Multifactor Authentication Market by Model (Two-, Three-, Four-, and Five-Factor), Application (Banking and Finance, Government, Military and Defense, Commercial Security, Consumer Electronics, Healthcare), and Geography - Global Forecast to 2022

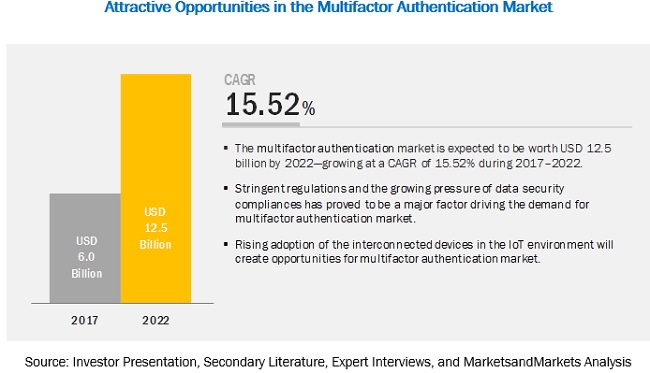

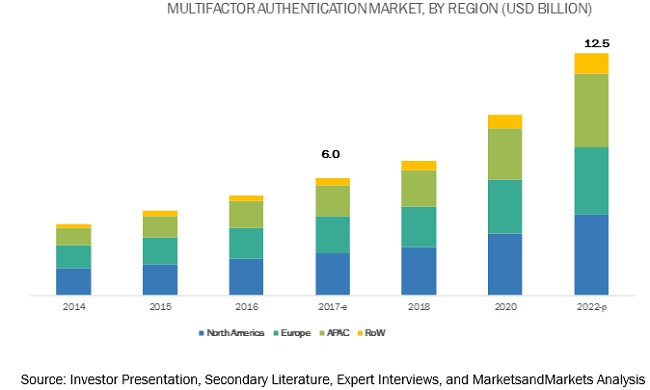

MarketsandMarkets forecasts the multifactor authentication market to grow from USD 6.0 billion in 2016 to USD 12.5 billion by 2022, at a compound annual growth rate (CAGR) of 15.52% during the forecast period. The major factors that are expected to be driving the multifactor authentication market are increase in data breaches & cyber-attacks and growing adoption of bring-your-own-device (BYOD) among enterprises. The objective of the report is to define, describe, and forecast the multifactor authentication market size based on model, application, technology and region.

By model, the five-factor segment is expected to grow at the highest growth rate during the forecast period

Five-factor authentication is the most complicated and expensive type of authentication models. This model is used in applications that require high levels of security. Five authentication models can involve smart cards, PIN, and biometric technologies. This model provides a high level of security to top secret information, which is of high importance. This model has a good potential in the near future, as it is a good solution for government applications such as homeland security services, access to top secret national data/files, safeguarding data, and technology in national research centers. Although this model is very low in terms of shipments, it is one of the most powerful authentication models.

By application, the banking and finance segment holds the largest share of the market

Banking and finance application accounted for the largest share in the MFA market in 2016. The major factors for the growth of this market are increasing online traction and the growth of e-Commerce for which secure transactions are required. Many regulatory bodies have passed regulation for use of MFA technology in this application. For the security of banking and financial applications such as core banking, online banking, banking cards personalization systems, trade finance, international payments, foreign exchange, bank guarantee, and other banking and financial services, MFA plays an important role in the authentication resulting in the largest market share. On the other hand, healthcare application accounted for the highest growth rate in the MFA market due to the stringent government and industry regulations and requirement for highly secure infrastructure. This Industry is expected to rely more on MFA solution in the near future for protecting sensitive information.

The Americas to account for the largest market size during the forecast period.

The Americas is one of the largest markets for MFA. The Americas uses different MFA models from the most basic to the most advanced model. Countries such as the US and Canada use MFA in almost all the applications. Healthcare is the largest application in the US. At present, North America, which comprises the US and Canada, is one of the top users of MFA products at a global level.

As security issues have become vital in the government sector, local, regional, and national government organizations are deploying biometric systems owing to advantages such as high accuracy, convenience, and time efficiency. The need for solid security to tackle fraudulence, illegal immigration, and criminal activities has made it necessary for government enterprises to resort security solutions.

