Permanent Magnet Market by Type (Neodymium Iron Boron magnet, Samarium Cobalt magnet, Ferrite magnet, AlNiCo magnet), End-Use Industries (Consumer Electronics, Automotive, Medical, Environment & Energy, Aerospace & Defense) - Global Forecast to 2029

Updated on : November 25, 2024

Permanent Magnet Market

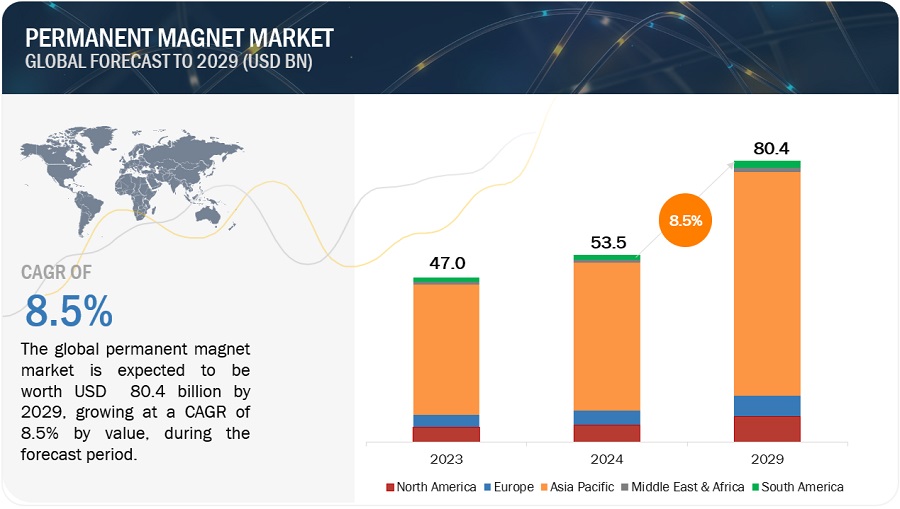

The global permanent magnet market is valued at USD 53.5 billion in 2024 and is projected to reach USD 80.4 billion by 2029, growing at 8.5% cagr from 2024 to 2029. It is expected to witness steady growth during the forecast period, owing to the increasing demand for motors, generators, sensors, loudspeakers, wearable devices, smart appliances, MRI machines and so on. The demand for permanent magnet market is mostly from Neodymium Iron Boron magnets. The major end use industries of permanent magnets are Consumer Electronics, General Industrial, Automotive, Medical Technology, Environment & Energy, Aerospace & Defense Industries.

Attractive Opportunities in Permanent Magnet Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Permanent Magnet Market Dynamics

Driver: Growing demand for permanent magnets due to increased deployment of wind turbines

The growing demand for offshore wind turbines in Environment & Energy industry is pushing the companies to manufacture advance magnet-based generators. According to GWEC, more than 25 GW of offshore wind will be installed in as single year in 2025. Countries and regions across the globe are investing heavily in the wind sector and trying to grab a significant market share in the renewable energy industry. This is likely to change the market dynamics of components used in manufacturing of wind turbines including permanent magnets. Countries like France, and the US are developing recycling technologies to recycle wind turbine blades by 2030 and achieve net zero emissions in future. Additionally, a Swedish company, Vatenfall has undertaken a sustainability initiative to achieve 100% circular economy of permanent magnets from its wind turbines.

Restraint: Fluctuating raw material cost of rare earth magnets

Fluctuating cost of raw materials is one of the major restraints hampering the growth of global permanent magnet market. Sudden increase in the prices of rare earth magnets, particularly neodymium can lead to higher production cost affecting the profit margins. Due to this factor it becomes challenging for the rare earth magnet manufacturers to deliver high quality products at low prices. Similarly, sudden decrease in the cost of rare earth magnets leads to higher inventory cost affecting the competitiveness in the market.

Opportunity: Growing demand for EVs and Hybrid Vehicles

With the increasing population, the demand for permanent magnets is growing in automotive industry. Consumer spending has been increased with the changing consumer preferences and advancement in technologies. Many well-established players in the permanent magnet market are adopting electrification to meet the stringent regulations set by the government to promote clean energy. Major automotive manufacturers such as Audi, and MG Motors are utilizing permanent magnet synchronous motor in EVs and hybrid vehicles that provides 15% more efficiency than the induction motors. Due to its low maintenance cost, durability, and reliability, the demand for permanent magnets synchronous motors is rising that mostly uses Neodymium Iron Boron permanent magnets.

Challenge: High reliance on China for raw materials and magnets

China dominates the global Rare Earth Elements (REE) market and is also a crucial supplier of REEs to majority of the countries. Additionally majority of the permanent magnet manufacturers are in China. Countries across the world are trying to establish domestic magnet manufacturing facilities to reduce the vulnerability of supply chain of permanent magnets. Japan, US and European countries are exploring the existing mines for extracting rare earth elements. China being the largest producer of rare earth elements has undertaken the magnet industry due to absence of these materials in western regions.

Permanent Magnet Market Ecosystem:

Based on the type, Neodymium Iron Boron magnet type is estimated to be the fastest-growing type during the forecast period, in terms of value.

Neodymium Iron Boron magnet, a most advanced rare earth magnet available in the market offers compressive strength, high residual induction (Br), high coercivity (Hc), and maximum energy product (BHmax). It is available in variety of sizes, shapes and grades. Neodymium Iron Boron magnet is 18 times stronger than the ferrite magnets. Due to its exceptional magnetic properties and versatility, it is widely used in Consumer Electronics, General Industrial, Automotive, Medical Technology, Environment & Energy, Aerospace & Defense Industries. With the growing demand for Neodymium Iron Boron magnet in aerospace & defense applications, the Defense Department has awarded $5.1 million to Rare Resource Recycling Inc. for its recycling capabilities.

