Vibration Monitoring Market by Accelerometers, Proximity Probes, Velocity Sensors, Transmitters, Vibration Analyzers, Vibration Meters, Online Vibration Monitoring, Portable Vibration Monitoring, On-premises, Cloud Software - Global Forecast to 2029

Viberation Monitoring Market Size and Growth

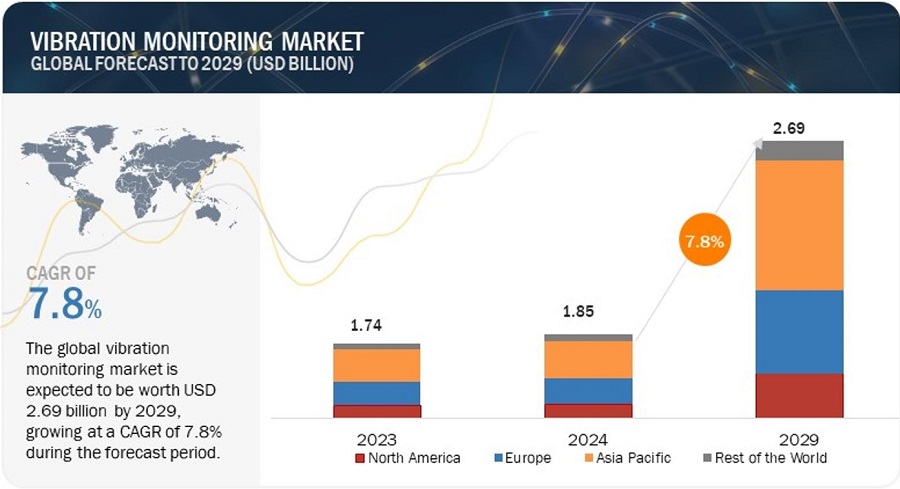

[250 Pages Report] The global vibration monitoring market size is projected to grow from USD 1.85 billion in 2024 to USD 2.69 billion by 2029, at a CAGR of 7.8%. The growing demand for vibration monitoring systems is driven by the increasing adoption of smart manufacturing, which integrates technologies and services through a network to improve production quality. The prevailing global trend of smart manufacturing is expected to improve the efficiency and productivity of industries in the coming years. Vibration monitoring systems save time by eliminating downtime and failures, increasing monitoring flexibility using portable devices, providing automatic error-free solutions, and improving the reliability of factories. The growing demand for vibration monitoring is driven by its ability to enable predictive maintenance, improve efficiency, enhance safety, comply with regulations, and reduce costs.

Vibration Monitoring Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

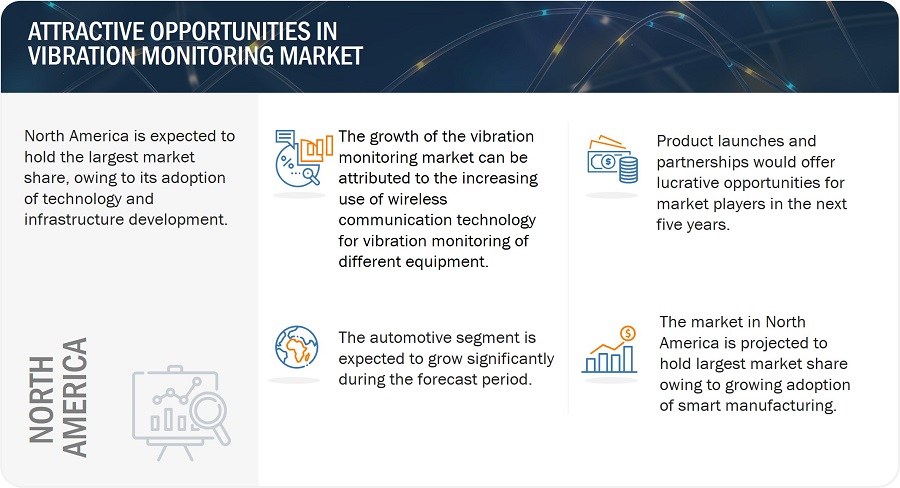

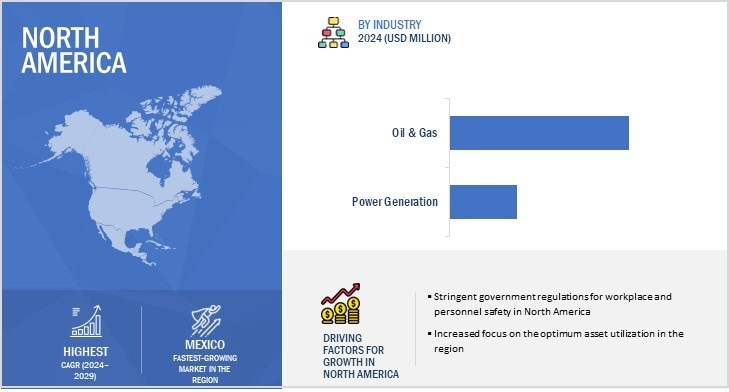

North America accounted for a significant share of (USD 609.2) million in the vibration monitoring market, and it is considered one of the most advanced regions in terms of technology adoption and infrastructure development. Energy and utilities, aerospace, and manufacturing are some verticals investing increasingly in vibration monitoring solutions and systems in the region. Further, Asia Pacific is expected to grow with the highest CAGR of 8.7% in the vibration monitoring market during the forecast period, owing to the rising need for process optimization in manufacturing industries.

