germany), Kawasaki Heavy Industries (Japan), Mitsubishi Electric (Japan), DENSO CORPORATION (Japan), NACHI-FUJIKOSHI (Japan), Seiko Epson (Japan), Dürr (Germany), Omron Adept (US), b+m Surface Systems (Germany), Universal Robots (Denmark), Techman Robot (Taiwan), Doosan Robotics (South Korea), AUBO Robotics (US), Precise Automation (US), Rethink Robotics (US), Comau (Italy), F&P Robotics (Switzerland), MABI Robotic (Switzerland), Franka Emika (Germany), Stäubli (Switzerland), Bosch Group (Germany) |

This report categorizes the industrial robotics market based on type, industry, and geography.

COVID-19 Impact on Industrial Robotics Market

by Type:

- Articulated robots

- SCARA robots

- Parallel/delta robots

- Cartesian/gantry/linear robots

- Other robots (cylindrical, spherical, swing arm)

COVID-19 Impact on Industrial Robotics Market by Industry:

- Automotive

- Electrical and electronics

- Chemicals, rubber, and plastics

- Metals and machinery

- Food & beverages

- Precision engineering and optics

- Pharmaceuticals and cosmetics

COVID-19 Impact on Industrial Robotics Market by Geography:

- North America

- Europe

- APAC

- RoW

Key Questions Addressed in the Report

- Which stakeholders in the industrial robotics ecosystem will gain/ lose? Who will be impacted most adversely?

- How are the major customers of industrial robotics players shifting their spending and strategies? What implication will this have on the player’s short term revenue growth?

- How are the top 25-30 players in the ecosystem changing their short term strategies – in terms of product focus, end-use industry focus, regional focus, technology focus, etc.? What are the most significant changes expected?

- Post-COVID-19, which would be the most attractive industry for the industrial robot OEMs to invest in?

- How will this pandemic impact the short term (2020, 2021) and mid-term growth for industrial robotics market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON ECONOMY—SCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH ASSUMPTIONS

2.2 PRIMARY DATA

2.2.1 BREAKDOWN OF PRIMARIES

2.3 INCLUSIONS AND EXCLUSIONS

2.4 APPROACH TO ESTIMATE POST-COVID-19 DECLINE IN 2020

2.5 STAKEHOLDERS

3 EXECUTIVE SUMMARY (Page No. - 26)

4 IMPACT ON ECOSYSTEM AND EXTENDED ECOSYSTEM (ADJACENT MARKETS) (Page No. - 30)

4.1 INTRODUCTION

4.1.1 COMPONENT SUPPLIERS

4.1.2 ORIGINAL EQUIPMENT MANUFACTURERS

4.1.3 SYSTEM INTEGRATORS

4.1.4 SOFTWARE PROVIDERS

4.1.5 ACCESSORY PROVIDERS

4.1.6 END USERS

4.2 COVID-19-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

4.2.1 DRIVERS

4.2.1.1 Solicitation of proposals by governments and public–private companies to mitigate adverse impact of COVID-19

4.2.1.2 Anticipated shortage of skilled workforce in manufacturing industries due to ban on migration

4.2.2 RESTRAINTS

4.2.2.1 High installation cost of industrial robots, especially for small and medium-sized enterprises

4.2.3 OPPORTUNITIES

4.2.3.1 Accelerating spread of COVID-19 pandemic prompting several industries to adopt automation technologies

4.2.4 CHALLENGES

4.2.4.1 Difficulties faced by start-up companies to demonstrate their products virtually

5 BUSINESS IMPLICATIONS OF COVID-19 ON INDUSTRIAL ROBOTICS MARKET (Page No. - 36)

5.1 IMPLICATIONS BASED ON VARIOUS TYPES OF ROBOTS (PESSIMISTIC (POST-COVID-19) AND REALISTIC (POST-COVID-19))

5.1.1 ARTICULATED ROBOTS MARKET FORECAST (2020–2025)

5.1.2 SCARA ROBOTS MARKET FORECAST (2020–2025)

5.1.3 PARALLEL/DELTA ROBOTS MARKET FORECAST (2020–2025)

5.1.4 CARTESIAN/GANTRY/LINEAR ROBOTS MARKET FORECAST (2020–2025)

5.1.5 OTHER ROBOTS (CYLINDRICAL, SPHERICAL, SWING ARM) MARKET FORECAST (2020–2025)

6 USE CASES SHOWING IMPACT OF COVID-19 ON MAJOR VERTICALS AND STEPS TAKEN BY CLIENTS TO RESPOND TO CURRENT SCENARIO (Page No. - 45)

