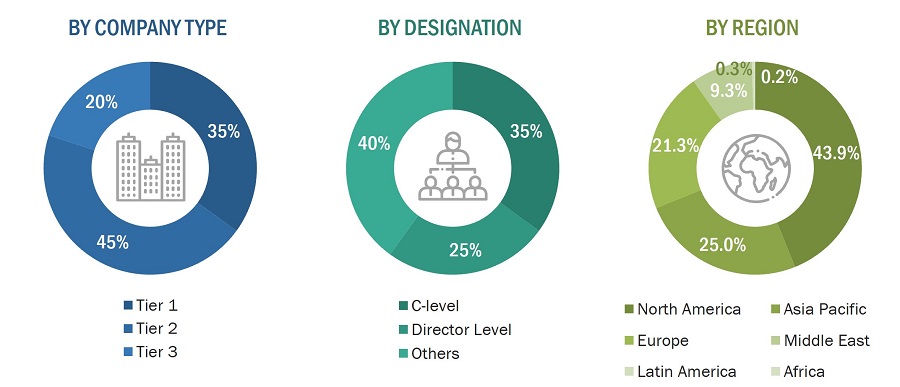

This research study on the military drones market involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the military drones market and assess the market's growth prospects.

Secondary Research

The market share of companies in the military drones market was determined using the secondary data acquired through paid and unpaid sources and analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study on the military drones market included government sources, such as Association for Unmanned Vehicle Systems International (AUVSI), Jane's Information Group, Aerospace Industries Association (AIA), Unmanned Aviation and Advanced Air Mobility, Defense News, US Department of Defense Reports and federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to determine the overall size of the military drones market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the military drones market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

-

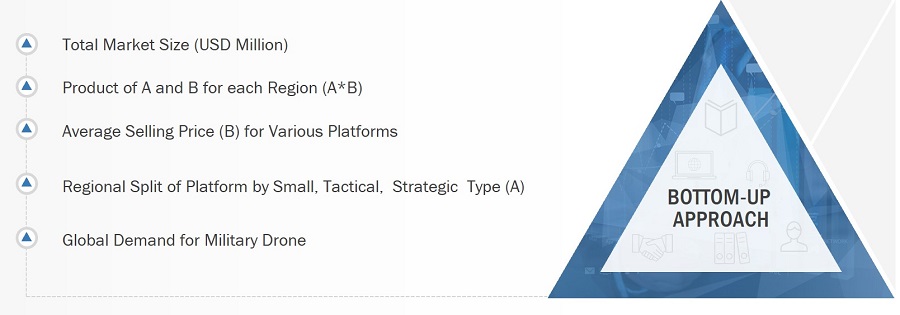

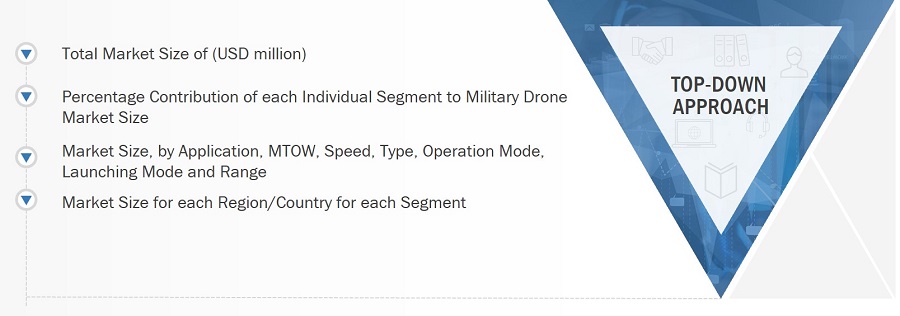

Both top-down and bottom-up approaches were used to estimate and validate the size of the Military Drones market.

-

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-down Approach

Data triangulation

After arriving at the overall size of the military drones market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures explained below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Military drones, also known as unmanned aerial vehicles, find application in diverse military roles like combat, intelligence, surveillance, reconnaissance (ISR), and delivery. The global armed forces increasingly embrace unmanned combat aerial vehicles (UCAVs), including lethal drones, combat drones, and target drones. These drones can be remotely piloted, optionally piloted, or fully autonomous, and they are categorized based on platforms such as small, strategic, and tactical. High Altitude Long Endurance (HALE) and Medium Altitude Long Endurance (MALE) drones, characterized by extended endurance, serve as fixed platforms capable of carrying substantial ISR payloads and precision munitions for combat.

Stakeholders

Various stakeholders of the market are listed below:

-

Military Drone Manufacturers

-

Defence contractors

-

Original Equipment Manufacturers

-

Military Service Providers

-

Payload & Warhead Suppliers

-

Research Organizations

-

Investors and Venture Capitalists

-

Ministries of Defense

-

R&D Companies

Report Objectives

-

To define, describe, and forecast the size of the military drones market based on platform, application, MTOW, speed, type, operation mode, launching mode, propulsion, and region from 2023 to 2028

-

To forecast the size of market segments with respect to five major regions, namely North America, Europe, Asia Pacific, the Middle East, Latin America and Africa.

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

-

To analyze opportunities for stakeholders in the market by identifying key market trends

-

To analyze competitive developments such as contracts, acquisitions, expansions, agreements, joint ventures and partnerships, product developments, and research and development (R&D) activities in the market

-

To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players

-

To strategically profile key market players and comprehensively analyze their core competencies2

1 Micromarkets are referred to as the segments and subsegments of the Military Drones markets considered in the scope of the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at the country level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Kutay

Aug, 2019

Dear Madam/Sir, I have been assigned a project as an outsourced contractor to understand global military UAVs and analyze deeper details of the addressable markets for each UAV types. If you bless me with a sample report, I will convince my contractor to purchase the full report in order to conduct my analysis. Thank you in advance. Best regards, Kutay PINARCI.

Ronald

Feb, 2019

I would like to get some statistical data on the use of drones, their market share, distribution, and economic outlook in Africa, with a strong concentration on the Nigerian market..

Dunja

Jan, 2019

I am looking for insights into the drone industry, specifically information about the use of drones in the military and counterdrone markets for a presentation about these subejcts. .

Claire

Jul, 2019

To understand the key drivers of the military drone market, particularly in relation to the US defence sector..

John

Apr, 2019

I am conducting an analysis for a customer interested in the growth/development of the military UAS technology over the next 10+ years..