Based on End-use Industries, the automotive industry segment is anticipated to register the highest CAGR in permanent magnet market.

The automotive industry is expected to be the fastest-growing end use industry in the permanent magnet market during the forecast period. Permanent magnets are mostly preferred for automotive industry due to its compact design, durability, high performance and efficiency. Permanent magnets are widely used in electric motors, generators, sensors, actuators, magnetic bearing systems and braking systems. Growing demand for EVs and hybrid vehicles is driving the growth of automotive industry in permanent magnet market. Furthermore, increased demand for energy-efficient solutions, developments in automation, and the adoption of renewable energy sources fuel the need for permanent magnets in the automotive industry.

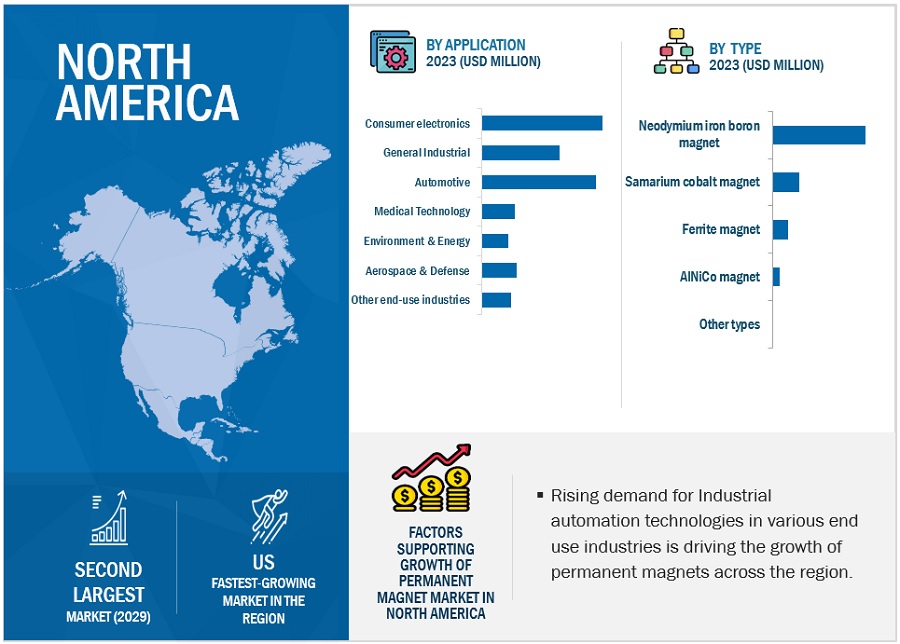

North America to be the second-largest market for permanent magnet market during the forecast period, in terms of value.

North America is the second-largest permanent magnet market across the world. The major end-use industries in this region include Consumer Electronics, General Industrial, Automotive, Medical Technology, Environment & Energy, Aerospace & Defense Industries. The demand for permanent magnet is high in consumer electronics industry due to changing consumer preferences and advancements in technologies. US is the largest permanent magnet market in North America, which is witnessing significant growth in permanent magnet market for general industrial and automotive industry apart from consumer electronics. In US, the demand for electric vehicles is booming, so to fulfil the need, there has been sudden increase in the production of permanent magnets. In 2024, E-VAC Magnets, a subsidiary of Vacuumschmelze has established a manufacturing facility in South Carolina to boost the supply of EV infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Permanent Magnet Market Players

The permanent magnet market is dominated by well-established players, Proterial, Ltd.(Japan), Arnold Magnetic Technologies (US), TDK Corporation (Japan), Yantai Dongxing Magnetic Materials Inc. (China), Shin-Etsu Chemical Co., Ltd. (Japan), Electron Energy Corporation (US), Adams Magnetic Products, LLC (US), Bunting Magnetics Co. (US), Tengam Engineering, Inc. (US), Ningbo Yunsheng Co., Ltd. (China), Chengdu Galaxy Magnets Co., Ltd. (China), Goudsmit Magnetics (Netherlands), Eclipse Magnetics (UK), Dexter Magnetic Technologies (US), and Earth Panda Advance Magnetic Material Co., Ltd. (China)., are the main producers in the global permanent magnet market.

These companies are attempting to establish themselves in the permanent magnet market by adopting advanced technologies. A thorough competitive analysis of these major permanent magnet market participants is included in the research, along with information on their company profiles, most recent advancements, and important market strategies.

Permanent Magnet Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

Type, End-use Industries and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, Middle East & Africa and South America |

|

Companies covered |

Proterial, Ltd. (Japan), Arnold Magnetic Technologies (US), TDK Corporation (Japan), Yantai Dongxing Magnetic Materials Inc. (China), Shin-Etsu Chemical Co., Ltd. (Japan), Electron Energy Corporation (US), Adams Magnetic Products, LLC (US), Bunting Magnetics Co. (US), Tengam Engineering, Inc. (US), Ningbo Yunsheng Co., Ltd. (China), Chengdu Galaxy Magnets Co., Ltd. (China), Goudsmit Magnetics (Netherlands), Eclipse Magnetics (UK), Dexter Magnetic Technologies (US), and Earth Panda Advance Magnetic Material Co., Ltd. (China) (UK), Dexter Magnetic Technologies (US), and Earth Panda Advance Magnetic Material Co., Ltd. (China). |

The study categorizes the permanent magnet market based on type, End-use industries, and Region.

