Satellite Ground Station Market by Function (Communication, Earth Observation, Space Research, Navigation), Solution (Equipment, Software, Ground Station as a Service), Frequency, Platform, Orbit, End User, and Region - Global Forecast to 2028

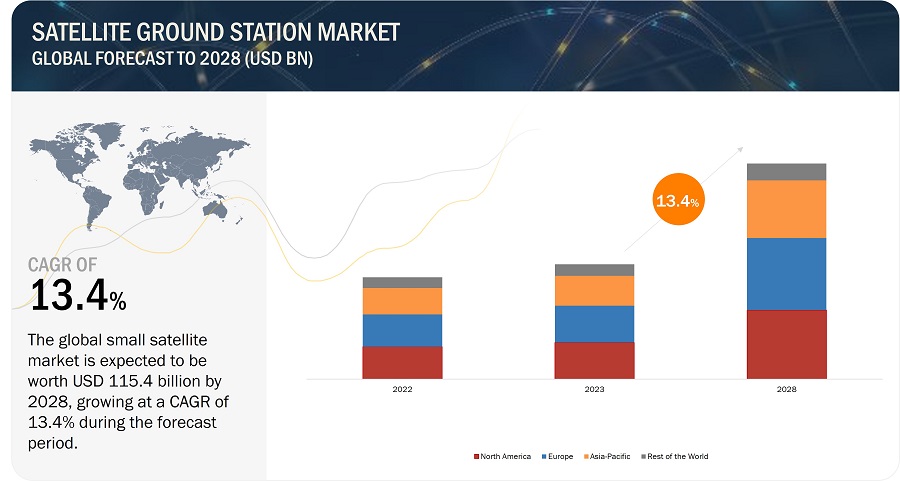

The Satellite Ground Station Market is projected to grow from USD 61.5 billion in 2023 to USD 115.4 billion by 2028, at a CAGR of 13.4 %. Satellite ground stations are built per the function of the satellite they are supposed to communicate with. The rigorous development of satellite ground station equipment and the increased scope of satellite communication across insurance, homeland security, defense, marine, and search & rescue, among other sectors, are primarily responsible for the rapid growth of the satellite ground station market.

The space industry is shifting toward a future with a large constellation of satellites that creates an efficient satcom network for offering all types of satellite services globally. Government support and growing investments are propelling the launch of satellites into space, further boosting the growth of the satellite ground station industry. Increased adoption of big data, artificial intelligence (AI), the Industrial Internet of Things (IIoT), the Internet of Things (IoT), and data analytics in satellite ground stations are democratizing space and making new space applications a reality.

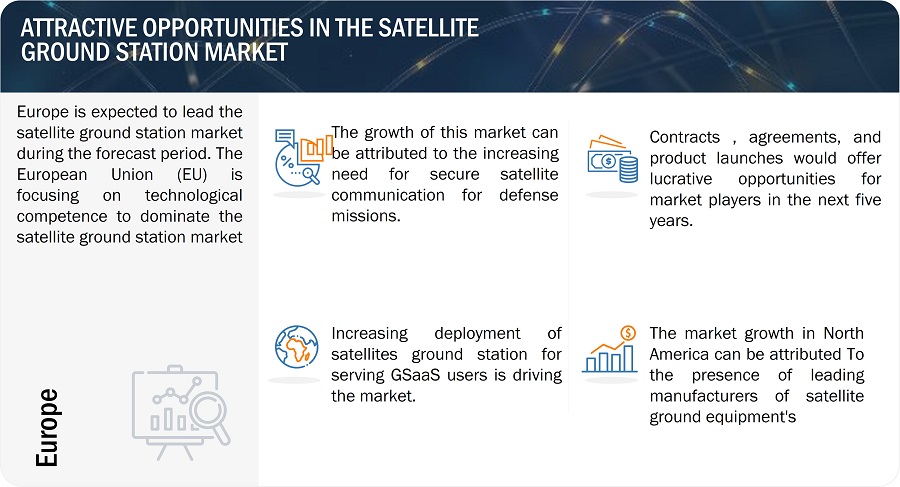

These satellite ground stations help provide a stable space-based communication platform for IoT devices. They are now being developed in large volumes for mega-constellations for communication, earth observation, and IoT. Furthermore, the deployment of satellite ground stations for providing services to multiple users is the latest trend in the market. This technology is known as Ground Station as a Service (GSaaS). By offering GSaaS, a satellite and a base station owner offers services related to SATCOM to more than one user. These users do not own a satellite themselves, but still can avail the satcom services by owning the particular frequency band from the system owned by the GSaaS service providers.

Satellite Ground Station Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Satellite Ground Station Market Dynamics

Driver: High demand for satellite-based services

High-speed internet, digital broadcasting, and other satellite-based services are becoming popular, especially in rural areas with little terrestrial infrastructure. Given the launch of new satellites and the expansion of their service regions, satellite operators are experiencing a surge in demand for ground stations that can connect with and manage these satellites. The demand for low-cost broadband is also increasing among consumers in underdeveloped countries that may not have access to the internet. These market expectations are driving investments in ground stations and networking. Large constellations of satellites are being launched by satellite companies such as SpaceX (US), OneWeb (UK), and Amazon’s Project Kuiper to offer international broadband internet services. This reflects the dire need for ground stations that can interact with and command these satellites. In response, several businesses are creating novel ground station technologies. For instance, UbiquitiLink (US) is creating a “cell tower in space” using a network of LEO satellites to enable cellular connectivity in remote regions.

