Oil Condition Monitoring Market by Product Type (Turbines, Compressors, Engines, Gear Systems, Hydraulic Systems), Sampling Type, Vertical (Transportation, Industrial, Oil & Gas), and Region - 2030

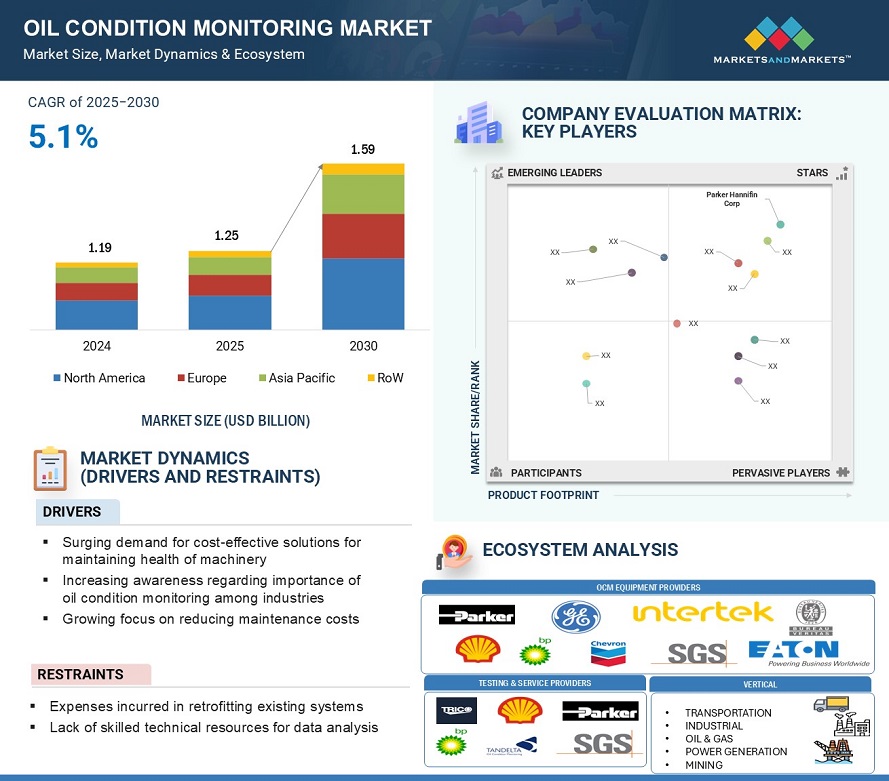

The Global Oil Condition Monitoring market is expected to grow from USD 1.25 billion in 2025 to USD 1.59 billion by 2030; it is expected to grow at a CAGR of 5.1% during the forecast period. The Oil Condition Monitoring market encompasses technologies and solutions for the real-time monitoring, diagnostics, and predictive maintenance of hydraulic fluids and lubricants. It includes Oil Condition Monitoring Sensors, Fluid Monitoring Sensors, and Oil Condition Monitoring Software to improve the reliability of equipment by detecting contamination, attrition, and degradation.In sectors like manufacturing, transportation, and energy, these solutions maximise maintenance schedules, lower running hazards, and prolong asset lifetime. The market is expanding with growing acceptance of hydraulic oil condition monitoring and equipment, therefore promoting efficiency, safety, and sustainability in asset management.

Attractive Opportunities in the Oil Condition Monitoring Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

DRIVER: Surging demand for cost-effective solutions for maintaining health of machinery

The growing demand for cost-effective solutions to maintain machinery health is a key driver of the Oil Condition Monitoring market, as industries seek to minimize downtime, reduce maintenance costs, and enhance operational efficiency. Sectors such as manufacturing, transportation, energy, and marine rely on continuous machinery performance, where unexpected failures can lead to significant financial losses. Oil condition monitoring enables real-time analysis of lubricants and hydraulic fluids, detecting contamination, wear, and degradation before critical failures occur. By utilizing oil condition monitoring sensors, fluid monitoring sensors, and advanced software, businesses can transition from reactive to predictive maintenance, optimizing schedules and reducing unplanned downtime. This not only extends equipment lifespan but also lowers operational costs by preventing unnecessary oil changes and resource wastage. Industries with heavy machinery, such as construction, mining, and power generation, benefit significantly from these solutions by improving asset reliability and reducing overall maintenance expenses. As cost efficiency and sustainability become top priorities, the adoption of oil condition monitoring systems continues to rise, driving market growth globally.

RESTRAINT: Lack of skilled technical resources for data analysis

The effective implementation of predictive maintenance strategies is significantly restricted by the absence of competent technical resources for data analysis in the Oil Condition Monitoring market. Oil condition monitoring systems produce large volumes of real-time data on lubricant condition, contaminant levels, and equipment wear, and high-level analytical capabilities are needed to derive meaningful information. Unfortunately, most industries do not have trained personnel who can accurately interpret this data and incorporate it into maintenance workflows. Lack of trained personnel means companies are missing the full benefits of oil condition monitoring sensors, fluid monitoring sensors, and oil condition monitoring software and thus end up making ineffective decisions and losing cost savings. Additionally, data analysis often demands state-of-the-art expertise in machine learning and predictive analytics, further widening the skill gap. The issue is common in industries with extensive fleets of machinery, e.g., manufacturing, power generation, and transport, where incorrect analysis leads to expensive downtime and equipment failure. Automation and AI-based analytics are set to be encouraged as potential solutions, but absence of trained staff is a big bottleneck, inhibiting widespread adoption of oil condition monitoring technology and reducing its contribution to operation efficiency and asset life.

