Sputter Coating Market by Target Material (Pure Material, Compound), by Substrate (Metal, Glass, Plastic, Semiconductor), by Application (Architecture, Electronics, Optical, Tribological & Decorative Coating) & by Geography - Global Forecast to 2020

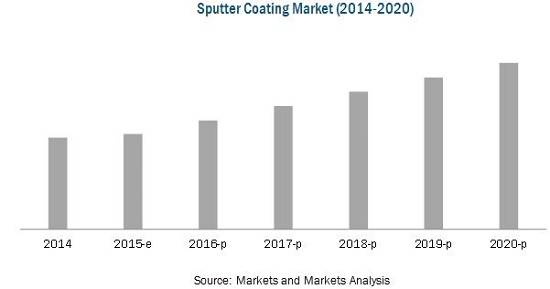

Sputter coating is one of the popular and fastest growing physical vapour deposition techniques. The technology has major applications in electronics & semiconductor sector and is expected to remain an important market during the forecast period. The sputter coating market for target materials and equipment is expected to grow from USD 4166.3 Million in 2014 to USD 5.6 Billion in 2020, at a CAGR of 4.96 % during the forecast period (2015-2020).

Market Segments and Aspects Covered:

Market by target material type:

The Sputter Coating market based on the target material type is segmented into pure material, alloy, and compounds sputter target.

Market by substrate type:

The Sputter Coating market based on the substrate type is segmented into metal & dielectric, glass, plastic, other insulator, semiconductors.

Market by application:

Major application of the sputter coating technology includes automotive and transportation, architecture, electronics (microelectronics, data storage, display), energy, lighting, medical, defense and security, optical coating, tribological coating, decorative coating, and others.

Market by Geography:

The sputter coating market is segmented based on geography into four different regions, namely, the North America (the U.S., Canada, and Mexico), Europe (Germany, the U.K., France, and Rest of Europe ), APAC (China, India, Indonesia, Japan, and Rest of APAC), and the Rest of the World (the Middle East, South America and Africa).

Automotive & Transportation and optical coating application are the fastest growing areas for the technology. The APAC region is expected to have the highest growth for the technology during the forecast period. Some of the companies involved in the market include JX Nippon Mining & Metals Corporation (Japan), Tosoh SMD Inc. (U.S.), Hitachi Metals Ltd. (Japan), Mitsui Mining & Smelting Co., Ltd. (Japan), Umicore (Belgium), and Hereaus Deutschland Gmbh & Co. Kg. (Germany).

Three major aspects of the Sputter coating market are covered in this report. Market Overview and Industry Trends, along with Market Dynamics and additional qualitative analysis account for Market Analysis. Market Classification encompasses segmentation & sub-segmentation of the market by material type, substrate type, application, and geography. Lastly, the current market is covered with a detailed competitive landscape and company profiles of all key players across the ecosystem.

This report would cater to the needs of leading operators, contractors, and service providers in the sputter coating market. Other parties that could benefit from the report include government bodies, environmental agencies, consulting firms, business development executives, C-level employees, and VPs. Our report would help you analyze new opportunities and potential revenue sources and enhance your decision making process for new business strategies. The quantitative and qualitative information in the report along with our comprehensive analysis would help you stay competitive in the market.

The following customization options are available for the Sputter Coating market report.

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of top companies

Vertical Analysis

- Further breakdown of the countries at feasible application levels

Company Information

- Detailed analysis and profiling of additional market players (Up to 5).

Sputter coating technology is used for thin film deposition of target material on the desired surface called substrate. In sputter coating a target is bombarded with heavy gas atoms (usually argon but air is a fair substitute). Metal atoms ejected from the target by the ionized gas cross the plasma to deposit onto any surface, and this process is used to form a desired coating on the substrate. It is the popular physical vapor deposition technique used in application such as optics (for e.g. architectural glass, reflectors, lenses), optoelectronics (solar cells, photodiodes, liquid crystal displays - LCD), electronics (for e.g. microchips,), the memory technology (for e.g. laser discs, magneto-optical media), the surface protection (tools, machine parts), or the barrier technology (diffusion barriers for e.g.in flexible packing).

The report segments the sputter coating market based on material type (pure material, alloy and compounds), by substrate type (Ceramic, Metal & dielectric, Glass, Plastic, Textile and Others), and by application (Automotive & Transport, Architecture, Microelectronics, Data storage, Electronics, Display, Energy, Lighting, Medical, Defense & Security, Optical Coating, tribological coating, decorative coating and others), and by geography (North America, APAC, Europe, and the Rest of the world). Further, it contains market size estimations, and analyses the trends in the market.

The sputter coating market has seen a high growth in the recent years. The demand for consumer electronic devices with advance display technology (smart phones, LCDs, tablets laptops), automotive electronics, advance medical & defense and optoelectronics devices (solar cells, photo diode) had significantly increased which is driving the market for sputter coating as sputter coating technology is used in these applications.