6.1 SHIFT IN CLIENTS’ REVENUES

6.2 AUTOMOTIVE

6.2.1 FORECAST FROM 2020 TO 2025

6.2.1.1 Pessimistic scenario

6.2.1.2 Realistic scenario

6.2.2 KEY USE CASES

6.2.3 MNM VIEW

6.3 ELECTRICAL AND ELECTRONICS

6.3.1 FORECAST FROM 2020 TO 2025

6.3.1.1 Pessimistic scenario

6.3.1.2 Realistic scenario

6.3.2 KEY USE CASES

6.3.3 MNM VIEW

6.4 CHEMICALS, RUBBER, AND PLASTICS

6.4.1 FORECAST FROM 2020 TO 2025

6.4.1.1 Pessimistic scenario

6.4.1.2 Realistic scenario

6.4.2 KEY USE CASES

6.4.3 MNM VIEW

6.5 METALS AND MACHINERY

6.5.1 FORECAST FROM 2020 TO 2025

6.5.1.1 Pessimistic scenario

6.5.1.2 Realistic scenario

6.5.2 KEY USE CASES

6.5.3 MNM VIEW

6.6 FOOD & BEVERAGES

6.6.1 FORECAST FROM 2020 TO 2025

6.6.1.1 Pessimistic scenario

6.6.1.2 Realistic scenario

6.6.2 KEY USE CASES

6.6.3 MNM VIEW

6.7 PRECISION ENGINEERING AND OPTICS

6.7.1 FORECAST FROM 2020 TO 2025

6.7.1.1 Pessimistic scenario

6.7.1.2 Realistic scenario

6.7.2 KEY USE CASES

6.7.3 MNM VIEW

6.8 PHARMACEUTICALS AND COSMETICS

6.8.1 FORECAST 2020–2025

6.8.1.1 Pessimistic scenario

6.8.1.2 Realistic scenario

6.8.2 KEY USE CASES

6.8.3 MNM VIEW

7 IMPACT OF COVID-19 ON GEOGRAPHIC REGIONS (Page No. - 59)

7.1 GEOGRAPHIC ANALYSIS

7.1.1 FORECAST FROM 2020 TO 2025

7.1.2 MNM VIEW

7.2 NORTH AMERICA

7.2.1 FORECAST FROM 2020 TO 2025

7.2.2 MNM VIEW

7.2.2.1 US

7.2.2.1.1 US to dominate traditional industrial robots market in North America in 2020

7.2.2.2 Canada

7.2.2.2.1 Government initiatives to fuel growth of Canadian traditional industrial robots market

7.2.2.3 Mexico

7.2.2.3.1 Growth of Mexican market to slow down owing to COVID-19

7.3 EUROPE

7.3.1 FORECAST FROM 2020 TO 2025

7.3.2 MNM VIEW

7.3.2.1 Italy

7.3.2.1.1 Most affected European country by COVID-19

7.3.2.2 Germany

7.3.2.2.1 Country to hold largest share of traditional industrial robots market in Europe in 2020 even after outbreak of COVID-19

7.4 APAC

7.4.1 FORECAST FROM 2020 TO 2025

7.4.2 MNM VIEW

7.4.2.1 China

7.4.2.1.1 China might witness decline in purchasing manager index and production index in 2020

7.4.2.2 Japan

7.4.2.2.1 Robot OEMs in Japan design and manufacture their own components to prevent supply chain disruptions

7.5 ROW

7.5.1 FORECAST FROM 2020 TO 2025

7.5.2 MNM VIEW

7.5.2.1 Middle East and Africa

7.5.2.1.1 Market in Middle East and Africa to witness sluggish growth owing to reduced oil prices and rapid spread of COVID-19

