Wireless Devices Market for Medical by Technology (BT/BLE, Wi-Fi, ZigBee, ANT+), Component (Sensors, ICs, Processors), Application (Monitoring, Medical Therapeutics, Diagnosis, Fitness & Wellness), and Geography Global Forecast to 2020

Wireless portable medical devices, which are widely used in applications such as monitoring, medical therapeutics, diagnosis, and fitness and wellness, have proved to be very useful to cater to the growing need of advanced healthcare services. Portable medical electronics have proved to be a boon to medical science as it plays an important role in overall diagnosis and patient monitoring activities. The burgeoning population, increasing income levels, increase in ageing population and awareness about health and wellness has catalyzed the growth of the portable medical devices market. In addition to that, a rise in lifestyle diseases, increasing urbanization and healthcare facilities expansion have increased the demand for personalized medical care, boosting the growth of the portable medical industry. With the advent of smart and advanced wireless capabilities, this medical field has become one of the most intriguing with the promise of great potential for healthcare sector. Additionally, government expenditures on healthcare are increasing continuously in various countries; this is also a major driving factor for the growth of wireless devices market for medical.

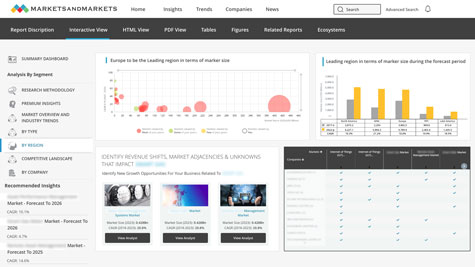

The report on the wireless devices market for medical analyzes the portable medical devices supply chain, giving a very clear insight of all major and supported segments to the industry. The market has been segmented based on different technologies, components, applications and discussed in detail with market size projections in terms of value and volume. This report also analyzes market trends and technologies in market dynamics such as drivers, restraints, and opportunities along with the industrys burning issues and winning imperatives.

The report also includes company profiles of leading players in this industry with their recent developments and other strategic business activities. The competitive landscape section of the report entails key growth strategies and a detailed market share analysis of key industry players. Some of the major players in wireless devices market for medical are GE Healthcare (U.K.), Maxim Integrated (U.S.), Texas Instruments (U.S.), STMicroelectronics N.V. (Switzerland), Freescale Semiconductor Inc. (U.S.), ON Semiconductor Corporation (U.S.), Philips Healthcare (Netherland), Omron Healthcare (Japan), Medtronic, Inc. (U.S.), Analog Devices (U.S.) and Renesas Electronics Corporation (Japan).

The total wireless devices market for medical is expected to grow from $7.52 Billion in 2013 to $17.71 Billion in 2020, growing at an estimated CAGR of 12.20% from 2014 to 2020.

Want to explore hidden markets that can drive new revenue in Wireless Devices Market?

This report categorizes the global market for wireless portable medical devices on the basis of technology, component, application, and geography. It also covers the projected value of components and emerging technologies in the wireless devices market for medical.

Market on the basis of Technology:

Technologies covered include BT/BLE, ZigBee, Wi-Fi, and ANT+.

Market on the basis of Applications:

Application areas of wireless portable medical devices include monitoring, medical therapeutics, diagnosis, and fitness and wellness.

Market based on Components:

The wireless devices market for medical based on different types of components is segmented into sensors (temperature sensor, blood glucose sensor, blood oxygen sensor, ECG sensor, image sensor, flow sensor, heart rate sensor, inertial sensor, pressure sensor, level sensor, and position sensor), ICs, and processors.

Market based on Geography:

The geographic analysis covers North America, Europe, Asia-Pacific, and Rest of the World (RoW). The cross segmentation data included in the report gives a deep insight about the regional markets.

With the advent of advanced wireless technologies for portable medical devices the modern healthcare industry is witnessing an exponential growth in the market. The growth of global wireless devices market for medical is attributed to various technological advancements, integration of the healthcare industry with information technology and convergence with internet of things. Increasing urbanization, increasing ageing population, increasing income levels and awareness about fitness and wellness have catalyzed the growth of the wireless devices market for medical. In addition to that, an increasing demand for personalized healthcare has also fueled the growth.

