This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Mental Health Screening market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organisation for Economic Co-operation and Development (OECD), Agency for Healthcare Research and Quality (AHRQ), Primary Care Companion for CNS Disorders Journal, Centers for Medicare & Medicaid Services (CMS), Centers for Disease Control and Prevention (CDC), Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

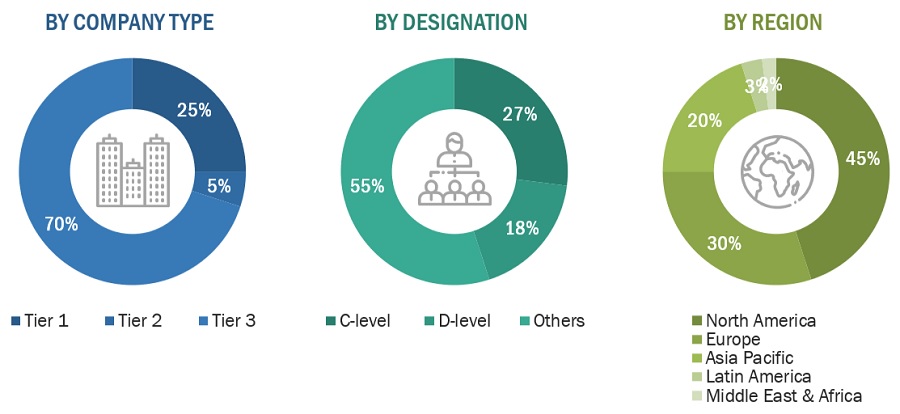

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital personnel, department heads, hospital directors, corporate personnel) and supply side (such as C-level and D-level executives, technology experts, software developers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Breakdown of Primary Interviews

Note 1: Tiers are defined based on the total revenues of companies. As of 2022, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the mental health screening market was arrived at after data triangulation from various approaches, as mentioned below. After completing each approach, a weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Approach 1: Mental Health Screening Market (Revenue Share Analysis)

-

Revenues for individual companies were gathered from public sources and databases for each market segment.

-

Revenues of private companies were gathered through paid databases such as Factiva and Hoovers.

-

Shares of the mental health screening businesses of leading players were gathered from secondary sources to the extent available. In certain cases, shares have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, and geographic reach.

-

Individual shares or revenue estimates were validated through expert interviews.

-

The market size was then extrapolated to obtain the global market. It was further validated through expert interviews.

Approach 2: Segmental Extrapolation

Separate research approaches were followed to estimate the revenue from mental health screening tools and continuous monitoring wearable devices used for mental health screening.

-

Mental health screening tools (excluding continuous monitoring wearable devices):

-

The total number of psychiatrists in the US was determined for 2022. The percentage of psychiatrists using mental health screening tools offered by vendors was identified through extensive secondary research and validated through insights from primary interviews.

-

The average price of mental health screening tools for yearly subscriptions was considered to arrive at the US mental health screening market for clinical settings in 2022.

-

Considering the share of clinical settings, revenues of the overall market in the US were determined for 2022.

-

The US mental health screening market was extrapolated to arrive at the global market.

-

The market for continuous monitoring wearable devices:

-

The total prevalence of mental health disorders in the US was determined for 2022, and the share of people opting for assessments was identified through extensive secondary research and validated through insights from primary interviews.

-

The share of people using continuous monitoring wearable devices for mental health screening was assumed based on secondary research and insights from primary interviews.

-

The average price of continuous monitoring wearable devices was determined through secondary sources to arrive at the US market for continuous monitoring wearable devices.

-

The US market for continuous monitoring wearable devices was extrapolated to arrive at the global market for continuous monitoring wearable devices.

-

The sum of revenues from mental health screening tools and continuous monitoring wearable devices used for mental health screening provided the revenue of the global mental health screening market. The assumptions at each step were validated through primary interviews.

Approach 3: Primary Interviews

-

As a part of the primary research process, individual respondents’ insights on the market size and growth were taken during the interview (regional and global, as applicable).

-

All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation:

After arriving at the overall market size, from the market size estimation process explained above, the Mental Health Screening market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Mental Health Screening market.

Market Definition:

Mental health screening refers to the process of assessing an individual’s mental health status to identify potential signs or symptoms of mental health conditions. It is a preliminary step in recognizing and addressing mental health concerns early on. The goal of mental health screening is to identify individuals who may be at risk of or experiencing mental health issues so that appropriate interventions, support, or further assessments can be provided.

Screening tools may include questionnaires, surveys, or interviews that assess various aspects of an individual’s mental health, such as mood, behavior, thoughts, and emotions. These screenings are often administered by healthcare professionals, counselors, or mental health providers in different settings, including schools, workplaces, clinical settings, and others.

Key Stakeholders:

-

Manufacturers of mental health screening solutions/products

-

Suppliers and distributors of mental health screening solutions/products

-

Third-party refurbishers/suppliers

-

Clinical settings

-

Educational institutions

-

Group purchasing organizations (GPOs)

-

Academic medical centers and universities

-

Corporate entities

-

Community centers

-

Government institutes

-

Market research & consulting firms

-

Contract manufacturing organizations (CMOs)

-

Venture capitalists & investors

Report Objectives

-

To define, describe, and forecast the mental health screening market by application, screening method, technology, age group, setting, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall mental health screening market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To profile the key players in the market and comprehensively analyze their market shares and core competencies

-

To forecast the size of the market segments with respect to five main regions: North America, the Asia Pacific, Europe, Latin America, and the Middle East & Africa

-

To track and analyze competitive developments, such as partnerships, acquisitions, and launches

-

To benchmark players within the mental health screening market using the Competitive Evaluation Matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Additional Company Profiling

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

-

Further breakdown of the Rest of Europe mental health screening market into Spain, Italy, Russia, and others

-

Further breakdown of the Rest of Asia Pacific mental health screening market into Australia, South Korea, Singapore, and others

Growth opportunities and latent adjacency in Mental Health Screening Market