7.5.2.2 South America

7.5.2.2.1 Automotive industry is major contributor to growth of traditional industrial robots market in South America

8 COVID-19 FOCUSED PROFILES OF KEY VENDORS (Page No. - 68)

(Company overview, COVID-19 company-specific developments)*

8.1 INDUSTRIAL ROBOTICS ECOSYSTEM

8.1.1 ABB

8.1.2 YASKAWA

8.1.3 FANUC

8.1.4 KUKA

8.1.5 KAWASAKI HEAVY INDUSTRIES

8.1.6 MITSUBISHI ELECTRIC

8.1.7 DENSO CORPORATION

8.1.8 NACHI-FUJIKOSHI

8.1.9 SEIKO EPSON

8.1.10 DÜRR

8.1.11 OMRON ADEPT

8.1.12 B+M SURFACE SYSTEMS

8.2 COLLABORATIVE ROBOT ECOSYSTEM

8.2.1 UNIVERSAL ROBOTS

8.2.2 TECHMAN ROBOT

8.2.3 DOOSAN ROBOTICS

8.2.4 AUBO ROBOTICS

8.2.5 PRECISE AUTOMATION

8.2.6 RETHINK ROBOTICS

8.2.7 COMAU

8.2.8 F&P ROBOTICS

8.2.9 MABI ROBOTIC

8.2.10 FRANKA EMIKA

8.2.11 STÄUBLI

8.2.12 BOSCH GROUP

8.3 ROBOT END-EFFECTOR ECOSYSTEM

8.3.1 SCHUNK

8.3.2 ROBOTIQ

8.3.3 ZIMMER GROUP

8.3.4 SCHMALZ

8.3.5 DESTACO

8.3.6 TÜNKERS

8.3.7 FESTO

8.3.8 ATI INDUSTRIAL AUTOMATION

8.3.9 PIAB AB

8.3.10 SOFT ROBOTICS

8.3.11 BASTIAN SOLUTIONS

8.3.12 EMI

8.3.13 IAI

8.4 SERVICE ROBOTICS ECOSYSTEM

8.4.1 IROBOT

8.4.2 DELAVAL

8.4.3 DAIFUKU

8.4.4 DJI

8.4.5 KONGSBERG MARITIME

8.4.6 SOFTBANK ROBOTICS GROUP

8.4.7 NORTHROP GRUMMAN

8.4.8 NEATO ROBOTICS

8.4.9 ECA GROUP

8.4.10 LELY

8.4.11 STARSHIP TECHNOLOGIES

8.4.12 GENERAL ELECTRIC

8.4.13 PARROT DRONES SAS

8.5 MEDICAL ROBOTS ECOSYSTEM

8.5.1 INTUITIVE SURGICAL

8.5.2 MAZOR ROBOTICS

8.5.3 STRYKER

8.5.4 ACCURAY

8.5.5 OMNICELL

8.5.6 HOCOMA

8.5.7 HANSEN MEDICAL (A WHOLLY OWNED SUBSIDIARY OF AURIS SURGICAL ROBOTICS)

8.5.8 ARXIUM

8.5.9 EKSO BIONICS

8.5.10 KIRBY LESTER

8.5.11 CYBERDYNE

*Company overview, COVID-19 company-specific developments might not be captured in case of unlisted companies.

9 APPENDIX (Page No. - 107)

9.1 INSIGHTS OF INDUSTRY EXPERTS

9.2 DISCUSSION GUIDE

9.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

9.4 AUTHOR DETAILS

LIST OF TABLES (16 TABLES)

TABLE 1 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

TABLE 2 PMI-BASED CALCULATIONS TO OBTAIN DECLINING MARKET SIZE AND REDUCING PERCENTAGE FOR 2020

TABLE 3 ARTICULATED ROBOTS: SUMMARY TABLE

TABLE 4 ARTICULATED ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 5 SCARA ROBOTS: SUMMARY TABLE

TABLE 6 SCARA ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 7 PARALLEL ROBOTS: SUMMARY TABLE

TABLE 8 PARALLEL ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 9 CARTESIAN ROBOTS: SUMMARY TABLE

TABLE 10 CARTESIAN ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 11 OTHER ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD MILLION))

TABLE 12 GLOBAL TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 13 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 14 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 15 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN APAC, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

TABLE 16 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD MILLION)

LIST OF FIGURES (38 FIGURES)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: MAXIMUM COVID-19 CASES REGISTERED IN US

FIGURE 3 CUMULATIVE NUMBER OF CONFIRMED COVID-19 CASES IN KEY COUNTRIES

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 6 TRADITIONAL INDUSTRIAL ROBOTS MARKET TO DECLINE CONSIDERABLY DURING 2019–2020 OWING TO COVID-19 PANDEMIC

FIGURE 7 ARTICULATED ROBOTS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2020

FIGURE 8 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF TRADITIONAL INDUSTRIAL ROBOTS MARKET IN 2020

FIGURE 9 APAC TO HOLD LARGEST SHARE OF TRADITIONAL INDUSTRIAL ROBOTS MARKET IN 2020

FIGURE 10 ROBOTICS ECOSYSTEM

FIGURE 11 COVID-19-DRIVEN MARKET DYNAMICS

FIGURE 12 REPRESENTATION OF 6-AXIS ARTICULATED ROBOTS

FIGURE 13 PRE- AND POST-COVID-19 ESTIMATES FOR ARTICULATED ROBOTS MARKET

FIGURE 14 REPRESENTATION OF 4-AXIS SCARA ROBOT

FIGURE 15 PRE- AND POST-COVID-19 ESTIMATES FOR SCARA ROBOTS MARKET

FIGURE 16 REPRESENTATION OF PARALLEL ROBOT

FIGURE 17 PRE- AND POST-COVID-19 ESTIMATES FOR PARALLEL ROBOTS MARKET

FIGURE 18 REPRESENTATION OF CARTESIAN ROBOT

FIGURE 19 PRE- AND POST-COVID-19 ESTIMATES FOR CARTESIAN ROBOTS MARKET

FIGURE 20 PRE- AND POST- COVID-19 ESTIMATES FOR OTHER ROBOTS MARKET

FIGURE 21 SHIFT IN CLIENTS’ REVENUES: WITH EXTENDED LENS ON AUTOMOTIVE, ELECTRICAL AND ELECTRONICS, PHARMACEUTICALS AND COSMETICS, AND FOOD & BEVERAGES INDUSTRIES

