COVID-19 Impact on Global Machine Tool Market by Machine Type (Cutting and Forming), Automation Type (CNC and Conventional), Industry (Automotive, Sheet Metal, Capital Goods and Energy), Sales Channel (Direct Sales, Events & Exhibitions and Dealer & Distributor) and Region - Global Forecast to 2021

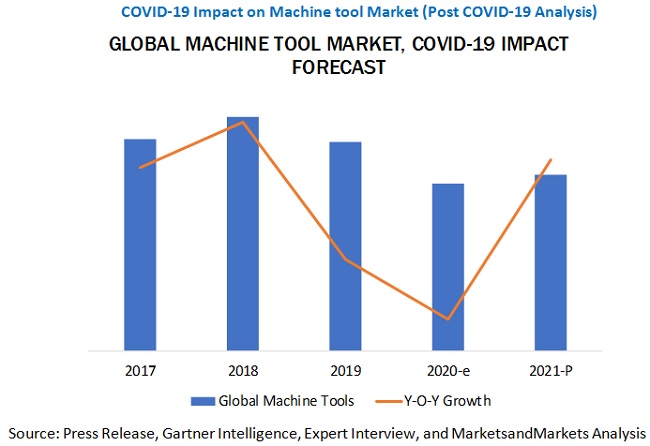

[60 Pages Report] Post COVID-19, the global machine tool market size is projected to reach USD 68.9 billion by 2021 from an estimated USD 65.6 billion in 2020, at a CAGR of 5.0%. The projections were based on the ongoing automotive industry production drop, which is the biggest consumer of machine tools and, additionally, the supply chain disruptions caused by the COVID-19 pandemic in the manufacturing industry.

The machine tool market reached an all-time high in 2018. However, with the continuous decrease in automotive production over the last 2-3 years, the trade war (between the US and China) on tariffs creating a weak demand in downstream industries and the uncertainty in the international relations has impacted investment decisions, resulting in ~11% decline in the machinery demand for 2019.

“Asia Pacific is expected to recover at a faster growth than compared with other regions post the COVID crisis during the forecast period.”

Even with COVID-19 originating from China, the country has been successfully implementing strategies to control the spread, where it has been successful when compared to Europe and North America. Recently China has slowly started its production activities with minimum workforce and Asia being the largest automotive producer. Thus, the machine tool market is expected to rebound faster with investments in new technologies like chipmaking equipment, which will propel market growth, as the field likely will see increased demand amid advancement in technologies for 5G communication and artificial intelligence.

“Supply chain disruptions during the COVID-19 have made machine tool manufacturers, and other end-use industries realize the over-reliance on China could be destructive.”

Problems in the supply of materials have affected machine tool manufacturers due to supply shortages from China, as most of the materials were imported from China, and due to the lockdown or limited production, other countries were looked for supply. Due to the demand, large suppliers of components that dominate the market prioritized big companies to SMEs at the time of recovery. Also, the recent disruptions in the supply chain have revealed that machine tool manufacturers, over-rely on suppliers of key components, and their weak negotiation power vis-à-vis suppliers of CNC, electronic components, casting, high precision components, and others.

“Manufacturing industries are strategically re-tooling their production systems to make different products.”

Some OEMs have strategically planned to re-tool their production systems to make completely different products. For example, when the automotive industry was down by more than 90% in China in February, automobile manufacturers like Shanghai-GM-Wuling (SGMW) quickly retooled its production system to produce medical face masks. This positively contributed to mitigating the COVID-19 spread and, at the same time, generated rewarding revenues and a positive reputation for the company.

Key Market Players

Some of the major players in the machine tool market are Doosan (South Korea), Amada (Japan), Makino (Japan), JTEKT (Japan), GF Machining Solutions (Switzerland), DMG Mori (Japan), Komatsu (Japan), OKUMA (Japan), Hyundai WIA (South Korea), Schuler (Germany), and Chiron Group (Germany), among others.