Restraints: Difficulty in raising funds for satellite ground station construction & operation for commercial operators

As the satellite industry becomes competitive, ground station operators may find it difficult to obtain finance for the expensive investments required to build and maintain satellite ground stations. To fund their operations and expansion ambitions, operators may need to look for funding from a variety of sources, including banks, private equity firms, or venture capitalists. The high expenses of constructing and operating satellite ground stations, the need for lengthy expenditures, and the inherent dangers of the satellite sector are just a few of the factors that may make it difficult for commercial ground station operators to obtain funding. It costs a lot of money to build and maintain satellite ground stations. The infrastructure that ground station operators are required to invest in includes antennas, radio frequency equipment, and data processing and storage facilities. Also, to make sure they have qualified people to run and maintain the facilities, ground station operators may need to spend in staff training and development programs.

Financing is difficult since satellite ground station investments are long-term in nature. In order to create the required infrastructure, ground station operators must invest a large sum of money up front, and the profits on that investment might not be seen for several years. Moreover, spending on satellite ground station infrastructure frequently necessitates expensive, long-term upkeep and improvements. Last but not least, the risks involved with the satellite sector could make funding more difficult. The satellite sector faces a number of hazards, such as governmental obstacles, technological obsolescence, and competition from new players. When looking for financing, ground station operators must take these risks into account because they could affect the investment's feasibility.

Opportunities: 5G and networking

The deployment of new infrastructure to accommodate the rising demand for mobile data services is a key component of both the implementation of 5G and network compression, two ideas that are closely related. In comparison to earlier wireless network generations, 5G networks offer faster speeds, lower latency, and more dependable connections; yet, in order to provide coverage and capacity, more cell sites are needed. The goal of network compression is to increase the number of cell sites in a specific area in order to boost network capacity and coverage. Little cells-miniature, low-power antennas that can be mounted on lampposts, rooftops, and other urban infrastructure-must be used for this. Small cells can be placed in higher numbers to give more granular coverage and capacity despite having a smaller coverage area than conventional macro cell towers.

The higher frequency bands used by 5G have a shorter range and are more easily blocked by objects like buildings and trees, the deployment of tiny cells is essential for 5G networks. This means that compared to earlier wireless network generations, 5G networks will need a lot tinier cells. There are a number of potential effects that the introduction of 5G networks and network compaction may have on the satellite ground station business. First, there may be new business prospects for satellite ground station suppliers due to the growing demand for small cells and related infrastructure. Satellite ground stations could offer an alternative method of communication where traditional terrestrial infrastructure deployment is difficult or prohibitively expensive. Second, chances for satellite-based backhaul, which involves transmitting data between small cells and the main network, may arise as a result of 5G networks and network compression. In locations where traditional backhaul techniques, like fibre optic cables, are neither practical or cost-effective, satellite-based backhaul may be employed.

Finally, the demand for satellite-based remote sensing and Earth observation applications may expand with the adoption of 5G networks and network compression. For instance, satellite data might be used to keep an eye on the condition of buildings and other types of infrastructure to make sure they are not harmed by the increased density of small cells. It is important to keep in mind that the market for satellite ground stations may not be completely impacted by 5G networks and network compression. These technologies may open up new possibilities, but they may also put existing satellite-based services in some situations in direct competition. For instance, satellite communication may not be as competitive in places with easy access to terrestrial infrastructure.

Challenges: Bandwidth constraint

One of the major issues facing the industry for satellite ground stations is a lack of bandwidth. The maximum quantity of data that may be sent across a communication link in a specific length of time is referred to as bandwidth. The physical characteristics of the communication medium and the usable frequency ranges place a restriction on the amount of bandwidth available for satellite communication. Radio frequency bands are frequently used in satellite communication to convey data between the satellite and the ground station. Transnational organisations like the International Telecommunications Union (ITU) manage the satellite communication frequency bands to prevent interference with other communication systems. The need for bandwidth is rising as more satellites are launched and more data-intensive applications are created, yet the frequency bands that are currently available are limited.

The management of satellite communication's constrained bandwidth involves ground stations significantly. By receiving and sending data between the satellite and the end user, ground stations serve as a gateway. Ground station operators employ a number of strategies to optimise data transmission in order to manage limited bandwidth. Using sophisticated modulation and coding techniques, which enable the transmission of more data over the same bandwidth, is one strategy. It can enhance the quantity of data that can be transmitted through a specific frequency band and is known as spectral efficiency. Frequency reuse is a different strategy that entails using the same frequency band for several satellites while sparingly distributing frequency slots and minimising interference.

Operators of ground stations manage bandwidth allotment using sophisticated scheduling techniques as well. These algorithms maximise the use of available resources by taking into consideration elements like satellite orbit, customer demand, and available bandwidth. Also, to improve the signal-to-noise ratio and lessen interference, ground station operators can change the power levels of their transmission. Limited bandwidth continues to be a major obstacle for the satellite ground station market despite these strategies. Ground station operators will need to come up with creative new ways to manage scarce resources as bandwidth demand rises. By increasing the number of satellites in orbit and utilising cutting-edge communication technology, new satellite constellations, like those put forth by SpaceX and OneWeb, hope to solve the problem. It is yet unclear whether these systems will be able to solve the bandwidth problem because they are still in the early stages of development.

Satellite Ground Station Market Ecosystem

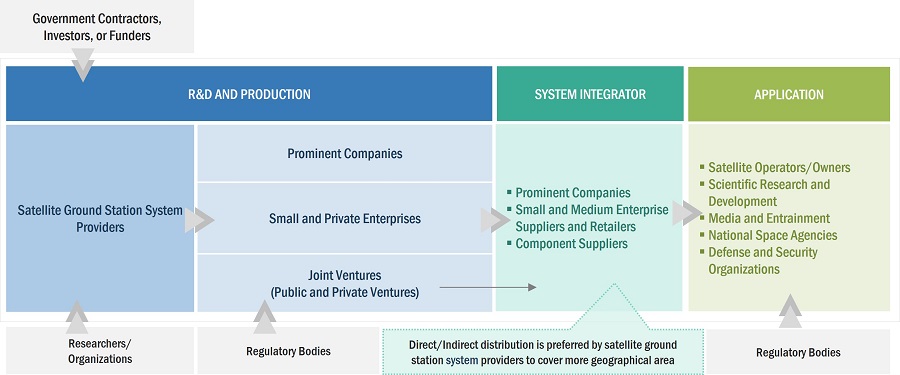

Prominent companies in this market include well-established, financially stable manufacturers of Satellite Ground Station systems and platforms. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and Kongsberg Gruppen ASA (Norway).