Some of the companies involved in the market are JX Nippon Mining & Metals Corporation (Japan), Tosoh SMD Inc. (U.S.), Hitachi Metals Ltd. (Japan), Mitsui Mining & Smelting Co., Ltd. (Japan), Umicore (Belgium), and Hereaus Deutschland Gmbh & Co. Kg. (Germany)

The overall sputter coating market is expected to grow to USD 5.6 Billion by 2020, at a CAGR of 4.96% from 2015 to 2020. Electronics and semiconductor sector represent the major application for the sputter coating technology. The sputter coating technique is profoundly used for metal deposition on silicon wafer for electronic circuit generation in semiconductor devices. The coating done by sputtering is used to improve data storage capacity of the memory device and to enhance image quality of display devices used in consumer electronics. As per the geographic analysis, APAC region is expected to grow the fastest during the forecast period.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Sputter Coating Market

4.2 Sputter Coating Market Key Applications

4.3 Sputter Coating Market in Asia Pacific

4.4 Global Growth Map

4.5 Sputter Coating Application Market, By Region

4.6 Sputter Coating Market, By Country

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Target Material

5.2.2 Market, By Substrate

5.2.3 Market, By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Applications of Glass Coating

5.3.1.2 Environmental Regulations for Controlled Hexavalent Chrome (CR6) Emission

5.3.2 Restraints

5.3.2.1 High Cost Associated With Sputter Coating

5.3.3 Opportunities

5.3.3.1 Potential Market in the Medical Industry

5.3.3.2 Increased Demand for Semiconductor and Solar

5.3.3.3 Growing Telecommunication Market

5.3.4 Challenges

5.3.4.1 Difficulty in Handling and Fabrication

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threats From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of the Buyers

6.3.5 Degree of Competition

6.4 Industry Trends

7 Market Analysis, By Target Material (Page No. - 51)

7.1 Introduction

7.2 Pure Material

7.3 Alloys

7.4 Compounds

8 Market Analysis, By Substrate (Page No. - 54)

8.1 Introduction

8.2 Metals & Dielectric

8.3 Insulators

8.3.1 Glass

8.3.2 Plastic

8.3.3 Others

8.4 Semiconductor

9 Market Analysis, By Application (Page No. - 58)

9.1 Introduction

9.2 Automotive and Transportation

9.3 Architecture

9.4 Electronics

9.4.1 Microelectronics

9.4.2 Data Storage

9.4.3 Display

9.5 Defense and Security

9.6 Energy

9.7 Lighting

9.8 Medical

9.9 Optical Coating

9.9.1 Anti-Reflection Coating (ARC)

9.9.2 High Reflection Coating

9.9.3 Beam Splitter Coating

9.9.4 Transparent Conductive Coatings

9.10 Tribological Coating

9.10.1 Wear Resistance

9.10.2 Friction Resistance

9.10.3 Corrosion Resistance

9.11 Decorative Coating

9.12 Others

10 Market Analysis, By Geography (Page No. - 91)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Taiwan

10.4.5 India

10.4.6 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 110)

11.1 Overview

11.2 Sputter Coating Market: Comparative Analysis

11.3 Market Share Analysis, Sputtering Target Market - 2014

11.4 Competitive Situation and Trends

11.4.1 Acquisition, Expansion & Collaboration

11.4.2 New Product Launch and Development

11.4.3 Agreement and Contract

12 Company Profiles (Page No. - 117)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 JX Nippon Mining & Metals Corporation

12.3 Tosoh Smd Inc.

12.4 Hitachi Metals, Ltd.

12.5 Mitsui Mining & Smelting Co., Ltd

12.6 Paxair Surface Technologies

12.7 Intevac Inc.

12.8 Mitsubishi Materials Corporation

12.9 Umicore Group

12.10 Ulvac Inc.

12.11 Heraeus Deutschland GmbH & Co. Kg

12.12 Plansee

12.13 Treibacher Industries AG

12.14 Soleras Advanced Coatings

12.15 AJA International Inc.

12.16 Kamis Inc.

12.17 Corning Precision Materials Korea Co., Ltd.

12.18 Honeywell Electronics Material

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 152)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (70 Tables)

Table 1 Market Share of Sputter Coating Equipment vs Target Material

Table 2 Market Share of Substrates

Table 3 Increasing Demand for Glass Coating is Propelling the Growth of the Sputter Coating Market

Table 4 High Sputtering Cost is Expected to Affect the Growth of the Market

Table 5 Growing Semiconductor, Solar and Medical Industry Would Generate New Opportunities for the Sputter Coating Market

Table 6 Wide Spread Adoption of Wi-Fi and Wimax is the Major Challenge for the Sputter Coating Market