Market Dynamics

Driver: Growing adoption of bring-your-own-device (BYOD) among enterprises

Automotive The growing bring-your-own-device (BYOD) movement continues to draw authentication concerns for the enterprise security, which is dealing with the ways to seal the cracks that exist between employee authentication and enterprise security.

Companies can implement MFA to allow employees and consultants to use BYODs to access firm applications securely while saving on company-issued devices. For easy onboarding, firms can implement MFA to manage employee access on enterprise applications. In the context of providing high security, secure authentication and authorization of a user are as crucial as applying strong authentication techniques/methods to protect the user's personal information, where in the end, the security of the whole infrastructure is involved. Thus, the growing adoption of BYOD concept acts as a driving factor for the growth of MFA market.

Restraint: Increasing response time in higher order authentication models

The average time required to handle a single query for two-factor authentication systems is less, as compared to that of three-, four-, and five-factor authentication. Authentication system has to be simple and perfect, to implement it successfully. Authentication systems with multiple factors are being designed and prototyped with the advancement of technology, but this would increase the time required to handle a single query as it would involve multiple processes for the authentication of data or user. As a result, this would result in long queues and increase service/response time. The impact of this restraint is currently high but will reduce in the future because of the ease in access techniques.

Opportunity: Demand for MFA for data security in the cloud environment

The adoption of cloud is rapidly increasing among industries, giving rise to many security challenges for the cloud service providers and other ecosystem vendors, especially in dealing with the complexity of privacy and data protection regulations. To guarantee the security and safety of data on the cloud, the cloud service providers are adopting technologies such as tokenization, biometric authentication etc. by implementing various models of MFA which can provide authentication for the safety of data stored on the cloud. The demand for MFA for securing the data and information on the cloud environment is likely to provide huge opportunities to MFA solution providers and the cloud service providers.

Challenge: Uncertainty and pushback from end users

The general perception is that there has never been a serious security breach, which requires robust authentication methods. This ignorance results in the lesser adoption of MFA solutions for the authentication purpose, which acts as a major challenge in the MFA market. Small and mid-size organizations find it difficult to integrate the existing IT infrastructure with the MFA solution. Thus, the uncertainty and pushback from end users for the adoption of MFA solutions act as a major challenge for the MFA market.

Want to explore hidden markets that can drive new revenue in Multifactor Authentication Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in Multifactor Authentication Market?

|

Report Metric |

Details |

|

Market size available for years |

20142022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Model, Application, Technology, and Region |

|

Geographies covered |

The Americas, Europe, Asia Pacific, RoW (The Middle East and Africa) |

|

Companies covered |

Safran (France), NEC Corporation (Japan), Gemalto NV (The Netherlands), RSA Security LLC (US), HID Global Corporation/ASSA ABLOY AB (Sweden), 3M (US), CA Technologies (US), Fujitsu (Japan), VASCO Data Security International, Inc.(US), Suprema Inc. (South Korea), Crossmatch (US), aPersona, Inc.(US), BIOMIO (Denmark), iovation Inc.(US), ZK Software (US). |

Multifactor Authentication Market Segmentation:

The research report categorizes the multifactor authentication to forecast the revenues and analyze the trends in each of the following sub-segments:

Multifactor Authentication Market, By Model

- Two-factor authentication

- Multifactor with Three-factor authentication

- Multifactor with Four-factor authentication

- Multifactor with Five-factor authentication

Multifactor Authentication Market, By Application

- Banking and finance

- Government

- Travel and Immigration

- Military and Defense

- Commercial security

- Healthcare

- Consumer Electronics

- Others

Multifactor Authentication Market, By Region

- The Americas

- Europe

- Asia Pacific (APAC)

- RoW

Key Market Players

Safran (France), NEC Corporation (Japan), Gemalto NV (The Netherlands), RSA Security LLC (US), HID Global Corporation/ASSA ABLOY AB (Sweden), 3M (US), CA Technologies (US), Fujitsu (Japan), VASCO Data Security International, Inc.(US), Suprema Inc. (South Korea), Crossmatch (US), aPersona, Inc.(US), BIOMIO (Denmark), iovation Inc.(US), ZK Software (US) are the key market players in the multifactor authentication market.

