Speech and Voice Recognition Market by Deployment Mode (On-Cloud, On-Premises/Embedded), Technology (Speech Recognition, Voice Recognition), Vertical and Geography (Americas, Europe, APAC, Rest of the World) - Global Forecast to 2030

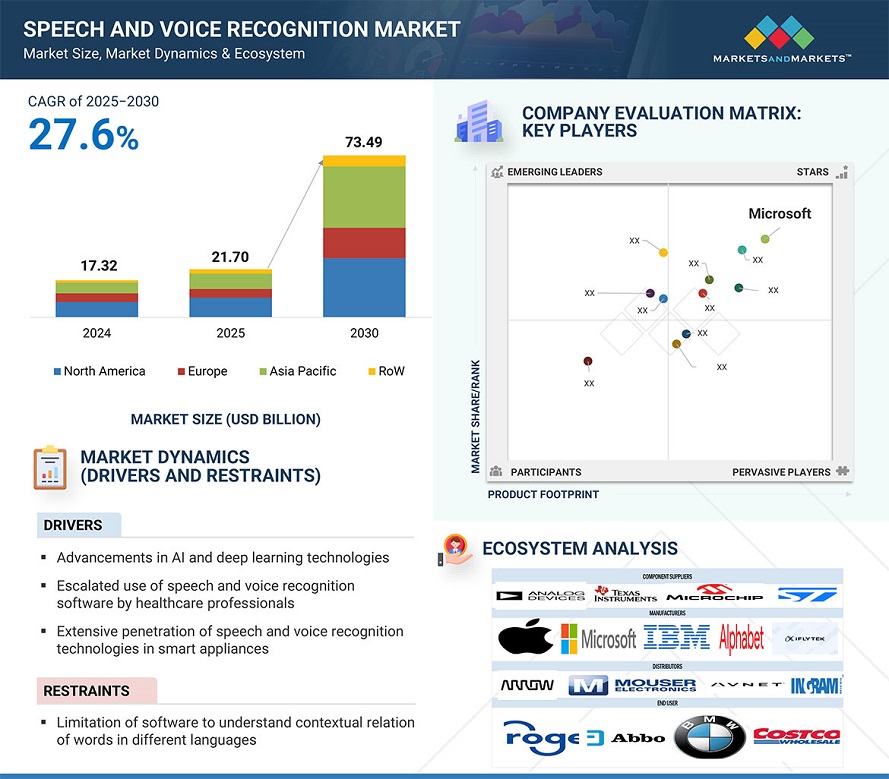

The global speech and voice recognition market was valued at USD 21.70 billion in 2025 and is estimated to reach USD 73.49 billion by 2030, registering a CAGR of 27.6% during the forecast period. The speech and voice recognition market is powered by AI and deep learning technological improvements, increasing contactless engagement demands, and pervasive adoption of virtual assistants and smart devices. Increased multilingual and customized voice growth enhances customer experience, whereas increased security requirements lead to the adoption of voice biometrics. Additionally, increased applications in the automotive, banking, and healthcare sectors, as well as advanced cloud-based processing, are boosting global market growth.

Attractive Opportunities in Speech and Voice Recognition Market

Speech and Voice Recognition Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

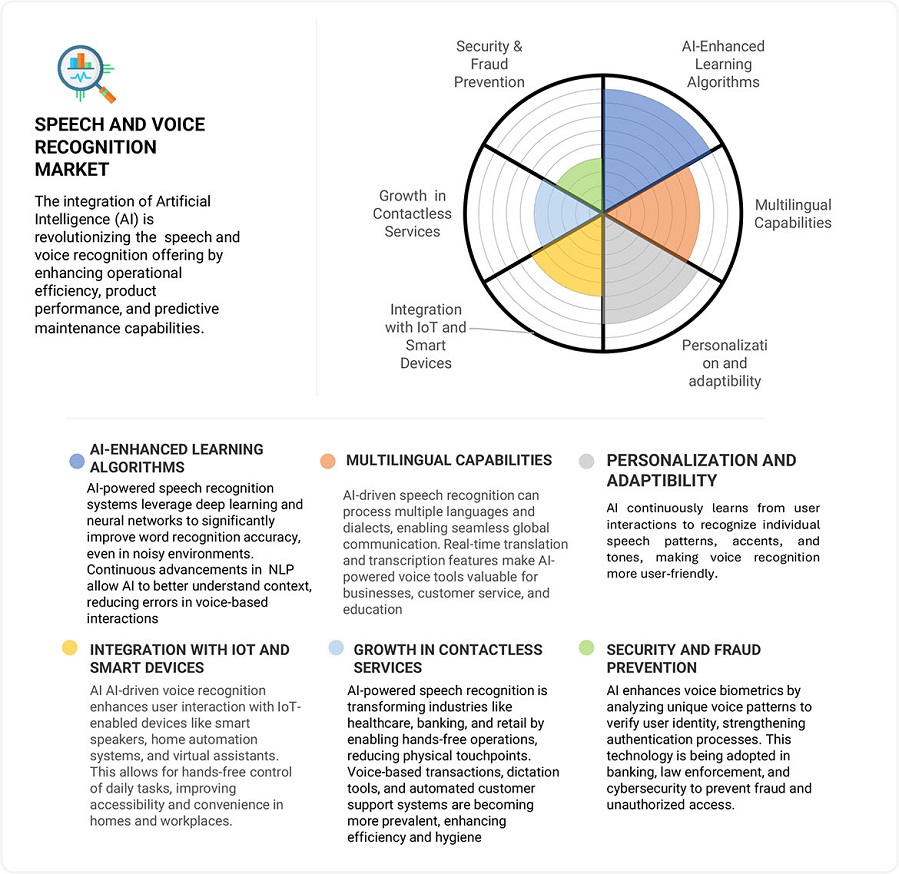

Impact of AI on Speech and voice recognition Market

AI is transforming the speech and voice recognition sector by greatly improving accuracy, multilingual support, and personalization through deep learning and NLP advancements. AI makes global communication seamless, enhances IoT device interaction, and stimulates the adoption of contactless services in healthcare, banking, and retail. Voice biometrics based on AI increase security by protecting against fraud, while real-time transcription and automation increase efficiency. As AI continues to advance, speech recognition technology becomes wiser, more adaptive, and well-rooted in everyday..

Market Dynamics:

Driver: Advancements in AI and deep learning technologies.