Based on Solution, Ground Station as a Service (GSaaS) segment is estimated to account for the largest market share of the Satellite Ground Station market

Based on Solution, the Ground Station as a Service (GSaaS) segment is estimated to account for the largest market share. GSaaS is a promising development in the space industry and is expected to grow in popularity as more organizations look to leverage the benefits of satellite communications without investing in their own ground station infrastructure.

Based on Platform, the fixed segment is anticipated to dominate the market

Based on platform, the fixed segment holds the largest market share. Fixed satellite ground stations are suitable for remote sensing & Earth observation, satellite broadcasting, and scientific research applications, as they can quickly send and receive massive amounts of data. They can also be used for data relay, enabling real-time communication between satellites even when outside their ground stations’ communication range. Mobile segment is also expanding as the platform is widely adopted for the military operations.

Communication Segment of the Satellite Ground Station market is to dominate the market.

Based on function, the market is segmented into communication, earth observation, navigation, space research. The introduction to of 5G and the development of new hardware systems are creating exploiting lucrative numerous opportunities in the field of satellite-enabled communication. Additionally increased in R&D activities for communication-related missions are expected to offer enhanced quality communication systems with the help of highly sophisticated miniaturized on-board systems, along with and advanced mission-compatible satellite ground -station technologies.

Commercial segment of the Satellite Ground Station market by End user is projected to witness the highest market share of the Satellite Ground Station market.

The end user segment is to hold the highest market share. Satellite ground station manufacturers are constantly upgrading their equipment and system to produce a more technically advanced ground system to meet the demand of the commercial sector. Businesses can communicate with clients, partners, and suppliers worldwide due to satellite ground stations, which offer dependable and secure data, phone, and video transmission.

The C-band segment of the Satellite Ground Station market by frequency is projected to dominate the market.

The market based on frequency is segmented into C-band, S-band, K-band, X-band, UHF/VHF/HF-band, and other frequency bands. Increased demand for the C-band spectrum for 5G networks has resulted in discussions and suggestions for sharing this spectrum between satellite and terrestrial services in recent years. Hence the adoption of C-band is expected to increase during the forecast period.

The LEO segment of the Satellite Ground Station market by orbit is projected to dominate the market.

The Low Earth Orbiting (LEO) Segment holds the major market share of the Satellite Ground Station market by orbit segment. The market is influenced by the growing demand for communication and small satellites that help achieve attitude and orbit control and orbital transfers , which will enhance the growth of the market.

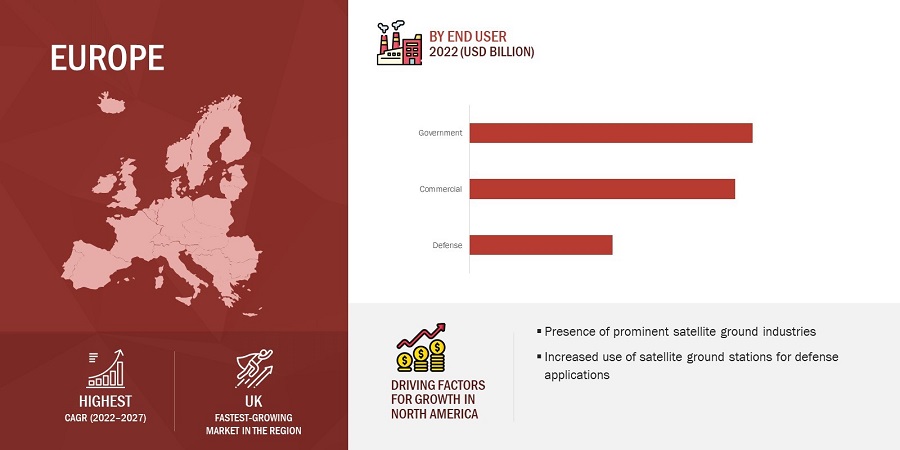

The Europe market is projected to witness the highest growth rate for the Satellite Ground Station market.

Europe is expected to hold the highest growth rate in the Satellite Ground Station market during the forecast period. The north America holds the highest market share. The US is the largest market for Satellite Ground Station market in North America. The growth of the market in North America can be attributed to the increased demand for Satellite Ground Station deployments. The satellite ground station market in Europe was predicted to develop and evolve in future years, owing to advancements in satellite technology and rising demand for satellite-based applications and services.

Satellite Ground Station Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Satellite Ground Station Companies - Key Market Players

The Satellite Ground Station Companies are dominated by a few globally established players such as General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and Kongsberg Gruppen ASA (Norway) are some of the leading players operating in the Satellite Ground Station market, are the key manufacturers that secured Satellite Ground Station contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, government and military & space users across the world.

Want to explore hidden markets that can drive new revenue in Satellite Ground Station Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in Satellite Ground Station Market?

|

Segment |

Subsegment |

|

Estimated Market Size |

USD 61.5 Billion by 2023 |

|

Projected Market Size |

USD 115.4 Billion by 2028 |

|

CAGR |

13.4% |

|

Market size available for years |

2019–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Solution, By Fucntion, By Platform, By End User, By Frequency, By Orbit |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and Kongsberg Gruppen ASA (Norway) and among others. |

Satellite Ground Station Market Highlights

The study categorizes the Satellite Ground Station market based on Application, Sub-system, End-use, Mass, Frequency, Orbit and Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Function |

|

|

By Frequency |

|

|

By Orbit |

|

|

By End User |

|

|

By Solution |

|

|

By Region |

|

Recent Developments

- In April 2023, Aselsan A.S. :- Aselsan A.S. designed an airborne satellite communication system terminal to provide video teleconferencing and data and fax communication through satellites on UAVs, maritime airplanes, and other platforms. It can accurately track the satellite and has two axes: stabilization and polarization tracking.