Safran (France) held the leading position in the global MFA market, in 2016. The company has entered into several partnerships with other companies for the development of new technologies. For instance, in February 2017, the company entered into a partnership with Tessera Holding Corporation, through its wholly owned subsidiary FotoNation Ltd., to deliver advanced iris recognition solutions for mobile devices in India. Safran has established seven values on which the identity and image of the company are based on amongst its stakeholders. The values are focused on customers, compliance with commitments in accordance with the ethical guidelines, innovation, responsiveness, teamwork, people development, and corporate citizenship.

Recent Developments

- In March 2017, Safran launched MorphoAccess SIGMA Extreme, its new access and time fingerprint terminal. This device is the newest addition to the award-winning SIGMA family of fingerprint readers, which replaced MorphoAccess and Bioscrypt 4G. Based on the same platform as the entire SIGMA product line, the outdoor MA SIGMA Extreme is specifically designed to operate in harsh conditions, resisting rain, snow, dust, and salt mist. The ruggedized biometric reader is designed for secure access control in challenging environments such as mines, seaports, airports, and industrial sites.

- In August 2016, NEC Corporation acquired Brazil-based IT security business Arcon Informatica S.A. (Arcon), as part of reinforcing IT Services in the region. The acquisition of Arcon enables NEC to mutually capitalize on leading technologies, know-how, and customer base to drive the expansion of the cybersecurity field in Brazil.

- In December 2016, Gemalto entered into agreements to acquire 3M's Identity Management Business for USD 850 million. 3M's Identity Management Business comprised 3M Cogent Inc., which provides a full spectrum of biometric solutions with a focus on civil identification, border control and law enforcement, and 3M's Document Reader and Secure Materials businesses.

- In February 2017, RSA enhanced its RSA SecurID Access offerings, helping to enable organizations to provide stronger identity protection without sacrificing ease of use or forcing users to take on additional security burdens. The enhancements come as RSA unveiled new Business- Driven Security solutions that comprehensively and rapidly link security incidents with business context to respond effectively and protect what matters most.

- In February 2017, HID Global entered into a partnership with Infineon Technologies AG for supplying chips for their ultra-thin Polycarbonate (PC) ePrelaminate inlay for electronic ID (e-ID) cards. The inlays are more than 30% thinner than alternatives, freeing space for added security features. The offering uses patented HID DBond technology, which is available for high-frequency (HF) systems. The ultra-thin Polycarbonate ePrelaminate was introduced by HID Global in August 2015.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the multifactor authentication market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this multifactor authentication market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Source

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.1.3.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Growth Opportunities in the Multifactor Authentication Market