The most significant trend in the speech and voice recognition space is the creation of AI and deep learning technologies. AI speech recognition systems utilize neural networks and natural language processing (NLP) to enhance accuracy, providing enhanced contextual understanding and a smooth user experience.The best advantage of AI-based speech recognition is that it can accommodate multiple languages and dialects and offer real-time translation and transcription. This is useful a great deal in international business settings, customer service, and education. AI also makes it possible to have more personalization depending on learning each person's speech pattern, accent, and leaning, which makes it easier to recognize voices and makes it more convenient.Health, finance, and automotive industries are being used in voice recognition to facilitate hands-free use, customer verification, and AI-based automation. AI-based voice biometrics also improved security by means of combating identity fraud and improving authentication processes. With increasing contactless service and smart devices, AI continues to drive market growth through improved speech recognition to provide accuracy, reliability, and worldwide use in applications on a daily basis. With continued improvement of AI, its application to speech recognition can only become more revolutionary, setting the tone for human-machine interaction in the future..

Restraint: concerns regarding data privacy and security

Concerns related to data security and privacy is one of the major restraint in the said market. As voice technologies find increased usage in consumer, commercial, and industrial processes, consumers and organizations alike are growing concerned with how their voice data is harvested, stored, and utilized. Because speech recognition systems depend on cloud processing and AI algorithms, they tend to need constant data harvesting, generating concerns about possible misuse, unauthorized access, and monitoring.One of the major concerns is the threat of data breaches and cyberattacks, in which sensitive voice recordings, personal information, and authentication credentials are put at risk. Hackers could use weaknesses in voice recognition technology to gain access to devices, bank accounts, or sensitive business data without permission. Moreover, users also fear loss of control over their voice data, particularly in the case of always-on voice assistants such as Alexa, Google Assistant, and Siri. These devices are always listening for wake words, which raises concerns about accidental recording and third-party data sharing. Data handling transparency and encryption practices must be employed to mitigate these privacy threats and establish consumer trust.To counter these issues, speech recognition companies are making investments in edge computing, on-device processing, and enhanced encryption technologies to provide security for data. Yet, a balance between convenience, accuracy, and privacy is still a primary challenge in the use and expansion of voice recognition technology..

Opportunity : Consumer preference for cloud based speech-to-text software

Increased consumer demand for cloud-based speech-to-text software also remains a major opportunity for the speech and voice recognition industry. Cloud-based products have high scalability, real-time processing, and seamless integration across devices, appealing to both business and consumer use. In comparison to on-premise speech recognition systems, which need large hardware and infrastructure, cloud-based software enables remote access to AI-powered voice recognition tools, enhancing convenience and saving costs. One of the main strengths of cloud speech recognition is that it can efficiently process large amounts of data. With ongoing improvement in artificial intelligence (AI) and machine learning (ML), cloud models enhance speech accuracy, accommodate multiple languages, and recognize various accents to the benefit of global users. These capabilities are especially useful in industries like customer service, healthcare, legal, media, and education, where accurate transcription and voice automation increase productivity. Companies are increasingly turning to cloud-based speech-to-text technology to streamline operations, enhance accessibility, and facilitate customer engagement. Security and data privacy issues have long been an impediment, but innovations in cloud encryption, data anonymization, and regulatory compliance like GDPR and CCPA are building consumer trust. Providers are also introducing on-device processing and hybrid cloud models to provide users with more control of their voice data while preserving the advantages of cloud computing.With the growing need for multilingual support, voice-enabled applications, and AI-powered automation, cloud-based speech-to-text software is set to grow at a fast pace. As industries continue to adopt digital transformation, the speech and voice recognition market will gain from the scalability, accuracy, and accessibility that cloud solutions offer, propelling adoption across global markets...

Challenge: Lack of standardization and Regulatory Compliance

Major challenges in the speech and voice recognition industry is creating industry-specific vocabulary that properly recognizes and processes jargon. Each industry—such as medical, legal, financial, engineering, and automotive—poses its own lingo, abbreviations, and technical terms to which standard models of speech recognition might not readily respond. Being able to render high accuracy through speech-to-text conversion in fields that are dissimilar from the training data needs extensive customization as well as on-going training for AI models.

The principal challenge is in the specialization and nuance of industry vocabulary. For example, in medicine, myocardial infarction (heart attack) or "laparoscopic cholecystectomy" (gallbladder removal)** must be precisely identified, because even minor discrepancies affect medical record-keeping and patient treatment. Likewise, contracts and court trials in law feature specialized vocabulary requiring high accuracy in order to ensure legal validity. A generic speech model tends not to have the industry domain-specific knowledge required to differentiate between homophones (i.e., "capital" vs. "capitol") or technical subtleties in these sectors. The second challenge is the dynamic nature of industry vocabularies**. New vocabulary keeps emerging on a regular basis, particularly in areas such as technology, pharmaceuticals, and finance, where innovation creates new terms and phrases. Speech recognition systems need to be constantly updated to remain relevant, which demands substantial investment in data acquisition, annotation, and AI model retraining. Industry experts also have to work together with AI developers to optimize models, and the process thus becomes resource intensive.

Speech And Voice Recognition Market Ecosystem

The speech and voice recognition market is competitive. Major companies, such as IBM, Apple Inc, Microsoft, among others, are the major providers of speech and voice recognition. The market has numerous small- and medium-sized vital enterprises. Many players offer components and technologies, while other players offer integration services. These integration services are required in various applications.

Automatic speech recognition segment to account for largest market share

Automatic Speech Recognition (ASR) is anticipated to rule the market in the speech and voice recognition space because it is utilized extensively across various industries and is capable of translating speech to text with very high accuracy. ASR technology uses artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) to upgrade real-time speech processing, thereby making it a vital tool in applications including virtual assistants, transcription services, automated customer service, and hand-free control. One of the strongest ASR leadership drivers is its congruence with cloud computing and AI-based platforms, which allow consumers and enterprises to be able to utilize highly scalable and accurate speech recognition solutions.Firmes are increasingly utilizing ASR-powered chatbots, call center automation, and intelligent assistants in order to achieve higher efficiency and customer satisfaction Moreover, innovation in multi-lingual support, industry-specific vocabulary customization, and noise cancellation technologies has also enhanced the reliability of ASR, which is now being chosen by enterprise as well as consumers.Besides, ASR is being used more and more in voice biometrics for identification, smart speakers, in-car voice control, and accessibility products for disabled people. The increasing smartphone penetration, IoT penetration, and penetration of AI-powered voice apps will further accelerate the market growth of ASR. As more sectors adopt digital transformation and automation, ASR will continue to be the most dominant technology in the market for speech and voice recognition and will keep shaping innovation and propelling its applications to many different fields.