Permanent Magnet Market by Type:

- Neodymium Iron Boron Magnets

- Ferrite Magnets

- Samarium Cobalt Magnets

- AlNiCo Magnets

- Others

Permanent Magnet Market by End-use industries:

- Consumer Electronics

- General Industrial

- Automotive

- Medical technology

- Environment & Energy

- Aerospace & Defense

- Other end-use industries

Permanent Magnet Market by Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In October 2024, Arnold Magnetic Technologies has expanded its production facility in Thailand to produce various types of permanent magnet assemblies and serve wide rang of customers across Asia Pacific, Europe, and the US.

- In July 2024, Electron Energy Corporation has collaborated with Magnetic Holdings, LLC to offer unique and comprehensive solutions based on samarium cobalt formulations in the magnetics industry for various applications.

- In April 2023, Arnold Magnetic Technologies announced its partnership with Cyclic Materials to develop rare earth cycling program to increase the resiliency of their supply chain for rare earth materials.

- In March 2022, Dexter Magnetic Technologies expanded its production capacity by doubling its manufacturing facilities to make a greater impact on semi-conductor, defense and medical sectors with their critical components.

- In March 2021, Arnold Magnetic Technologies acquired Ramco Electric Motors to enhance its portfolio with advanced electric motor solutions and expand its offerings across diverse markets such as industrial, military and aerospace.

Frequently Asked Questions (FAQ):

Which are the major companies in the permanent magnet market? What are their major strategies to strengthen their market presence?

Some of the key players in the permanent magnet market are Proterial, Ltd. (Japan), Arnold Magnetic Technologies (US), TDK Corporation (Japan), Yantai Dongxing Magnetic Materials Inc. (China), Shin-Etsu Chemical Co., Ltd. (Japan), Electron Energy Corporation (US), Adams Magnetic Products, LLC (US), Bunting Magnetics Co. (US), Tengam Engineering, Inc. (US), Ningbo Yunsheng Co., Ltd. (China), Chengdu Galaxy Magnets Co., Ltd. (China), Goudsmit Magnetics (Netherlands), Eclipse Magnetics (UK), Dexter Magnetic Technologies (US), and Earth Panda Advance Magnetic Material Co., Ltd. (China).

What are the drivers and opportunities for the permanent magnet market?

Growing demand for permanent magnets due to increased deployment of wind turbines is one of the major drivers of the permanent magnet market, and one of the major opportunities lies in growing demand for EVs and Hybrid vehicles.

Which region is expected to hold the highest market share?

Asia Pacific and North America’s permanent magnet market have been witnessing growth and significant industry demand.

What is the total CAGR expected to be recorded for the permanent magnet market during 2024-2029?

The CAGR is expected to record a CAGR of 8.5% from 2024-2029.

How is the permanent magnet market aligned?

The market is aligned due to high demand from end-use industries including consumer electronics, general industrial, automotive, medical technology, environment & energy, and aerospace & defense. The market is a potential market and is dominated by well-established players such as Proterial, Ltd., TDK Corporation, Shin-Etsu Chemical Co., Ltd., and others.

What are the primary growth drivers for the permanent magnet market in Europe?

The European market is primarily driven by increasing demand from the automotive and renewable energy sectors, particularly for electric vehicles and wind turbine applications.

How is the surge in electric vehicle production affecting the permanent magnet market in North America?

The rapid growth of electric vehicle production in North America is significantly boosting demand for high-performance permanent magnets, essential for efficient electric motors and battery systems.

How are European regulations impacting the sourcing of materials for permanent magnets?

Strict environmental and supply chain regulations in Europe are pushing companies to source sustainably and explore alternative materials, reducing reliance on rare-earth imports.

What is influencing growth in the North American permanent magnet market?

Rising demand in sectors such as automotive, defense, and electronics, along with advancements in magnet technology, are key drivers for market growth in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Partnerships between automakers and permanent magnets manufacturers- Surge in wind turbine installations to drive demand for permanent magnets- Growing automotive industry in Asia PacificRESTRAINTS- Fluctuating raw material costs of rare earth magnets- Environmental challenges & recycling hurdles in rare earth mining for permanent magnetsOPPORTUNITIES- Growing demand for permanent magnets in EVs and hybrid vehicles- Increasing efforts to develop environment-friendly magnets- Global government investments to enhance domestic production of magnetsCHALLENGES- High reliance on China for raw materials and magnets- Huge investments required in R&D- Technical challenges to overcome environmental effects during permanent magnet production

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 SUPPLY CHAIN ANALYSISRAW MATERIALMANUFACTURING PROCESSFINAL PRODUCT

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023AVERAGE SELLING PRICE TREND, BY END USE, 2023AVERAGE SELLING PRICE TREND, BY TYPE, 2023AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023

-

5.9 TRADE ANALYSISEXPORT SCENARIO FOR HS CODE 850511IMPORT SCENARIO FOR HS CODE 850511

-

5.10 TECHNOLOGY ANALYSIS FOR PERMANENT MAGNETSKEY TECHNOLOGY- Powder MetallurgyCOMPLEMENTARY TECHNOLOGY- Injection MoldingADJACDENT TECHNOLOGY- Additive Manufacturing

-

5.11 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP APPLICANTSTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

-

5.12 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS IN 2024–2025

-

5.14 CASE STUDY ANALYSISARNOLD MAGNETIC TECHNOLOGIES LAUNCHED SAMARIUM COBALT PERMANENT MAGNET RECOMAVACUUMSCHMELZE (VAC) PARTNERED WITH CYCLIC MATERIALS TO RECYCLE CRITICAL MAGNET MANUFACTURING BY-PRODUCTS

-

5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 INVESTMENT AND FUNDING SCENARIO