Wireless portable medical devices exhibit a huge potential in terms of applications such as monitoring, medical therapeutics, diagnosis, and fitness and wellness. A continuous development of innovative electronic devices, low cost medical facilities, and continuous support by various governments is leading towards heavy investment in research and development in healthcare and the portable medical devices market. Geographically, this market in the report covers North America, APAC, Europe, and Rest of the World (RoW).

In the medical electronics market, the sensors segment has captured the majority of the market share. Some of the major companies in wireless devices market for medical include GE Healthcare (U.K.), Maxim Integrated (U.S.), Texas Instruments (U.S.), STMicroelectronics N.V. (Switzerland), Freescale Semiconductor Inc. (U.S.), ON Semiconductor Corporation (U.S.), Philips Healthcare (Netherland), Omron Healthcare (Japan), Medtronic, Inc. (U.S.), Analog Devices (U.S.) and (Japan).

Table of Contents

1 Introduction

1.1 Objectives of The Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

2 Research Methodology

2.1 Description of The Wireless Portable Medical Devices Demand Model

2.1.1 High Burden of Lifestyle Diseases

2.1.2 Growth In Healthcare Expenditure

2.1.3 Increasing Penetration of Healthcare Insurance

2.1.3.1 Impact of Increasing Penetration of Healthcare Insurance On The Wireless Portable Medical Device Market

2.2 Market Size Estimation

2.3 Market Crackdown And Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data Taken From Secondary Sources

2.4.2 Key Data Taken From Primary Sources

2.4.2.1 Key Industry Insights

2.4.3 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Wireless Portable Medical Device Market Growing At An Augmented Rate

4.2 Market By Components Segment

4.3 Market Global Scenario

4.4 Emerging Countries Set To Grow At Very High Growth Rate

4.5 Asia Pacific An Attractive Destination For The Wireless Portable Medical Devices Market

4.6 Life Cycle Analysis, By Geography

5 Market Overview

5.1 Introduction

5.1.1 Evolution

5.2 Market Segmentation

5.2.1 Market By Application

5.2.2 Market By Component

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Population & Growing Lifestyle Diseases

