The research study involved extensive secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the food and beverage metal cans market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), the Can Manufacturers India (CMI), Eurostat (EU Database), and various national ministries of the agricultural department, corporate filings (such as annual reports, press releases, investor presentations, and financial statements), and trade, business, and professional associations such as In the secondary research process, various organizations such as The Aluminium Association, Metal Construction Association, and Metal Packaging Europe (MPE), were referred to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry's supply chain—the total pool of key players, market classification, and segmentation according to the industry trends and key developments from market-oriented perspectives.

Primary Research

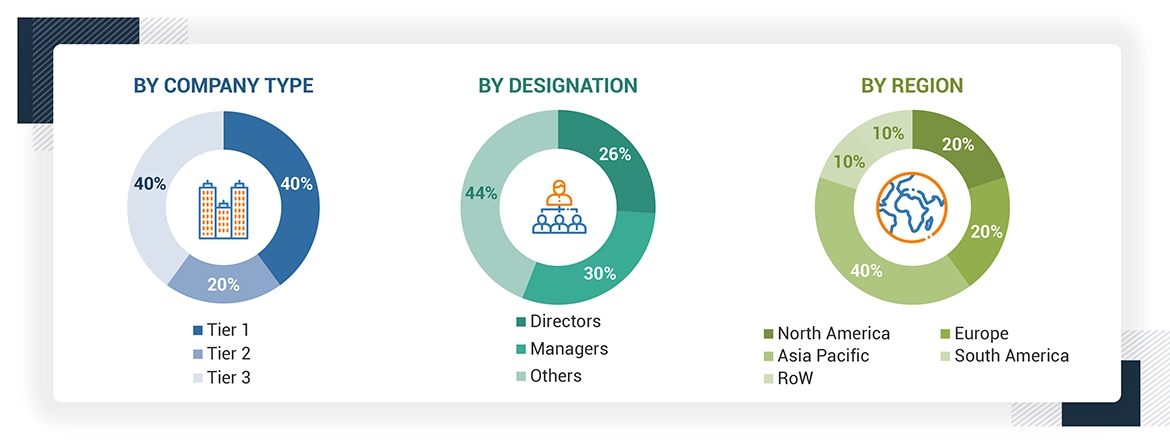

The food and beverage metal cans market comprises several stakeholders, including raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, distributors, wholesalers, importers & exporters of aluminium/steel manufacturers and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs through questionnaires, emails, and telephonic interviews.

Note: Three tiers of the companies are defined based on their total revenues in 2022 or 2023, according to the availability of financial data.

Tier 1: Revenue > USD 1 billion

Tier 2: USD 100 million = Revenue = USD 1 billion

Tier 3: Revenue < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the food and beverage metal cans market. These approaches were extensive to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Food and Beverage Metal Cans Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall food and beverage metal cans market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The food and beverage metal cans market refers to the global industry involved in the production, distribution, and utilization of metal cans, primarily made from aluminum or steel, for packaging food and beverages. These cans are widely used for preserving a range of products, including soft drinks, beer, fruit juices, energy drinks, canned vegetables, soups, and ready-to-eat meals.

Key characteristics of metal cans in this market include their durability, ability to protect the contents from contamination, extend shelf life, and support recycling initiatives, which align with sustainability goals. The demand for metal cans is driven by factors such as their lightweight, corrosion-resistant properties, and consumer preference for eco-friendly packaging solutions, along with their ability to be fully recycled without loss of quality. The market encompasses manufacturers of metal cans, suppliers of raw materials (like aluminum and steel), end-user industries (food and beverage companies), and consumers.

Stakeholders

-

Food manufacturers

-

Aluminum can manufacturers

-

Steel can manufacturers

-

Fruit and Vegetable manufacturers

-

Food importers and exporters

-

Intermediary suppliers include traders and distributors of packed foods such as pet food and convenience foods.

-

Government and research organizations

-

Associations and industry bodies:

-

Food and Agriculture Organization (FAO)

-

United States Department of Agriculture (USDA)

-

European Food Safety Authority (EFSA)

-

European Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

-

Organization for Economic Co-operation and Development (OECD)

-

Venture capitalists and investors

Report Objectives

-

To determine and project the size of the food and beverage metal cans market by fabrication type, application, degree of internal pressure, coating type, material type, beverage can capacity, and region over five years, ranging from 2024 to 2029.

-

To analyze opportunities for stakeholders by identifying the high-growth segments of the food and beverage metal cans market

-

To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To analyze subsegments of the food and beverage metal cans market with respect to individual growth trends, prospects, and contributions to the overall market

-

To profile the key players and comprehensively analyze their market sizes and core competencies

-

To track and analyze competitive developments such as product enhancements and new product launches, acquisitions, and partnerships & collaborations in the food and beverage metal cans market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company.

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

-

Further breakdown of the Rest of the European food and beverage metal cans market, by key country

-

Further breakdown of the Rest of the South American food and beverage metal cans market market, by key country

-

Further breakdown of the Rest of Asia Pacific food and beverage metal cans market market, by key country

COMPANY INFORMATION

-

Detailed analyses and profiling of additional market players

Charlotte

May, 2022

what are the different types of metals used for canned food packaging?.