FIGURE 22 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY

FIGURE 23 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL AND ELECTRONICS INDUSTRY

FIGURE 24 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR CHEMICALS, RUBBER, AND PLASTICS INDUSTRY

FIGURE 25 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS AND MACHINERY INDUSTRY

FIGURE 26 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY

FIGURE 27 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING AND OPTICS INDUSTRY

FIGURE 28 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS AND COSMETICS INDUSTRY

FIGURE 29 IMPACT OF COVID-19 ON GLOBAL TRADITIONAL INDUSTRIAL ROBOTS MARKET

FIGURE 30 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA

FIGURE 31 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE

FIGURE 32 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN APAC

FIGURE 33 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW

FIGURE 34 IMPACT OF COVID-19 ON KEY PLAYERS IN INDUSTRIAL ROBOTICS ECOSYSTEM

FIGURE 35 IMPACT OF COVID-19 ON KEY PLAYERS IN COLLABORATIVE ROBOT ECOSYSTEM

FIGURE 36 IMPACT OF COVID-19 ON KEY PLAYERS IN ROBOT END-EFFECTOR ECOSYSTEM

FIGURE 37 IMPACT OF COVID-19 ON KEY PLAYERS IN SERVICE ROBOTICS ECOSYSTEM

FIGURE 38 IMPACT OF COVID-19 ON KEY PLAYERS IN MEDICAL ROBOTS ECOSYSTEM

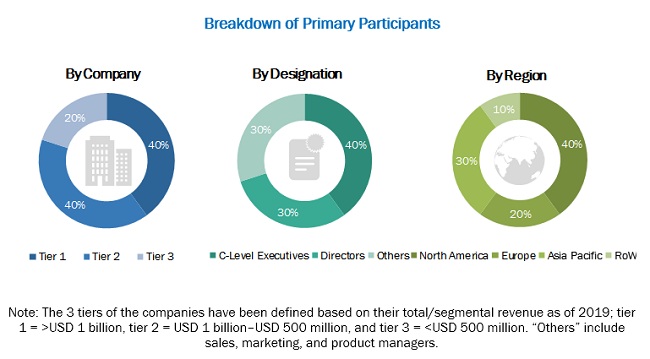

The study involved the estimation of the COVID-19 impact on the industrial robotics market. The market has been estimated and forecasted for the pre- and post-COVID-19 scenarios. Exhaustive secondary research was carried out to collect information about the market and its peer markets. It was followed by the validation of findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete size of the market. It was followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study on the COVID-19 impact on the industrial robotics market. Secondary sources included annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles by recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the supply chain of the industry, value chain of the market, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology oriented perspectives.

After the complete market engineering (which included calculations for the market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was carried out to gather information, as well as to verify and validate the critical numbers obtained for estimating the COVID-19 impact on industrial robotics market.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the industrial robotics market through secondary research. Several primary interviews were conducted with the market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Approximately 20% and 80% of primary interviews were conducted with parties from the demand side and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, were used to estimate and validate the size of the industrial robotics market and other dependent submarkets, pre- and post-COVID-19. Key players in the market were determined through primary and secondary research. This entire research methodology involved the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives for key insights (both qualitative and quantitative) about the industrial robotics market. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analyses from MarketsandMarkets and presented in the report.

Data Triangulation

After arriving at the overall market size using the estimation processes explained above, the COVID-19 impact on the industrial robotics market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides for industrial robots.

Report Objectives

- To describe and forecast the COVID-19 impact on the industrial robotics market, based on type, industry, and geography.

- To describe and forecast the market size, for pre- and post-COVID-19 scenarios, for four main regions: North America, Europe, APAC, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the industrial robotics market amidst COVID-19.

- To provide an overview of the COVID-19 impact on the value chain pertaining to the industrial robotics market.

- To analyze strategies followed by various companies to mitigate the COVID-19 effect on the industrial robotics ecosystem, collaborative robot ecosystem, robot end-effector ecosystem, service robotics ecosystem, and medical robot ecosystem.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the COVID-19 impact on industrial robotics market report:

Company Information

Detailed analysis and profiling of market players (up to 12) from industrial robotics ecosystem, collaborative robot ecosystem, robot end-effector ecosystem, service robotics ecosystem, and medical robots ecosystem

Growth opportunities and latent adjacency in COVID-19 Impact on Industrial Robotics Market

What steps can be taken to maintain a balance between automation and manual labour, especially post-covid in the manufacturing sector?