-

5.17 IMPACT OF AI/GEN AI ON PERMANENT MAGNET MARKETTOP USE CASES AND MARKET POTENTIALCASE STUDIES OF AI IMPLEMENTATION IN PERMANENT MAGNET MARKETCLIENTS' READINESS TO ADOPT GENERATIVE AI IN PERMANENT MAGNET MARKET

-

6.1 INTRODUCTIONPERMANENT MAGNET MARKET, BY TYPE

-

6.2 NDFEB MAGNETSGROWING EV SALES TO BOOST DEMANDNDFEB MAGNET: PERMANENT MAGNET MARKET, BY REGION

-

6.3 SMCO MAGNETINCREASING DEMAND OF SMCO MAGNET FROM WIND ENERGY SECTOR TO DRIVE MARKETSMCO MAGNET: PERMANENT MAGNET MARKET, BY REGION

-

6.4 ALNICO MAGNETRISING DEMAND FOR ALNICO IN CONSUMER ELECTRONICS TO DRIVE MARKETALNICO MAGNET: PERMANENT MAGNET MARKET, BY REGION

-

6.5 FERRITE MAGNETCOST-EFFECTIVENESS OF FERRITE MAGNET TO BOOST DEMANDFERRITE MAGNET: PERMANENT MAGNET MARKET, BY REGION

-

6.6 OTHER TYPESOTHER TYPES: PERMANENT MAGNET MARKET, BY REGION

-

7.1 INTRODUCTIONPERMANENT MAGNET MARKET, BY END-USE INDUSTRY

-

7.2 CONSUMER ELECTRONICSINCREASING DEMAND FOR CONSUMER ELECTRONICS IN DEVELOPING COUNTRIES TO DRIVE MARKETPERMANENT MAGNET MARKET IN CONSUMER ELECTRONICS END-USE INDUSTRY, BY REGIONDC MOTORSLOUDSPEAKERSGENERATORS

-

7.3 GENERAL INDUSTRIALINCREASING INDUSTRIAL AUTOMATION TO BOOST MARKETPERMANENT MAGNET MARKET IN GENERAL INDUSTRIAL END-USE INDUSTRY, BY REGIONMAGNETIC ASSEMBLIESMAGNETIC SEPARATORS

-

7.4 AUTOMOTIVEGROWING DEMAND FOR PERMANENT MAGNETS FROM EV MANUFACTURERS TO DRIVE MARKETPERMANENT MAGNET MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGIONMOTORSSENSORSSWITCHES

-

7.5 MEDICAL TECHNOLOGYINCREASING DEMAND FOR MRI SCANNERS TO BOOST MARKETPERMANENT MAGNET MARKET IN MEDICAL TECHNOLOGY END-USE INDUSTRY, BY REGIONSCANNING DEVICESIMPLANTABLE DEVICES

-

7.6 ENVIRONMENT & ENERGYINCREASING NUMBER OF WIND ENERGY INSTALLATIONS TO DRIVE DEMANDPERMANENT MAGNET MARKET IN ENVIRONMENT & ENERGY END-USE INDUSTRY, BY REGIONWIND TURBINES

-

7.7 AEROSPACE & DEFENSEINCREASING DEMAND FOR PRIVATE JETS TO DRIVE MARKETPERMANENT MAGNET MARKET IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGIONELECTRIC ENGINESMAGNETIC BEARINGS

-

7.8 OTHER END-USE INDUSTRIESPERMANENT MAGNET MARKET IN OTHER END-USE INDUSTRIES, BY REGION

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAPERMANENT MAGNET MARKET IN NORTH AMERICA, BY TYPEPERMANENT MAGNET MARKET IN NORTH AMERICA, BY END-USE INDUSTRYPERMANENT MAGNET MARKET IN NORTH AMERICA, BY COUNTRY- US- Canada- Mexico

-

8.3 EUROPEPERMANENT MAGNET MARKET IN EUROPE, BY TYPEPERMANENT MAGNET MARKET IN EUROPE, BY END-USE INDUSTRYPERMANENT MAGNET MARKET IN EUROPE, BY COUNTRY- Germany- France- UK- Italy- Russia- Rest of Europe

-

8.4 ASIA PACIFICPERMANENT MAGNET MARKET IN ASIA PACIFIC, BY TYPEPERMANENT MAGNET MARKET IN ASIA PACIFIC, BY END-USE INDUSTRYPERMANENT MAGNET MARKET IN ASIA PACIFIC, BY COUNTRY- China- Japan- India- South Korea- Indonesia- Rest of Asia Pacific

-

8.5 MIDDLE EAST & AFRICAPERMANENT MAGNET MARKET IN MIDDLE EAST & AFRICA, BY TYPEPERMANENT MAGNET MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRYPERMANENT MAGNET MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY- GCC Countries- South Africa- Rest of Middle East & Africa

-

8.6 SOUTH AMERICAPERMANENT MAGNET MARKET IN SOUTH AMERICA, BY TYPEPERMANENT MAGNET MARKET IN SOUTH AMERICA, BY END-USE INDUSTRYPERMANENT MAGNET MARKET IN SOUTH AMERICA, BY COUNTRY- Brazil- Argentina- Rest of South America

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.3 REVENUE ANALYSIS, 2019–2023

-

9.4 MARKET SHARE ANALYSIS, 2023MARKET RANKING

- 9.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

-

9.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Type footprint- End-use industry footprint- Region footprint

-

9.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 9.8 COMPANY VALUATION AND FINANCIAL METRICS