Consumer vertical segment to hold largest share of speech and voice recognition during forecast period

The consumer vertical is expected to account largest market share in the speech and voice recognition market. The growth is boosted by the universal use of smartphones, smart speakers, virtual assistants, and wearable devices. Consumers increasingly apply voice-enabled technologies to hands-free voice conversation, smart home control, entertainment, and web searches, positioning speech recognition as an integral element of daily online interactions. Enhanced popularity of AI-based virtual assistants such as Amazon Alexa, Google Assistant, and Apple Siri has increased consumer demand for speech recognition substantially. Further, the growth of the market has been sped up by increasing voice commands for navigation, home shopping, and home automation. The merging of voice recognition with IoT devices, connected vehicles, and mobile apps is also a driving force behind such domination.

Consumers are fond of voice interfaces due to their ease of use, convenience, and speed of execution, especially when it comes to multitasking and accessibility. Increasing adoption of contactless interaction and voice biometrics for verification in mobile commerce, e-banking, and security has fueled adoption too.In addition, advances in multilingual speech recognition, personalization, and AI innovation have enhanced user experience, rendering the technology more efficient and convenient. With growing demand on the part of customers for smooth, voice-driven experiences, this industry shall be the most important contributor in the speech and voice recognition marketplace.

North America to contribute largest market share for speech and voice recognition market

North America is to lead the speech and voice recognition market owing to its high technology infrastructure, increased usage of AI-powered voice technology, and wide base of leading industry players. The area is dominated by top technology players like Amazon, Google, Apple, Microsoft, and IBM, which have played an important role in research and deployment of speech recognition technologies in smartphones, virtual assistants, smart speakers, and business applications. The high adoption of AI-driven virtual assistants, voice-enabled IoT devices, and biometric authentication solutions in the U.S. and Canada have contributed to driving market growth. Also, North America requires contactless interactions, automated customer service, and speech-to-text use cases with increasing demand in sectors such as healthcare, banking, retail, and automotive.

Besides, growing government initiatives and regulations for AI adoption across industrieshave encouraged the adoption of voice recognition technology. The mounting demand for secure authentication mechanisms, such as voice biometrics for banking and cyber security has also propelled the growth of the market. The presence of a technology-friendly population and continuous voice-enabled application advancements has made North America capable of retaining its leading position in the global speech and voice recognition market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Apple(US)

- Alphabet Inc (US)

- IBM(US)

- Microsoft (US)

- Baidu (China)

- IFLYTEK (China)

- SPEECH ENABLED SOFTWARE TECHNOLOGIES (SESTEK) (Istanbul)

- SPEAK2WEB (US)

- VERINT (US)

- SPEECHMATICS (UK)

- DEEPGRAM (US)

- VOICEITT (US)

- VOICEGAIN (US)

- SENSORY INC. (US)

- ASSEMBLYAI (US)

- VERBIT (US)

Speech and Voice Recognition Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 21.70 Billion |

| Projected Market Size | USD 73.49 Billion |

| Growth Rate | CAGR of 27.6% |

|

Market size available for years |

2025–2030 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Increased Software By Healthcare Professionals |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Technological Advancement in Medical Segment |

| Highest CAGR Segment | Consumer Segment |

The study categorizes the speech and voice recognition market based on Technology, Deployment mode, Vertical, and Region.

By Technology:

- Speech Recognition

- Automatic Speech Recognition

- Text-To-Speech

- Voice Recognition

- Speaker Identification

- Speaker Verification

By Deployment mode:

- On Cloud

- On-Premises/Embedded

By Vertical:

- Automotive

- Enterprise

- Consumer

- Banking, Finance Service & Insurance (BFSI)

- Government

- Retail

- Healthcare

- Military

- Legal

- Education

- Others

By Region:

- Americas

- Europe

- APAC

- RoW

Recent Developments

- In September 2023, Amazon unveiled a new large language model (LLM) for Alexa, optimized for voice applications. This model enables more natural conversations, proactive personalization, and improved speech recognition, enhancing user interactions with Alexa-enabled devices.

- In September 2024, Apple launched the iPhone 16 series, emphasizing AI capabilities branded as "Apple Intelligence." The update includes an improved Siri voice assistant and features like enhanced text generation and photo editing, aiming to provide a more intuitive user experience.

- In May 2023 Apple previewed software features for cognitive, vision, hearing, and mobility accessibility, along with innovative tools for individuals who are nonspeaking or at risk of losing their ability to speak. These updates draw on advances in hardware and software, include on-device machine learning to ensure user privacy, and expand on Apple’s long-standing commitment to making products for everyone.

Frequently Asked Questions (FAQs):

Which are the major companies in the speech and voice recognition market? What are their significant strategies to strengthen their market presence?

The major companies in the speech and voice recognition market Apple(US), Alphabet Inc (US), IBM(US), Microsoft (US), Baidu (China). The significant strategies these players adopt are product launches & developments, contracts, collaborations, acquisitions, and expansions.

Which region has the highest potential in the speech and voice recognition market?

The North American region is expected to register the share in the speech and voice recognition market.

What are the opportunities for new market entrants?

The speech and voice recognition market offers opportunities include customer preference for cloud-based speech-to-text software, Increasing popularity of online shopping, Development of personalized application for users,Integration of speech and voice recognition technology with mobile applications,Development of speech and voice recognition software for micro-linguistics and local languages, Application of speech and voice recognition in service robotics, Focus on utilizing speech and voice recognition technologies for educating disabled studentsand Deployment of speech and voice recognition technology in autonomous cars.

What are the drivers and opportunities for the speech and voice recognition market?

The speech and voice recognition market is driven by AI and deep learning advancements, improving accuracy and efficiency in voice-based interactions. The rising demand for contactless interfaces in healthcare, banking, and retail fuels adoption, while IoT and smart device integration expands usage in homes and enterprises. Multilingual and personalized speech recognition enhances accessibility, and voice biometrics strengthens security against fraud. Additionally, the shift toward cloud-based and edge AI processing boosts scalability and real-time speech recognition capabilities.

