Renewable Chemicals Market (2010 - 2015)

Updated Version of this Report available here

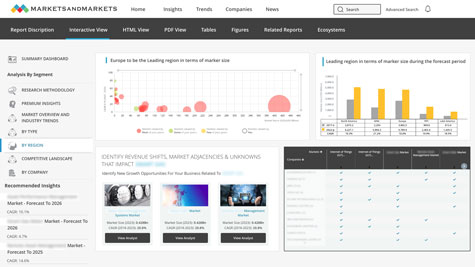

Report Description

This report analyzes the markets for major types of renewable chemicals such as alcohols, polymers, ketones, and acids; as well as the major application markets of renewable chemicals, including industrial, textiles, housing, transportation, environment, communication, recreation, and health applications. The report also analyzes the submarkets for these products and applications; and familiarizes the industry players with the market trends, opportunities, drivers, and inhibitors.

This report identifies the market drivers and inhibitors for each sub-segment to support its analysis of market trends and forecasts. All the submarkets are sized for the four major geographical markets of U.S., Europe, Asia, and Rest of the World (ROW). More than 60 market tables categorized as per products, geography, and applications, are provided for a deeper insight into the market’s competitive landscape. None of the other third-party reports analyze the renewable chemicals market into its various submarkets.

In addition to the market size, data trends, and forecasts, the report will also highlight key market opportunities for the relevant stakeholders. It also analyzes and profiles the key market developments of the top 40 companies while drawing a competitive landscape for major markets and their sub-segments. The existing studies and third-party market reports do not provide an in-depth understanding of the recent developments in the renewable chemicals market.

Want to explore hidden markets that can drive new revenue in Renewable Chemicals Market?

This report uses the term ‘renewable chemicals’ to refer to chemicals derived from renewable sources. The renewable chemicals market is categorized as follows:

- Products: Alcohols, organic acids, ketones, polymers and others products.

- Applications: Industrial, transportation, textiles, food safety, environment, communication, housing, recreation, health and hygiene, and others.

- Catalysis: Biocatalysis – enzymes, microorganism, multicellular Chemical catalysis – heterogeneous and homogeneous catalysts.

- Technology: Thermo-chemical conversion, fermentation and bioconversion, product separation and upgrading, enzymatic hydrolysis, gasification-fermentation, acid hydrolysis, biochemical-thermochemical, biochem-organisolve, fischer-tropsch diesel, reductive transformation, dehydrative transformation and other technologies.

- Platform chemicals: 1,4-diacids, 2,5-furan dicarboxylic acid, 3-hydroxypropionic acid, aspartic acid, glucaric acid, glutamic acid, itaconic acid, levulinic acid, glycerol and other chemicals.

- Bio-feedstock: Starch, cellulose, hemicellulose, lignin, fats, oils, and protein.

- Source: Plant biomass, animal biomass, and marine biomass.

What makes our reports unique?

- We provide the longest market segmentation chain in the industry with our three-level market breakdown and our analysis of minimum 40 collectively exhaustive and mutually exclusive micro markets.

- We provide 10% customization to ensure that our clients find the specific market intelligence they need.

- Each report is about 150 pages, featuring 30+ market data tables, 30+ company profiles, and an analysis of 200 patents.

- No single report by any other publisher provides market data for all market segments (i.e. products, services, applications, ingredients, and technology) covering the four geographies of North America, Europe, Asia Pacific, and ROW.

- 15 pages of high level analysis identifying opportunities, best practices, entry strategies, benchmarking strategies, market positioning, product positioning, and competitive positioning.

Key questions answered

- Which are the high-growth segments and how is the market segmented in terms of applications, products, services, ingredients, technologies, stakeholders?

- What are market estimates and forecasts; which markets are doing well and which are not?

- Where are the gaps and opportunities; what factors are driving market growth?

- Which are the key playing fields and winning-edge imperatives?

- What is the competitive landscape; who are the main players in each segment; what are their strategic directives, operational strengths, key selling products, and product pipelines? Who is doing what?

Powerful Research and analysis

The analysts working with MarketsandMarkets come from renowned publishers and market research firms globally, adding their expertise and domain understanding. We get the facts from over 22,000 news and information sources, a huge database of key industry participants and draw on our relationships with more than 900 market research companies.

