This research study involved the use of extensive secondary sources, directories, and databases, which were used to classify and gather the facts and figures useful for the technical, market-oriented, and commercial study of the global machine tools market. Primary interviews were conducted to obtain and verify critical inputs on qualitative and quantitative information and to assess the prospects of the machine tools industry. Primary sources mainly included experts from the core and related industries, suppliers, manufacturers, distributors, technology developers, and organizations related to various segments of this industry’s value chain. Detailed interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

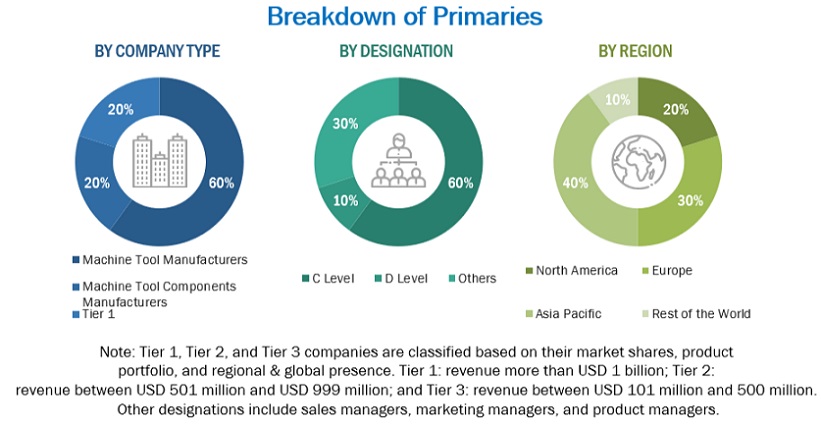

Extensive primary research was conducted after acquiring an understanding of the global machine tools market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, and machine tools manufacturers) and supply (machine tools manufacturers, machine tools component manufacturers, and raw material suppliers) sides across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. The experts involved in primary interviews are 24% from the demand side, and 76% from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primary interviews. This, along with the in-house subject matter experts’ opinions, led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

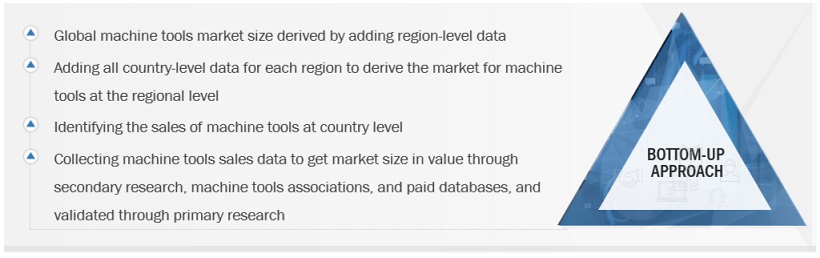

The bottom-up approach was used to estimate and validate the size of the global machine tools market. In this approach, the machine tools sales statistics were considered at the country level.

-

In terms of value, consumption data of machine tools at the country level was derived to determine the market size. The number of machine tools varied from country to country. The country-level data was summed up to arrive at the region-level data in terms of value. The summation of the country-level market size gave the regional market size, and further summation of the regional market size provided the global machine tools market size.

To know about the assumptions considered for the study, Request for Free Sample Report

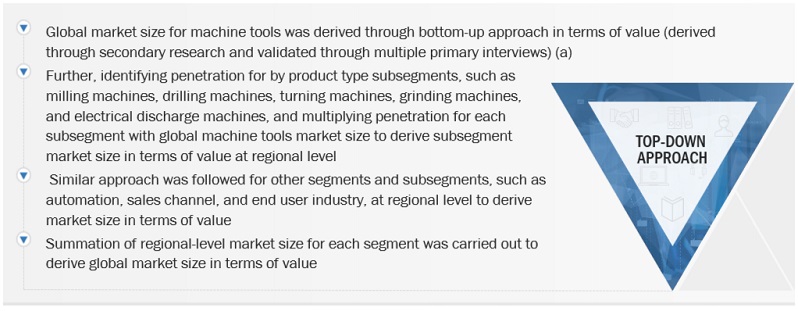

The top-down approach was used to estimate and validate the size of the global machine tools market by automation, product type, sales channel, and end user industry. To derive the market size by product type, the global market size in terms of value was divided into milling machines, drilling machines, turning machines, grinding machines, and electrical discharge machines using the penetration and percentage split, respectively. The global market was further segmented at the regional level. A similar approach was used to derive the market size of automation, sales channel, and end user industry segments in terms of value.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Machine tools are stationary, power-driven equipment used to shape or form parts made of metals, alloys, and composites by cutting, grinding, boring, shearing, etc. These machine tools include milling, drilling, turning, grinding, and electrical discharge machines. CNC machine tools are computer-controlled machines, which provide better precision and control than conventional machine tools.

List of Key Stakeholders

-

Automation consultants

-

Companies developing and integrating industrial software

-

Dealers and distributors of machine tools

-

Government regulatory bodies, industry associations, and experts

-

Integrators of automation systems

-

Manufacturers of machine tools

-

Manufacturers of machine tool components

-

Research organizations and consulting companies

-

Technology investors

-

Technology standards organization, forums, alliances, and associations

-

Vendors of CNC machining software

Report Objectives

-

To analyze and forecast the global machine tools market size, in terms of value (USD billion)

-

To define, describe, and project the market based on product type, automation, end user industry, sales channel, and region

-

To analyze and forecast the market, in terms of value, based on product type [milling machines (4-axis, 5-axis, others, universal machines, machining centers), drilling machines, turning machines (Swiss-type, multi-spindle, others, universal machines), grinding machines, and electrical discharge machines]

-

To analyze and forecast the market in terms of value, based on sales channels (events and exhibitions, dealers and distributors, and direct sales)

-

To analyze and forecast the market, in terms of value, based on automation (CNC machine tools and conventional machine tools)

-

To analyze and forecast the market, in terms of value, based on end user industry (automotive and transportation, aerospace, medical, semiconductor, sheet metals, energy and power, capital goods, and others).

-

To analyze and forecast the market across four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with major countries in each region.

-

To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

-

Additional company profile (Up to 5)

-

Machine tools market, by end user industry, at the country level

-

Machine tools market, by automation, at the country level

Growth opportunities and latent adjacency in Global Machine Tools Market