Who are the major applications of speech and voice recognition that are expected to drive the market’s growth in the next five years?

The significant consumers for speech and voice recognition include consumer electronics, healthcare, banking, automotive, and customer service, virtual assistants, smart speakers, and smartphones leverage speech recognition for hands-free control, while healthcare uses it for medical transcription and patient diagnostics. Banking and finance rely on voice biometrics for authentication, and automotive systems integrate voice commands for safer navigation. Additionally, call centers and enterprises adopt ai-driven voice automation to enhance customer interactions and efficiency.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SUMMARY OF CHANGES

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 PROCESS FLOW: SPEECH AND VOICE RECOGNITION MARKET SIZE ESTIMATION

FIGURE 2 SPEECH RECOGNITION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interview breakup

2.1.3.4 List of key primary respondents

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 52)

3.1 SPEECH AND VOICE RECOGNITION MARKET: POST-COVID-19

FIGURE 7 IMPACT OF COVID-19 ON SPEECH RECOGNITION MARKET

FIGURE 8 SPEECH RECOGNITION TO ACCOUNT FOR LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

FIGURE 9 ON-CLOUD DEPLOYMENT MODE TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 CONSUMER VERTICAL TO DOMINATE VOICE RECOGNITION MARKET BETWEEN 2022 AND 2027

FIGURE 11 AMERICAS HELD LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 12 INCREASING DEMAND FOR SPEECH AND VOICE RECOGNITION TECHNOLOGY-BASED PRODUCTS IN ASIA PACIFIC TO DRIVE MARKET GROWTH

4.2 MARKET, BY TECHNOLOGY

FIGURE 13 SPEECH RECOGNITION TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SHARE THAN VOICE RECOGNITION TECHNOLOGY DURING FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODE

FIGURE 14 ON-CLOUD SEGMENT TO COMMAND IN 2022

4.4 MARKET IN AMERICAS, BY REGION AND TECHNOLOGY

FIGURE 15 NORTH AMERICA AND SPEECH RECOGNITION TECHNOLOGY TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN AMERICAS BY 2027

4.5 VOICE RECOGNITION MARKET, BY VERTICAL

FIGURE 16 CONSUMER VERTICAL TO EXHIBIT HIGHEST CAGR FROM 2022 TO 2027

4.6 MARKET, BY COUNTRY (2021)

FIGURE 17 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Escalated use of speech and voice recognition software by healthcare professionals

5.2.1.2 Extensive penetration of speech and voice recognition technologies in smart appliances

FIGURE 19 SALES DATA FOR VOICE ASSISTANT DEVICES OFFERED BY KEY BRANDS, 2020

5.2.1.3 Elevated demand for speech and voice recognition technologies to transcribe audio

5.2.1.4 Strong requirement for voice-based biometric systems, especially by financial service providers, for multifactor authentication and mobile banking applications

FIGURE 20 USE OF VOICE RECOGNITION TO PREVENT IDENTITY THEFT IN BANKING AND FINANCE

FIGURE 21 DATA BREACH COMPLAINTS IN US (2018–2020)

5.2.1.5 Successful integration of AI into speech and voice recognition systems to achieve more accurate results

FIGURE 22 DRIVERS FOR MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Limitation of software to understand contextual relation of words in different languages

5.2.2.2 Need for numerous channels in speech-to-text APIs while transcribing audio data that includes multiple channels

5.2.2.3 Limited capacity to recognize and respond to customer intent

5.2.2.4 Concerns regarding data privacy and security

5.2.2.5 High cost of high-end voice recognition systems deployed in automobiles

5.2.2.6 Requirement for huge investment keeps small players out

FIGURE 23 RESTRAINTS FOR SPEECH AND VOICE RECOGNITION MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Customer preference for cloud-based speech-to-text software

5.2.3.2 Increasing popularity of online shopping

5.2.3.3 Development of personalized applications for users

5.2.3.4 Integration of speech and voice recognition technology with mobile applications

5.2.3.5 Development of speech and voice recognition software for micro-linguistics and local languages

5.2.3.6 Application of speech and voice recognition in service robotics

5.2.3.7 Focus on utilizing speech and voice recognition technologies for educating disabled students

5.2.3.8 Deployment of speech and voice recognition technology in autonomous cars

5.2.3.9 Consumer preference for technologically advanced products

FIGURE 24 OPPORTUNITIES FOR MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Creating unique vocabulary for various industries

5.2.4.2 Limited awareness regarding availability and benefits of voice assistant technologies

5.2.4.3 Increased errors due to background noise

5.2.4.4 Lack of standardized platform for development of customized products

5.2.4.5 Slow network speeds posing challenge to cloud-based speech recognition services

FIGURE 25 CHALLENGES FOR SPEECH RECOGNITION MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS : MARKET

5.4 ECOSYSTEM

FIGURE 27 VOICE RECOGNITION MARKET: ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.4.1 REVENUE SHIFT IN MARKET

FIGURE 28 REVENUE SHIFT IN MARKET

5.5 PATENT ANALYSIS

TABLE 3 IMPORTANT PATENT REGISTRATIONS, 2017–2021

FIGURE 29 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

FIGURE 30 ANNUAL NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS

TABLE 4 TOP 10 PATENT OWNERS

5.6 TRADE ANALYSIS

TABLE 5 IMPORT STATISTICS: SOUND RECORDING OR SOUND REPRODUCING APPARATUS, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 6 EXPORT STATISTICS: SOUND RECORDING OR SOUND REPRODUCING APPARATUS, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.7 TARIFF ANALYSIS

TABLE 7 TARIFF FOR SOUND RECORDING OR SOUND REPRODUCING APPARATUS EXPORTED BY NETHERLANDS IN 2020

TABLE 8 TARIFF FOR SOUND RECORDING OR SOUND REPRODUCING APPARATUS EXPORTED BY CHINA IN 2020

TABLE 9 TARIFF FOR SOUND RECORDING OR SOUND REPRODUCING APPARATUS EXPORTED BY UK IN 2020

TABLE 10 TARIFF FOR SOUND RECORDING OR SOUND REPRODUCING APPARATUS EXPORTED BY US IN 2020

TABLE 11 TARIFF FOR SOUND RECORDING OR SOUND REPRODUCING APPARATUS EXPORTED BY GERMANY IN 2020

5.8 CASE STUDY ANALYSIS

TABLE 12 SESTEK HELPS TEKNOSA TO INCREASE FIRST-CALL RESOLUTION RATE AND SHORTEN CALL DURATIONS AT CONTACT CENTER

TABLE 13 SESTEK HELPS AGENTS AT AL BARAKA BANK CONTACT CENTER TO SIGNIFICANTLY IMPROVE THEIR EFFICIENCY AND REDUCE WORKLOAD