4.2 Market, By Application

4.3 Market, By Region and Model

4.4 Geographic Snapshot of the Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Driver

5.2.1.1 Increase in Data Breaches and Cyber Attacks

5.2.1.2 Stringent Regulations and the Growing Pressure of Data Security Compliances

5.2.1.3 Growing Adoption of Byod Among Enterprises

5.2.2 Restraints

5.2.2.1 Cost and Technical Complexity in Implementing the Multifactor Authentication

5.2.2.2 Increasing Response Time in Higher Order Authentication Models

5.2.3 Opportunities

5.2.3.1 Demand for MFA for Data Security in the Cloud Environment

5.2.3.2 Rising Adoption of the Interconnected Devices in the Iot Environment

5.2.3.3 Emerging Markets

5.2.4 Challenges

5.2.4.1 Uncertainty and Pushback From End Users

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Regulatory Landscape

6.3.1 Regulatory Compliances

6.3.1.1 Criminal Justice Information System (CJIS) Security Policy

6.3.1.2 Payment Card Industry (PCI) Data Security Standard

6.3.1.3 Ffiec Authentication in an Internet Banking Environment Guidance

6.3.1.4 Fair and Accurate Credit Transaction Act (FACTA)

6.3.1.5 Identity Theft Red Flags

6.3.1.6 Health Insurance Portability and Accountability Act (HIPPA)

6.3.1.7 SarbanesOxley Act (SOX)

6.3.1.8 GrammLeachBliley Act

6.4 New Industry Trends

6.4.1 Out-Of-Band Authentication

6.4.2 Built-In Fingerprint Readers

6.4.3 Baked-In Authentication

7 Multifactor Authentication Market, By Model (Page No. - 45)

7.1 Introduction

7.2 Two-Factor Authentication

7.2.1 Smart Card With Pin

7.2.2 Smart Card With Biometric Technology

7.2.3 Biometric Technology With Pin

7.2.4 Two-Factor Biometric Technology

7.2.5 One Time Password With Pin

7.3 Multifactor With Three-Factor Authentication

7.3.1 Smart Card With Pin and Biometric Technology

7.3.2 Smart Card With Two-Factor Biometric Technologies

7.3.3 Pin With Two-Factor Biometric Technologies

7.3.4 Three-Factor Biometric Technology

7.4 Multifactor With Four-Factor Authentication

7.5 Multifactor With Five-Factor Authentication

8 Multifactor Authentication Market, By Application (Page No. - 65)

8.1 Introduction

8.2 Banking and Finance

8.2.1 Case Study: Cooperative Financial Services (UK)

8.3 Government

8.3.1 Case Study: Government Department (Putrajaya, Malaysia)

8.4 Travel and Immigration

8.4.1 Case Study: the International Airport of Mexico City (Mexico)

8.5 Military and Defense

8.5.1 Case Study: US Department of Defense (US)

8.6 Commercial Security

8.6.1 Case Study: City Point (London, UK)

8.7 Healthcare

8.7.1 Case Study: Nemours Childrens Health System (Florida, US)

8.8 Consumer Electronics

8.9 Others

9 Geographical Analysis (Page No. - 80)

9.1 Introduction

9.2 The Americas

9.2.1 US

9.2.2 Canada

9.2.3 Rest of the Americas

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Italy

9.3.5 Rest of Europe

9.4 APAC

9.4.1 Australia

9.4.2 China

9.4.3 Japan

9.4.4 South Korea

9.4.5 India

9.4.6 Rest of APAC

9.5 RoW

10 Competitive Landscape (Page No. - 108)

10.1 Overview

10.2 Market Ranking Analysis

10.2.1 New Product Launches and Developments

10.2.2 Mergers, Acquisitions, and Collaborations

10.2.3 Contracts, Partnerships, and Agreements

10.2.4 Expansions

10.3 Dive Chart Analysis

10.3.1 Vanguards

10.3.2 Dynamic

10.3.3 Innovator

10.3.4 Emerging

10.4 Business Strategy

10.5 Product Offerings

*Top 25 Companies Analyzed for This Study are - 3M, Apersona, Inc, Biomio, CA Technology, Censornet Ltd, Crossmatch, Deepnet Security, Duo Secuirty, Entrust Inc., Fujitsu, Gemalto NV, Hid Global Corporation/Assa Abloy Ab, Iovation Inc, NEC Corporation, Nexus Group, Rcg Holdings Limited, Rsa Security LLC, Safran, Secugen Corporation, Securenvoy Ltd, Suprema HQ Inc., Symantec Corporation, Vasco Data Security International , Inc., Watchdata.Com, ZK Software

11 Company Profile (Page No. - 120)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Introduction

11.2 Safran

11.3 NEC Corporation

11.4 Gemalto NV

11.5 Rsa Security LLC

11.6 Hid Global Corporation/Assa Abloy Ab

11.7 3M

11.8 CA Technologies

11.9 Fujitsu

11.10 Vasco Data Security International, Inc.

11.11 Suprema HQ Inc.

11.12 Crossmatch

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Emerging Players (Page No. - 160)

12.1 Apersona, Inc.

12.1.1 Key Strategies

12.2 Biomio

12.2.1 Key Strategies

12.3 Iovation Inc.

12.3.1 Key Strategies

12.4 ZK Software

12.4.1 Key Strategies

13 Appendix (Page No. - 164)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (66 Tables)

Table 1 Global Multifactor Authentication Market Size, By Model, 20142022 (USD Million)

Table 2 Global Two-Factor Authentication Market Size, By Model Type, 20142022 (USD Million)

Table 3 Two-Factor Authentication Market Size, By Geography, 20142022 (USD Million)

Table 4 Two-Factor Authentication Market Size in the Americas, By Country, 20142022 (USD Million)

Table 5 Two-Factor Authentication Market Size in Europe, By Country, 20142022 (USD Million)

Table 6 Two-Factor Authentication Market Size in APAC, By Country, 20142022 (USD Million)

Table 7 Two-Factor Authentication Market Size in RoW, By Country, 20142022 (USD Million)

Table 8 Global Three-Factor Authentication Market Size, By Type, 20142022 (USD Million)

Table 9 Three-Factor Authentication Market Size, By Geography, 20142022 (USD Million)