OPPORTUNITY: Increasing adoption of big data analytics and IIoT

The growing use of big data analytics and Industrial Internet of Things (IIoT) offers a revolutionary opportunity to the Oil Condition Monitoring market, allowing industries to shift from reactive to predictive maintenance practices. IIoT-enabled oil condition monitoring sensors and fluid monitoring sensors continuously monitor real-time information on lubricant quality, contamination levels, and wear trends, offering invaluable insights into equipment health. Through the use of big data analytics, these systems can analyze huge amounts of data to determine trends, detect anomalies, and optimize maintenance schedules, minimizing unplanned downtime and extending equipment life. Sophisticated oil condition monitoring software, backed by machine learning and AI algorithms, further enhances predictive performance with actionable insights and automated notifications. Cloud-based systems also enable smooth data integration between multiple assets, empowering centralized monitoring and improved decision-making. Manufacturing, transportation, power generation, and marine sectors benefit from greater operational efficiency, lower maintenance expenditure, and increased asset reliability. As businesses invest more in digital transformation and Industry 4.0 technologies, the market for IIoT-enabled oil condition monitoring solutions keeps growing, pushing market growth and innovation in predictive maintenance applications in industrial sectors.

CHALLENGE: Challenges with offline oil sampling

In the Oil Condition Monitoring industry, challenges with offline oil sampling create a major obstacle that influences the accuracy, efficiency, and timeliness of maintenance decisions. Periodic hand sample is the foundation of conventional oil analysis, and this usually results in delayed discovery of lubricant deterioration, contamination, or wear-related problems. Uncovering undetectable faults resulting from the time lag between sample collecting, laboratory analysis, and reporting findings raises the possibility of unanticipated equipment malfunctions and expensive downtime. Furthermore, influencing data dependability includes uneven sample techniques, environmental contamination during handling, and human mistakes, thus resulting in erroneous estimates of oil conditions. Offline sampling adds to operational expenses and labor needs as it requires qualified individuals for correct sample extraction and analysis. Furthermore, businesses running far-off sites in hostile conditions—such as offshore drilling, mining, and power plants—have logistical challenges routinely gathering and moving samples for testing. These constraints make predictive maintenance plans difficult to apply, which is why real-time, IIoT-enabled oil condition monitoring systems are so much needed. The industry is moving towards in-line and on-site oil analysis solutions that provide instantaneous insights as businesses search for more dependable, automated, and continuous monitoring systems, therefore allowing predictive maintenance and enhancing general equipment dependability.

Oil Condition Monitoring Market Ecosystem:

Key players operating in Oil Condition Monitoring market are Parker Hannifin Corp (US), General Electric Company (US), BP p.l.c. (UK), Shell plc (Netherlands), and Chevron Corporation (US).These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint. Players in this market have adopted various growth strategies including partnerships and expansions in order to set their foothold in the market. The market ecosystem has several participants, and each participant has played a crucial role in developing and deploying Oil Condition Monitoring solutions worldwide

Turbine Segment to Hold the Largest Market Share During the Forecast Period.

Driven by the vital need for consistent lubrication in power generation, aviation, and industrial applications, the turbine sector is likely to dominate the oil condition monitoring market throughout the forecast period. Turbines run under demanding circumstances, so real-time oil condition monitoring is crucial to avoid failures, save downtime, and maximize maintenance plans. The growing acceptance of renewable energy sources—especially wind and hydro turbines—further increases the need for sophisticated monitoring technologies to improve operational effectiveness. Rising IIoT-enabled sensors and AI-driven analytics are also changing turbine oil monitoring by allowing predictive maintenance, hence reducing unexpected failures, and prolonging equipment life. Condition-based monitoring is being given top priority by sectors like power plants, aircraft, and heavy manufacturing in order to increase asset dependability and save maintenance costs, thereby enhancing the market share of that sector. Growing focus on sustainability and energy efficiency is also driving businesses to use cutting-edge monitoring solutions, therefore guaranteeing the best turbine performance and lowering environmental effects. Driven by creativity and growing industry acceptance, these elements in action help the turbine sector to maintain its leading position in the oil condition monitoring market.

Power Generation Segment to Hold a Significant Share in the Oil Condition Monitoring Market

Driven by the need to improve equipment dependability and reduce unscheduled downtime, the power generation sector is expected to have a significant share of the oil condition monitoring market throughout the forecast period. Thermal, hydro, nuclear, and renewable energy facilities as well as power plants depend on turbines, generators, and transformers needing constant oil monitoring to avoid breakdowns and maximize performance. Advanced oil condition monitoring technologies are now even more important given the growing need for continuous electrical supply and the change towards greener energy sources. Power generating firms may increase operating efficiency, prolong equipment lifetime, and save maintenance costs by using predictive maintenance plans. Furthermore, the combination of artificial intelligence-driven analytics and Industrial IoT (IIoT) helps operators to monitor conditions in real time, hence guiding data-driven maintenance choices. The acceptance of oil condition monitoring systems in the power generating industry will keep increasing as governments and businesses concentrate on enhancing energy efficiency and sustainability, therefore confirming their significant position in the market.

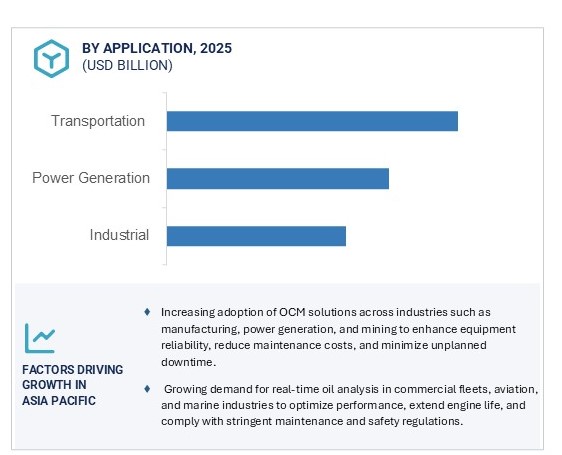

Asia Pacific is expected to grow at the highest rate during the forecast period.