TABLE 14 MICROSOFT TRANSLATOR APPLICATION FACILITATES MULTILINGUAL PARENT–TEACHER COMMUNICATION AT CHINOOK MIDDLE SCHOOL

TABLE 15 IBM WATSON HELPS BRADESCO BANK TO REDUCE RESPONSE TIME

TABLE 16 ALEXA HELPS HAWAII PACIFIC HEALTH TO ENHANCE PATIENT EXPERIENCE BY QUERY RESOLUTION

TABLE 17 CHATBOT BY ROANUZ ANSWERS USER QUERIES QUICKLY

5.9 PORTER'S FIVE FORCES ANALYSIS

TABLE 18 SPEECH AND VOICE RECOGNITION MARKET: PORTER'S FIVE FORCES ANALYSIS, 2020

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 INTENSITY OF RIVALRY

5.10 TECHNOLOGY ANALYSIS

5.10.1 MICROSOFT ALLOWS USERS CONTROL OVER USING VOICE CLIPS TO IMPROVE SPEECH RECOGNITION ALGORITHM

5.10.2 APPLE DEVELOPS AI MODEL FOR AUTOMATIC SPEECH TRANSCRIPTION AND SPEAKER RECOGNITION

5.10.3 SPEECHMATICS LAUNCHES SPEECH RECOGNITION SERVICE ON MICROSOFT AZURE

5.10.4 CRESCENDO SPEECH PROCESSING SOFTWARE OFFERS MULTILINGUAL SUPPORT

5.10.5 FACEBOOK'S AI OPEN SOURCE PROVIDES NEW DATASET FOR SPEECH RECOGNITION

5.10.6 LUMENVOX LAUNCHED NEXT-GENERATION AUTOMATIC SPEECH RECOGNITION (ASR) ENGINE WITH TRANSCRIPTION

5.10.7 SENSORY'S SPEECH RECOGNITION MODEL HELPS UNDERSTAND CHILDREN’S VOICE PATTERN

5.11 KEY REGULATIONS FOR VOICE RECOGNITION MARKET

TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 CODES AND STANDARDS

TABLE 23 SPEECH AND VOICE RECOGNITION CODES AND STANDARDS

5.13 PRICING ANALYSIS

TABLE 24 AVERAGE SELLING PRICE OF SPEECH RECOGNITION SOFTWARE

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.14.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 26 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.15 KEY CONFERENCES AND EVENTS (2022–2023)

TABLE 27 VOICE RECOGNITION MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 TYPES OF SPEECH AND VOICE RECOGNITION SYSTEMS (Page No. - 102)

6.1 INTRODUCTION

FIGURE 33 DELIVERY METHODS IN SPEECH AND VOICE RECOGNITION

6.2 ARTIFICIAL INTELLIGENCE-BASED

6.2.1 ARTIFICIAL INTELLIGENCE IS MOST EFFECTIVE TECHNIQUE FOR FLAWLESS AND ACCURATE SPEECH RECOGNITION

6.3 NON-ARTIFICIAL INTELLIGENCE-BASED

6.3.1 NON-AI-BASED SYSTEMS OFFER INDUSTRY-LEADING ACCURACY, SECURITY, AND CONSISTENCY

7 SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY (Page No. - 105)

7.1 INTRODUCTION

FIGURE 34 SPEECH RECOGNITION MARKET SEGMENTATION, BY TECHNOLOGY

FIGURE 35 VOICE RECOGNITION TECHNOLOGY TO RECORD HIGHER CAGR THAN SPEECH RECOGNITION TECHNOLOGY DURING FORECAST PERIOD

TABLE 28 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 VOICE RECOGNITION

7.2.1 NON-CONTACT, EASY-TO-USE, AND NON-INTRUSIVE FEATURES OF VOICE RECOGNITION DEVICES ARE EXPECTED TO FACILITATE THEIR DEMAND IN COMING YEARS

FIGURE 36 VOICE RECOGNITION PHASE PROCESS

TABLE 30 VOICE RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2 SPEAKER IDENTIFICATION

7.2.2.1 Speaker identification technology authenticates users by capturing unique speech characteristics

7.2.3 SPEAKER VERIFICATION

7.2.3.1 Speaker verification technology is increasingly used in banks and financial services for security purposes

FIGURE 37 SPEAKER VERIFICATION PROCESS

7.3 SPEECH RECOGNITION

7.3.1 MULTILINGUAL ENVIRONMENTS ARE EXPECTED TO WITNESS HIGH DEMAND FOR SPEECH RECOGNITION TECHNOLOGY TO ELIMINATE LANGUAGE BARRIERS

TABLE 32 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.2 AUTOMATIC SPEECH RECOGNITION

7.3.2.1 Advancements in ASR technology empower businesses to improve customer experience

7.3.3 TEXT-TO-SPEECH

7.3.3.1 Integration of AI and ML technologies into TTS software enables conversion of text into natural-sounding audio

FIGURE 38 AUTOMATIC SPEECH RECOGNITION TECHNOLOGY TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

TABLE 34 SPEECH RECOGNITION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 MARKET, BY TYPE, 2022–2027 (USD MILLION)

8 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE (Page No. - 115)

8.1 INTRODUCTION

FIGURE 39 DEPLOYMENT MODES IN SPEECH AND VOICE RECOGNITION

FIGURE 40 ON-CLOUD SPEECH AND VOICE RECOGNITION SOLUTIONS TO HOLD MAXIMUM MARKET SHARE IN 2027

TABLE 36 MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 37 VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 ON-CLOUD

8.2.1 ON-CLOUD SEGMENT TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

TABLE 38 ON-CLOUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 ON-CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 ON-PREMISES/EMBEDDED

8.3.1 ON-PREMISES DEPLOYMENT PROJECTED TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 40 ON-PREMISES/EMBEDDED: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 ON-PREMISES/EMBEDDED: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MARKET, BY VERTICAL (Page No. - 121)

9.1 INTRODUCTION

FIGURE 41 CONSUMER VERTICAL TO COMMAND MARKET DURING FORECAST PERIOD

TABLE 42 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 43 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