5.3.1.2 Demand For Personalization of Healthcare Systems

5.3.1.3 Emergence of Wearable Electronics In Medical Industry

5.3.1.4 Urbanization & Increasing Healthcare Facilities Drive The Market.

5.3.1.5 Convergence of Information Technology Into Medical Industry: The Rise of Electronic Medicine

5.3.2 Restraints

5.3.2.1 Designing & Compatibility of Wireless Portable Medical Devices

5.3.2.2 High Maintenance & Refurbishment Cost

5.3.2.3 Lack of Product Differentiation

5.3.3 Opportunities

5.3.3.1 Emerging Markets

5.3.3.2 Increasing Healthcare Infrastructure In Developing Countries

5.3.4 Challenges

5.3.4.1 Stringent Government Policies & Standards

5.3.4.2 Advancement In Healthcare Informatics

5.3.5 Burning Issues

5.3.5.1 Regulatory Compliance Adding Burden On Device Manufacturers

6 Industry Trends

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Key Influencers

6.3 Industry Trends

6.4 Pest Analysis

6.4.1 Political Factors

6.4.2 Economic Factors

6.4.3 Social Factors

6.4.4 Technological Factors

6.5 Pricing Analysis

6.6 Porters Analysis

6.6.1 Threat of New Entrants

6.6.2 Threat of Substitutes

6.6.3 Bargaining Power of Suppliers

6.6.4 Bargaining Power of Buyers

6.6.5 Degree of Competition

7 Wireless Portable Medical Device Market, By Components

7.1 Introduction

7.2 Sensors

7.2.1 Temperature Sensor

7.2.2 Blood Glucose Sensor

7.2.3 Blood Oxygen Sensor

7.2.4 ECG Sensor

7.2.5 Image Sensor

7.2.6 Flow Sensor

7.2.7 Level Sensor

7.2.8 Heart Rate Sensor

7.2.9 Inertial Sensor

7.2.10 Pressure Sensor

7.2.11 Position Sensor

7.3 IC's

7.3.1 Logic Ic

7.3.2 Power Ic

7.3.3 Driver Ic

7.4 Microprocessors/Microcontrollers

7.4.1 DSP

7.4.2 ASIC

7.4.3 MCU

8 Wireless Portable Medical Device Market, By Application

8.1 Introduction

8.2 Monitoring

8.2.1 Cardiac Monitors

8.2.1.1 ECG/Ekg

8.2.1.2 Holter Monitor

8.2.1.3 Heart Rate Monitor

8.2.1.4 Doppler Monitor

8.2.2 Hemodynamic Monitoring

8.2.2.1 Blood Pressure Monitor

8.2.2.2 Blood Glucose Monitor

8.2.2.3 Blood Gas Monitor

8.2.2.4 Cholesterol Monitor

8.2.3 Respiratory Monitoring

8.2.3.1 Pulse Oximeter

8.2.3.2 Continuous Positive Airway Pressure (Cpap)

8.2.3.3 Sleep Apnea Monitors

8.5.4 Multi Parameter Monitor

8.3 Medical Therapeutics

8.3.1 Programmable Syringe Pumps

8.3.2 Infusion Pumps

8.3.3 Dialysis Machine

8.3.4 Anesthesia Delivery System

8.4 Diagnosis

8.4.1 Endoscope

8.4.2 Ophthalmoscope

8.4.3 Digital Thermometer

8.5 Fitness And Wellness

8.5.1 Wearable Electronics

8.5.1.1 Electronic Pedometer

8.5.1.2 Smartwatches

8.5.1.3 Wearable Injectors

8.5.1.4 Continuous Glucose Monitor (CGM)

8.5.1 Others

8.5.2.1 Automated External Defibrillator (AED)

8.5.2.2 Hearing Aids

9 Geographic Analysis

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific (APAC)

9.5 Rest of The World (ROW)

10 Competitive Landscape

10.1 Overview

10.2 Market Share Ranking Analysis For The Wireless Portable Medical Devices, 2013

10.3 Competitive Situations And Trends

10.3.1 New Product Launches

10.3.2 Agreements, Partnerships, Collaborations, & Joint Ventures

10.3.3 Mergers And Acquisitions

10.3.4 Expansions

10.4 Others

11 Company Profiles (Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Analog Devices, Inc.

11.3 Freescale Semiconductor, Inc.

11.4 Ge Healthcare

11.5 Infineon Technologies

11.6 Maxim Integrated

11.7 Medtronic

11.8 Omron Healthcare

11.9 On Semiconductor Corporation

11.10 Philips Healthcare

11.11 Renesas Electronics Corporation

11.12 Stmicroelectronics

11.13 Texas Instruments

*Details On Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured In Case of

Unlisted Companies.

12 Appendix

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (102 Tables)

Table 1 Emerging Markets & Urbanization of Healthcare Infrastructure Are Opportunities For The Wireless Portable Medical Device Market

Table 2 Advancement In Healthcare Informatics Is A Challenge For The Global Wireless Portable Medical Device Market

Table 3 Market Size, By Sensor, 2013 2020 ($Million)

Table 4 Market Size, By Sensor, 2013 2020 (Million Units)

Table 5 Temperature Sensors Market Size, By Application, 2013 2020 ($Million)

Table 6 Temperature Sensors Market Size, By Application, 2013 2020 (Million Units)

Table 7 Temperature Sensor Market Size, By Medical Therapeutics Application, 2013 2020 ($Million)

Table 8 Temperature Sensor Market Size, By Medical Therapeutics Application, 2013 2020 (Million Units)

Table 9 Temperature Sensor Market Size, By Diagnosis Application, 2013 2020 ($Million)

Table 10 Temperature Sensor Market Size, By Diagnosis Application, 2013 2020 (Million Units)

Table 11 Temperature Sensor Market Size, By Monitoring Application, 2013 2020 ($Million)

Table 12 Temperature Sensor Market Size, By Monitoring Application, 2013 2020 (Million Units)

Table 13 Temperature Sensor Market Size, By Monitoring Application (Hemodynamic Monitors), 2013 2020 ($Million)

Table 14 Temperature Sensor Market Size, By Monitoring Application (Hemodynamic Monitors), 2013 2020 (Million Units)

Table 15 Temperature Sensor Market Size, By Monitoring Application (Respiratory Monitors), 2013 2020 ($Million)

Table 16 Temperature Sensor Market Size, By Monitoring Application (Respiratory Monitors), 2013 2020 (Million Units)