- In November 2022, Northrop Grumman Corporation: - Northrop Grumman Corporation demonstrated its prototype Tactical Intelligence Targeting Access Node (TITAN). It is an all-domain ground station that will provide rapid satellite images and data to command centers across the borders.

- In June 2021, Lockheed Martin Corporation: - Lockheed Martin Corporation developed cloud-based software for ground control systems. Verge is a service that uses a network of low-cost receivers combined with cloud computing and storage power.

Frequently Asked Questions (FAQ):

Which are the major companies in the Satellite Ground Station market? What are their major strategies to strengthen their market presence?

Some of the key players in the Satellite Ground Station market are General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and Kongsberg Gruppen ASA (Norway) among others, are the key manufacturers that secured satellite ground station system contracts in the last few years.

What are the drivers and opportunities for the Satellite Ground Station market?

The market for Satellite Ground Station equipment has grown substantially across the globe, and especially in Europe. With new capabilities, including faster data rates, better imaging resolution, and increased dependability, satellite technology is growing vigorously quickly. Due to this increases the demand, there is an increased need for ground stations with the necessary capabilities, such as antennas that can receive higher-frequency signals and data processing systems that can manage bigger data loads. Several A number of advancements in ground station technology have been made recently, including the use of software-defined radios (SDRs) to increase signal processing flexibility and the creation of cutting-edge antenna technologies such as like phased-array antennas. Because of these developments, ground stations can now communicate with a wider variety of satellites and support more advanced sophisticated applications. Various end-users, basically commercial industries such as defense and security are utilizing software-defined satellites for their product mapping, earth exploration, and communication.

Which region is expected to grow at the highest rate in the next five years?

The market in the Europe region is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand from Satellite Ground Station in the region. The Several European countries and organizations are also actively investing in deployment of satellite ground stations around Europe.

What is the CAGR of Satellite Ground Market?

The CAGR of Satellite Ground Market is 13.4%

Which function of Satellite Ground Station is expected to significantly lead in the coming years?

Communication segment of the Satellite Ground Station market is projected to witness the highest CAGR. There has been a continuous production of satellite ground station for different purposes such as communications and earth observation Increased deployment of miniature satellites for various communication for various end-user. The market will be driven by the widespread usage of satellite ground station to improve network connectivity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High demand for satellite-based services- Need for Earth observation imagery and analytics- Technological advancements in satellite ground stations- Increased use in remote sensing applications- Developments in space technologiesRESTRAINTS- Absence of unified regulations and government policies- Difficulty in raising funds for satellite ground station construction and operation by commercial operatorsOPPORTUNITIES- 5G and networking- Growth of small satellite market- Increased government investments in space agenciesCHALLENGES- Bandwidth constraint- Criticality of electronic information security- Issues related to telemetry, tracking, and command- Rising cost of constructing and operating satellite ground stations- Challenges associated with deployment of new technologies in satellite ground stations

- 5.3 RECESSION IMPACT ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 TECHNOLOGY EVOLUTION OF SATELLITE GROUND STATIONS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR SATELLITE GROUND STATION EQUIPMENT MANUFACTURERS

-

5.7 SATELLITE GROUND STATION MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESRESEARCH ORGANIZATIONS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PRICING ANALYSISAVERAGE PRICE OF SATELLITE GROUND STATIONS, 2022

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 TECHNOLOGY ANALYSISKEY TECHNOLOGY- Development of active electronically scanned array (ASEA)SUPPORTING TECHNOLOGY- AI in satellite ground stations

-

5.16 CASE STUDY ANALYSISUSE CASE 1: GSAAS SERVICES FOR NETFLIXUSE CASE 2: SATELLITE GROUND STATION FOR IOT AND COMMUNICATIONSUSE CASE 3: USE OF OPTICAL COMMUNICATION

- 5.17 OPERATIONAL DATA

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSMULTIBAND ANTENNASDIGITAL SATELLITE COMMUNICATIONSGROUND STATION AS A SERVICEDIGITAL GROUND STATIONSOPTICAL GROUND STATIONS

-

6.4 IMPACT OF MEGATRENDSSATELLITE INTERNET OF THINGS5G COMMUNICATION NETWORK

- 7.1 INTRODUCTION

-

7.2 EQUIPMENTINCREASED OPERATIONAL EFFICIENCYANTENNA SYSTEMS- High demand for satellite communication servicesRF SYSTEMS- Preference for advanced manufacturing techniques- Transmit RF systems- Receiver RF systemsDATA PROCESSING UNITS- Increased efficiency of data processing- Mission data recoveries- Data user interfaces- Station control centers- System clocksTELEMETRY, TRACKING, AND COMMAND (TT&C)- Need for effective communication between satellites and ground stations

-

7.3 SOFTWAREIMPROVED GROUND STATION OPTIMIZATIONSATELLITE GROUND STATION DEVELOPMENT SOFTWARE- Assists in optimizing ground station operationsSATELLITE GROUND STATION MAINTENANCE SOFTWARE- Advanced diagnostic capabilities help reduce downtime