FIGURE 42 GOVERNMENT VERTICAL TO HOLD LARGEST SHARE OF MARKET IN 2027

TABLE 44 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 45 VOICE RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

FIGURE 43 CONSUMER VERTICAL TO HOLD LARGEST SHARE OF MARKET IN 2027

TABLE 46 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 47 SPEECH RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 AUTOMOTIVE

9.2.1 INCREASING USE OF SPEECH AND VOICE RECOGNITION TECHNOLOGIES IN IN-CAR INFOTAINMENT SYSTEMS

FIGURE 44 VEHICLE INSURANCE APPLICATION TO RECORD HIGHER CAGR IN MARKET DURING FORECAST PERIOD

TABLE 48 AUTOMOTIVE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 49 AUTOMOTIVE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 50 AUTOMOTIVE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 51 AUTOMOTIVE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 52 AUTOMOTIVE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 AUTOMOTIVE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 54 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 AUTOMOTIVE: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 AUTOMOTIVE: VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ENTERPRISE

9.3.1 GROWING ADOPTION OF VIRTUAL ASSISTANTS IN POST-PANDEMIC PERIOD TO BOOST MARKET GROWTH

TABLE 58 ENTERPRISE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 ENTERPRISE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 ENTERPRISE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 61 ENTERPRISE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 62 ENTERPRISE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 63 ENTERPRISE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 64 ENTERPRISE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 ENTERPRISE: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 ENTERPRISE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 ENTERPRISE: VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 CONSUMER

9.4.1 SURGING ADOPTION OF VOICE-CONTROLLED SMART ASSISTIVE DEVICES

FIGURE 45 MOBILE DEVICE CONTROL APPLICATION TO CAPTURE LARGER SHARE OF SPEECH AND VOICE RECOGNITION MARKET FOR CONSUMER VERTICAL IN 2027

TABLE 68 CONSUMER: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 CONSUMER: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 CONSUMER: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 CONSUMER: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 CONSUMER: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 73 CONSUMER: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 74 CONSUMER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 CONSUMER: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 CONSUMER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 CONSUMER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

9.5.1 RISING NEED FOR VOICE AUTHENTICATION IN MOBILE BANKING TO STIMULATE MARKET GROWTH

TABLE 78 BFSI: VOICE RECOGNITION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 BFSI: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 BFSI: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 BFSI: SPEECH RECOGNITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 BFSI: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 83 BFSI: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 BFSI: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 BFSI: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 GOVERNMENT

9.6.1 INCREASING USE OF SPEECH AND VOICE RECOGNITION SYSTEMS TO IMPROVE EFFICIENCY BOOSTS MARKET GROWTH

FIGURE 46 PROOF-OF-LIFE APPLICATION TO LEAD MARKET FOR GOVERNMENT VERTICAL FROM 2022 TO 2027

TABLE 88 GOVERNMENT: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 GOVERNMENT: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 GOVERNMENT: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 GOVERNMENT: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 GOVERNMENT: VOICE RECOGNITION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 GOVERNMENT: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 GOVERNMENT: SPEECH RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 GOVERNMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 RETAIL

9.7.1 INCREASING USE OF ADVANCED TECHNOLOGIES BY RETAILERS TO PROVIDE PERSONALIZED EXPERIENCE TO CUSTOMERS SUPPORTS MARKET GROWTH

TABLE 98 RETAIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 RETAIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 RETAIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 101 RETAIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 102 RETAIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 RETAIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 RETAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 RETAIL: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 RETAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 RETAIL: VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 HEALTHCARE

9.8.1 GROWING RELIANCE OF CARE PROVIDERS ON SPEECH AND VOICE RECOGNITION TO AVOID ERRORS, INCREASE PRODUCTIVITY, AND IMPROVE EFFICIENCY OF STAFF TO FUEL MARKET GROWTH

FIGURE 47 SPECIAL-PURPOSE ROBOTS EXPECTED TO REGISTER HIGHER CAGR IN MARKET FOR HEALTHCARE DURING FORECAST PERIOD

TABLE 108 HEALTHCARE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 109 HEALTHCARE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 HEALTHCARE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 HEALTHCARE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 HEALTHCARE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 113 HEALTHCARE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 114 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 115 HEALTHCARE: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 116 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 HEALTHCARE: VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 MILITARY

9.9.1 ONGOING INNOVATION IN SPEECH RECOGNITION TECHNOLOGY-BASED PRODUCTS TO FACILITATE THEIR DEMAND IN MILITARY APPLICATIONS

TABLE 118 MILITARY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 MILITARY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 MILITARY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 121 MILITARY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 MILITARY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 MILITARY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 124 MILITARY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 125 MILITARY: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 126 MILITARY: VOICE RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 127 MILITARY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.1 LEGAL

9.10.1 ELEVATING ADOPTION OF SPEECH AND VOICE RECOGNITION TOOLS BY LAW FIRMS TO FUEL MARKET GROWTH

TABLE 128 LEGAL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 129 LEGAL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 LEGAL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 131 LEGAL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 132 LEGAL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 133 LEGAL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 LEGAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 135 LEGAL: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 136 LEGAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 137 LEGAL: VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 EDUCATION

9.11.1 RISING USE OF SPEECH AND VOICE RECOGNITION TO EDUCATE DISABLED STUDENTS TO CREATE GROWTH OPPORTUNITIES

FIGURE 48 EDUCATION FOR DISABLED & E-LEARNING SEGMENT TO RECORD HIGHER CAGR IN MARKET DURING FORECAST PERIOD

TABLE 138 EDUCATION: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 139 EDUCATION: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 140 EDUCATION: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 141 EDUCATION: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 142 EDUCATION: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 143 EDUCATION: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 144 EDUCATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 145 EDUCATION: SPEECH RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 146 EDUCATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 147 EDUCATION: VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.12 OTHERS

TABLE 148 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 149 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 150 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 151 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 SPEECH AND VOICE RECOGNITION MARKET, BY REGION (Page No. - 171)

10.1 INTRODUCTION

FIGURE 49 MARKET SEGMENTATION, BY REGION

FIGURE 50 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 51 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 152 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 153 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 AMERICAS

FIGURE 52 AMERICAS: MARKET SNAPSHOT

TABLE 154 AMERICAS: SPEECH RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 155 AMERICAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 157 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 NORTH AMERICA