-

9.9 COMPETITIVE SCENARIODEALSEXPANSIONS

-

10.1 KEY COMPANIESPROTERIAL, LTD.- Business overview- Products offered- MnM viewARNOLD MAGNETIC TECHNOLOGIES- Business overview- Products offered- Recent developments- MnM viewTDK CORPORATION- Business overview- Product offered- Recent developments- MnM viewYANTAI DONGXING MAGNETIC MATERIALS INC.- Business overview- Products offered- MnM viewSHIN-ETSU CHEMICAL CO., LTD.- Business overview- Products offered- MnM viewELECTRON ENERGY CORPORATION- Business overview- Products Offered- Recent developments- MnM viewADAMS MAGNETIC PRODUCTS, LLC- Business overview- Products offered- Recent developments- MnM viewBUNTING MAGNETICS CO.- Business overview- Products offered- Recent developments- MnM viewTENGAM ENGINEERING, INC.- Business overview- Products offered- MnM viewNINGBO YUNSHENG CO., LTD.- Business overview- Products offered- MnM viewCHENGDU GALAXY MAGNETS CO., LTD.- Business overview- Products offered- MnM viewGOUDSMIT MAGNETICS- Business overview- Products offered- MnM viewECLIPSE MAGNETICS- Business overview- Products offered- MnM viewDEXTER MAGNETIC TECHNOLOGIES- Business overview- Products offered- Recent developments- MnM viewEARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.- Business overview- Products offered- MnM view

-

10.2 OTHER PLAYERSHANGZHOU PERMANENT MAGNET GROUP., LTDJPMF GUANGDONG CO., LTDNINGBO NINGGANG PERMANENT MAGNETIC MATERIALS CO., LTD.THOMAS AND SKINNER INC.YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.NINGBO CO-STAR MATERIALS HI-TECH CO., LTD.NINGBO RISHENG MAGNETS CO., LTD.VACUUMSCHMELZE GMBH & CO. KGDAIDO ELECTRONICS CO., LTD.PERMANENT MAGNETS LTD.MAGNEQUENCH INTERNATIONAL, LLC

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 ONSHORE WIND OUTLOOK FOR NEW INSTALLATIONS (GW)

- TABLE 2 AUTOMOTIVE PRODUCTION STATISTICS, BY REGION (2023)

- TABLE 3 NEODYMIUM PRICE VOLATILITY, 2021–2024

- TABLE 4 PERMANENT MAGNET MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES IN PERMANENT MAGNET MARKET

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES IN PERMANENT MAGNET MARKET

- TABLE 7 PERMANENT MAGNET MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 PERMANENT MAGNET MARKET: ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 9 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023

- TABLE 10 TOP 10 EXPORTING COUNTRIES IN 2023

- TABLE 11 TOP 10 IMPORTING COUNTRIES IN 2023

- TABLE 12 PERMANENT MAGNET MARKET: TOTAL NUMBER OF PATENTS

- TABLE 13 LIST OF PATENTS BY MITSUBISHI ELECTRIC CORPORATION

- TABLE 14 LIST OF PATENTS BY UNIVERSITY OF JIANGSU

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 CURRENT STANDARD CODES FOR PERMANENT MAGNETS

- TABLE 20 PERMANENT MAGNET MARKET: KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 21 TOP USE CASES AND MARKET POTENTIAL

- TABLE 22 CASE STUDIES OF GEN AI IMPLEMENTATION IN PERMANENT MAGNET MARKET

- TABLE 23 PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 24 PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (KILOTON)

- TABLE 25 PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 26 PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (KILOTON)

- TABLE 27 NDFEB MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 28 NDFEB MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (KILOTON)

- TABLE 29 NDFEB MAGNET: PERMANENT MAGNET MARKET, BY REGION,2024–2029 (USD MILLION)

- TABLE 30 NDFEB MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (KILOTON)

- TABLE 31 SMCO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 32 SMCO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (KILOTON)

- TABLE 33 SMCO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 34 SMCO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (KILOTON)

- TABLE 35 ALNICO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 36 ALNICO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (KILOTON)

- TABLE 37 ALNICO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 38 ALNICO MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (KILOTON)

- TABLE 39 FERRITE MAGNET: PERMANENT MAGNET MARKET, BY REGION,2020–2023 (USD MILLION)

- TABLE 40 FERRITE MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (KILOTON)

- TABLE 41 FERRITE MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 42 FERRITE MAGNET: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (KILOTON)

- TABLE 43 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 44 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (KILOTON)

- TABLE 45 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 46 OTHER TYPES: PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (KILOTON)

- TABLE 47 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 48 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 49 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 50 PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 51 PERMANENT MAGNET MARKET IN CONSUMER ELECTRONICS, BY REGION, 2020–2023 (USD MILLION)

- TABLE 52 PERMANENT MAGNET MARKET IN CONSUMER ELECTRONICS, BY REGION, 2020–2023 (KILOTON)

- TABLE 53 PERMANENT MAGNET MARKET IN CONSUMER ELECTRONICS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 54 PERMANENT MAGNET MARKET IN CONSUMER ELECTRONICS, BY REGION, 2024–2029 (KILOTON)

- TABLE 55 PERMANENT MAGNET MARKET IN GENERAL INDUSTRIAL, BY REGION, 2020–2023 (USD MILLION)

- TABLE 56 PERMANENT MAGNET MARKET IN GENERAL INDUSTRIAL, BY REGION, 2020–2023 (KILOTON)

- TABLE 57 PERMANENT MAGNET MARKET IN GENERAL INDUSTRIAL, BY REGION, 2024–2029 (USD MILLION)

- TABLE 58 PERMANENT MAGNET MARKET IN GENERAL INDUSTRIAL, BY REGION, 2024–2029 (KILOTON)

