Non-Destructive Testing (NDT) Market by Component (Equipment, Services) Method (Ultrasonic, Radiography, Liquid Penetrant, Magnetic) End-User (Oil & Gas, Aerospace & Defense, Automotive, Infra) Technique, Application & Region - Global Forecast to 2022

The non-destructive testing (NDT) market is estimated to be USD 15.06 Billion in 2016 and is projected to reach USD 24.23 Billion by 2022, at a CAGR of 8.24% from 2016 to 2022. 2015 is considered as the base year and the forecast period for this report is from 2016 to 2022. Non-destructive testing techniques are increasingly utilized by varied industries such as aerospace, oil & gas, petroleum, and construction, among others. Innovations in the non-destructive testing market have increased commercially after the introduction of advanced X-ray equipment, such as micro focus X-ray tools, integrated X-ray equipment, glass X-ray tubes with window, and radiation shielded X-ray equipment, among others. Advancements in the field of non-destructive testing have further offered huge growth potential for technologies such as computed tomography, phased array ultrasonic testing, and data management tools, as these techniques are used to derive highly accurate results.

Non-destructive testing market report provides qualitative and quantitative information about the non-destructive testing market. It identifies the market application gaps, emerging technologies, the need for new product launches, and high potential geographic regions & countries. It also provides insights on the market size, market share, revenue projections, and financial portfolio. Non-destructive testing market report offers information on different methods, end users, components, applications, and techniques of the non-destructive testing industry.

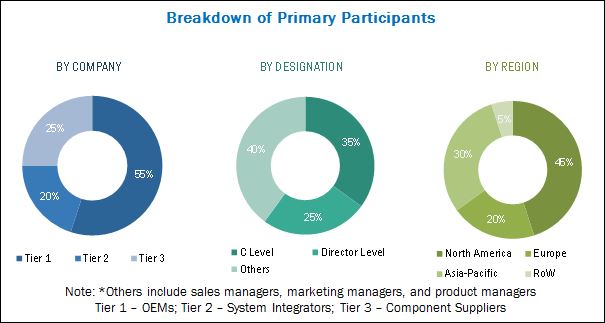

The research methodology used to estimate and forecast the non-destructive testing market begins with capturing data on key non-destructive testing equipment revenues through secondary sources such as ASNT (The American Society for Nondestructive Testing). The non-destructive testing service offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the non-destructive testing market by estimating the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key personnel that include CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the non-destructive testing market comprises oil exploration companies; oil refineries such as Shell Nederland (Netherlands) and Exxon Mobil Corp. (U.S.); aerospace companies such as Bombardier (Canada) and Airbus SAS (France); construction companies such as Bechtel (U.S.) and TECHNIP (France); inspection service providers such as Olympus Corporation (Japan) and MISTRAS Group, Inc. (U.S.); and non-destructive testing facilities among others.

Target Audience for this Report:

- NDT Equipment Manufacturers

- Original Equipment Manufacturers (OEMs)

- Software Solution Providers

- Component Suppliers

- Aerospace & Defense Industry

- Turbine, Ship Hull, and Aircraft Manufacturers

- Automotive Industry

- Oil & Gas Industry

- Infrastructure Industry

- Power Plants

“This study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

Want to explore hidden markets that can drive new revenue in Non-Destructive Testing (NDT) Market?

This research report categorizes the non-destructive testing market into the following segments and subsegments:

NDT Market, By Component

- Equipment

- Services

NDT Market, By Method

- Ultrasonic Testing

- Radiography Testing

- Liquid Penetrant Testing

- Magnetic Particle Testing

- Eddy-current Testing

- Visual Inspection

NDT Market, By End User

- Aerospace & Defense Industry

- Automotive Industry

- Oil & Gas Industry

- Infrastructure Industry

- Power Generation Industry

NDT Market, By Technique

- Surface Examination Technique

- Volumetric Examination Technique

- Condition Monitoring Technique

- Integrity Examination Technique

- Other Non-Destructive Techniques

NDT Market, By Application

- Flaw Detection

- Leak Detection

- Dimensional Measurement

- Estimation of Physical Properties

- Chemical Composition Determination

- Stress & Structure Analysis

NDT Market, By Region

- G7 Nations

- U.S.

- Canada

- Japan

- Italy

- France

- Germany

- U.K.