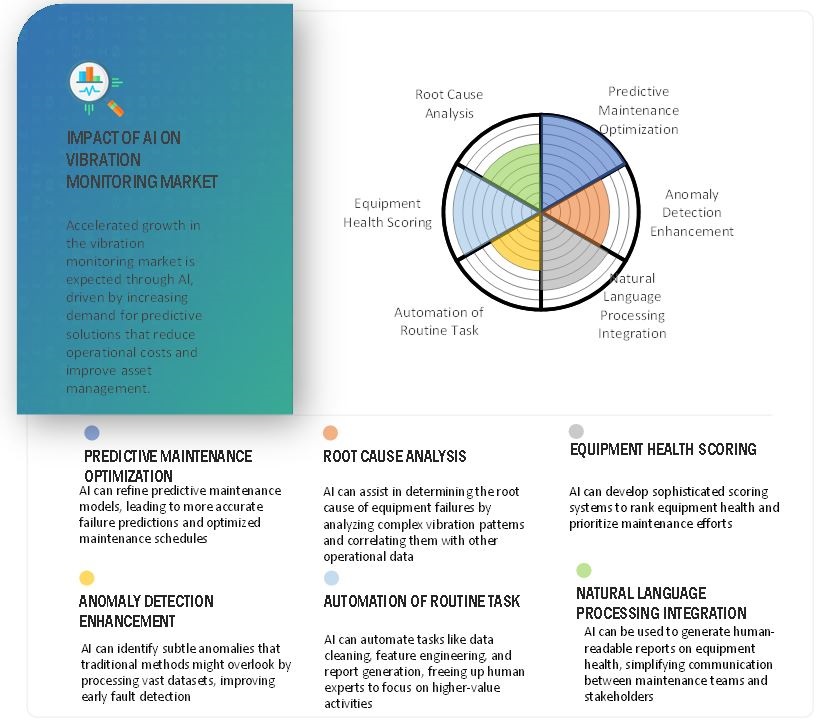

Al is changing vibration monitoring by processing vast reams of data to support complex patterns. This enables advanced anomaly detection, predictive maintenance, and fault diagnosis. These detection, maintenance, and fault diagnosis techniques form the basis for highly accurate assessments of equipment health, optimum maintenance schedules, and reduced downtime. Al helps to gain deeper insight and facilitates faster decision-making. Accelerated growth in the vibration monitoring market is expected through Al, which is driven by increasing demand for predictive solutions to reduce operational costs and improve asset management. As a result, interest from enterprises of different industrial verticals is developing to invest in Al-based vibration monitoring systems so that extra operational efficiency and reliability can help sustain competitiveness.

Viberation Monitoring Market Trends & Dynamics

DRIVERS: Deployment of automation systems across various industries

Automation is among the most significant new technologies adopted in different industries, particularly in industries wherein processes and conditions are repeatable and predictable. These systems are gradually becoming highly flexible and intelligent, eliminating the requirement of close human supervision. They can offer optimal outcomes when a combination of sensors, actuators, microprocessors, and machine intelligence algorithms are used in these systems. Costs of various components used in automated systems have decreased in recent years, subsequently lowering the overall costs of these systems. Automation also reduces production costs and expenses on overall processes and increases the return on investments (Rol). This has resulted in the adoption of vibration monitoring systems by several small and mid-sized companies.

RESTRAINTS: Misconceptions regarding vibration monitoring system reliability and capability

Some operators rely on their instincts and experiences to judge the condition of machines, which is not always a reliable option. There may be instances where operators can overrule the analysis based on their personal experiences or due to a lack of trust in vibration monitoring technology's prediction capabilities. Experienced operators are sometimes skeptical about the diagnostics and predictions provided by vibration monitoring systems owing to mistakes made by these machines in the form of dropped metrics, service outages, and unreliable alerting signals.

OPPORTUNITIES: Rising interest in big data analytics and machine learning

The advent of machine learning, coupled with efficient big data analytics and a parallel processing framework, is transforming the vibration monitoring market. Big data analytics has accelerated the process of data analysis generated by condition monitoring systems owing to its capability of processing large data volumes. Machine learning carries out easy benchmarking of machine performance, enables transparency in data, and supports efficient collaboration among different processes of vibration monitoring systems. Big data-enabled vibration monitoring helps companies reduce overall asset ownership costs and improve business efficiency.

