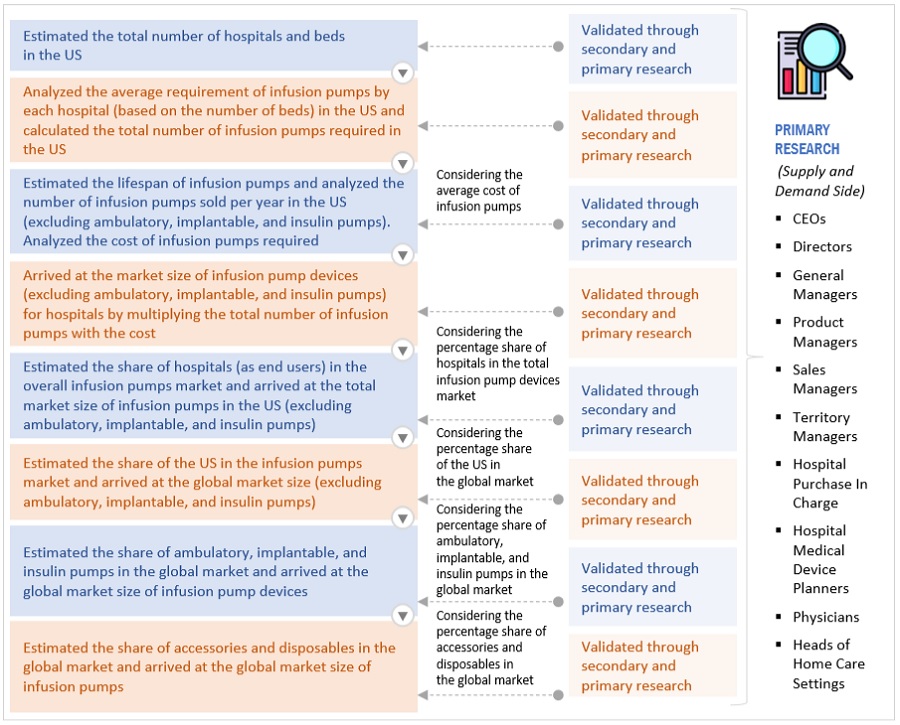

The study involved four major activities to estimate the current size of the Infusion pump market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), American Diabetes Association (ADA), American Association of Diabetes Educators (AADE), European Association for the Study of Diabetes] were referred to identify and collect information for the infusion pump market study.

Primary Research

The infusion pump market comprises several stakeholders such as manufacturers of insulin pumps, accessories and consumbales, original equipment manufacturing companies, suppliers and distributors of infusion pumps and accessories & consumables, healthcare service providers, teaching hospitals and academic medical centers, health insurance players, government bodies/municipal corporations, regulatory bodies, business research and consulting service providers, authorities framing reimbursement policies for infusion pumps and related products, venture capitalists, and market research and consulting firms.

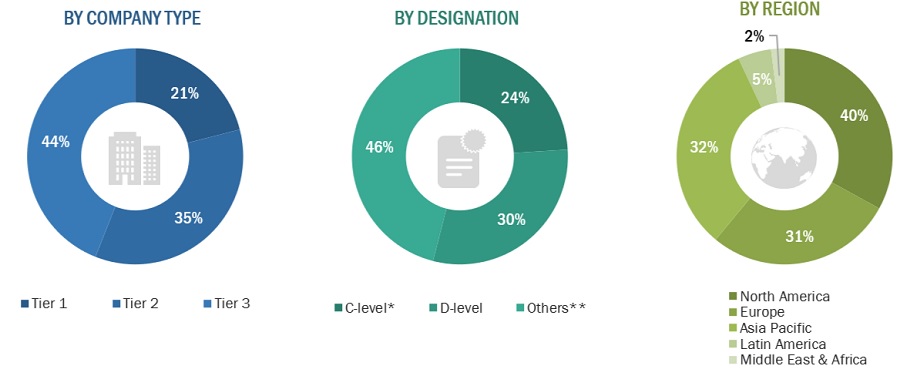

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

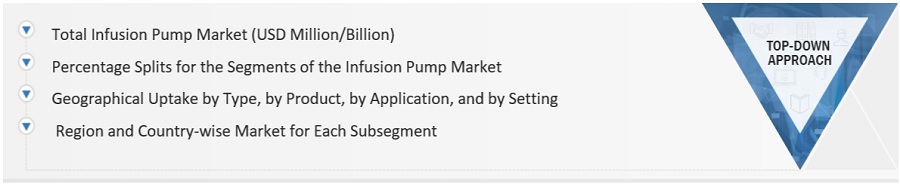

Both top-down and bottom-up approaches were used to estimate and validate the total size of the infusion pump market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Demand-Side Analysis (Bottom-Up Approach)

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Market Definition

An infusion pump is a medical device that delivers controlled amounts of medication into a patient’s body. Various types of pumps deliver nutrients or medication, such as antibiotics, insulin or other hormones, pain relievers, and chemotherapy drugs, to patients. The advantages of this method over manual fluid administration include the ability to deliver fluids at precisely programmed rates or automated intervals and in very small volumes. Infusion pumps are highly adopted in clinical settings such as ambulatory surgical centers, hospitals, in the home, and nursing homes. There are many types of infusion pumps, including large patient-controlled analgesia (PCA), volume, enteral, syringe, and insulin pumps.

Key stakeholders

-

Medical Device Manufacturers and Distributors

-

Infusion Pump Manufacturers

-

Infusion Pump and Related Instrument Manufacturing Companies

-

Suppliers and Distributors of Infusion Pumps

-

Hospitals and Ambulatory Surgery Centers

-

Clinics

-

Home Healthcare Agencies

-

Research and Consulting Firms

-

Contract Manufacturing Organizations

-

Venture Capitalists

Report Objectives

-

To define, describe, and forecast the global infusion pump market on the basis of product, application, setting, and region.

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

-

To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

-

To forecast the size of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, Southeast Asia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

-

To profile the key market players and comprehensively analyze their market shares and core competencies2

-

To track and analyze competitive developments such as partnerships, agreements, collaborations, and expansions in the global infusion pump market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the global infusion pump market report

Geographic Analysis

-

Further breakdown of the RoE infusion pump market into Belgium, Russia, the Netherlands, Switzerland, and others.

-

Further breakdown of the RoAPAC infusion pump market

-

Further breakdown of the RoLA infusion pump market

Portfolio Assessment

-

Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies

Ashley

Mar, 2022

How does China dominates the APAC Infusion Pump Market?.

Kimberly

Mar, 2022

How much is the geography-wise value for the Infusion Pump Market?.

Emily

Mar, 2022

Can you elaborate more on the product segment of the Global Infusion Pump Market?.