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Global Machine Tool Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in COVID-19 Impact on Global Machine Tool Market?

|

Report Metric |

Details |

|

Market size available for years |

2017–2021 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2021 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Machine type, Automation type, Industry, and Sales Channel |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of World |

|

Companies covered |

Doosan (South Korea), Amada (Japan), Makino (Japan), JTEKT (Japan), GF Machining Solutions (Switzerland), DMG Mori (Japan), Komatsu (Japan), OKUMA (Japan), Hyundai WIA (South Korea), Schuler (Germany), Chiron Group (Germany) |

The COVID-19 Impact on Global Machine Tool Market research report categorizes the given market based on, machine type, automation type, industry, sales channel, and region

Based on machine type:

- Metal Cutting Machine

- Metal Forming Machine

Based on the automation type:

- CNC Machine tools

- Conventional Machine tools

Based on the industry:

- Automotive Industry

- Sheet Metal Industry

- Capital Goods

- Energy Industry

Based on the Sales Channel:

- Direct Sales

- Events & exhibitions

- Dealers & distributors

Based on the region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Vietnam

- Thailand

- Europe

- Germany

- Italy

- Turkey

- France

- Russia

- North America

- US

- Mexico

- Canada

Key Questions Addressed by the Report:

- What is the impact of COVID-19 on the machine tool market and its segments?

- What are the opportunities for machine tool manufacturers?

- How much growth is expected from the machine tool market amid COVID-19 impact?

- What are the company-specific developments amid COVID-19?

- Who are the major competitors in the machine tool segment, and what are their growth strategies?

- What are the supply chain disruptions caused by the COVID-19 in manufacturing industries?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

2 INTRODUCTION

2.1 COVID-19

2.2 CONFIRMED CASES AND DEATHS BY GEOGRAPHY

2.3 KEY MEASURES TAKEN BY KEY COUNTRIES

3 COVID-19 IMPACT ON GLOBAL MACHINE TOOL MARKET OVERVIEW

3.1 INTRODUCTION

3.2 GLOBAL MACHINE TOOLS MARKET – AN OVERALL ECOSYSTEM

3.3 IMPACT OF COVID-19 ON MACHINE TOOL MANUFACTURING COMPANIES

(List of Key Players and matrix indicating their presence in machine tool market and how they will get impacted by the COVID 19)