Table 10 Three-Factor Authentication Market Size in the Americas, By Country, 20142022 (USD Million)

Table 11 Three-Factor Authentication Market Size in Europe, By Country, 20142022 (USD Million)

Table 12 Three-Factor Authentication Market Size in APAC, By Country, 20142022 (USD Million)

Table 13 Three-Factor Authentication Market Size in RoW, By Country, 20142022 (USD Million)

Table 14 Four-Factor Authentication Market Size, By Geography, 20142022 (USD Million)

Table 15 Four-Factor Authentication Market Size in the Americas, By Country, 20142022 (USD Million)

Table 16 Four-Factor Authentication Market Size in Europe, By Country, 20142022 (USD Million)

Table 17 Four-Factor Authentication Market Size in APAC, By Country, 20142022 (USD Million)

Table 18 Four-Factor Authentication Market Size in RoW, By Country, 20142022 (USD Million)

Table 19 Five-Factor Authentication Market Size, By Geography, 20142020 (USD Million)

Table 20 Five-Factor Authentication Market Size in the Americas, By Country, 20142022 (USD Million)

Table 21 Five-Factor Authentication Market Size in Europe, By Country, 20142022 (USD Million)

Table 22 Five-Factor Authentication Market Size in APAC, By Country, 20142022 (USD Million)

Table 23 Five-Factor Authentication Market Size in RoW, By Country, 20142022 (USD Thousand)

Table 24 Global Multifactor Authentication Market Size, By Application, 20142022 (USD Million)

Table 25 Market Size for Banking and Finance Application, By Geography, 20142000 (USD Million)

Table 26 Market Size for Government Application, By Geography, 20142022 (USD Million)

Table 27 Market Size for Travel and Immigration Application, By Geography, 20142022 (USD Million)

Table 28 Market Size for Military and Defense Application, By Geography, 20142000 (USD Million)

Table 29 Market Size for Commercial Security Application, By Geography, 20142000 (USD Million)

Table 30 Market Size for Healthcare Application, By Geography, 20142000 (USD Million)

Table 31 Market Size for Consumer Electronics Application, By Geography, 20142000 (USD Million)

Table 32 Market Size for Others, By Geography, 20142000 (USD Million)

Table 33 Market Size, By Region, 20142022 (USD Million)

Table 34 The Americas: Market Size, By Model, 20142022 (USD Million)

Table 35 The Americas: Market Size, By Application, 20142022 (USD Million)

Table 36 The Americas: Market Size, By Country, 20142022 (USD Million)

Table 37 US: Market Size, By Model, 20142022 (USD Million)

Table 38 Canada: Market Size, By Model, 20142022 (USD Million)

Table 39 Rest of Americas: Market Size, By Model, 20142022 (USD Million)

Table 40 Europe: Market Size, By Model, 20142022 (USD Million)

Table 41 Europe: Market Size, By Application, 20142022 (USD Million)

Table 42 Europe: Market Size, By Country, 20142022 (USD Million)

Table 43 Germany: Market Size, By Model, 20142022 (USD Million)

Table 44 UK: Market Size, By Model, 20142022 (USD Million)

Table 45 France: Market Size, By Model, 20142022 (USD Million)

Table 46 Italy: Market Size, By Model, 20142022 (USD Million)

Table 47 Rest of Europe: Market Size, By Model, 20142022(USD Million)

Table 48 APAC: Market Size, By Model, 20142022(USD Million)

Table 49 APAC: Market Size, By Application, 20142022(USD Million)

Table 50 APAC: Market Size, By Country, 20142022(USD Million)

Table 51 Australia: Market Size, By Model, 20142022(USD Million)

Table 52 China: Market Size, By Model, 20142022(USD Million)

Table 53 Japan: Market Size, By Model, 20142022(USD Million)

Table 54 South Korea: Market Size, By Model, 20142022(USD Million)

Table 55 India: Market Size, By Model, 20142022(USD Million)

Table 56 Rest of APAC: Market Size, By Model, 20142022(USD Million)

Table 57 RoW: Market Size, By Model, 20142022(USD Million)

Table 58 RoW: Market Size, By Application, 20142022(USD Million)

Table 59 RoW: Market Size, By Region, 20142022(USD Million)

Table 60 Middle East: Market Size, By Region, 20142022(USD Million)