Table 17 Blood Glucose Sensor Market Size, By Application, 2013-2020 ($Million)

Table 18 Blood Glucose Sensor Market Size, By Application, 2013-2020 (Million Units)

Table 19 Blood Glucose Sensor Market Size, By Monitoring Application, 2013-2020 ($Million)

Table 20 Blood Glucose Sensor Market Size, By Monitoring Application, 2013-2020 (Million Units)

Table 21 Blood Oxygen Sensor Market Size, By Monitoring Application, 2013 2020, ($Million)

Table 22 Blood Oxygen Sensor Market Size, By Monitoring Application, 2013 2020, (Million Units)

Table 23 Blood Oxygen Sensor Market Size, By Hemodynamic Monitoring Application, 2013 2020, ($Million)

Table 24 Blood Oxygen Sensor Market Size, By Hemodynamic Monitoring Application, 2013 2020, (Million Units)

Table 25 ECG Sensor Market Size, By Application, 2013 2020 ($Million)

Table 26 ECG Sensor Market Size, By Application, 2013 2020 (Million Units)

Table 27 ECG Sensor Market Size, By Monitoring Application, 2013 2020 ($Million)

Table 28 ECG Sensor Market Size, By Monitoring Application, 2013 2020 (Million Units)

Table 29 ECG Sensor Market Size, By Cardiac Monitors, 2013 2020 ($Million)

Table 30 ECG Sensor Market Size, By Cardiac Monitors, 2013 2020 (Million Units)

Table 31 Image Sensors Market Size, By Application, 2013 2020 ($Million)

Table 32 Image Sensors Market Size, By Application, 2013 2020 (Million Units)

Table 33 Image Sensors Market Size, By Diagnosis Application, 2013 2020 ($Million)

Table 34 Image Sensors Market Size, By Diagnosis Application, 2013 2020 (Million Units)

Table 35 Motion Sensors Market Size, By Application, 2013 2020, ($Million)

Table 36 Motion Sensors Market Size, By Application, 2013 2020, (Million Units)

Table 37 Motion Sensors Market Size, By Fitness And Wellness Application, 2013 2020, ($Million)

Table 38 Motion Sensors Market Size, By Fitness And Wellness Application, 2013 2020, (Million Units)

Table 39 Motion Sensors Market Size, By Wearable Devices, 2013 2020, ($Million)

Table 40 Motion Sensors Market Size, By Wearable Devices, 2013 2020, (Million Units)

Table 41 Heart Rate Sensor Market Size, By Application, 2013 2020 ($Million)

Table 42 Heart Rate Sensor Market Size, By Application, 2013 2020 (Million Units)

Table 43 Heart Rate Sensor Market Size, By Monitoring Application, 2013 2020 ($Million)

Table 44 Heart Rate Sensor Market Size, By Monitoring Application, 2013 2020 (Million Units)

Table 45 Heart Rate Sensor Market Size, By Fitness And Wellness, 2013 2020 ($Million)

Table 46 Heart Rate Sensor Market Size, By Fitness And Wellness, 2013 2020, (Million Units)

Table 47 Heart Rate Sensor Market Size, By Others (Fitness And Wellness), 2013 2020 ($Million)

Table 48 Heart Rate Sensor Market Size, By Others (Fitness And Wellness), 2013 2020 (Million Units)

Table 49 Inertial Sensor Market Size, By Application, 2013 2020 ($Million)

Table 50 Inertial Sensor Market Size, By Application, 2013 2020 (Million Units)

Table 51 Inertial Sensor Market Size, By Others (Fitness And Wellness) Application, 2013 2020 ($Million)

Table 52 Inertial Sensor Market Size, By Others (Fitness And Wellness) Application, 2013 2020 (Million Units)

Table 53 Pressure Sensor Market Size, By Application, 2013 2020 ($Million)

Table 54 Pressure Sensor Market Size, By Application, 2013 2020 (Million Units)

Table 55 Pressure Sensor Market Size, By Medical Therapeutics Application, 2013 2020 ($Million)

Table 56 Pressure Sensor Market Size, By Medical Therapeutics Application, 2013 2020 (Million Units)

Table 57 Pressure Sensor Market Size, By Monitoring Application, 2013 2020 ($Million)

Table 58 Pressure Sensor Market Size, By Monitoring Application, 2013 2020 (Million Units)

