SIP Trunking Services Market by Organization Size (Small Businesses, Mid-sized Businesses, and Enterprises), End-user (Wholesale and Verticals (BFSI, Healthcare, Government, High-Tech, Retail, and Education)), and Region - Global Forecast to 2023

[143 Pages Report] The global Session Initiation Protocol Trunking Services market size was USD 6.88 billion in 2017 and is projected to reach USD 12.70 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 10.7% during the forecast period. The base year considered for the study is 2017, and the forecast period is 20182023.

The report aims at estimating the market size and potential of the SIP Trunking services market across segments, such as organization size, end users (wholesale and verticals), and regions. The primary objectives of the report is to provide a detailed analysis of the major factors (drivers, restraints, opportunities, industry-specific challenges, and recent developments) influencing the market growth, analyze the market opportunities for stakeholders, and offer details of the competitive landscape to the market leaders.

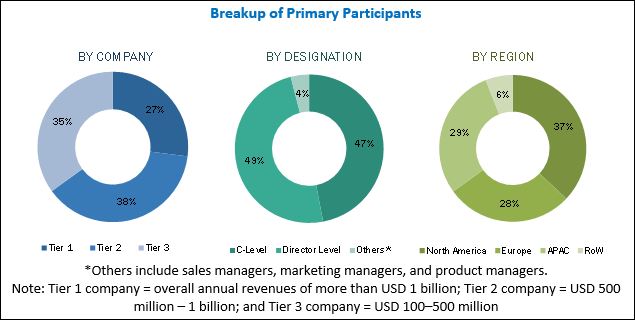

The research methodology used to estimate and forecast the SIP Trunking services market begins with the capturing of data about revenues of the key vendors through secondary sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. The research study involves the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other than these sources, analyses and releases from industry trade associations such as government regulatory bodies are considered during the research process. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure is employed to arrive at the overall market size of the global SIP Trunking services market from the revenues of the key market players. After arriving at the overall market size, the market is split into several segments and subsegments that are then verified through primary research by conducting extensive interviews with the key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakup procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The figure below depicts the breakup of primary participants profiles:

To know about the assumptions considered for the study, download the pdf brochure

Major players in the global SIP Trunking Services Market include AT&T (US), Bandwidth (US), BT Group (UK), CenturyLink (US), Colt (UK), Fusion (US), GTT Communications (US), IntelePeer (US), Mitel (Canada), Net2Phone (US), Nextiva (US), Orange (France), Rogers Communications (Canada), Sprint (US), Tata Communications (India), Telstra (Australia), Twilio (US), Verizon (US), Vodafone (UK), Vonage (US), Voyant Communications (US), West Corporation (US), and Windstream (US).

Key Target Audience for SIP Trunking Services Market

- SIP Trunking service solution vendors

- Cloud service providers

- Telecom operators

- System integrators

- Third-party vendors

- Mobile Network Operators (MNOs)

- Mobile Virtual Network Operators (MVNOs)

- Communication Service Providers (CSPs)

- Financial analysts and investors

- Voice over Internet Protocol (VoIP) service providers

- Managed Service Providers (MSPs)

- Government telecom regulatory authorities

Scope of the SIP Trunking Services Market Report

|

Report Metric |

Details |

|

Market size available for years |

20182023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Organization size, End users (wholesale and verticals) and Regions. |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

AT&T (US), 8x8 (US), Bandwidth (US), BT Group (UK), CenturyLink (US), Colt (UK), Fusion (US), GTT Communications (US), IntelePeer (US), Mitel (Canada), Net2Phone (US), Nextiva (US), Orange (France), Rogers Communications (Canada), Sprint (US), Tata Communications (India), Telstra (Australia), Twilio (US), Verizon (US), Vodafone (UK), Vonage (US), Voyant Communications (US), West Corporation (US), and Windstream (US). |

The research report categorizes the SIP Trunking services market to forecast revenues and analyze trends in each of the following subsegments:

By Organization Size

- Small Businesses

- Mid-sized Businesses

- Enterprises

SIP Trunking Services Market By End-user

- Verticals

- Banking, Financial Services, and Insurance (BFSI)

- High-Tech

- Government

- Healthcare

- Education

- Retail

- Transportation and Logistics

- Manufacturing

- Travel and Hospitality

- Others (Media and Entertainment and Legal)

- Wholesale

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the North American SIP Trunking services market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global Session Initiation Protocol (SIP) Trunking services market size to grow from USD 7.63 billion in 2018 to USD 12.70 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 10.7% between 2018 and 2023. Major growth factors for the market include low Capital Expenditure (CAPEX) and Total Cost of Ownership (TCO), and an increasing adoption of cloud and Unified Communications (UC).

The objective of the report is to define, describe, and forecast the SIP Trunking services market size by organization size, end users (wholesale and verticals) and regions. Among organization sizes, the enterprises segment is expected to hold a larger market size. SIP Trunking service providers offer reliable, centralized phone services to enterprises, without the hassle of onsite setup and maintenance costs. Enterprises across emerging countries are investing substantial capital in their core network infrastructure to cope with the growing business communication needs.