- TABLE 59 PERMANENT MAGNET MARKET IN AUTOMOTIVE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 60 PERMANENT MAGNET MARKET IN AUTOMOTIVE, BY REGION, 2020–2023 (KILOTON)

- TABLE 61 PERMANENT MAGNET MARKET IN AUTOMOTIVE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 PERMANENT MAGNET MARKET IN AUTOMOTIVE, BY REGION, 2024–2029 (KILOTON)

- TABLE 63 PERMANENT MAGNET MARKET IN MEDICAL TECHNOLOGY, BY REGION, 2020–2023 (USD MILLION)

- TABLE 64 PERMANENT MAGNET MARKET IN MEDICAL TECHNOLOGY, BY REGION, 2020–2023 (KILOTON)

- TABLE 65 PERMANENT MAGNET MARKET IN MEDICAL TECHNOLOGY, BY REGION, 2024–2029 (USD MILLION)

- TABLE 66 PERMANENT MAGNET MARKET IN MEDICAL TECHNOLOGY, BY REGION, 2024–2029 (KILOTON)

- TABLE 67 ESTIMATED NEW ONSHORE WIND INSTALLATIONS, BY REGION, 2023–2027

- TABLE 68 PERMANENT MAGNET MARKET IN ENVIRONMENT & ENERGY, BY REGION, 2020–2023 (USD MILLION)

- TABLE 69 PERMANENT MAGNET MARKET IN ENVIRONMENT & ENERGY, BY REGION, 2020–2023 (KILOTON)

- TABLE 70 PERMANENT MAGNET MARKET IN ENVIRONMENT & ENERGY, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 PERMANENT MAGNET MARKET IN ENVIRONMENT & ENERGY, BY REGION, 2024–2029 (KILOTON)

- TABLE 72 PROJECTED DELIVERIES IN GLOBAL COMMERCIAL AIRCRAFT FLEET FROM 2023 TO 2042, BY AIRCRAFT TYPE, 2023–2042

- TABLE 73 PERMANENT MAGNET MARKET IN AEROSPACE & DEFENSE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 PERMANENT MAGNET MARKET IN AEROSPACE & DEFENSE, BY REGION, 2020–2023 (KILOTON)

- TABLE 75 PERMANENT MAGNET MARKET IN AEROSPACE & DEFENSE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 76 PERMANENT MAGNET MARKET IN AEROSPACE & DEFENSE, BY REGION, 2024–2029 (KILOTON)

- TABLE 77 PERMANENT MAGNET MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2023 (USD MILLION)

- TABLE 78 PERMANENT MAGNET MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2023 (KILOTON)

- TABLE 79 PERMANENT MAGNET MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 80 PERMANENT MAGNET MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2024–2029 (KILOTON)

- TABLE 81 PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 82 PERMANENT MAGNET MARKET, BY REGION, 2020–2023 (KILOTON)

- TABLE 83 PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 84 PERMANENT MAGNET MARKET, BY REGION, 2024–2029 (KILOTON)

- TABLE 85 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE,2020–2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (KILOTON)

- TABLE 87 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE,2024–2029 (KILOTON)

- TABLE 89 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 91 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 93 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (KILOTON)

- TABLE 95 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY,2024–2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (KILOTON)

- TABLE 97 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 98 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY,2020–2023 (KILOTON)

- TABLE 99 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 100 US: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 101 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 102 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 103 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 104 CANADA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 105 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 106 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 107 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 108 MEXICO: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 109 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 110 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (KILOTON)

- TABLE 111 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 112 EUROPE: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (KILOTON)

- TABLE 113 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 114 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 115 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 116 EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 117 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 118 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (KILOTON)

- TABLE 119 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 120 EUROPE: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (KILOTON)

- TABLE 121 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 122 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 123 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 124 GERMANY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 125 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 126 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 127 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 128 FRANCE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 129 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 130 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 131 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 132 UK: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 133 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 134 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY,2020–2023 (KILOTON)

- TABLE 135 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 136 ITALY: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 137 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 138 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 139 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY,2024–2029 (USD MILLION)

- TABLE 140 RUSSIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 141 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 142 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 143 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 144 REST OF EUROPE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY,2024–2029 (KILOTON)

- TABLE 145 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (KILOTON)

- TABLE 147 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (KILOTON)

- TABLE 149 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 151 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 153 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (KILOTON)

- TABLE 155 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 156 ASIA PACIFIC: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (KILOTON)

- TABLE 157 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 158 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 159 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 160 CHINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 161 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 162 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 163 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 164 JAPAN: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 165 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 166 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 167 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 168 INDIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 169 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 170 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 171 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 172 SOUTH KOREA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 173 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 174 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 175 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 176 INDONESIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 177 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 179 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (KILOTON)

- TABLE 193 GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 194 GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 195 GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 196 GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 197 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY,2020–2023 (USD MILLION)

- TABLE 198 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 199 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 200 UAE: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 201 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 202 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 203 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 204 SAUDI ARABIA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 205 REST OF GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 206 REST OF GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 207 REST OF GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 208 REST OF GCC COUNTRIES: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 209 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 210 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 211 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 212 SOUTH AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 217 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 218 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2020–2023 (KILOTON)

- TABLE 219 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 220 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY TYPE, 2024–2029 (KILOTON)

- TABLE 221 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 222 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 223 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 224 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 225 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 226 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2020–2023 (KILOTON)

- TABLE 227 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 228 SOUTH AMERICA: PERMANENT MAGNET MARKET, BY COUNTRY, 2024–2029 (KILOTON)