CHALLENGES: Shortage of experts ready to work at remote locations

Vibration monitoring systems are deployed by several companies to achieve operational excellence in their manufacturing processes by reducing equipment failures. It is a predictive maintenance strategy with the main objective of determining the current health condition of assets and predicting their future behavior to carry out maintenance at the most appropriate time. However, technical expertise is necessary for system optimization, software updates, system networking, data transmissions, and others, and it is becoming increasingly difficult to get experts who are ready to work in remote locations. As oil & gas production facilities and power generation plants are located in remote locations, the availability of experts at these locations is a challenge. Therefore, it becomes difficult to implement vibration monitoring systems in locations where access to expertise is difficult.

Vibration Monitoring Market Ecosystem

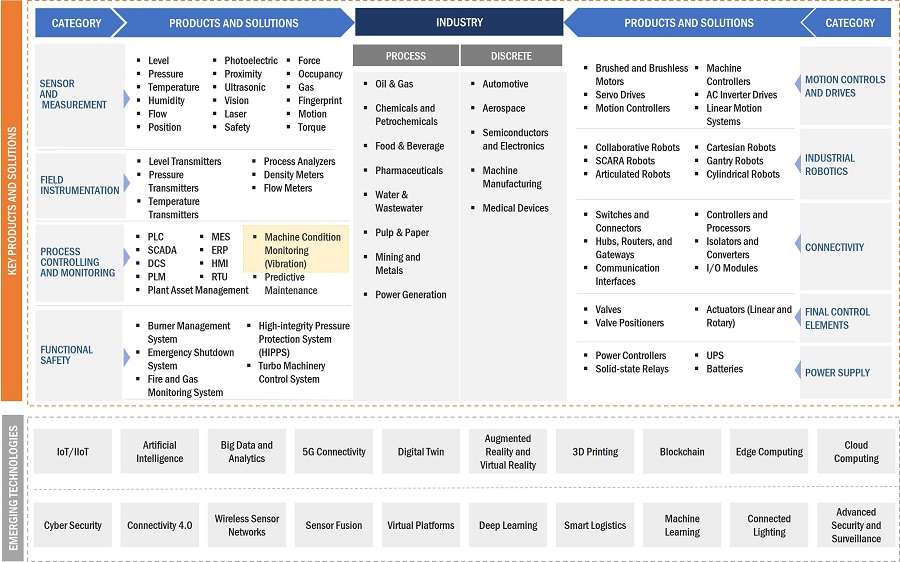

Prominent companies in this market include well-established, financially stable vibration monitoring solutions providers such as Baker Hughes Company (US), Emerson Electric Co. (US), SKF (Sweden), Schaeffler AG (Germany), and Parker Hannifin Corp (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Along with the well-established companies, many small and medium companies operate in this market, such as Machine Saver (US) and Petasense Inc. (US). Vibration monitoring plays an important role in the vast market ecosystem of industrial and process automation, as shown in the diagram below:

On-premises software segment is projected to hold largest market share during forecast period.

On-premises deployment is the conventional method of deploying vibration monitoring solutions and systems. Organizations have complete control over the on-premises data flow, as it is physically stored in the organizations where these solutions and systems are deployed. This is one of the key reasons for adopting on-premises vibration monitoring solutions and systems. On-premises deployment is feasible for small and medium-sized enterprises as data management becomes easy for them.

On-premises vibration monitoring solutions and systems collect data in real time with high accuracy, thereby reducing the response time for solving issues. On-premises deployment of vibration monitoring solutions and systems provides more control over data security than cloud deployment, leading to increased adoption of these solutions and systems over cloud deployment. However, high installation, setup, and maintenance costs restrict the adoption of on-premises deployment of vibration monitoring solutions and systems.

Automotive segment to exhibit highest CAGR during forecast period.

The automotive sector has a wide range of companies operating in it that are involved in the process of designing, developing, manufacturing, and selling motor vehicles. As customer requirements change, the automotive industry faces a technological shift from traditional manufacturing processes to new ones. The global automotive industry depends on the performance of assets to effectively perform core business activities, as system downtime can affect the revenues of automobile companies. Time plays a crucial role in the automotive industry, and any unplanned asset breakdown can significantly impact the company’s brand image and sales. Vibration monitoring systems and solutions help automobile organizations manage component wear and failures in an improved manner.

North America to hold substantial market share in 2029.

The vibration monitoring market in North America has been studied for US, Canada, and Mexico. This region is a key market for vibration monitoring solutions and systems as it is home to some of the largest multinational corporations in this market, including Baker Hughes Company (US), Honeywell International Inc. (US), Emerson Electric Co. (US), Parker Hannifin Corp (US), Rockwell Automation (US), etc. Within the complete ecosystem of vibration monitoring solutions and systems, vibration monitoring systems and solutions can accurately forecast equipment failure and help organizations reduce their maintenance and operational expenses.