Table 59 Pressure Sensor Market Size, By Cardiac Monitor, 2013-2020 ($Million)

Table 60 Pressure Sensor Market Size, By Cardiac Monitor, 2013-2020 (Million Units)

Table 61 Pressure Sensor Market Size, By Respiratory Monitors, 2013-2020 ($Million)

Table 62 Pressure Sensor Market Size, By Respiratory Monitors, 2013-2020 (Million Units)

Table 63 Touch Sensor Market Size, By Application, 2013 2020 ($Million)

Table 64 Wireless Portable Medical Device Market Size, By Microcontroller/Microprocessor, 2013 2020 ($Million)

Table 65 Market Size, By Microcontroller/Microprocessor, 2013 2020 (Million Units)

Table 66 DSP Market Size, By Application, 2013 2020 ($Million)

Table 67 DSP Market Size, By Application, 2013 2020 (Million Units)

Table 68 DSP Market Size, By Diagnosis Application, 2013 2020 ($Million)

Table 69 DSP Market Size, By Diagnosis Application, 2013 2020 (Million Units)

Table 70 DSP Market Size, By Monitoring Application, 2013 2020 ($Million)

Table 71 DSP Market Size, By Monitoring Application, 2013 2020 (Million Units)

Table 72 DSP Market Size, By Cardiac Monitor, 2013 2020 ($Million)

Table 73 DSP Market Size, By Cardiac Monitor, 2013 2020 (Million Units)

Table 74 MCU Market Size, By Application, 2013 2020 ($Million)

Table 75 MCU Market Size, By Application, 2013 2020 (Million Units)

Table 76 MCU Market Size, By Medical Therapeutics Application, 2013 2020 ($Million)

Table 77 MCU Market Size, By Medical Therapeutics Application, 2013 2020 (Million Units)

Table 78 MCU Market Size, By Monitoring Application, 2013 2020 ($Million)

Table 79 MCU Market Size, By Monitoring Application, 2013 2020 (Million Units)

Table 80 MCU Market Size, By Cardiac Monitor, 2013 2020 ($Million)

Table 81 MCU Market Size, By Cardiac Monitor, 2013 2020 (Million Units)

Table 82 MCU Market Size, By Hemodynamic Monitor, 2013 2020 ($Million)

Table 83 MCU Market Size, By Hemodynamic Monitor, 2013 2020 (Million Units)

Table 84 MCU Market Size, By Respiratory Monitor, 2013 2020 ($Million)

Table 85 MCU Market Size, By Respiratory Monitor, 2013 2020 (Million Units)

Table 86 MCU Market Size, By Fitness & Wellness, 2013 2020 ($Million)

Table 87 MCU Market Size, By Fitness & Wellness, 2013 2020 (Million Units)

Table 88 MCU Market Size, By Wearable Devices, 2013 2020 ($Million)

Table 89 MCU Market Size, By Wearable Devices, 2013 2020 (Million Units)

Table 90 MCU Market Size, By Others (Fitness & Wellness), 2013 2020 ($Million)

Table 91 MCU Market Size, By Others (Fitness & Wellness), 20132020 (Million Units)

Table 92 Asic Market, By Imaging Application, 2013 2020 ($Million)

Table 93 Asic Market Size, By Imaging Application, 2013 2020 (Million Units)

Table 94 Wireless Portable Medical Device Market Size, By Geography, 2013 2020 ($Million)

Table 95 Sensors Market Size, By Geography, 2013 2020 ($Million)

Table 96 Microprocessor/Microcontroller Market Size, By Geography, 2013 2020, ($Million)

Table 97 Market Share Ranking Analysis, 2013

Table 98 New Product Launches, 2011 2020

Table 99 Agreements, Partnerships, Collaborations, And Joint Ventures, 2011 - 2020

Table 100 Mergers And Acquisit Ions, 2011 - 2014

Table 101 Expansions, 2012 2014

Table 102 Other Developments, 2010 2013

List of Figures (62 Figures )

Figure 1 Wireless Portable Medical Device Market: Research Methodology

Figure 2 Healthcare Expenditure Across Various Prominent Countries In The Wireless Portable Medical Device Market, 2011