10.2.1.1 US

10.2.1.1.1 Prominent presence of key market players boosts demand for speech and voice recognition technologies

10.2.1.2 Canada

10.2.1.2.1 High deployment of voice-activated biometrics in banking applications to support market growth

10.2.1.3 Mexico

10.2.1.3.1 Strong focus of giant companies on setting up development centers in Mexico to create growth opportunities

10.2.2 SOUTH AMERICA

10.2.2.1 Rapid internet penetration to drive market growth

10.3 EUROPE

FIGURE 53 EUROPE: SPEECH RECOGNITION MARKET SNAPSHOT

TABLE 158 EUROPE: VOICE RECOGNITION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 159 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Strong government support and technological advancements boost market growth

10.3.2 GERMANY

10.3.2.1 Greater reliance on AI and cognitive technologies in enterprises to fuel demand for speech and voice recognition technologies

10.3.3 FRANCE

10.3.3.1 Significant focus on improving air traffic control fosters growth of speech and voice recognition market

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 54 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: VOICE RECOGNITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Rapid deployment of Al into innovative robotic devices fuels market growth

10.4.2 CHINA

10.4.2.1 Robust presence of key market players is boosting market growth

10.4.3 INDIA

10.4.3.1 Large-scale technological development and increasing number of mobile and internet users to drive market growth

10.4.4 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 55 MARKET IN ROW, 2022 VS. 2027

TABLE 162 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 163 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Remarkable adoption of voice assistant devices fosters demand for speech and voice recognition technologies

10.5.2 AFRICA

10.5.2.1 Africa to record higher CAGR than Middle East in speech recognition market in RoW from 2022 to 2027

11 COMPETITIVE LANDSCAPE (Page No. - 189)

11.1 INTRODUCTION

11.2 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 56 REVENUE ANALYSIS (USD MILLION), 2017–2021

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 164 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURERS OF SPEECH AND VOICE RECOGNITION PRODUCTS

11.4 MARKET SHARE ANALYSIS

TABLE 165 VOICE RECOGNITION MARKET: DEGREE OF COMPETITION (2021)

FIGURE 57 MARKET SHARE ANALYSIS: MARKET, 2021

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE COMPANIES

11.5.4 PARTICIPANTS

FIGURE 58 MARKET COMPANY EVALUATION QUADRANT, 2021

11.6 STRENGTH OF PRODUCT PORTFOLIO

11.7 BUSINESS STRATEGY EXCELLENCE

11.8 COMPETITIVE BENCHMARKING

TABLE 166 COMPETITIVE BENCHMARKING: VOICE RECOGNITION MARKET

FIGURE 59 COMPANY VERTICAL FOOTPRINT: MARKET

TABLE 167 COMPANY TECHNOLOGY FOOTPRINT: MARKET

TABLE 168 COMPANY REGION FOOTPRINT: SPEECH RECOGNITION MARKET

11.9 SME EVALUATION QUADRANT FOR MARKET, 2021

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 60 SPEECH AND VOICE RECOGNITION MARKET STARTUP/SME EVALUATION QUADRANT, 2021

11.10 COMPETITIVE SITUATION AND TRENDS

11.10.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 169 PRODUCT LAUNCHES AND DEVELOPMENTS, 2018–2021

11.10.2 DEALS

TABLE 170 DEALS, 2018–2021

12 COMPANY PROFILES (Page No. - 205)

(Business Overview, Products Offered, Recent Developments, COVID-19 Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 APPLE