Asia Pacific is expected to experience the maximum CAGR during the forecast period for the oil condition monitoring market, supported by high-speed industrialization, increasing energy infrastructure, and increasing adoption of predictive maintenance solutions. China, India, and Japan are some of the nation’s experiencing high investments in manufacturing, power generation, and transportation, and this is supporting high demand for oil condition monitoring for enhancing equipment efficiency and reducing the cost of operations. The region’s focus on digitalization, combined with the rising implementation of Industry 4.0 and IIoT-based solutions, is further accelerating the adoption of advanced condition monitoring technologies. Additionally, the expanding automotive and aerospace industries, along with stringent government regulations on emissions and equipment maintenance, are contributing to market growth. The presence of key industry players and the rising awareness about the benefits of real-time oil monitoring are expected to drive further advancements in this sector. As industries across Asia Pacific seek to improve asset reliability and minimize downtime, the demand for oil condition monitoring solutions will continue to grow, positioning the region as a key growth driver in the global market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players operating in oil condition monitoring market are as follows:

- Parker Hannifin Corp (US)

- General Electric (US)

- Shell Global (Netherlands)

- BP p.l.c. (UK)

- Chevron Corporation (US)

- Intertek (UK)

- SGS Société Générale de Surveillance SA. (France)

- Bureau Veritas (France)

- Eaton (Ireland)

- TotalEnergies (France)

Want to explore hidden markets that can drive new revenue in Oil Condition Monitoring Market?

Scope of the Report:

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Oil Condition Monitoring Market?

|

Report Metric |

Details |

|

Market size available for years |

2021–2030 |

|

Base year |

2024 |

|

Forecast period |

2025–2030 |

|

Forecast Unit |

Value (USD Million) |

|

Segments covered |

Sampling Type, Product Type, Vertical, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Parker-Hannifin Corporation (US), General Electric (US), Shell plc (Netherlands), BP plc (UK), Bureau Veritas (France), Chevron Corporation (Switzerland), Intertek Group plc (UK), SGS SA (France), Eaton Corporation (Ireland), and TotalEnergies (France). |

This report categorizes the Oil condition monitoring market based on sampling type, product type, vertical, and region.

By SamplingType:

-

On-site

- Portable Kit (On-board)

- Fixed Continuous Monitoring

- Off-site

By Product Type:

- Turbine

- Compressor

- Engine

- Hydraulic System

- Others (Gear Systems, Insulating Systems, Industrial Tooling Systems, and Transformers)

By Vertical:

-

Transportation

- Automobile

- Aerospace

- Marine

- Heavy Vehicle

- Locomotive Engine

- Industrial

- Oil & Gas

- Power Generation

- Mining

By Geography:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe (Italy, Spain, Sweden, Russia, the Netherlands, Finland, Switzerland, and Norway)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC (South Korea, Hong Kong, Australia, New Zealand, Indonesia, Singapore, Malaysia, and Thailand)

-

Rest of the World (RoW)

- Middle East And Africa

- South America

Recent Developments

- In June 2024, Eaton (US) introduced the PFS 02 particle flow sensor, a compact in-line solution for continuous contamination monitoring in hydraulic and lubrication oils. The sensor integrates measurement and evaluation into a single unit, offering real-time diagnostics to prevent equipment failures. It supports multiple data output options, including serial interface, CAN-Bus, and analog output, and complies with ISO 4406:99, SAE AS 4059, NAS 1638, and GOST 17216 standards.

- In December 2023, Tan Delta Systems (UK) launched the SENSE-2 oil condition monitoring kit, featuring the OQSx-G2 sensor for real-time oil quality analysis. Using full-spectrum holistic (FSHTM) technology, it detects oil degradation and contamination at the molecular level, optimizing maintenance, reducing costs, and preventing equipment failures. The plug-and-play system integrates seamlessly with existing equipment, supports various oil types, and enables on-site and remote diagnostics for enhanced reliability across industries.

- In September 2021, BP, Abu Dhabi National Oil Company (ADNOC) (UAE), and Abu Dhabi Future Energy Company Masdar (UAE) formed a strategic partnership to provide clean energy solutions for the UK and the UAE. The three companies aim to develop low-carbon hydrogen hubs and decarbonized air corridors between the two countries.

- In June 2021, Bureau Veritas (France) entered into a framework agreement with the Veolia group, which applies solutions for water, waste, and energy management worldwide. The three-year contract covers the listing of Bureau Veritas as a preferred supplier for regulatory and non-regulatory verifications and certification of Veolia group sites.

- In July 2020, Intertek (UK) launched Carbonclear, the world’s first certification program that independently verifies the upstream carbon intensity per barrel of oil. Carbonclear brings unique clarity on the carbon impact of cradle-to-gate operations across all aspects of oil & gas exploration and production, providing producers with continuous opportunities to reduce their carbon emissions and participate in the transition to a low-carbon economy.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the oil condition monitoring market during 2025-2030?

The global oil condition monitoring market is expected to record a CAGR of 5.1% from 2025–2030.

What are the driving factors for the oil condition monitoring market?

The oil condition monitoring market is driven by the growing emphasis on predictive maintenance, increasing adoption of real-time monitoring solutions, and the need to optimize equipment performance across industries such as automotive, power generation, and manufacturing. Advancements in sensor technology, including AI-driven diagnostics and molecular-level oil analysis, are enhancing detection accuracy and efficiency. Additionally, stringent environmental regulations, rising awareness of sustainability in lubricant usage, and expanding applications in aerospace, marine, and heavy machinery sectors are creating new opportunities for market growth.

Which are the significant players operating in the oil condition monitoring market?

Parker Hannifin Corp (US), General Electric Company (US), BP p.l.c. (UK), Shell plc (Netherlands), and Chevron Corporation (US) are dominant players in the global oil condition monitoring market. Deals is one of the key strategies adopted by these players. Apart from acquisitions, these players extend their focus on partnerships, agreements, and collaborations.

What factors are influencing the adoption of oil condition monitoring equipment?

Stringent regulatory requirements, the rising need for efficiency in industrial operations, and the growing shift toward Industry 4.0 are key factors influencing the adoption of oil condition monitoring equipment. Companies are investing in advanced monitoring solutions to ensure compliance, improve sustainability, and extend machinery life cycles.

