Business Jet Market by Point of Sale (Pre-owned, OEM, Aftermarket), Aircraft Type (Light, Mid-Sized, Large, Airliner), End-Use (Private Jet User, Operator), Systems (Aerostructures, Avionics, Aircraft Systems), Range - Global Forecast to 2032

Business Jet Market Size & Growth

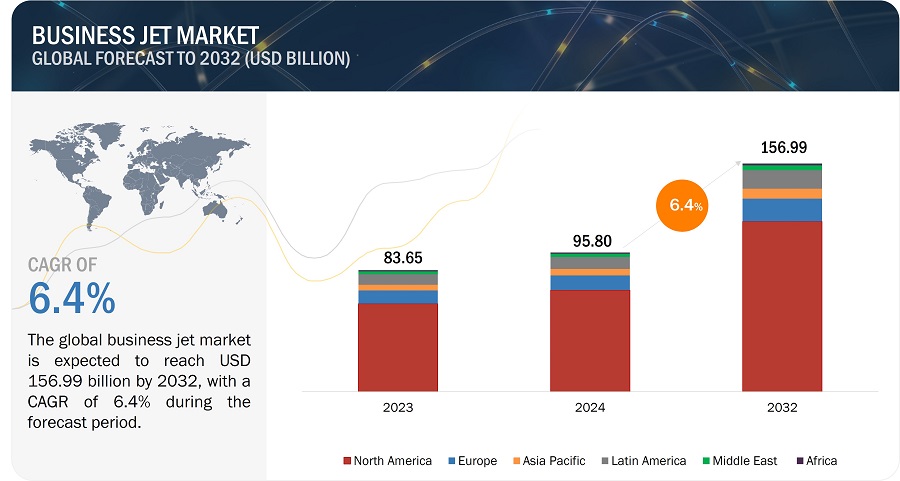

[271 Pages Report] The business jet market is projected to grow from USD 95.80 billion in 2024 to USD 156.99 billion by 2032, registering a CAGR of 6.4%. Business jet manufacturers are increasingly focusing on developing aircraft with reduced carbon footprints. This involves the adoption of sustainable aviation fuels (SAFs) and the integration of cutting-edge technologies aimed at improving fuel efficiency. This shift toward sustainability and the surge in demand for greener aviation solutions are anticipated to drive market growth. The unique appeal of business jets, providing point-to-point travel, flexible scheduling, and quicker journey times, propels the demand for private aviation further. Advancements in technology related to aircraft design, passenger comfort, and fuel efficiency are also spurring the expansion of both new and pre-owned business jet industry.

Business Jet Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Business Jet Market Trends

Driver: Advancements in hybrid and electric technologies

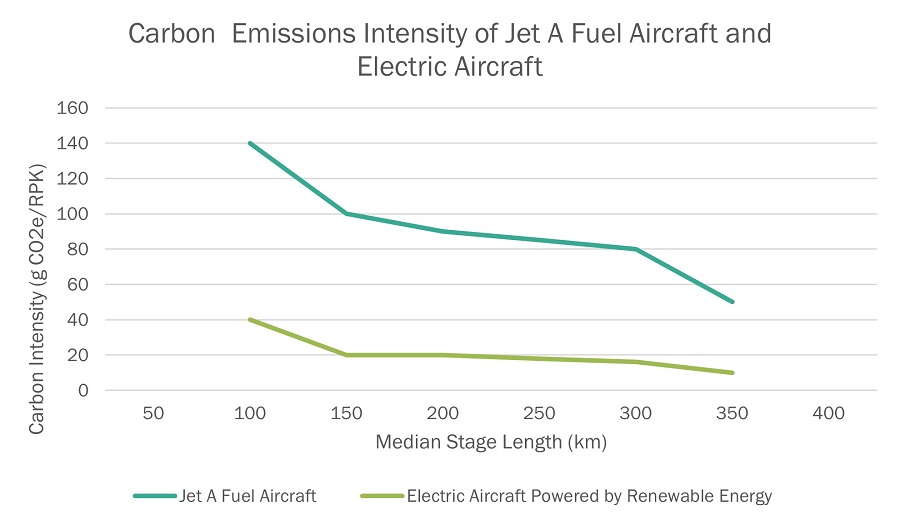

The rise in fuel costs, stringent government regulations, and increased awareness of environmental issues have driven the sales of fuel-efficient aircraft. Hybrid electric propulsion is an appealing technology for decarbonization in the aviation sector. These aircraft use traditional engines (reciprocating or gas generators) to achieve longer ranges and higher payloads than fully electric aircraft while reducing emissions and fuel consumption. Additionally, they operate with no hydrocarbon-fueled engines during critical phases of operation, such as take-off/climb-out or approach/landing, providing a significant drop in noise emissions at low altitudes, where disruptions can be bothersome.

A 2022 white paper from the International Council on Clean Transportation suggests that by 2030, the operation of electric aircraft will decrease carbon intensity by 49–82% compared to traditional fossil fuel-powered alternatives, with further reductions of 57–88% by 2050. This highlights the low energy consumption of electric aircraft and their use of other options for petroleum-derived energy. The paper also includes a figure comparing the intensity of carbon emissions from Jet A aircraft to those of electric aircraft powered by renewable energy sources. Jet A fuel aircraft will have approximately 1.5x more emissions intensity at a median stage length than electric aircraft in renewable energy.

Carbon Emissions Intensity Of Jet Fuel Aircraft And Electric Aircraft

Restraint: High maintenance costs

New and existing operators in the business jet market are often hindered by high aircraft maintenance costs. Aircraft maintenance involves inspections, repairs, and parts replacement, which can occur regularly or unexpectedly, resulting in financial challenges. Proper maintenance is crucial for safety, passenger comfort, and airworthiness. Failure to comply with maintenance regulations can render jets unairworthy and legally inoperable. However, these limitations can be addressed through new technology, improved maintenance schedules, and cost management, leading to sustainable market growth and performance improvements. The operating cost of commercial aircraft varies based on the annual flight hours, as shown in the table below.