Renewable chemicals Market

The renewable chemicals market includes all the chemicals that are obtained from renewable feedstock such as agricultural raw materials, agricultural waste products or biomass, microorganisms etc. The primary motivation behind the development of this market is decoupling economic growth from finite non renewable resource consumption as well as diversifying the feedstock portfolio. The renewable chemicals market is estimated to reach $59 billion in 2014 from about $45 billion in 2009.

Though the alcohols market is the primary contributor to the significant market size, it is expected to grow at the slowest pace among all the market segments. In contrast to the alcohols market, polymers represent the highest growth potential at an expected CAGR of 11.0% from 2009 to 2014.The market is driven by its expected rise in the demand from the food packaging industry, biodegradable and compostable plastics and other consumer products.

Transportation commands the maximum share among the application areas of the renewable chemicals at 23% of the overall market followed by health & hygiene and safe food supply at 19% and 15% respectively. Economic as well as environmental factors are responsible for the large scale adaptation of renewable chemicals in the above stated areas.

Platform chemicals are estimated to reach $3.5 billion in 2014 from $1.9 billion in 2009 at an optimistic CAGR of 12.6% from 2009 to 2014. Platform chemicals play an important role in the renewable chemicals market since they contain multiple functional groups and hence present practical potential for their conversion to families of useful products.

The renewable chemicals market is currently restrained due to competition from conventional chemicals derived from petrochemical feedstock. Though volatility in crude oil prices affects the market for chemicals by putting strain on the margins of the companies, the stability in their prices in a relatively short duration of time has again brought back confidence in the market participants. There is an immediate need for a paradigm shift of these participants from petrochemical feedstock to the renewable feedstock not only due to the economic reasons but also due to the rising concern over green house gas emissions and their lasting impact on the global environment. Moreover, the role played by technology and catalysis is of considerable importance in the renewable chemicals market. Catalysis use in renewable chemicals is estimated to grow at a CAGR of 10.2% for the next five years.

Immense market opportunity lies for the renewable chemicals in the developing economies of India, China along with Japan and Russia. The market for renewable chemicals is untapped in these economies that largely consume chemicals from petrochemical feedstock. It is expected that government support and initiatives for the consumption of these chemicals will provide necessary boost to the market for renewable chemicals in these economies.

The renewable chemicals market is not fragmented with limited competition in this niche market. Some of the key players in this field are Cargill, Inc. Novozymes, Genencor International, Inc. BASF, DSM, DuPont and Metabolix. Strategic alliances and new technology developments are a few of the popular strategies incorporated by the companies in this field to gain competitive edge over other leading market players and to build their strength by knowledge and resource sharing. Our patent analysis indicates that consumer demand for green products, government support and economic concern has resulted in an apparent increase in the number of patents especially for renewable or bio polymers in 2008.