Table 61 Africa: Market Size, By Region, 20142022(USD Million)

Table 62 Ranking of Top 5 Market Players, 2015

Table 63 New Product Launches and Developments (20142017)

Table 64 Mergers, Acquisitions, and Collaborations (20142016)

Table 65 Contracts, Partnerships, and Agreements (20142016)

Table 66 Expansions (2016)

List of Figures (53 Figures)

Figure 1 Multifactor Authentication Market Segmentation

Figure 2 Multifactor Authentication Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: TopDown Approach

Figure 5 Data Triangulation

Figure 6 Five-Factor Authentication Expected to Grow at the Highest Rate During the Forecast Period

Figure 7 Banking and Finance Application to Hold the Largest Size of the Market During the Forecast Period

Figure 8 The Americas Held the Largest Share of the Market in 2016

Figure 9 Market Expected to Rise at A Moderate Rate During the Forecast Period

Figure 10 Banking and Finance Application to Exhibit the Largest Size of the Market During the Forecast Period

Figure 11 The Americas to Hold the Largest Share of the Market in 2017

Figure 12 Market in India is Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 13 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Number of Data Breach Incidents, By Industry

Figure 15 Value Chain Analysis: Major Value Added During the Assembly and Distribution Phases

Figure 16 The Multi-Factor Authentication Market, By Model

Figure 17 Two-Factor Authentication: Largest Market Share in the MFA Market Between 2016 and 2022

Figure 18 Smart Card With Pin is Expected to Dominate the Two-Factor Authentication Market 2017 vs 2022

Figure 19 The Americas is Expected to Have the Largest Market Share for the Two-Factor MFA Market During the Forecast Period

Figure 20 Smart Card With Two-Factor Biometric Technology is Expected to Grow at the Highest Rate From 2017 vs 2022

Figure 21 North America is Expected to Hold the Largest Market Value in the Three-Factor MFA Market From 2017 to 2022

Figure 22 RoW Region is Expected to Grow at the Highest Rate in the Four-Factor MFA Market From 2017 to 2022

Figure 23 The Americas is Expected to Have the Largest Market Share in the Five-Factor MFA Market From 2016 to 2022

Figure 24 Market, By Application

Figure 25 Banking and Finance Application Expected to Hold the Largest Market Share From 2016 vs 2022

Figure 26 The Americas is Expected to Lead the Government Application Market in MFA By 2022

Figure 27 The RoW Region is Expected to Grow at the Highest Rate in the Military and Defense Application in the MFA Market During the Forecast Period

Figure 28 The APAC Region is Expected to Grow at the A Highest Rate in Consumer Electronics Application for the MFA Market From 2017 to 2022

Figure 29 Market, By Geography

Figure 30 The Americas is Estimated to Dominate the MFA Market Between 2016 and 2022

Figure 31 Segmentation: the Americas

Figure 32 Market Snapshot in the America

Figure 33 Three-Factor Authentication Model Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 34 Segmentation: Europe

Figure 35 Market Snapshot in Europe

Figure 36 Five-Factor Authentication Model Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 37 Segmentation: Asia Pacific

Figure 38 Market Snapshot in APAC

Figure 39 Banking and Financial Application to Lead the MFA Market During the Forecast Period

Figure 40 Segmentation: Rest of the World

Figure 41 Five-Factor Authentication Model Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 42 Organic and Inorganic Strategies Adopted By Companies in the Market

Figure 43 Battle for Market Share: New Product Launches and Developments Were the Key Strategies