Annual Budget For Business Jets Based On Hours Flown

|

Aircraft |

Cost |

Flying 200 Hours/Year (USD) |

Flying 400 Hours/Year (USD) |

Insights |

|

Boeing Business Jet |

Total Direct Operating Costs (Maintenance, Engine Overhaul, and Others) |

1,605,630 |

3,211,260 |

|

|

Total Fixed Costs |

839,970 |

839,970 |

||

|

Eclipse 500 |

Total Direct Operating Costs (Maintenance, Engine Overhaul, and Others) |

214,322 |

428,644 |

|

|

Total Fixed Costs (Crew Training, Hangar, Insurance, Jet Management, and Miscellaneous) |

213,510 |

213,510 |

||

|

Gulfstream G700 |

Total Direct Operating Costs (Maintenance, Engine Overhaul, and Others) |

1,185,572 |

2,371,144 |

|

|

Total Fixed Costs |

988,000 |

988,000 |

Opportunity: Emphasis on use of sustainable aviation fuel

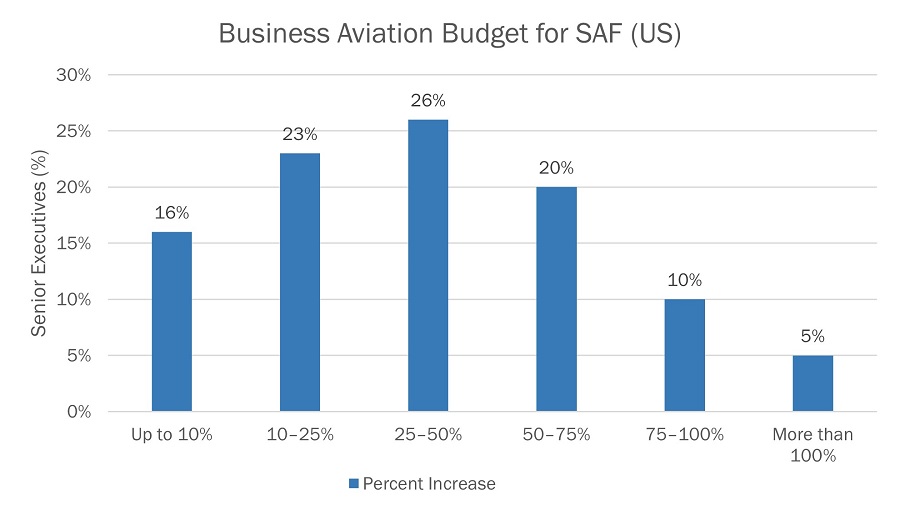

The introduction of sustainable aviation fuel (SAF) offers a lucrative opportunity for the business jet market, promoting environmentally friendly air travel. SAF is produced from materials emitting 80% lower CO2 than traditional jet fuels and requires minimal modifications to existing aircraft engines and fuel supply systems. The combustion of jet fuel, currently prevalent in commercial aircraft, has an adverse impact on the environment, contributing to the carbon footprint. In response, the aviation sector has committed to achieving net-zero emissions by 2050 during the International Air Transport Association (IATA)’s Annual General Meeting in 2021. This opportunity to incorporate SAF into operations could position the business jet market at the forefront of greener air travel, shifting focus from conventional jets to sustainable aviation solutions.

A survey of senior executives of large Fortune 500 US companies who use business aviation reveals significant trends to prioritize the reduction of carbon emissions through their flight travel. The chart below provides the portfolios of senior executives that were influenced by the increase in responses to the interview measurement results.

Increase In Business Aviation Budget For Sustainable Aviation Fuel

Challenge: Shortage of pilots and aircraft maintenance engineers

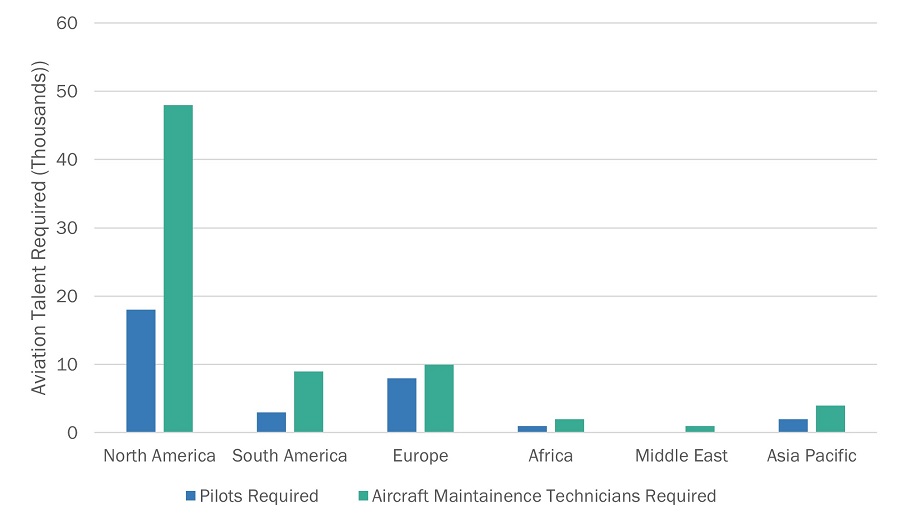

The business jet market is experiencing a shortage of pilots and aircraft maintenance engineers. The major contributing factors are demographic shifts, new retirement policies, and early retirement trends. With a significant part of the aviation workforce nearing retirement age, the demand for skilled pilots and technicians to operate and maintain both new and older aircraft is surging. According to the Federal Aviation Administration (FAA), the retirement of a large number of pilots from commercial airlines is imminent, placing higher strain on the business aviation sector to recruit and train approximately 99,000 new pilots globally over the next decade. This measure is necessary to replenish the workforce and offset the number of retiring pilots. The looming pilot shortage will pose a critical challenge to the business jet market, demonstrating the need for strategic planning and investment to mitigate the impact on operations and future state planning. The CAE Aviation Talent Forecast report, published in July 2023, indicates that the demand for pilots will increase by 39% from 2023 to 2031. Meanwhile, the demand for aircraft maintenance technicians is expected to be 78%, further highlighting the need for trained professionals in the aviation sector.

Pilot And Aircraft Maintenance Technician Requirement, 2023–2032

Ecosystem Analysis for Business Jet Market

In the business jet market ecosystem, prominent companies providing business jet, private and small enterprises, distributors/suppliers/retailers, and end users are the key stakeholders. Investors, funders, distributors, and service providers are the major influencers in this market.

Business Jet Market Segmentation

By system, aftermarket systems segment to account for largest share in 2024

The aftermarket systems segment is estimated to hold the largest share of the business jet market in 2024. The growing demand for premium onboard facilities is a key driver of the need for aftermarket systems. This segment encompasses a wide range of MRO activities, including the replacement, repair, and maintenance of essential business jet systems and components. It covers critical areas such as aerostructures, avionics, aircraft systems, cabin interiors, doors, windows, and windshields, which are vital for maintaining the operational efficiency and luxury standards of the business aviation sector.