1. Introduction

1.1. Key takeaways

1.2. Report description

1.3. Market covered

1.4. Stakeholders

2. Summary

3. Market overview

3.1. Driving factors analysis for renewable chemicals market

3.2. Drivers

3.2.1. Economic and environmental pressure on petroleum-derived feedstock

3.2.2. Growing popularity of platform chemicals and biopolymers

3.2.3. Growing industrial responsibility

3.2.4. Consumer awareness and end-product acceptance

3.2.5. Increased decoupling from food supply chain

3.3. Restraints

3.3.1. Problems associated with the production process

3.3.2. Cost of production inhibiting growth of polymers

3.4. Opportunities

3.4.1. Improvement in chemical conversion can improve yields

3.4.2. Opportunities presented by lignin

3.4.3. Under-penetration in Asian countries

4. Renewable chemicals products

4.1. Alcohols

4.1.1. Drivers

4.1.1.1. Multiple sources eco-friendly receive governmental support

4.1.1.2. ‘green image’ garners public favor

4.1.1.3. Relatively lower price-sensitivity

4.1.2. Restraints

4.1.3. C1 and c2

4.1.3.1. Methanol

4.1.3.2. Ethanol

4.1.4. C3 and above

4.1.4.1. 1-propanol

4.1.4.2. Isobutanol

4.1.4.3. 1-pentanol

4.1.4.4. 2-propanol

4.1.4.5. 2-ethyl-1-hexanol

4.1.4.6. 1-nonanol

4.1.4.7. 2-octanol

4.1.4.8. 1-octanol

4.1.4.9. 1-decanol

4.1.4.10. 1-dodecanol

4.2. Organic acids

4.2.1. C1 and c2 acids

4.2.1.1. Formic acid

4.2.1.2. Acetic acid

4.2.1.3. Glycolic acid

4.2.2. C3 and above

4.2.2.1. Propionic acid

4.2.2.2. Butyric acid

4.3. Ketones

4.3.1. Acetone

4.3.2. Methyl ethyl ketone

4.4. Polymers

4.4.1. Market drivers

4.4.1.1. Technology push

4.4.1.2. Economical benefit

4.4.1.3. Reduced correlation with food supply

4.4.1.4. At par with conventional petrochemical derived polymers

4.4.2. Restraints

4.4.2.1. Lack of cost competitiveness

4.4.2.2. Limited potential in certain high growth areas

4.4.3. Opportunities

4.4.3.1. Wider range of applications

4.4.3.2. Biotechnology companies

4.4.4. Polylactic acid

4.4.5. Polyhydroxyalkanoates

4.4.6. Polyvinyl acetate

4.4.7. Polyamino acids

4.4.8. Polyglycolic acid

4.4.9. Polyacrylamide

5. Renewable chemicals application

5.1. Industrial

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Corrosion inhibitor

5.1.4. Emission abatement

5.1.5. Specialty lubricants

5.2. Transportation

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Fuels

5.2.4. Oxygenates

5.2.5. Anti-freeze

5.2.6. Wiper fluids

5.3. Textiles

5.3.1. Carpets

5.3.2. Fabrics

5.3.3. Fabric coatings

5.3.4. Foam cushions

5.4. Food preservation & production enhancement

5.4.1. Drivers

5.4.2. Restraints

5.4.3. Food packaging

5.4.4. Antimicrobial packaging

5.4.5. Fertilizers

5.4.6. Beverage bottles

5.5. Environment

5.6. Housing

5.7. Recreation

5.8.Health & hygiene

6. Catalysis

6.1. Biocatalysis

6.1.1. Drivers

6.1.1.1. Improved enzymes help in better industrial processes

6.1.1.2. Benefits over chemical catalysis

6.1.1.3. High specificity and multi-step reactions yield improved results

6.1.1.4. Governmental concern over environmental issues

6.1.2. Restraints

6.1.2.1. Slower process increases production costs

6.1.2.2. Limited ‘biocatalyst inventory’

6.1.2.3. Limited knowledge of industrially significant reactions

6.1.3. Opportunities

6.1.3.1. Cost-effective preparation of biocatalysts

6.1.3.2. Lower water and energy consumption

6.1.4. Enzymes

6.2. Chemical catalysis

6.2.1. Drivers