Among verticals, the Banking, Financial Services, and Insurance (BFSI) segment is expected to hold the largest market size during forecast period. BFSI companies are under significant pressure to offer anytime connectivity to value chain partners and customers. SIP Trunking services help simplify communication management and cost reduction. Hence, the BFSI vertical is expected to witness the rapid adoption of SIP Trunking services during the forecast period.

North America is the overall leader in the adoption and implementation of SIP Trunking services, followed by Europe. Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America are also increasingly adopting SIP Trunking services owing to the advancements in the network infrastructure. SIP service providers have an immense potential in these untapped markets. Wholesale carriers and enterprises in these regions are adopting SIP Trunking services as a cost-effective and reliable alternative to traditional phone systems to achieve reliable connectivity within organizations, irrespective of the location. Globally, businesses are utilizing the SIP trunk services to minimize operational cost, streamline business operations, and enhance the network efficiency.

An increasing demand for SIP Trunking services among Small and Mid-sized businesses and untapped potential market are expected to create significant growth opportunities for vendors in the market. However, growing concerns over Quality of Service (QoS) and difficulties in implementing SIP trunks may restrain the market growth, but for a specific period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the SIP Trunking Services Market

4.2 Market Share of Top 3 Verticals and Regions

4.3 Market Investment Scenario

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Reduced TCO By Leveraging the Pay-As-You-Go Model

5.2.1.2 Rising Adoption of Cloud and UC

5.2.1.3 Ease of Integration With PBX Systems

5.2.2 Restraints

5.2.2.1 Security and Privacy Concerns

5.2.3 Opportunities

5.2.3.1 Increasing Demand for SIP Trunking Services Among SMEs

5.2.3.2 Untapped Potential Markets

5.2.4 Challenges

5.2.4.1 Increasing Concerns Over QOS

5.2.4.2 Difficulties in Implementing SIP Trunks

5.3 SIP Trunking Services Architecture

6 SIP Trunking Services Market, By Organization Size (Page No. - 38)

6.1 Introduction

6.2 Small Businesses

6.3 Mid-Sized Businesses

6.4 Enterprises

7 SIP Trunking Services Market, By End-User (Page No. - 43)

7.1 Introduction

7.2 Verticals

7.2.1 Banking, Financial Services, and Insurance

7.2.2 High-Tech

7.2.3 Government

7.2.4 Healthcare

7.2.5 Education

7.2.6 Retail

7.2.7 Transportation and Logistics

7.2.8 Manufacturing

7.2.9 Travel and Hospitality

7.2.10 Others

7.3 Wholesale

8 SIP Trunking Services Market, By Region (Page No. - 56)

8.1 Introduction

8.2 North America

8.2.1 United States

8.2.2 Canada

8.3 Europe

8.3.1 United Kingdom

8.3.2 Germany

8.3.3 France

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.2 Australia

8.4.3 Rest of Asia Pacific

8.5 Middle East and Africa

8.5.1 Kingdom of Saudi Arabia

8.5.2 United Arab Emirates

8.5.3 Rest of Middle East and Africa

8.6 Latin America

8.6.1 Brazil

8.6.2 Mexico

8.6.3 Rest of Latin America

9 Competitive Landscape (Page No. - 78)

9.1 Overview

9.2 Competitive Scenario

9.2.1 Partnerships, Agreements, and Collaborations

9.2.2 New Product/Service Launches and Product Enhancements

9.2.3 Mergers and Acquisitions

9.2.4 Business Expansions

10 Company Profiles (Page No. - 83)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Introduction

10.2 AT&T

10.3 BT Group

10.4 Centurylink

10.5 Fusion

10.6 Verizon

10.7 8x8

10.8 Windstream

10.9 Bandwidth

10.10 Colt Technology Services

10.11 GTT Communications

10.12 Intelepeer

10.13 Mitel Networks

10.14 Net2phone (IDT Corporation)

10.15 Nextiva

10.16 Orange

10.17 Rogers Communications

10.18 Sprint

10.19 Tata Communications

10.20 Telstra

10.21 Twilio

10.22 Vodafone

10.23 Vonage

10.24 Voyant Communications

10.25 West Corporation

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 137)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (43 Tables)

Table 1 SIP Trunking Services Market Size, By Organization Size, 20162023 (USD Million)

Table 2 Small Businesses: Market Size By Region, 20162023 (USD Million)

Table 3 Mid-Sized Businesses: Market Size By Region, 20162023 (USD Million)

Table 4 Enterprises: Market Size By Region, 20162023 (USD Million)

Table 5 SIP Trunking Services Market Size, By End-User, 20162023 (USD Million)

Table 6 Verticals: Market Size By Type, 20162023 (USD Million)

Table 7 Verticals: Market Size By Region, 20162023 (USD Million)