3.4 MACRO-ECONOMIC INDICATORS

3.4.1 SHORT TERM DRIVERS

3.4.2 SHORT TERM RESTRAINTS

4 COVID-19 IMPACT ON GLOBAL MACHINE TOOL MARKET SIZE

4.1 INTRODUCTION

4.1.1 RESEARCH METHODOLOGY

4.1.2 ASSUMPTIONS AND DEFINITIONS

4.2 COVID-19 IMPACT ON MACHINE TYPE

4.2.1 MOST LIKELY (MEDIUM IMPACT) MARKET SCENARIO FOR MACHINE TYPE MARKET, 2017-2021

4.2.1.1 METAL CUTTING MACHINES

4.2.1.2 METAL FORMING MACHINES

4.2.2 OPTIMISTIC MARKET (LOW IMPACT) SCENARIO FOR MAHCINE TYPE, 2017-2021

4.2.3 PESSIMISTIC MARKET (HIGH IMPACT) SCENARIO FOR MAHCINE TYPE, 2017-2021

4.3 COVID-19 IMPACT ON MACHINE TOOL, BY AUTOMATION TYPE

4.3.1 MOST LIKELY (MEDIUM IMPACT) MARKET SCENARIO FOR AUTOMATION TYPE MARKET, 2017-2021

4.3.1.1 CNC MACHINE TOOLS

4.3.1.2 CONVENTIONAL MACHINE TOOLS

4.3.2 OPTIMISTIC MARKET (LOW IMPACT) SCENARIO FOR AUTOMATION TYPE, 2017-2021

4.3.3 PESSIMISTIC MARKET (HIGH IMPACT) SCENARIO FOR AUTOMATION TYPE, 2017-2021

4.4 COVID-19 IMPACT ON GLOBAL MACHINE TOOL MARKET, BY INDUSTRY SEGMENT

4.4.1 MOST LIKELY (MEDIUM IMPACT) MARKET SCENARIO, BY INDUSTRY, 2017-2021

4.4.1.1 AUTOMOTIVE INDUSTRY

4.4.1.2 SHEET METAL INDUSTRY

4.4.1.3 CAPITAL GOODS INDUSTRY

4.4.1.4 ENERGY INDUSTRY

4.4.2 OPTIMISTIC MARKET (LOW IMPACT) SCENARIO, BY INDUSTRY, 2017-2021

4.4.3 PESSIMISTIC MARKET (HIGH IMPACT) SCENARIO, BY INDUSTRY, 2017-2021

4.5 COVID-19 IMPACT ON GLOBAL MACHINE TOOL MARKET, BY SALES CHANNEL

4.5.1 MOST LIKELY (MEDIUM IMPACT) MARKET SCENARIO, BY SALES CHANNEL, 2017-2021

4.5.2 OPTIMISTIC MARKET (LOW IMPACT) SCENARIO, BY SALES CHANNEL, 2017-2021

4.5.3 PESSIMISTIC MARKET (HIGH IMPACT) SCENARIO, BY SALES CHANNEL, 2017-2021

4.6 COVID-19 IMPACT ON GLOBAL MACHINE TOOL MARKET, BY REGION

4.6.1 MOST LIKELY (MEDIUM IMPACT) MARKET SCENARIO, BY SALES CHANNEL, 2017-2021

4.6.2 OPTIMISTIC MARKET (LOW IMPACT) SCENARIO, BY SALES CHANNEL, 2017-2021

4.6.3 PESSIMISTIC MARKET (HIGH IMPACT) SCENARIO, BY SALES CHANNEL, 2017-2021

5 COVID-19 IMPACT ON Global MACHINE TOOL MARKET IN KEY COUNTRIES

5.1 INTRODUCTION

5.2 CHINA

5.3 US

5.4 GERMANY

5.5 JAPAN

5.6 ITALY

5.7 KOREA

5.8 INDIA

5.9 MEXICO

5.10 TAIWAN

5.11 RUSSIA

5.12 CANADA

6 BUSINESS OPPORTUNITIES (TOP GAINERS VS TOP LOSERS)

6.1 IN TERMS OF MANUFACTURING

6.2 IN TERMS OF SUPPLY CHAIN

7 COMPETITIVE LANDSCAPE AND COVID-19 IMPACT

7.1 INTRODUCTION

7.2 IMPACT ON INDUSTRY SEGMENTS

7.3 IMPACT ON MACHINE TOOL MANUFACTURERS

7.4 IMPACT ON SALES CHANNEL

7.5 WINNING STRATEGIES TO GAIN THE MARKET SHARE

8 CONSUMER TRENDS OUTLOOK

8.1 INTRODUCTION

8.2 EXPECTED TRENDS IN INDUSTRY SEGMENTS OWING TO COVID-19 IMPACT

8.3 EXPECTED TRENDS IN SALES CHANNEL OWING TO COVID-19 IMPACT

The study involved four major activities in estimating the current size of the global machine tool market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market, and the impact of COVID-19. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of machine tool journals, country-level machine tool associations & trade organizations], machine tool magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles were used to identify and collect information useful for an extensive commercial study of the global machine tool market.

Primary Research

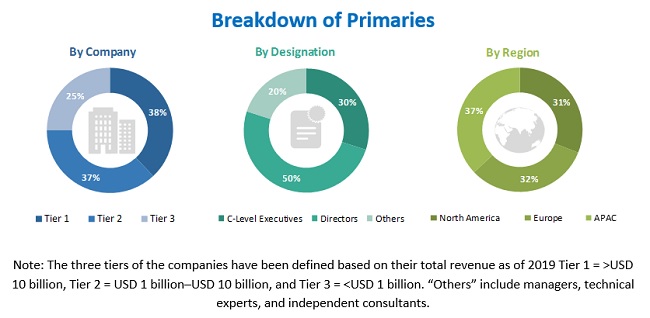

Extensive primary research has been conducted after acquiring an understanding of the machine tool market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of machine suppliers, country-level associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down was used to estimate and validate the total machine tool market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The historical key countries' machine tool consumption has been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the machine tool market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global machine tool market size, in terms of value (USD)

- To define, describe, and forecast the machine tool market based on machine type, Automation, Industry segment, sales channel, and region

- To segment and forecast the market by machine type (Metal cutting and metal forming)

- To segment and forecast the market by automation type (CNC machine tool and conventional machine tool)

- To segment and forecast the market by Industry segment (Automotive, Sheet metal, Capital goods, and Energy)

- To segment and forecast the market by Sales Channel (Direct sales, events & exhibitions and dealers & distributors)

- To assess the impact of COVID-19 on each of the above segments and regions in the machine tool market

- To strategically identify the key players and comprehensively analyze the measures and steps taken by manufacturers during COVID-19 on their respective lines of businesses

Growth opportunities and latent adjacency in COVID-19 Impact on Global Machine Tool Market

The major machine tools consumption countries data is informative, and going forward which countries are affected and particular which industry growth can be expected post-COVID-19 situation is good.