6.2.1.1. Faster and simpler processes

6.2.1.2. Development of heterogeneous catalysts

6.2.2. Restraints & Opportunities

6.2.2.1. High energy requirements

7. Technology

7.1. Thermochemical conversion

7.2. Gasification

7.3. Pyrolysis

7.4. Hydrothermal upgrading

7.5. Fermentation and bioconversion

7.6. Product separation and upgrading

7.7. Enzymatic hydrolysis

7.8. Gasification-fermentation

7.9. Acid hydrolysis

7.10. Biochemical-thermochemical

7.11. Biochem-organisolve

7.12. Fischer tropsch diesel

7.13. Reductive transformation

7.14. Dehydrative transformation

8. Platform chemicals

8.1. 1, 4-diacids

8.1.1. Succinic acid

8.1.1.1. Drivers

8.1.1.1.1. Commercial use for derivatives

8.1.1.1.2. Application in varied industries

8.1.1.1.3. Demand expected to see double digit rise

8.1.1.2. Restraints and opportunities

8.2. Fumaric acid

8.2.1. Drivers

8.2.2. Restraints

8.3. 2, 5- furan dicarboxylic acid

8.3.1. Drivers

8.3.1.1. Fdca derivatives have wide-ranging applications

8.3.2. Restraint

8.3.2.1. Non-selective dehydration of sugar

8.3.2.2. Lack of knowledge about polymer formation

8.3.3. Opportunities

8.3.3.1. Problem of non selective production of FCDA to be removed

8.3.3.2. Overcoming technological barriers

8.4. 3- Hydroxypropionic acid

8.4.1. Drivers

8.4.1.1. Uses only via renewable feedstock route

8.4.1.2. Wide ranging applications

8.4.2. Restraints

8.4.2.1. Fermentation routes still expensive

8.4.2.2. New catalysts increase R&D costs

8.5. Aspartic acid

8.5.1. Drivers

8.5.1.1. Several benefits to producers

8.5.1.2. Market potential for amino analogs

8.5.2. Opportunities

8.5.2.1. An alternative direct fermentation route

8.5.2.2. Better quality products

8.6. Glucaric acid

8.7. Glutamic acid

8.8. Itaconic acid

8.9. Levulinic acid

8.9.1. Drivers

8.9.1.1. All derivatives of levulinic acid of significant value

8.9.2. Opportunities

8.10. Glycerol

8.10.1. Drivers

8.10.1.1. Demand associated with that of biodiesel

8.10.1.2. Cost effectiveness and biodegradable products

8.10.2. Restraints

8.10.3. Opportunities

9. Biofeedstock and source

10. Geographic analysis

10.1. The u.s. Renewable chemicals market

10.2. The european renewable chemicals market

10.3. The asian renewable chemicals market

11. Company profiles

11.1. Abengoa bioenergy

11.2. Altus pharmaceuticals

11.3. Archer-daniels-midland company

11.4. Arkenol

11.5. Avantium technologies

11.6. Basf

11.7. Bio-amber

11.8. Bio-mer

11.9. Bluefire ethanol

11.10. Braskem

11.11. Cargill inc.

11.12. Chevron corporation

11.13. Codexis, inc.

11.14. Croda inc.

11.15. Degussa evonik

11.16. Dow chemical company

11.17. Dsm

11.18. Dupont

11.19. Eastman chemicals

11.20. Ensyn technologies inc.

11.21. Genecor international, inc.

11.22. General biomass company

11.23. Greenfield ethanol, inc.

11.24. Gushan environmental energy

11.25. Ineos bio

11.26. Innovia films

11.27. Inventure chemicals

11.28. Iogen corporation

11.29. Materia, inc.

11.30. Nature works llc

11.31. Novozymes

11.32. Panda ethanol

11.33. Purac biochem bv

11.34. Pure vision technology

11.35. Sapphire energy, inc.

11.36. Seambiotic

11.37. Solvay chemicals

11.38. Spartan chemical company inc.

11.39. Uop llc

11.40. Verenium corporation

12. Patent analysis

12.1. Appendix

12.1.1. U.s. Patents

12.1.2. E.u. Patents

12.1.3. Asia patents

List of Tables

SUMMARY TABLE GLOBAL renewable chemicals MARKET 2007 – 2014 ($thousands)