- TABLE 229 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 230 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 231 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 232 BRAZIL: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 233 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 234 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 235 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 236 ARGENTINA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 237 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 238 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2020–2023 (KILOTON)

- TABLE 239 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 240 REST OF SOUTH AMERICA: PERMANENT MAGNET MARKET, BY END-USE INDUSTRY, 2024–2029 (KILOTON)

- TABLE 241 STRATEGIES ADOPTED BY PERMANENT MAGNET MANUFACTURERS

- TABLE 242 DEGREE OF COMPETITION: PERMANENT MAGNET MARKET

- TABLE 243 PERMANENT MAGNET MARKET: BY TYPE FOOTPRINT

- TABLE 244 PERMANENT MAGNET MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 245 PERMANENT MAGNET MARKET: REGION FOOTPRINT

- TABLE 246 PERMANENT MAGNET MARKET: KEY STARTUPS/SMES

- TABLE 247 PERMANENT MAGNET MARKET: DEALS, JANUARY 2018–DECEMBER 2024

- TABLE 248 PERMANENT MAGNET MARKET: EXPANSIONS, JANUARY 2018–DECEMBER 2024

- TABLE 249 PROTERIAL, LTD.: COMPANY OVERVIEW

- TABLE 250 PROTERIAL, LTD.: PRODUCTS OFFERED

- TABLE 251 ARNOLD MAGNETIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 252 ARNOLD MAGNETIC TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 253 ARNOLD MAGNETIC TECHNOLOGIES: DEALS

- TABLE 254 ARNOLD MAGNETIC TECHNOLOGIES: EXPANSIONS

- TABLE 255 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 256 TDK CORPORATION: PRODUCTS OFFERED

- TABLE 257 TDK CORPORATION: DEALS

- TABLE 258 YANTAI DONGXING MAGNETIC MATERIALS INC.: COMPANY OVERVIEW

- TABLE 259 YANTAI DONGXING MAGNETIC MATERIALS INC.: PRODUCTS OFFERED

- TABLE 260 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 261 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 262 ELECTRON ENERGY CORPORATION: COMPANY OVERVIEW

- TABLE 263 ELECTRON ENERGY CORPORATION: PRODUCTS OFFERED

- TABLE 264 ELECTRON ENERGY CORPORATION: DEALS

- TABLE 265 ADAMS MAGNETIC PRODUCTS, LLC: COMPANY OVERVIEW

- TABLE 266 ADAMS MAGNETIC PRODUCTS, LLC: PRODUCTS OFFERED

- TABLE 267 ADAMS MAGNETIC PRODUCTS, LLC: EXPANSIONS

- TABLE 268 BUNTING MAGNETICS CO.: COMPANY OVERVIEW

- TABLE 269 BUNTING MAGNETICS CO.: PRODUCTS OFFERED

- TABLE 270 BUNTING MAGNETICS CO.: DEALS

- TABLE 271 TENGAM ENGINEERING, INC.: COMPANY OVERVIEW

- TABLE 272 TENGAM ENGINEERING, INC.: PRODUCTS OFFERED

- TABLE 273 NINGBO YUNSHENG CO., LTD.: COMPANY OVERVIEW

- TABLE 274 NINGBO YUNSHENG CO., LTD.: PRODUCTS OFFERED

- TABLE 275 CHENGDU GALAXY MAGNETS CO., LTD.: COMPANY OVERVIEW

- TABLE 276 CHENGDU GALAXY MAGNETS CO., LTD.: PRODUCTS OFFERED

- TABLE 277 GOUDSMIT MAGNETICS: COMPANY OVERVIEW

- TABLE 278 GOUDSMIT MAGNETICS: PRODUCTS OFFERED

- TABLE 279 ECLIPSE MAGNETICS: COMPANY OVERVIEW

- TABLE 280 ECLIPSE MAGNETICS: PRODUCTS OFFERED

- TABLE 281 DEXTER MAGNETIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 282 DEXTER MAGNETIC TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 283 DEXTER MAGNETIC TECHNOLOGIES: DEALS

- TABLE 284 DEXTER MAGNETIC TECHNOLOGIES: EXPANSIONS

- TABLE 285 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 286 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 287 HANGZHOU PERMANENT MAGNET GROUP., LTD: COMPANY OVERVIEW

- TABLE 288 JPMF GUANGDONG CO., LTD: COMPANY OVERVIEW

- TABLE 289 NINGBO NINGGANG PERMANENT MAGNETIC MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 290 THOMAS AND SKINNER INC.: COMPANY OVERVIEW

- TABLE 291 YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 292 NINGBO CO-STAR MATERIALS HI-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 293 NINGBO RISHENG MAGNETS CO., LTD.: COMPANY OVERVIEW

- TABLE 294 VACUUMSCHMELZE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 295 DAIDO ELECTRONICS CO., LTD: COMPANY OVERVIEW

- TABLE 296 PERMANENT MAGNETS LTD.: COMPANY OVERVIEW

- TABLE 297 MAGNEQUENCH INTERNATIONAL, LLC: COMPANY OVERVIEW

- FIGURE 1 PERMANENT MAGNET: MARKET SEGMENTATION

- FIGURE 2 PERMANENT MAGNET MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 METHODOLOGY FOR “SUPPLY-SIDE” SIZING OF PERMANENT MAGNET MARKET

- FIGURE 6 METHODOLOGY FOR “DEMAND-SIDE” SIZING OF PERMANENT MAGNET MARKET

- FIGURE 7 PERMANENT MAGNET MARKET: DATA TRIANGULATION

- FIGURE 8 NEODYMIUM IRON BORON MAGNET DOMINATED PERMANENT MAGNET MARKET IN 2023

- FIGURE 9 CONSUMER ELECTRONICS END-USE INDUSTRY LED PERMANENT MAGNET MARKET IN 2023

- FIGURE 10 CHINA DOMINATED PERMANENT MAGNET MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC LED PERMANENT MAGNET MARKET IN 2023

