The research study involved four major activities in estimating the autonomous enterprise market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering autonomous enterprise solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

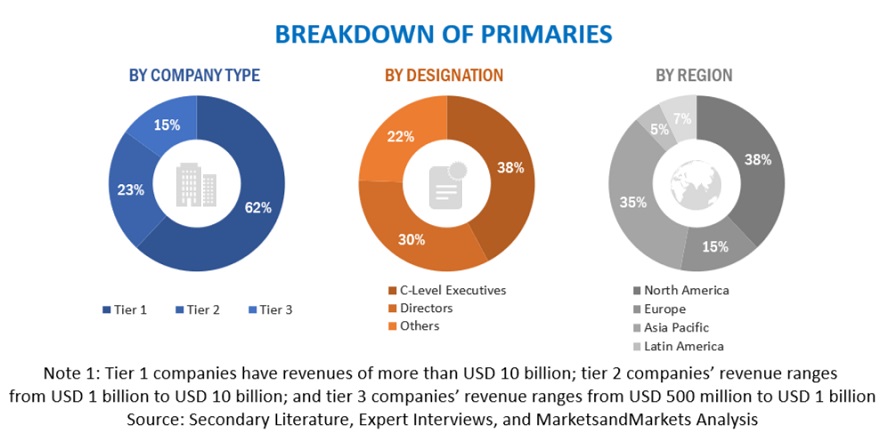

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, Such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from autonomous enterprise solution vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use autonomous enterprise, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Autonomous enterprise solutions which is expected to affect the overall autonomous enterprise market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the autonomous enterprise market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the critical market area have been considered.

-

Tracking the recent and upcoming developments in the autonomous enterprise market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

-

Conduct multiple discussions with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakdown of the scope of work carried out by major companies.

-

Segmenting the market based on technology types concerning applications wherein the types are to be used and deriving the size of the global application market.

-

Segmenting the overall market into various market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the autonomous enterprise market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The autonomous enterprise market size has been validated using top-down and bottom-up approaches.

Market Definition

Autonomous Enterprise is a self-optimizing business that applies AI and automation to decisions, operations, and servicing across the organization. It is a collection of various solutions that enable business functions such as supply chain and operations, IT, HR, accounting & finance, and sales & marketing in an enterprise.

Stakeholders

-

Managed service providers

-

Support and maintenance service providers

-

System Integrators (Sls)/migration service providers

-

Value-Added Resellers (VARs) and distributors

-

Distributors and Value-added Resellers (VARs)

-

System Integrators (Sls)

-

Independent Software Vendors (ISV)

-

Third-party providers

-

Technology providers

Report Objectives

-

To determine and forecast the global autonomous enterprise market by offering (solution and services), business functions, applications, vertical, and region from 2024 to 2029, and analyze the various macroeconomic and microeconomic factors affecting the market growth.

-

To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the autonomous enterprise market.

-

Analyze each submarket concerning individual growth trends, prospects, and contributions to the overall Autonomous enterprise market.

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the autonomous enterprise market.

-

To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

-

Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further break-up of the North American market into countries contributing 75% to the regional market size

-

Further break-up of the Latin American market into countries contributing 75% to the regional market size

-

Further break-up of the Middle East African market into countries contributing 75% to the regional market size

-

Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Autonomous Enterprise Market