- BRICS

- Brazil

- Russia

- India

- China

- South Africa

- Rest of the World

- South Korea

- Saudi Arabia

- Others

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

- Regional Analysis

- Further breakdown of the Rest of the World Non-Destructive Testing Market into Malaysia and New Zealand, among others

- Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The non-destructive testing (NDT) market is estimated to be USD 15.06 Billion in 2016 and is projected to reach USD 24.23 Billion by 2022, at a CAGR of 8.24% from 2016 to 2022. The market is evolving with the increased demand for error-free production and service delivery in industries, such as infrastructure, automotive, aerospace & defense, industrial manufacturing, power generation, and oil & gas, among others. Strict safety regulations formulated by governments, the need to preserve aging infrastructure, and development of advanced automated non-destructive testing equipment are additional factors driving the growth of this market.

Based on method, the non-destructive testing market has been segmented into visual inspection, ultrasonic testing, radiography, magnetic particle testing, liquid penetrant testing, and eddy-current testing. The ultrasonic testing segment is projected to lead the non-destructive testing market during the forecast period, owing to the increasing demand for this testing method from manufacturing, aerospace & defense, infrastructure, power generation, automotive, and transportation industries. This testing method also helps detect the depth of internal flaws and determine thickness of parts.

Based on end user, the non-destructive testing market has been segmented into aerospace & defense, automotive, oil & gas, infrastructure, and power generation. The aerospace & defense segment is estimated to account for the largest share of the non-destructive testing market in 2016. The increasing demand for non-destructive testing in the aerospace & defense sector is mainly attributed to the fact that NDT helps ensure safety and efficiency in the production process of geometrically complex aircraft components.

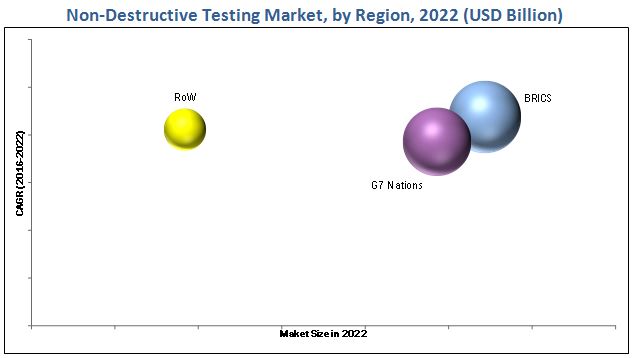

The non-destructive testing market in BRICS is expected to grow at the highest CAGR during the forecast period. Extensive investments in shale oil & gas exploration as well as civil infrastructure, modernizing ports, rebuilding the crumbling infrastructure, rapid industrialization, and increasing investments in the nuclear power generation industry are key factors driving the growth of the non-destructive testing market in BRICS.

The high cost of equipment and lack of qualified technicians are some of the key factors that limit the growth of this market globally. In addition to this, reluctance towards the adoption of new inspection methods poses a key challenge for non-destructive testing equipment manufacturing companies.

The non-destructive testing market is diversified and competitive, with a majority of well-established players from the North American and European regions. Market players focus on entering new markets by launching technologically advanced and cost-effective products, and acquiring new businesses. New product launch is the key strategy adopted by industry players to strengthen their presence in the non-destructive testing market. Key players in this market include MISTRAS Group, Inc. (U.S.), Olympus Corporation (Japan), GE Inspection Technologies (U.S.), Intertek Group PLC (U.K.), and SGS S.A. (Switzerland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase in Renewable Energy Use

2.2.2.2 Pipeline Network Safety

2.2.2.3 Growth in Aircraft Fleet Size

2.2.3 Supply-Side Indicators

2.2.3.1 Increased R&D Activities

2.2.3.2 Development of Efficient Materials

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 37)

4 Premium Insights (Page No. - 42)

4.1 Attractive Opportunities in NDT Market

4.2 NDT Market, By End-User

4.3 NDT Market, By Technique

4.4 Opportunities in NDT Market: Regional Analysis

4.5 NDT Market, By Technique

4.6 BRICS NDT Market, By End-User

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 47)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Method

5.3.2 By Technique

5.3.3 By Application

5.3.4 By Component

5.3.5 By End-User

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Extending the Useful Life of Aging Infrastructure