Table 7 Sputter Coating Market, By Material, 20142020 (USD Million)

Table 8 Sputter Coating Market, By Substrate, 20142020 (USD Million)

Table 9 Sputter Coating Market, By Application, 20142020 (USD Million)

Table 10 Sputter Coating Equipment Market, By Application, 20142020 (USD Million)

Table 11 Sputter Coating Material Market, By Application, 20142020 (USD Million)

Table 12 Sputter Coating Market in Automotive and Transportation, By Region, 2014-2020 (USD Million)

Table 13 Sputter Coating Equipment Market in Automotive and Transportation, By Region, 20142020 (USD Million)

Table 14 Sputter Coating Material Market in Automotive and Transportation, By Region, 20142020 (USD Million)

Table 15 Sputter Coating Market in Architecture, By Region, 20142020 (USD Million)

Table 16 Sputter Coating Equipment Market in Architecture, By Region, 20142020 (USD Million)

Table 17 Sputter Coating Material Market in Architecture, By Region, 20142020 (USD Million)

Table 18 Sputter Coating Equipment Market, for Electronics, 2014-2020 (USD Million)

Table 19 Sputter Coating Material Market, for Electronics, 20142020 (USD Million)

Table 20 Sputter Coating Market in Microelectronics, By Region, 20142020 (USD Million)

Table 21 Sputter Coating Equipment Market in Microelectronics, By Region, 20142020 (USD Million)

Table 22 Sputter Coating Material Market in Microelectronics, By Region, 20142020 (USD Million)

Table 23 Sputter Coating Market in Data Storage, By Region, 20142020 (USD Million)

Table 24 Sputter Coating Equipment Market in Data Storage, By Region, 20142020 (USD Million)

Table 25 Sputter Coating Material Market in Data Storage, By Region, 20142020 (USD Million)

Table 26 Sputter Coating Market in Display, By Region, 20142020 (USD Million)

Table 27 Sputter Coating Equipment Market in Display, By Region, 20142020 (USD Million)

Table 28 Sputter Coating Material Market in Display, By Region, 20142020 (USD Million)

Table 29 Sputter Coating Market in Defense & Security, By Region, 20142020 (USD Million)

Table 30 Sputter Coating Equipment Market in Defense and Security, By Region, 20142020 (USD Million)

Table 31 Sputter Coating Material Market in Defense & Security, By Region, 20142020 (USD Million)

Table 32 Sputter Coating Material Market in Defense & Security, By Region, 20142020 (USD Million)

Table 33 Sputter Coating Market in Energy, By Region, 20142020 (USD Million)

Table 34 Sputter Coating Equipment Market in Energy, By Region, 20142020 (USD Million)

Table 35 Sputter Coating Material Market in Energy, By Region, 20142020 (USD Million)

Table 36 Sputter Coating Market in Lighting, By Region, 20142020 (USD Million)

Table 37 Sputter Coating Equipment Market in Lighting, By Region, 20142020 (USD Million)

Table 38 Sputter Coating Material Market in Lighting, By Region, 20142020 (USD Million)

Table 39 Sputter Coating Market in Medical, By Region, 20142020 (USD Million)

Table 40 Sputter Coating Equipment Market in Medical, By Region, 20142020 (USD Million)

Table 41 Sputter Coating Material Market in Medical, By Region, 20142020 (USD Million)

Table 42 Sputter Coating Market in Optical Coating, By Region, 20142020 (USD Million)

Table 43 Sputter Coating Equipment Market in Optical Coating, By Region, 20142020 (USD Million)

Table 44 Sputter Coating Material Market in Optical Coating, By Region, 20142020 (USD Million)

Table 45 Sputter Coating Market in Tribological Coating, By Region, 20142020 (USD Million)

Table 46 Sputter Coating Equipment Market in Tribological Coating, By Region, 20142020 (USD Million)

Table 47 Sputter Coating Material Market in Tribological Coatings, By Region, 20142020 (USD Million)

Table 48 Sputter Coating Market in Decorative Coating, By Region, 20142020 (USD Million)

Table 49 Sputter Coating Equipment Market in Decorative Coatings, By Region, 20142020 (USD Million)

Table 50 Sputter Coating Material Market in Decorative Coatings, By Region, 20142020 (USD Million)

Table 51 Sputter Coating Market in Others, By Region, 20142020 (USD Million)

Table 52 Sputter Coating Equipment Market in Other Applications, By Region, 20142020 (USD Million)

Table 53 Sputter Coating Material Market in Others, By Region, 20142020 (USD Million)

Table 54 Global Sputter Coating Market, 20142020 (USD Million)

Table 55 Sputter Coating Market, By Region, 20142020 (USD Million)

Table 56 North America Sputter Coating Equipment Market, By Application, 20142020 (USD Million)