Figure 3 Decentralization Across Prominent Countries In The Market, 2011

Figure 4 Healthcare Insurance Across Prominent Countries In The Market, 2011

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Break Down of Primary Interviews: By Company Type, Designation, And Region

Figure 8 Wireless Portable Medical Devices Components Market Snapshot (2013 Vs 2020)

Figure 9 Wireless Portable Medical Device Market Prospects, By Component, 2013

Figure 10 Market Share, By Region, 2013

Figure 11 Market Growing At An Augmented Rate

Figure 12 Sensors Held The Highest Share In The Wireless Portable Medical Device Market

Figure 13 Emerging Countries Set To Grow At Very High Growth Rate

Figure 14 Asia Pacific An Attractive Destination For The Wireless Portable Medical Device Market

Figure 15 Latin America Soon To Enter Growth Phase In Coming Years

Figure 16 Evolution of Wireless Portable Medical Devices

Figure 17 Wireless Portable Medical Device Market, By Component

Figure 18 Increasing Population, Lifestyle Diseases & Convergence of Information Technology Will Spur The Demand For Wireless Portable Medical Devices

Figure 19 Country Wise Percentage of World Population

Figure 20 Country Wise Average Heart Bypass Surgery Cost

Figure 21 Supply Chain Analysis

Figure 22 Huge Potential In Emerging Markets Such As China, India, And Brazil

Figure 23 ASP Trend (2013 2020): Average Selling Price (ASP) of Mcu Are Declining Year On Year Owing To The Highly Intense Competition

Figure 24 Porters Five Forces Analysis, 2013

Figure 25 Threat of New Entrants In Wireless Portable Medical Device Market, 2013

Figure 26 Threat of Substitutes In Market, 2013

Figure 27 Bargaining Power of Suppliers In Market, 2013

Figure 28 Bargaining Power of Buyers In Market, 2013

Figure 29 Degree of Competition In Market, 2013

Figure 30 Sensors Held The Highest Market Share In The Market

Figure 31 Types of Sensors

Figure 32 Temperature Sensors For Automated External Defibrillator (Aed) Are Poised To Grow At A Steady Pace

Figure 33 Rise In Incidences of Diabetes Has Elevated The Need of Continuous Glucose Monitoring (Cgm) Devices

Figure 34 Types of Motion Sensors

Figure 35 Wearable Devices Are Increasingly Being Used By Healthcare Professionals, Which Is Ultimately Driving The Wireless Portable Medical Device Market

Figure 36 Types of Microprocessors/ Microcontrollers

Figure 37 Wireless Portable Medical Device Market Segmentation, By Application

Figure 38 Programmable Syringe Pumps Poised To Grow At A Healthy Rate

Figure 39 Wireless Portable Medical Device Market Segmentation, By Monitoring Application

Figure 40 Rise In Cost of Cardiovascular Diseases Is Expected To Drive The Cardiac Monitors Market

Figure 41 User Friendly Systems Increases Adoption of Respiratory Monitors

Figure 42 Demand For Real-Time Data Is Driving The Adoption of Wearable Devices

Figure 43 Geographic Snapshot (2013) Rapid Growth Markets Are Emerging As New Hot Spots

Figure 44 North America Market Snapshot

Figure 45 European Market Snapshot

Figure 46 Asia-Pacific (APAC) Market Snapshot

Figure 47 Rest of The World (Row) Market Snapshot

Figure 48 Companies Adopting Product Innovation As The Key Growth Strategy Over The Last Three Years

Figure 49 Battle For Market Share: New Product Launches Was The Key Strategy

Figure 50 Geographic Revenue Mix of Key Players

Figure 51 Analog Devices, Inc.: Business Overview

Figure 52 Freescale Semiconductor, Inc.: Business Overview

Figure 53 Ge Healthcare: Business Overview

Figure 54 Infineon Technologies: Business Overview

Figure 55 Maxim Integrated: Business Overview

Figure 56 Medtronic: Business Overview

Figure 57 Omron Healthcare: Business Overview

Figure 58 On Semiconductor Corporation: Business Overview

Figure 59 Philips Healthcare: Business Overview

Figure 60 Renesas Electronics Corporation: Business Overview

Figure 61 Stmicroelectronics: Business Overview

Figure 62 Texas Instruments: Business Overview

Growth opportunities and latent adjacency in Wireless Devices Market