Why is hydraulic oil condition monitoring gaining prominence?

Hydraulic oil condition monitoring is gaining prominence due to its critical role in maintaining system efficiency across industries like construction, mining, and heavy machinery. Contamination and viscosity changes in hydraulic oil can lead to performance degradation and costly failures, making continuous monitoring essential for minimizing risks and optimizing machine performance.

How is the demand for oil condition monitoring software evolving?

The demand for oil condition monitoring software is rising due to its ability to analyze large datasets from sensors and provide actionable insights. Advanced software solutions leverage AI and machine learning to detect patterns, predict failures, and recommend optimal maintenance schedules, improving operational efficiency across industries.

What is the impact of the AI on the oil condition monitoring market?

AI is transforming the oil condition monitoring market by enabling real-time data analysis, predictive maintenance, and automated diagnostics, reducing downtime and operational costs. AI-driven algorithms enhance sensor accuracy, detect anomalies early, and optimize oil change intervals, improving equipment efficiency and sustainability. Integration with IoT and machine learning further refines predictive insights, supporting industries like automotive, aerospace, and power generation in maximizing asset longevity and minimizing failures.

Which region to offer lucrative growth for the oil condition monitoring market by 2030?

During the projected period, the Asia Pacific is expected to offer lucrative opportunities in the oil condition monitoring market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 OIL CONDITION MONITORING MARKET: SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 OIL CONDITION MONITORING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up approach (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size by top-down approach (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM OIL CONDITION MONITORING OFFERINGS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN OIL CONDITION MONITORING MARKET

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 10 OIL CONDITION MONITORING MARKET: GROWTH PROJECTIONS FOR REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 11 TURBINES SEGMENT TO HOLD LARGEST MARKET SHARE, BY PRODUCT TYPE, DURING FORECAST PERIOD

FIGURE 12 OIL CONDITION MONITORING MARKET, BY SAMPLING TYPE, 2021 VS. 2026

FIGURE 13 OIL CONDITION MONITORING MARKET FOR POWER GENERATION INDUSTRY TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 14 APAC TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN OIL CONDITION MONITORING MARKET

FIGURE 15 INCREASING NEED FOR COST-EFFECTIVE PRODUCTS TO BOOST GROWTH OF OIL CONDITION MONITORING MARKET

4.2 OIL CONDITION MONITORING MARKET, BY SAMPLING TYPE

FIGURE 16 ON-SITE SAMPLING TO REGISTER HIGHER CAGR FROM 2021 TO 2026

4.3 OIL CONDITION MONITORING MARKET, BY PRODUCT TYPE

FIGURE 17 TURBINES TO HOLD LARGEST SHARE OF OIL CONDITION MONITORING MARKET BY 2026

4.4 OIL CONDITION MONITORING MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

FIGURE 18 TRANSPORTATION VERTICAL AND US HELD LARGEST SHARE OF NORTH AMERICA OIL CONDITION MONITORING MARKET IN 2020

4.5 OIL CONDITION MONITORING MARKET, BY REGION

FIGURE 19 CHINA OIL CONDITION MONITORING MARKET TO EXHIBIT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 IMPACT OF DRIVERS AND OPPORTUNITIES ON OIL CONDITION MONITORING MARKET

FIGURE 21 IMPACT OF CHALLENGES AND RESTRAINTS ON OIL CONDITION MONITORING MARKET

5.2.1 DRIVERS

5.2.1.1 Surging demand for cost-effective solutions for maintaining health of machinery

5.2.1.2 Increasing awareness regarding importance of oil condition monitoring among industries

5.2.1.3 Growing focus on reducing maintenance costs

5.2.2 RESTRAINTS

5.2.2.1 Expenses incurred in retrofitting existing systems

5.2.2.2 Lack of skilled technical resources for data analysis

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for energy

5.2.3.2 Increasing adoption of big data analytics and IIoT

5.2.4 CHALLENGES

5.2.4.1 Challenges with offline oil sampling

5.2.4.2 Decline in demand from oil & gas industry due to COVID-19

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MOST VALUE IS ADDED DURING TESTING LABS AND DATA ANALYSTS PHASES

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 IMPACT OF PORTER’S FIVE FORCES ON OIL CONDITION MONITORING MARKET

5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 23 REVENUE SHIFT IN OIL CONDITION MONITORING MARKET

5.6 OIL CONDITION MONITORING MARKET: ECOSYSTEM

FIGURE 24 OIL CONDITION MONITORING MARKET: ECOSYSTEM

5.7 AVERAGE SELLING PRICE ANALYSIS

5.8 CASE STUDIES

5.8.1 WEAR DEBRIS ANALYSIS OF STERN TUBE LUBRICANTS ON MARINE CARGO VESSELS BY INTERTEK PLC

5.8.2 LONG-TERM APPLICATION OF ONLINE OIL CONDITION MONITORING ON HIGHWAY DIESEL ENGINE BY POSEIDON SYSTEMS

5.9 PATENTS ANALYSIS

5.9.1 PATENT REGISTRATIONS, 2018–2021

TABLE 3 PATENTS RELATED TO OIL CONDITION MONITORING FILED DURING 2018–2021

5.9.2 PATENTS ANALYSIS

5.9.2.1 Methodology

5.9.2.2 Document type

TABLE 4 PATENTS FILED

FIGURE 25 PATENTS FILED BETWEEN 2018 AND 2021

FIGURE 26 TREND OF PATENTS GRANTED DURING 2018–2021

5.9.2.3 Insight

5.9.2.4 General Electric

TABLE 5 LIST OF PATENTS BY GENERAL ELECTRIC (US)

5.10 TRADE ANALYSIS

5.10.1 IMPORTS SCENARIO FOR PRODUCTS UNDER HS CODE 903190

TABLE 6 IMPORTS DATA FOR PRODUCTS UNDER HS CODE 903190, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORTS SCENARIO FOR PRODUCTS UNDER HS CODE 903190