5.4.1.2 Outsourcing of Non-Core Activities and Technical Resource Constraints

5.4.1.3 Stringent Safety Regulations Formulated By Governments

5.4.1.4 Emergence of Industrial Internet of Things

5.4.2 Restraints

5.4.2.1 Lack of Skilled Professionals

5.4.2.2 High Cost of Advanced NDT Equipment

5.4.3 Opportunities

5.4.3.1 New Power Generation Projects

5.4.3.2 Integration of Robotic Technology

5.4.3.3 Increasing Use of Advanced Materials

5.4.3.4 Large-Scale Infrastructure Projects

5.4.4 Challenges

5.4.4.1 Price Volatility of Natural Gas and Crude Oil

5.4.4.2 Reluctance to Adopt New NDT Techniques By End-Users

5.4.5 Winning Imperatives

5.4.5.1 Expanding End-User Market

5.4.5.2 Expanding Geographical Reach

5.4.6 Burning Issues

5.4.6.1 Lack of Skilled Workforce and Increasing Mechanical Complications

5.4.6.2 Rapid Industrial Transformation

6 Industry Trends (Page No. - 65)

6.1 Introduction

6.2 Emerging Technology Trends

6.2.1 Cloud Testing: Integrated Innovation Technology

6.2.2 Robotic Integrated Technology

6.2.2.1 Film X-Ray vs Digital Radiography (DR)

6.2.3 Iiot

6.3 Product Launches

6.4 Technological Advancements

6.5 Innovation & Patent Registrations

6.6 NDT Regulatory Bodies, By Region

6.7 Average Selling Price, 2016

7 NDT Market, By Method (Page No. - 76)

7.1 Introduction

7.2 Visual Inspection

7.3 Magnetic Particle Testing (MPT)

7.4 Liquid Penetrant Testing (LPT)

7.5 Ultrasonic Testing

7.6 Radiography Testing

7.7 Eddy Current Testing (ECT)

7.8 Others

7.8.1 Terahertz Imaging

7.8.2 Magnetic Resonance Imaging (MRI)

7.8.3 Acoustic Emission Testing (AET)

7.8.4 Near-Infrared Spectroscopy

7.8.5 Optical Microscopic Testing

7.8.6 Thermographic Testing

8 NDT Market, By Technique (Page No. - 97)

8.1 Introduction

8.2 Surface Examination

8.3 Volumetric Examination

8.4 Condition Monitoring

8.5 Integrity Examination Technique

8.6 Others

9 NDT Market, By Application (Page No. - 107)

9.1 Introduction

9.2 Flaw Detection

9.3 Leak Detection

9.4 Dimensional Measurement

9.5 Physical Properties Determination

9.6 Chemical Composition Determination

9.7 Plasma Emission Spectrography

9.8 Corrosion Resistance Testing

9.9 Stress & Structure Analysis

9.10 Others

10 NDT Market, By Component (Page No. - 117)

10.1 Introduction

10.2 Equipment

10.3 Services

11 NDT Market, By End-User (Page No. - 120)

11.1 Introduction

11.2 Aerospace & Defense

11.3 Automotive

11.4 Oil & Gas

11.5 Infrastructure

11.6 Power Generation

11.7 Others

12 NDT Market, By Region (Page No. - 135)

12.1 Introduction

12.2 G7 Nations

12.2.1 By End-User

12.2.2 By Method

12.2.3 By Technique

12.2.4 By Country

12.2.4.1 U.S.

12.2.4.1.1 By End-User

12.2.4.1.2 By Method

12.2.4.2 Germany

12.2.4.2.1 By End-User

12.2.4.2.2 By Method

12.2.4.3 Japan

12.2.4.3.1 By End-User

12.2.4.3.2 By Method

12.2.4.4 U.K.

12.2.4.4.1 By End-User

12.2.4.4.2 By Method

12.2.4.5 France

12.2.4.5.1 By End-User

12.2.4.5.2 By Method

12.2.4.6 Canada

12.2.4.6.1 By End-User

12.2.4.6.2 By Method

12.2.4.7 Italy

12.2.4.7.1 By End-User

12.2.4.7.2 By Method

12.3 BRICS

12.3.1 By End-User

12.3.2 By Method

12.3.3 By Technique

12.3.4 By Country

12.3.4.1 China

12.3.4.1.1 By End-User

12.3.4.1.2 By Method

12.3.4.2 India

12.3.4.2.1 By End-User

12.3.4.2.2 By Method

12.3.4.3 Russia

12.3.4.3.1 By End-User

12.3.4.3.2 By Method

12.3.4.4 Brazil

12.3.4.4.1 By End-User

12.3.4.4.2 By Method

12.3.4.5 South Africa

12.3.4.5.1 By End-User

12.3.4.5.2 By Method

12.4 RoW

12.4.1 By End-User

12.4.2 By Method

12.4.3 By Technique

12.4.4 By Country

12.4.4.1 Saudi Arabia

12.4.4.1.1 By End-User