1. TABLE 1 GLOBAL renewable alcohol MARKET, by products 2007 - 2014 ($thousands)

2. TABLE 2 GLOBAL renewable alcohol MARKET, by geography 2007 - 2014 ($thousands)

3. TABLE 3 major players and product developments

4. TABLE 4 GLOBAL renewable C1 and C2 alcohol MARKET, by product 2007 - 2014 ($thousands)

5. TABLE 5 GLOBAL renewable C1 and C2 alcohol MARKET, by geography 2007 - 2014 ($thousands)

6. TABLE 6 GLOBAL renewable methanol MARKET, by geography 2007 - 2014 ($thousands)

7. TABLE 7 GLOBAL renewable ethanol MARKET, by geography 2007 - 2014 ($thousands)

8. TABLE 8 GLOBAL renewable C3 and above Alcohol MARKET, by product 2007 – 2014 ($thousands)

9. TABLE 9 GLOBAL renewable C3 and above Alcohol MARKET, by geography 2007 - 2014 ($thousands)

10. TABLE 10 GLOBAL renewable 1-propanol MARKET, by geography 2007 - 2014 ($thousands)

11. TABLE 11 GLOBAL renewable Iso-butanol MARKET, by geography 2007 - 2014 ($thousands)

12. TABLE 12 GLOBAL renewable 1-pentanol MARKET, by geography 2007 - 2014 ($thousands)

13. TABLE 13 GLOBAL renewable 2-propanol MARKET, by geography 2007 - 2014 ($thousands)

14. TABLE 14 GLOBAL renewable 2-ethyl-1-hexanol MARKET, by geography 2007 - 2014 ($thousands)

15. TABLE 15 GLOBAL renewable 1-nonanol MARKET, by geography 2007 - 2014 ($thousands)

16. TABLE 16 GLOBAL renewable 2-octanol MARKET, by geography 2007 - 2014 ($thousands)

17. TABLE 17 GLOBAL renewable 1-octanol MARKET, by geography 2007 – 2014 ($thousands)

18. TABLE 18 GLOBAL renewable 1-decanol MARKET, by geography 2007 - 2014 ($thousands)

19. TABLE 19 GLOBAL renewable 1-dodecanol MARKET, by geography 2007 - 2014 ($thousands)

20. TABLE 20 GLOBAL renewable organic acids MARKET, by products 2007 - 2014 ($thousands)

21. TABLE 21 GLOBAL renewable organic acids MARKET, by geography 2007 - 2014 ($thousands)

22. TABLE 22 GLOBAL renewable C1 and c2 acids MARKET, by product 2007 - 2014 ($thousands)

23. TABLE 23 GLOBAL renewable C1 and c2 acids MARKET, by geography 2007 - 2014 ($thousands)

24. TABLE 24 GLOBAL renewable formic acid MARKET, by geography 2007 - 2014 ($thousands)

25. TABLE 25 GLOBAL renewable acetic acid MARKET, by geography 2007 - 2014 ($thousands)

26. TABLE 26 GLOBAL renewable glycolic acid MARKET, by geography 2007 - 2014 ($thousands)

27. TABLE 27 GLOBAL renewable C3 and above acids MARKET, by product 2007 - 2014 ($thousands)

28. TABLE 28 GLOBAL renewable C3 and above acids MARKET, by geography 2007 - 2014 ($thousands)

29. TABLE 29 GLOBAL renewable propionic acid MARKET, by geography 2007 - 2014 ($thousands)

30. TABLE 30 GLOBAL renewable butyric acid MARKET, by geography 2007 - 2014 ($thousands)

31. TABLE 31 GLOBAL renewable ketones MARKET, by product 2007 - 2014 ($thousands)

32. TABLE 32 GLOBAL renewable ketones MARKET, by geography 2007 - 2014 ($thousands)

33. TABLE 33 GLOBAL renewable Acetone MARKET, by geography 2007 - 2014 ($thousands)

34. TABLE 34 GLOBAL renewable methyl ethyl ketone MARKET, by geography 2007 - 2014 ($thousands)

35. TABLE 35 GLOBAL renewable polymers MARKET, by product 2007 - 2014 ($thousands)

36. TABLE 36 GLOBAL renewable polymers MARKET, by geography 2007 - 2014 ($thousands)

37. TABLE 37 major players and product developments

38. TABLE 38 GLOBAL renewable polylactic acid MARKET, by geography 2007 - 2014 ($thousands)

39. TABLE 39 GLOBAL renewable polyhydroxyalkanoates MARKET, by geography 2007 - 2014 ($thousands)

40. TABLE 40 GLOBAL renewable polyvinyl acetate MARKET, by geography 2007 - 2014 ($thousands)

41. TABLE 41 GLOBAL renewable polyamino acids MARKET, by geography 2007 - 2014 ($thousands)

42. TABLE 42 GLOBAL renewable polglycolic acid MARKET, by geography, 2007 - 2014 ($thousands)

43. TABLE 43 GLOBAL renewable polyacrylamide MARKET, by geography 2007 - 2014 ($thousands)

44. TABLE 44 GLOBAL industrial MARKET, by application 2007 – 2014 ($thousands)