Vibration Monitoring Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Viberation Monitoring - Key Market Players

Baker Hughes Company (US), Emerson Electric Co. (US), SKF (Sweden), Schaeffler AG (Germany), and Parker Hannifin Corp (US) are among a few top players in the vibration monitoring companies.

Scope of the Viberation Monitoring Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 1.85 billion in 2024 |

| Projected Market Size | USD 2.69 billion by 2029 |

| Growth Rate | at a CAGR of 7.8%. |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Monitoring Process, Deployment Type, Application and Industry |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Baker Hughes Company (US), Honeywell International Inc (US), Emerson Electric Co. (US), SKF (Sweden), Schaeffler AG (Germany), Parker Hannifin Corp (US), Rockwell Automation (US), Analog Devices, Inc. (US), ALS (Australia), Teledyne FLIR LLC (US), and Others - (Total 25 players have been covered) |

Vibration Monitoring Market Highlights

This research report categorizes the vibration monitoring market by offering, monitoring process, deployment type, application, and industry, and region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Monitoring Process: |

|

|

By Deployment Type: |

|

|

By Application: |

|

|

By Industry: |

|

|

By Region |

|

Recent Developments

- In November 2023, SKF launched the SKF Enlight Collect IMx-1-EX sensor solution, which helps wirelessly monitor assets and predict machine failure before it escalates into a serious problem or unscheduled shutdown.

- In May 2023, Schaeffler AG combined its OPTIME Condition Monitoring system with OPTIME 3, OPTIME 5, and OPTIME 5 Ex sensors and OPTIME C1 for automated lubrication to form one solution: the OPTIME Ecosystem. This solution provided a cost-effective predictive maintenance solution that minimizes downtimes and high maintenance costs in production facilities.

- In October 2022, Emerson Electric Co. launched the AMS Condition Monitoring Service. This solution is designed to build comprehensive monitoring strategies to handle large amounts of data when there is insufficient time or staff to process and analyze it.

Frequently Asked Questions (FAQs)

What is the total CAGR expected to be recorded for the vibration monitoring market from 2024 to 2029?

The global vibration monitoring market is expected to record a CAGR of 7.8% from 2024–2029.

What are the driving factors for the vibration monitoring market?

Rising adoption of smart manufacturing, which eliminates the requirement of close human supervision, is one of the driving factors for the vibration monitoring market.

Which industry will grow at a fast rate in the future?

Automotive is expected to grow at the highest CAGR during the forecast period.

Which are the significant players operating in the vibration monitoring market?

Baker Hughes Company (US), Emerson Electric Co. (US), SKF (Sweden), Schaeffler AG (Germany), and Parker Hannifin Corp (US) are among a few top players in the vibration monitoring market.

Which region will grow at a fast rate in the future?

The vibration monitoring market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of wireless communication technology to optimize operational efficiency- Growing use of cloud computing platforms to monitor industrial equipment health- Rapid transition from preventive to predictive maintenance approach- Surging adoption of automation and smart manufacturing techniques- Increasing awareness regarding benefits of vibration monitoring systemsRESTRAINTS- Trust issues related to prediction capabilities of vibration monitoring systems- Shortage of trained resourcesOPPORTUNITIES- Increasing use of big data analytics and machine learning technologies- Rising focus of established players on collaborations and partnerships with technology and software solution providersCHALLENGES- Additional expenses associated with retrofitting existing systems- System integration issues

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF VIBRATION MONITORING HARDWAREAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWAREAVERAGE SELLING PRICE TREND OF VIBRATION MONITORING HARDWARE, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- IoTCOMPLEMENTARY TECHNOLOGIES- Cloud computingADJACENT TECHNOLOGIES- AI

-

5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIO (HS CODE 903190)EXPORT SCENARIO (HS CODE 903190)

- 5.11 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.12 CASE STUDY ANALYSISSTEEL ROLLING MILL DEPLOYED ONLINE VIBRATION MONITORING SYSTEM TO PREVENT BEARING FAILUREEMERSON ELECTRIC INSTALLED VIBRATION TRANSMITTER IN BARKING POWER STATION TO REDUCE PLANT DOWNTIMETWI DEVELOPED ADVANCED CONDITION MONITORING SYSTEM TO IMPROVE WIND TURBINE MACHINERY RELIABILITY

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.14 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 IMPACT OF AI/GEN AI ON VIBRATION MONITORING MARKETINTRODUCTIONVIBRATION MONITORING MARKET POTENTIAL IN KEY INDUSTRIES- Oil & gas- Power generationAI USE CASES IN VIBRATION MONITORINGKEY COMPANIES IMPLEMENTING/ADAPTING AIFUTURE OF GENERATIVE AI IN VIBRATION MONITORING ECOSYSTEM