- FIGURE 12 HIGH DEMAND FROM END-USE INDUSTRIES TO DRIVE PERMANENT MAGNET MARKET

- FIGURE 13 FERRITE MAGNET TYPE DOMINATED OVERALL MARKET, BY VOLUME, IN 2023

- FIGURE 14 GENERAL INDUSTRIAL SEGMENT ACCOUNTED FOR SIGNIFICANT SHARE IN PERMANENT MAGNET MARKET

- FIGURE 15 MARKET IN US TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PERMANENT MAGNET MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 EV SALES, BY MAJOR MARKET (REGION/COUNTRY), 2023

- FIGURE 18 EV SALES FORECAST

- FIGURE 19 RARE EARTH RESERVES, 2022

- FIGURE 20 PERMANENT MAGNET MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 23 PERMANENT MAGNET MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 PERMANENT MAGNET MARKET: RAW MATERIAL

- FIGURE 25 PERMANENT MAGNET MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 PERMANENT MAGNET MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023

- FIGURE 28 AVERAGE SELLING PRICE OF PERMANENT MAGNET, BY END USE (USD/KG), 2023

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PERMANENT MAGNET, BY TYPE (USD/KG), 2023

- FIGURE 30 EXPORT OF PERMANENT MAGNETS, BY KEY COUNTRY, 2019–2023 (USD THOUSAND)

- FIGURE 31 IMPORT OF PERMANENT MAGNET, BY KEY COUNTRY, 2019–2023 (USD THOUSAND)

- FIGURE 32 PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 33 PATENT PUBLICATION TREND, 2014−2024

- FIGURE 34 PERMANENT MAGNET MARKET: LEGAL STATUS OF PATENTS

- FIGURE 35 CHINESE JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2014 AND 2024

- FIGURE 36 MITSUBISHI ELECTRIC CORPORATION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 37 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN PERMANENT MAGNET MARKET

- FIGURE 38 DEALS AND FUNDING IN PERMANENT MAGNET MARKET SOARED IN 2022

- FIGURE 39 PROMINENT PERMANENT MAGNET MANUFACTURING FIRMS IN 2024 (USD MILLION)

- FIGURE 40 NDFEB MAGNETS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 CONSUMER ELECTRONICS INDUSTRY TO CONTINUE LEADING PERMANENT MAGNET MARKET

- FIGURE 42 CHINA TO BE FASTEST-GROWING PERMANENT MAGNET MARKET

- FIGURE 43 NORTH AMERICA: PERMANENT MAGNET MARKET SNAPSHOT

- FIGURE 44 EUROPE: PERMANENT MAGNET MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: PERMANENT MAGNET MARKET SNAPSHOT

- FIGURE 46 PERMANENT MAGNET MARKET: REVENUE ANALYSIS OF TOP-THREE MARKET PLAYERS, 2019–2023

- FIGURE 47 SHARES OF TOP COMPANIES IN PERMANENT MAGNET MARKET, 2023

- FIGURE 48 RANKING OF TOP FIVE PLAYERS IN PERMANENT MAGNET MARKET

- FIGURE 49 PERMANENT MAGNET MARKET: TOP TRENDING BRAND/PRODUCTS

- FIGURE 50 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY PERMANENT MAGNET PRODUCT

- FIGURE 51 PERMANENT MAGNET MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 52 PERMANENT MAGNET MARKET: COMPANY FOOTPRINT

- FIGURE 53 PERMANENT MAGNET MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 54 PERMANENT MAGNET MARKET: ENTERPRISE VALUE/EBITDA OF KEY VENDORS

- FIGURE 55 COMPANY VALUATION

- FIGURE 56 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 NINGBO YUNSHENG CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 CHENGDU GALAXY MAGNETS CO., LTD.: COMPANY SNAPSHOT

The study involves two major activities in estimating the current market size for the permanent magnet market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering permanent magnet products and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the permanent magnet market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the permanent magnet market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of Asia Pacific, Europe, North America, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from permanent magnet industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using permanent magnet products were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of permanent magnets and outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the permanent magnet market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in permanent magnet products in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the permanent magnet industry for each end-use industry. For each end-use industry, all possible segments of the permanent magnet market were integrated and mapped.

Permanent Magnet Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Permanent Magnet Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Permanent magnets are the materials that generate magnetic field with the internal structure of material itself. They retain their magnetic properties for a longer time even after removing the external magnetic force. These magnets are made of ferromagnetic materials such as iron, boron or nickel and possess maximum energy product, high remanence and coercivity. Permanent magnets are used in wide range of applications such as hard drives, CDs, speakers, microphones, motors, MRI machines, generators and sensors.

Key Stakeholders

- Permanent Magnet manufacturers

- Permanent Magnet suppliers

- Raw material suppliers

- End-use industries

- Government bodies

- Universities, Governments, and research organizations

- Research and consulting firms

- R&D institutions

- Investment banks and private equity firms

- Magnet and permanent magnet associations

Report Objectives

- To define, describe, and forecast the permanent magnet market size in terms of volume and value.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global permanent magnet market by type, end-use industries, and region.

- To forecast the market size concerning five main regions (along with country-level data), namely, Asia Pacific, Europe, North America, the Middle East & Africa and South America, and analyze the significant region-specific trends.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape.

- To strategically profile the key market players and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the permanent magnet market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Permanent Magnet Market

General information on Permanent Magnet Market for Energy industry