12.4.4.1.2 By Method

12.4.4.2 South Korea

12.4.4.2.1 By End-User

12.4.4.2.2 By Method

12.4.4.3 Others

12.4.4.3.1 By End-User

12.4.4.3.2 By Method

13 Competitive Landscape (Page No. - 170)

13.1 Introduction

13.2 Brand Analysis

13.3 Market Share Analysis

13.4 Competitive Situations and Trends

13.4.1 New Product Launches

13.4.2 Acquisitions, Partnerships, Joint Ventures, and Agreements

13.4.3 Contracts

13.4.4 Expansions

14 Company Profiles (Page No. - 185)

(Company Overview, Product/Service Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.1.1 Financial Highlights

14.2 Olympus Corporation

14.3 Mistras Group, Inc.

14.4 Intertek Group PLC

14.5 SGS S.A.

14.6 GE Measurement & Control

14.7 Nikon Metrology, Inc.

14.8 Ashtead Technology, Inc.

14.9 Sonatest Ltd.

14.10 Bosello High Technology S.R.L.

14.11 Fujifilm Holdings Corporation

*Details on Company Overview, Product/Service Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 214)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (96 Tables)

Table 1 Investments in Renewable Energy, By Country, 2015

Table 2 Total Length of the Pipeline Network, By Country, 2013 (Km)

Table 3 Cost Comparision Between Film X-Ray and DR

Table 4 Recent Product Launches in NDT Market, 2014–2016

Table 5 Recent Technology Trends in NDT Market, By Industry

Table 6 Important Innovation & Patent Registrations, 2011-2016

Table 7 NDT Market Size, By Method, 2014-2022 (USD Million)

Table 8 Types of NDT Methods

Table 9 Visual Inspection Testing: NDT Market, By Region, 2014-2022 (USD Million)

Table 10 MPT: NDT Market, By Region, 2014-2022 (USD Million)

Table 11 LPT: NDT Market, By Region, 2014-2022 (USD Million)

Table 12 Ultrasonic Testing: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 13 Radiography Testing: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 14 ECT: NDT Market, By Region, 2014-2022 (USD Million)

Table 15 Applications of Terahertz Imaging Method, By Industry

Table 16 Applications of MRI Method, By Industry

Table 17 Applications of AET Method, By Industry

Table 18 Applications of Near-Infrared Spectroscopy Method, By Industry

Table 19 Application of Optical Microscopic Testing Method, By Industry

Table 20 Applications of Thermographic Testing, By Industry

Table 21 NDT Techniques for Detection of Surface Cracks

Table 22 NDT Market Size, By Technique, 2014-2022 (USD Million)

Table 23 Surface Examination Technique: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 24 Volumetric Examination Technique: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 25 Condition Monitoring Technique: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 26 Integrity Examination Technique: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 27 Others: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 28 Application of Ultrasonic Transducers for Flaw Detection

Table 29 Flaw Detection Products, By Key Players

Table 30 Techniques for Leak Testing

Table 31 Dimension Measurement Products, By Key Players

Table 32 Techniques Involved in Dimension Evalution

Table 33 Physical Properties Determination Products, By Key Players

Table 34 Ultrasonic Velocity and Concrete Structure Condition

Table 35 Methods for Corrosion Testing, By Category

Table 36 NDT Techniques for Stress & Structures Damages

Table 37 Other Applications of Ndt

Table 38 NDT Market Size, By Component, 2014-2022 (USD Million)

Table 39 NDT Market Size, By Equipment, 2014-2022 (USD Million)

Table 40 NDT Market Size, By Services, 2014-2022 (USD Million)

Table 41 NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 42 NDT Market Future Outlook, By End-User