TABLE 7 EXPORTS DATA FOR PRODUCTS UNDER HS CODE 903190, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 TECHNOLOGY TRENDS

5.11.1 KEY TECHNOLOGY

5.11.1.1 Full Spectrum Holistic (FSH)

5.11.1.2 Internet of Things (IoT)

5.11.2 ADJACENT TECHNOLOGIES

5.11.2.1 Carbon-free energy resources

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

TABLE 8 MFN TARIFFS FOR PRODUCTS UNDER HS CODE 903190 EXPORTED BY CHINA

TABLE 9 MFN TARIFFS FOR PRODUCTS UNDER HS CODE 903190 IMPORTED BY GERMANY

5.13 GOVERNMENT REGULATIONS AND STANDARDS

5.13.1 GOVERNMENT REGULATIONS

5.13.2 STANDARDS

5.13.2.1 ISO 14830-1:2019(en): Condition monitoring and diagnostics of machine systems — Tribology-based monitoring and diagnostics

5.13.2.2 ASTM D7720 - 11(2017): Standard Guide for Statistically Evaluating Measurand Alarm Limits when Using Oil Analysis to Monitor Equipment and Oil for Fitness and Contamination

5.14 TYPES OF OIL CONTAMINATION

5.14.1 WATER CONTAMINATION

5.14.2 PARTICLE CONTAMINATION

6 TECHNIQUES USED FOR OIL CONDITION MONITORING (Page No. - 76)

6.1 INTRODUCTION

6.2 FERROGRAPHY

6.3 ON-LINE ACOUSTIC VISCOMETRY IN OIL CONDITION MONITORING

6.4 INDUCTIVELY COUPLED PLASMA – OPTICAL EMISSION SPECTROSCOPY (ICP-OES)

6.5 FOURIER TRANSFORM INFRARED (FTIR) SPECTROSCOPY

6.6 DIELECTRIC STRENGTH TEST

6.7 POTENTIOMETRIC TITRATION

7 TYPES OF SENSORS USED IN OIL CONDITION MONITORING (Page No. - 78)

7.1 INTRODUCTION

7.2 OIL QUALITY SENSORS

7.3 WEAR DEBRIS SENSORS/METALLIC PARTICLE SENSORS

7.4 VISCOSITY/DENSITY SENSORS

7.5 WATER-IN-OIL SENSORS

8 PARAMETERS FOR MEASURING OIL CONDITION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 27 PARAMETERS FOR MEASURING OIL CONDITION

8.2 TEMPERATURE

8.3 PRESSURE

8.4 DENSITY

8.5 VISCOSITY

8.6 DIELECTRIC

8.7 TAN/TBN

8.8 FUEL DILUTION

8.9 WATER DILUTION

8.10 SOOT

8.11 WEAR PARTICLES

9 OIL CONDITION MONITORING MARKET, BY SAMPLING TYPE (Page No. - 85)

9.1 INTRODUCTION

FIGURE 28 OFF-SITE SAMPLING TO HOLD LARGER MARKET SIZE BY 2026

TABLE 10 OIL CONDITION MONITORING MARKET, BY SAMPLING TYPE, 2018–2020 (USD MILLION)

TABLE 11 OIL CONDITION MONITORING MARKET, BY SAMPLING TYPE, 2021–2026 (USD MILLION)

9.2 ON-SITE

9.2.1 PORTABLE KITS

9.2.1.1 Ease of operating propels demand for portable kits for oil analysis

9.2.2 FIXED CONTINUOUS MONITORING

9.2.2.1 Fixed continuous monitoring is suitable for real-time oil monitoring and analysis

TABLE 12 OIL CONDITION MONITORING MARKET FOR ON-SITE SAMPLING, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 13 OIL CONDITION MONITORING MARKET FOR ON-SITE SAMPLING, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

9.3 OFF-SITE

9.3.1 OFF-SITE SAMPLING IS TRADITIONAL METHOD OF OIL CONDITION MONITORING

TABLE 14 OIL CONDITION MONITORING MARKET FOR OFF-SITE SAMPLING, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 15 OIL CONDITION MONITORING MARKET FOR OFF-SITE SAMPLING, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10 OIL CONDITION MONITORING MARKET, BY PRODUCT TYPE (Page No. - 91)

10.1 INTRODUCTION

FIGURE 29 TURBINE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE FOR OIL CONDITION MONITORING BY 2026

TABLE 16 OIL CONDITION MONITORING MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 17 OIL CONDITION MONITORING MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.2 TURBINES

10.2.1 GROWING NEED FOR MAXIMUM RELIABILITY TO FUEL MARKET GROWTH FOR TURBINES

TABLE 18 OIL CONDITION MONITORING MARKET FOR TURBINES, BY SAMPLING TYPE, 2018–2020 (USD MILLION)

TABLE 19 OIL CONDITION MONITORING MARKET FOR TURBINES, BY SAMPLING TYPE, 2021–2026 (USD MILLION)

TABLE 20 OIL CONDITION MONITORING MARKET FOR TURBINES, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 21 OIL CONDITION MONITORING MARKET FOR TURBINES, BY INDUSTRY, 2021–2026 (USD MILLION)

10.3 COMPRESSORS

10.3.1 REDUCTION IN MAINTENANCE COSTS FOR COMPRESSORS TO DRIVE GROWTH OF MARKET

TABLE 22 OIL CONDITION MONITORING MARKET FOR COMPRESSORS, BY SAMPLING TYPE, 2018–2020 (USD MILLION)

TABLE 23 OIL CONDITION MONITORING MARKET FOR COMPRESSORS, BY SAMPLING TYPE, 2021–2026 (USD MILLION)

TABLE 24 OIL CONDITION MONITORING MARKET FOR COMPRESSORS, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 25 OIL CONDITION MONITORING MARKET FOR COMPRESSORS, BY INDUSTRY, 2021–2026 (USD MILLION)

