The Wi-Fi 7 market study extensively used secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals, such as the Institute of Electrical and Electronics Engineers (IEEE), ScienceDirect, ResearchGate, Academic Journals, Scientific.Net, and various telecom and Wi-Fi 7 associations/forums, Wi-Fi Alliance, and 3GPP were also referred. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and in-depth segmentation according to industry trends, regional markets, and key developments.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Wi-Fi 7 market. The primary sources from the demand side included Wi-Fi 7 end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

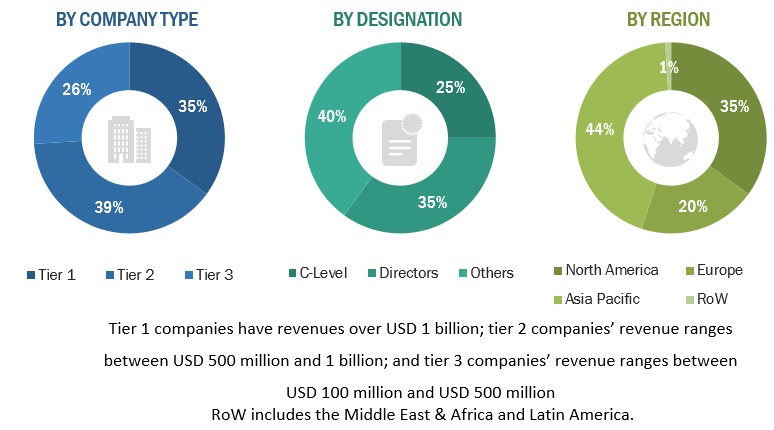

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

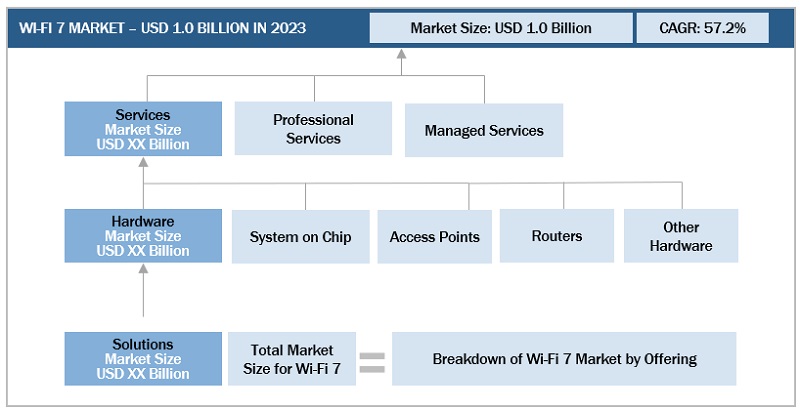

Multiple approaches were adopted to estimate and forecast the size of the Wi-Fi 7 market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Wi-Fi 7 offerings, such as hardware, solutions, and services.

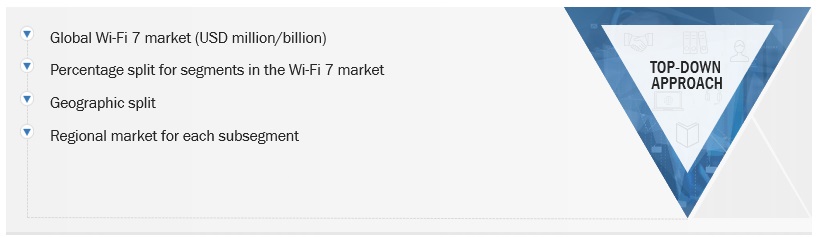

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Wi-Fi 7 market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

-

Key players in the market have been identified through extensive secondary research.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Wi-Fi 7 Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Wi-Fi 7 Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the Wi-Fi 7 market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

As per Pareteum, Wi-Fi 7 is the next-generation Wi-Fi standard that succeeds Wi-Fi 6E and Wi-Fi 6. Its technical name is IEEE 802.11be EFT (Extremely High Throughput), indicating that it is an amendment to the original 802.11 Wi-Fi standard. It will use various new technologies and protocols to reduce latency, increase network capacity, and boost efficiency. It is especially committed to lightning-fast connections and improving user experiences for use cases such as live streaming and gaming.

Key Stakeholders

-

Network Server Providers

-

Technology Vendors

-

Mobile Network Operators (MNOs)

-

Independent Software Vendors (ISVs)

-

System Integrators (SIs)

-

Resellers

-

Value-added Resellers (VARs)

-

Managed Service Providers (MSPs)

-

Compliance Regulatory Authorities

-

Government Authorities

-

Wi-Fi 7 Alliances/Groups

-

Original Equipment Manufacturers (OEMs)

Report Objectives

-

To determine and forecast the global Wi-Fi 7 market by offering (hardware, solutions, and services), location type, application, vertical, and region from 2023 to 2030, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

-

To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Rest of world.

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Wi-Fi 7 market.

-

To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Wi-Fi 7 market.

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Wi-Fi 7 market.

-

To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

-

Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the MEA market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Wi-Fi 7 Market