- 6.1 INTRODUCTION

- 6.2 PUMPS

- 6.3 MOTORS

- 6.4 CHILLERS

- 6.5 FANS

- 6.6 COMPRESSORS

- 6.7 TURBINES

- 6.8 BEARINGS

- 6.9 OTHER APPLICATIONS

- 7.1 INTRODUCTION

-

7.2 HARDWAREVIBRATION ANALYZERS- Portability and handheld features to drive adoptionVIBRATION METERS- Simplicity and convenience features to boost deploymentACCELEROMETERS- Capacitive sensing ability and need to detect source of vibration to fuel segmental growthPROXIMITY PROBES- Requirement to measure displacements of physical devices to foster segmental growthVELOCITY SENSORS- Ability to record low- and medium-frequency measurements to boost demandVIBRATION TRANSMITTERS- Need to gather vibration-related information in hard-to-reach locations to spike demandOTHER HARDWARE TYPES

-

7.3 SOFTWAREON-PREMISES- Rising adoption by SMEs for simplified data management to support segmental growthCLOUD-BASED- Lower initial investment to accelerate adoption

-

7.4 SERVICESTRAINING AND SUPPORT SERVICES TO CONTRIBUTE MOST TO SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 ONLINENEED FOR REAL-TIME MACHINERY HEALTH INFORMATION TO CONTRIBUTE TO MARKET GROWTH

-

8.3 PORTABLEEMERGENCE OF LOW-COST PORTABLE VIBRATION MONITORING SOLUTIONS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 OIL & GASSTRONG FOCUS ON REDUCING UNPLANNED OUTAGES IN OIL & GAS PLANTS TO DRIVE ADOPTION

-

9.3 POWER GENERATIONRAPID TRANSITIONING TO RENEWABLE ENERGY SOURCES TO CREATE OPPORTUNITIES

-

9.4 METALS & MININGRISING DEMAND FOR REMOTE DIAGNOSTICS OF PORTABLE AND FIXED MINING ASSETS TO SUPPORT MARKET GROWTH

-

9.5 CHEMICALSSIGNIFICANT FOCUS ON INCREASING PLANT PROFITABILITY AND REDUCING OPERATING COSTS TO FUEL MARKET GROWTH

-

9.6 AUTOMOTIVEGROWING ADOPTION OF IIOT AND DIGITAL TECHNOLOGIES TO FOSTER MARKET GROWTH

-

9.7 AEROSPACESURGING DEPLOYMENT OF SMART FACTORY SOLUTIONS AND ONLINE VIBRATION MONITORING TO ACCELERATE DEMAND

-

9.8 FOOD & BEVERAGESELEVATING NEED TO MAINTAIN OPTIMAL EQUIPMENT CONDITION AND ENSURE QUALITY STANDARDS TO DRIVE MARKET

- 9.9 OTHER INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Rising use of Industry 4.0 and smart manufacturing to drive marketCANADA- Thriving oil & gas and aerospace industries to support market growthMEXICO- Increasing adoption of automation in industrial plants to fuel market growth

-

10.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEGERMANY- Rising adoption of digitalization to accelerate market growthUK- Inclination toward smart manufacturing to contribute to market growthFRANCE- Elevating use of automation to foster demandITALY- Increasing industrial safety concerns to drive adoptionSPAIN- Considerable focus on workplace safety and environmental sustainability to fuel demandREST OF EUROPE

-

10.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Increasing labor costs to boost adoptionJAPAN- Growing use of automation in automotive industry to fuel market growthINDIA- Make in India initiative to support market growthSOUTH KOREA- Growing deployment of robotics in manufacturing plants to drive marketSINGAPORE- Surging focus of manufacturers on improving operational efficiency and reducing plant downtime to drive marketMALAYSIA- Manufacturing and oil & gas industries to contribute to market growthREST OF ASIA PACIFIC

-

10.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST- Booming oil & gas industry to drive market- GCC countries- Rest of Middle EastSOUTH AMERICA- Increasing investment in industrial infrastructure development to fuel market growthAFRICA- Growing adoption of predictive maintenance approach to ensure uninterrupted operations to boost demand

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- 11.3 REVENUE ANALYSIS, 2019–2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Industry footprint- Offering footprint- System type footprint- Region footprint

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSBAKER HUGHES COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMERSON ELECTRIC CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSKF- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCHAEFFLER AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPARKER HANNIFIN CORP- Business overview- Products/Solutions/Services offered- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offeredROCKWELL AUTOMATION- Business overview- Products/Solutions/Services offered- Recent developmentsANALOG DEVICES, INC.- Business overview- Products/Solutions/Services offeredALS- Business overview- Products/Solutions/Services offeredTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSIFM ELECTRONIC GMBHFLUKE CORPORATIONPCB PIEZOTRONICS, INC.SPM INSTRUMENT ABADASHBRÜEL & KJÆR VIBRO GMBHANHUI RONDS SCIENCE & TECHNOLOGY INCORPORATED COMPANYERBESSD INSTRUMENTSISTEC INTERNATIONALPETASENSE INC.MACHINE SAVERKCFSTI VIBRATION MONITORING INC.HANSFORD SENSORSMONITRAN