45. TABLE 45 GLOBAL transportation MARKET, by application 2007 - 2014 ($thousands)

46. TABLE 46 GLOBAL textiles MARKET, by application 2007 - 2014 ($thousands)

47. TABLE 47 GLOBAL food preservation & production enhancement MARKET, by application 2007 - 2014 ($thousands)

48. TABLE 48 GLOBAL environment MARKET, by application 2007 - 2014 ($thousands)

49. TABLE 49 GLOBAL housing MARKET, by application 2007 - 2014 ($thousands)

50. TABLE 50 GLOBAL recreation MARKET, by application 2007 - 2014 ($thousands)

51. TABLE 51 GLOBAL health & hygiene MARKET, by application 2007 - 2014 ($thousands)

52. TABLE 52 GLOBAL Catalysis MARKET, by product 2007 - 2014 ($millions)

53. TABLE 53 major players and product developments

54. TABLE 54 GLOBAL bioCatalysis MARKET, by product 2007 - 2014 ($millions)

55. TABLE 55 GLOBAL chemical catalysis MARKET, by product 2007 - 2014 ($millions)

56. TABLE 56 GLOBAL technology MARKET 2007 - 2014 ($thousands)

57. TABLE 57 major players and product developments

58. TABLE 58 GLOBAL platform chemicals MARKET, by product 2007 - 2014 ($millions)

59. TABLE 59 major players and product developments

60. TABLE 60 GLOBAL 1, 4-diacids MARKET, by product 2007 - 2014 ($millions)

61. TABLE 61 GLOBAL renewable chemicals MARKET 2007 - 2014 ($ millions)

62. TABLE 62 U.S renewable chemicals MARKET 2007 - 2014 ($ millions)

63. TABLE 63 european renewable chemicals MARKET 2007 - 2014 ($ millions)

64. TABLE 64 asian renewable chemicals MARKET 2007 - 2014 ($ thousands)

List of Figure

1. FIGURE 1 PARENTAL STRUCTURE OF renewable chemicals MARKET

2. FIGURE 2 EVOLUTION OF renewable chemicals

3. FIGURE 3 DRIVING FACTORS ANALYSIS FOR renewable chemicals MARKET

4. Figure 4 Production of ethanol from cellulose

5. Figure 5 FAVORABILITY of biopolymers

6. Figure 6 Analysis of the market potential of renewable chemicals under four distinct scenarios

7. Figure 7 Relation among renewable chemicals, biocatalysis, and chemical catalysis

8. Figure 8 Market potential for renewable platform chemicals

9. Figure 9 expected renewable chemicals application in 2009

10. Figure 10 biofeedstock utilization in renewable chemicals

11. Figure 11 source of renewable chemicals

12. FIGURE 12 GEOGRAPHic SEGMENTATION OF renewable chemicals patents

13. FIGURE 13 product SEGMENTATION OF renewable chemicals patents

14. FIGURE 14 company WISE SEGMENTATION OF renewable chemicals patents

LIST OF ACRONYMS

1. API: Active pharmaceutical ingredients

2. ASTM: American Society for Testing and Materials

3. BDO: Butanediol

4. BOPP: Baxially Oriented Polypropylene

5. BTX: Benzene-toluene-xylene

6. CAGR: Compounded annual growth rate

7. CPI: Chemical process industries

8. DOE: United States Department of Energy

9. EPA: Environmental Protection Agency

10. FDCA: 2,5- furan dicarboxylic acid

11. GBL: Gamma-butyrolactone

12. GHG: Green house gasses

13. GM: General Motors

14. GTBE: Glycerol tertiary butyl ether

15. HAZOP: Hazard and operability studies

16. IB: Industrial biotechnology

17. LA: Levulinic acid

18. LCD: Liquid crystal display

19. MTBE: Methyl tertiary butyl ether

20. NRC-BRI: National Research Council of Canada Biotechnology Research Institute

21. NREL: National Renewable Energy Laboratory

22. PBT: Polybutyleneterephthalate

23. PDO: 1,3-propanediol

24. PET: Polyethylene terephthalate

25. PGA: Polyglycolic acid

26. PHA: Polyhydroxyalkanoates

27. PLA: Polylactic acid

28. PTT: Polytrimethylene terephthalate

29. PVAM: Polyvinylamine

30. R&D: Research and development

31. REACH: Registration, Evaluation, Authorization and Restriction of Chemical substances

32. RRM: Renewable raw material

33. SDTC: Sustainable Development Technology Canada

34. THF: Tetrahydrofuran

35. 3-HP: 3-hydroxypropionic acid

Growth opportunities and latent adjacency in Renewable Chemicals Market