By point of sale, pre-owned segment to account for largest share in 2024

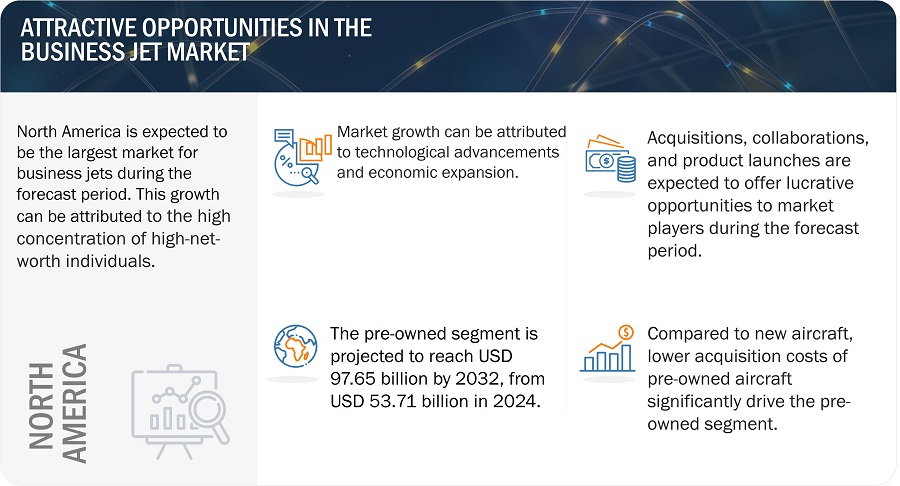

The pre-owned segment is estimated to hold the largest share of the business jet market in 2024. The lower acquisition cost of pre-owned jets than new ones significantly drives this segment. Pre-owned jets have a slower depreciation rate and are a more stable investment. They are commonly preferred by charter services, first-time buyers, and corporates. Additionally, due to the availability of a wide range of models, buyers are attracted to these jets, fueling the growth of the pre-owned business jet market.

Business Jet Market Regional Analysis

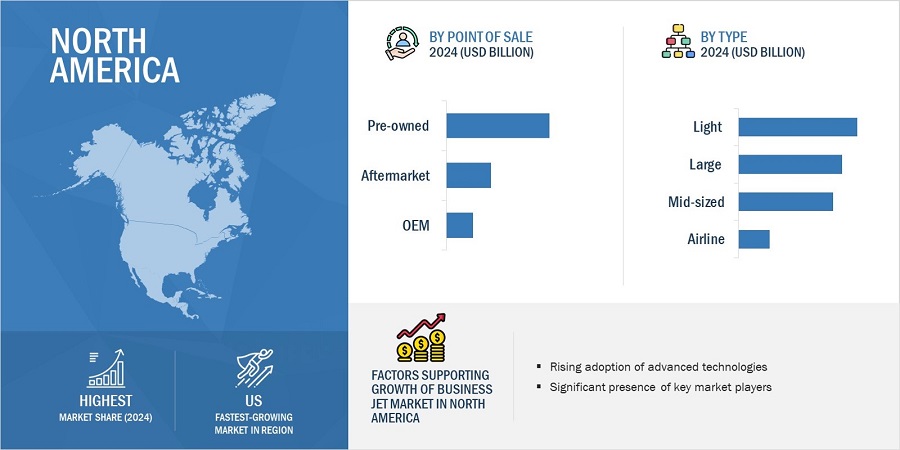

By region, North America to account for the largest share in 2024

North America is expected to hold the largest share of the business jet market in 2024. This can be primarily attributed to major business jet providers in the region. North America is a well-developed market with a strong growth potential for pre-owned, new, and aftermarket services. High demand for fractional ownership and charter services further contributes to market growth. North America has a robust ecosystem that supports business jet operations. This includes maintenance repair and overhaul facilities as well as a network of airports and FBOs that cater to business aviation needs, ensuring reliable and high-quality services for operators and owners.

Business Jet Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Business Jet Companies - Key Market Players

Major players operating in the business jet market are

Bombardier Inc. (Canada), Boeing (US), Dassault Aviation (France), Honda Aircraft Company (US), Airbus (Netherlands), General Dynamics Corporation (US), Piaggio Aero Industries (Italy), Eclipse Aerospace, Inc. (US) and Piper Aircraft (US). The report covers various industry trends and technological innovations in the business jet market.

Business Jet Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 95.80 billion in 2024 |

|

Projected Market Size |

USD 156.99 billion by 2032 |

|

Business Jet Market Growth Rate (CAGR) |

6.4% |

|

Market size available for years |

2020–2032 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2032 |

|

Forecast units |

Value (USD billion) |

|

Segments covered |

Aircraft Type, End Use, Point of Sale, System, Range, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, Middle East, and Africa |

|

Companies covered |

Textron Inc. (US), Embraer SA (Brazil), General Dynamics (US), Bombardier Inc. (Canada), Airbus SE (Netherlands), The Boeing Company (US), Dassault Aviation (France), Pilatus Aircraft Ltd. (Switzerland), and Honda Aircraft Company (US) |

Business Jet Market Highlights

This research report categorizes the Business Jet Market based on aircraft type, end-use, point of sale, systems, range, and region.

|

Segment |

Subsegment |

|

By Aircraft Type |

|

|

By End Use |

|

|

By Point of Sale |

|

|

By Systems |

|

|

By Range |

|

|

By Region |

|

Recent Developments

- In January 2025, Gulfstream Aerospace Corp. (US) has announced the delivery of two additional Gulfstream G700 aircraft to the Qatar Executive fleet. The two new aircraft delivered will use a blend of sustainable aviation fuel (SAF), which will increase the total number of G700 aircraft in the Qatar Executive fleet to six with an additional four scheduled.

- In October 2024, Ryan Samples has entered into a purchase agreement with the Textron Inc. (US) to take delivery of the first CJ4 Gen3, which is expected to enter service in 2026.

- In June 2024, Pilatus (Switzerland) and Synhelion (Switzerland) entered a partnership focused on advancing solar fuel technology for the aviation sector to expedite the adoption of solar-derived fuels. Pilatus plans to integrate Synhelion’s innovative solar fuels into its operations and make them available to its customers.

- In July 2024, Boeing (US) announced a definitive agreement to acquire Spirit AeroSystems (US). This acquisition will include Boeing’s commercial operations and expand its footprint in other commercial, defense, and aftermarket operations.

- In May 2024, Vertical Aerospace (Germany) secures $50 million in new funding as part of a $180 million transaction from Mudrick Capital Management (US), bolstering its financial position and driving progress on its Flightpath 2030 Strategy.

Frequently Asked Questions (FAQs):

What is the current size of the business jet market?

The business jet market is estimated at USD 95.80 billion in 2024. It is projected to reach USD 156.99 billion by 2032, with a CAGR of 6.4%.

Who are the leading players in the business jet market?

Gulfstream Aerospace (US), Bombardier Inc. (Canada), Textron Inc. (US), Embraer SA (Brazil), and Dassault Aviation (France) are the leading players in the market.

What are the opportunities available in the business jet market?

Increased charter services & fractional ownership and an emphasis on the use of SAF are a few lucrative opportunities in the business jet market.

What are the latest technological advancements in the business jet market?

Technological advancements in the business jet market include electric propulsion, autonomous aircraft, and urban air mobility, among others.

What are the key factors driving the growth of the business jet market?