- 13.1 INTRODUCTION

- 13.2 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION

-

13.3 NORTH AMERICAUS- Rising adoption by IT & telecom and aerospace & defense companies to fuel market growthCANADA- Extensive manufacturing base to create opportunitiesMEXICO- Escalating demand for automobiles and electronic products to drive market

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 VIBRATION MONITORING MARKET: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING TREND OF VIBRATION MONITORING HARDWARE OFFERED BY MAJOR PLAYERS, 2020–2023 (USD)

- TABLE 3 INDICATIVE PRICING TREND OF VIBRATION MONITORING HARDWARE OFFERINGS, 2023 (USD)

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 LIST OF PATENTS, 2021–2024

- TABLE 6 IMPORT SCENARIO FOR HS CODE 903190-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 7 EXPORT SCENARIO FOR HS CODE 903190-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 8 KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 VIBRATION MONITORING MARKET: STANDARDS

- TABLE 14 PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 17 VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 18 VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 19 HARDWARE: VIBRATION MONITORING MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 20 HARDWARE: VIBRATION MONITORING MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 21 VIBRATION MONITORING MARKET, BY TYPE, 2020–2023 (MILLION UNITS)

- TABLE 22 VIBRATION MONITORING MARKET, BY TYPE, 2024–2029 (MILLION UNITS)

- TABLE 23 HARDWARE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 24 HARDWARE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 25 SOFTWARE: VIBRATION MONITORING MARKET, BY DEPLOYMENT TYPE, 2020–2023 (USD MILLION)

- TABLE 26 SOFTWARE: VIBRATION MONITORING MARKET, BY DEPLOYMENT TYPE, 2024–2029 (USD MILLION)

- TABLE 27 SOFTWARE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 28 SOFTWARE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 29 SERVICES: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 30 SERVICES: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 31 VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 32 VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 33 ONLINE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 34 ONLINE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 35 PORTABLE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 36 PORTABLE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 37 VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 38 VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 39 OIL & GAS: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 40 OIL & GAS: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 41 OIL & GAS: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 42 OIL & GAS: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 43 OIL & GAS: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 44 OIL & GAS: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 45 POWER GENERATION: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 46 POWER GENERATION: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 47 POWER GENERATION: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 48 POWER GENERATION: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 49 POWER GENERATION: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 50 POWER GENERATION: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 METALS & MINING: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 52 METALS & MINING: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 53 METALS & MINING: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 54 METALS & MINING: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 55 METALS & MINING: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 56 METALS & MINING: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 57 CHEMICALS: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 58 CHEMICALS: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 59 CHEMICALS: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 60 CHEMICALS: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 61 CHEMICALS: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 62 CHEMICALS: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 63 AUTOMOTIVE: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 64 AUTOMOTIVE: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 65 AUTOMOTIVE: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 66 AUTOMOTIVE: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 67 AUTOMOTIVE: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 68 AUTOMOTIVE: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 69 AEROSPACE: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 70 AEROSPACE: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 71 AEROSPACE: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 72 AEROSPACE: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 73 AEROSPACE: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 AEROSPACE: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 FOOD & BEVERAGES: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 76 FOOD & BEVERAGES: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 77 FOOD & BEVERAGES: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 78 FOOD & BEVERAGES: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 79 FOOD & BEVERAGES: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 80 FOOD & BEVERAGES: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 81 OTHER INDUSTRIES: VIBRATION MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 82 OTHER INDUSTRIES: VIBRATION MONITORING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 83 OTHER INDUSTRIES: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 84 OTHER INDUSTRIES: VIBRATION MONITORING MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 85 OTHER INDUSTRIES: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 86 OTHER INDUSTRIES: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 87 VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 88 VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 89 VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (MILLION UNITS)

- TABLE 90 VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (MILLION UNITS)

- TABLE 91 NORTH AMERICA: VIBRATION MONITORING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: VIBRATION MONITORING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 95 EUROPE: VIBRATION MONITORING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 96 EUROPE: VIBRATION MONITORING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 97 EUROPE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 98 EUROPE: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: RT VIBRATION MONITORING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: VIBRATION MONITORING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 103 ROW: VIBRATION MONITORING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 104 ROW: VIBRATION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 105 ROW: VIBRATION MONITORING MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 106 ROW: VIBRATION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 107 MIDDLE EAST: VIBRATION MONITORING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 108 MIDDLE EAST: VIBRATION MONITORING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 109 VIBRATION MONITORING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2024

- TABLE 110 VIBRATION MONITORING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 111 VIBRATION MONITORING MARKET: INDUSTRY FOOTPRINT

- TABLE 112 VIBRATION MONITORING MARKET: OFFERING FOOTPRINT

- TABLE 113 VIBRATION MONITORING MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 114 VIBRATION MONITORING MARKET: REGION FOOTPRINT

