The study involves identifying the top trends in the food safety testing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated by industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

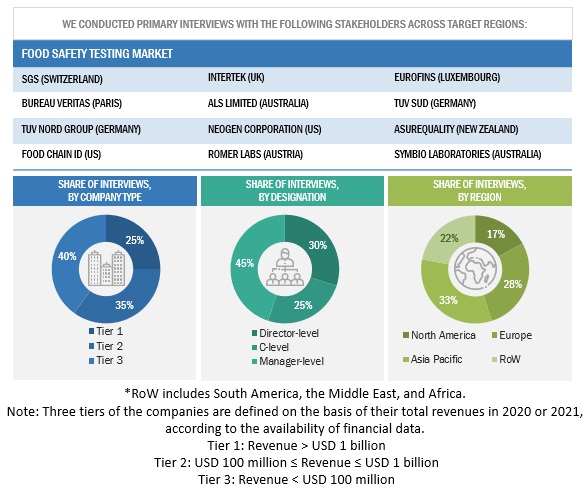

The market comprises several stakeholders in the supply chain, which include suppliers, manufacturers, and end-use product manufacturers. Various primary sources from both the supply and demand sides of both markets have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies manufacturing biologicals. The primary sources from the supply side include research institutions involved in R&D, key opinion leaders, and manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

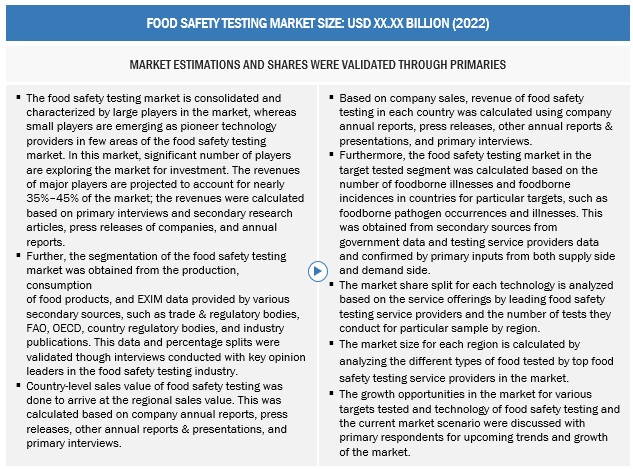

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets.

The research methodology used to estimate the market size includes the following:

-

The key players were identified through extensive secondary research.

-

The 'industry's supply chain and market size were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: top-down approach

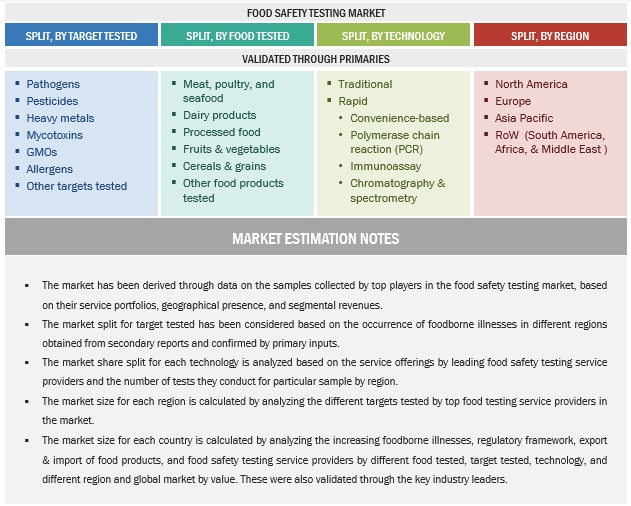

In the top-down approach, the overall market size was used to estimate the size of individual markets (target tested, food tested, technology, and region) through percentage splits from secondary and primary research. To calculate each specific market segment, the most appropriate and immediate parent market size was used to implement the top-down approach. The data obtained was further validated by conducting primary interviews with industry experts, key suppliers, and manufacturers of food safety testing in the market.

Data Triangulation

In order to evaluate the overall food safety testing market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition:

Food safety testing is performed to supervise the quality and prevent unwanted incidents of foodborne illnesses, toxicity, or poisoning.

-

“Food safety audit” means a systematic and functionally independent examination of food safety measures adopted by manufacturing units to determine whether such measures and related results meet the objectives of food safety.

-

“Food Safety Management System (FSMS)” means adopting good manufacturing practices, good hygienic practices, hazard analysis, critical control points, and other practices as may be specified by the regulations for the food business.

According to Governing Food Security in Indonesia, the Food Law No 18/2012: “Food safety is a condition and effort that is required to prevent food from the possibility of biological, chemical, and other pollution that can interfere, harm, and endanger the human health as well as not conflicting with religion, belief, and culture of the society so that it is safe for consumption.”

Key Stakeholders:

-

Manufacturers, importers & exporters, traders, distributors, and suppliers of food safety testing kits, equipment, reagents and chemicals

-

Food safety testing laboratories

-

Food raw material suppliers

-

Food ingredient, intermediate, and end-product manufacturers, and processors

-

Government, research organizations, and institutions

-

World Health Organization (WHO)

-

Codex Alimentarius Commission (CAC)

-

Food traders, trade associations, and industry bodies

-

Regulatory bodies

-

Food and Agriculture Organization (FAO)

-

Food Safety Council (FSC)

-

The European Federation of National Associations of Measurement, Testing, and Analytical Laboratories (EUROLAB)

-

European Food Safety Authority (EFSA)

-

Food Standards Australia New Zealand (FSANZ)

-

Canadian Food Inspection Agency (CFIA)

-

Mexico’s National Service of Health, Food Safety, and Agro-Alimentary Quality (SENASICA)

-

Food Safety Commission (FSC)

-

Ministry of Health, Labor, and Welfare (Japan)

-

Food Safety and Standards Authority of India (FSSAI)

-

Commercial research & development (R&D) institutions and financial institutions

-

Regulatory bodies, including government agencies and NGOs

Report Objectives

-

To describe, segment, and project the global market size for the food safety testing market

-

To offer detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To evaluate the micro-markets, concerning individual growth trends, prospects, and their contribution to the total food safety testing market

-

To propose the size of the submarkets, in terms of value, for various regions

-

To profile the major players and comprehensively analyze their core competencies

-

To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

-

To analyze competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Top 10 Food Safety Testing and Technologies Trends Market