The rise of high-net-worth individuals, high demand for digitalization, increased advancements in hybrid & electric technologies, and the need for enhanced productivity and efficiency by businesses are the key factors driving the growth of the business jet market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Shift toward electric and hybrid-electric technologies- Advent of digitalization- Demand for enhanced productivity and efficiency from businesses- Rise of high-net-worth individualsRESTRAINTS- High maintenance costs- Complex regulations for business jet certificationsOPPORTUNITIES- Inclination toward charter services and fractional ownership- Emergence of sustainable aviation fuelCHALLENGES- Shortage of pilots and aircraft maintenance engineers- Supply chain disruptions- Potential delays due to air traffic control authorities

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 ECOSYSTEM ANALYSISPROMINENT COMPANIESSTART-UPS AND SMALL ENTERPRISESEND USERSAFTERMARKET

-

5.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Safety management systemsCOMPLEMENTARY TECHNOLOGIES- Advanced avionics- Cabin management systemsADJACENT TECHNOLOGIES- Noise reduction technologies

- 5.6 USE CASE ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 REGULATORY LANDSCAPE

- 5.10 TRADE ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025–2026

-

5.12 TOP BUSINESS JET MODELSTOP BUSINESS JET MODELS DELIVEREDTOP BUSINESS JET MODELS PREFERRED FOR TRAVEL

-

5.13 PRICING ANALYSISINDICATIVE PRICING OF TOP FIVE BUSINESS JET MODELSINDICATIVE PRICING OF PRE-OWNED BUSINESS JETS, BY AIRCRAFT TYPEFACTORS AFFECTING PRICING OF BUSINESS JETS

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 BILL OF MATERIALS

- 5.16 TECHNOLOGY ROADMAP

- 5.17 TOTAL COST OF OWNERSHIP

-

5.18 BUSINESS MODELSBUSINESS MODELS IN BUSINESS JET SERVICE MARKETBUSINESS MODELS IN BUSINESS JET OEM MARKETBUSINESS MODELS IN PRE-OWNED BUSINESS JET MARKET

-

5.19 IMPACT OF GENERATIVE AI/AIINTRODUCTIONADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

-

5.20 MACROECONOMIC OUTLOOKNORTH AMERICAEUROPEASIA PACIFICMIDDLE EASTLATIN AMERICAAFRICA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSGLASS COCKPIT DISPLAYSHYBRID-ELECTRIC PROPULSION SYSTEMSFLIGHT MANAGEMENT SYSTEMSCOMBINED VISION SYSTEMSFLIGHT DECK CONNECTIVITY SYSTEMSADVANCED IN-FLIGHT ENTERTAINMENT SYSTEMSHYDROGEN-POWERED PROPULSION SYSTEMS

-

6.3 IMPACT OF MEGA TRENDSSUSTAINABILITY INITIATIVESDIGITALIZATION AND ARTIFICIAL INTELLIGENCEADVANCED MATERIALS AND MANUFACTURING TECHNIQUES

-

6.4 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 LIGHTCONSUMER DEMAND FOR COST-EFFECTIVE AND FLEXIBLE TRAVEL SOLUTIONS TO DRIVE MARKET

-

7.3 MID-SIZEDEXTENSIVE USE IN ROUTE OPTIMIZATION TO DRIVE MARKET

-

7.4 LARGELOWER FLIGHT TIMES THAN SMALLER JETS TO DRIVE MARKET

-

7.5 AIRLINERNEED FOR LONG-DISTANCE CORPORATE TRAVEL TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 PRIVATE USERSPREFERENCE FOR PRIVATE TRAVEL TO DRIVE MARKET

-

8.3 OPERATORSPREVALENCE OF COMMERCIAL AVIATION SERVICES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 PRE-OWNED<10 YEARS- Access to latest avionics technologies at lower costs to drive market11–25 YEARS- More reliable performance than older pre-owned models to drive market>25 YEARS- Substantial cost savings to drive market

-

9.3 OEMCONVENTIONAL- Reduced fuel consumption and low maintenance requirements to drive marketHYBRID-ELECTRIC- Growing emphasis on sustainability to drive market

-

9.4 AFTERMARKETMRO- Need for maintenance of existing aircraft fleets to drive marketPARTS REPLACEMENT- Focus on upgrading newer technologies to drive marketBUSINESS JET MARKET, BY RANGE

- 10.1 INTRODUCTION

-

10.2 <3,000 NMWIDESPREAD ADOPTION IN SHORT-HAUL TRAVEL TO DRIVE MARKET

-

10.3 3,000–5,000 NMGROWTH OF INTERCONTINENTAL TRAVEL TO DRIVE MARKET

-

10.4 >5,000 NMNEED FOR LONG-HAUL FLIGHTS WITH NON-STOP OPERATIONS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 OEM SYSTEMSAEROSTRUCTURES- Fuselages- Empennages- Flight control surfaces- Wings- Nacelles & pylons- NosesAVIONICS- Flight management systems- Communications systems- Navigation systems- SoftwareAIRCRAFT SYSTEMS- Hydraulic systems- Pneumatic systems- Environmental control systems- Emergency systems- Electrical systems- Propulsion systems- Landing systemsCABIN INTERIORS- Seats- In-flight entertainment & connectivity systems- Galleys- Panels- Stowage bins- LavatoriesDOORS, WINDOWS, & WINDSHIELDS

-

11.3 AFTERMARKET SYSTEMSAEROSTRUCTURESAVIONICS- Flight management systems- Communications systems- Navigation systems- SoftwareAIRCRAFT SYSTEMS- Hydraulic systems- Pneumatic systems- Environmental control systems- Emergency systems- Electrical systems- Propulsion systems- Landing systemsCABIN INTERIORS- Seats- In-flight entertainment & connectivity systems- Galleys- Panels- Stowage bins- LavatoriesDOORS, WINDOWS, & WINDSHIELDS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAPESTLE ANALYSISUS- Significant presence of leading manufacturers and service providers to drive marketCANADA- Modernization programs for enhancing fuel efficiency in business jets to drive market

-

12.3 EUROPEPESTLE ANALYSISGERMANY- Anticipated growth in electric air mobility to drive marketFRANCE- Stringent environmental regulations for low-carbon aviation to drive marketUK- Domestic focus on sustainability to drive marketSWITZERLAND- Access to prominent business airports to drive marketAUSTRIA- Economic stability to drive marketITALY- Advancements in maintenance and overhaul capabilities to drive marketSPAIN- Government initiatives for strengthening aviation industry to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICPESTLE ANALYSISCHINA- Surge in domestic use of business jets to drive marketAUSTRALIA- Booming aviation industry to drive marketSINGAPORE- Strategic location connecting major air routes in Asia, Europe, and Americas to drive marketJAPAN- Increasing orders of new aircraft to drive marketINDIA- Rapid technology adoption to drive marketREST OF ASIA PACIFIC