- TABLE 115 VIBRATION MONITORING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 116 VIBRATION MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 117 VIBRATION MONITORING MARKET: PRODUCT LAUNCHES, JANUARY 2020–JULY 2024

- TABLE 118 VIBRATION MONITORING MARKET: DEALS, JANUARY 2020–JULY 2024

- TABLE 119 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 120 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 BAKER HUGHES COMPANY: DEALS

- TABLE 122 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 123 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 125 SKF: COMPANY OVERVIEW

- TABLE 126 SKF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 SKF: PRODUCT LAUNCHES

- TABLE 128 SKF: DEALS

- TABLE 129 SCHAEFFLER AG: COMPANY OVERVIEW

- TABLE 130 SCHAEFFLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 SCHAEFFLER AG: PRODUCT LAUNCHES

- TABLE 132 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 133 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 135 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 137 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 ROCKWELL AUTOMATION: DEALS

- TABLE 139 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 140 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ALS: COMPANY OVERVIEW

- TABLE 142 ALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 144 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 146 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 147 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 148 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 149 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 150 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 151 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

- TABLE 152 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024–2029 (USD MILLION)

- FIGURE 1 VIBRATION MONITORING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 VIBRATION MONITORING MARKET: RESEARCH DESIGN

- FIGURE 3 VIBRATION MONITORING MARKET: RESEARCH APPROACH

- FIGURE 4 VIBRATION MONITORING MARKET: TOP-DOWN APPROACH

- FIGURE 5 VIBRATION MONITORING MARKET: BOTTOM-UP APPROACH

- FIGURE 6 VIBRATION MONITORING MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 VIBRATION MONITORING MARKET: DATA TRIANGULATION

- FIGURE 8 VIBRATION MONITORING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 VIBRATION MONITORING MARKET SIZE IN TERMS OF VALUE, 2020–2029

- FIGURE 10 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN VIBRATION MONITORING MARKET FROM 2024 TO 2029

- FIGURE 11 ONLINE SEGMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 12 OIL & GAS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2024

- FIGURE 13 NORTH AMERICA DOMINATED VIBRATION MONITORING MARKET IN 2023

- FIGURE 14 GROWING USE OF VIBRATION MONITORING IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF VIBRATION MONITORING MARKET IN 2024

- FIGURE 16 OIL & GAS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 17 OIL & GAS INDUSTRY AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN VIBRATION MONITORING MARKET IN 2023

- FIGURE 18 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL VIBRATION MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 19 VIBRATION MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF VIBRATION MONITORING HARDWARE, 2020–2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF VIBRATION MONITORING HARDWARE OFFERED BY KEY PLAYERS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF VIBRATION MONITORING HARDWARE, BY REGION, 2020−2023

- FIGURE 28 VALUE CHAIN ANALYSIS

- FIGURE 29 VIBRATION MONITORING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2018–2023

- FIGURE 31 INDUSTRIAL DEVELOPMENT MODEL

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2014–2023

- FIGURE 33 IMPORT DATA FOR HS CODE 903190-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR HS CODE 903190-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 35 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 37 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 38 PUMPS ACCOUNTED FOR LARGEST SHARE OF VIBRATION MONITORING MARKET, BY APPLICATION, IN 2023

- FIGURE 39 VIBRATION MONITORING MARKET, BY OFFERING

- FIGURE 40 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 41 LIMITATIONS OF ON-PREMISES DEPLOYMENT OF VIBRATION MONITORING SOLUTIONS AND SYSTEMS

- FIGURE 42 ADVANTAGES OF CLOUD-BASED VIBRATION MONITORING SYSTEMS AND SOLUTIONS

- FIGURE 43 VIBRATION MONITORING MARKET, BY SYSTEM TYPE

- FIGURE 44 ONLINE VIBRATION MONITORING SYSTEMS TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 45 VIBRATION MONITORING MARKET, BY INDUSTRY

- FIGURE 46 OIL & GAS INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 47 VIBRATION MONITORING MARKET, BY REGION

- FIGURE 48 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL VIBRATION MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: VIBRATION MONITORING MARKET SNAPSHOT

- FIGURE 50 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN VIBRATION MONITORING MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 51 EUROPE: VIBRATION MONITORING MARKET SNAPSHOT

- FIGURE 52 GERMANY TO DOMINATE EUROPEAN VIBRATION MONITORING MARKET FROM 2023 TO 2028

- FIGURE 53 ASIA PACIFIC: VIBRATION MONITORING MARKET SNAPSHOT

- FIGURE 54 INDIA TO WITNESS HIGHEST CAGR IN VIBRATION MONITORING MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 55 VIBRATION MONITORING MARKET IN ROW, BY REGION, 2024 VS. 2029

- FIGURE 56 VIBRATION MONITORING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019–2023