10.4 ENGINES

10.4.1 DEMAND FOR OIL CONDITION MONITORING IS ATTRIBUTED TO INCREASING NEED FOR SCHEDULED ENGINE MONITORING

TABLE 26 OIL CONDITION MONITORING MARKET FOR ENGINES, BY SAMPLING TYPE, 2018–2020 (USD MILLION)

TABLE 27 OIL CONDITION MONITORING MARKET FOR ENGINES, BY SAMPLING TYPE, 2021–2026 (USD MILLION)

TABLE 28 OIL CONDITION MONITORING MARKET FOR ENGINES, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 29 OIL CONDITION MONITORING MARKET FOR ENGINES, BY INDUSTRY, 2021–2026 (USD MILLION)

10.5 HYDRAULIC SYSTEMS

10.5.1 NEED FOR MAINTAINING HYDRAULIC SYSTEMS IN WORKING CONDITION CREATES LUCRATIVE MARKET OPPORTUNITIES

TABLE 30 OIL CONDITION MONITORING MARKET FOR HYDRAULIC SYSTEMS, BY SAMPLING TYPE, 2018–2020 (USD MILLION)

TABLE 31 OIL CONDITION MONITORING MARKET FOR HYDRAULIC SYSTEMS, BY SAMPLING TYPE, 2021–2026 (USD MILLION)

TABLE 32 OIL CONDITION MONITORING MARKET FOR HYDRAULIC SYSTEMS, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 33 OIL CONDITION MONITORING MARKET FOR HYDRAULIC SYSTEMS, BY INDUSTRY, 2021–2026 (USD MILLION)

10.6 OTHERS

10.6.1 GROWING DEMAND FOR CHLORINE DETECTORS IN WATER & WASTEWATER TREATMENT APPLICATION TO DRIVE MARKET GROWTH

TABLE 34 OIL CONDITION MONITORING MARKET FOR OTHERS, BY SAMPLING TYPE, 2018–2020 (USD MILLION)

TABLE 35 OIL CONDITION MONITORING MARKET FOR OTHERS, BY SAMPLING TYPE, 2021–2026 (USD MILLION)

TABLE 36 OIL CONDITION MONITORING MARKET FOR OTHERS, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 37 OIL CONDITION MONITORING MARKET FOR OTHERS, BY INDUSTRY, 2021–2026 (USD MILLION)

11 OIL CONDITION MONITORING MARKET, BY VERTICAL (Page No. - 104)

11.1 INTRODUCTION

FIGURE 30 TRANSPORTATION TO ACCOUNT FOR LARGEST SIZE OF OIL CONDITION MONITORING MARKET BY 2026

TABLE 38 OIL CONDITION MONITORING MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 39 OIL CONDITION MONITORING MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 TRANSPORTATION

11.2.1 DECLINE IN GLOBAL DEMAND FOR AUTOMOBILES DUE TO COVID-19 PANDEMIC TO IMPACT GROWTH OF SEGMENT

TABLE 40 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 41 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 42 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 45 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 46 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 47 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 48 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 49 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 50 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 51 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION IN ROW, BY REGION, 2021–2026 (USD MILLION)

FIGURE 31 AUTOMOBILE SEGMENT TO LEAD OIL CONDITION MONITORING MARKET FOR TRANSPORTATION VERTICAL DURING FORECAST PERIOD

TABLE 52 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 53 OIL CONDITION MONITORING MARKET FOR TRANSPORTATION, BY TYPE, 2021–2026 (USD MILLION)

11.2.2 AUTOMOBILE

11.2.3 AEROSPACE

11.2.4 MARINE

11.2.5 HEAVY VEHICLE

11.2.6 LOCOMOTIVE ENGINES

11.3 INDUSTRIAL

11.3.1 DEMAND FOR LUBRICANTS WILL BE HIGH FOR INDUSTRIAL MACHINERIES DUE TO NEED FOR CONTINUOUS FUNCTIONING OF MANUFACTURING FACILITIES

TABLE 54 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 55 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 56 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 57 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 58 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 59 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 60 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 61 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 62 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 63 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 64 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 65 OIL CONDITION MONITORING MARKET FOR INDUSTRIAL IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.4 OIL & GAS

11.4.1 GROWING NEED TO MONITOR OIL IN EXPLORATION AND REFINING PROCESSES TO BOOST MARKET GROWTH

TABLE 66 OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 67 OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 68 OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY REGION, 2018–2020 (USD MILLION)

TABLE 69 OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 70 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 71 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 73 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 74 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 75 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 76 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 77 OIL CONDITION MONITORING MARKET FOR OIL & GAS IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.5 POWER GENERATION

11.5.1 GROWING INVESTMENTS FOR POWER GENERATION TO DRIVE GROWTH OF OIL CONDITION MONITORING MARKET

FIGURE 32 APAC TO LEAD OIL CONDITION MONITORING MARKET FOR INDUSTRIAL SEGMENT DURING FORECAST PERIOD

TABLE 78 OIL CONDITION MONITORING MARKET FOR POWER GENERATION, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 79 OIL CONDITION MONITORING MARKET FOR POWER GENERATION, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 80 OIL CONDITION MONITORING MARKET FOR POWER GENERATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 81 OIL CONDITION MONITORING MARKET FOR POWER GENERATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 82 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 83 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 84 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 85 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 86 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 87 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 89 OIL CONDITION MONITORING MARKET FOR POWER GENERATION IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.6 MINING

11.6.1 GROWING NEED FOR LUBRICANTS FOR HEAVY MACHINERIES IN MINES TO FUEL MARKET GROWTH

TABLE 90 OIL CONDITION MONITORING MARKET FOR MINING, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 91 OIL CONDITION MONITORING MARKET FOR MINING, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 92 OIL CONDITION MONITORING MARKET FOR MINING, BY REGION, 2018–2020 (USD MILLION)

TABLE 93 OIL CONDITION MONITORING MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