Table 43 Aerospace & Defense : NDT Market, By Region, 2014-2022 (USD Mn)

Table 44 Automotive: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 45 Oil & Gas: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 46 Infrastructure: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 47 Power Generation: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 48 Others: NDT Market Size, By Region, 2014-2022 (USD Million)

Table 49 NDT Market Size, By Region, 2014-2022 (USD Million)

Table 50 G7 Nations: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 51 G7 Nations: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 52 G7 Nations: NDT Market Size, By Technique, 2014-2022 (USD Million)

Table 53 G7 Nations: NDT Market Size, By Country, 2014-2022 (USD Million)

Table 54 U.S.: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 55 U.S.: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 56 Germany: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 57 Germany: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 58 Japan: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 59 Japan: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 60 U.K.: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 61 U.K.: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 62 France: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 63 France: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 64 Canada: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 65 Canada: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 66 Italy: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 67 Italy: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 68 BRICS: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 69 BRICS: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 70 BRICS: NDT Market Size, By Technique, 2014-2022 (USD Million)

Table 71 BRICS: NDT Market Size, By Country, 2014-2022 (USD Million)

Table 72 China: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 73 China: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 74 India: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 75 India: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 76 Russia: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 77 Russia: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 78 Brazil: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 79 Brazil: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 80 South Africa: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 81 South Africa: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 82 RoW: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 83 RoW: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 84 RoW: NDT Market Size, By Technique, 2014-2022 (USD Million)

Table 85 RoW: NDT Market Size, By Country, 2014-2022 (USD Million)

Table 86 Saudi Arabia: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 87 Saudi Arabia: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 88 South Korea: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 89 South Korea: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 90 Others: NDT Market Size, By End-User, 2014-2022 (USD Million)

Table 91 Others: NDT Market Size, By Method, 2014-2022 (USD Million)

Table 92 Brand Analysis of Top Players in NDT Market

Table 93 New Product Launches, 2014-2016

Table 94 Acquisitions, Partnerships, and Agreements, 2014–2016

Table 95 Contracts, 2014-2016

Table 96 Expansions, 2014-2015

List of Figures (81 Figures)

Figure 1 Markets Covered: Non-Destructive Testing Market

Figure 2 Report Flow

Figure 3 NDT Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Global Investments in Renewable Energy, 2009-2015

Figure 6 Global Investments in Renewable Energy Sector, 2015 (USD Billion)

Figure 7 Total Growth in Aircraft Fleet Size, 2015-2035

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation Methodology

Figure 11 NDT Market, By End-User, 2016 & 2022 (USD Million)

Figure 12 BRICS to Lead NDT Market From 2014 to 2022 (USD Million)

Figure 13 BRICS to Record Highest CAGR During Forecast Period

Figure 14 India, A Lucrative Market to Invest During Forecast Period

Figure 15 New Product Launches Key Growth Strategy Adopted By Market Players From 2014 to 2016

Figure 16 Increasing Demand From Oil & Gas Industry to Fuel NDT Market Growth, From 2016 to 2022

Figure 17 Oil & Gas Industry to Lead Global NDT Market, By End-User, During Forecast Period

Figure 18 Surface Examination to Lead Global NDT Market, By Technique, By 2022

Figure 19 BRICS to Lead Global NDT Market, By Value, By 2022

Figure 20 BRICS NDT Market, By Technique, 2016 & 2022 (USD Billion)

Figure 21 BRICS NDT Market, By End-User, 2016 & 2020

Figure 22 BRICS NDT Market to Witness Significant Growth During Forecast Period

Figure 23 NDT Market: Technological Evolution

Figure 24 NDT Market, By Method

Figure 25 NDT Market, By Technique

Figure 26 NDT Market, By Application

Figure 27 NDT Market, By Component

Figure 28 NDT Market, By End-User

Figure 29 Stringent Government Regulations and Increased Demand for NDT Techniques Driving the Growth of NDT Market

Figure 30 Aging Infrastructure: Relationship Between Maintenance, Condition, and Time

Figure 31 U.S.: Expenditure to Upgrade Existing Infrastructure (USD Billion)

Figure 32 U.S.: Number of Pipeline Damage Incidents, 2006-2015

Figure 33 Age Profile of Professionals in European NDT Industry, By Country (2010)