Table 57 North America Sputter Coating Material Market, By Application, 20142020 (USD Million)

Table 58 North America Sputter Coating Market, By Country, 20142020 (USD Million)

Table 59 Europe Sputter Coating Equipment Market, By Application, 20142020 (USD Million)

Table 60 Europe Sputter Coating Material Market, By Application, 20142020 (USD Million)

Table 61 Europe Sputter Coating Market, By Country, 20142020 (USD Million)

Table 62 APAC Sputter Coating Equipment Market, By Application, 20142020 (USD Million)

Table 63 APAC Sputter Coating Material Market, By Application, 20142020 (USD Million)

Table 64 APAC Sputter Coating Market, By Country, 20142020 (USD Million)

Table 65 RoW Sputter Coating Equipment Market, By Application, 20142020 (USD Million)

Table 66 Sputter Coating Material Market, By Application, 20142020 (USD Million)

Table 67 RoW Sputter Coating Market, By Country, 20142020 (USD Million)

Table 68 Acquisition, Expansion & Collaboration, 20122015

Table 69 New Product Launch and Development, 20122015

Table 70 Agreement and Contract, 20122015

List of Figures (54 Figures)

Figure 1 Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown and Data Triangulation

Figure 8 Sputter Coating Market (2014 - 2020)

Figure 9 Sputtering Equipment Market is Estimated to Dominate the Sputter Coating Market During the Forecast Period

Figure 10 Microelectronics to Dominate the Sputter Coating Market During the Forecast Period

Figure 11 Semiconductor is the Most Widely Used Substrate in the Sputter Coating Market

Figure 12 The Global Sputter Coating Market Share, By Geography, 2014

Figure 13 Optical Coating Through Sputtering Present Growth Opportunities in the Sputter Coating Market

Figure 14 Microelectronics to Have the Largest Share in the Sputter Coating Market in the Forecast Period

Figure 15 China Held the Largest Share in the Sputter Coating Market

Figure 16 India to Experience the Fastest Growth in the Sputter Coating Market From 2015 to 2020

Figure 17 Optical Coating Market is Expected to Grow at the Highest CAGR in the APAC Region

Figure 18 Developing Countries to Experience More Growth Than the Developed Countries

Figure 19 Sputter Coating Market, By Target Material

Figure 20 Sputter Coating Market, By Substrate

Figure 21 Sputter Coating Market, By Application

Figure 22 Sputter Coating Market, By Geography

Figure 23 Growing Telecommunication, Medical, and Semiconductor Industry are Expected to Present Growth Opportunities in the Sputter Coating Market

Figure 24 Revenue From the Consumption of Semiconductors, 20092014

Figure 25 Value Chain for Sputter Coating Market

Figure 26 Porters Five Forces Analysis

Figure 27 Growing Demand in End User Industries is A Leading Trend in the Sputter Coating Market

Figure 28 Types of Target Materials Used in Sputter Coatings

Figure 29 Types of Substrate for Sputter Coatings

Figure 30 Market, By Application

Figure 31 Sputter Coating Market, By Geography

Figure 32 North America: Market Snapshot

Figure 33 Asia Pacific: Market Snapshot

Figure 34 Optic Test Equipment Industry Players Prefer New Product Launches as Key Strategy for Business Expansion

Figure 35 Sputtering Target Market Share Analysis, By Key Players, 2014

Figure 36 Battle for Market Share: Companies Follow New Product Launches as the Key Strategy

Figure 37 Market Evaluation Framework Various New Product Developments and Inorganic Expansion Fueled the Growth of the Sputter Coating Market Between 2012 and 2015

Figure 38 Geographic Revenue Mix of Key Market Players

Figure 39 SWOT Analysis: JX Nippon Mining & Metals Corporation

Figure 40 Hitachi Metals Ltd.: Company Snapshot

Figure 41 SWOT Analysis: Hitachi Metals, Ltd.

Figure 42 Mitsui Mining & Smelting Co., Ltd: Company Snapshot.

Figure 43 SWOT Analysis: Mitsui Mining & Smelting Co., Ltd.

Figure 44 Paxair Surface Technologies: Company Snapshot

Figure 45 Intevac Inc.: Company Snapshot

Figure 46 SWOT Analysis: Intevac Inc.

Figure 47 Mitsubishi Material Corporation: Company Snapshot.

Figure 48 SWOT Analysis: Mitsubishi Materials Corporation

Figure 49 Umicore Group: Company Snap Shot

Figure 50 ULVAC Inc.: Company Snapshot

Figure 51 SWOT Analysis: ULVAC Inc.

Figure 52 SWOT Analysis: Heraeus Deutschland GmbH & Co.

Figure 53 SWOT Analysis: Plansee

Figure 54 SWOT Analysis: Soleras Advanced Coatings

Growth opportunities and latent adjacency in Sputter Coating Market