- FIGURE 57 SHARE ANALYSIS OF VIBRATION MONITORING MARKET, 2023

- FIGURE 58 COMPANY VALUATION

- FIGURE 59 FINANCIAL METRICS

- FIGURE 60 BRAND/PRODUCT COMPARISON

- FIGURE 61 VIBRATION MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 62 VIBRATION MONITORING MARKET: COMPANY FOOTPRINT

- FIGURE 63 VIBRATION MONITORING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 64 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 65 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 66 SKF: COMPANY SNAPSHOT

- FIGURE 67 SCHAEFFLER AG: COMPANY SNAPSHOT

- FIGURE 68 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 69 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 70 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 71 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 72 ALS: COMPANY SNAPSHOT

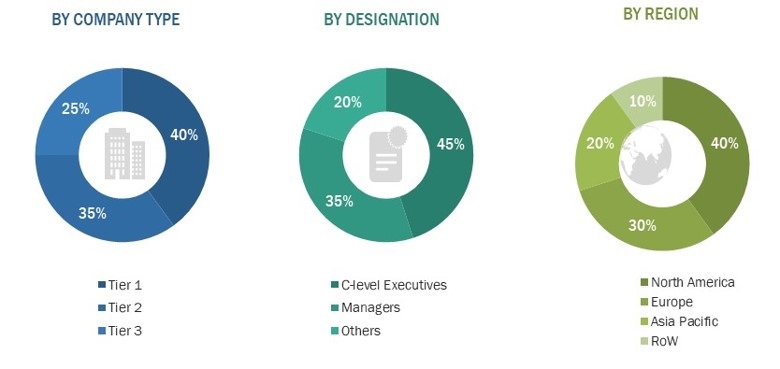

The study involved four major activities in estimating the current size of the vibration monitoring market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the vibration monitoring market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred vibration monitoring system providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from vibration monitoring system providers, such as Baker Hughes Company (US), Emerson Electric Co. (US), SKF (Sweden), Schaeffler AG (Germany), and Parker Hannifin Corp (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the vibration monitoring market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

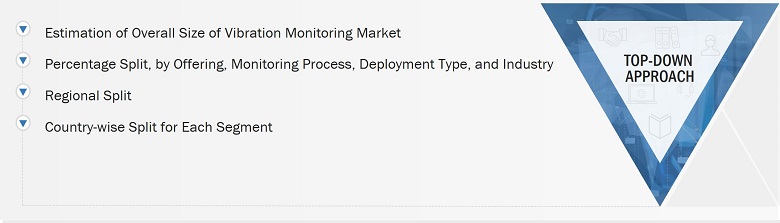

Vibration Monitoring Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

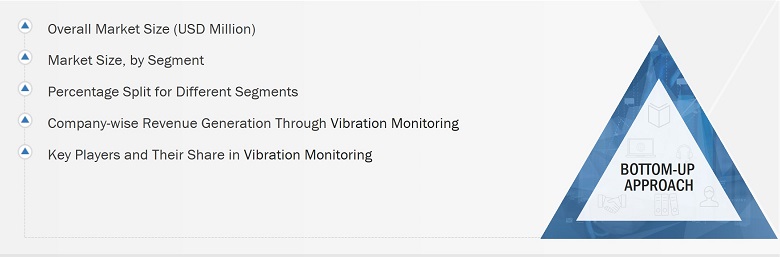

Vibration Monitoring Market: Bottom-up Approach

The bottom-up approach has been used to arrive at the overall size of the vibration monitoring market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Vibration can be defined as a cyclic or periodic displacement of a machine from its static position due to its back and forth motion. This motion is mainly caused by the oscillation of various components of the machine, such as belts, gears, bearings, and drive motors. Vibration monitoring plays a critical role in plant operations because of its diverse applications on different types of critical machinery.

The vibration monitoring process includes periodical or continuous collection, analysis, interpretation, and diagnosis of data to determine the operational state and condition of machines for detecting potential failures before they turn into functional failures. This approach is different from traditional methods wherein the process of determining the condition of machines is manually controlled by the maintenance personnel. The technology is capable of detecting problems caused by misalignments and improper functioning of various sources such as bearings and gears. Vibration monitoring is widely implemented in most of the conventional rotating machinery such as pumps, motors, and turbines. It optimizes equipment readiness while reducing maintenance and staff requirements. This technique is widely used in chemical, oil & gas, aerospace & defense, power generation, automotive, heavy equipment, manufacturing, and other industries.

Key Stakeholders

- Asset management consultants specializing in physical asset management

- Associations and regulatory authorities related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of components such as accelerometers, Eddy current sensors, IR detectors, ultrasonic detectors, and other instruments used for vibration monitoring

- Maintenance personnel, as well as manufacturers and suppliers of vibration monitoring systems

- Research institutes and organizations

Report Objectives

- To define and forecast the vibration monitoring market regarding offering, deployment type, monitoring process, and industry.

- To describe and forecast the vibration monitoring market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the vibration monitoring market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the vibration monitoring market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vibration Monitoring Market

What is the differentiation between the market participants mentioned?