-

12.5 MIDDLE EASTPESTLE ANALYSISGCC- UAE- Saudi Arabia- QatarTURKEY- Expanding tourism industry to drive marketISRAEL- Presence of multinational corporations to drive marketREST OF MIDDLE EAST

-

12.6 AFRICAPESTLE ANALYSISSOUTH AFRICA- Robust aviation infrastructure to drive marketKENYA- Growing interest in larger jets to drive marketREST OF AFRICA

-

12.7 LATIN AMERICAPESTLE ANALYSISBRAZIL- Emphasis on technological innovation to drive marketMEXICO- Presence of globally recognized charter operators to drive marketREST OF LATIN AMERICA

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- 13.3 REVENUE ANALYSIS, 2020–2023

- 13.4 MARKET SHARE ANALYSIS, 2023

-

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT- Company footprint- Aircraft type footprint- Range footprint- Point of sale footprint- Region footprint

-

13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING- List of start-ups/SMEs- Competitive benchmarking of start-ups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

-

13.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALS

-

14.1 KEY PLAYERSBOMBARDIER- Business overview- Products offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products offered- Recent developments- MnM viewTEXTRON INC.- Business overview- Products offered- Recent developments- MnM viewDASSAULT AVIATION- Business overview- Products offered- Recent developments- MnM viewEMBRAER- Business overview- Products offered- Recent developments- MnM viewPILATUS AIRCRAFT LTD- Business overview- Products offered- Recent developmentsAIRBUS- Business overview- Products offered- Recent developmentsBOEING- Business overview- Products offered- Recent developmentsCIRRUS AIRCRAFT- Business overview- Products offeredPIAGGIO AERO INDUSTRIES- Business overview- Products offered- Recent developmentsPIPER AIRCRAFT, INC.- Business overview- Products offered- Recent developmentsDEUTSCHE AIRCRAFT GMBH- Business overview- Products offered- Recent developmentsECLIPSE AEROSPACE, INC.- Business overview- Products offeredHONDA AIRCRAFT COMPANY, LLC- Business overview- Products offered- Recent developmentsVERTICAL AEROSPACE GROUP LTD.- Business overview- Products offered- Recent developments

-

14.2 OTHER PLAYERSSTELLAR AVIATION AGELECTRA AEROEVIATIONVAERIDION GMBHAURA AEROHEART AEROSPACELYTE AVIATIONNEW HORIZON AIRCRAFT LTDBEYOND AEROOVERAIR, INCODYS AVIATIONNIMBUS AEROSPACE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 ANNUAL BUDGET FOR BUSINESS JETS BASED ON HOURS FLOWN

- TABLE 4 REGULATIONS IMPOSED ON BUSINESS JETS

- TABLE 5 DELAY OF ENTRY OF BUSINESS JETS DUE TO SUPPLY CHAIN DISRUPTIONS

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 CABIN CONFIGURATIONS OF BUSINESS JETS

- TABLE 8 FRACTIONAL OWNERSHIP OF BUSINESS JETS

- TABLE 9 SUSTAINABLE ELECTRIC PROPULSION FOR EVTOL

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO POINTS OF SALE (%)

- TABLE 11 KEY BUYING CRITERIA, BY END USE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2025–2026

- TABLE 18 COMPARISON OF MATERIALS USED IN BUSINESS JETS

- TABLE 19 COMPARISON OF BUSINESS MODELS IN BUSINESS JET SERVICE MARKET

- TABLE 20 COMPARISON OF BUSINESS MODELS IN BUSINESS JET OEM MARKET

- TABLE 21 COMPARISON OF BUSINESS MODELS IN PRE-OWNED BUSINESS JET MARKET

- TABLE 22 PATENT ANALYSIS

- TABLE 23 BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 24 BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 25 BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 26 BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 27 BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 28 BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 29 PRE-OWNED BUSINESS JET VOLUME, BY AIRCRAFT TYPE, 2024–2032 (UNITS)

- TABLE 30 PRE-OWNED BUSINESS JET MARKET, BY AIRCRAFT AGE, 2020–2023 (USD BILLION)

- TABLE 31 PRE-OWNED BUSINESS JET MARKET, BY AIRCRAFT AGE, 2024–2032 (USD BILLION)

- TABLE 32 OEM BUSINESS JET VOLUME, BY AIRCRAFT TYPE, 2024–2032 (UNITS)

- TABLE 33 BUSINESS JET OEM MARKET, BY TYPE, 2020–2023 (USD BILLION)

- TABLE 34 BUSINESS JET OEM MARKET, BY TYPE, 2024–2032 (USD BILLION)

- TABLE 35 BUSINESS JET AFTERMARKET, BY OPERATION, 2020–2023 (USD BILLION)

- TABLE 36 BUSINESS JET AFTERMARKET, BY OPERATION, 2024–2032 (USD BILLION)

- TABLE 37 BUSINESS JET MARKET, BY RANGE, 2020–2023 (USD BILLION)

- TABLE 38 BUSINESS JET MARKET, BY RANGE, 2024–2032 (USD BILLION)

- TABLE 39 BUSINESS JET MARKET, BY SYSTEM, 2020–2023 (USD BILLION)

- TABLE 40 BUSINESS JET MARKET, BY SYSTEM, 2024–2032 (USD BILLION)

- TABLE 41 BUSINESS JET OEM MARKET, BY SYSTEM, 2020–2023 (USD BILLION)

- TABLE 42 BUSINESS JET OEM MARKET, BY SYSTEM, 2024–2032 (USD BILLION)

- TABLE 43 AEROSTRUCTURES: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2020–2023 (USD BILLION)

- TABLE 44 AEROSTRUCTURES: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2024–2032 (USD BILLION)

- TABLE 45 AVIONICS: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2020–2023 (USD BILLION)

- TABLE 46 AVIONICS: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2024–2032 (USD BILLION)

- TABLE 47 AIRCRAFT SYSTEMS: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2020–2023 (USD BILLION)

- TABLE 48 AIRCRAFT SYSTEMS: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2024–2032 (USD BILLION)

- TABLE 49 CABIN INTERIORS: BUSINESS JET OEM MARKET, BY SUBSYSTEM, 2020–2023 (USD BILLION)

- TABLE 50 CABIN INTERIORS: BUSINESS JET OEM MARKET, BY SUBSYSTEM,2024–2032 (USD BILLION)

- TABLE 51 BUSINESS JET AFTERMARKET, BY SYSTEM, 2020–2023 (USD BILLION)

- TABLE 52 BUSINESS JET AFTERMARKET, BY SYSTEM, 2024–2032 (USD BILLION)

- TABLE 53 AIRCRAFT SYSTEMS: BUSINESS JET AFTERMARKET, BY SUBSYSTEM, 2020–2023 (USD BILLION)