-

7.4 GROUND STATION AS A SERVICE (GSAAS)OPTIMIZED COST AND OPERATIONAL EFFICACY

- 8.1 INTRODUCTION

-

8.2 FIXEDNEED FOR HANDLING DATA FROM REMOTE SENSING AND EARTH OBSERVATION SATELLITES

-

8.3 PORTABLEEFFECTIVE UTILIZATION IN HIGH-SPEED DATA TRANSFER AND REMOTE SENSINGHAND-HELD- Used for surveillance and securityBAG-MOUNTED- Used for quick data transfer and communication

-

8.4 MOBILEEASY DEPLOYMENT AND ENHANCED CONNECTIVITYVEHICLE-MOUNTED- Used for communication in adverse environment- Ground vehicles- Ships- Aircraft- Unmanned vehiclesTRAILER-MOUNTED- Used for broadcasting events

- 9.1 INTRODUCTION

-

9.2 NAVIGATIONHIGH DEMAND FOR MAPPING AND NAVIGATION SATELLITES

-

9.3 EARTH OBSERVATIONADVANCEMENTS IN GEOSPATIAL IMAGERY ANALYTICS WITH INTRODUCTION OF AI AND BIG DATA ANALYTICS

-

9.4 COMMUNICATIONDEVELOPMENT OF 5G AND NEW HARDWARE SYSTEMS

-

9.5 SPACE RESEARCHNEED FOR LOW-COST SATELLITES TO EXPLORE EARTH AND CONDUCT SPACE RESEARCH

- 9.6 OTHER FUNCTIONS

- 10.1 INTRODUCTION

-

10.2 DEFENSEWIDE-SCALE ADOPTION FOR MONITORING BORDERS AND CRITICAL INFRASTRUCTUREAIR FORCE- Used for surveillance and reconnaissanceARMY- Used for communication between military units and command centersNAVY- Used for communication between navy ships and command centers

-

10.3 GOVERNMENTEFFECTIVE USAGE IN WEATHER MONITORING AND DISASTER RELIEFHOMELAND SECURITY- Used for surveillance and reconnaissance operations- Law enforcement- Special task forcesRESEARCH CENTERS- Facilitates data transfer and communication for research purposes

-

10.4 COMMERCIALLUCRATIVE OPPORTUNITIES FOR COMMERCIAL EARTH OBSERVATION AND COMMUNICATION SATCOM USERS

- 11.1 INTRODUCTION

-

11.2 X-BANDUSED TO PROVIDE HIGH-THROUGHPUT COMMUNICATION FROM SPACECRAFT TO GROUND STATIONS

-

11.3 C-BANDUSED FOR NAVIGATION PURPOSES

-

11.4 S-BANDUSED FOR SPACE OPERATIONS

-

11.5 K-BANDUSED FOR BORDER SURVEILLANCE & SCIENTIFIC OPERATIONS

-

11.6 UHF/VHF/HF-BANDUSED FOR SMALL SATELLITE COMMUNICATION

- 11.7 OTHER FREQUENCY BANDS

- 12.1 INTRODUCTION

-

12.2 LOW EARTH ORBIT (LEO)EXTENSIVE DEPLOYMENT IN COMMUNICATIONS SATELLITES

-

12.3 MEDIUM EARTH ORBIT (MEO)INCREASED NUMBER OF SATELLITE NAVIGATION SYSTEMS

-

12.4 GEOSTATIONARY EARTH ORBIT (GEO)USED TO ENHANCE CONNECTIVITY

- 13.1 INTRODUCTION

- 13.2 REGIONAL RECESSION IMPACT ANALYSIS

-

13.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increased investments by government in space initiativesCANADA- High domestic demand for satellite-based services

-

13.4 EUROPEPESTLE ANALYSIS: EUROPERUSSIA- Growing reliance on self-developed space systemsUK- Innovations in satellite ground station technologiesGERMANY- Increased investments by private companiesFRANCE- Earth observation and science missions by domestic space agenciesREST OF EUROPE

-

13.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Dependence on self-made space technologyINDIA- Lucrative space initiativesJAPAN- Involvement of private companies in government space programsSINGAPORE- Fewer government restrictionsREST OF ASIA PACIFIC

-

13.6 ROWPESTLE ANALYSIS: ROWMIDDLE EAST & AFRICA- Need for surveillance and securityLATIN AMERICA- Need for cost-effective solutions in space research

- 14.1 INTRODUCTION

- 14.2 MARKET SHARE ANALYSIS, 2022

- 14.3 RANKING ANALYSIS, 2022

- 14.4 REVENUE ANALYSIS, 2022

- 14.5 COMPETITIVE BENCHMARKING

-

14.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.7 START-UP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

14.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT DEVELOPMENTSDEALS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKONGSBERG GRUPPEN ASA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAIRBUS SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsTHE BOEING COMPANY- Business overview- Products/Solutions/Services offered- Recent developmentsASELSAN A.S.- Business overview- Products/Solutions/Services offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offeredBALL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offeredSPACE EXPLORATION TECHNOLOGIES CORPORATION (SPACEX)- Business overview- Products/Solutions/Services offered- Recent developmentsTELEDYNE TECHNOLOGIES INC.- Business overview- Products/Solutions/Services offered- Recent developmentsTERMA GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsBAE SYSTEMS PLC- Business overview- Products/Solutions/Services offeredLEONARDO S.P.A.- Business overview- Products/Solutions/Services offeredECA GROUP- Business overview- Products/Solutions/Services offeredINDRA SISTEMAS, S.A.- Business overview- Products/Solutions/Services offered- Recent developmentsELECNOR GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsAMAZON (AWS)- Business overview- Products/Solutions/Services offeredMICROSOFT CORPORATION (AZURE)- Business overview- Products/Solutions/Services offered