TABLE 171 APPLE: BUSINESS OVERVIEW

FIGURE 61 APPLE: COMPANY SNAPSHOT

TABLE 172 APPLE: PRODUCTS OFFERED

TABLE 173 APPLE: DEALS

12.1.2 MICROSOFT

TABLE 174 MICROSOFT: BUSINESS OVERVIEW

FIGURE 62 MICROSOFT: COMPANY SNAPSHOT

TABLE 175 MICROSOFT: PRODUCTS OFFERED

TABLE 176 MICROSOFT: PRODUCT LAUNCHES

TABLE 177 MICROSOFT: DEALS

12.1.3 IBM

TABLE 178 IBM: BUSINESS OVERVIEW

FIGURE 63 IBM: COMPANY SNAPSHOT

TABLE 179 IBM: PRODUCT OFFERED

TABLE 180 IBM: PRODUCT LAUNCHES

TABLE 181 IBM: DEALS

12.1.4 ALPHABET

TABLE 182 ALPHABET: BUSINESS OVERVIEW

FIGURE 64 ALPHABET: COMPANY SNAPSHOT

TABLE 183 ALPHABET: PRODUCTS OFFERED

TABLE 184 ALPHABET: PRODUCTS LAUNCHES

TABLE 185 ALPHABET: DEALS

12.1.5 AMAZON

TABLE 186 AMAZON: BUSINESS OVERVIEW

FIGURE 65 AMAZON: COMPANY SNAPSHOT

TABLE 187 AMAZON: PRODUCTS OFFERED

TABLE 188 AMAZON: PRODUCTS LAUNCHES

TABLE 189 AMAZON: DEALS

12.1.6 BAIDU

TABLE 190 BAIDU: BUSINESS OVERVIEW

FIGURE 66 BAIDU: COMPANY SNAPSHOT

TABLE 191 BAIDU: PRODUCTS OFFERED

TABLE 192 BAIDU: PRODUCTS LAUNCHES

TABLE 193 BAIDU: DEALS

12.1.7 IFLYTEK

TABLE 194 IFLYTEK: BUSINESS OVERVIEW

FIGURE 67 IFLYTEK: COMPANY SNAPSHOT

TABLE 195 IFLYTEK: PRODUCTS OFFERED

TABLE 196 IFLYTEK: PRODUCTS LAUNCHES

12.1.8 SPEECH ENABLED SOFTWARE TECHNOLOGIES (SESTEK)

TABLE 197 SESTEK: BUSINESS OVERVIEW

TABLE 198 SESTEK: PRODUCTS OFFERED

TABLE 199 SESTEK: PRODUCTS LAUNCHES

TABLE 200 SESTEK: DEALS

12.1.9 SPEAK2WEB

TABLE 201 SPEAK2WEB: BUSINESS OVERVIEW

TABLE 202 SPEAK2WEB: PRODUCTS OFFERED

12.1.10 VERINT

TABLE 203 VERINT: BUSINESS OVERVIEW

FIGURE 68 VERINT: COMPANY SNAPSHOT

TABLE 204 VERINT: PRODUCTS OFFERED

TABLE 205 VERINT: PRODUCTS LAUNCHES

TABLE 206 VERINT: DEALS

12.1.11 SPEECHMATICS

TABLE 207 SPEECHMATICS: BUSINESS OVERVIEW

TABLE 208 SPEECHMATICS: PRODUCTS OFFERED

TABLE 209 SPEECHMATICS: PRODUCT LAUNCHES

TABLE 210 SPEECHMATICS: DEALS

12.1.12 DEEPGRAM

TABLE 211 DEEPGRAM: BUSINESS OVERVIEW

TABLE 212 DEEPGRAM: PRODUCTS OFFERED

TABLE 213 DEEPGRAM: DEALS

12.1.13 VOICEITT

TABLE 214 VOICEITT: BUSINESS OVERVIEW

TABLE 215 VOICEITT: PRODUCTS OFFERED

12.1.14 VOICEGAIN

TABLE 216 VOICEGAIN: BUSINESS OVERVIEW

TABLE 217 VOICEGAIN: PRODUCTS OFFERED

TABLE 218 VOICEGAIN: PRODUCT LAUNCHES

TABLE 219 VOICEGAIN: DEALS

12.1.15 SENSORY INC.

TABLE 220 SENSORY: BUSINESS OVERVIEW

TABLE 221 SENSORY: PRODUCTS OFFERED

TABLE 222 SENSORY: PRODUCT LAUNCHES

TABLE 223 SENSORY: DEALS

12.1.16 ASSEMBLYAI

TABLE 224 ASSEMBLYAI: BUSINESS OVERVIEW

TABLE 225 ASSEMBLYAI: PRODUCTS OFFERED

TABLE 226 ASEEMBLYAI: DEALS

12.1.17 VERBIT

TABLE 227 VERBIT: BUSINESS OVERVIEW

TABLE 228 VERBIT: PRODUCTS OFFERED

TABLE 229 VERBIT: DEALS

12.1.18 OTTER.AI

TABLE 230 OTTER.AI: BUSINESS OVERVIEW

TABLE 231 OTTER.AI: PRODUCTS OFFERED

TABLE 232 OTTER.AI: PRODUCT LAUNCHES

TABLE 233 OTTER.AI: DEALS

12.1.19 REV

TABLE 234 REV: BUSINESS OVERVIEW

TABLE 235 REV: PRODUCTS OFFERED

12.2 OTHER PLAYERS

12.2.1 RAYTHEON BBN TECHNOLOGIES

12.2.2 M2SYS

12.2.3 M*MODAL

12.2.4 VALIDSOFT

12.2.5 LUMENVOX

12.2.6 ACAPELA GROUP

12.2.7 VOCALZOOM

12.2.8 UNIPHORE SOFTWARE

12.2.9 ISPEECH

12.2.10 GOVIVACE

12.2.11 ADVANCED VOICE RECOGNITION SYSTEMS

12.2.12 DOLBEY

12.2.13 READSPEAKER

12.2.14 PARETEUM CORPORATION

12.2.15 SOUNDHOUND INC.

*Details on Business Overview, Products Offered, Recent Developments, COVID-19 Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 279)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATION

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

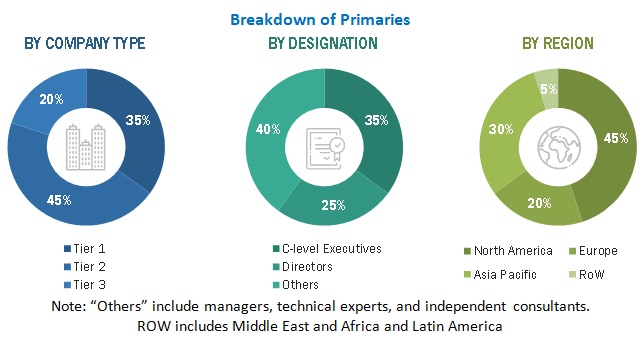

The study involved four major activities in estimating the size of the speech and voice recognition market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations (such as Consumer Technology Association (CTA), Integrated Systems Europe, the Organisation Internationale des Constructeurs d'Automobiles (OICA), the Society for Information Display (SID), and Touch Taiwan); white papers, certified publications, and articles by recognized authors; gold and silver standard websites; directories; and databases.

Secondary research has been conducted to obtain key information about the supply chain of the speech and voice recognition industry, the monetary chain of the market, the total pool of key players, and market segmentation according to the industry trends to the bottommost level, regional markets, and key developments from both market- and technology oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the speech and voice recognition market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (consumers, industries) and supply-side (speech and voice recognition device manufacturers) players across four major regions, namely, Americas, Europe, Asia Pacific, and the Rest of the World (the Middle East & Africa). Approximately 75% and 25% of primary interviews have been conducted from the supply and demand side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the speech and voice recognition market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various applications that use or are expected to use the speech and voice recognition market.

- Analyzing historical and current data pertaining to the size of the speech and voice recognition market, in terms of volume, for each application using their production statistics

- Analyzing the average selling prices of speech and voice recognition based on different technologies

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases

- Identifying leading manufacturers of speech and voice recognition sensors, studying their portfolios, and understanding features of their products and their underlying technologies, as well as the types of speech and voice recognition offered

- Tracking ongoing and identifying upcoming developments in the market through investments, research and development activities, product launches, expansions, and partnerships, and forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the technologies used in speech and voice recognition, raw materials used to develop them, and products wherein they are deployed, and analyze the break-up of the scope of work carried out by key manufacturers of speech and voice recognition solutions providers

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The main objectives of this study are as follows:

- To define, describe, segment, and forecast the speech and voice recognition market, in terms of value, based on technology, deployment mode, vertical, and region.

- To forecast the speech and voice recognition market, in terms of volume, based on application

- To forecast the size of the market and its segments with respect to four main regions, namely, Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors influencing market growth, such as drivers, restraints, opportunities, and challenges

- To provide a detailed analysis of the speech and voice recognition supply chain

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies2

- To analyze key growth strategies such as expansions, contracts, joint ventures, acquisitions, product launches and developments, and research and development activities undertaken by players operating in the speech and voice recognition market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Speech and Voice Recognition Market

We require such analysis which can exclusively help our organization with revenue growth. Are there specific insights in this domain which you could share?