Figure 34 Costs Involved in Degree of Automation

Figure 35 New Nuclear Reactors Connected to the Grid Globally, 2006-2015

Figure 36 Upcoming Nuclear Reactors, By Country (2016-2026)

Figure 37 Worldwide Infrastructure Expenditure Across Major Sectors, By Region, 2010-2025 (USD Trillion)

Figure 38 Emerging Technology Trends in NDT Market

Figure 39 Visual Inspection Method Segment Led NDT Market, By Method, in 2016

Figure 40 BRICS to Lead Visual Inspection Method Segment of NDT Market From 2016 to 2022 (USD Million)

Figure 41 BRICS to Lead MPT Method Segment of NDT Market From 2016 to 2022, (USD Million)

Figure 42 BRICS to Lead LPT Method Segment of NDT Market, By 2022 (USD Million)

Figure 43 Long Range Ultrasonic Inspection Program

Figure 44 BRICS to Lead Ultrasonic Testing Method Segment of NDT Market, From 2016 to 2022

Figure 45 BRICS to Lead Radiography Testing Method Segment of NDT Market From 2016 to 2022 (USD Million)

Figure 46 BRICS to Lead ECT Method Segment of NDT Market, By 2022 (USD Million)

Figure 47 Surface Examination Technique Segment to Lead NDT Market, By Technique, From 2016 to 2022 (USD Million)

Figure 48 G7 Nations to Lead Surface Examination Technique Segment of NDT Market, From 2016 to 2022 (USD Million)

Figure 49 BRICS to Lead Volumetric Examination Technique Segment of NDT Market From 2016 to 2022 (USD Million)

Figure 50 BRICS to Lead Condition Monitoring Technique Segment of NDT Market From 2016 to 2022 (USD Million)

Figure 51 G7 Nations to Lead Integrity Examination Technique Segment of NDT Market From 2016 to 2022 (USD Million)

Figure 52 Oil & Gas Industry Dominated NDT Market in 2016

Figure 53 BRICS to Lead Global NDT Market for Aerospace & Defense Industry From 2016 to 2022 (USD Million)

Figure 54 G7 Nations to Lead Global NDT Market for Automotive Industry, From 2016 to 2022 (USD Million)

Figure 55 BRICS to Lead Global NDT Market for Oil & Gas Industry, From 2016 to 2022 (USD Million)

Figure 56 BRICS to Lead Global NDT Market for Infrastructure By 2022 (USD Million)

Figure 57 BRICS to Lead Global NDT Market for Power Generation Industry, From 2016 to 2022 (USD Million)

Figure 58 G7 Nations to Lead Global NDT Market for Others, By 2022 (USD Million)

Figure 59 G7 Nations: Market Share, Country-Wise (2016)

Figure 60 G7 Nations NDT Market Witnessed Significant Growth in 2016, Owing to Contributions By Japan and Canada

Figure 61 G7 Nations NDT Market Snapshot:2016

Figure 62 BRICS NDT Market Snapshot: 2016

Figure 63 RoW NDT Market Snapshot: 2016

Figure 64 Companies Adopted Contracts & New Product Launches as Key Growth Strategies From 2014 to 2016

Figure 65 NDT Market Share Analysis, By Key Player, 2015

Figure 66 Number of Patent Applications Filed By Olympus Corporation in Japan

Figure 67 Number of Patent Applications Filed By Olympus Corporation Overseas

Figure 68 Strategic Benchmarking in NDT Market, 2014-2016

Figure 69 New Product Launches: Key Growth Strategy From 2014 to 2016

Figure 70 Regional Revenue Mix of Top Five Market Players, 2015

Figure 71 Financial Highlights of Major Players in NDT Market, 2016

Figure 72 Olympus Corporation: Company Snapshot

Figure 73 Olympus Corporation: SWOT Analysis

Figure 74 Mistras Group, Inc.: Company Snapshot

Figure 75 Mistras Group, Inc.: SWOT Analysis

Figure 76 Intertek Group PLC: Company Snapshot

Figure 77 Intertek Group PLC: SWOT Analysis

Figure 78 SGS SA: Company Snapshot

Figure 79 SGS SA: SWOT Analysis

Figure 80 GE Measurement & Control: Company Snapshot

Figure 81 GE Measurement & Control: SWOT Analysis

Growth opportunities and latent adjacency in Non-Destructive Testing (NDT) Market