-

15.3 OTHER PLAYERSDHRUVA SPACE PRIVATE LIMITEDCOBHAM PLCGAUSS SRLELEVATE ANTENNA SOLUTIONS

-

16.1 DISCUSSION GUIDESATELLITE GROUND STATION MARKET (2023–2028)SECTION-1: INTRODUCTIONSECTION-2: MARKET DYNAMICS

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 PARAMETRIC ASSUMPTIONS MADE FOR MARKET FORECAST

- TABLE 3 SATELLITE GROUND STATION MARKET ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 SATELLITE GROUND STATION MARKET: COUNTRY-WISE IMPORT, 2019–2022 (USD THOUSAND)

- TABLE 10 SATELLITE GROUND STATION MARKET: COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 11 MAJOR PATENTS FOR SATELLITE GROUND STATIONS, 2023

- TABLE 12 OTHER INNOVATIONS AND PATENT REGISTRATIONS, 2021–2022

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING SATELLITE GROUND STATIONS, BY END USER (%)

- TABLE 14 KEY BUYING CRITERIA FOR SATELLITE GROUND STATIONS, BY FUNCTION

- TABLE 15 CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 SATELLITE LAUNCHES, BY FUNCTION, 2019–2028

- TABLE 17 NEW SATELLITE GROUND STATIONS BUILT PER YEAR, BY FUNCTION, 2019–2028

- TABLE 18 VOLUME FOR MOBILE SATELLITE GROUND STATIONS, BY PLATFORM, 2019–2028

- TABLE 19 SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 20 SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 21 EQUIPMENT: SATELLITE GROUND STATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 22 EQUIPMENT: SATELLITE GROUND STATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 SATELLITE GROUND STATION MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 24 SATELLITE GROUND STATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 25 MOBILE: SATELLITE GROUND STATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 MOBILE: SATELLITE GROUND STATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 VEHICLE-MOUNTED: SATELLITE GROUND STATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 VEHICLE-MOUNTED: SATELLITE GROUND STATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 SATELLITE GROUND STATION MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 30 SATELLITE GROUND STATION MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 31 SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 32 SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 33 DEFENSE: SATELLITE GROUND STATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 34 DEFENSE: SATELLITE GROUND STATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 GOVERNMENT: SATELLITE GROUND STATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 GOVERNMENT: SATELLITE GROUND STATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 SATELLITE GROUND STATION MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 38 SATELLITE GROUND STATION MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 39 SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 40 SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 41 SATELLITE GROUND STATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 SATELLITE GROUND STATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2019–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2019–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 US: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 58 US: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 59 US: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 60 US: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 61 US: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 62 US: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 63 CANADA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 64 CANADA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 65 CANADA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 66 CANADA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 67 CANADA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 68 CANADA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 70 EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 71 EUROPE: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2019–2022 (USD MILLION)

- TABLE 72 EUROPE: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2019–2022 (USD MILLION)

- TABLE 74 EUROPE: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 RUSSIA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 84 RUSSIA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 85 RUSSIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 86 RUSSIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 87 RUSSIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 88 RUSSIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 89 UK: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 90 UK: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 91 UK: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 92 UK: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 93 UK: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 94 UK: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 95 GERMANY: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 96 GERMANY: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 97 GERMANY: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 98 GERMANY: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 100 GERMANY: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 101 FRANCE: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 102 FRANCE: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 103 FRANCE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 104 FRANCE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 105 FRANCE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 106 FRANCE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2019–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 CHINA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 128 CHINA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 129 CHINA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 130 CHINA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 131 CHINA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 132 CHINA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 133 INDIA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 134 INDIA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 135 INDIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 136 INDIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 137 INDIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 138 INDIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 139 JAPAN: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 140 JAPAN: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 141 JAPAN: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 142 JAPAN: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 143 JAPAN: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 144 JAPAN: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 145 SINGAPORE: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 146 SINGAPORE: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 147 SINGAPORE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 148 SINGAPORE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 149 SINGAPORE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 150 SINGAPORE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 157 ROW: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 158 ROW: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 159 ROW: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2019–2022 (USD MILLION)

- TABLE 160 ROW: SATELLITE GROUND STATION MARKET, BY DEFENSE, 2023–2028 (USD MILLION)

- TABLE 161 ROW: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2019–2022 (USD MILLION)

- TABLE 162 ROW: SATELLITE GROUND STATION MARKET, BY GOVERNMENT, 2023–2028 (USD MILLION)

- TABLE 163 ROW: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 164 ROW: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 165 ROW: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 166 ROW: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 167 ROW: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 168 ROW: SATELLITE GROUND STATION MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 169 ROW: SATELLITE GROUND STATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 170 ROW: SATELLITE GROUND STATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 178 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 180 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 183 SATELLITE GROUND STATION MARKET: DEGREE OF COMPETITION

- TABLE 184 KEY DEVELOPMENTS BY LEADING PLAYERS IN SATELLITE GROUND STATION MARKET, 2019–2023

- TABLE 185 COMPANY PRODUCT FOOTPRINT

- TABLE 186 COMPANY REGIONAL FOOTPRINT

- TABLE 187 COMPANY FUNCTION FOOTPRINT

- TABLE 188 SATELLITE GROUND STATION MARKET: KEY START-UPS/SMES

- TABLE 189 SATELLITE GROUND STATION MARKET: PRODUCT DEVELOPMENTS, JANUARY 2019–DECEMBER 2023

- TABLE 190 SATELLITE GROUND STATION MARKET: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 191 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 192 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 194 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 195 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 196 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 198 KONGSBERG GRUPPEN ASA: BUSINESS OVERVIEW

- TABLE 199 KONGSBERG GRUPPEN ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 KONGSBERG GRUPPEN ASA: DEALS

- TABLE 201 AIRBUS SE: BUSINESS OVERVIEW

- TABLE 202 AIRBUS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AIRBUS SE: DEALS

- TABLE 204 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 205 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 LOCKHEED MARTIN CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 207 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 208 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 209 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 ELBIT SYSTEM LTD.: PRODUCT DEVELOPMENTS