Table 8 Banking, Financial Services, and Insurance Market Size, By Region, 20162023 (USD Million)

Table 9 High-Tech Market Size, By Region, 20162023 (USD Million)

Table 10 Government Market Size, By Region, 20162023 (USD Million)

Table 11 Healthcare Market Size, By Region, 20162023 (USD Million)

Table 12 Education Market Size, By Region, 20162023 (USD Million)

Table 13 Retail Market Size, By Region, 20162023 (USD Million)

Table 14 Transportation and Logistics Market Size, By Region, 20162023 (USD Million)

Table 15 Manufacturing Market Size, By Region, 20162023 (USD Million)

Table 16 Travel and Hospitality Market Size, By Region, 20162023 (USD Million)

Table 17 Others Market Size, By Region, 20162023 (USD Million)

Table 18 Wholesale: Market Size By Region, 20162023 (USD Million)

Table 19 SIP Trunking Services Market Size, By Region, 20162023 (USD Million)

Table 20 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 21 North America: Market Size By End-User, 20162023 (USD Million)

Table 22 North America: Market Size By Vertical, 20162023 (USD Million)

Table 23 North America: Market Size By Country, 20162023 (USD Million)

Table 24 Europe: SIP Trunking Services Market Size, By Organization Size, 20162023 (USD Million)

Table 25 Europe: Market Size By End-User, 20162023 (USD Million)

Table 26 Europe: Market Size By Vertical, 20162023 (USD Million)

Table 27 Europe: Market Size By Country, 20162023 (USD Million)

Table 28 Asia Pacific: SIP Trunking Services Market Size, By Organization Size, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size By End-User, 20162023 (USD Million)

Table 30 Asia Pacific: Market Size By Vertical, 20162023 (USD Million)

Table 31 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 32 Middle East and Africa: SIP Trunking Services Market Size, By Organization Size, 20162023 (USD Million)

Table 33 Middle East and Africa: Market Size By End-User, 20162023 (USD Million)

Table 34 Middle East and Africa: Market Size By Vertical, 20162023 (USD Million)

Table 35 Middle East and Africa: Market Size By Country, 20162023 (USD Million)

Table 36 Latin America: SIP Trunking Services Market Size, By Organization Size, 20162023 (USD Million)

Table 37 Latin America: Market Size By End-User, 20162023 (USD Million)

Table 38 Latin America: Market Size By Vertical, 20162023 (USD Million)

Table 39 Latin America: Market Size By Country, 20162023 (USD Million)

Table 40 Partnerships, Agreements, and Collaborations, 2018

Table 41 New Product/Service Launches and Product Enhancements, 2018

Table 42 Mergers and Acquisitions, 2018

Table 43 Business Expansions, 2018

List of Figures (49 Figures)

Figure 1 SIP Trunking Services Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 SIP Trunking Services Market: Assumptions

Figure 8 Global SIP Trunking Services Market

Figure 9 Market By Organization Size

Figure 10 Market By End-User

Figure 11 Market By Vertical

Figure 12 North America is Estimated to Hold the Largest Market Share in 2018

Figure 13 Increasing Adoption of Cloud and Unified Communications is Expected to Drive the SIP Trunking Services Market

Figure 14 BFSI Vertical and North American Region are Estimated to Hold the Largest Market Shares in 2018

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investment in the Next 5 Years

Figure 16 SIP Trunking Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Small Businesses Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Verticals Segment is Expected to Dominate the Market During the Forecast Period

Figure 19 Healthcare Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Key Strategies Adopted By the Leading Players in the SIP Trunking Services Market During 20162018

Figure 24 Geographic Revenue Mix of the Top Market Players

Figure 25 AT&T: Company Snapshot

Figure 26 AT&T: SWOT Analysis

Figure 27 BT Group: Company Snapshot

Figure 28 BT Group: SWOT Analysis

Figure 29 Centurylink: Company Snapshot

Figure 30 Centurylink: SWOT Analysis

Figure 31 Fusion: Company Snapshot

Figure 32 Fusion: SWOT Analysis

Figure 33 Verizon: Company Snapshot

Figure 34 Verizon: SWOT Analysis

Figure 35 8x8: Company Snapshot

Figure 36 Windstream: Company Snapshot

Figure 37 Bandwidth: Company Snapshot

Figure 38 GTT Communications: Company Snapshot

Figure 39 Mitel Networks: Company Snapshot

Figure 40 Net2phone (IDT Corporation): Company Snapshot

Figure 41 Orange: Company Snapshot

Figure 42 Rogers Communications: Company Snapshot

Figure 43 Sprint: Company Snapshot

Figure 44 Tata Communications: Company Snapshot

Figure 45 Telstra: Company Snapshot

Figure 46 Twilio: Company Snapshot

Figure 47 Vodafone: Company Snapshot

Figure 48 Vonage: Company Snapshot

Figure 49 West Corporation: Company Snapshot

Growth opportunities and latent adjacency in SIP Trunking Services Market