TABLE 94 OIL CONDITION MONITORING MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 95 OIL CONDITION MONITORING MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 96 OIL CONDITION MONITORING MARKET FOR MINING IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 97 OIL CONDITION MONITORING MARKET FOR MINING IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 98 OIL CONDITION MONITORING MARKET FOR MINING IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 99 OIL CONDITION MONITORING MARKET FOR MINING IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 OIL CONDITION MONITORING MARKET FOR MINING IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 101 OIL CONDITION MONITORING MARKET FOR MINING IN ROW, BY REGION, 2021–2026 (USD MILLION)

12 OIL CONDITION MONITORING MARKET, BY REGION (Page No. - 132)

12.1 INTRODUCTION

FIGURE 33 GEOGRAPHIC SNAPSHOT: APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 34 OIL CONDITION MONITORING MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 102 OIL CONDITION MONITORING MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 103 OIL CONDITION MONITORING MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: OIL CONDITION MONITORING MARKET SNAPSHOT

TABLE 104 OIL CONDITION MONITORING MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 105 OIL CONDITION MONITORING MARKET IN NORTH AMERICA, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 106 OIL CONDITION MONITORING MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 107 OIL CONDITION MONITORING MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Presence of key oil condition monitoring solution providers in US to propel market growth during forecast period

TABLE 108 OIL CONDITION MONITORING MARKET IN US, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 109 OIL CONDITION MONITORING MARKET IN US, BY VERTICAL, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Implementation of smart factory solutions to boost market growth in Canada

TABLE 110 OIL CONDITION MONITORING MARKET IN CANADA, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 111 OIL CONDITION MONITORING MARKET IN CANADA, BY VERTICAL, 2021–2026 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Increasing industrialization in Mexico to drive growth of oil condition monitoring market

TABLE 112 OIL CONDITION MONITORING MARKET IN MEXICO, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 113 OIL CONDITION MONITORING MARKET IN MEXICO, BY VERTICAL, 2021–2026 (USD MILLION)

12.3 EUROPE

FIGURE 36 EUROPE: OIL CONDITION MONITORING MARKET SNAPSHOT

TABLE 114 OIL CONDITION MONITORING MARKET IN EUROPE, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 115 OIL CONDITION MONITORING MARKET IN EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 116 OIL CONDITION MONITORING MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 117 OIL CONDITION MONITORING MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Germany to lead oil condition monitoring market in Europe during forecast period owing to its automotive industry

TABLE 118 OIL CONDITION MONITORING MARKET IN GERMANY, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 119 OIL CONDITION MONITORING MARKET IN GERMANY, BY VERTICAL, 2021–2026 (USD MILLION)

12.3.2 UK

12.3.2.1 Growing investments in manufacturing sectors to boost growth of oil condition monitoring market during forecast period in UK

TABLE 120 OIL CONDITION MONITORING MARKET IN UK, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 121 OIL CONDITION MONITORING MARKET IN UK, BY VERTICAL, 2021–2026 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Growing use of oil condition monitoring in automotive industry and power stations to drive market growth

TABLE 122 OIL CONDITION MONITORING MARKET IN FRANCE, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 123 OIL CONDITION MONITORING MARKET IN FRANCE, BY VERTICAL, 2021–2026 (USD MILLION)

12.3.4 REST OF EUROPE

TABLE 124 OIL CONDITION MONITORING MARKET IN REST OF EUROPE, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 125 OIL CONDITION MONITORING MARKET IN REST OF EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 37 APAC: OIL CONDITION MONITORING MARKET SNAPSHOT

TABLE 126 OIL CONDITION MONITORING MARKET IN APAC, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 127 OIL CONDITION MONITORING MARKET IN APAC, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 128 OIL CONDITION MONITORING MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 129 OIL CONDITION MONITORING MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 China to witness rapid growth in global oil condition monitoring market due to industrialization

TABLE 130 OIL CONDITION MONITORING MARKET IN CHINA, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 131 OIL CONDITION MONITORING MARKET IN CHINA, BY VERTICAL, 2021–2026 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Notable growth in automotive industry to boost oil condition monitoring market in Japan

TABLE 132 OIL CONDITION MONITORING MARKET IN JAPAN, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 133 OIL CONDITION MONITORING MARKET IN JAPAN, BY VERTICAL, 2021–2026 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Expanding manufacturing industries and government initiatives for renewable power development to drive market growth

TABLE 134 OIL CONDITION MONITORING MARKET IN INDIA, BY VERTICAL, 2018–2020 (USD THOUSAND)

TABLE 135 OIL CONDITION MONITORING MARKET IN INDIA, BY VERTICAL, 2021–2026 (USD THOUSAND)

12.4.4 REST OF APAC

TABLE 136 OIL CONDITION MONITORING MARKET IN REST OF APAC, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 137 OIL CONDITION MONITORING MARKET IN REST OF APAC, BY VERTICAL, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 138 OIL CONDITION MONITORING MARKET IN REST OF WORLD, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 139 OIL CONDITION MONITORING MARKET IN REST OF WORLD, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 140 OIL CONDITION MONITORING MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 141 OIL CONDITION MONITORING MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Middle East & Africa to witness increasing demand for oil condition monitoring during forecast period

TABLE 142 OIL CONDITION MONITORING MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 143 OIL CONDITION MONITORING MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2021–2026 (USD MILLION)

12.5.2 SOUTH AMERICA

12.5.2.1 Implementation of oil condition monitoring in automotive, infrastructure, oil & gas, chemicals, and mining industries to drive market growth

TABLE 144 OIL CONDITION MONITORING MARKET IN SOUTH AMERICA, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 145 OIL CONDITION MONITORING MARKET IN SOUTH AMERICA, BY VERTICAL, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 163)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

TABLE 146 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN OIL CONDITION MONITORING MARKET

13.2.1 PRODUCT PORTFOLIO

13.2.2 REGIONAL FOCUS

13.2.3 MANUFACTURING FOOTPRINT

13.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.3 MARKET SHARE ANALYSIS, 2020

TABLE 147 DEGREE OF COMPETITION

13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS IN OIL CONDITION MONITORING MARKET