Figure 44 Market Overview: Dive Analysis

Figure 45 Safran: Company Snapshot

Figure 46 NEC Corporation: Company Snapshot

Figure 47 Gemalto NV: Company Snapshot

Figure 48 Hid Global Corporation/Assa Abloy AB: Company Snapshot

Figure 49 3M: Company Snapshot

Figure 50 CA Technologies: Company Snapshot

Figure 51 Fujitsu: Company Snapshot

Figure 52 Vasco Data Security International Inc.: Company Snapshot

Figure 53 Suprema HQ Inc.: Company Snapshot

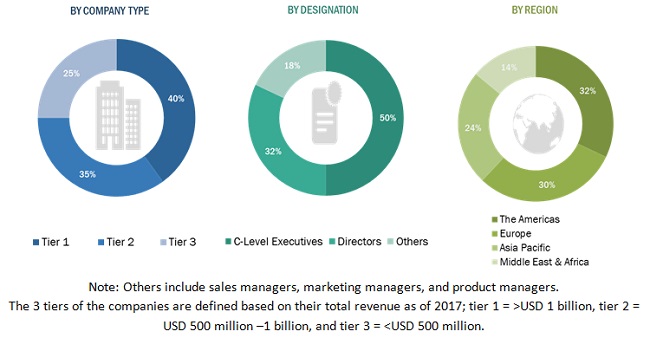

This research study incorporates a usage of extensive secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the multifactor authentication market. In-depth interviews have been conducted with various primary respondents, which include key industry participants, subject matter experts (SMEs), C-level executives of key players, and industry consultants among other experts to obtain and verify critical qualitative and quantitative information, as well as to assess prospects.

Secondary Research

The secondary sources referred to for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations among others. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by the primary research.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the multifactor authentication market scenario through secondary research. Several primary interviews have been conducted with experts from both demand side (end-users) and supply side (MFA providers) across 4 major geographic regions: the Americas, Europe, APAC, and RoW. Approximately, 60% and 40% of the primary interviews have been conducted from the supply side and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the global market and other dependent submarkets in the overall multifactor authentication market. The key players in the multifactor authentication market have been identified through secondary research, and their market share in the major regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of top players and extensive interviews of industry experts such as CEOs, VPs, directors, and marketing executives for key insights.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that can affect the markets covered in this study have been accounted for, viewed in extensive detail, verified through the primary research, and analyzed to get the final quantitative and qualitative data.

The bottom-up procedure has been employed to arrive at the overall size of the multifactor authentication market, considering the revenue of key players (companies) and their share in the market. Calculations based on the revenue of the key companies identified in the market led to the overall market size.

The overall multifactor authentication market size has been used in the top-down procedure to estimate the size of individual markets (mentioned in the market segmentation based on model, and application) via percentage splits from secondary and primary research. For the calculation of each type of a specific market segment, the most appropriate parent market size has been used for implementing the top-down procedure. The bottom-up procedure has been implemented for the data extracted from the secondary research to validate the market size of concerned segments. Then, the market share of each company has been estimated to verify the revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and the validation of the data through primaries, exact values of the overall parent market size and each individual market size have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the multifactor authentication market based on model, application, and geography

- To provide the market statistics with detailed classifications along with the respective market size

- To strategically analyze the micromarkets with regard to individual growth trends, prospects, and contribution to the total market

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and winning imperatives)

- To forecast the size of the market segments with regard to 4 main geographies (along with countries): the Americas, Europe, Asia Pacific, and Rest of the World

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape of the multifactor authentication market leaders

- To analyze the competitive developments such as joint ventures, mergers and acquisitions, new product launches, and R&D activities in the market

- To strategically profile key players and core competencies

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20142022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Model, Application, and Geography |

|

Geographies covered |

The Americas, Europe, APAC, and RoW |

|

Companies covered |

Safran (France), Gemalto NV (the Netherlands), NEC Corporation (Japan), 3M (US), CA Technologies (US), Fujitsu (Japan), VASCO Data Security International Inc. (US), HID Global Corporation/ASSA ABLOY AB (Sweden), RSA Security LLC (US), Suprema HQ Inc. (South Korea), and Crossmatch (US). |

This research report categorizes the overall multifactor authentication market on the basis of model, application, and region.

Market, by Model

- Two Factor Authentication

- Smart Card with Pin

- Smart Card with Biometric Technology

- Biometric Technology with Pin

- Two Factor Biometric Technology

- One time password with Pin

- Multifactor with Three Factor Authentication

- Smart Card with Pin and Biometric Technologies

- Smart Card with Two Factor Biometric Technologies

- Pin with Two Factor Biometric Technologies

- Three Factor Biometric Technology

- Multifactor with Four Factor Authentication

- Multifactor with Five Factor Authentication

Market, by Application

- Banking & Finance

- Government

- Travel & Immigration

- Military & Defense

- Commercial Security

- Healthcare

- Consumer Electronics

- Others

Market, by Geography

- The Americas

- US

- Canada

- Rest of the Americas

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- APAC

- Australia

- China

- Japan

- South Korea

- India

- Rest of APAC

- RoW

- Middle East

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the value chain

Growth opportunities and latent adjacency in Multifactor Authentication Market