- TABLE 211 THE BOEING COMPANY: BUSINESS OVERVIEW

- TABLE 212 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 THE BOEING COMPANY: DEALS

- TABLE 214 ASELSAN A.S.: BUSINESS OVERVIEW

- TABLE 215 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 ASELSAN A.S.: PRODUCT DEVELOPMENTS

- TABLE 217 ASELSAN A.S.: DEALS

- TABLE 218 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 219 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 221 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 222 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 NORTHROP GRUMMAN CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 224 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 225 SAAB AB: BUSINESS OVERVIEW

- TABLE 226 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 BALL CORPORATION: BUSINESS OVERVIEW

- TABLE 228 BALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 BALL CORPORATION: DEALS

- TABLE 230 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

- TABLE 231 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 MITSUBISHI ELECTRIC CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 233 THALES GROUP: BUSINESS OVERVIEW

- TABLE 234 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 THALES GROUP: DEALS

- TABLE 236 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 237 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SPACEX: BUSINESS OVERVIEW

- TABLE 239 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 SPACEX: DEALS

- TABLE 241 TELEDYNE TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 242 TELEDYNE TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 TELEDYNE TECHNOLOGIES INC.: PRODUCT DEVELOPMENTS

- TABLE 244 TELEDYNE TECHNOLOGIES INC.: DEALS

- TABLE 245 TERMA GROUP: BUSINESS OVERVIEW

- TABLE 246 TERMA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 TERMA GROUP: PRODUCT DEVELOPMENTS

- TABLE 248 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 249 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 LEONARDO S.P.A.: BUSINESS OVERVIEW

- TABLE 251 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ECA GROUP: BUSINESS OVERVIEW

- TABLE 253 ECA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 INDRA SISTEMAS, S.A.: BUSINESS OVERVIEW

- TABLE 255 INDRA SISTEMAS, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 INDRA SISTEMAS, S.A.: DEALS

- TABLE 257 ELECNOR GROUP: BUSINESS OVERVIEW

- TABLE 258 ELECNOR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 ELECNOR GROUP: DEALS

- TABLE 260 AMAZON (AWS): BUSINESS OVERVIEW

- TABLE 261 AMAZON (AWS): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 MICROSOFT CORPORATION (AZURE): BUSINESS OVERVIEW

- TABLE 263 MICROSOFT CORPORATION (AZURE): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 DHRUVA SPACE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 265 COBHAM PLC: COMPANY OVERVIEW

- TABLE 266 GAUSS SRL: COMPANY OVERVIEW

- TABLE 267 ELEVATE ANTENNA SOLUTIONS: COMPANY OVERVIEW

- FIGURE 1 SATELLITE GROUND STATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 FIXED SEGMENT TO SECURE MAXIMUM MARKET SHARE BY 2028

- FIGURE 9 COMMUNICATION TO SURPASS OTHER FUNCTIONS DURING FORECAST PERIOD

- FIGURE 10 C-BAND TO HOLD LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 11 LOW EARTH ORBIT SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 12 COMMERCIAL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 GSAAS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 EUROPE TO BE FASTEST-GROWING REGION FROM 2023 TO 2028

- FIGURE 15 INCREASED USE OF SATELLITE GROUND STATIONS FOR HANDLING DATA FROM COMMUNICATION AND EARTH OBSERVATION SATELLITES

- FIGURE 16 EUROPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 US TO OWN MAJORITY SHARES IN NORTH AMERICA

- FIGURE 18 UK TO REGISTER HIGHEST CAGR AMONG OTHER EUROPEAN COUNTRIES

- FIGURE 19 CHINA TO EXCEED OTHER ASIA PACIFIC COUNTRIES DURING FORECAST PERIOD

- FIGURE 20 MIDDLE EAST & AFRICA TO ACCOUNT FOR LARGER MARKET SHARE THAN LATIN AMERICA

- FIGURE 21 US TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 22 SATELLITE GROUND STATION MARKET DYNAMICS

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 TECHNOLOGY EVOLUTION ROADMAP

- FIGURE 25 REVENUE SHIFT IN SATELLITE GROUND STATION MARKET

- FIGURE 26 SATELLITE GROUND STATION MARKET ECOSYSTEM MAP

- FIGURE 27 MAJOR PATENTS FOR SATELLITE GROUND STATIONS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING SATELLITE GROUND STATIONS, BY END USER

- FIGURE 29 KEY BUYING CRITERIA FOR SATELLITE GROUND STATIONS, BY FUNCTION

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- FIGURE 31 SATELLITE GROUND STATION MARKET, BY SOLUTION, 2023–2028

- FIGURE 32 DATA PROCESSING UNITS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 GSAAS USERS, 2018–2028

- FIGURE 34 SATELLITE GROUND STATION MARKET, BY PLATFORM, 2023–2028

- FIGURE 35 TRAILER-MOUNTED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 UNMANNED VEHICLES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 37 SATELLITE GROUND STATION MARKET, BY FUNCTION, 2023–2028

- FIGURE 38 SATELLITE GROUND STATION MARKET, BY END USER, 2023–2028

- FIGURE 39 ARMY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 HOMELAND SECURITY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 SATELLITE GROUND STATION MARKET, BY FREQUENCY, 2023–2028

- FIGURE 42 SATELLITE GROUND STATION MARKET, BY ORBIT, 2023–2028

- FIGURE 43 SATELLITE GROUND STATION MARKET, BY REGION, 2023–2028

- FIGURE 44 NORTH AMERICA: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 45 EUROPE: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 47 ROW: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- FIGURE 49 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 50 REVENUE OF TOP FIVE PLAYERS, 2022

- FIGURE 51 SATELLITE GROUND STATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- FIGURE 52 SATELLITE GROUND STATION MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 53 GLOBAL SNAPSHOT OF KEY MARKET PLAYERS, BY REGION