- TABLE 54 AIRCRAFT SYSTEMS: BUSINESS JET AFTERMARKET, BY SUBSYSTEM, 2024–2032 (USD BILLION)

- TABLE 55 CABIN INTERIORS: BUSINESS JET AFTERMARKET, BY SUBSYSTEM, 2020–2023 (USD BILLION)

- TABLE 56 CABIN INTERIORS: BUSINESS JET AFTERMARKET, BY SUBSYSTEM, 2024–2032 (USD BILLION)

- TABLE 57 BUSINESS JET MARKET, BY REGION, 2020–2023 (USD BILLION)

- TABLE 58 BUSINESS JET MARKET, BY REGION, 2024–2032 (USD BILLION)

- TABLE 59 NORTH AMERICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 60 NORTH AMERICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 61 NORTH AMERICA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 62 NORTH AMERICA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 63 NORTH AMERICA: BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 64 NORTH AMERICA: BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 65 NORTH AMERICA: BUSINESS JET MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 66 NORTH AMERICA: BUSINESS JET MARKET, BY COUNTRY, 2024–2032 (USD BILLION)

- TABLE 67 US: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 68 US: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 69 US: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 70 US: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 71 CANADA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 72 CANADA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 73 CANADA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 74 CANADA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 75 EUROPE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 76 EUROPE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 77 EUROPE: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 78 EUROPE: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 79 EUROPE: BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 80 EUROPE: BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 81 EUROPE: BUSINESS JET MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 82 EUROPE: BUSINESS JET MARKET, BY COUNTRY, 2024–2032 (USD BILLION)

- TABLE 83 GERMANY: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 84 GERMANY: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 85 GERMANY: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 86 GERMANY: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 87 FRANCE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 88 FRANCE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 89 FRANCE: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 90 FRANCE: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 91 UK: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 92 UK: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 93 UK: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 94 UK: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 95 SWITZERLAND: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 96 SWITZERLAND: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 97 SWITZERLAND: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 98 SWITZERLAND: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 99 AUSTRIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 100 AUSTRIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 101 AUSTRIA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 102 AUSTRIA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 103 ITALY: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 104 ITALY: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 105 ITALY: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 106 ITALY: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 107 SPAIN: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 108 SPAIN: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 109 SPAIN: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 110 SPAIN: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 111 REST OF EUROPE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 112 REST OF EUROPE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 113 REST OF EUROPE: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 114 REST OF EUROPE: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 115 ASIA PACIFIC: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 116 ASIA PACIFIC: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 117 ASIA PACIFIC: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 118 ASIA PACIFIC: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 119 ASIA PACIFIC: BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 120 ASIA PACIFIC: BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 121 ASIA PACIFIC: BUSINESS JET MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 122 ASIA PACIFIC: BUSINESS JET MARKET, BY COUNTRY, 2024–2032 (USD BILLION)

- TABLE 123 CHINA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 124 CHINA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 125 CHINA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 126 CHINA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 127 AUSTRALIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 128 AUSTRALIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 129 AUSTRALIA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 130 AUSTRALIA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 131 SINGAPORE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 132 SINGAPORE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 133 SINGAPORE: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 134 SINGAPORE: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 135 JAPAN: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 136 JAPAN: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 137 JAPAN: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 138 JAPAN: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 139 INDIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 140 INDIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 141 INDIA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 142 INDIA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 143 REST OF ASIA PACIFIC: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 144 REST OF ASIA PACIFIC: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 145 REST OF ASIA PACIFIC: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 146 REST OF ASIA PACIFIC: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 147 MIDDLE EAST: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 148 MIDDLE EAST: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 149 MIDDLE EAST: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 150 MIDDLE EAST: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 151 MIDDLE EAST: BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 152 MIDDLE EAST: BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 153 MIDDLE EAST: BUSINESS JET MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 154 MIDDLE EAST: BUSINESS JET MARKET, BY COUNTRY, 2024–2032 (USD BILLION)

- TABLE 155 UAE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 156 UAE: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 157 UAE: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 158 UAE: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 159 SAUDI ARABIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 160 SAUDI ARABIA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 161 SAUDI ARABIA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 162 SAUDI ARABIA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 163 QATAR: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 164 QATAR: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 165 QATAR: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 166 QATAR: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 167 TURKEY: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 168 TURKEY: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 169 TURKEY: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 170 TURKEY: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 171 ISRAEL: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 172 ISRAEL: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 173 ISRAEL: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 174 ISRAEL: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 175 REST OF MIDDLE EAST: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 176 REST OF MIDDLE EAST: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 177 REST OF MIDDLE EAST: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 178 REST OF MIDDLE EAST: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 179 AFRICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 180 AFRICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 181 AFRICA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 182 AFRICA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 183 AFRICA: BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 184 AFRICA: BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 185 AFRICA: BUSINESS JET MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 186 AFRICA: BUSINESS JET MARKET, BY COUNTRY, 2024–2032 (USD BILLION)

- TABLE 187 SOUTH AFRICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 188 SOUTH AFRICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 189 SOUTH AFRICA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 190 SOUTH AFRICA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 191 KENYA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 192 KENYA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 193 KENYA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 194 KENYA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 195 REST OF AFRICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 196 REST OF AFRICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 197 REST OF AFRICA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 198 REST OF AFRICA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 199 LATIN AMERICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 200 LATIN AMERICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 201 LATIN AMERICA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 202 LATIN AMERICA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 203 LATIN AMERICA: BUSINESS JET MARKET, BY END USE, 2020–2023 (USD BILLION)

- TABLE 204 LATIN AMERICA: BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- TABLE 205 LATIN AMERICA: BUSINESS JET MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 206 LATIN AMERICA: BUSINESS JET MARKET, BY COUNTRY, 2024–2032 (USD BILLION)

- TABLE 207 BRAZIL: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 208 BRAZIL: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 209 BRAZIL: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 210 BRAZIL: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 211 MEXICO: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 212 MEXICO: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 213 MEXICO: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 214 MEXICO: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 215 REST OF LATIN AMERICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2020–2023 (USD BILLION)

- TABLE 216 REST OF LATIN AMERICA: BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- TABLE 217 REST OF LATIN AMERICA: BUSINESS JET MARKET, BY POINT OF SALE, 2020–2023 (USD BILLION)

- TABLE 218 REST OF LATIN AMERICA: BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- TABLE 219 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- TABLE 220 BUSINESS JET MARKET: DEGREE OF COMPETITION

- TABLE 221 AIRCRAFT TYPE FOOTPRINT

- TABLE 222 RANGE FOOTPRINT

- TABLE 223 POINT OF SALE FOOTPRINT

- TABLE 224 REGION FOOTPRINT

- TABLE 225 LIST OF START-UPS/SMES

- TABLE 226 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 227 BUSINESS JET MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2024