FIGURE 38 FIVE-YEAR REVENUE ANALYSIS OF TOP MARKET PLAYERS IN OIL CONDITION MONITORING MARKET

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 PERVASIVE

13.5.3 EMERGING LEADER

13.5.4 PARTICIPANT

FIGURE 39 OIL CONDITION MONITORING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

13.6 STARTUP/SME EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 40 OIL CONDITION MONITORING MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2020

13.7 COMPANY PRODUCT FOOTPRINT

TABLE 148 COMPANY PRODUCT FOOTPRINT

TABLE 149 COMPANY PRODUCT FOOTPRINT

TABLE 150 COMPANY VERTICAL FOOTPRINT

TABLE 151 COMPANY REGIONAL FOOTPRINT

13.8 COMPETITIVE SITUATIONS & TRENDS

13.8.1 PRODUCT LAUNCHES

TABLE 152 PRODUCT LAUNCHES (2018–2021)

13.8.2 DEALS

TABLE 153 DEALS (2018–2021)

14 COMPANY PROFILES (Page No. - 183)

14.1 KEY PLAYERS

(Business overview, Products/Solutions offered, Recent Developments, COVID-19-related developments, MNM view)*

14.1.1 PARKER-HANNIFIN CORPORATION

TABLE 154 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 41 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT

14.1.2 GENERAL ELECTRIC COMPANY

TABLE 155 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 42 GENERAL ELECTRIC: COMPANY SNAPSHOT

14.1.3 ROYAL DUTCH SHELL PLC

TABLE 156 ROYAL DUTCH SHELL PLC: BUSINESS OVERVIEW

FIGURE 43 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

14.1.4 BP PLC

TABLE 157 BP PLC: BUSINESS OVERVIEW

FIGURE 44 BP PLC: COMPANY SNAPSHOT

14.1.5 CHEVRON CORPORATION

TABLE 158 CHEVRON CORPORATION: BUSINESS OVERVIEW

FIGURE 45 CHEVRON CORPORATION: COMPANY SNAPSHOT

14.1.6 INTERTEK GROUP PLC

TABLE 159 INTERTEK GROUP PLC: BUSINESS OVERVIEW

FIGURE 46 INTERTEK GROUP PLC: COMPANY SNAPSHOT

14.1.7 SGS SA

TABLE 160 SGS SA: BUSINESS OVERVIEW

FIGURE 47 SGS SA: COMPANY SNAPSHOT

14.1.8 BUREAU VERITAS

TABLE 161 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 48 BUREAU VERITAS: COMPANY SNAPSHOT

14.1.9 EATON CORPORATION PLC

TABLE 162 EATON CORPORATION PLC: BUSINESS OVERVIEW

FIGURE 49 EATON CORPORATION PLC: COMPANY SNAPSHOT

14.1.10 TOTAL SE (TOTALENERGIES SE)

TABLE 163 TOTAL SE: BUSINESS OVERVIEW

FIGURE 50 TOTAL SE: COMPANY SNAPSHOT

14.2 RIGHT TO WIN

14.3 OTHER COMPANIES

14.3.1 UNIMARINE PTE. LTD.

14.3.2 HYDAC INTERNATIONAL

14.3.3 TAN DELTA SYSTEMS

14.3.4 MONITION LTD.

14.3.5 VERITAS PETROLEUM SERVICES (VPS) BV

14.3.6 SPECTRO ANALYTICAL INSTRUMENTS GMBH

14.3.7 DELTA SERVICES INDUSTRIES (DSI)

14.3.8 AVENISENSE SA

14.3.9 MICROMEM APPLIED SENSOR TECHNOLOGIES INC. (MAST)

14.3.10 GILL SENSORS & CONTROLS LIMITED

14.3.11 POSEIDON SYSTEMS, LLC

14.3.12 CM TECHNOLOGIES GMBH

14.3.13 SPECIAL OILFIELD SERVICES CO. LLC

14.3.14 DES-CASE CORPORATION

14.3.15 INSIGHT SERVICES INC.

*Details on Business overview, Products/Solutions offered, Recent Developments, COVID-19-related developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 234)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the oil condition monitoring market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the oil condition monitoring market begins with capturing data on revenues of key vendors in the market through secondary research. This study incorporates extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the oil condition monitoring market. Vendor offerings have also been taken into consideration to determine market segmentation. The entire research methodology includes studying annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

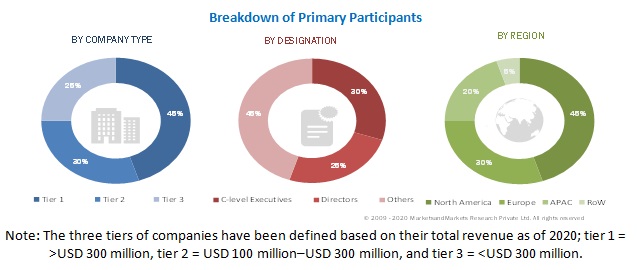

The Oil condition monitoring market comprises several stakeholders, such as suppliers of oil condition monitoring systems and solutions. The demand side of this market is characterized by various product types, verticals, and regions. The supply side is characterized by oil condition monitoring systems and solutions. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the oil condition monitoring market and its subsegments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the oil condition monitoring market.

Research Objective

- To define, describe, and forecast the oil condition monitoring market, in terms of value, on the basis of sampling type, product type, vertical, and region

- To describe the different types of sensors used in oil condition monitoring

- To describe the various techniques used for oil condition analysis and measuring parameters

- To forecast the market size, in terms of value, for four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain of the market

- To analyze the impact of COVID-19 on the market, market segments, and market players

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments such as product launches and developments, partnerships, acquisitions, contracts, agreements, and R&D in the market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What new application areas are Oil condition monitoring providers exploring?

- Who are the key market players, and how intense is the competition?

- Which applications and geographies would be the biggest markets for Oil condition monitoring?

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Oil Condition Monitoring Market