- FIGURE 54 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

- FIGURE 57 AIRBUS SE: COMPANY SNAPSHOT

- FIGURE 58 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 60 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 61 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 62 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 63 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 SAAB AB: COMPANY SNAPSHOT

- FIGURE 65 BALL CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 68 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 69 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 70 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 71 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 72 ECA GROUP: COMPANY SNAPSHOT

- FIGURE 73 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- FIGURE 74 ELECNOR: COMPANY SNAPSHOT

- FIGURE 75 AMAZON (AWS): COMPANY SNAPSHOT

- FIGURE 76 MICROSOFT CORPORATION (AZURE): COMPANY SNAPSHOT

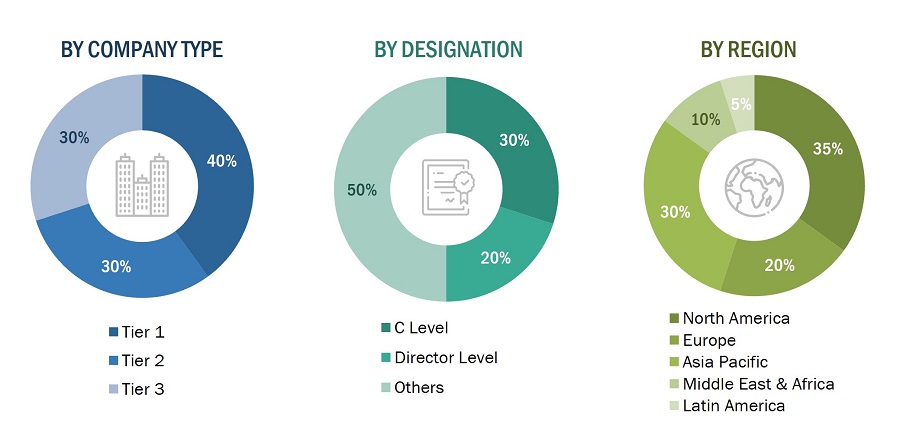

The study involved four major activities in estimating the current size of the Satellite Ground Station market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the Satellite Ground Station market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Satellite Ground Station market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Satellite Ground Station vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using Satellite Ground Station were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Satellite Ground Station and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Satellite Ground Station market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the Satellite Ground Station market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

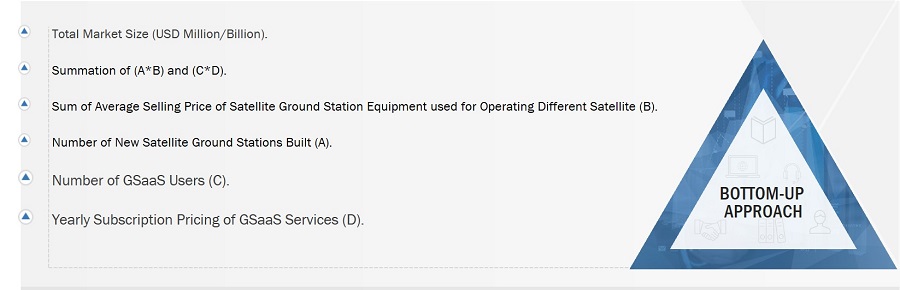

Global Satellite Ground Station market size: Bottom-Up Approach

The Satellite Ground Station market, by application and mass, was used as a primary segment for estimating and projecting the global market size from 2023 to 2028.

The market size was calculated by adding the platform subsegments mentioned below, and the different methodologies adopted for each to arrive at the market numbers are delineated below:

Satellite Ground Station Market = (Volume * Average Selling Price of Satellite Ground Station) + (Number of GSaaS Users * Yearly Subscription Price of GSaaS)

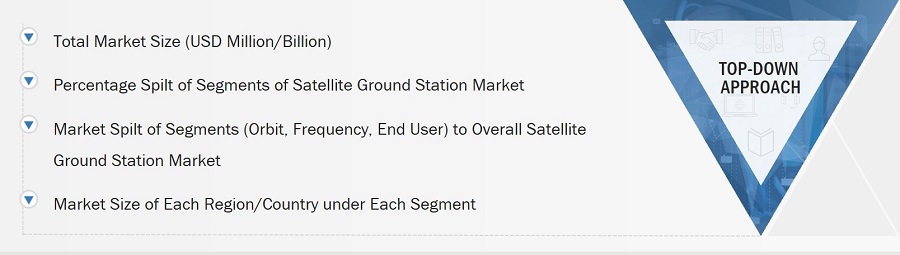

Global Satellite Ground Station market Size: Top-Down Approach

- In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing satellite ground station equipment are included in the report.

- The total revenue of companies was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees, sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to satellite ground stations were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of satellite ground stations in each segment was estimated.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Satellite Ground Station market based on function, solution, end user, platform , frequency, orbit and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Satellite Ground Station market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies.

Market Definition

Satellite ground stations are facilities that interface with the orbiting satellite. They are critical in a satellite network because they recover information from the received signal, which is typically weak and noisy after traversing from the satellite to the Earth. The following elements are found in a satellite ground station: a reception antenna, a feed horn, a waveguide, and a receiver. Most satellite ground stations are pedestal mounted.

Satellite ground stations are widely used to collect and process data for a wide range of applications, such as television broadcasting, communication, mapping & navigation, surveillance & security, scientific research & exploration, and space observation, among others, across defense, civil, commercial, and government verticals.

Market Stakeholders

- Satellite Ground Station Component Manufacturers

- Satellite Ground Station Manufacturers

- Satellite Ground Station Service Providers

- Government and Civil Organizations

- Satellite Ground Station Operators

- Meteorological Organizations

- Component Suppliers

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Satellite Ground Station market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Satellite Ground Station market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite Ground Station Market