- TABLE 228 BUSINESS JET MARKET: DEALS, 2020–2024

- TABLE 229 BUSINESS JET MARKET: OTHER DEVELOPMENTS, 2020 -2025

- TABLE 230 BOMBARDIER: COMPANY OVERVIEW

- TABLE 231 BOMBARDIER: PRODUCTS OFFERED

- TABLE 232 BOMBARDIER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 233 BOMBARDIER: DEALS

- TABLE 234 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 235 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 236 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 237 GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 238 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 239 TEXTRON INC.: PRODUCTS OFFERED

- TABLE 240 TEXTRON INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 241 TEXTRON INC.: DEALS

- TABLE 242 TEXTRON INC.: OTHER DEVELOPMENTS

- TABLE 243 DASSAULT AVIATION: COMPANY OVERVIEW

- TABLE 244 DASSAULT AVIATION: PRODUCTS OFFERED

- TABLE 245 DASSAULT AVIATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 246 DASSAULT AVIATION: DEALS

- TABLE 247 EMBRAER: COMPANY OVERVIEW

- TABLE 248 EMBRAER: PRODUCTS OFFERED

- TABLE 249 EMBRAER: DEALS

- TABLE 250 PILATUS AIRCRAFT LTD: COMPANY OVERVIEW

- TABLE 251 PILATUS AIRCRAFT LTD: PRODUCTS OFFERED

- TABLE 252 PILATUS AIRCRAFT LTD: DEALS

- TABLE 253 PILATUS AIRCRAFT LTD: OTHER DEVELOPMENTS

- TABLE 254 AIRBUS: COMPANY OVERVIEW

- TABLE 255 AIRBUS: PRODUCTS OFFERED

- TABLE 256 AIRBUS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 257 AIRBUS: DEALS

- TABLE 258 BOEING: COMPANY OVERVIEW

- TABLE 259 BOEING: PRODUCTS OFFERED

- TABLE 260 BOEING: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 261 BOEING: DEALS

- TABLE 262 CIRRUS AIRCRAFT: COMPANY OVERVIEW

- TABLE 263 CIRRUS AIRCRAFT: PRODUCTS OFFERED

- TABLE 264 PIAGGIO AERO INDUSTRIES: COMPANY OVERVIEW

- TABLE 265 PIAGGIO AERO INDUSTRIES: PRODUCTS OFFERED

- TABLE 266 PIAGGIO AERO INDUSTRIES: DEALS

- TABLE 267 PIAGGIO AERO INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 268 PIPER AIRCRAFT, INC.: COMPANY OVERVIEW

- TABLE 269 PIPER AIRCRAFT, INC.: PRODUCTS OFFERED

- TABLE 270 PIPER AIRCRAFT, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 271 DEUTSCHE AIRCRAFT GMBH: COMPANY OVERVIEW

- TABLE 272 DEUTSCHE AIRCRAFT GMBH: PRODUCTS OFFERED

- TABLE 273 DEUTSCHE AIRCRAFT GMBH: DEALS

- TABLE 274 ECLIPSE AEROSPACE, INC.: COMPANY OVERVIEW

- TABLE 275 ECLIPSE AEROSPACE, INC.: PRODUCTS OFFERED

- TABLE 276 HONDA AIRCRAFT COMPANY, LLC: COMPANY OVERVIEW

- TABLE 277 HONDA AIRCRAFT COMPANY, LLC: PRODUCTS OFFERED

- TABLE 278 HONDA AIRCRAFT COMPANY, LLC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 279 VERTICAL AEROSPACE GROUP LTD.: COMPANY OVERVIEW

- TABLE 280 VERTICAL AEROSPACE GROUP LTD.: PRODUCTS OFFERED

- TABLE 281 VERTICAL AEROSPACE GROUP LTD.: DEALS

- TABLE 282 VERTICAL AEROSPACE GROUP LTD: OTHER DEVELOPMENTS

- TABLE 283 STELLAR AVIATION AG: COMPANY OVERVIEW

- TABLE 284 ELECTRA AERO: COMPANY OVERVIEW

- TABLE 285 EVIATION: COMPANY OVERVIEW

- TABLE 286 VAERIDION GMBH: COMPANY OVERVIEW

- TABLE 287 AURA AERO: COMPANY OVERVIEW

- TABLE 288 HEART AEROSPACE: COMPANY OVERVIEW

- TABLE 289 LYTE AVIATION: COMPANY OVERVIEW

- TABLE 290 NEW HORIZON AIRCRAFT LTD: COMPANY OVERVIEW

- TABLE 291 BEYOND AERO: COMPANY OVERVIEW

- TABLE 292 OVERAIR, INC: COMPANY OVERVIEW

- TABLE 293 ODYS AVIATION: COMPANY OVERVIEW

- TABLE 294 NIMBUS AEROSPACE: COMPANY OVERVIEW

- FIGURE 1 BUSINESS JET MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 LARGE SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 8 OPERATORS TO HOLD HIGHER SHARE THAN PRIVATE USERS DURING FORECAST PERIOD

- FIGURE 9 PRE-OWNED TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LARGEST MARKET FOR BUSINESS JETS DURING FORECAST PERIOD

- FIGURE 11 RISE OF HIGH-NET-WORTH INDIVIDUALS TO DRIVE MARKET

- FIGURE 12 3000–5000 NM TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 13 PRE-OWNED SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 14 BRAZIL TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 BUSINESS JET MARKET DYNAMICS

- FIGURE 16 CARBON EMISSIONS INTENSITY OF JET A FUEL AIRCRAFT AND ELECTRIC AIRCRAFT

- FIGURE 17 CONCEPTUAL DIGITALIZATION ARCHITECTURE

- FIGURE 18 GLOBAL BUSINESS JET OPERATIONS, 2020–2022

- FIGURE 19 HIGH-NET-WORTH INDIVIDUAL WEALTH, BY REGION, 2016–2023

- FIGURE 20 HIGH-NET-WORTH INDIVIDUAL POPULATION, BY REGION, 2016–2023

- FIGURE 21 BUSINESS JETS DELIVERIES TO FRACTIONAL PROGRAMS

- FIGURE 22 BUSINESS AVIATION BUDGET FOR SUSTAINABLE AVIATION FUEL IN US

- FIGURE 23 PILOT AND AIRCRAFT MAINTENANCE TECHNICIAN REQUIREMENT GLOBALLY

- FIGURE 24 DELAYS DUE TO AIR TRAFFIC FLOW MANAGEMENT IN EUROPE

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 26 ECOSYSTEM ANALYSIS

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO POINTS OF SALE

- FIGURE 29 KEY BUYING CRITERIA, BY END USE

- FIGURE 30 IMPORT DATA OF HS CODE 8802, BY COUNTRY, 2019–2023 (USD THOUSAND)

- FIGURE 31 EXPORT DATA OF HS CODE 8802, BY COUNTRY, 2019–2023 (USD THOUSAND)

- FIGURE 32 TOP BUSINESS JET MODELS DELIVERED, 2023

- FIGURE 33 TOP BUSINESS JET MODELS PREFERRED FOR TRAVEL, 2023

- FIGURE 34 INDICATIVE PRICING OF TOP FIVE BUSINESS JET MODELS

- FIGURE 35 INDICATIVE PRICING OF PRE-OWNED BUSINESS JETS, BY AIRCRAFT TYPE

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO, 2020–2024

- FIGURE 37 BILL OF MATERIALS FOR CONVENTIONAL BUSINESS JETS

- FIGURE 38 BILL OF MATERIALS FOR ELECTRIC BUSINESS JETS

- FIGURE 39 INTRODUCTION TO TECHNOLOGY ROADMAP

- FIGURE 40 EVOLUTION OF KEY TECHNOLOGIES

- FIGURE 41 BREAKDOWN OF TOTAL COST OF OWNERSHIP OF BUSINESS JETS

- FIGURE 42 TOTAL COST OF OWNERSHIP OF BUSINESS JETS, BY POINT OF SALE

- FIGURE 43 TOTAL COST OF OWNERSHIP OF BUSINESS JETS, BY AIRCRAFT TYPE

- FIGURE 44 BUSINESS MODELS IN BUSINESS JET SERVICE MARKET

- FIGURE 45 BUSINESS MODELS IN BUSINESS JET OEM MARKET

- FIGURE 46 BUSINESS MODELS IN PRE-OWNED BUSINESS JET MARKET

- FIGURE 47 GENERATIVE AI LANDSCAPE

- FIGURE 48 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- FIGURE 49 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 50 MACROECONOMIC OUTLOOK FOR LATIN AMERICA AND AFRICA

- FIGURE 51 PATENT ANALYSIS

- FIGURE 52 BUSINESS JET MARKET, BY AIRCRAFT TYPE, 2024–2032 (USD BILLION)

- FIGURE 53 BUSINESS JET MARKET, BY END USE, 2024–2032 (USD BILLION)

- FIGURE 54 BUSINESS JET MARKET, BY POINT OF SALE, 2024–2032 (USD BILLION)

- FIGURE 55 BUSINESS JET MARKET, BY RANGE, 2024–2032 (USD BILLION)

- FIGURE 56 BUSINESS JET MARKET, BY SYSTEM, 2024–2032 (USD BILLION)

- FIGURE 57 BUSINESS JET MARKET, BY REGION, 2024–2032

- FIGURE 58 NORTH AMERICA: BUSINESS JET MARKET SNAPSHOT

- FIGURE 59 EUROPE: BUSINESS JET MARKET SNAPSHOT

- FIGURE 60 ASIA PACIFIC: BUSINESS JET MARKET SNAPSHOT

- FIGURE 61 MIDDLE EAST: BUSINESS JET MARKET SNAPSHOT

- FIGURE 62 AFRICA: BUSINESS JET MARKET SNAPSHOT

- FIGURE 63 LATIN AMERICA: BUSINESS JET MARKET SNAPSHOT

- FIGURE 64 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2023

- FIGURE 65 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 66 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 67 COMPANY FOOTPRINT

- FIGURE 68 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 69 COMPANY VALUATION OF PROMINENT PLAYERS

- FIGURE 70 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 71 BRAND/PRODUCT COMPARISON

- FIGURE 72 BOMBARDIER: COMPANY SNAPSHOT

- FIGURE 73 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 75 DASSAULT AVIATION: COMPANY SNAPSHOT

- FIGURE 76 EMBRAER: COMPANY SNAPSHOT

- FIGURE 77 PILATUS AIRCRAFT LTD: COMPANY SNAPSHOT

- FIGURE 78 AIRBUS: COMPANY SNAPSHOT

- FIGURE 79 BOEING: COMPANY SNAPSHOT

The research study conducted on the business jet market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the business jet market. The primary sources considered included industry experts from the business jet market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the business jet market as well as to assess the growth prospects of the market.

Secondary Research

The secondary sources referred for this research study included government sources, such as the Federal Aviation Industry (FAA), the European Aviation Safety Agency (EASA), the General Civil Aviation Authority (GCAA), the International Air Transport Association (IATA), and corporate filings, such as annual reports, investor presentations, and financial statements of trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall market size, which primary respondents further validated. Other secondary sources referred for this research study included Airfleets, Bombardier, Honeywell’s Global Business Aviation Outlook and Embraer Market Outlook 2023, General Aviation Manufacturers Association (GAMA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand industry trends, type, range, aftermarket systems, services, and region. Stakeholders from the demand side included government telecommunication organizations, system integrators, technology providers, and solution providers.

After obtaining information regarding the business jet market scenario, extensive primary research was conducted with market experts from the demand and supply sides across six regions, namely, North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. This primary data is obtained through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the business jet market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the business jet market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the business jet market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-down Approach

Data triangulation

After arriving at the overall size of the business jet market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A business jet is an aircraft used by business people, politicians and other government officials, and high-net-worth individuals. Business jet provide an efficient and productive means of air travel to cater to schedules of various individuals or groups and to reach destinations that are not covered by commercial airlines. These aircraft are also used during emergencies such as floods, evacuations, etc. Business jet are generally owned by high-net-worth individuals, governments, businesses, and operators such as charter companies.

Pre-owned business jet refers to used business jet, and resale of business jet refer to the sale of pre-owned business jet.

Stakeholders

Various stakeholders of the market are listed below:

- Business Jet Manufacturers

- Business Jet Systems and Component Manufacturers

- Aircraft System Integrators

- Pre-owned aircraft providers

- Charter Operators

- Maintenance, Repair, and Overhaul (MRO) Companies

- Research Bodies

- Government Bodies and Agencies

- Regulators

- Investors

Report Objectives

- To define, describe, segment, and forecast the size of the business jet market based on aircraft type, end-use, point of sale, system, range, and region

- To forecast the market size of various segments of the business jet market with respect to 6 major regions: North America, Europe, Asia Pacific, Latin America, Middle East, and Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of business jet market

- To identify and analyze various regional contracts in the business jet market

- To identify industry trends, market trends, and technology trends currently prevailing in the business jet market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the degree of competition in the business jet market by identifying key market players

- To analyze competitive developments such as contracts, agreements, mergers & acquisitions, and new product launches & developments of key players in the business jet market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the business jet market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the business jet market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Business Jet Market

more info about middle east ?

I want to know an approximate market size of business jets, and which aircraft (model/pax) this is assessed against. Private vs operator split.

Our company is based in Sri Lanka and Maldives and it deals with servicing private aircraft. I am looking out for the global trends to understand the market size of my surrounding regions.

I am looking for more information about Africa and possible growth on this continent?